image description

Twitter @Phyrex_Ni

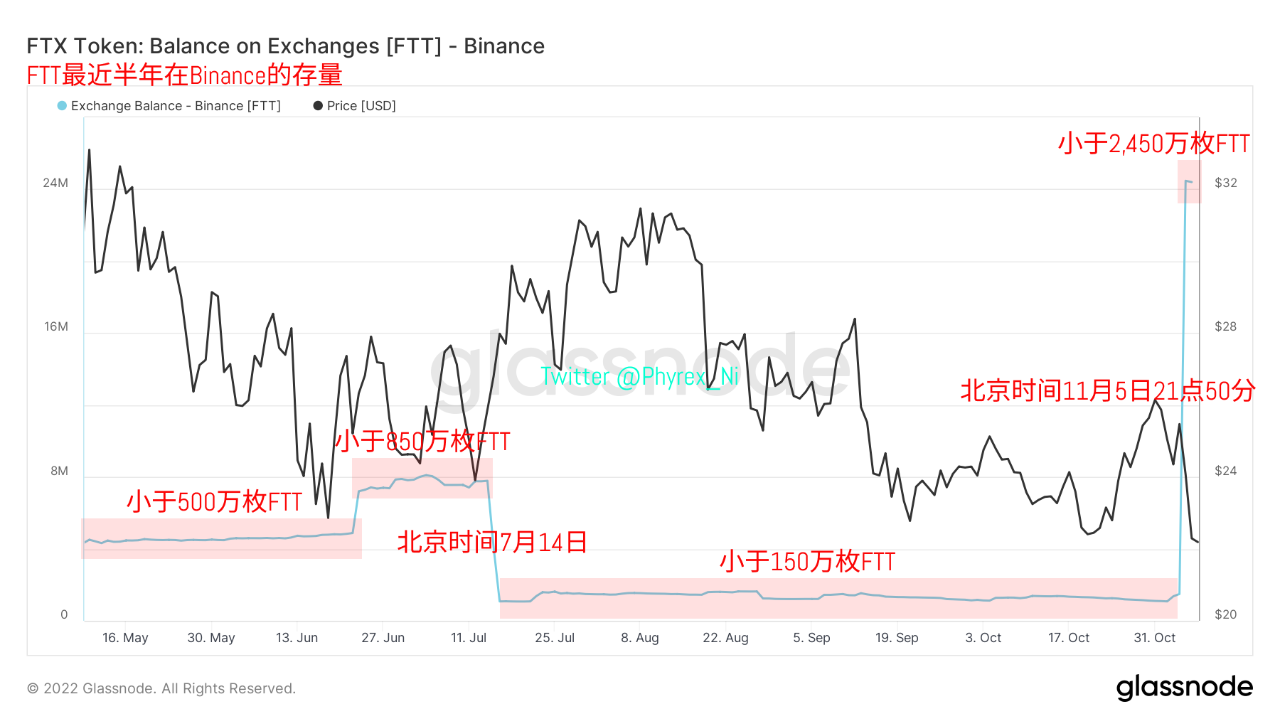

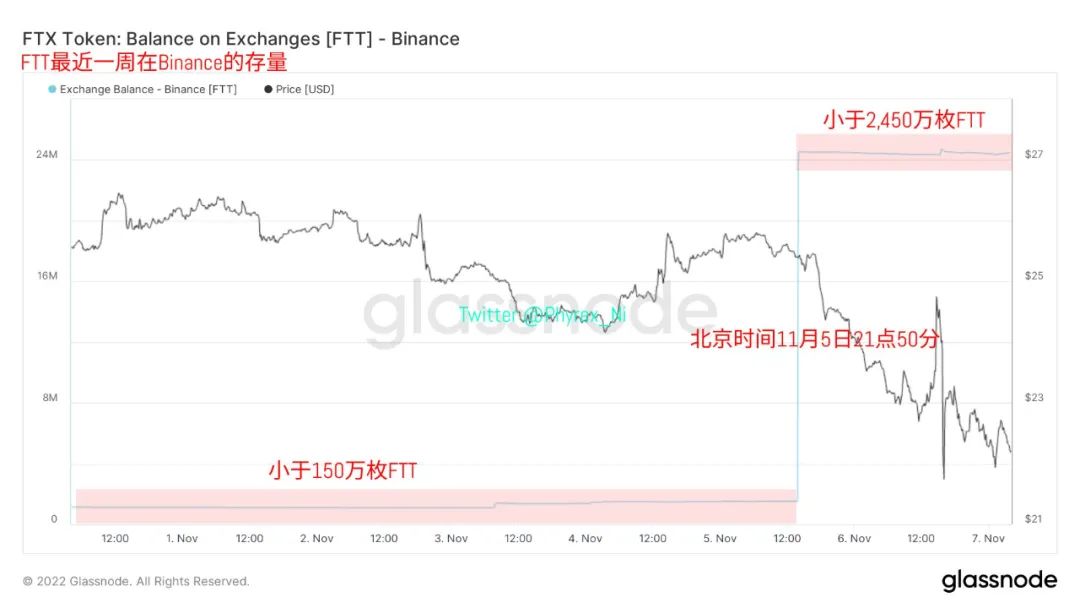

However, since July 14th, there has been a sharp decrease in the stock of the exchange, which directly reduced a maximum of nearly 7 million FTT. Of course, these chips cannot be ruled out because the cold wallet was replaced, but after a long period of time The FTT in the Binance address can be seen as a horizontal line without too many changes. The turning point was on the evening of November 5, when nearly 23 million FTT were transferred from an external address to a wallet controlled by Binance.

Moreover, CZ also personally admitted the transfer of this amount, and the 23 million FTT transferred to Binance should have nothing to do with the user's stock, and the biggest problem is here, whether Binance has enough users to consume so many FTT FTT, after all, as we have seen before, for a long time, no matter how much FTT there is in Binance’s stock, the volatility is relatively low, and the withdrawal amount of FTT on the chain is not high.

Then we can draw a conclusion. CZ said that it may take several months to consume these FTTs. These months may not refer to the circulation that Binance users participated in. In other words, these 23 million FTTs should not be ready to sell. For retail investors. Moreover, it can be seen from the overall exchange inventory that, except for FTX, mainstream exchanges hold less than 26.5 million FTT, and Binance accounts for 92.45%.

Similarly, I also checked the fluctuations of FTT on the chain, and found that since June 2022, there have been more frequent and large amounts of FTT fluctuation data, but it has no effect on the price trend, which should be regarded as a bargaining chip. Constantly change hands and integrate, even if it is sold, it should be through the direction of OTC, not directly sold to the secondary market on the exchange. After all, the purchasing power of the secondary market is not that strong.

Therefore, for the additional 23 million FTT held by Binance, it is estimated that several months are not enough to sell them in Binance’s own secondary market without affecting the price trend. And from the market data of CMC, it can be seen that the trading volume of Binance is even higher than that of FTX itself. From a certain angle, it also confirms what CZ said, and he does not want to cause too much damage to the price. Otherwise, the panic caused by transferring to FTX may be even greater.

After all, whether it is Binance or Alamaeda, there are currently top-level market-making teams. If you want to sell 23 million FTT quietly and with a small impact, it is not impossible. In other words, if it is not disclosed, it is still relatively easy to do, and only a small amount of transfer is required every day without attracting the attention of the market. But CZ chose to place the chips on the table with great fanfare.

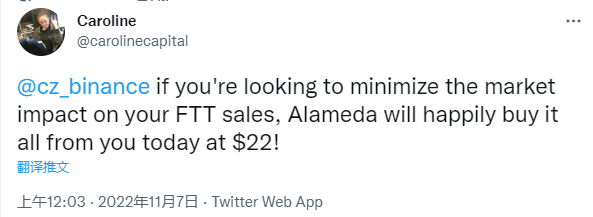

It should mean that the meaning of "negotiation" is greater than the meaning of actually preparing to smash the deal. Of course, Alamaeda's purchase price of US$22 did not get a response from CZ, but this happened to be part of the "negotiation". After all, for FTX, there are only 133 million ERC20FTTs currently in circulation in the market, and nearly 18% of the chips entering the market are definitely not affordable by the secondary market. It must be a huge blow to FTX and FTT.

Another data that needs to be paid attention to is that among the FTT circulating in ERC20, more than 58% of the shares are locked in smart contracts before September 28, 2022, and after the 28th, this data is reduced to 5.8 at one time. %, nearly 53% of the FTT is unlocked from the smart contract at one time, which is equivalent to 70.5 million FTT leaving the smart contract, and this part of the chips should be controlled by FTX. What needs to be considered is why FTX does this.

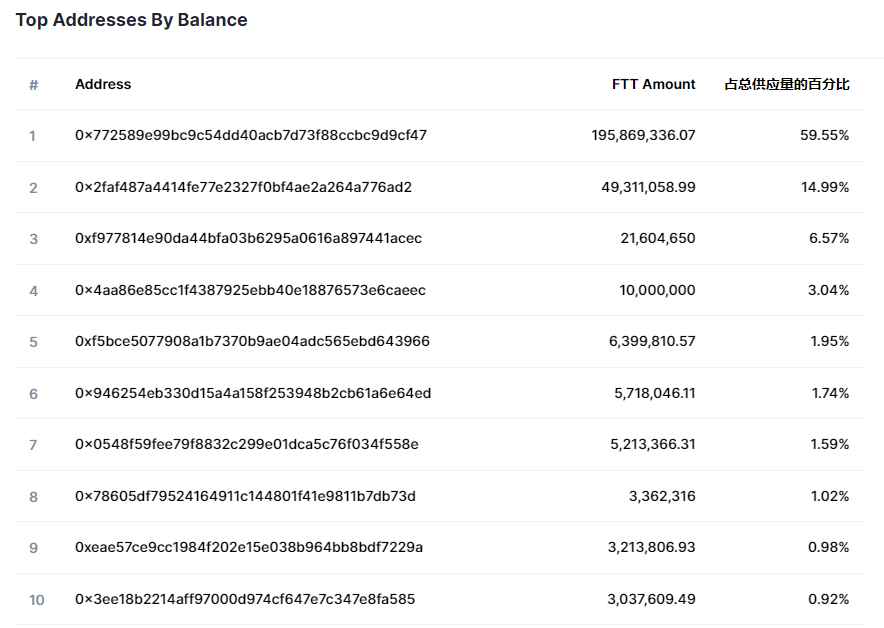

And judging from the current FTT holdings, the first and second are FTX's own addresses, while the third is Binance, and the fourth address has a common contact with the address transferred to Binance pulsechaindotcom .eth, ranked fifth is Sushi, ranked sixth is an address that has a high degree of interaction with FTX, and ranked seventh is an address marked OTC, which also interacts with pulsechaindotcom.eth.

Original link