This article comes fromCoindesk, original author: Sage D. Young

Odaily Translator |

Over the past week, the market has been flooded with speculation about SBF and its cryptocurrency exchange, FTX. Now, with FTX's planned sale to rival Binance, the whole affair seems to be on hold. By analyzing the liquidity data on the FTX chain, this article uses four charts to provide readers with a new perspective to understand how "this drama" escalated rapidly and eventually led to the decline of FTX.

secondary title

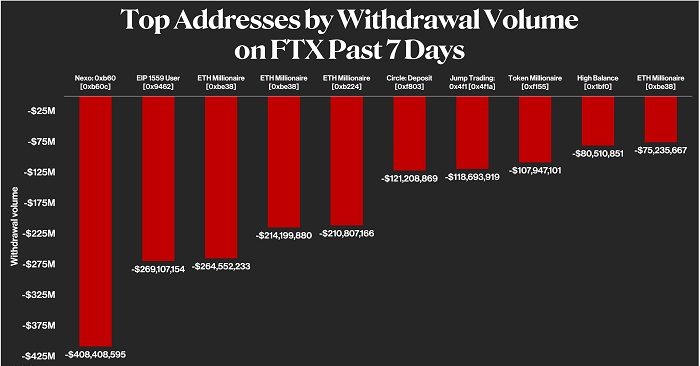

1. Top 10 FTX wallet withdrawals

The earliest red flags actually came from several addresses in the top 10 of FTX withdrawals. According to Nansen data, giant whale addresses including Nexo, Circle, and Jump Trading raised as much as 18.7 in the past 7 days. billion dollars of funds.

Nexo, a crypto lending platform with more than 5 million users worldwide, has withdrawn over $408 million worth of ETH from FTX, the company has executed at least 9 large transactions, each 4,999 ETH, blockchain Browser site Etherscan also confirmed Nansen's analysis was correct.

According to data from Coinglass, in the past 24 hours, the number of bitcoins on FTX has decreased by 19,941.64, and there are currently only 36.14 BTCs.

secondary title

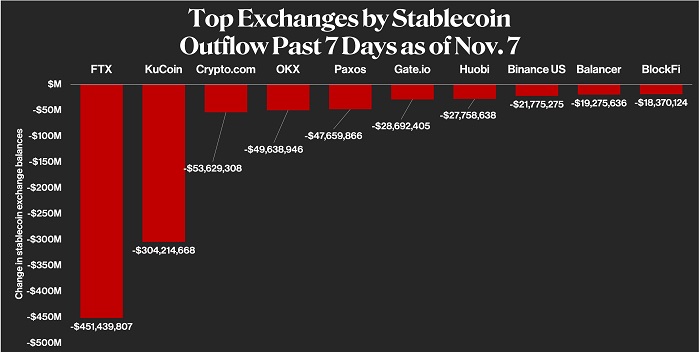

2. Outflow of stablecoins

With the outflow of a large number of stablecoins on the FTX platform, market volatility has further increased. According to Nansen data, in the past 7 days starting this Monday (November 7), FTX’s stablecoin outflow exceeded all other leading cryptocurrency exchanges. About $451 million worth of stablecoins have left FTX so far, more than the combined stablecoin outflows of KuCoin, Crypto.com, and OKX.

According to CryptoQuant data, the current total value of FTX stablecoin reserves is about 156 million U.S. dollars, which has fallen by more than 78% since October 24. FTX’s stablecoin reserves have fallen to their lowest level in a year, and market participants fear a repeat of the LUNA event on FTX, as UST deposits on the Anchor lending protocol began to drop rapidly as the first sign of Terra Luna’s debacle.

secondary title

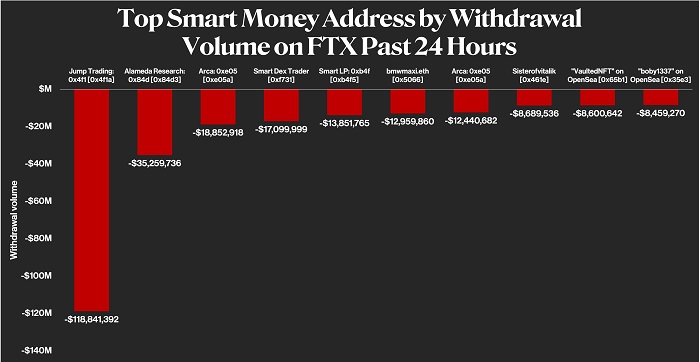

3. Top 10 “Smart Money” among FTX withdrawers

Still, according to data from blockchain analytics firm Nansen, prolific and active cryptocurrency traders have been moving their wealth out of FTX. The top 10 withdrawal wallets, classified by Nansen as “Smart Money,” have moved around $246.6 million worth of tokens in the past 24 hours.

The Nansen "Samrt Money" wallet identification standard is - if the wallet meets at least one of the following items, including:

1. Investment funds.

2. Provide liquidity (excluding so-called impermanent losses) through DeFi protocols (such as SushiSwap and Uniswap) and earn at least $100,000.

3. Among the top 300 addresses ranked by realized profit, only on-chain transactions that occur on DEX are considered.

Other noteworthy "Smart Money" include asset management company Arca and SBF's trading company Alameda Research, such as Alameda Research, which has transferred 92 million BIT (approximately $35 million) from FTX to their own addresses.

secondary title

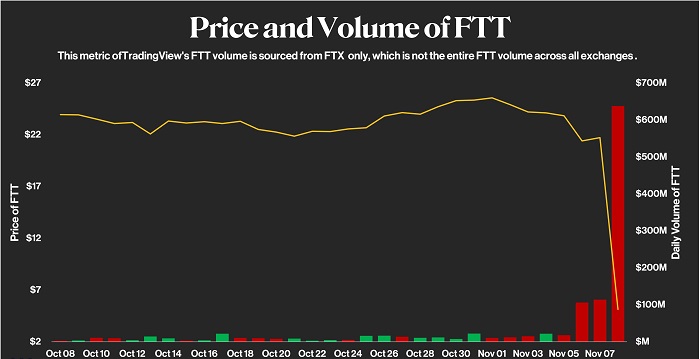

4. FTT price and trading volume

The chart above shows the daily price and trading volume of the FTT token on the FTX exchange. FTT is mainly used to provide holders with discounts on trading fees on the FTX market. Since November 2, the price of FTT has fallen by about 79%, and its trading volume has increased sharply.