In the Web3 world, Hong Kong is back at the center of attention in the crypto world in Asia after traffic from Singapore waned.

Related topicsRelated topics), the Hong Kong Special Administrative Region Government officially issued the "Policy Declaration on the Development of Virtual Assets in Hong Kong》, setting out the government's policy stance and approach to develop a vibrant virtual asset industry and ecosystem in Hong Kong.

The government is open to reviewing the property rights of tokenized assets and the legality of smart contracts in the future to facilitate their development in Hong Kong.

secondary title

List of existing encryption regulatory policies in Hong Kong

As early as 2017, the Hong Kong Securities Regulatory Commission issued the "Circular on Announcing the Regulatory Sandbox of the Securities Regulatory Commission》。The China Securities Regulatory Commission has made it clear many years ago that innovation in the field of "financial technology" can adopt a regulatory sandbox position.

“Firms can conduct regulated activities within a restricted regulatory environment (i.e. the SFC regulatory sandbox) if they have a sincere and serious commitment to using fintech to conduct regulated activities. In order to minimize the risk for investors In order to avoid future risks, the CSRC may impose licensing conditions on qualified firms, and conduct more rigorous monitoring and supervision on qualified firms when they operate in the sandbox.”

This regulatory rule is broader in scope and applies to the larger fintech sector. When it comes to encrypted assets, there are some clearer regulatory standards.

The China Securities Regulatory Commission has formulated different regulatory requirements for entities engaged in different businesses. Previously existing regulatory requirements forVirtual asset fund management company、Virtual Asset Fund Distributor、Virtual asset trading platform, and involvingSecurity Token Offering、bitcoin futuresright

rightVirtual asset fund management companyIn other words, if a fund manages a portfolio containing more than 10% virtual assets, it must meet additional regulatory standards. These additional regulatory standards to be met will be imposed in the form of licensing conditions which are established by reference to a set of terms and conditions.

Specifically, the China Securities Regulatory Commission further formulated in 2018Statement on the Regulatory Framework for Virtual Asset Portfolio Managers, Fund Distributors and Trading Platform Operatorsand its appendices ""and""and"right》。

rightVirtual Asset Fund DistributorIn general, firms distributing (in whole or in part) funds investing in virtual assets in Hong Kong will be required to be licensed or registered for Type 1 regulated activity (dealing in securities). Given the significant risks to investors, the 2018 CSRC has issued"Circular to Intermediaries - Distribution of Virtual Asset Funds"right

rightVirtual asset trading platformFor example, the China Securities Regulatory Commission introduced a regulatory framework for virtual asset trading platforms in 2019, and"Position Paper - Supervision of Virtual Asset Trading Platforms"specified in detail. Central platforms that provide virtual asset trading services may apply to the SFC for Type 1 (securities trading) and Type 7 (provision of automated trading services) regulated activities if they intend to provide trading services for at least one security token license plate. The regulatory framework includes strict standards in custody of assets, cyber security, anti-money laundering, market surveillance, accounting and auditing, product due diligence and risk management.

security tokensecurity tokenIt is likely that they are "securities" as defined in the Securities and Futures Ordinance and thus subject to Hong Kong's securities laws. To the extent that security tokens are "securities", any person who intends to market and distribute security tokens (whether in Hong Kong or to Hong Kong investors) must, unless an applicable exemption is granted, be required to comply with the Securities and Exchange Futures Ordinance is licensed for Type 1 regulated activity (dealing in securities). In addition, the China Securities Regulatory Commission has also formulated specifically for this business"Statement on the Issuance of Security Tokens", which had already been issued in 2019.

The "contract" business, which is familiar to crypto investors, has also introduced special regulatory rules. Pursuant to the Securities and Futures Ordinance, those traded on traditional exchanges and subject to their rulesbitcoin futuresConsidered a "futures contract". Therefore, persons who carry on the business of dealing in bitcoin futures are required to be licensed for Type 2 regulated activity (dealing in futures contracts) under the SFO. For details, please refer tosecondary title。

List of existing encryption licenses in Hong Kong

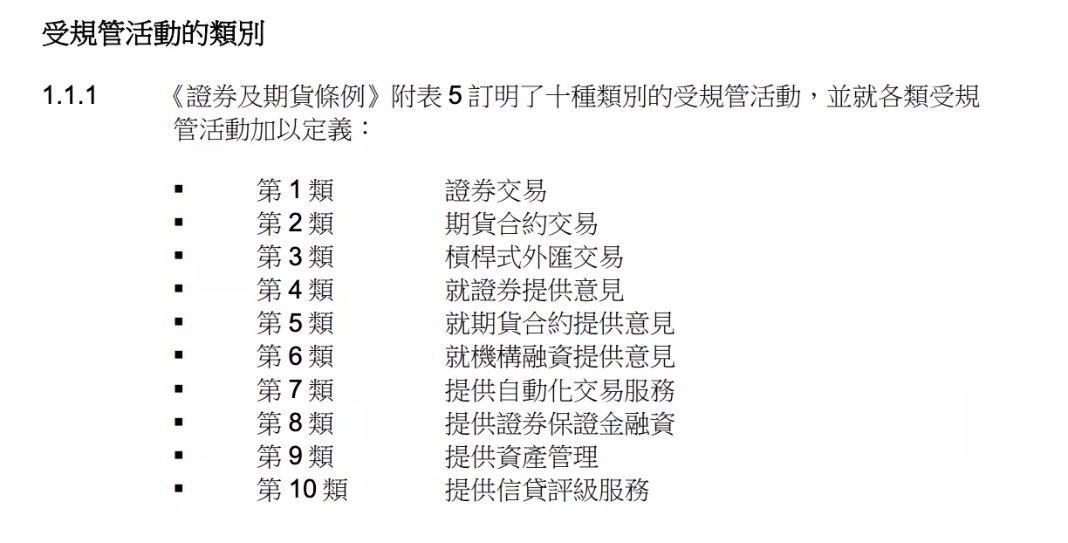

According to the licensing and registration requirements of Hong Kong's "Securities and Futures Ordinance", any person who conducts regulated activities must apply for a license from the Hong Kong Securities and Futures Commission. As a new type of financial market, the encryption market is naturally also included in the supervision.

From November 6, 2019, the Hong Kong Securities Regulatory Commission began to regulate virtual asset trading platforms that provide virtual asset trading, settlement and settlement services and have control over investors' assets (ie, central virtual asset trading platforms).

image description

Hong Kong Securities Regulatory Commission "Licensing Manual"

Among them, Type 1 license (securities trading), Type 7 license (providing automated trading services), and Type 9 license (providing asset management) are the closest to the encryption industry.

According to the regulations of the Hong Kong government, companies that operate a central virtual asset trading platform (ie CEX) in Hong Kong and intend to provide trading services for at least one security token on its platform can apply to the Hong Kong Securities Regulatory Commission for Type 1 and Type 7 A license for such regulated activities.

License applicants and licensed corporations are required to notify the SFC if they are managing or planning to manage one or more portfolios investing in virtual assets. Once the SFC is aware of the situation, it will first seek to understand the company's business activities. If the company appears capable of meeting the required regulatory standards, the proposed terms and conditions will be provided and the SFC will discuss with the company and make changes based on its specific business model to ensure that the proposed terms and conditions is reasonable and appropriate.

Once a virtual asset trading platform operator is licensed, it will be placed in the regulatory sandbox of the Hong Kong Securities Regulatory Commission. This generally means that more frequent reporting, monitoring and inspections will be required. Through strict supervision, the SFC will be able to highlight the areas where operators should improve their internal control and risk management.

The regulatory framework has been around for a long time, and there are very few compliance entities

Hong Kong's attempts at system building are not later than other financial centers. As early as 2018, the Hong Kong government issued the "Statement on the Regulatory Framework for Virtual Asset Portfolio Management Companies, Fund Distributors and Trading Platform Operators". This is Hong Kong's first comprehensive regulatory framework for encrypted assets. Since then, various supporting constructions have appeared one after another.

But so far, Hong Kong has not achieved dazzling results in the "authorization" of the encryption industry.

At the end of 2020, OSL Exchange obtained the first virtual asset trading platform license issued by the Hong Kong Securities Regulatory Commission. In April 2022, the encrypted financial company HashKey also obtained this license. The license allows the platform to engage in Type 1 (securities trading) and Type 7 (providing automated trading services) businesses.

The license imposes certain restrictions on trading platform users, and the licensee can only provide services to professional investors. The lack of retail users makes this license not as "sexy" as people imagined. In the four years since 2018, only two companies have obtained this license, and no well-known CEX has successfully obtained the "encryption license".

The number of companies approved to manage investment portfolios investing in virtual assets is slightly larger, but there are only 6 companies, including Xinhuo Asset Management (formerly "Huobi Asset Management"), Lion Global Asset Management, MaiCapital, Fore Elite Capital wait.

In the highly competitive high-value track of "trading platform", the "ease of use" and "breadth of business approval" of Hong Kong licenses are slightly insufficient.

For example, licensed brokers lose a lot of potential clients by only targeting professional investors rather than retail clients. The C2C function also has different regulatory requirements from CEX transactions.

secondary title

Can the New Encryption Policy Trend Bring New Prosperity?

In the spring of this year, Xu Zhengyu, the Secretary for Financial Affairs and the Treasury, issued a document stating that a new licensing system will be implemented. The system requires all virtual asset exchanges to apply for a license from the Securities Regulatory Commission before providing services in Hong Kong. The licensing system will apply to both securities-type and non-securities-type virtual assets.

On top of this Fintech Week, the full embrace of encrypted assets by regulators has also allowed people to see the deepening of compliance and the direction of regulation.

How far can Hong Kong's encryption regulation go in the future? Can Hong Kong compete with Singapore as an East Asian encryption center under favorable policies? The answers to these questions remain to be tested for us by time.

Hong Kong's open markets, strict regulatory regime, well-established rule of law and infrastructure, and the free flow of capital and information have fueled impressive growth. Perhaps as Hong Kong Financial Secretary Paul Chan said in his opening speech,"Together with financial regulators, the government is working hard to provide a conducive environment to promote the sustainable and responsible development of the virtual asset industry in Hong Kong."