Over the past week, the market has been flooded with speculation (and accusations) about SBF and FTX. With the intervention of CZ, the battle situation continued to intensify and deepen. Everyone was shocked by the way things went last night. CZ intends to acquire FTX. The encryption market ushered in an extremely short-lived recovery. However, with the sound of "acquisition may not be possible due to the anti-monopoly law", the market that had just risen fell sharply again.

secondary title

The parties speak out

November 11

Binance Holds a Position of 5% of FTT’s Total Supply After Abandoning FTX Acquisition

Although Binance announced that it would not acquire FTX, it still currently holds 5% of the total supply of FTT, which is worth about $65 million as of press time. In addition, a person involved in Binance’s due diligence on FTX said that before announcing its abandonment of the acquisition of FTX, Binance was able to sell not many FTXs. As more and more people dumped FTT, Binance's FTT position increased sharply.

November 10

SBF: FTX International's current total asset/collateral value is higher than customer deposits, but liquidity is problematic

At 10 o'clock tonight, Beijing time, FTX founder SBF sent 22 tweets in a row to respond to the reasons behind FTX's recent liquidity crisis.

FTX International's current total asset/collateral market value is higher than customer deposits (varies with price). To translate this tweet, click hereview full text。

SBF letter to employees: It has talked with Sun Yuchen and will try to conduct a round of financing next week

A letter from FTX founder Sam Bankman-Fried (SBF) to internal employees leaked by crypto KOL Cobie on Twitter. SBF stated that FTX still has the possibility of raising funds in theory, which is FTX’s top priority next week. , Justin Sun, as a potential investor, is already in dialogue with him. In addition, SBF also stated that Binance may not have plans to complete the transaction at all.

November 9

Binance says it has never taken on debt

CZ tweeted that two lessons can be learned from this FTX incident: 1. Don’t use the tokens you created as collateral. 2. If you run a cryptocurrency business, don’t take out loans. Don't use capital efficiently. Keep a large reserve fund. Binance has never used BNB as collateral and has never taken on debt.

SBF's personal assets fell by more than 90%

FTX CEO Sam Bankman-Fried's worth after this incidentrapid decline. Currently, SBF has disappeared from the billionaire index tracked by Bloomberg. Before FTX's cash crunch, SBF was worth an estimated $15.6 billion. According to Bloomberg, $14.6 billion evaporated overnight, and his personal wealth is estimated to have plummeted nearly 94% in one day to $991.5 million, a record among the Bloomberg Billionaires Index. The biggest drop in a single day.

In addition, Vitalik Buterin, the founder of Ethereum, responded under related topics, saying, "$1 billion is still much more than what I have."

Binance will provide proof of assets

Binance Founder CZ Makes Proof of Assetstake a stand, he said that banks practice a fractional reserve system, while crypto exchanges should not. And said that Binance will soon start to make proof of reserves to maintain full transparency.

Binance Expands SAFU Fund to $1 Billion

postpostIt said that in order to adapt to the recent price fluctuations, Binance has increased the user security asset fund (SAFU) again to 1 billion US dollars, BUSD and BNB addresses are about 700 million US dollars, and BTC addresses are about 300 million US dollars.

November 7

Alameda speaks out to support the bottom, FTT $22 defense battle begins

Alameda Research Co-CEO Caroline Ellison on Twitterto respondAccording to Changpeng Zhao, "If you want to minimize the impact of the market on your FTT sales, Alameda is happy to buy all FTT from you at today's price of $22".

November 6

The curtain of "Lehman Moment" kicked off, Binance liquidated FTT

TweetTweetsecondary title

Stakeholders

November 11

Chain CEO: Due to liquidity problems with FTX exposure, he is selling blue-chip NFT to raise funds

Deepak.eth, an NFT collector and CEO of Chain Protocol, tweeted that Chain Protocol has an eight-figure risk exposure on FTX. The project is currently experiencing liquidity problems, so it decided to sell a large number of precious blue-chip NFTs to raise funds. At present, all NFTs for sale have been listed on Deepak.eth’s twitter, indicating that 8000ETH is considered to be packaged or sold at a single highest price.

Tether CTO: No plans to invest or borrow in FTX/Alameda

Tether CTO Paolo Ardoino issued a document stating that Tether has no plans to invest in or borrow from FTX and Alameda.

Bloomberg: Bahamian regulators have frozen assets of FTX Digital Markets

Bahamian regulators have frozen the assets of FTX subsidiary FTX Digital Markets. Separately, the Bahamas Securities Commission is seeking a provisional liquidator for the assets.

Ontario Teachers' Pension Fund: Invested a total of $95 million in FTX and FTX US, accounting for less than 0.05% of total net assets

Ontario Teachers' Pension Plan (Ontario Teachers' Pension Plan) issued a statement on FTX stating that it invested a total of US$75 million in FTX and FTX US in October 2021, and added an additional US$20 million to FTX US in January 2022. Follow-up investment in dollars. While the future of FTX remains uncertain, any financial loss on the investment would have limited impact on the fund, as the investment represents less than 0.05% of the retirement fund's total net assets.

Encrypted lending company BlockFi announced that it will suspend withdrawal services, asking customers not to deposit in BlockFi Wallet and Interest Accounts now.

As previously reported, Flori Marquez, founder of the encrypted lending company BlockFi, tweeted that all BlockFi products are fully operational, including deposits, withdrawals, transactions, and lending. BlockFi, which has a $400 million line of credit from FTX, is currently a separate business entity from FTX and will remain so until at least July 2023.

November 10

Tether starts freezing USDT addresses owned by FTX at the request of law enforcement

Tether started freezing USDT addresses owned by FTX at the request of law enforcement. Data on the chain showed that an unknown address with a balance of 46,360,701 USDT was frozen, and the address was later confirmed to belong to FTX.

CoinShares: about $30.3 million worth of assets in FTX

Digital asset investment firm CoinShares said about $30.3 million of its cryptocurrencies and other assets are in FTX, about 11% of its assets.

CZ: The President of El Salvador claims that he has not deposited BTC in FTX and has never had any business dealings with it

According to CZ, who just exchanged information with El Salvador President Nayib, he said: "We don't have any bitcoins in FTX, we have never had any business dealings with them."

Alameda borrowed short USDT on Aave, and sold USDT on Curve in exchange for USDC

Elindinga, research director of 21.co, the parent company of 21Shares, said that Alameda shorted USDT by borrowing on Aave (so the APY of USDT is higher), and sold USDT on Curve in exchange for USDC.

Tonight, the Curve 3pool has tilted, and USDT accounted for 83.17%. The conversion ratio of USDT and USDC is 1:0.987318. There is a negative premium of more than 1% when USDT is exchanged for BUSD and USDC.

Binance: Abandoning FTX Acquisition Based on Due Diligence Results

Odaily News Binance officially issued a statement saying that based on the results of the company’s due diligence, as well as the latest news reports about the improper handling of customer funds and the investigation of the so-called US agency, it has decided not to pursue a potential acquisition of FTX.com.

In the beginning, Binance hoped to be able to support FTX’s customers and provide liquidity, but these issues were beyond Binance’s control or ability to help.

Every time a major player in an industry fails, retail investors lose money. Over the past few years, Binance has seen that the crypto ecosystem is becoming more resilient, and Binance believes that abnormal actions that misuse user funds will sooner or later be eliminated by the free market.

As the regulatory framework evolves, the ecosystem will grow stronger as the industry continues to move toward greater decentralization.

Binance Acquisition of FTX Initially Traded at $1, Sources Say

According to people familiar with the matter, the transaction price of Binance’s acquisition of FTX.com was initially at $1, but despite this, Binance still gave up the acquisition of FTX.com after due diligence. Earlier news, the Federal Trade Commission and the Commodity Futures Trading Commission have launched investigations into FTX this morning, which means that Binance will not consider entering into a deal with FTX's independent business. Counsel for the deal worried that U.S. regulators would block the sale of a U.S. entity to Binance, which has multiple public investigations involving the Justice Department and the Internal Revenue Service.

FalconX has no exposure to Alameda and less exposure to FTX

Raghu Yarlagadda, co-founder and CEO of FalconX, an encrypted financial services company, tweeted that FalconX, as one of the largest participants in the encrypted market, will cooperate with most major liquidity providers including Alameda and FTX, but has no support for Alameda. Risk exposure, less exposure to FTX.

In addition, Raghu also said that FalconX will continue to operate as usual with enhanced risk and infrastructure security monitoring.

Justin Sun will work with FTX to find a solution

Justin Sun, the founder of TRON and a member of Huobi Global’s global advisory committee, said through his personal Twitter account that he will work with FTX to find a solution to make the situation develop in a positive direction. , BTT, JST, SUN and token HT holders of Huobi exchange to provide support.

In addition, Sun Yuchen's tweet "will work with FTX to find a solution" was reposted by FTX's official account and was pinned by FTX. This seems to imply the possibility of further cooperation between the two parties in the future.

As previously reported, at present, the transactions of TRX, JST, SUN, and HT on FTX have resumed, and the withdrawal function is being processed.

Multicoin Capital Holds FTX Related Exposure

Soldman Gachs, creditor of Three Arrows, shared a letter from Multicoin Capital to LP on Twitter. In addition to clarifying the cause and process of the FTX incident, the letter also stated that "For transparency and communication, we hope to provide updates. The situation with LUNA/UST Instead, the Fund invests directly in FTX. The Fund has exposure to assets and entities that are directly and indirectly affected by the situation: direct investments include assets held on FTX and FTT positions, and indirect investments include SOL positions and SRM positions .”

Sequoia Capital invested a total of US$213.5 million in FTX and FTX US, which has been impaired to 0

Sequoia Capital released its Global Growth Fund III (GGFIII) statement on FTX to LPs to share the latest progress of its investment in FTX. The statement stated that the liquidity crunch poses a solvency risk for FTX. The full nature and extent of this risk is currently unknown. Based on its understanding of the current situation, Sequoia Capital is reducing its investment in it to $0.

Sequoia has limited exposure to FTX, but has investments in FTX.com and FTX.US in GGFIII. FTX isn’t among the top 10 positions in the fund, and the $150 million cost basis represents less than 3% of the fund’s committed capital. The $150 million loss was offset by a $7.5 billion realized and unrealized gain, so the fund remains in good shape. Separately, the SCGE Fund invested $63.5 million in FTX.com and FTX.US, representing less than 1% of the SCGE Fund's Sept. 30, 2022 portfolio (measured at fair value). When we invested in FTX, we performed rigorous due diligence. In 2021, the year we invested, FTX generated approximately $1 billion in revenue and over $250 million in operating income, which was announced in August 2022. The current situation is developing rapidly. If there is any further news, we will communicate in time.

GSR: will bear the customer losses caused by the collapse of FTX, and will no longer trade on Huobi

Jakob Palmstierna, CEO of crypto market maker GSR, said it has no exposure to Alameda and exposure to FTX is limited to a single-digit percentage of the company's cash balance. The company will bear the customer losses caused by FTX’s collapse and will no longer trade on Huobi.

Foreign media: Tether began to freeze the USDT address owned by FTX at the request of law enforcement agencies

Odaily News According to reports, Tether has begun freezing USDT addresses owned by FTX at the request of law enforcement agencies. (Bitcoin Magazine)

According to Whale Alert, according to the data on the chain, an unknown address with a balance of 46,360,701 USDT was frozen, and then the address was confirmed to belong to FTX.

November 9

Genesis and Crypto Clarify Own Risks

clarifyclarify, their exposure to FTX is minimal and will not be affected by this event.

Genesis official Twitter said, "As far as today's market events are concerned, we have managed our loan books and have no significant net credit exposure. In addition, Genesis has no exposure to tokens issued by centralized exchanges."

Crypto.com CEO Kris Marszalek also tweeted, "Our direct exposure to the FTX crash was minimal, with less than $10 million of our funds held for client trade execution, the same as our two consecutive years Worldwide revenue of more than $1 billion is nothing compared to that."

Jump Crypto may be frustrated by over-investment in Solana ecology and FTX

Adam Cochran, Partner, Cinneamhain Venturestweeted, "I don't know about Jump Crypto, but I just realized that today must be a bad day for them, because they have an overinvestment in the Solana ecosystem and a co-investment in FTX. Currently, what I can find The status of addresses on several related chains is still stable.”

Credit liquidation warning lifted

Previously, according to CoinDesk reports, Amber Group and other institutions reached the maximum value in the Clearpool credit pool and received a "warning" label. Amber Group then responded that the permissionless pool was functioning normally.

Clearpool, Amber Group, Auros, etc. license pools on ClearpoolThere is no liquidation warningsecondary title

other practitioners

November 11

KuCoin CEO: No exposure to FTX and FTT

In response to the rumor on Twitter that "KuCoin has a large amount of exposure to FTX," KuCoin CEO Johnny Lyu responded, "This is false news. KuCoin has no exposure to FTX and FTT."

According to previous reports, KuCoin CEO Johnny called on users to stop FUD on Twitter, saying that "protecting user funds is KuCoin's top priority. We will release the Merkle tree reserve proof in about a month."

November 10

Amber Group: No contact with Alameda or FTT, transaction funds related to FTX accounted for less than 10%

Avalanche: No significant exposure to FTX or Alameda

Avalanche: No significant exposure to FTX or Alameda

Avalanche stated that the foundation does not use assets to speculate or take risks for short-term gain, and will never engage in the kind of "financial engineering" seen on the balance sheets of FTX and Alameda. My sympathy goes out to all those who have been adversely affected by the current situation and I hope everyone gets their assets back.

Avalanche stated that the foundation does not use assets to speculate or take risks for short-term gain, and will never engage in the kind of "financial engineering" seen on the balance sheets of FTX and Alameda. My sympathy goes out to all those who have been adversely affected by the current situation and I hope everyone gets their assets back.

Odaily News Aptos officially posted on social media that FTX does not hold Aptos Labs or Aptos Foundation funds, and the network will continue to operate as expected and will not be affected by this incident.

Odaily News Aptos officially posted on social media that FTX does not hold Aptos Labs or Aptos Foundation funds, and the network will continue to operate as expected and will not be affected by this incident.

As previously reported, Aptos announced on July 25 this year that it had completed a $150 million financing round led by FTX Ventures and Jump Crypto.

November 9

Ark Invest Adds 420,000 Coinbase Shares

After the news that Binance signed an agreement to acquire FTX's non-US business, the three funds under Ark Investment Management LLC managed by "Sister Wood" Cathie Wood totaledBuyMore than 420,000 shares of Coinbase stock were sold. Prior to this, Ark Investment also increased its holdings of Coinbase stock on October 24.

OKX does not have any debt exposure to FTX or Alameda Research

tweetstweetsSaid, "I sympathize with everyone affected by FTX. It is only a matter of time before the affected community recovers. OKX has no debt exposure to FTX, FTT or AlamedaResearch. We have always maintained a 1:1 reserve and never put customers' deposits For other business. Planning to issue our proof of reserve in the next few weeks (less than 30 days)."

Furthermore, it added, “At its core, OKX is a technology company, not a financial company. We do not use transactions as a way to generate profits. For true builders and believers, Crypto has never left.”

express

Circle CEO Jeremy Allaireexpress: Circle does not have significant exposure to FTX and Alameda. Circle has never loaned FTX or Alameda, never received FTT as collateral, and never held or traded FTT. Circle is a minority shareholder in FTX, and FTX is a minority shareholder in Circle. 80% of USDC reserves are held in US Treasury Bills of $3 million or less and are in custody with BNYM. The remaining cash reserves are held in fully segregated accounts at 7-8 banks for the convenience of USDC holders.

Huobi Voices to Accept FTX User Assets

announcementannouncement, indicating that the two will decide to permanently 1:1 rigidly accept all TRON tokens (TRX, BTT, JST, SUN, HT) on the FTX platform, and will coordinate and reconcile with the FTX platform based on the form filled out by the user. Withdrawal of TRX, BTT, JST, SUN, HT tokens. Huobi will support Binance’s due diligence and investment in the FTX exchange, as well as possible future acquisitions. Brother Sun, who loves "small essays", also wrote, "A grain of dust falling on the heads of ordinary people is like a mountain. Our starting point is always to report to the group to keep warm and the industry to save itself."

express

Coinbase CEO Brian Armstrongexpress, trading activity on the Coinbase platform is increasing, and there are no plans to acquire FTX US, a US subsidiary of FTX.

Tether has no contact with FTX or Alameda

Tether CTO Paolo ArdoinoTweet, to be clear, Tether has no contact with FTX or Alameda.

OKX Plans to Release Proof of Reserves in the Next 30 Days

OKXTweet: “It is critical for all major cryptocurrency exchanges to publicly share their auditable merkle tree Proof of Reserves or POF. We plan to release this in the next few weeks (within 30 days). This is an established industry An important step toward baseline trust."

November 8

Xu Mingxing, Founder of OKGroup: The collapse of FTX will not benefit the entire industry, and I hope that CZ and SBF will reach a new agreement

secondary title

Risk Alerter

November 10

Arthur Hayes: The final drop is coming

Odaily News BitMex founder Arthur Hayes published a blog post discussing the FTX incident and its impact on the market. The article reviewed the trend of the S&P after the financial crisis in 2008. Although the S&P only completed its historical bottom in March of the following year, but Arthur believes that since the encryption industry does not have a "helicopter money" rescue, the bubble will be released at the fastest speed, and "the final decline is coming." At the same time, Arthur pointed out that FTX is not the first, but it will not be the last trading platform with a thunderstorm.

Zhu Su: Alameda may have been playing against FTX users, but the LUNA incident caused huge losses

Zhu Su, co-founder of Three Arrows Capital, tweeted that Alameda may have been internalizing FTX client liquidations for many years.

However, in the LUNA mine explosion incident, LUNA experienced a unilateral sell-off for three consecutive days, and Alameda probably caused huge losses because it provided a large amount of liquidity for FTX.

November 9

Circle Warns of Flaws in Encrypted Corporate Balance Sheets

expressexpress, he believes that crypto businesses cannot use speculative tokens as the underlying assets of their vaults and balance sheets.

Jeremy Allaire said that he said it was scary to see such problems among peers and customer bases, saying: "In the market down cycle, the lack of transparency, lack of counterparty visibility, and the use of speculative tokens as vaults and balance sheets The underlying asset is the root cause of the problem. In past bull markets, much of the value creation has been almost speculative, and the focus on practicality has often been an afterthought or not at all. In addition, the lack of clear regulatory know-how in the U.S. According to the policy, the encryption industry must decisively shift from the speculative value stage of encryption to the practical value stage, and based on openness and transparency, durable and highly practical encryption products should be built in the future.”

Zhu Su speaks out, pays tribute to the older generation

tweetstweetsmeans that in the future, they may rebuild their homes with new goals.

“There I was, surfing the waves of the ocean, and in a moment was washed away, with broken boards and reefs everywhere. As the golden boy in the wider sense of the industry + business cycle, the sudden pain of business failure and loss of purpose, As hard as the ostracism and demonization that came with it. Thank you to everyone who supported us throughout and I deeply appreciate your empathy. I want to say to everyone who is not making judgments with reservations, I understand your skepticism and I Deeply thank you for your patience and enduring. To those who attack us and try to make us a scapegoat for the entire industry, I know the vitriol itself comes from pain and misdirection, you must have suffered tremendously and are looking to vent , some relief. I hope peace befalls you guys. Thanks to journalists and regulators who took a sober look at the facts, not hysteria, and let time prove that despite our mispositioning, our integrity stands firm. My heartfelt thanks to the old A new homage has emerged from a generation with a keen sense of history and proportion."

"So what did I do? Catch up with long-lost friends, rebuild my spirit and my health. And surf, learn new languages, pray for those who were hurt with me, pray for those who wanted to hurt me, pray for those who were hurt Pray for people. So what next? I'm not sure, on the one hand I want to live a quiet life in the woods, on the other hand I want to rebuild my home with new purpose. Will share more thoughts and musings later, I Missing you all."

BitMEX Founder Thinks the Market Has Not Bottom Yet

Arthur Hayes, founder of BitMEXTweet, FTX is the Lehman of the encryption circle. He also said that the current market has not yet bottomed out. With reference to the S&P index hitting 666 points in March 2009, the price of Bitcoin at $17,500 is still at risk.

secondary title

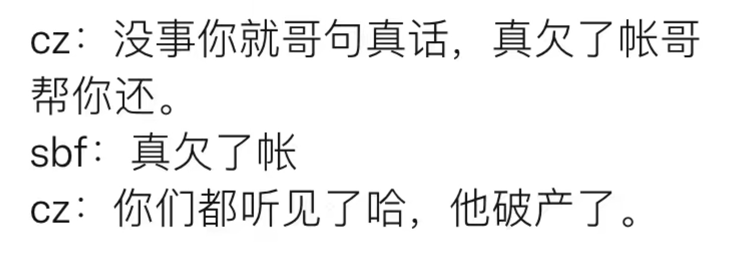

Tucao and jokes

When the market is jumping up and down, jokes and complaints become lubricants to adjust the tired spirit of traders. The addition of "old gods" such as DK and Zhu Su made this negative event even more comical. In this wonderful encryption war, the quantity and quality of jokes are not inferior to the event itself.

Related Reading

Related Reading

The epic reversal of the plot, CZ announced that it will completely acquire FTX

Four pictures show you what FTX has experienced

A Perspective on the DeFi Debt Crisis Alameda Is Facing Now

Encrypted Lehman moment: a full review of the market in the past 48 hours