Original editor: Colin Wu

Original editor: Colin Wu

(Note: This article is only for information sharing, has no interest in any of the listed projects, does not endorse any project, and does not make any investment advice. The article was written on October 12, and some data may lag behind)

Nearly a month has passed since the Ethereum Merge upgrade, and the migration of PoW miners has gradually come to an end. The computing power of the major PoW public chains has skyrocketed after the merger to stabilize, and the new forked chain has gradually changed from the "candy chain" Get rid of it and focus on building the ecology on the chain. As the largest PoW fork chain of ETH this time, ETHW, on the eve of the merger, it attracted a wave of traffic and supporters with the frequent social activities of the founder Guo Hongcai on social media; after the merger, not only successfully completed the split of the ETH chain It also forked high-quality dAPPs and NFTs on ETH, and attracted many players to come to Nuggets by virtue of the wealth effect brought by native NFT: Beatles and Meme Token: YZZ.

According to the Wagmi33 Foundation, there are at least 80 ecological applications or services including DeFi, GameFi, DEX, NFT, etc. on ETHW. Although there is a lot of water in the included list, as a public chain that was born less than a month ago, the degree of ecological construction on the chain can be said to be no less than that of the next-door competitor, ETC, which has existed for several years. The projects listed in this article are selected based on a comprehensive evaluation of the Wagmi33 Foundation's inclusion list, official inclusion list, social media attention, platform data, community discussions, and prospects. (Many projects on the ETHW chain are promoted by the Wagmi33 Foundation, which is part of the influential AWSB DAO in the Chinese community)

secondary title

DEX

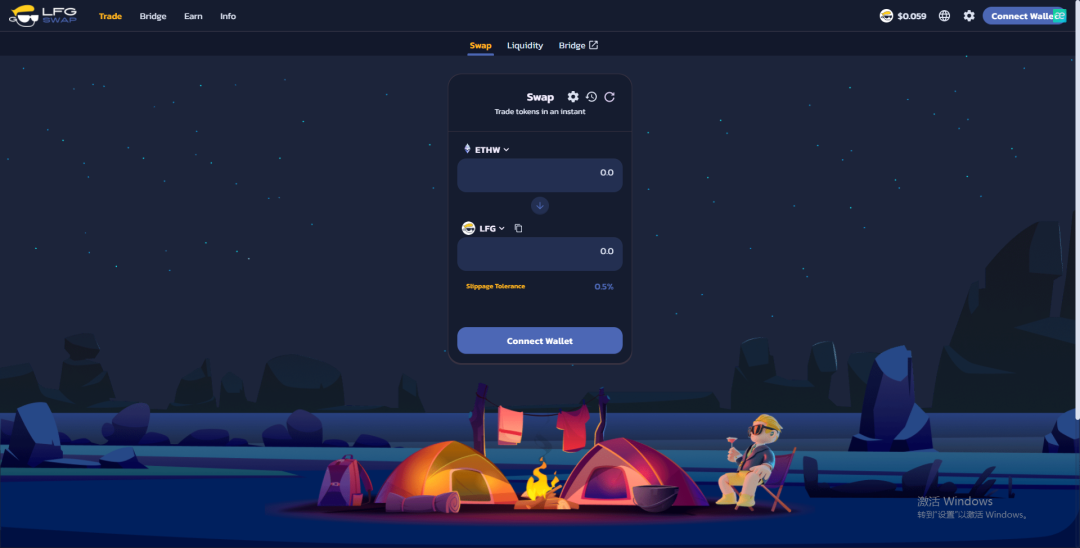

LFGSwap

Twitter Followers: 175k, Telegarm Subs: 330k

LFGSwap is currently the largest DEX on ETHW. The overall interface style is quite similar to Pancakeswap. It has built-in functions such as trading, cross-chain, mining and IDO, and has completed the Armors Labs audit. A 0.25% handling fee is charged for each transaction, 0.17% is allocated to LP, 0.0225% is allocated to the treasury, and 0.0575% is used for the repurchase and destruction of LFG. DeFi Llama data shows that LFGSwap has a lock-up volume of $1.86 million, accounting for 52.47% of the lock-up volume on the ETHW chain. Data from the official website interface shows that 8,000 users of LFGSwap have completed 900,000 transactions in the past 30 days.

secondary title

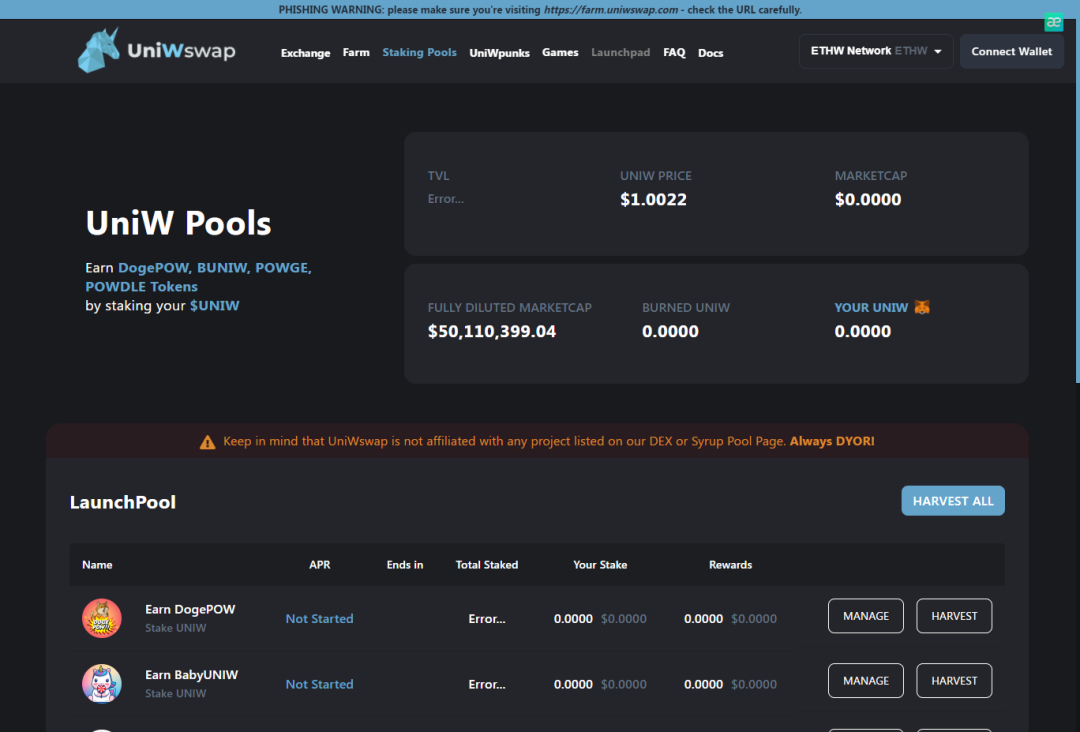

UniWswap

Twitter followers: 37k, Telegram subscriptions: 2.9k

first level title

secondary title

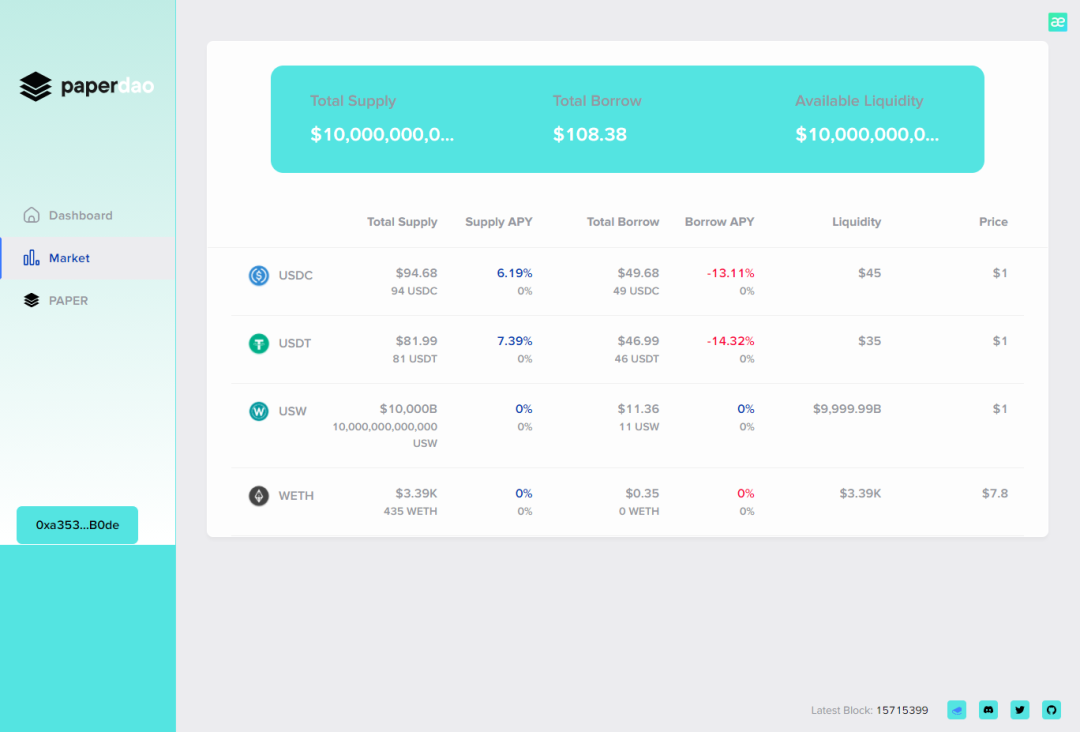

PaperDAO

Twitter Followers: 415, Telegram Subs: 140, Discord Community Members: 139

At present, PaperDAO (beta version), the first and only DeFi lending application on the ETHW chain, provides USDC, USDT, wETHW and native stable currency USW. According to the white paper, PaperDAO will use the stablecoin DAI as the economic model to launch the excess stablecoin USW, backed by ETHW as a guarantee. Users will be able to mint USW by staking ETHW. Then PaperDAO will launch a Uniswap V2-style AMM and add ETHW-USW LP liquidity. These two tools will be used to launch the ETHW ecosystem and allow various other dapps to be built on top of it. If other stablecoins are launched on the ETHW chain in the future, PaperDAO will launch stablecoin transactions with USW. (WETH in the above picture should be wETHW, the interface is wrong)

According to the design plan of the white paper, USW is modeled on DAI, but the underlying code is forked from Compound V2 (2022.4), and only includes two assets, wETHW and USW. USW has a fixed upper limit of 10 trillion pieces. Initially, the USW mortgage rate is set to 50%, and the reserve ratio is 10%. It can only be borrowed through ETHW's mortgage and casting.

However, the biggest problem that PaperDAO faces now is that it does not have the support of oracles. As early as August before the merger, Chainlink announced that it was consistent with the community, and its protocol and services did not support forks of the Ethereum network, including PoW forks. Without an oracle, there would be no meaningful on-chain liquidity, and it would be impossible to create a TWAP-based price feed, so in the early stages, PaperDAO may only be able to update prices manually.

secondary title

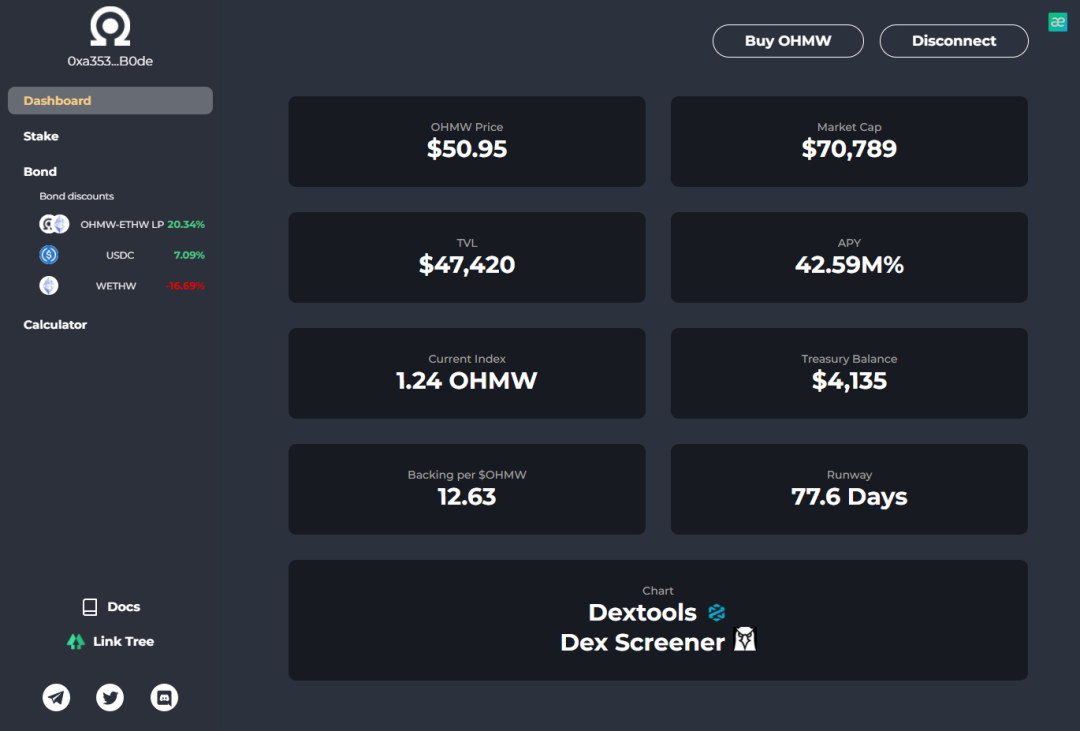

OHMPOW

Twitter Followers: 20k, Telegram Subs: 687

secondary title

NFT Marketplace

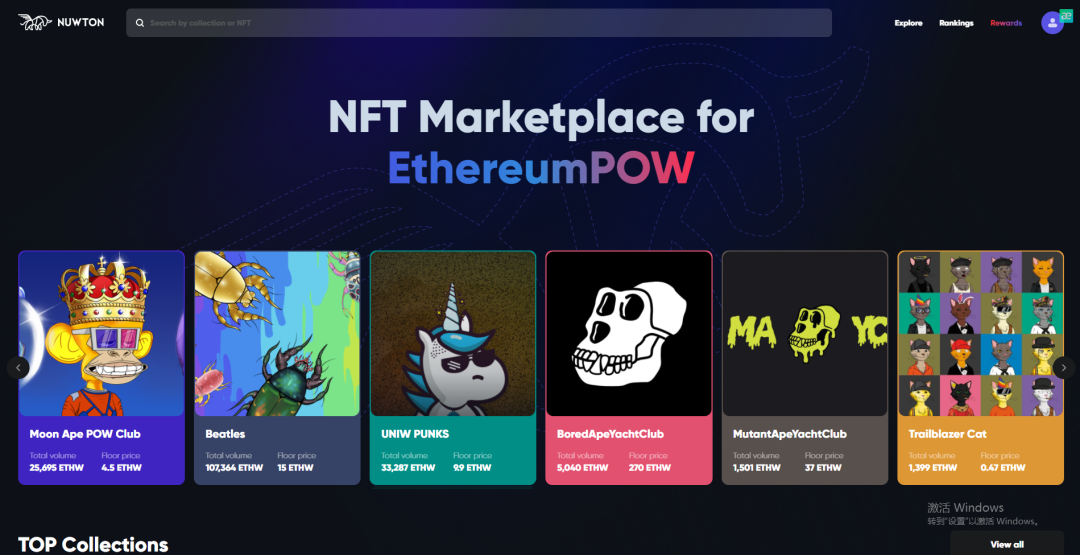

Nuwton

Twitter Followers: 10.7k, Discord Community Members: 5,165

secondary title

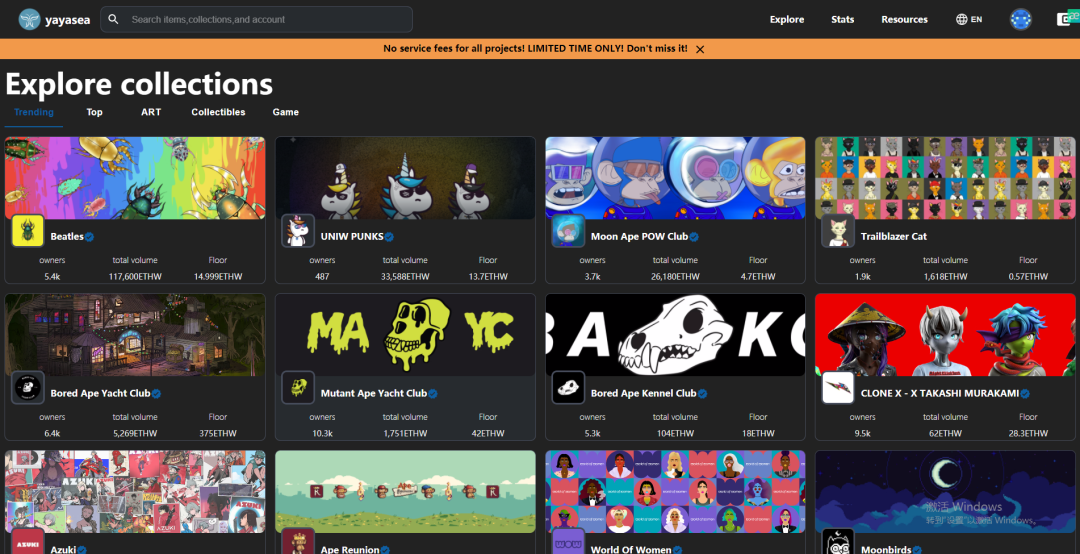

yayasea

Twitter followers: 510

The interface texture is much rougher than that of Nuwton, and the documentation link and Discord link are invalid. In the past 24 hours, the trading volume of yayasea was about 6,055 ETHW, which was about 48,000 US dollars. Among them, the Beatles had the largest trading volume, reaching 4,053 ETHW, accounting for 66.9%.

secondary title

OpenW

Twitter followers: 49.2k

secondary title

domain name service

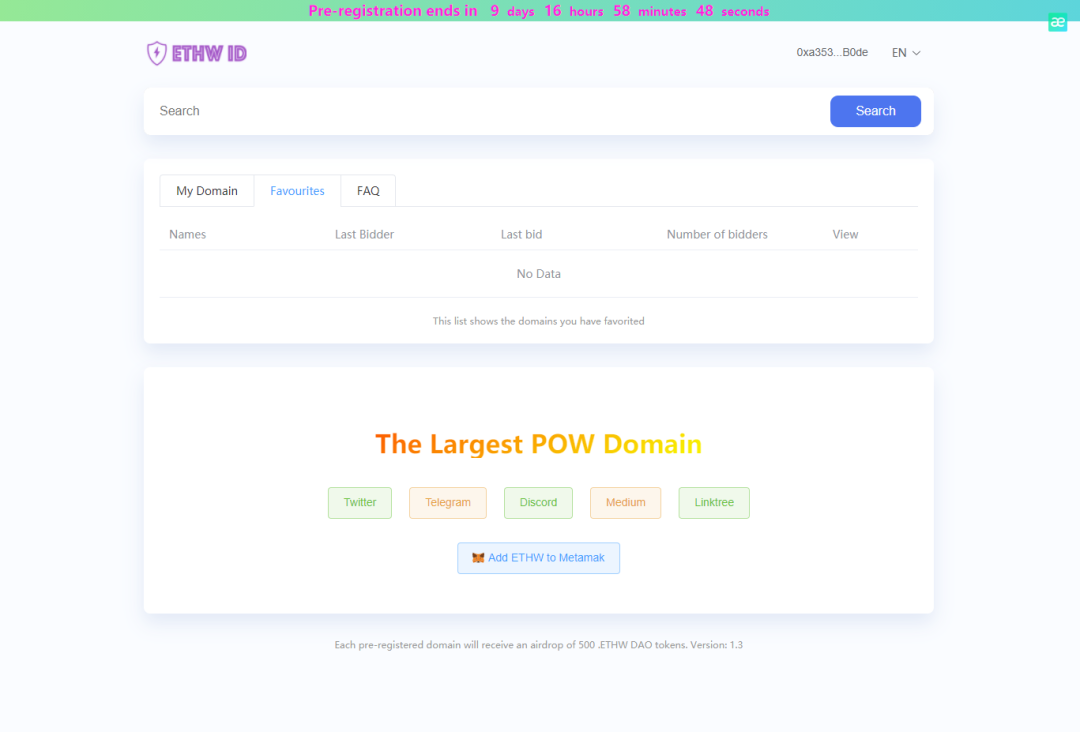

ETHW ID- .ethw

Twitter Followers: 37k, Telegram Subs: 40.5k, Discord Community Members: 17.9k

secondary title

WENS

Twitter followers: 15.8k, Discord community members: 2.9k

secondary title

Native NFT

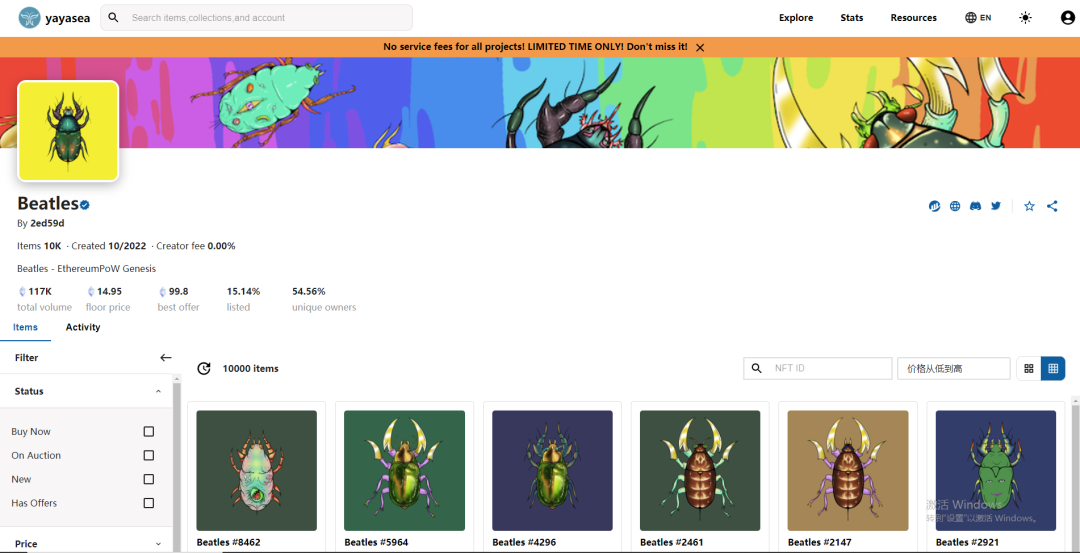

Beatles

Twitter followers: 11k, Discord community members: 7.3k

secondary title

Open Tigers

Twitter followers: 66.5k

secondary title

Meme

ShibaW

Twitter Followers: 1.7k, Telegram Subscriptions: 1.1k

secondary title

YZZ Token

Twitter Followers: 8k, Telegram Subs: 4.7k

Ten thousand times increase, driven by YZZ to the wind of gold nuggets in ETHW.

On the whole, ETHW’s DeFi applications are mainly concentrated in Swap. In addition to the ones listed in this article, there are nearly a dozen large and small Swaps. This is also because the transaction function is the simplest and most urgently needed function on the chain. After the currency and NFT trading functions were perfected, many speculators were attracted to Nuggets through the Meme narrative and the powerful wealth effect. After the foundation is built, ETHW is more innovative and dynamic than ETC, which not only forked some applications of Ethereum, but also opened the exploration of native stablecoins and on-chain lending.