Original source: Xiao Sa lawyer

Original source: Xiao Sa lawyer

Yesterday, the Financial Secretary of Hong Kong officially released the "Policy Declaration on the Development of Virtual Assets in Hong Kong". For a while, from the mainland to Singapore to Canada and Australia, people in the blockchain circle are very concerned. Indeed,This is a major benefit, but we should not be superficial, and should seriously study practical issues.This article willSummarize the legal norms and policies on the regulation of virtual assets in Hong Kong, provided to old friends in the circle for your reference.

first level title

1. Will Hong Kong’s policies related to virtual assets affect the mainland

I saw in the circle of friends that some people in the industry say that the clarion call for the financialization of virtual assets in Hong Kong is the prelude, and that the mainland will also liberalize the financialization of virtual assets in the future.Sister Sa does not agree with this point of view.In my opinion, Hong Kong and the Mainland are complementary in the development of virtual assets. At the same time, Hong Kong’s open attitude towards the financialization of virtual assets will ease the concerns of some mainland case-handling agencies about virtual asset advocates and occasional transactions.

On the one hand, the wind is blowing in Hong Kong, which shows that my country's legal attitude towards virtual assets is quietly making a strategic layout.The financial innovation of virtual assets and the entry of virtual assets into Web3.0 and the metaverse are major opportunities in the future. As an international financial center, HK will definitely be in place and become a bridge for the financial innovation of virtual assets between the mainland and overseas. It will also attract more projects, personnel and assets to Hong Kong for innovative attempts. Undoubtedly, this news is a great news. Friends in Singapore are still waiting and watching. We believe that Hong Kong’s virtual asset licenses will be gradually liberalized in the future. The number 1 and 9 licenses will increase, which will stimulate more "evangelist "Returned from abroad and "built a nest" in Hong Kong to develop virtual asset business.

On the other hand, the mainland will still treat the legal nature of virtual assets with caution.First of all, we can be sure that:The mainland will not give mainstream virtual currencies such as Bitcoin a "contraband" characterization.Holders of mainstream virtual currencies such as Bitcoin will still be protected in accordance with Article 127 of the Civil Code; secondly, alliance chains and private chains based on distributed accounting technology will be used in shipping, supply chain finance, power transmission transactions, and bank rolling accounts. It will continue to deepen and gradually iteratively upgrade; again, the ICO behavior based on the public chain will still be classified as "illegal financing". article); Finally, NFT and Web3.0 are highly compliant in the Mainland and Hong Kong, especiallyPay attention to anti-money laundering risks and financialization issues。

As for the "digital Hong Kong dollar", we also welcome it very much.Similarly, digital renminbi has been gradually accepted by consumers in online shopping. This year, on Double Eleven, large online shopping platforms have launched interesting activities about digital renminbi application scenarios and encouraging its use.

"Green Bond Tokens" allow the issuance of Hong Kong government green bonds to be tokenized for subscription by institutional investors.The logic behind this attempt is deep,first level title

2. Sorting out the regulatory framework of the blockchain industry in Hong Kong

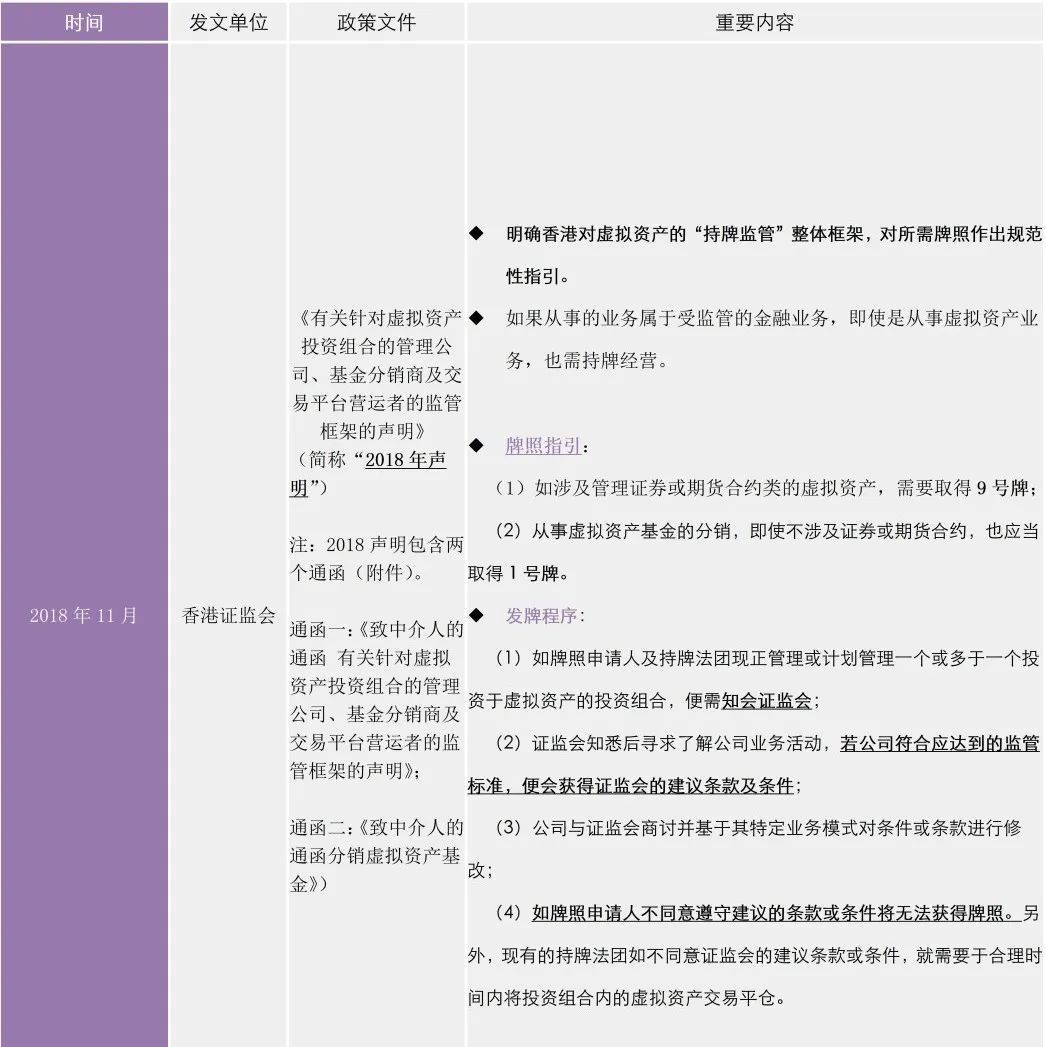

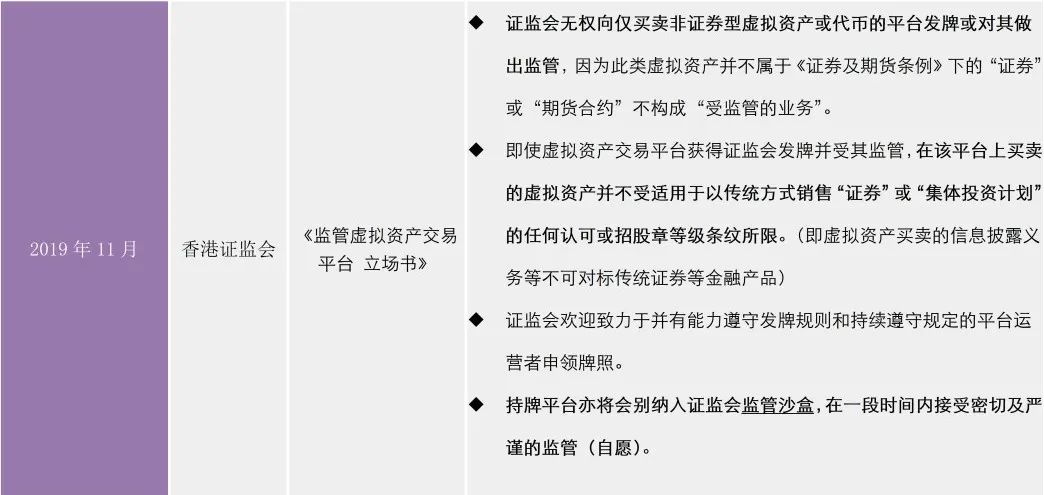

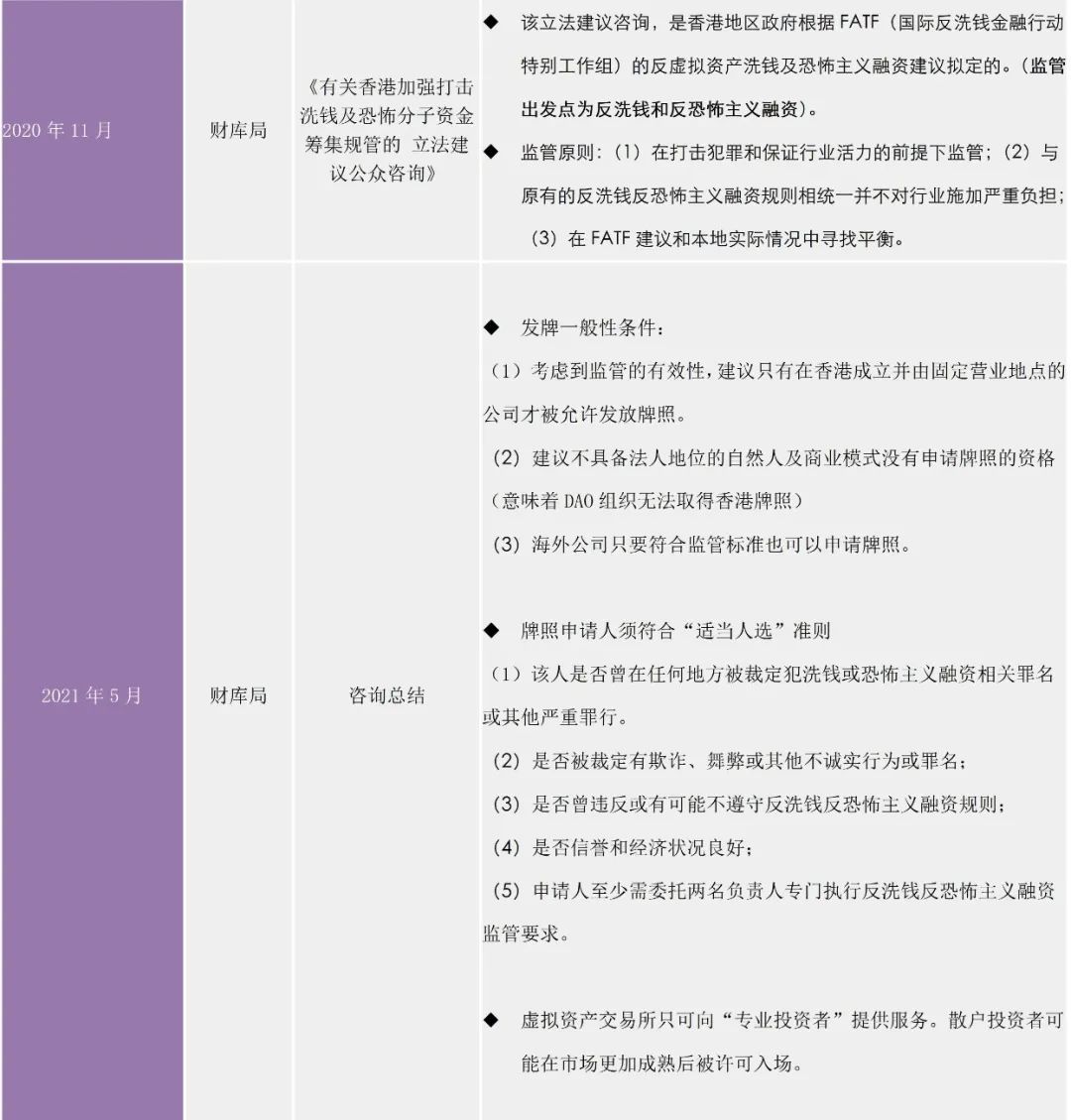

At present, Hong Kong currently has three main regulatory agencies for virtual assets: (1)Hong Kong Securities and Futures Commission(SCF, hereinafter referred to as "the Securities Regulatory Commission"); (2)Hong Kong Financial Services and the Treasury Bureau(hereinafter referred to as the "Finance Bureau") and (3)Hong Kong Monetary Authority(hereinafter referred to as "the HKMA"). Among them, the China Securities Regulatory Commission is the main force of supervision, and the virtual assets are divided into two parts:Regulated "securities financialization assets" and unregulated "non-securities financialization assets", while the Treasury Bureau and the Monetary Authority assist in supervision from different regulatory perspectives (the Treasury Bureau is the second main regulatory force, and its starting point is mainlyCombating virtual asset money laundering and terrorist financing activities). Under the planning of the three regulatory agencies, Hong Kong’s virtual asset licensing regulatory system has gradually become clear. Of course, referring to the classification of virtual digital artworks such as NFT in the US "Responsible Financial Innovation Act",It is not ruled out that in the future, Hong Kong's market supervision and management agencies will join the regulatory army and issue special regulatory norms for "non-financial securitization" virtual assets (pure digital artworks).

The supervision of virtual assets in Hong Kong can be roughly divided into two periods:

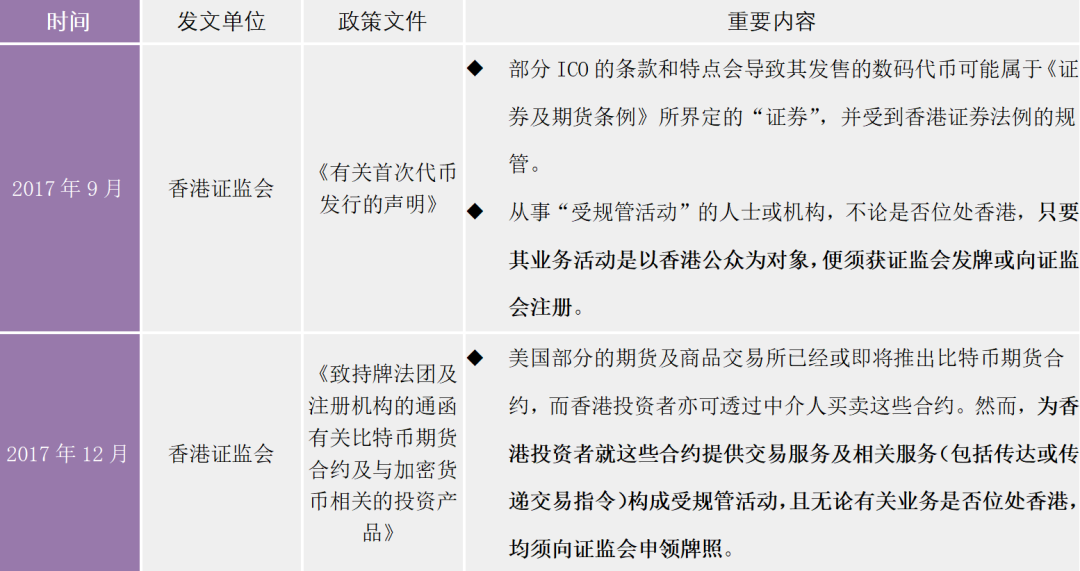

The first stage:From 2017 to 2018, it will focus on regulating ICO behavior. The regulatory idea in this period is to regulate virtual asset activities with financial attributes by analogy with traditional securities and financial products, and the CSRC will mainly regulate ICO behavior.

second stage:secondary title

The first stage

During this period in March 2018, there was aA typical landmark ICO event,secondary title

second stage

In Hong Kong's current licensing supervision practice, it is currently relatively cautious, and nowOnly two virtual asset trading platforms have successfully obtained trading licenses.One is issued to OSL (Digital Securities Limited, OSL DS), a member company of a technology group in 2020; the other is Hashkey Group, which just obtained a license in the first half of this year. Information can be found through public channels,OSL holds No. 1 license (securities trading) and No. 7 license (automated sales).

professional investorprofessional investor. Hong Kong's requirements for professional investors are: (1) individual investors, including their financial assets (cash, stocks and other highly liquid assets) reaching 8 million Hong Kong dollars or 1 million US dollars; (2) institutional investors, reaching 40 million HKD or USD 5 million. In addition, transactions need to fulfill KYC obligations and investor risk assessment to ensure that customers have sufficient net assets to bear risks and transaction losses.

Sister Sa’s team believes that, depending on the specific business types of the platform, if the virtual asset trading platform wants to operate in compliance, it may need to consider obtainingLicense No. 4 (Advising on Securities)As mentioned in the 2018 statement of the Hong Kong Securities Regulatory CommissionLicense No. 9 (management of virtual assets such as securities or futures contracts), a family statement, for reference only. In addition, it is the general trend of Hong Kong to bring all virtual asset trading platforms under the regulatory framework and licensing system in the future. According to the regulatory documents of the Treasury Bureau and the relevant laws and regulations of Hong Kong securities,first level title

3. Complementarity between Hong Kong and Mainland China’s blockchain industry segments

Regarding the supervision of virtual currency, the mainland issued the "Announcement of the People's Bank of China, the Central Cyberspace Administration of China, and the Ministry of Industry and Information Technology on Preventing the Risks of Token Issuance and Financing" in 2017, which was later called the announcement of the three associations. this announcementClearly define token issuance financing as an act of illegal public financing without approval,Linking this kind of behavior with illegal and criminal activities such as the illegal sale of token tickets, illegal issuance of securities, illegal fundraising, financial fraud, pyramid schemes, etc., expressly prohibits any organization and individual from illegally engaging in token issuance and financing activities, basically cutting off tokens. The road to financing in the Mainland.

in this regard,Hong Kong's attitude is to allow ICO (Hong Kong subdivides the issuance of securities tokens into STO), but it needs to be strictly licensed and supervised, because the financial attributes of such virtual assets constitute "regulated financial products".In 2017, the Hong Kong Securities Regulatory Commission issued the "Statement on Initial Coin Offerings". According to the statement, the following three situations will be identified as securitization ICOs and will be subject to special supervision: if the tokens sold represent the equity of a company or own Rights and interests, the purpose of tokens is to enter into or confirm debts or debts borrowed by the issuer, and the proceeds from the sale of tokens are collectively managed by the ICO plan operator and invested in different projects, so that tokens can be held People can participate in sharing the rewards provided by the project.

As far as NFT is concerned, the current supervision of NFT in the mainland is still a relatively extensive overall supervision.It is more to remind investors and consumers of traditional legal risks such as fraudulent gambling that may exist in NFT. In April 2022, the mainland issued the "China Internet Finance Association, China Banking Association, and China Securities Association's Initiative on Preventing NFT-related Financial Risks". From this initiative, it can be found that the mainland separates NFT from financial activities. , It is clearly proposed to curb the tendency of NFT financial securitization and prevent NFT financialization. The policy tone for NFT is to affirm its promotion of digital cultural creation in the real economy,The significance of promoting industrial digitization is to resolutely stay away from NFT financialization.

In this regard, Hong Kong's supervision has carried out a more detailed division.Hong Kong recognizes the existence of financialized NFT, and actively divides NFT into two parts: collectible NFT and financial asset NFT.For collectible NFT, its activities are completely outside the scope of the supervision of the China Securities Regulatory Commission, but for financial NFT, its promotion and distribution must be regulated by the China Securities Regulatory Commission, and it can only be carried out after the license is issued. So readers may be wondering, where is the boundary between the two? According to the Hong Kong SFC,If an NFT constitutes a structure similar to securities or equity under collective investment, it is defined as a financial NFT that needs to be issued with a license.

According to Hong Kong's Securities and Futures Ordinance,Security Definitionis "a share, stock, debenture, debenture stock, fund, bond or note of or issued by any body (whether incorporated or not) or government or municipal authority" which may sound too general, Collective investment interests are also included in securities. Under this definition, collective investment schemes are defined as containingFour elements:"shall involve an arrangement in respect of property in which the participant has no day-to-day control over the management of the property in question; the property is managed in its entirety by or on behalf of the person operating the arrangement, or the participants' contributions and the profits or proceeds paid to them are pooled; and the purpose or effect of the arrangement is to enable the participants to share in or receive profits, proceeds or other returns arising from the acquisition or management of such property.”Those who meet the above conditions will be defined as financial NFT for license supervision.

Overall,If you just want to make NFT art collections, both the mainland and Hong Kong are fine.But the mainland has a larger potential market and richer IP background. However, if you want to go through the financialization of NFT, there will be relatively large legal risks in the mainland, and you can consider Hong Kong to get a license to work.

At the underlying technical level of the blockchain, we all know that China and the United States have chosen two completely different directions on this track.China chose Metaverse to take the direction of hardware entity empowerment, and the United States chose web3.0 to take the direction of software creation.The direction also determines the policy. The mainland is relatively friendly to the development policy of the underlying technology of the entire blockchain. In 2020, the Ministry of Education issued a notice of the "Blockchain Technology Innovation Action Plan for Colleges and Universities", and by 2025, a number of blockchain technology innovation bases will be established in colleges and universities, and a group of blockchain technology research teams will be cultivated and brought together.

After this document, notices on the application of blockchain in various specific directions were issued, including the "Guiding Opinions of the Ministry of Industry and Information Technology and the Central Cyberspace Affairs Office on Accelerating the Application of Blockchain Technology and Industrial Development", "The Ministry of Transport's Notice of the General Office on Printing and Distributing the "Guidelines for the Construction of an Electronic Delivery Platform for Imported Containers Based on Blockchain", and even in May 2022, the Supreme People's Court issued the "Opinions on Strengthening the Judicial Application of Blockchain", affirming that the district The application prospect of block chain evidence storage technology in the judicial field.In this regard, Hong Kong does not have too many encouraging norms.

Generally speaking, the policyThe mainland encourages the development of virtual technologies that are more closely connected with entities,Including NFT that empowers the real economy, and the underlying blockchain technology that promotes the development of the entity;write at the end

write at the end

The policies of Hong Kong and the mainland are different, which leads to different directions of future development and completely different positioning of the division of labor.The mainland region will continue to provide Hong Kong with financial tools, digital art IP, and technical tools in the future, and will support Hong Kong in building itself into a world-leading virtual asset economic core area for a long time. andHong Kong has undertaken the great task of developing China's virtual economy, concentrating resources to build a regulated, fast-growing, healthy competition, open and inclusive virtual economic center.Original link