On the morning of November 10th, Binance officially issued a document announcing that based on the results of due diligence, as well as news reports about improper handling of customer funds and investigations by so-called US agencies, it has decided not to pursue a potential acquisition of FTX.com (the rumored acquisition price is only for $1).

secondary title

damaged party

Overall,The most directly damaged parties after the fall of FTX can be roughly divided into three groups: one is the capital that directly invested in FTX; the other is institutions that have financial involvement with FTX, including customers with balances on the platform and FTX debts The third is Solana and other "direct descendant projects" that are deeply involved with FTX.

Investors in FTX

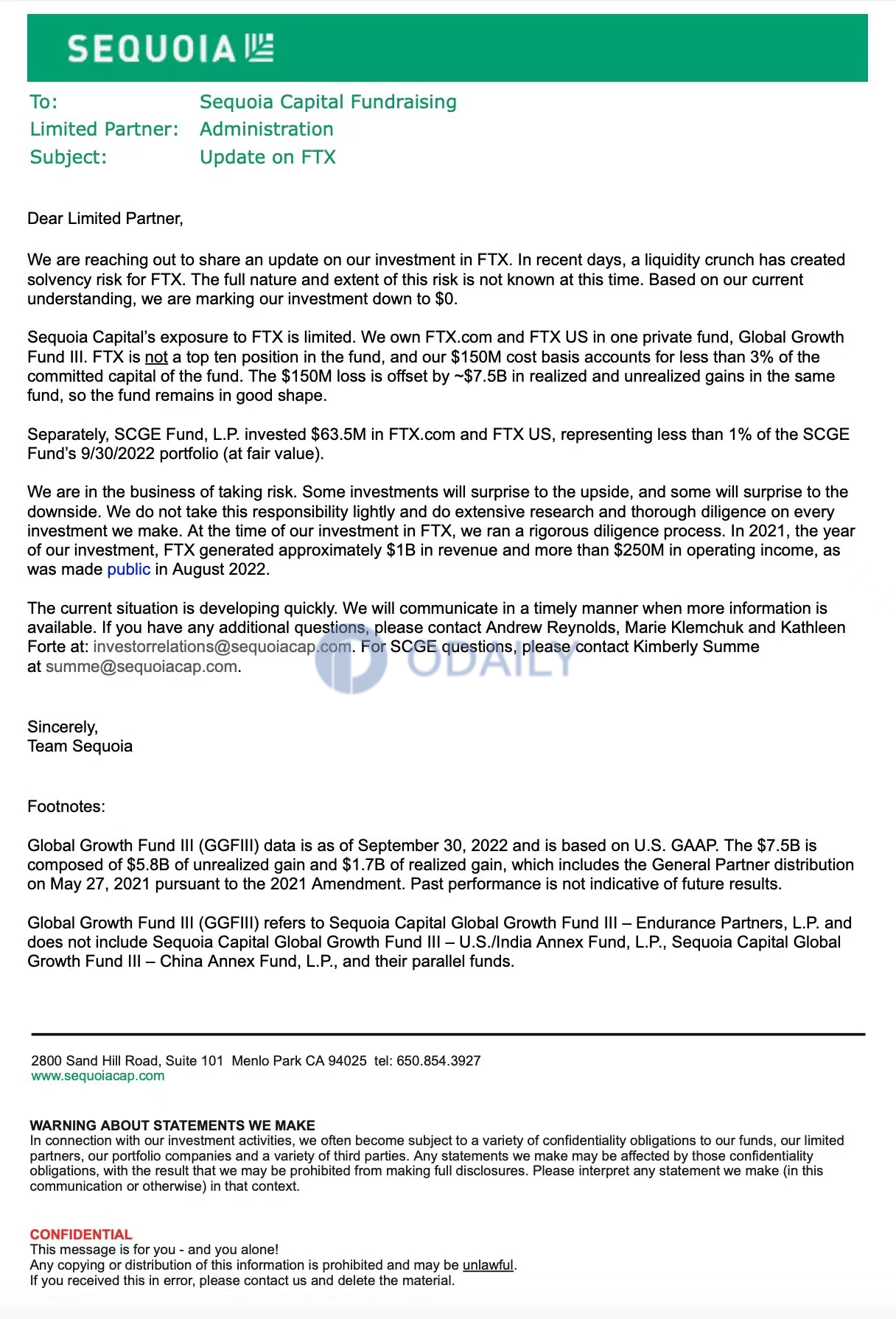

FTX’s most recent round of financing was completed in January this year. At that time, FTX completed a $400 million Series C round of financing at a valuation of $32 billion. Participating institutions included SoftBank, Paradigm, Tiger Global, and the Ontario Teachers’ Pension Plan Board . Not long ago (October last year), FTX also completed a $420 million B-1 round of financing at a valuation of $24 billion. Black Rock, Tiger Global, Ontario Teachers’ Pension Fund, Singapore investment company Temasek Holdings, 69 institutions including Sequoia Capital, Ocean Capital, International Venture Capital IVP, and ICONIQ Growth participated in the investment.

With the fall of FTX, there is a high probability that the shares that these institutions exchanged for real money will also disappear. This morning, Sequoia Capital issued a statement on FTX to LP, stating that the fund has invested a total of US$213.5 million in FTX and FTX US, which has been impaired to zero.

The situation of other institutions should generally be similar to that of Sequoia.

Institutions with financial involvement with FTX

As FTX closes the withdrawal channel, customers (including retail investors...) who still have funds in FTX will probably have no hope of withdrawing funds in a short period of time. At present, many institutions and projects have come forward to declare their exposure to FTX, and some have admitted that certain unexpected losses will indeed occur due to this incident.

Among them, the situation of Multicoin Capital is relatively serious. Its managing partners Kyle Samani and Tushar Jain stated in a letter to the fund’s LP on Tuesday that about 10% of the fund’s assets under management (AUM) are still waiting for withdrawals on FTX. . In addition, market makers Amber Group and Wintermute both stated that although they have reduced their risk exposure to FTX, there are still withdrawals of some assets on the platform that have not been processed.

As for lending institutions, it is unclear which institutions have provided loans to FTX (considering the three arrows, this may be the next big thunder). As for the leading lending institution, Nexo has clarified that it has not provided loans to FTX or Alameda, and has raised all funds in the exchange; Genesis Trading stated that it has no loan relationship with FTX, but due to violent market fluctuations, it is hedging and selling mortgages There was still a loss of $7 million after the product.

FTX's "direct descendant projects"

Undoubtedly, the project most impacted by the FTX incident this round is Solana (SOL). This once star project has been cut in half in the past few days. There are still a large number of pledged SOLs that are waiting for the pledge to be unlocked. It is expected that the selling pressure will not subside for some time to come.

In addition, many other projects in the Solana ecosystem are also more involved with FTX and Alameda, many of which are directly invested or incubated by them, such as Serum (SRM), MAPS (MAPS), Bonfida (FIDA) and so on.

Regarding which projects FTX and Alameda have invested in, some friends in the community have also conductedtidysecondary title

profit side

Similar to the injured party,The most direct beneficiaries after the fall of FTX can be roughly divided into three groups: one is the centralized exchange (CEX) represented by Binance; the other is the decentralized exchange (DEX) represented by dYdX ; The third is other projects that are in direct competition with some FTX "direct descendant projects".

CEX

In terms of CEX, Binance is naturally the biggest winner. So far, apart from the possible competitive pressure in some local areas (such as Coinbase in the United States), Binance’s position as the “number one player” globally is unshakable.

In addition to Binance, some of FTX’s original market share is expected to flow to some other second-tier exchanges with good reputation. At present, OKX, BitMEX, Crypto.com and many other companies are scrambling to announce their reserves. Both to appease existing users and to attract potential FTX exodus traffic.

DEX, especially the derivatives market

FTX’s thunderstorm this time has seriously impacted the reputation and image of CEX in the hearts of users. It is expected that after this campaign, some users will choose to bid farewell to CEX, which always has black box risks, and turn to the embrace of decentralization.

Since FTX's main business is perpetual contract transactions, among many DEXs, the derivatives market is expected to experience the largest traffic growth. This expectation has also been reflected in the market. The leading decentralized derivatives exchange dYdX bucked the trend and rose against the trend. As of the publication, it was tentatively reported at 1.526 USDT, an increase of 11.88% in 24 hours.

Projects that are in direct competition with FTX "direct descendant projects"

secondary title

Or maybe everyone is a loser

Although from the point of view, with the decline of FTX and its related projects, the cake can be re-divided, but considering that the already battered market confidence has been severely frustrated again, the size of this cake may also face shrinking. In this way, everyone may be a loser.

In addition, the FTX matter has received the attention of many regulatory agencies, which is bound to attract a new round of regulatory pressure. Some people may say that in the long run, compliance is the ultimate way out, and the advance of regulatory rhythm may not be a bad thing. I agree with the statement in the first half of the sentence, but I tend to think that gradual regulatory intervention is the least friction and damage to the industry. According to the path, such a vicious event will only lead to "storms". Once the correction is overdone, it may cause irreparable consequences.