Originally written by Galaxy Research-Sal Qadir, Gabe Parker

Original title: NFT Royalties: The $1.8bn Question

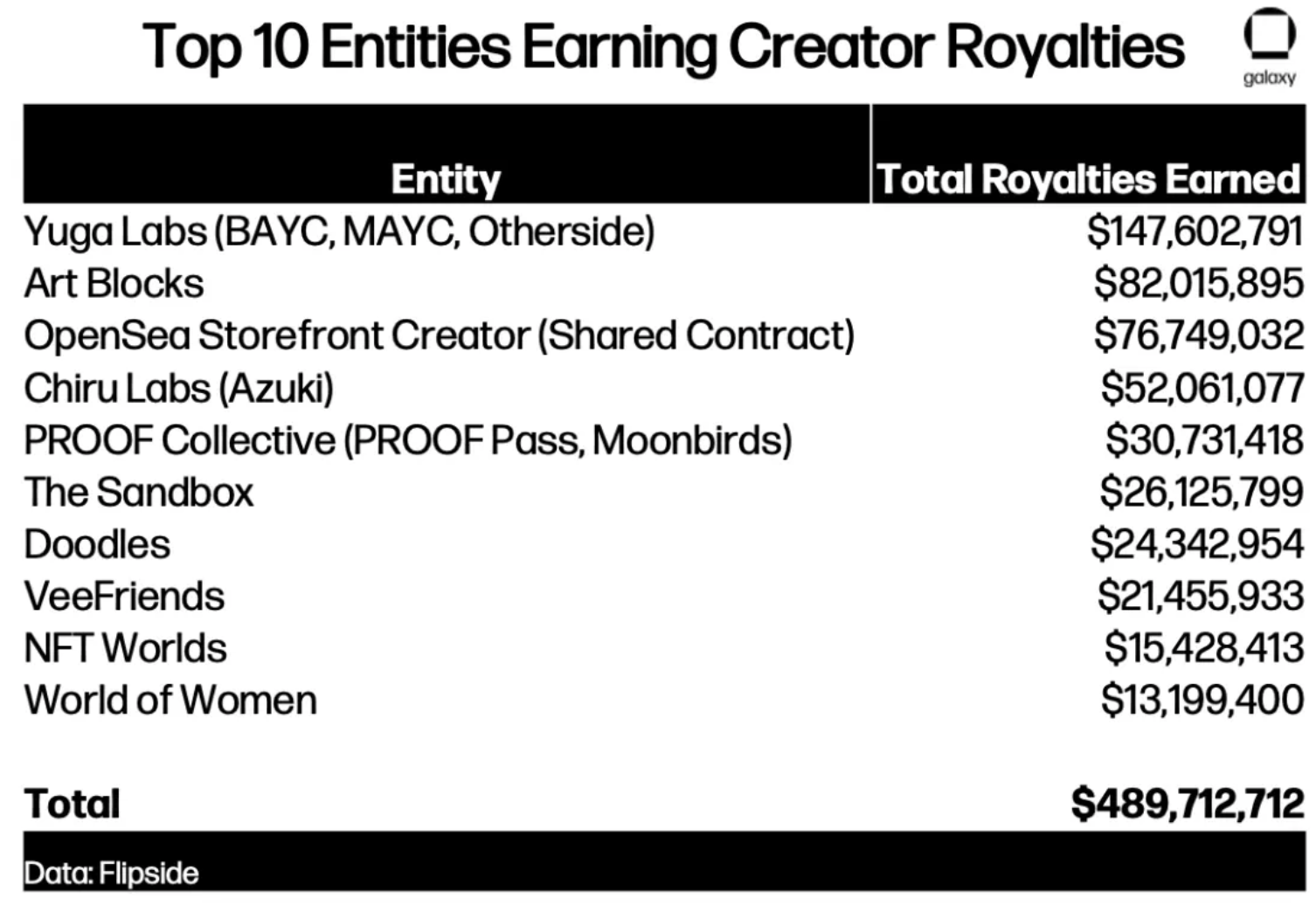

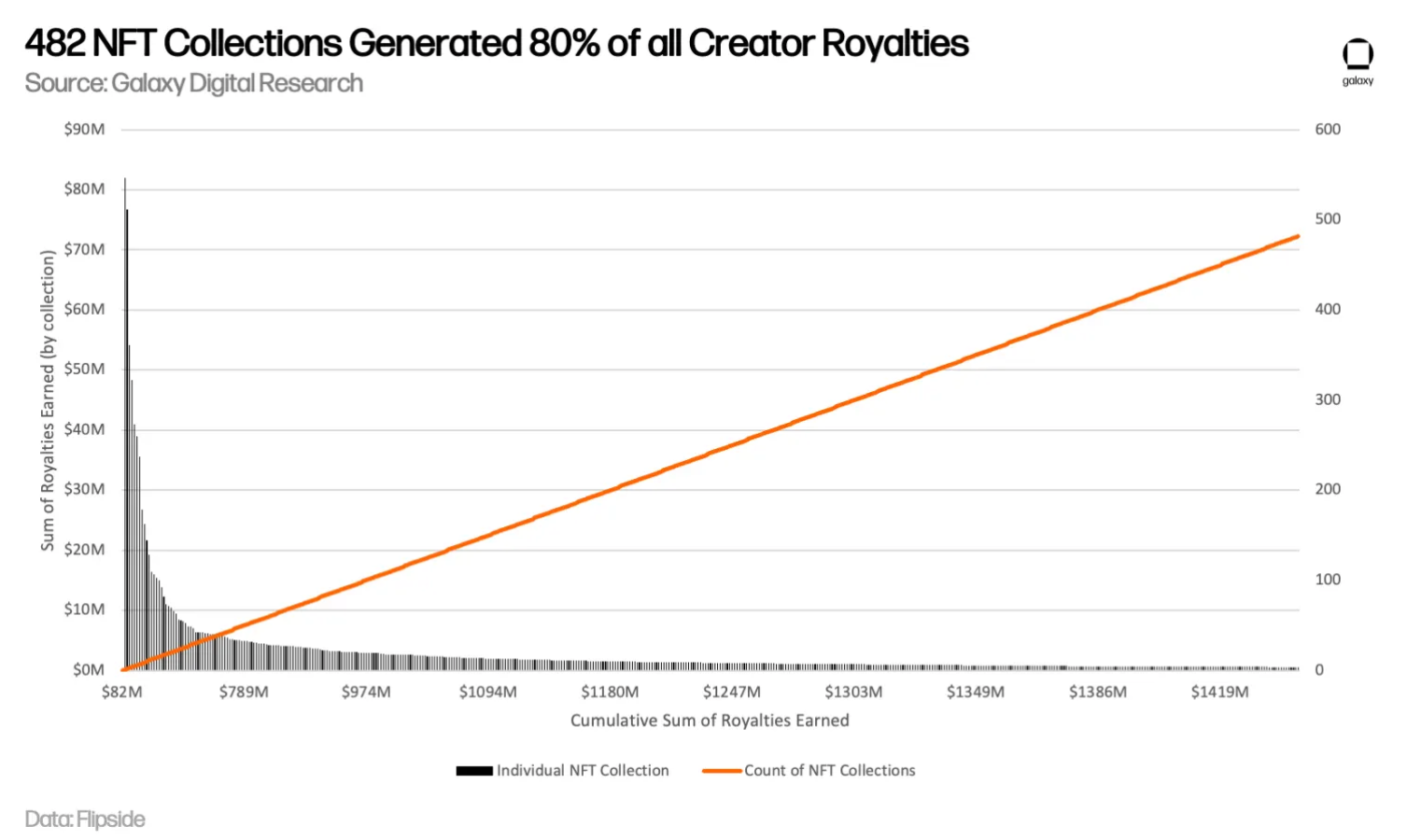

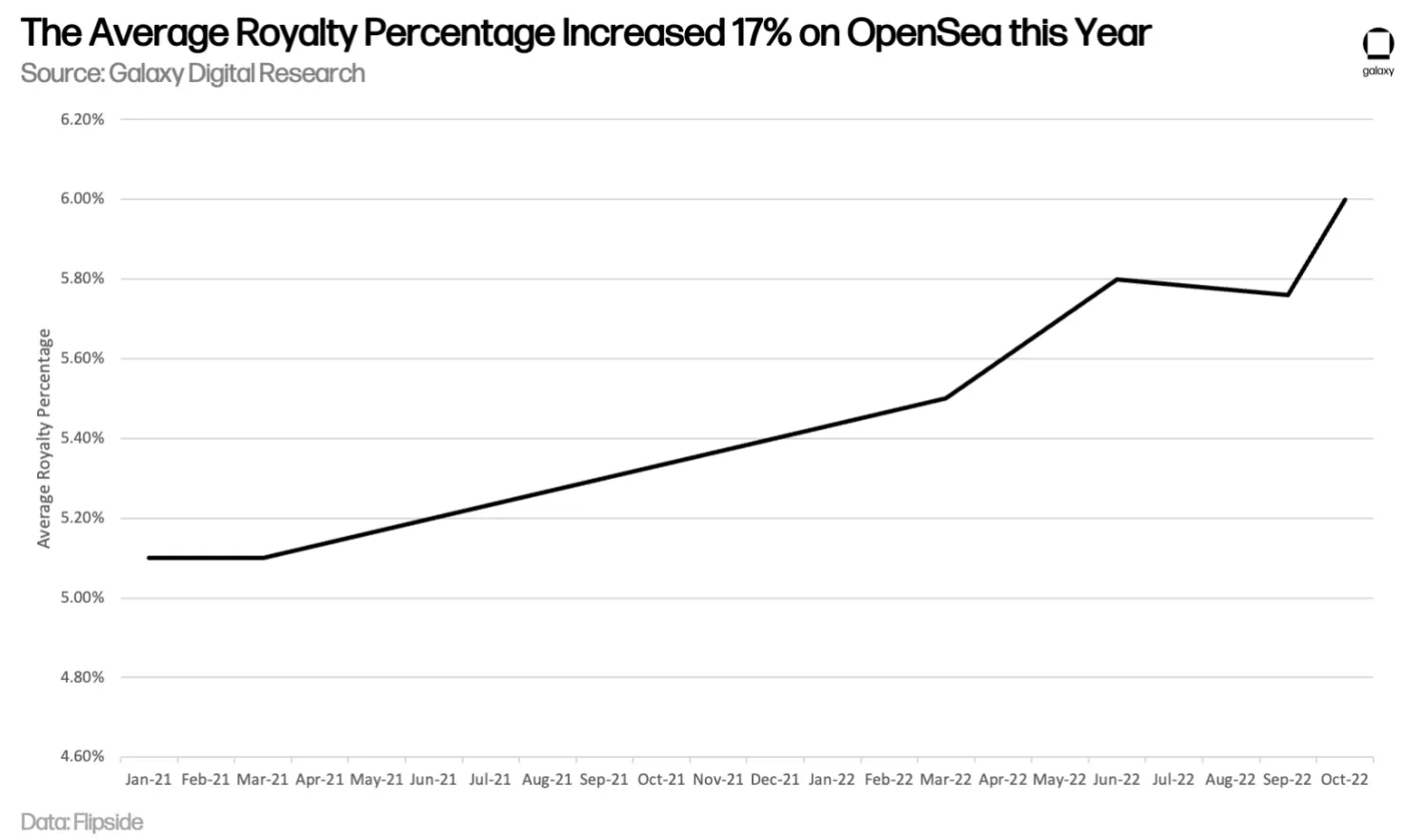

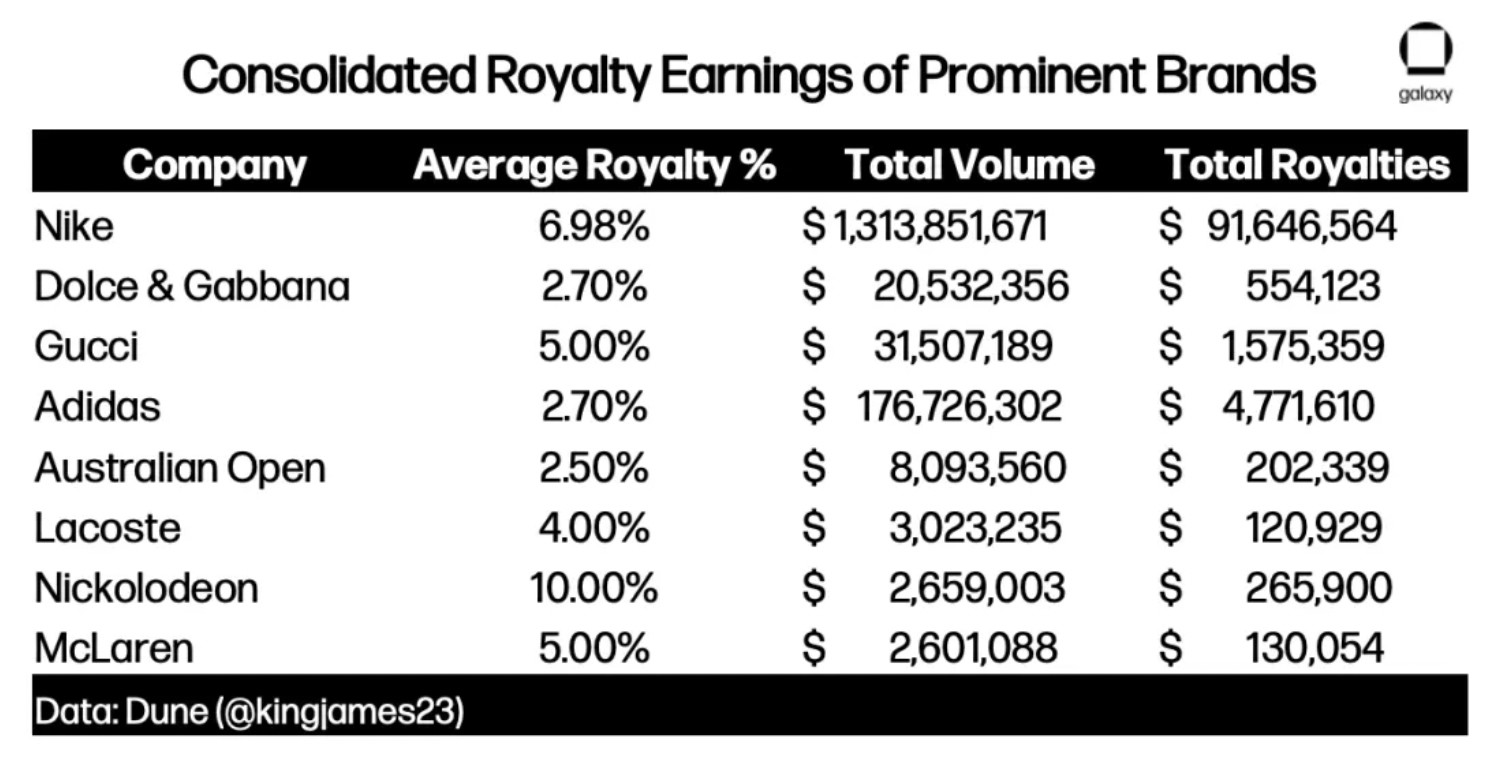

More than $1.8 billion in royalties have been paid to creators of ethereum-based NFT collections. Furthermore, on OpenSea, by far the platform that pays the most royalties to creators, the average percentage of royalties paid to creators has doubled from 3% to 6% in the past year. Major brands of NFTs, including traditional players and crypto-native organizations, have raked in hundreds of millions of dollars in royalties generated from secondary sales. In fact, just 10 entities accounted for 27% of all royalty revenue, and 482 NFT collections accounted for 80% of all royalty revenue to date. However, the recent resistance to the royalty model in the broader crypto community is bound to threaten what was once considered the core value proposition of NFTs. The reality is that royalties are not inherited primitives of the same on-chain permanence that are taken for granted in the crypto space. Galaxy Digital conducted research on NFT royalties and published the article "NFT Royalties: The $1.8bn Question". The DAOrayaki decentralized editorial board compiled the research: analysis method, royalty operation model, brief history, current situation and future direction, etc.

Analytical method

image description

image description

482 collectibles

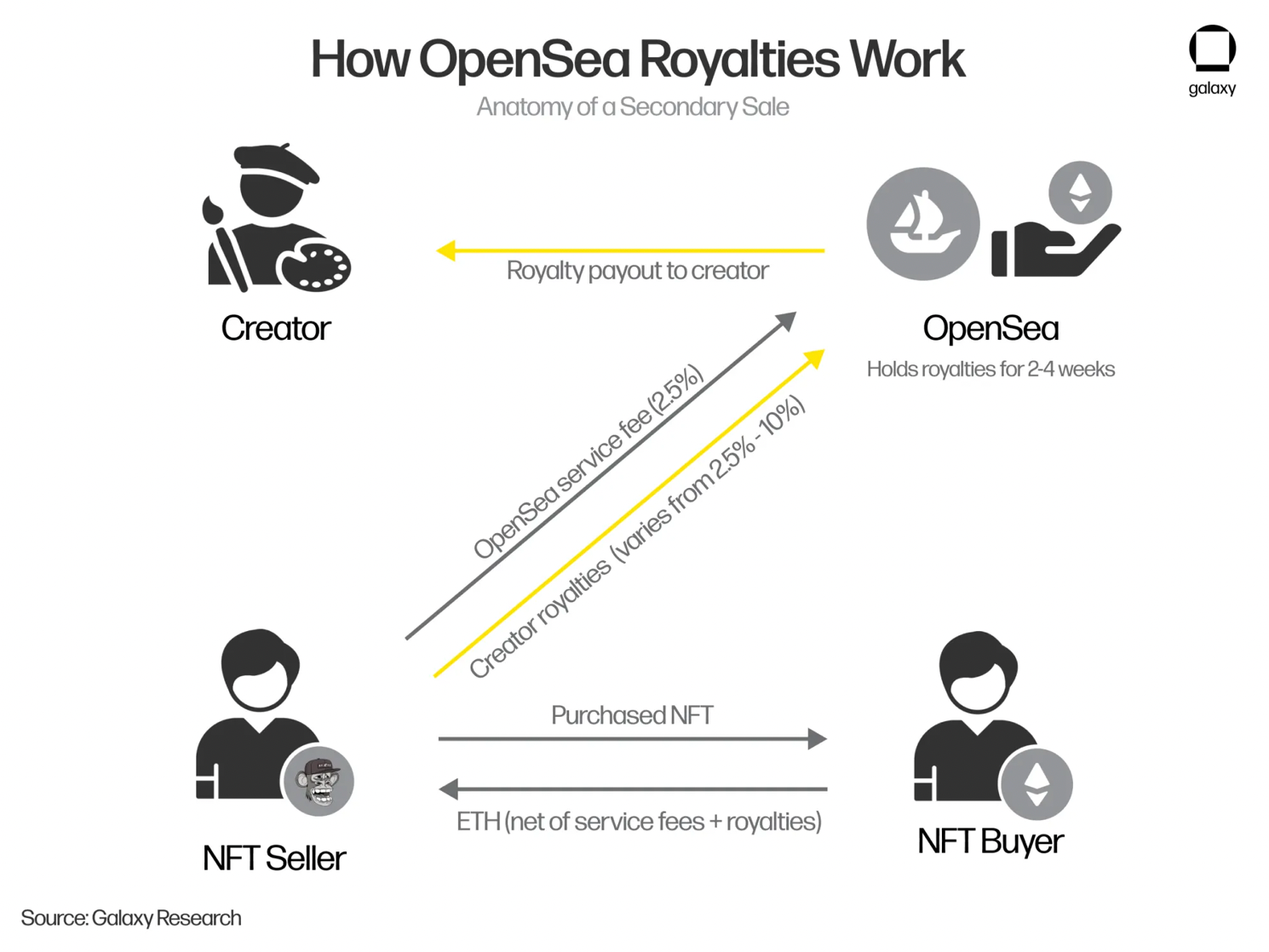

How do royalties work today?

image description

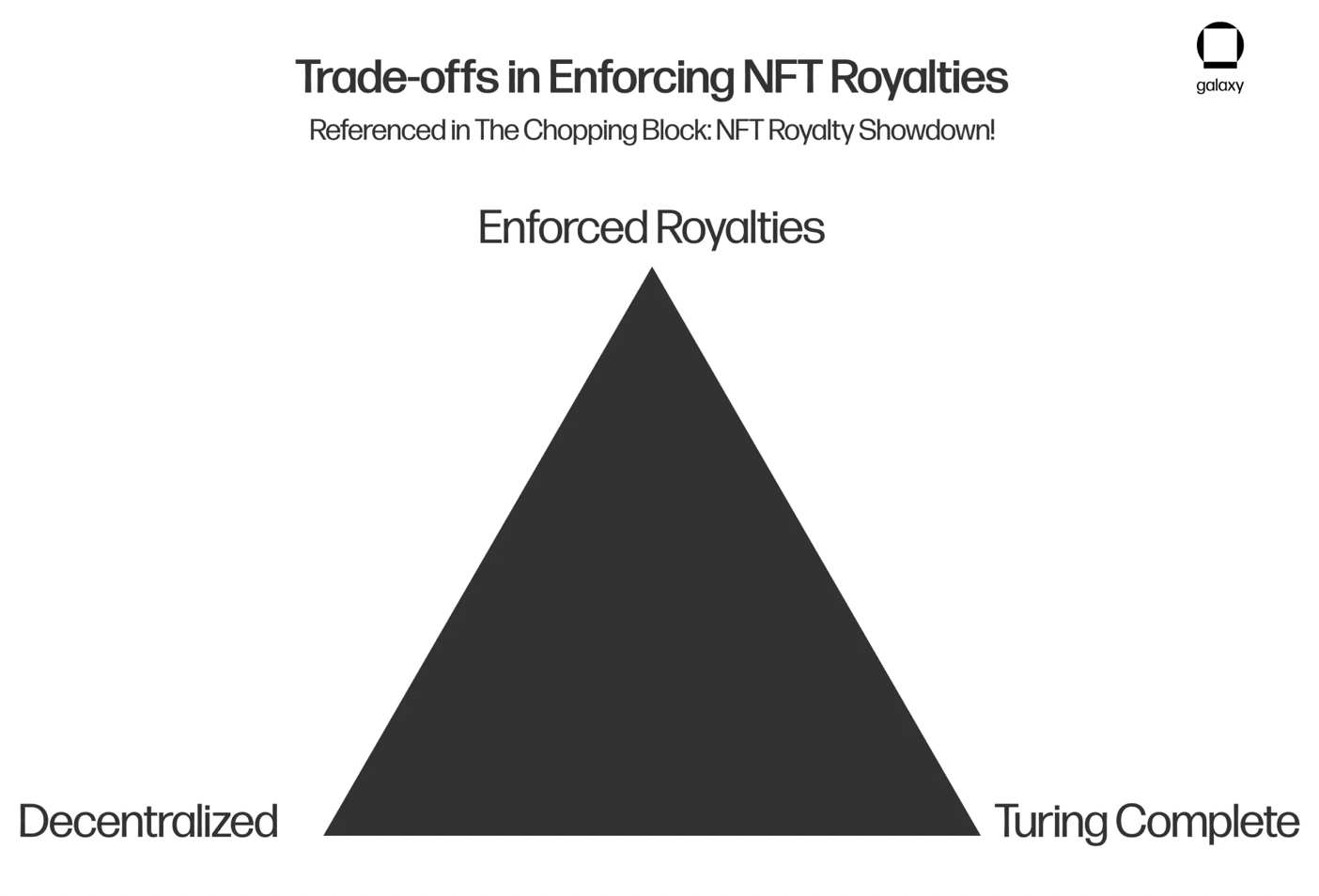

Royalty Trilemma

On a recent episode of The Chopping Block, Dragonfly’s Haseeb Qureshi and Magic Eden’s Zhuoxun Yin discussed the trilemma between successfully implementing royalties, decentralization, and Turing completeness. Successfully optimizing these three properties is currently not feasible and is a key reason why NFT royalties have not yet been implemented at the token/smart contract level.

Due to technical difficulties in enforcing royalties at the smart contract level, they are instead enforced by NFT marketplaces. In other words, royalties are enforced by social norms, and the market is effectively choosing to support the ongoing funding of creators by collecting and paying royalties (similar to tips) on behalf of creators. As a result, most NFT marketplaces have implemented custom royalty payment solutions to attract creators by promising a continuous revenue stream. This is important in the early days of NFTs, as the protocol needs to appease both sides of the market, creators and collectors. Now that the NFT space has matured considerably over the past 2 years, the market has adjusted accordingly. As mentioned above, some marketplaces such as SudoSwap have eliminated royalty payments entirely in order to attract as much liquidity as possible.

image description

introduce

introduce

NFTs gave rise to the concept of reselling creator royalties, revolutionizing the economic relationship between creators and consumers. Before the advent of NFT royalties, artists traditionally only made money from primary sales of their works. This restrictive economic paradigm prevents artists, especially those whose work might be considered too revolutionary for their time, from increasing their income streams as their work gains recognition. The logical extreme of this restrictive economic model is best represented from a historical perspective by the famous artist Vincent van Gogh. Van Gogh struggled with poverty all his life and only sold one painting, The Red Vineyard, in Belgium for 400 francs a few months before his death. Although never famous during his lifetime, Van Gogh eventually became one of the most famous painters in history, generating more than $670 million in secondary sales after his death. It's not hard to imagine van Gogh being able to earn royalties from his second-hand sales, directing the ongoing income stream toward posthumous causes of his choice (such as art education programs).

On the one hand, NFT royalties are a way for creators to earn additional income through the continued success of their creations. This business model is particularly beneficial to digital artists and musicians, who have historically struggled to generate profits from traditional distribution channels such as galleries and record labels. On the other hand, some in the crypto community increasingly believe that NFTs should be fully owned by their buyers, and that royalties paid to creators are unfair and extractive. Crucially, NFT royalties are currently enforced by the marketplace itself, rather than being hardcoded into the issued smart contracts. The decentralized nature of the crypto space has given rise to various NFT market structures that feature royalty-free NFT transactions as a core value proposition.

More recently, ongoing issues with NFT royalty enforcement at the market level have sparked a wave of change among the dominant players in the NFT ecosystem. The DeGods ecosystem recently removed royalties from all of its affiliated NFT collectibles (DeGods, y00ts). The move came despite DeGods founder Frank defending the royalty multiple times on Twitter, which he still believes is the best incentive alignment mechanism between NFT collection operators and holders. Some exchanges, albeit smaller ones, have also started changing royalty payments (or removing them), such as x2y2, although the largest, OpenSea, has not. Additionally, Solana NFT marketplace giant Magic Eden made a controversial shift to make all royalties on its platform entirely optional. Magic Eden's latest move to eliminate royalties is particularly noteworthy considering Magic Eden's September 2022 announcement of MetaShield, a controversial tool designed to improve royalty enforcement.

There are compelling arguments on both sides of this debate. While royalties have proven to be a lucrative revenue stream for collection owners, they are not enforceable at the smart contract level, as evidenced by the rise of the royalty-free market. The NFT community appears to be ideologically divided in favor of royalties, with some arguing that royalties are good for the health of the NFT ecosystem, while others see them as exploitative and unnecessary. This issue has the potential to have a long-term impact on the NFT space for years to come, given the substantial risk in terms of possible lost revenue streams. In this report, we examine the issue of NFT royalties from multiple angles and suggest how we think this critical issue will become a reality.

A brief history of NFT royalties

NFT royalties are a relatively new phenomenon compared to the age of the NFT space itself.

CryptoPunks, considered the godfather of PFP, never collected royalties when it debuted in 2017. The official CryptoPunks Exchange, the only marketplace where Punks are traded, still does not enforce any royalties on secondary sales. CryptoPunks creators Larva Labs opted for a different business model, opting to hold 1,000 Punks on their balance sheet and sell these Punks piecemeal for income.

image description

Average Royalty Trend

Royalties have only increased since the Otherside land sale frenzy. Goblintown, for example, debuted with a completely free series that took advantage of an elaborate viral meme campaign on Twitter. Behind the veil of an "anti-Discord, anti-roadmap, anti-utility" ethos, Goblintowns quietly set a 7.5% royalty on all secondary sales (very high at the time). This ended up netting the team about $7 million, and the collection ended up being little more than a meme. The highest royalty is probably the Metaverse collection NFT Worlds. Although the NFT Worlds land deal is down 94% from its all-time high, their 9.5% royalty is one of the highest for a famous collectible, netting the team $15 million. The platform also has a paltry 235 daily active users. Given the poor performance of collectibles and lackluster user growth, some community members are unhappy that the project's founders continue to collect royalties.

Due to the long-term bear market, users are more sensitive to NFT prices than ever before, and the market has also begun to oppose collectibles that generate continuous income through royalties. This dissatisfaction with royalties, along with some recent innovations in market structure, has ultimately sparked a surge in activity in the royalty-free NFT market.

today's situation

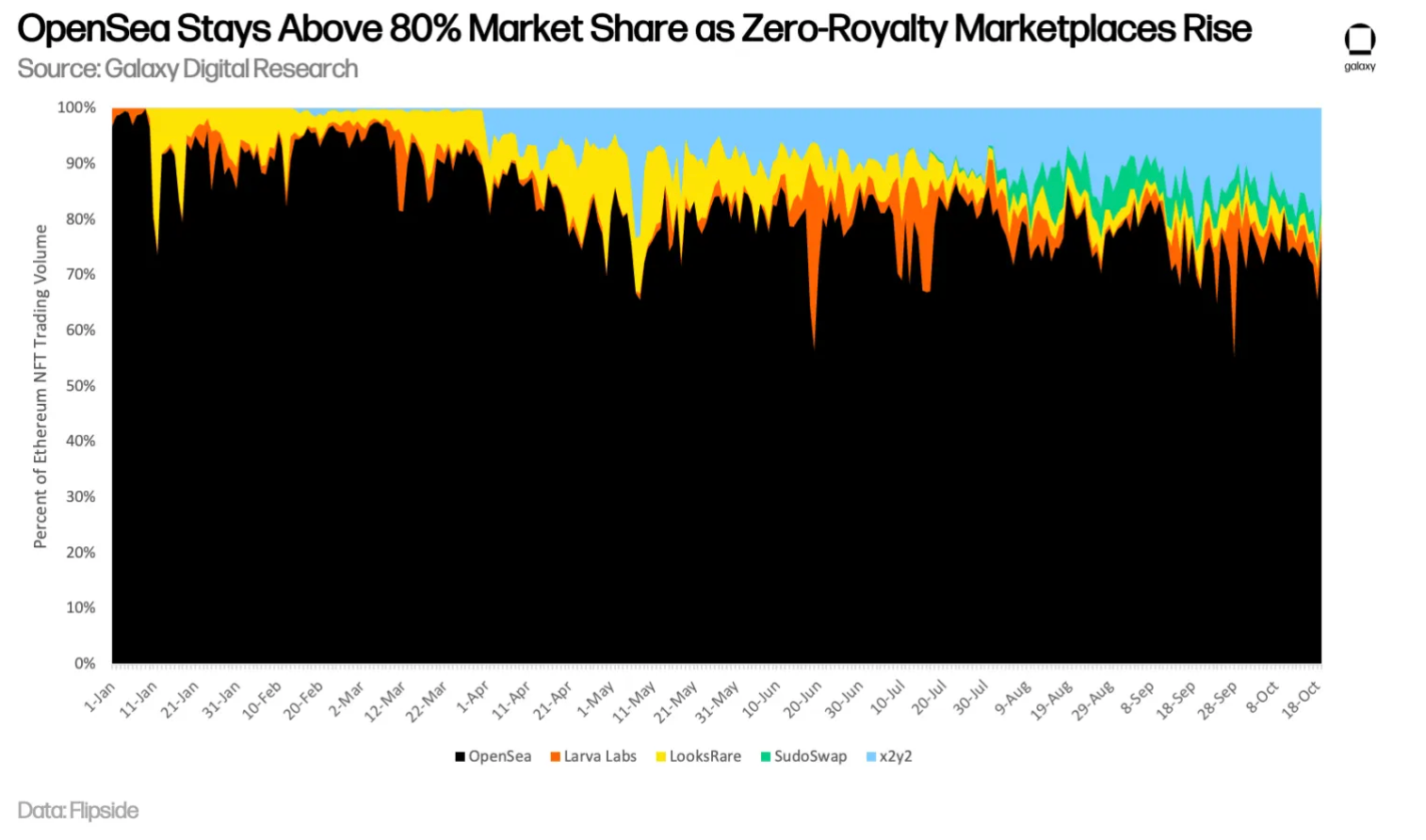

SudoSwap is the origin of the anti-royalty movement in the NFT field. Launched in July 2022, SudoSwap utilizes an AMM model for NFT transactions (similar to how Uniswap works for fungible tokens). Their goal with the AMM model is to increase NFT liquidity and market making while minimizing fees. Not only does SudoSwap charge a relatively low 0.5% transaction fee (compared to OpenSea's 2.5%), they also do not support enforcing any NFT royalties on the collectibles themselves. While SudoSwap's model is best suited for on-market NFTs, their core value proposition has proven very popular with sellers looking to maximize profits. Instead of losing out on royalties and platform fees of up to 12.5%, sellers are guaranteed to only pay a maximum of 0.5% per sale.

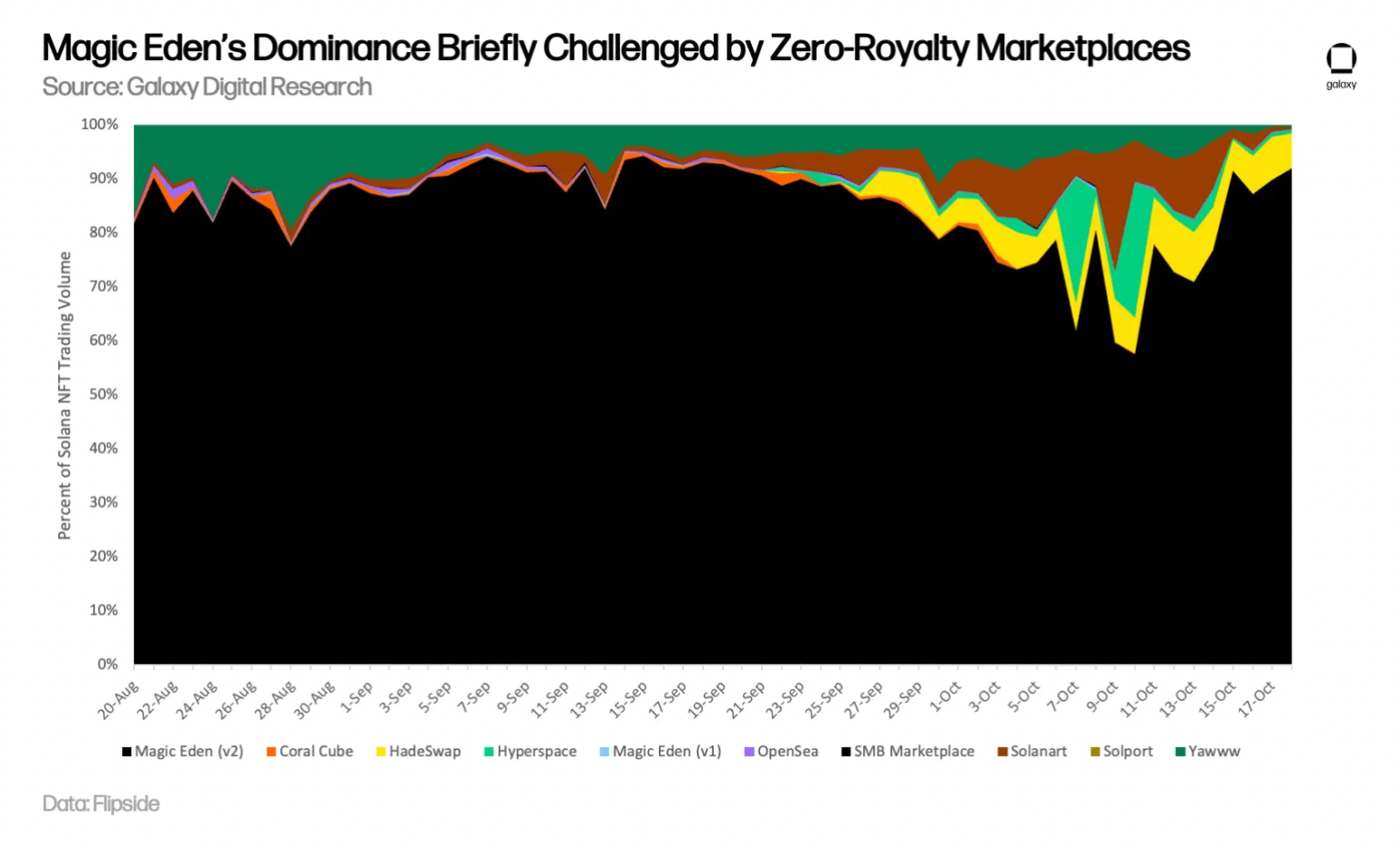

SudoSwap is starting to become the go-to destination for selling NFTs, and Gem has taken notice. Acquired by OpenSea last April, Gem is an NFT marketplace aggregator that helps users scoop up NFTs on exchanges at the lowest possible price. Naturally, this means that gems start including SudoSwap in their list of aggregators. This small gesture prompted the wider NFT space to interpret the Gem's integration with SudoSwap as a sort of endorsement of OpenSea. Soon after, another NFT marketplace, x2y2, followed suit, giving buyers and sellers the option to pay royalties. Around the same time that x2y2 removed royalties on the Ethereum side of the NFT, Yawww made an announcement on the Solana side of the NFT, which largely mirrors x2y2 making royalties optional. HadeSwap also made the move after Yawww removed its royalties, reflecting SudoSwap’s efforts to build a royalty-free AMM model for Solana NFTs transactions. Come September, what seemed to be a royalty-free movement, originally started with Ethereum NFTs, was taking the Solana NFTs by storm.

image description

image description

Opensea's market share

Interestingly, the Solana NFT ecosystem is more sensitive to this ongoing royalty debate than the Ethereum NFT ecosystem, as evidenced by the change in Magic Eden's market share users prior to the removal of the royalty, while OpenSea due to The market is huge, and the loss of share in the zero-royalty market is much smaller. One possible explanation is that the more strictly employed nature of Solana NFT traders favors profits over long-term holders and retail users. On the Ethereum side, there are more high dollar value collectibles such as Fidenzas and Punks, which attract a class of buyers who are more interested in displaying status and storing value in these rare collectibles than To make a quick profit and hype them. In other words, these high-net-worth users aren't bothered by the royalties each sale generates.

Tyler Hobbs, creator of the Fidenza and QQL generative art collectibles, supports the claim that Ethereum’s NFT community behaves fundamentally differently than Solana’s NFT community. Hobbs said:"Serious artists and serious collectors tend to be on Ethereum, not Solana. This is a better test of these systems, and I think the creators put more effort into it when it comes to Ethereum. So far, Hobbs seems to be right that Ethereum's NFT community will work hard to maintain royalties, as OpenSea, which enforces royalties, remains the dominant platform. Besides individual creators, Nike, Gucci and Adidas will not be able to enforce royalties if they are no longer enforced. Major brands such as , etc. will also lose tens of millions of dollars in potential revenue. We expect these large traditional institutions and large creators to work hard to protect the royalty-driven revenue streams they receive from Ethereum-based NFT collections.

debate:

In the ongoing battle over royalties, two main schools of thought have emerged. Proponents of royalties point to the potential for creators to earn more money as projects become more popular. That's because projects tend to start off with low initial sales, but gain popularity in the months after launch. DeGods and BAYC are two clear examples of NFT series that, in less than a year, have seen smaller major sales figures but leapt upstream in their respective ecosystems. Proponents of royalties worry that normalizing the removal of royalties will return the NFT space to the dark ages of traditional creator incentive structures, as Van Gogh experienced.

On the other hand, opponents of royalties claim that it is impossible to enforce mechanisms on-chain without rigorous trade-offs that negate many of the advantages of permissionless blockchains in the first place. Even Solana creator and respected engineer Anatoly Yakovenko admits that the only viable way to enforce royalties at the token level is to reimagine what the concept of ownership looks like. In his view, ownership of NFTs can be split between users and creator-defined smart contracts. This would allow creators’ smart contracts to enforce royalties and grant them the power to strip users of their NFTs if they fail to comply with the royalty parameters set forth in the token’s smart contracts. This structure has obvious implications for the concept of self-sovereignty, which many believe is antithetical to the entire purpose of NFTs. Royalty opponents also argue that collectors in the NFT space are very price sensitive and will increasingly favor markets that offer the lowest fees. At the same time, the battle for royalties is seen by naysayers as impractical, and the inevitable shift away from royalties means creators will be better served in developing more sustainable business models.

Several major NFT players offered solutions to address and/or enhance royalty enforcement.

Initial notable responses:

Tyler Hobbs' QQL minted card project is the first major NFT project to prevent transactions on the 0% royalty market at the smart contract level. This functionality is implemented via a blacklist filtering contract that checks whether msg.sender (the person trying to buy the NFT) is on the list of blocked users before allowing the user to complete the purchase. If the msg.sender receiver detects a blacklisted user, the transaction will automatically fail. Hobbs adds existing anti-royalty markets to blacklist. The QQL project draws attention to the fact that if NFT marketplaces have the right to decide whether to follow the royalty system, then NFT creators should also have the right to decide which marketplaces can sell their artwork.

Although Magic Eden has changed direction, they initially attempted to combat the 0% royalty movement with a tool called MetaShield. This new optional feature allows creators to track and identify Solana-native NFTs listed on 0% royalty platforms like Yawww. Through MetaShield, creators of these projects can deliberately modify the metadata of NFTs in an attempt to bypass royalty payments. Not only does the MetaShield tool blur or erase NFT images, but it also creates an accountability system for buyers. If a buyer purchases an NFT that bypasses royalties and is blocked, the buyer will accumulate a debt for unpaid royalties. This debt must be paid to"lifted"Protection of NFT images. While Magic Eden has faced pushback for this type of buyer accountability, the company clarified that it is set up to incentivize recognition of creator rights.

One of the most noteworthy NFT smart contract developers and tools providers, Manifold offers an eye-opening solution to the royalty distribution crisis. Manifold has partnered with OpenSea, Rarible, Nifty Gateway, and SuperRare to launch on-chain contracts that allow the marketplace to easily comply with the royalties required by the project. The key problem Manifold is solving is that creators have to manually update their desired royalty percentage in each marketplace where the NFT is traded. This is problematic because any new exchange that emerges won't know exactly what the preferred royalty preference for existing NFT collections is. Additionally, if a creator's royalty preference changes, they will also manually update their preferred royalty on each exchange. Manifold is standardizing this onerous process by creating tools that let creators update their preferences in one place on-chain. Manifold calls this the Royalty Registry Contract, and it makes it easy for smart contracts that previously did not support on-chain royalties to add them. While royalty registries do not necessarily facilitate royalty enforcement, they do make it easier for developers to comply with existing royalty preferences for creators in an on-chain fashion. This approach is very similar to the one originally proposed in EIP-2981: NFT Royalty Standard.

Outlook, Conclusions and Potential Solutions

As NFTs continue to grow, the future of royalties hangs in the balance. While these numbers suggest that Ethereum NFTs still have a large number of users willing to pay royalties, the royalty-free market has shown impressive growth in a short period of time. One thing is certain: the future of NFT creator revenue hangs in the balance as industry stakeholders weigh the pros and cons of this contentious issue. Only time will tell if creators will continue to benefit from secondary sales, or if they will lose out on potential revenue due to the "pure" ownership model. As this dynamic market continues to develop and mature, it will be interesting to watch how stakeholders mull over potential long-term solutions to this ongoing battle. Some potential solutions include:

Buyer Premium: In Beeple's view, shifting the responsibility for royalties from the seller to the buyer makes a lot of sense. Since buyers are looking to enter the NFT ecosystem, they may be more willing to pay royalties, as they may also take advantage of some of the utilities associated with NFTs (such as accessing Discord, earning rewards, or playing games). In all of these use cases, royalty payments can be checked programmatically before the program grants access to the user. On the other hand, since sellers are withdrawing from collections, they may be less willing to pay extra fees when withdrawing NFT collections. So it's no surprise that sellers are inherently more mercenary when it comes to finding the best execution price for their NFTs. This dynamic is exacerbated by NFT speculators, who seek to enter and exit NFT positions simply for profit.

Vertical integration of the marketplace: When Crypto Punks debuted in 2017, they could only be bought and sold on Larva Labs’ marketplace. By controlling the market, Larva Labs is able to enforce its own royalty preference (always 0%). Today, both Yuga Labs and RTFKT are building their own marketplaces. This vertical integration trend has many similarities to the e-commerce trend that has emerged over the past decade with the rise of direct-to-consumer. The analogy here is that Amazon is like OpenSea, maximizing distribution and minimizing profit margins. Companies with their own storefronts on Shopify retain more of their profits. While a vertically integrated market is unlikely to capture the majority of the NFT trading market, this trend may ensure that some level of collectible royalties perpetuates (similar to what we've seen with the rise of direct-to-consumer).

Alternative revenue streams: In the absence of guaranteed royalties, some platforms may be forced to introduce subscription-based business models to maintain their recurring revenue. Other collections may be forced to monetize the collection's IP through merchandising or commercial transactions outside of crypto (live events, restaurants, TV shows, games, movies, etc.). While this could be beneficial to the NFT space in the long run as it can force the ecosystem to implement a long-term strategy, we wouldn’t be surprised to see many failed attempts in this regard. When generating alternative revenue streams, the key question we ask is, what is the purpose of the collection of NFTs? This approach is logical if collections of NFTs are supposed to be like businesses. However, those who view collections as a decentralized community that should not be motivated by profit may be disappointed by this trend.

Increase minting price. The easiest way to address declining royalty income is to increase revenue from primary sales. This approach may only work in mature NFT ecosystems with a successful pedigree. However, we do see mint prices expected to increase over time (just like we saw royalties climb from 2.5% to 7.5% over the past year). However, this trend toward higher mints could also lead to increased scams due to misaligned incentives. As new projects raise more capital upfront, they may be less willing to provide sustained value over the long term.

A system of diminishing royalties. Originally proposed by jota.sol, this approach has similarities to historically proposed regressive tax systems. In this system, as the number of taxable objects increases, the amount of taxation decreases. In the case of NFTs, the higher the value of a particular NFT, the lower the percentage of royalties charged when it is sold. The economic theory behind this approach is known as"Laffer Curve", which argues that the logical extremes of taxation produce suboptimal outcomes in terms of revenue generation. In other words, there may be an optimal royalty percentage on the Laffer curve that most traders are willing to pay, which is >0%.

Enforce off-chain utility. This is similar to what Tyler Hobbs and MetaShield have already attempted, but it focuses entirely on off-chain use cases. The core idea here is that many users buy NFTs to access resources outside the chain (such as games, staking platforms, Discord servers, etc.), and this method will simply check access to the resources based on whether the NFT owner pays royalties. We've seen this with NFT Discord servers, where roles are awarded based on past royalty payments. These enforcement mechanisms typically work by checking that the NFT was purchased on a royalty-free exchange such as x2y2. By publicly excluding those who take advantage of royalty-free exchanges, buyers risk migrating back to exchanges that implement royalties, hoping to preserve the utility of their NFTs.