With the deepening of the battle between Binance and FTX, FTT, which is under heavy pressure today, fell below the $22 mark (That is, the price at which the Alameda CEO previously stated that he was willing to catch all selling orders) and then fell rapidly, and was temporarily reported at 16.97 USDT at around 14:35, a 24-hour drop of 23.07%.

secondary title

SOL

As a public chain strongly supported by SBF, Solana, which focuses on the concept of high performance, achieved a big explosion in the last round of bull market, and FTX also made a lot of money in the process. However, with the bearish market and the emergence of a new generation of competitors, the development momentum of Solana has also plummeted for a long time in the past, the currency price has been sluggish, and a large number of ecological projects have also begun to flow out.

After the outbreak of the "Binance vs FTX" battle, out of concerns about FTX, Alameda's financial situation and the final outcome, the panic surrounding SOL has continued to deepen, even in the case of successive releases of favorableWork with Google Cloud,NFT launched on Instagram,The phone will be delivered next month,EVM Compatible Network Coming Soon...), the price of SOL is still falling all the way, as of around 15:10, it was temporarily reported at 27.80 US dollars, a 24-hour drop of 15.23%.

secondary title

BIT

The relationship between BIT and FTT can be traced back to last year.

In October 2021, Alameda initiated a BIP-4 proposal to BitDAO, proposing to swap 100 million BitDAO governance tokens BIT (about 1% of the total) with about 3.3623 million FTT (about 1% of the total). At the same time, both parties need to publicly state that they will not sell each other's tokens within 3 years. The proposal was voted on October 30, 2021.

Today, while FTT dived, BIT also experienced a sharp drop, with a drop of more than 20%. As for the source of the selling pressure, Bybit (BitDAO initiator) CEO Ben Zhou pointed the finger at Alameda and FTT, suspecting that the latter two are filling the hole by selling BIT - "Someone promised not to sell the 100 million BIT they hold BIT, Bybit may have been cheated."

At the same time, in order to put pressure on Alameda, the BitDAO community also launched an emergency proposal, requiring Alameda to transfer 100 million BIT to the address on the chain within 24 hours for the BitDAO community to verify, otherwise it will be up to the BitDAO community to decide how to deal with the funds in the vault. 3.3623 million FTT.

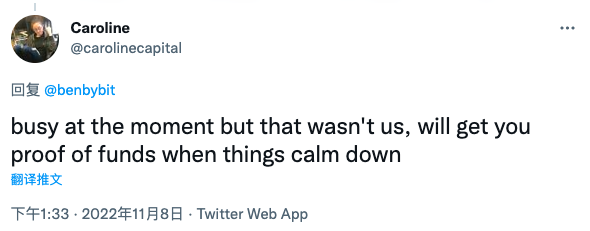

In response to Bybit's "accusations", Alameda co-CEO Caroline Ellison denied that she was selling BIT, and said that she is very busy at the moment, and will give proof of funds when things calm down.

secondary title

MIM

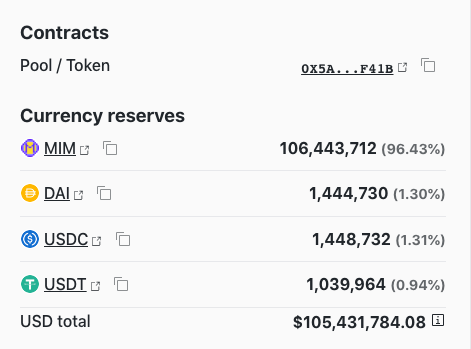

The stablecoin MIM is another project that has been severely affected.

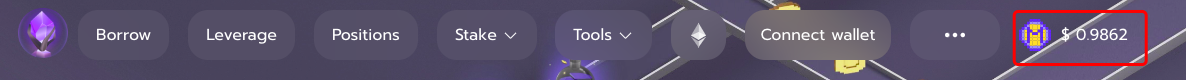

Since FTT is one of MIM's most important mortgage assets, when FTT fell rapidly, MIM also experienced a certain degree of de-anchoring, and even fell below $0.95 at one point. As of 15:40, as the market stabilized in the short term, MIM also rose back to around $0.986, but it has not yet recovered its anchor.

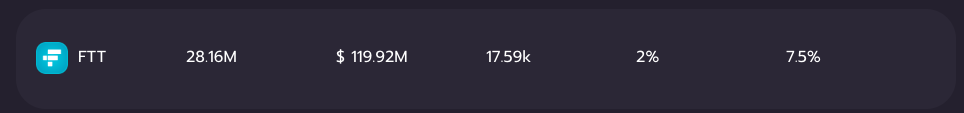

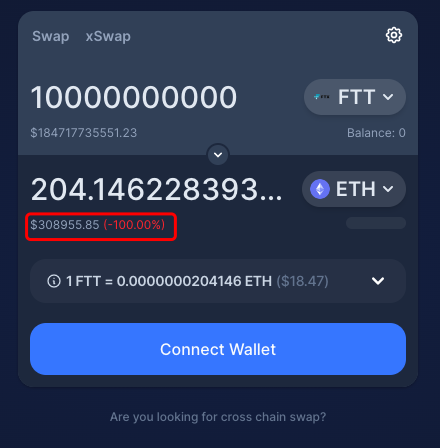

According to the mortgage situation of MIM, about 28.16 million MIM (accounting for 15.85%) are generated by FTT mortgage. Correspondingly, the total value of FTT used as mortgage assets is about 119 million US dollars, and the liquidation pain point is calculated from this Probably around $6.5 FTT. For the time being, the situation does not seem to be too critical, but due to the small scale of FTT liquidity in DEX on Ethereum (the main distribution chain of MIM) (the FTT in the main DEX Sushiswap is only about 300,000 US dollars), once FTT accelerates On the downside, prices on the chain are prone to large deviations, and related risks still need to be vigilant.

summary

summary

As one of the most powerful centralized entities in the current crypto world, the battle between Binance and FTX will inevitably involve many other roles. If the situation really intensifies in a certain direction, its scope of influence may even exceed that of UST, Three Arrows... After experiencing the storms in the past, the market seems to tell us that nothing is impossible. For ordinary investors, what they can do is to reduce their risk appetite and protect their "bullets" before the outcome becomes clearer. ".