This article comes from MediumThis article comes from

A few days ago, I asked a question on Twitter: "Who will be the Lehman Brothers of this crypto lending cycle?" Many people said it was FTX, and I laughed it off. I never believed that FTX would crash. However, in the past few days we have received news from various parties. The catalyst for its bankruptcy was the same as ever, a good business overextended and then flooded with cheap credit against its rising high valuation. As currency became expensive, they couldn't hide it anymore. But to be optimistic, I believe that the last candle of this crypto bear market is about to go out and we will come out of the bear market.

secondary title

event backtracking

It all started with a Coindesk article describing details of the leaked Alameda balance sheet.Of its $8 billion in liabilities, it has $292 million in "locked FTT" and $7.4 billion in loans. Other significant assets on the balance sheet include $3.37 billion in cryptocurrencies and a significant amount of the Solana blockchain’s native token — $292 million in “unlocked SOL,” $863 million in “locked SOL,” and $41 million in "SOL Collateral". SBF was an early investor in Solana. Other tokens mentioned are SRM (a token from Serum, a decentralized exchange co-founded by SBF), MAPS, OXY, and FIDA. There was also $134 million in cash and equivalents and $2 billion in equity securities investments.

Most of the assets on their balance sheet are illiquid FTT tokens and a bunch of crap coins.

Let's break down why FTT is so important to the FTX/Alameda empire.

According to FTT's stated token economy, FTX promises to use one-third of all transaction fees to buy back FTT. SBF owns a majority stake in Alameda, and he is constantly diluting his FTX stake in order to obtain capital from VC firms. A significant portion of FTX's revenue is transferred from FTX to Alameda through Alameda's substantial FTT stake. Presumably, Alameda received a substantial FTT allocation, provided basic market-making services for FTX, and participated in the FTT ICO.This is not ideal for FTX investors, but it is not the cause of fatal blow to FTX solvency.

If FTX did loan out the funds, this in itself is not a fatal problem. FTX is free to loan its proceeds to anyone. But the most pressing question is whether FTX re-hypothecated customer deposits to Alameda with FTT as collateral. And, as part of FTX, whether the value of FTT falls, or the value of some garbage coins on Alameda's balance sheet, will cause Alameda to go bankrupt. Finally, if Alameda becomes insolvent, will FTX lend out of client funds to prop it up? These are the questions people are asking after its balance sheet was exposed.

secondary title

How will it develop in the future?

We don't have a definite answer to this question. However, Binance signed a non-binding letter of intent to acquire FTX in its entirety, promising to attempt to pay all customer deposits in full.(Odaily note:(Odaily note:)According to the latest news on November 10, Binance gave up the acquisition of FTX based on the results of due diligence.

This indicated that FTX had a run on deposits and was unable to satisfy all withdrawal requests from customers. Otherwise, why would FTX need a Binance bailout? Wouldn't getting capital from VCs save Alameda?

The “two big lessons” CZ mentions are clearly implying that FTX may have done something shady with their clients’ funds, so they were “caught out” when the bank run happened.

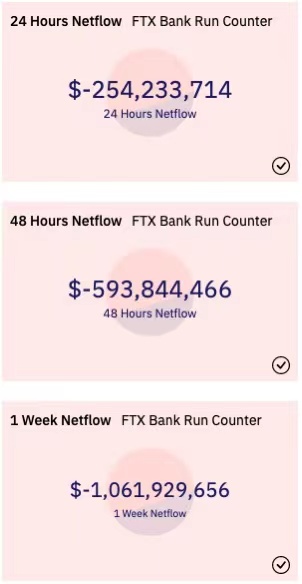

Last week, $1 billion in deposits were withdrawn from FTX, which is what led to this dire turn. These are processed withdrawals only. We don't know how many users are still waiting to get their money back.

Is Alameda insolvent or bankrupt?

We don't have a definite answer to this question. However, if FTX needs a bailout from Binance, and the reason it needs it is because FTX provided financial help to Alameda, then we can assume that Alameda may also be “dead.”

Can this deal really be done?A non-binding letter of intent is all well and good, but Binance would be better off with an explicit commitment to acquire FTX and segregate all of its liabilities from its other assets. I'm guessing Binance's corporate finance folks are busy looking into FTX and Alameda's finances. If the gap is too big, then I expect Binance to walk away from the deal.If Binance can't or won't do the deal, no one can afford to lose a lot on FTX.

text

What if FTX can't find a "new master"?

Similar to Mt Gox, we could be witnessing another bankruptcy ending, with depositors queuing up to get back what they can, which could be a long or short process. I think FTX assets are complex and it could take a long time to recover any part of the deposit.

Which companies that operate crypto lending have exposure to FTX and/or Alameda?

SBF is the most original credit king of all cryptocurrencies, he is a crypto pioneer. It was previously declared that investing with SBF is the only way to get rich, and then look at the dilemma Solana is facing now.

So, if there is a chance that FTX could use client funds to save Alameda, the two entities may use their reputations to borrow as much money as they can, grabbing at straws. Therefore, it is very likely that this possible outstanding debt has already affected the loan books of the remaining major centralized lenders.

Given this potentially large exposure, the question becomes - can the largest centralized banks survive:

Who can and will not stop the Fed Chairman's determination to curb inflation by continuing to raise short-term interest rates and reduce the size of the Fed's balance sheet?

Implosion of LUNA/TerraUSD?

The bankruptcy of Three Arrows Capital?

Now, FTX and Alameda may be out of business?

secondary title

Summarize

Summarize

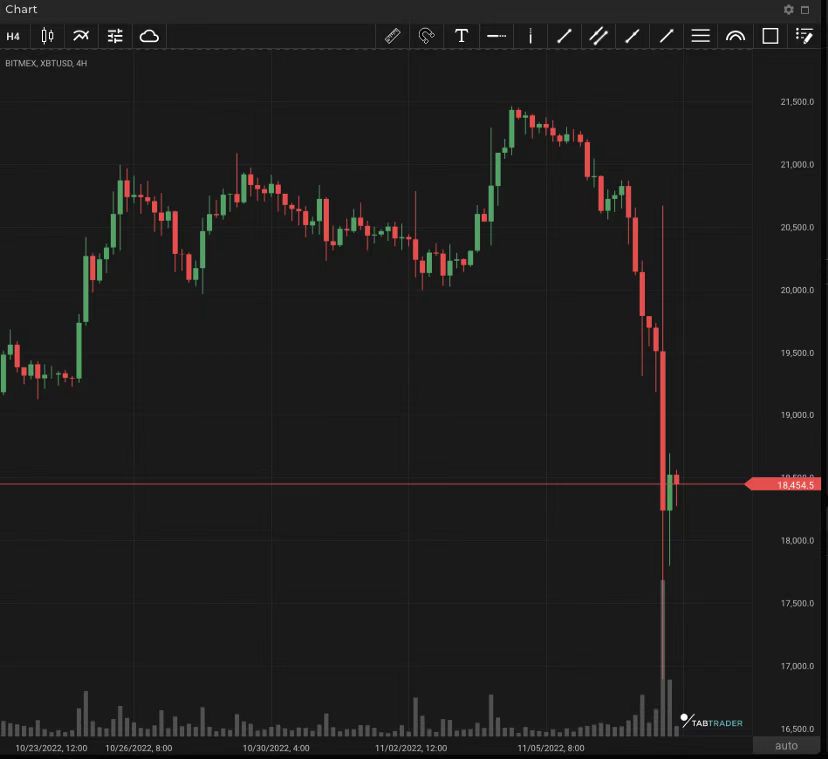

Bitcoin fell to nearly $17,500 in the XBTUSD perpetual contract on BitMEX. Across various other spot exchanges, Bitcoin experienced similar declines, dropping to levels close to $17,000. Get ready for a longer low, because it's coming.But the advantage of cryptocurrencies is that no central bank will bail out reckless corporations with newly printed fiat money.

The cryptocurrency industry will be forced to absorb these blows quickly, allowing it to recover quickly and emerge stronger than ever.Before I close this post, allow me to be clear:Centralized exchanges will always face the problem of customer distrust. FTX is not the first high-profile exchange to fail, nor will it be the last.