The plot between Binance and FTX experienced two reversals overnight, from disputes to acquisitions to regulatory uncertainty, and the entire market also rose briefly and then fell sharply. BNB once rushed to 398 USDT last night, and then fell to 326 USDT; FTT rose to 21 USDT after a day’s decline yesterday, and then plummeted to 6.1 USDT, the lowest fell to around 2.5 USDT, a 75% drop in 24H. Crash is just one step away. Affected by this event, BTC dropped from 20,700 USDT to 18,466 USDT, and ETH also dropped from 1,579 USDT to 1,325 USDT. Other FTX-linked tokens and altcoins have fallen by about 10%-20%. It can be seen that the liquidity crunch FTX is currently facing (and its impact) may be more serious than expected.

At present, regarding the debt issues of FTX and Alameda Research that everyone is more concerned about, RWA.xyz analyzed the debt situation of the latter in the DeFi field through data, and Odaily compiled and sorted it out.

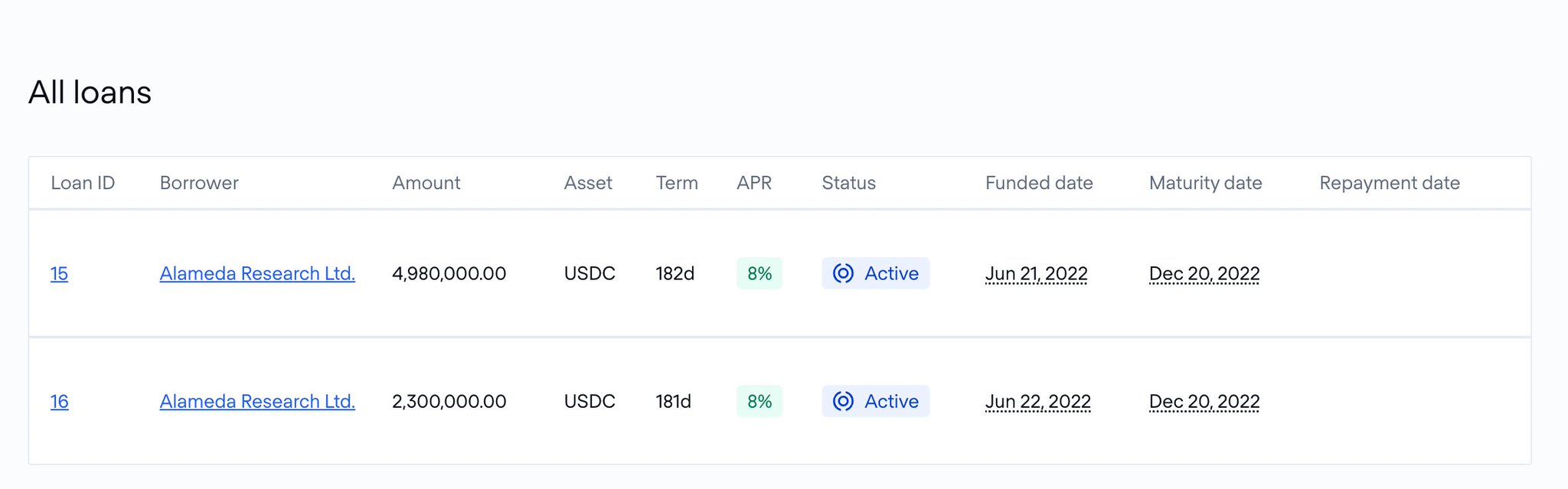

First, there is a $7.28 million loan from the TrueFiDAO pool, they successfully paid the interest a week ago, but the principal will be due in 50 days.

On a brighter note, Alameda still has $4.76 million in idle funds. But unfortunately, depositors appear to have started withdrawing their funds well before there was a risk of default.

$5.5 million loan from Alameda on September 15, 2016 from ClearpoolFi pool 2, Lenders: Apollo and Compound. Due to the mechanism design of Clearpool, Alameda neither pays interest nor has a set maturity date.

And Alameda's liquidity problems are spreading to crypto lenders, with multiple institutional crypto capital firms maxing out their credit pools on Clearpool. Amber Group, Auros and LedgerPrime have received “warning” labels on their respective Polygon Permissionless Pools on Clearpool because they reached 99% of the maximum credit limit available on the protocol. Folkvang and Nibbio also received a "warning" status on their Ethereum permissionless pools. Clearpool's loan dashboard shows the loans have a total debt of $14.8 million.

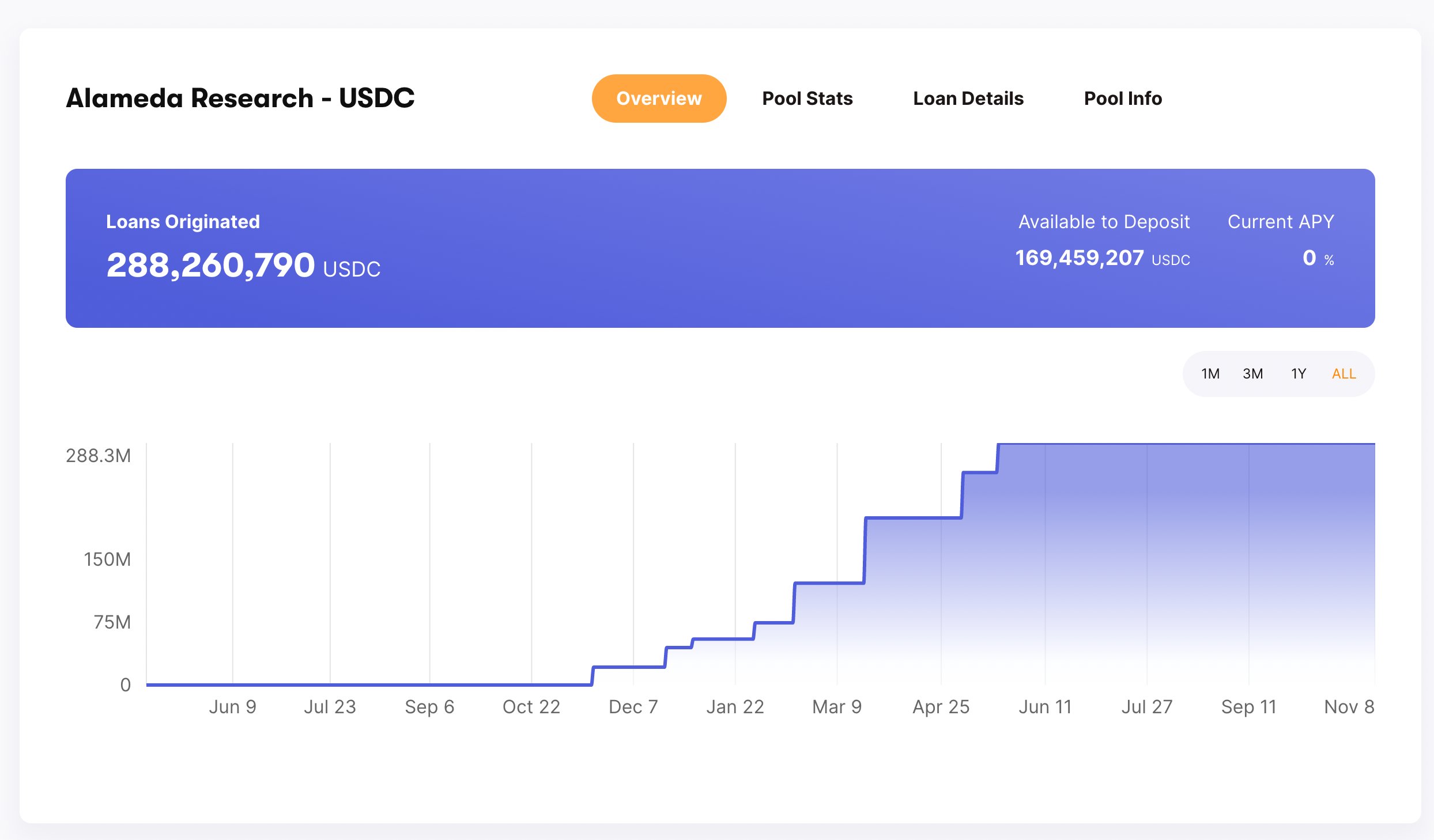

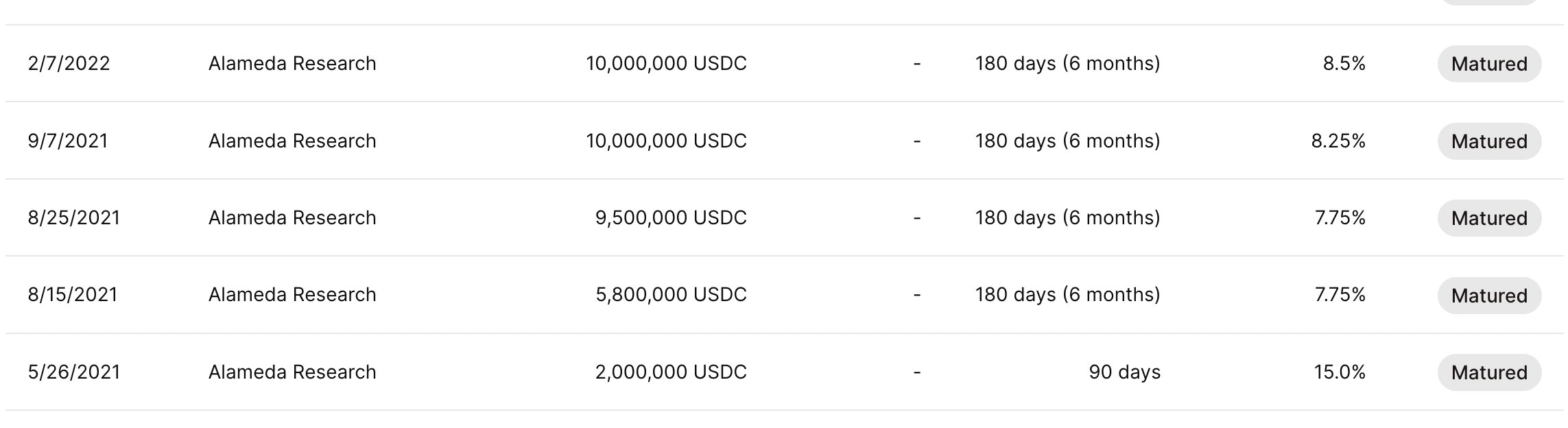

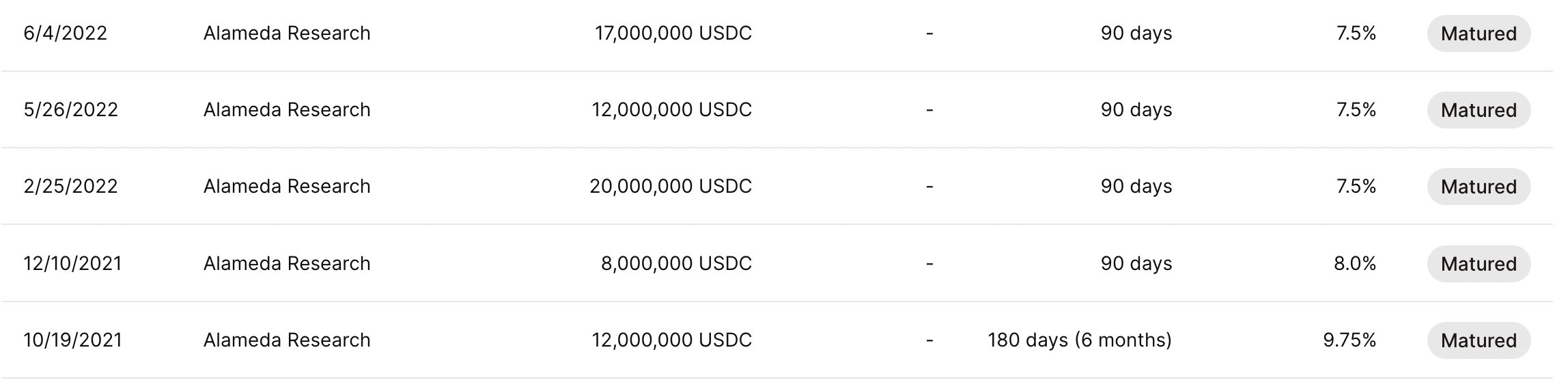

MapleFinanc provides them with a pool of nearly $300 million in loans, but currently has no active loans.

Below are the Maple pools managed by Ortho Credit and M11 Credit, although Alameda has over $100 million in loans in the past, with no outstanding loans.

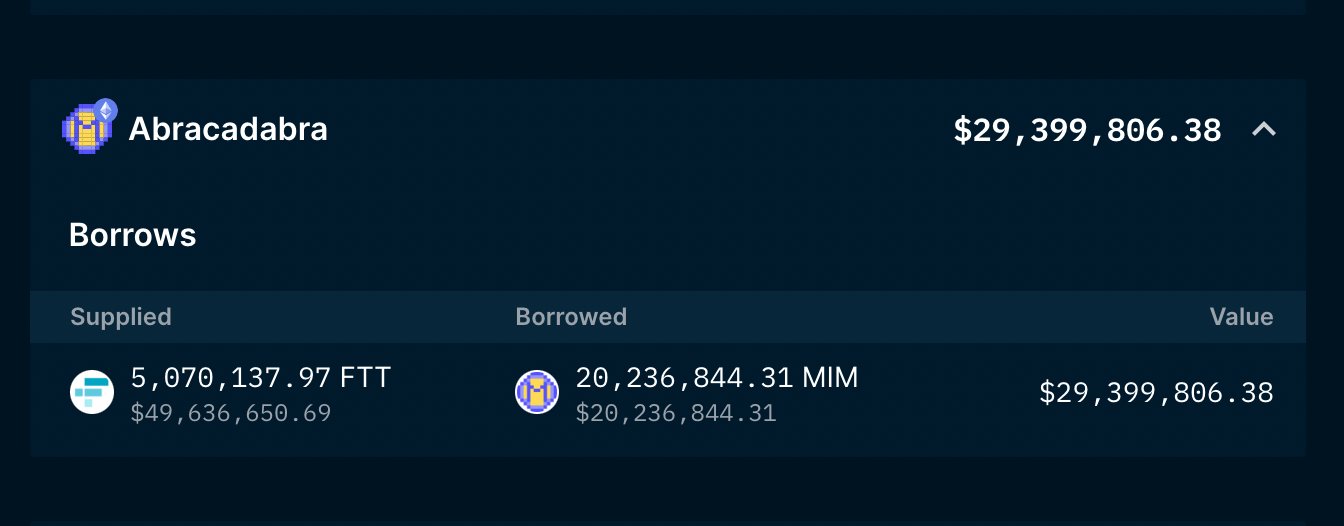

Alameda also borrowed over 20 million MIM tokens in FTT worth over $50 million. This may just be one of countless similar positions in the DeFi lending market, where losses are likely to be minimal due to their overcollateralized nature.

Four pictures show you what FTX has experienced