1. Summary of Industry Dynamics

1. Summary of Industry Dynamics

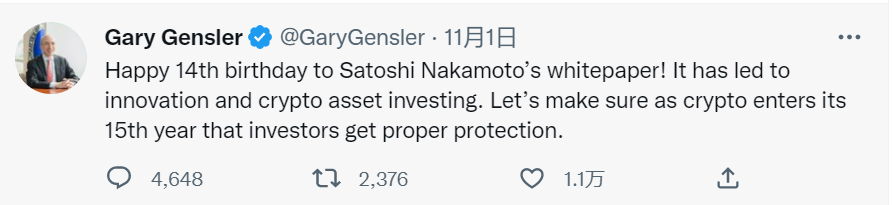

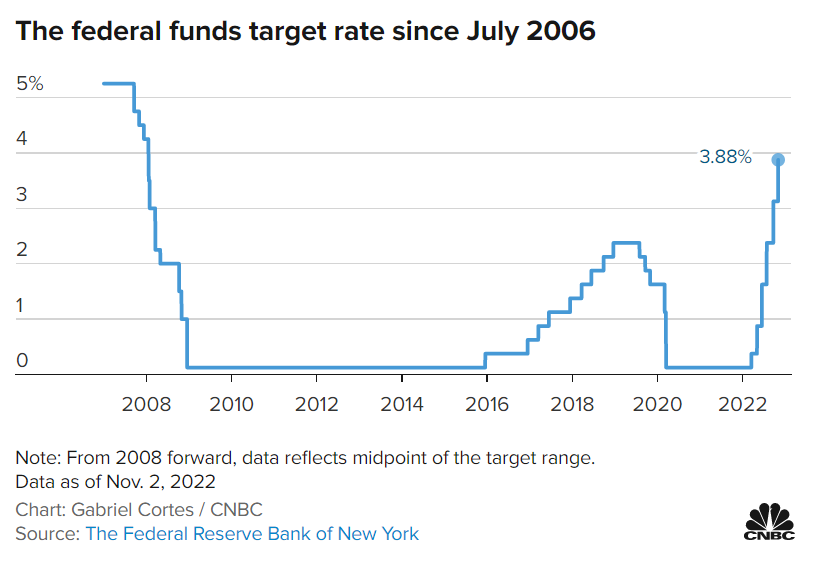

This week, the overall trend of U.S. stocks is weaker than that of the encryption market. The Nasdaq has been weak for five consecutive days, and the S&P index barely stopped its continuous decline on Friday. The biggest variable this week is the Federal Reserve’s meeting on interest rates. Powell showed his speech skills with hawks among doves and doves among hawks, which made it difficult for investors to grasp the future trend for a while. After Powell's speech, the Fed's interest rate hikes will change from each large rate hike to a slow and continuous rate hike mode. If the Fed raises interest rates at a slower pace and sets the target peak above 5%, it means that there is still room for more than 125 points of interest rate hikes, and each 25 basis points can be added more than 5 times until next year mid-year. A larger time span is like boiling frogs in warm water for US stocks, and it may be more difficult for ordinary investors. At the same time, Collins of the Boston Fed, who is also one of the 12 votes of the FOMC meeting committee members in 2022, also came out and said that it is necessary to prevent premature stop fighting against inflation. Cost, the longer the restrictive monetary policy is maintained, the funds in the economic system will continue to be pumped out, and it will be difficult for a large-scale bull market to appear in a short period of time. The expectation of raising interest rates by 50 basis points in December is gradually being established, and the possibility has also risen from 41% to 61.5%. It may have been good news for the market before, but the market’s concerns about boiling frogs in warm water have reduced the rate hike this time. benefits are gradually losing their effect. A clearer signal is likely to be known when the 11/10 CPI is announced.

2. Macro and technical analysis

2. Macro and technical analysis

The market is gradually desensitized from the traditional market and gradually enters the rebound range. We suggest that if the rebound is large, you can observe whether it breaks through the previous high point. If there is no breakthrough, you can choose an opportunity to short.

BTC is currently showing signs of an upward breakthrough. After the FOMC meeting, it did not adjust with Nasdaq, but rebounded. The rebound of other currencies was more intense. We suggest paying attention to whether it can break through the 22000usdt position. If it breaks through 22000usdt in the short term, an upward breakthrough is expected. We suggest that you can cautiously participate in the rebound in the short term.

The two-year U.S. debt has corrected to a high level and is currently at about 4.6%. The interest rate will be raised by 50bp in the next December.

The Nasdaq as a whole is still in a downward range.

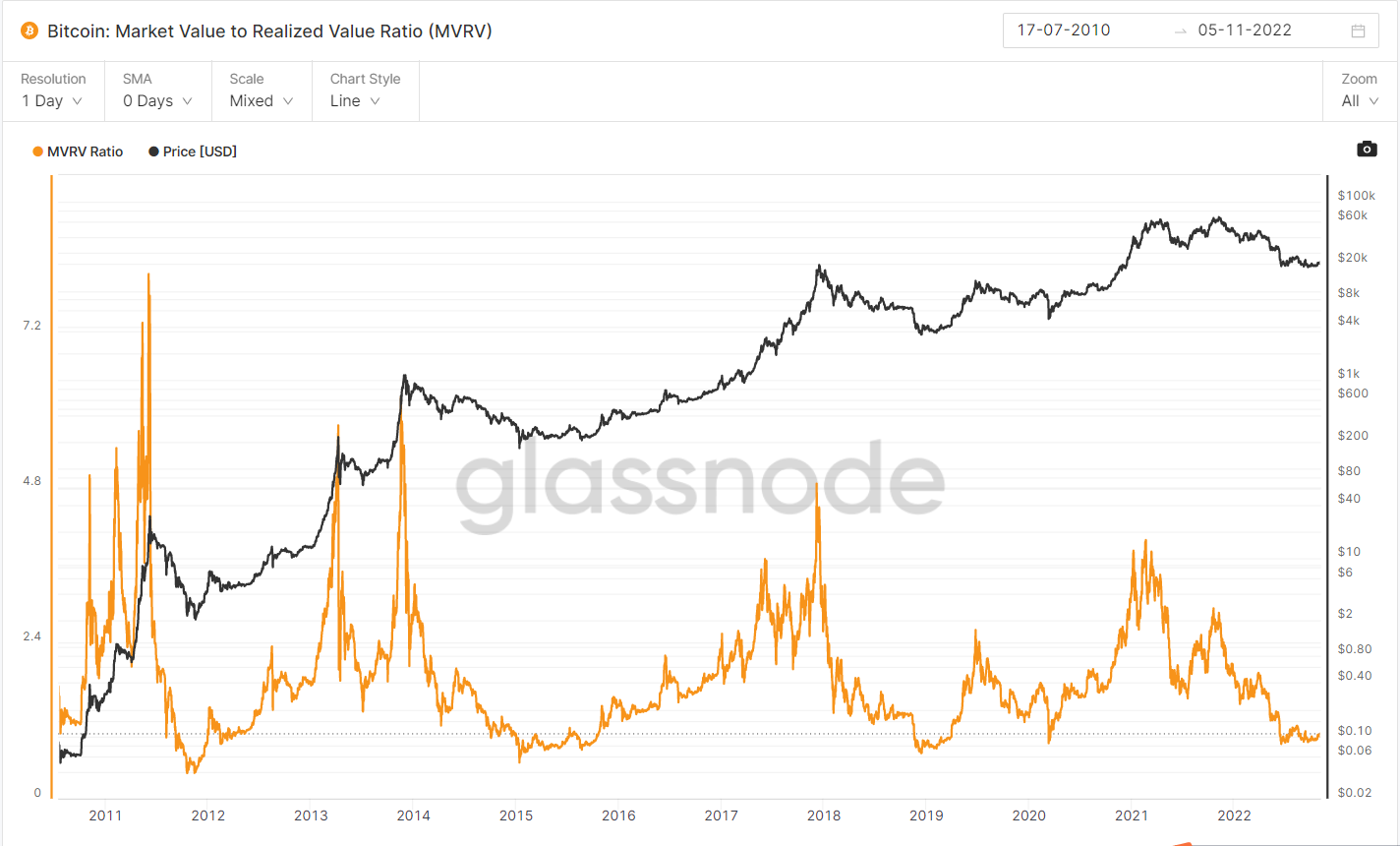

1. Arh999: 0.43, average cost performance.

2. MVRV: 1.03, the cost performance is the same as Arh999.

Number of BTC addresses: 1k currency-holding addresses began to decline.

Number of ETH holding addresses: The number of addresses holding more than 100 coins continues to decline.

3. Summary of investment and financing

1. Review of investment and financing

During the reporting period, the number of financing and projects were relatively sluggish. There were 12 disclosed investment and financing events (the chain remained stable), and the cumulative financing amount was about 120 million US dollars (a month-on-month increase of 104.1%).

During the reporting period, there were no large-amount financing projects. In terms of specific tracks, Web 3.0 & NFTs took the lead in terms of the number of financing projects and financing scale;

4. Encrypted ecological tracking

4. Encrypted ecological tracking

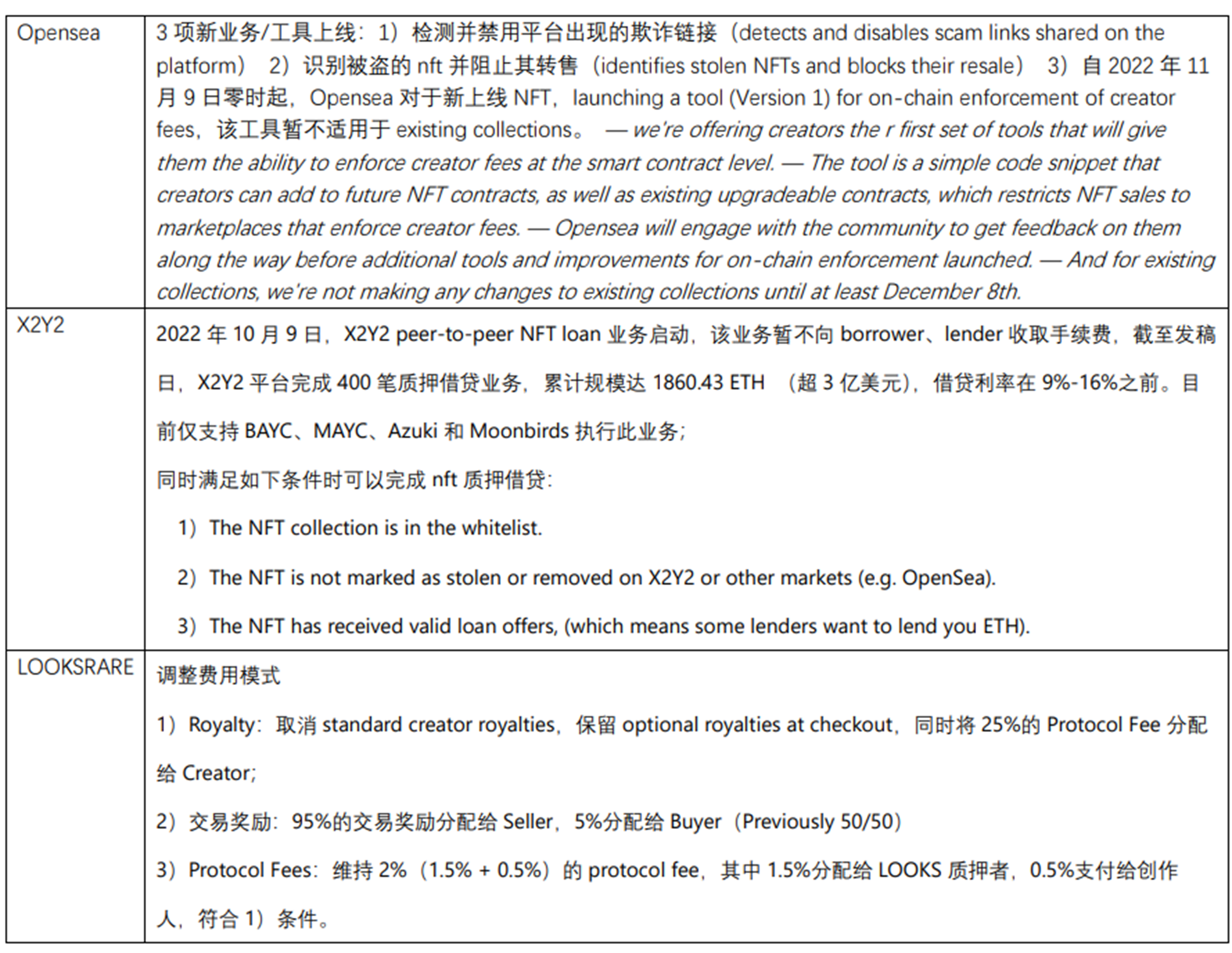

1.NFTs

1) Market overview

1) Market overview

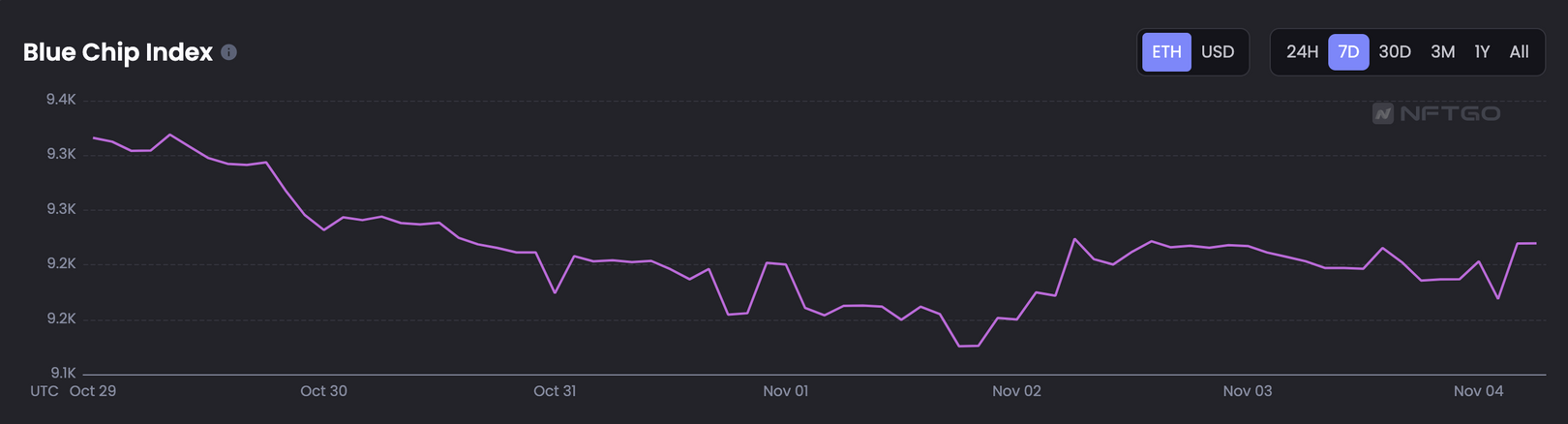

This week, the NFT blue chip index has not changed much. As of November 5, the blue chip index has dropped slightly compared with last week, but there has been no major change, and the market sentiment is still low.

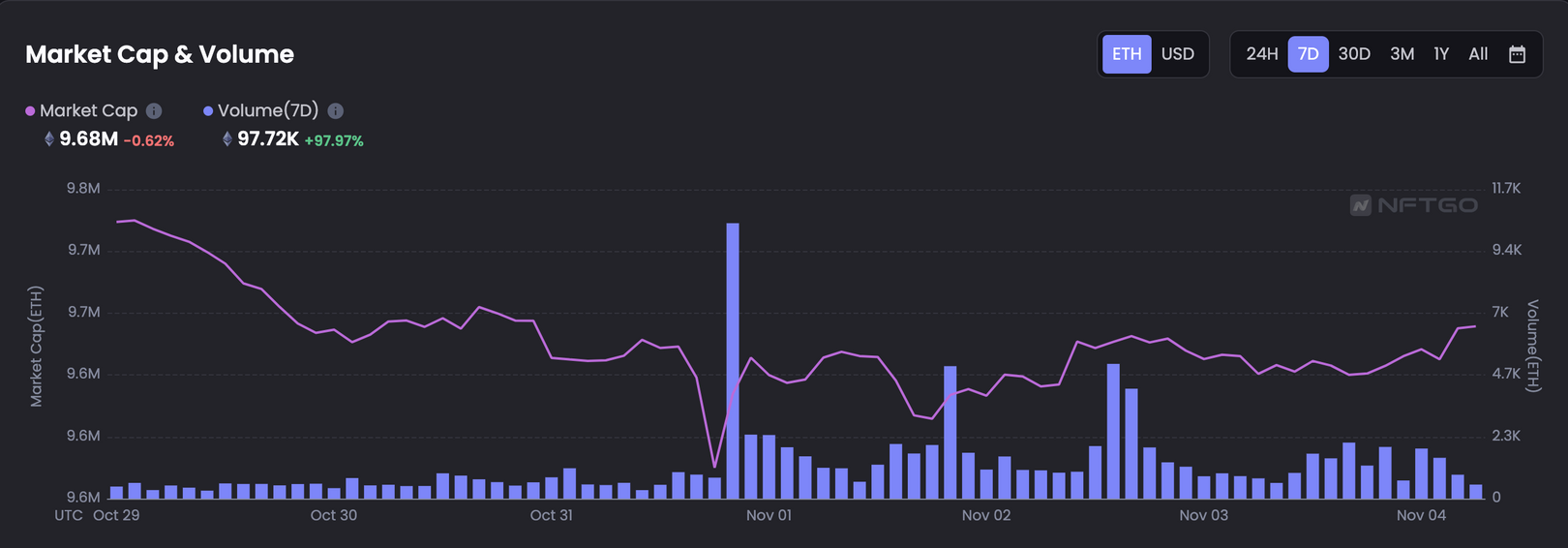

This week, the total market value of the NFT market decreased by 0.62% year-on-year, but the total transaction volume increased by 97.97% year-on-year. The NFT trading volume almost doubled this week. The direct reason is that on November 1st, the Art Gobblers project was launched, and the trading volume of nearly 40,000 ETH on the NFT trading platform directly corresponded to the popularity of Art Gobblers on November 1st.

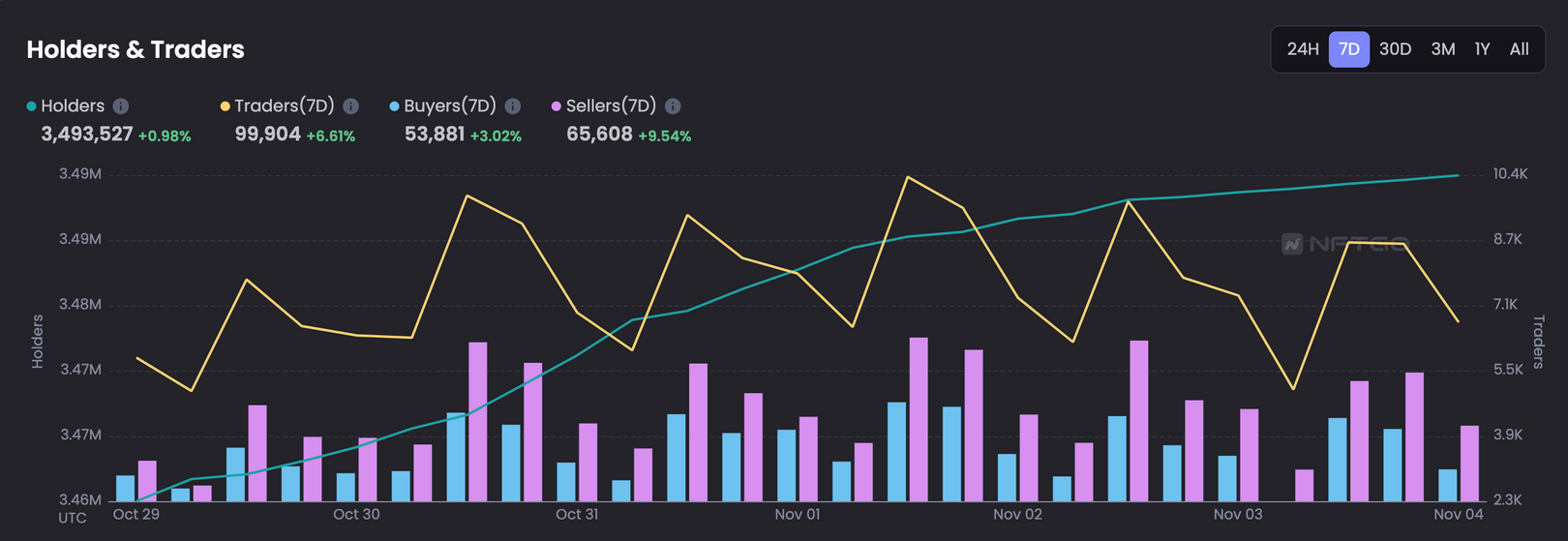

The activity of holders/traders in the NFT market has increased this week. Buyers have increased by 3.02% compared to last week, and sellers have increased by 9.54% year-on-year. the mood of the market as a whole.

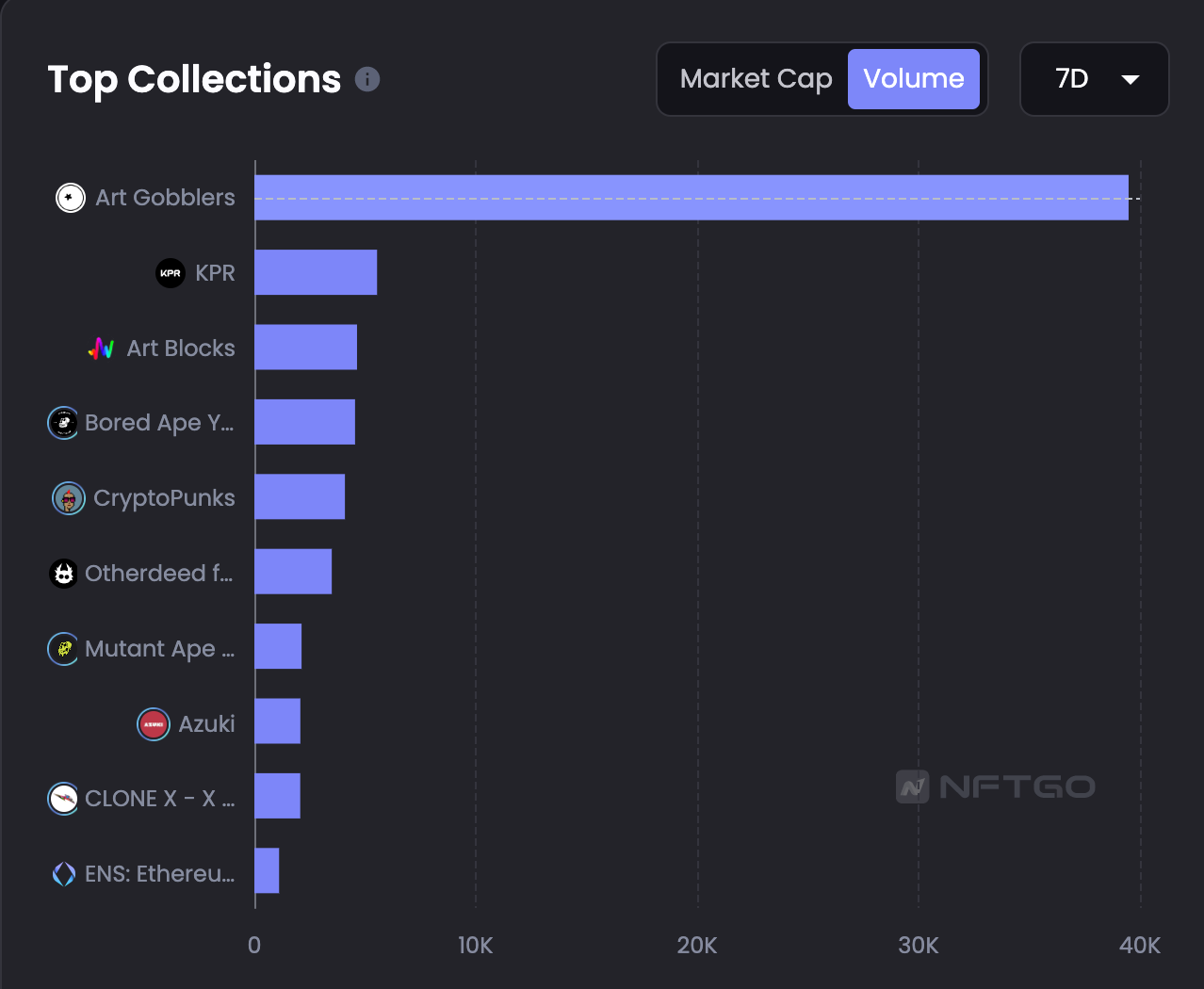

The top three NFTs with the highest trading volume in the market this week are Art Gobblers, KPR, and Art Blocks. Among them, the trading volume of Art Gobblers is larger than the total trading volume of the last nine.

2) Dynamic focus:

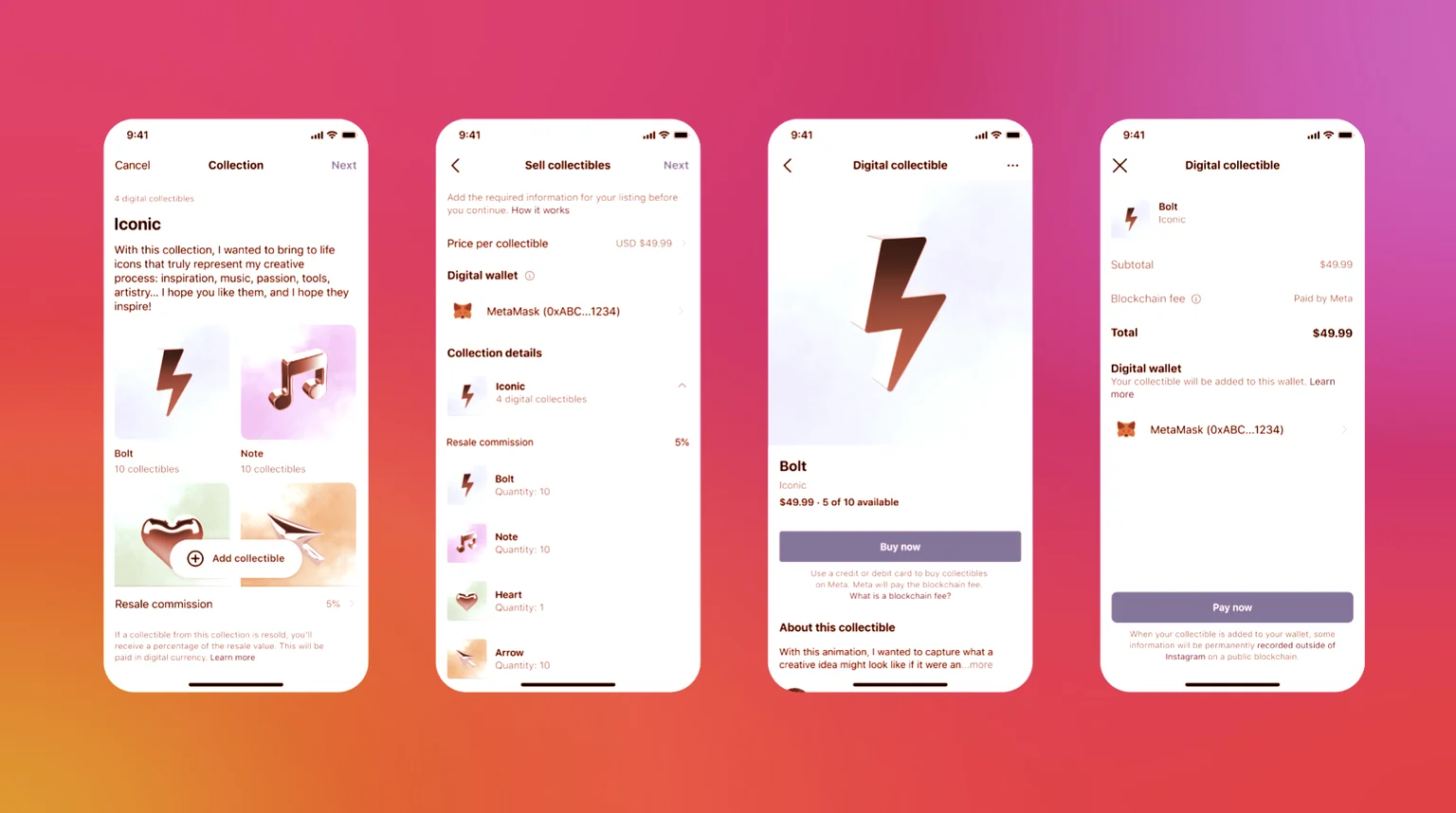

Instagram will support users to mint and trade NFT

Following Twitter's announcement last week that users can trade and display NFTs on the platform, Meta's Instagram announced this week that it will launch the NFT casting function (Mint). The function launched this time is different from that of Twitter. In the future, the project party can develop the casting function on Instagram for public sale through the Instagram platform.

Famous sports shoe brand ASICS announces cooperation with STEPN

The world-renowned sports shoe brand ASICS announced this week that it will cooperate with Solana UI to release a series of models. This cooperation is to obtain ASICS X STEPN sports shoes NFT by purchasing the newly released GT-2000 11 running shoes by ASICS. Chance. ASICS will cooperate with STEPN to release NFT, and users can get NFT airdrop opportunities by purchasing physical shoes.

Visa and Crypto.com to Launch World Cup NFT Project Auction

With the start of the World Cup, a large number of publicity activities have been launched one after another. Taking advantage of the opportunity of this World Cup, Visa and Crypto.com launched the World Cup NFT auction. The content covered in this activity is that users can obtain NFT by bidding on the platform, and NFT holders will also get personal letters from football stars. All proceeds from the event will go to Street Child United, a movement promoting the protection and welfare of children on the streets.

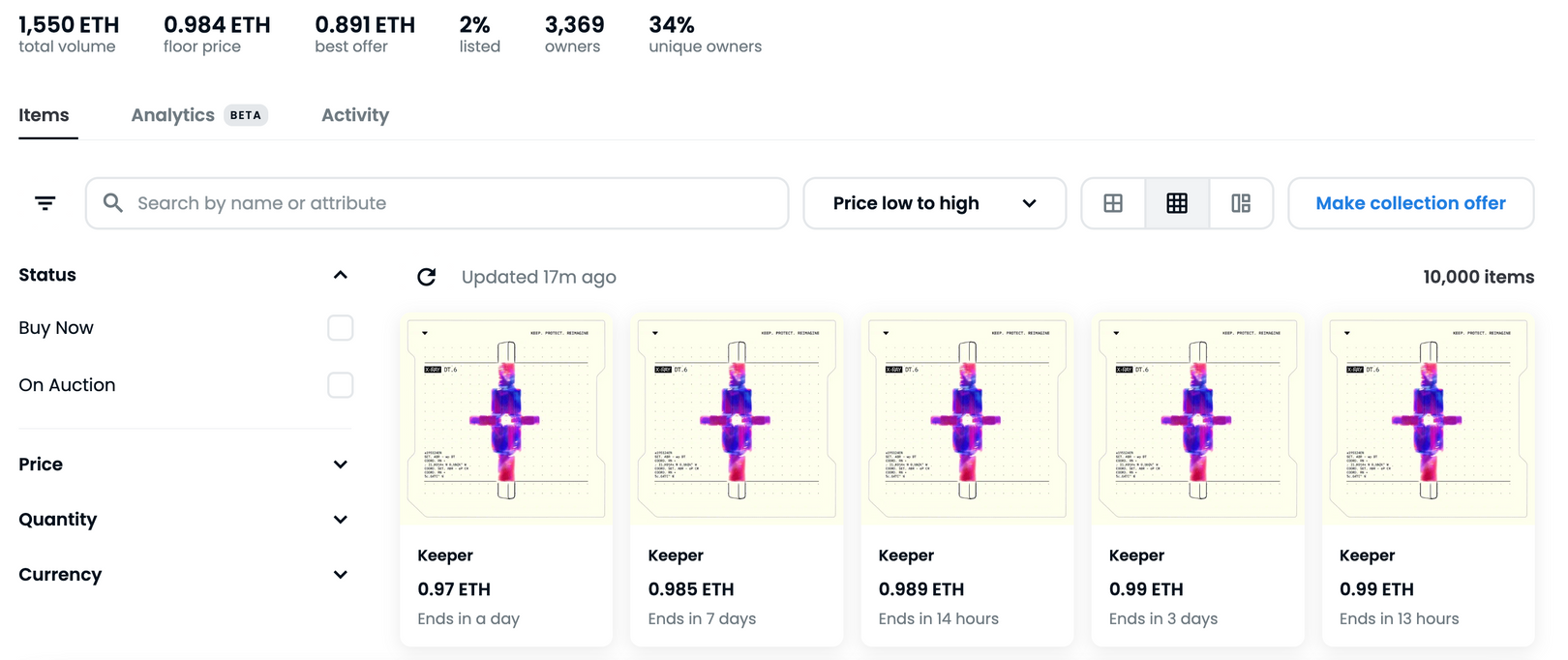

KPR

(3) Key projects:

KPR is an NFT with a large world view, and its main purpose is to protect the NFT with the theme of human thought progress. The style of the NFT is biased towards American comics, and has a sense of similarity to game characters such as "League of Legends" and "Overwatch". Its artistic style and world view have achieved a great drainage effect for the development of NFT.

KPR's style of painting and the composition of a huge world view can be further expanded in the future. At present, the market generally believes that the future direction of KPR will be metaverse or animation. Most of its team is also from the teams of Treasure DAO and Clone X, and has extensive experience in the industry.

2. GameFi blockchain games

2. GameFi blockchain games

overall review

overall review

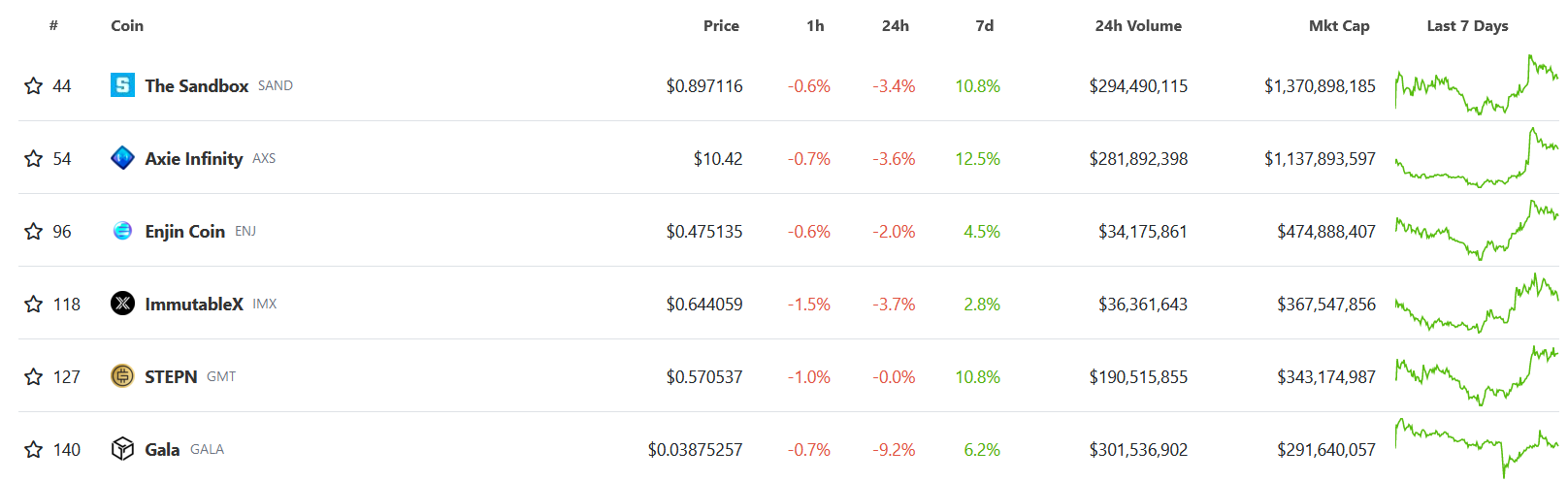

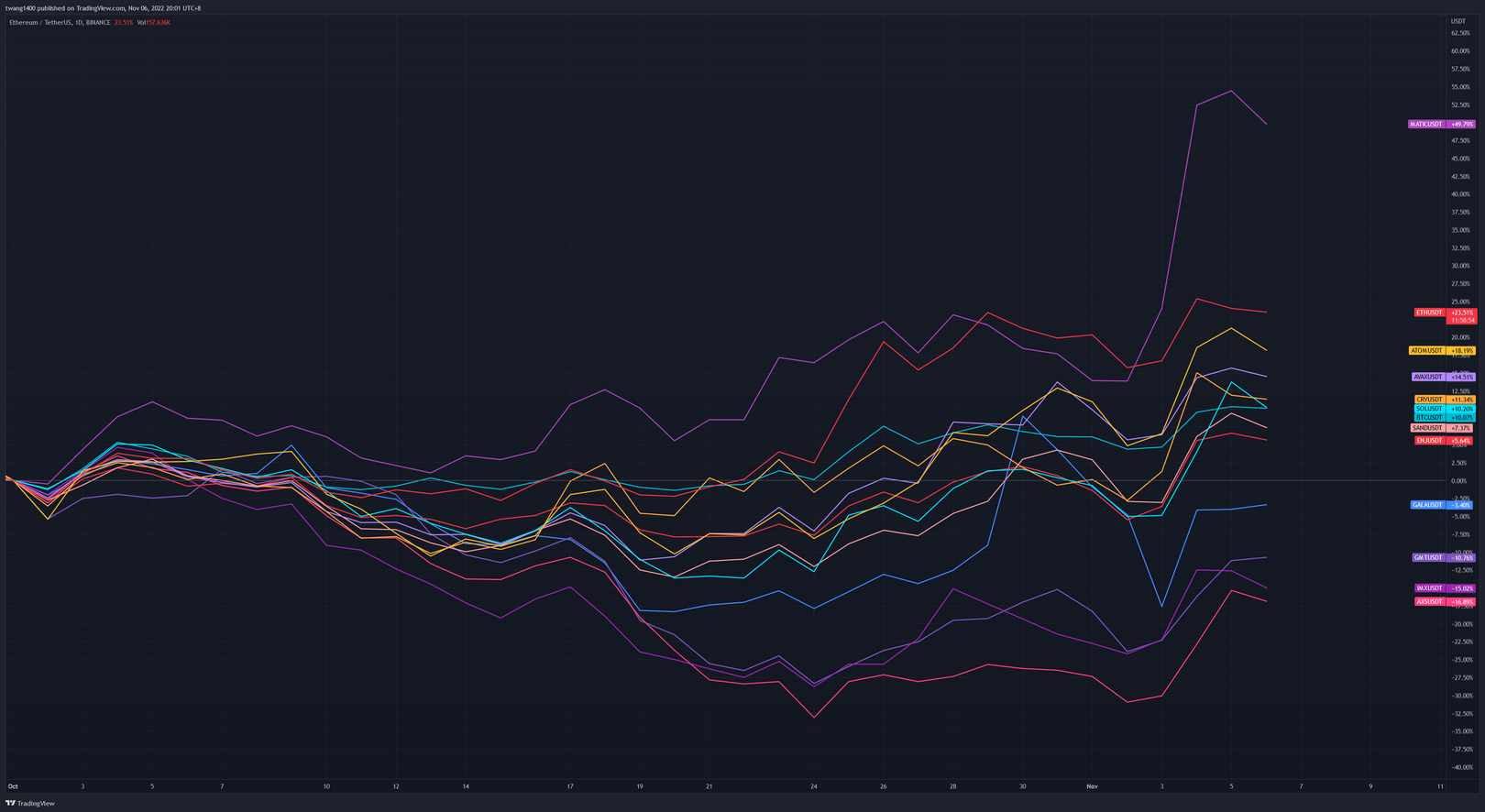

This week, the mainstream tokens in the Gaming sector continued to follow the market rebound. In the case of a significant decline in the previous period, the rebound was slightly stronger than the market, but weaker than the hot sectors such as L2 and Binance.

Since October, the mainstream tokens in the Gamefi sector are only SAND and ENJ with positive gains, but they have significantly underperformed the market.Item of the Week –

GALA event review

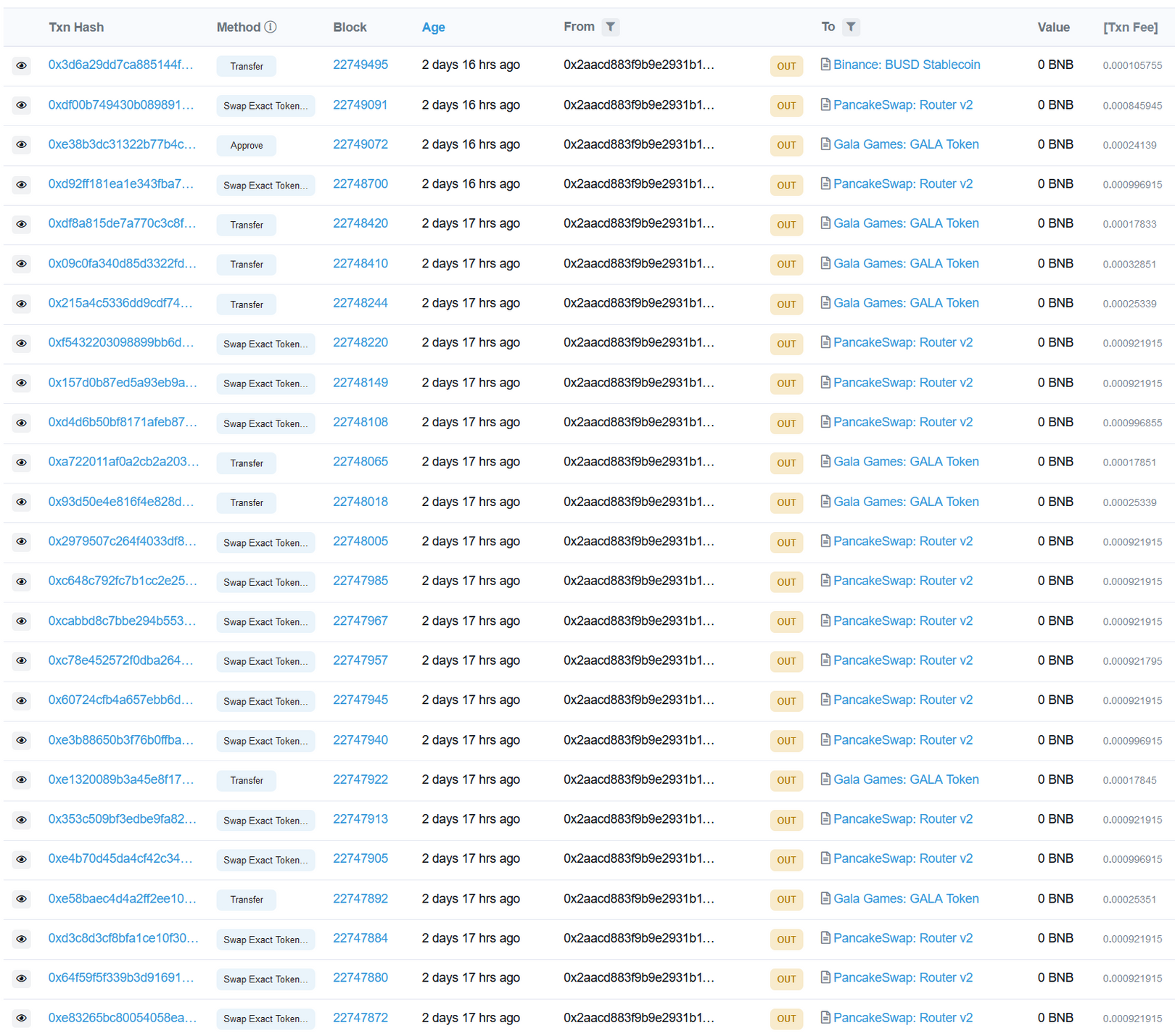

GALA, the head project of the GameFi track, was attacked. The cross-chain version pGALA on the BSC chain (the BEP20 specification token provided by pNetwork, which is linked to the GALA-ERC20 specification 1:1) was minted out of thin air, resulting in huge fluctuations in the short-term price of GALA. We review the events:

1. The cross-chain protocol pNetwork released an incident report stating that its team discovered a smart contract configuration error, which may lead to pGALA being used by hackers. Therefore, the team urgently contacted the GalaGames project party to warn of the existing risks and needed to save funds by evacuating the PancakeSwap fund pool, and then the team notified each exchange to close GALA withdrawals.

2. Subsequently, pNetwork minted about 55.6 billion unsecured pGALA out of thin air twice, and began to empty the fund pool on PancakeSwap. During this period, the price of pGALA plummeted, triggering DEX-CEX arbitrage behavior. Some users began to buy a large number of low-priced pGALA and withdraw it to the centralized exchange to sell it for arbitrage. Some addresses made profits of over 6.5 million US dollars through arbitrage.

3. Infrastructure & Web3 infrastructure

3. Infrastructure & Web3 infrastructure

1) Market Overview - Public Chain & TVL

1) Market Overview - Public Chain & TVL

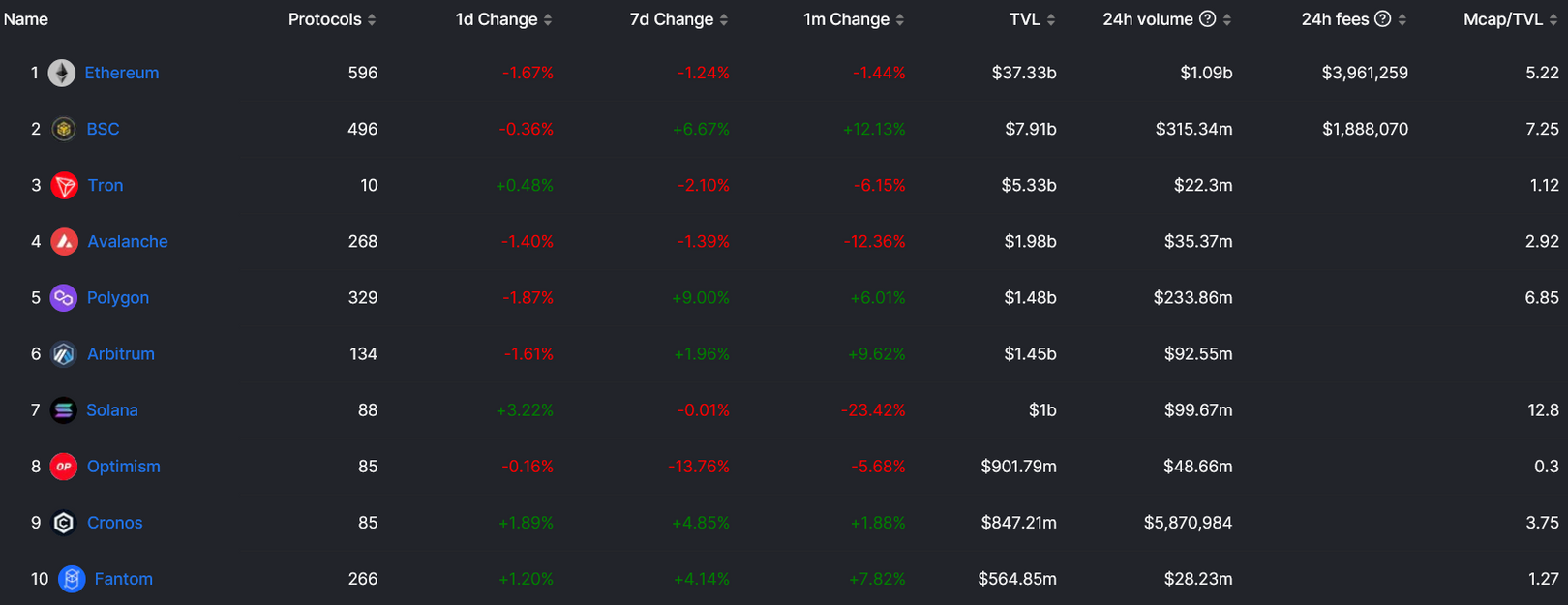

As of November 6, the overall lock-up volume (including staking) of all public chains denominated in US dollars has not changed much after a sharp increase in this period.

Among the major public chains, the overall ranking has not changed much. ETH, BSC and Tron are firmly in the top 3. Among them, BSC maintains its growth momentum, mainly due to Binance restarting the new coin launchpad after half a year (the last issue dates back to April this year. Monthly Project Galaxy, token $GAL), driving up the price of BNB. Since the beginning of 21, the BNB/BTC exchange rate has increased by 1300%+, reaching a record high. Since the beginning of this year, the price performance of BNB in the bear market has also been relatively strong.

In the past two weeks, the market sentiment has been relatively hot, and various good news have driven the market in turn, and the correlation with US stocks has weakened. Judging from news such as the restart of the launchpad by Binance and the return of AC, it is very likely that the market has bottomed out.

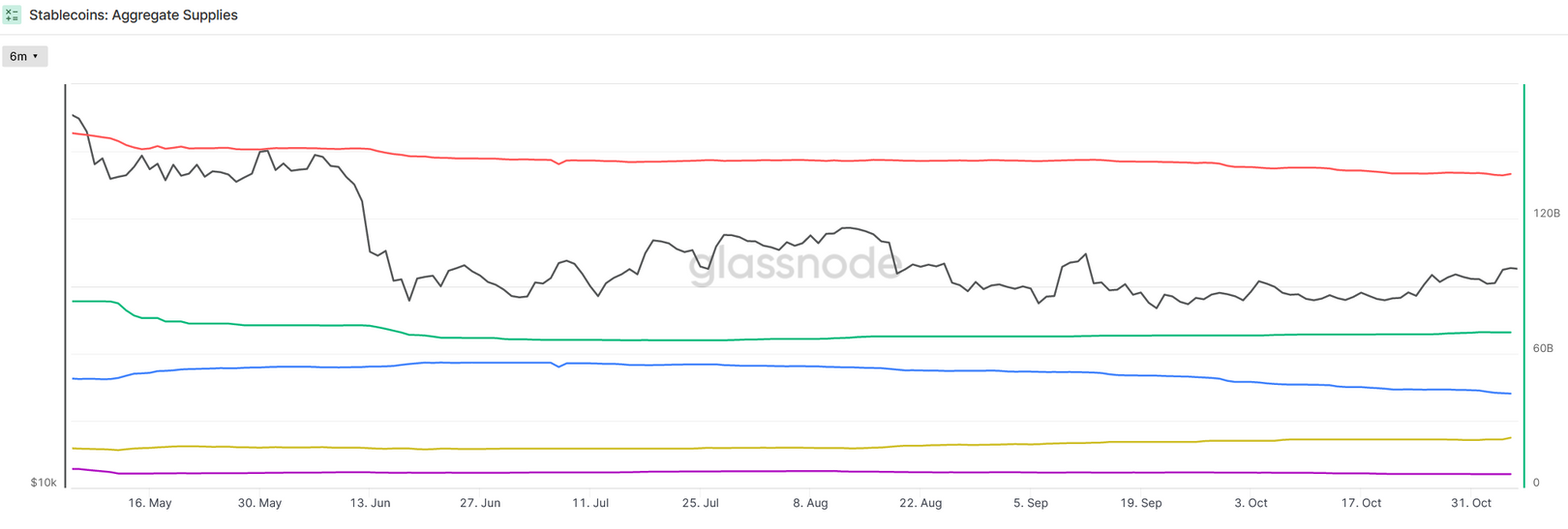

2) Market Overview - Stablecoin Supply

2) Market Overview - Stablecoin Supply

As of November 5th, the total supply of the top four stablecoins (USDT, USDC, BUSD, DAI) was approximately 139.976 billion, a decrease of approximately 533 million (0.37%) from 140.509 billion a week ago, a slight decrease, of which USDT, BUSD Supply continued to rise, but could not offset USDC's massive loss of about $1.7 billion. From this point of view, funds are still showing a slight outflow trend. The rebound in the past two weeks is mainly due to the impact of the rotation of stock funds driven by the news, and it is too early for a bull market.

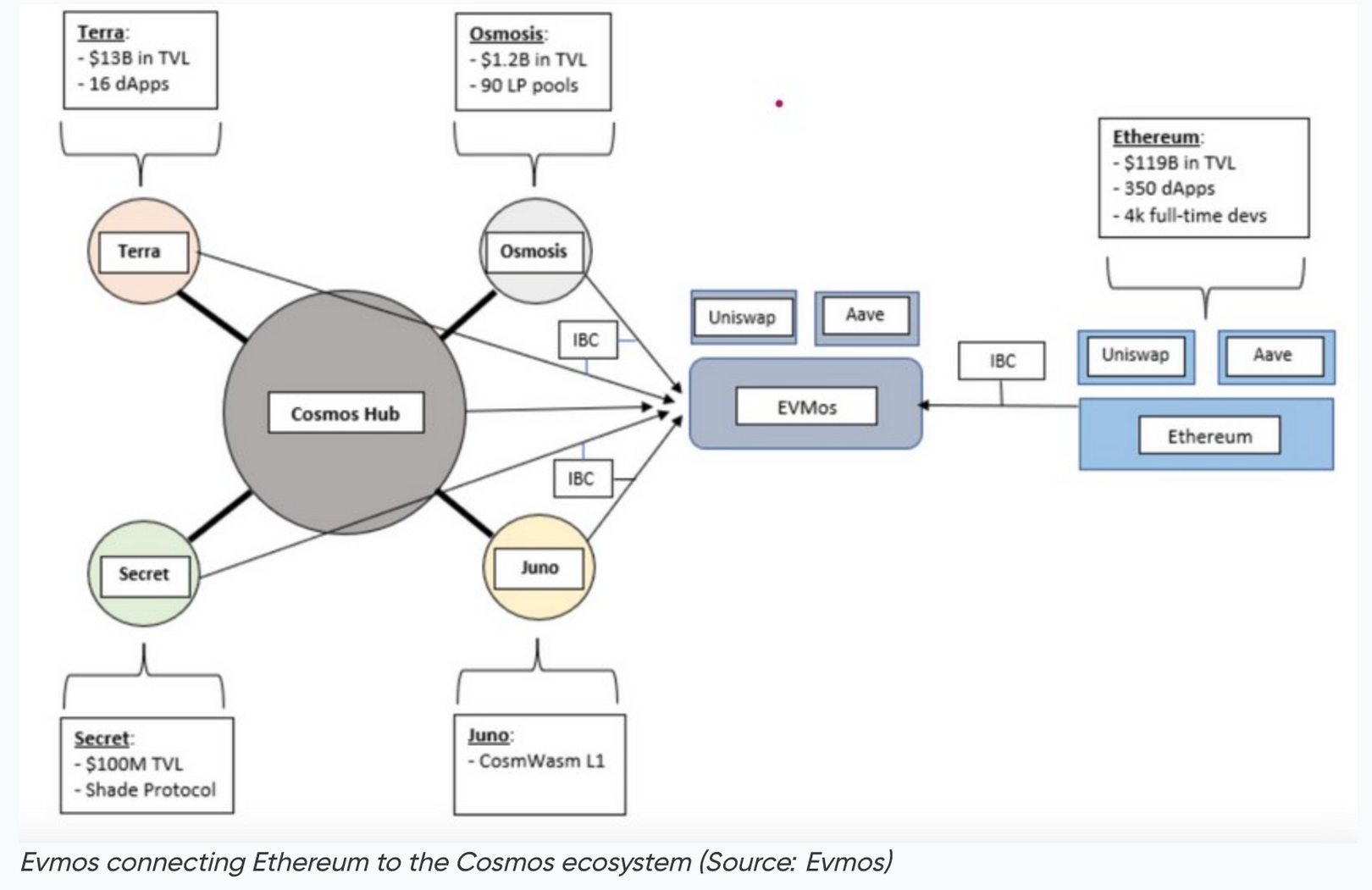

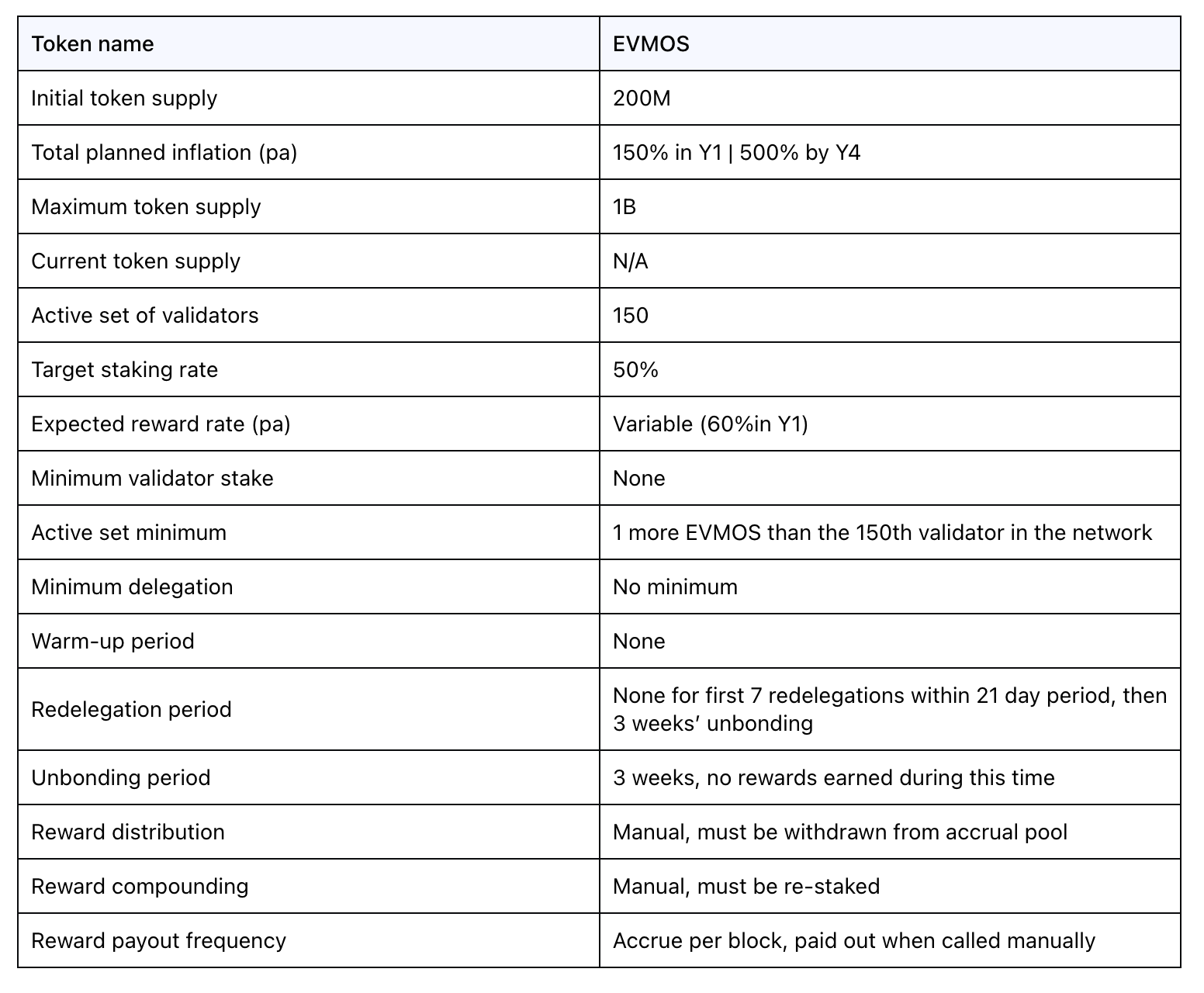

3) Important financing—EVMOSTharsis Labs, the core developer of Evmos, announced that it has raised $27 million, (Tharsis Labs is the core developer of Evmos, which aims to allow cross-chain transactions between Ethereum and Cosmos). The purpose of this funding is to accelerate the growth of Evmos’ ecosystem of interoperable dApps. This round of financing was led by Polychain Capital, and participants included Galaxy, Huobi, HashKey, Coinbase Ventures, Circle Ventures, Asymmetric, and some angel investors from the Web3 space.

This token sale will support Tharsis Labs' further development on Evmos and the accelerated development of the Evmos ecosystem.

Introduction:

Evmos is an open-source, Cosmos-based decentralized proof-of-stake blockchain developed to connect Ethereum tools with the scalability of the Cosmos ecosystem.Evmos is a layer 1 blockchain,

With hundreds of popular projects using the SDK (Software Development Kit) to produce their own Layer 1 blockchains, the Cosmos ecosystem has generated tens of billions of dollars in the cryptocurrency industry.

Features:

Features:

Evmos is committed to empowering dApp developers in multiple ways. For example, Evmos has pioneered a new method of sustainable compensation for developers. It has created a fee split mechanism that distributes half of each transaction fee to the developers who are using the dApp, instead of all transaction fees like Ethereum. Give to validators or partially burn.

Advantages of Evmos:It can provide faster transaction speed, lower transaction fee and larger user base than Ethereum.

It is compatible with the Ethereum Virtual Machine, which means that all existing Ethereum dapps written in the Solidity programming language can be ported over. Evmos' ecosystem has grown rapidly after the mainnet launch.

Evmos use cases:

1. Evmos supports NFT, and the first NFT marketplace called "Orbit" was launched in May this year. Users on Orbit can trade NFTs without mandatory escrow, meaning their assets remain in their wallets during the listing.

2. Stablecoin trading: Kinesis is the first stablecoin exchange launched on Evmos. The team hopes to leverage EVM compatibility and the Cosmos IBC communication system to enable seamless stablecoin transactions.

Why is Evmos needed?

Blockchain development is rapidly accelerating. There are two types of blockchain layers in the crypto world: layer 1 (Bitcoin, Ethereum, etc.) and layer 2 coins built on top of these blockchains.

Ethereum's maturity and large user base, while already making it a great place to build web3 applications, has also led to congestion, resulting in high operating expenses and slow transaction speeds. An EVM-compatible layer 1, such as Evmos, allows developers to roll out these same applications to a larger number of token holders, who in turn can reap the utility provided by the application.

Launching tokens is now easy, and layer-two tokens can be deployed on Ethereum (ETH) in under a second. But what happens when we want to build a layer 1 blockchain? It can cost millions of dollars and is very difficult.

There is an ecosystem designed to make this kind of development easier: Cosmos. Developers who want to create their own Layer 1 networks can use the Cosmos SDK (Software Development Kit) to deploy their own native blockchain.Cosmos ecosystems are growing rapidly and creating tens of billions of dollars in value, but they are limited because they are not compatible with the Ethereum Virtual Machine (EVM) and cannot use tools such as MetaMask. This is the origin of Evmos - Evmos is a project that combines Ethereum tools with the Cosmos SDK. It is an open source, scalable and interoperable version of Ethereum.

Evmos is a project that combines Ethereum tools with the Cosmos SDK. It is an open source, scalable and interoperable version of Ethereum.

EVMOS infrastructure products

Evmos has launched various infrastructure products. For example, a series of wallets enables Evmos users to manage their ERC20 and IBC assets in one place. On top of that, Evmos supports both Metamask and Keplr wallets, which are popular in the Ethereum and interchain ecosystems. Products like Fireblocks, Gnosis Safe, Aegis Custody, and Anchorage Custody partnered with Evmos to give institutional capital better access to Evmos, while Flux Protocol, DIA, and Redstone brought their cross-chain oracles to the ecosystem.

Evmos rewards and economic model

Evmos rewards and economic model

Since EVMOS is used to pay transaction/computational fees (gas), the current target pledge rate is around 50%. The Evmos team pointed out that if liquid staking is naturally realized on Evmos in the future, the target staking rate may increase.

There are four reward types on Evmos:1. Transaction fees

Transaction fees are evenly distributed among active validators in EVMOS2. Inflationary rewards

It means that the expansion of EVMOS will be distributed proportionally to all active participants in the network.3. Proposer rewards

It is a 1-5% reward for a validator successfully proposing a block under consensus, and the reward increases according to the number of pre-commits contained in the previous block.4. Usage incentives

The measures account for 25% of block emissions, as additional incentives, deferred gas rebates and liquidity mining, there may be additional rewards through governance.

Evmos is currently priced at $1.87 with a 24-hour trading volume of $2.93 million. Evmos traded at -4.81% over the past 24 hours. Currently, the stock is down 12.00% from its 7-day high of $2.13 and up 6.59% from its 7-day low of $1.76. The maximum supply of EVMOS is 1B.

4. Web3 Social & DAO & DID

4. Web3 Social & DAO & DID

(1) Dynamic follow-up of key projects

Instagram, a subsidiary of Web2 giant Meta, announced the launch of NFT casting and sales tools, allowing users to design and mint NFTs and sell them through Instagram, and supports users to display NFTs in video format on Instagram. The plan is to first support Polygon and integrate the storage function of Arweave. The news of Matic and AR surged on the day the news came out.

The ecology of the social graph project Lens Protocol continues to be active:

Received investment from FTX Ventures this week

Announced the use of the messaging protocol XMTP to provide private messaging services between Profiles for the entire Lens ecosystem, allowing users to send private messages to each other in Lenster. With XMTP, all messages are end-to-end encrypted and can only be decrypted by the wallet address, and since it happens off-chain, there will be no Gas fees

Its community Lenster issued Token airdrops for early users, which may become the weight basis for subsequent token airdrops

The 3D virtual human DID project Lifeform was officially launched on 11.1, and it once became the largest consumption on the BSC chain after the launch

(2) Investment and financing news

contact us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment.

The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.

Website www.jzlcapital.xyz

Twitter @jzlcapital

contact us

We are always looking for creative ideas, business and cooperation opportunities, and we also look forward to your reading feedback, welcome to contact hello@jzlcapital.xyz.

We are always looking for creative ideas, business and cooperation opportunities, and we also look forward to your reading feedback, welcome to contact hello@jzlcapital.xyz.