Table of contents

Summary

first level title

Table of contents

text

Summary

1. What is a merger?

2. Why merge?

2.1 POS is conducive to fragmentation management

2.2 POS is energy friendly

3. Post-merger changes

3.1 Block Structure

3.2 Network structure

3.3 Consensus mechanism

3.4 Status

4. Features of Merger

4.1 The certainty of the time required to generate a new block

4.2 Lowering the threshold for clients

4.3 Seamless Transition to POS

5. Possible impact

5.1 Deflation

5.2 Energy saving

6.1 Will there be a hard fork?

Summary

6.2 Will the degree of centralization be strengthened?

6.3 Will MEV be cancelled?

first level title

Summary"The current Ethereum mainnet will complete the transition from Proof-of-Work to Proof-of-Stake by merging with the Beacon Chain, while retaining full history of contract execution functions and current user states. The merger is not only in response to the call to reduce global carbon emissions, but also to lay the foundation for future upgrades including sharding."After the merger, the network structure, block structure, consensus mechanism and state will all change. The new block will carry the outer part of the Beacon block and the content of the Proof of Work (POW) from Ethereum. The network will adopt an architecture in the form of a consensus layer and an execution layer (execution engine) to generate and synchronize blocks. The new system will adopt the proof-of-stake (POS) consensus mechanism, and the verification committee will perform the functions of proposal and voting to form a consensus on certain blocks. The consensus layer and the execution layer will be connected, and statelessness will also be introduced, which will not only help maintain the degree of decentralization, but also help future sharding.

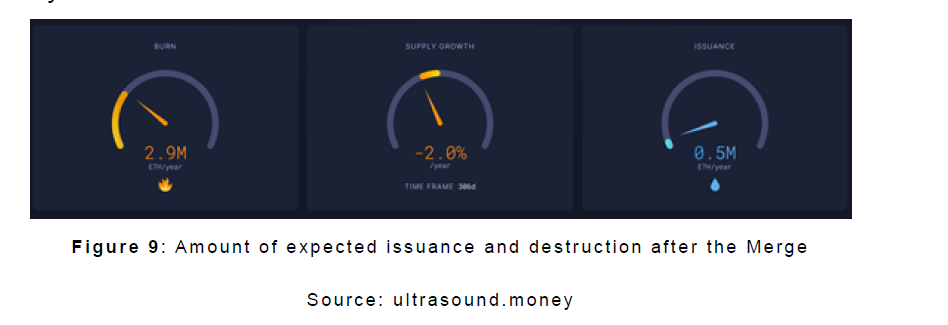

After the merger, ETH may enter a deflationary state, and the network will be more energy efficient. On this basis, the competition situation of the L1 layer chain will be redefined to some extent after the merger. Former ETH miners will flock to other networks, where the extra hash rate may increase the price of the corresponding token; meanwhile, the merged Ethereum network will be upgraded mainly through sharding; other POS L1 layer ecosystems may suffer dilemma.

the rich get richer

However, since the threshold is lower than POW, the degree of decentralization is not destroyed, and the maximum extractable value (MEV) still exists after the merger. Even if there are some technical problems during the merger process, they are still within the controllable range and the safety of assets can be guaranteed.

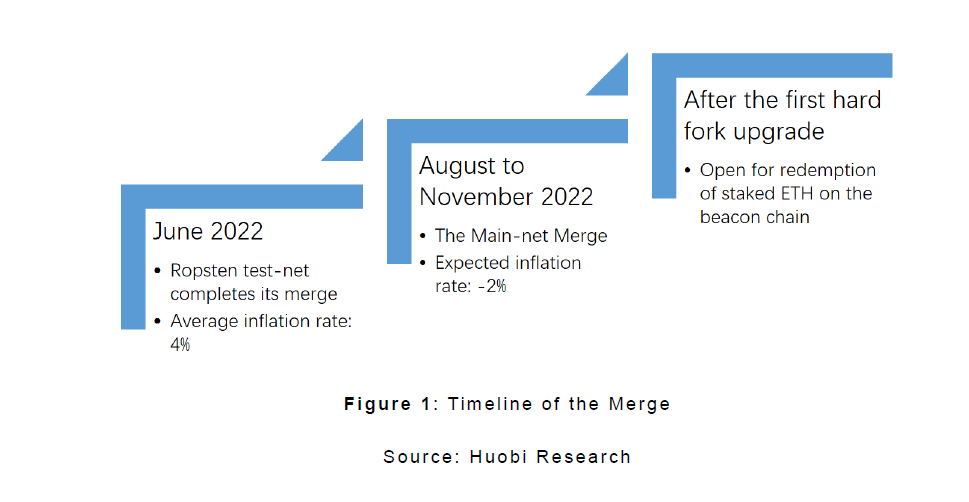

On June 9, the Ethereum Ropsten testnet completed the merger, which is the first testnet-based merger practice. After the transformation of Ropsten, Goerli and Sepolia will also transform into POS. The much-anticipated merger of the Ethereum mainnet and the beacon chain was completed on September 15. After the merger, the inflation rate of ETH will drop from 4% to around -2%. The redemption of the beacon chain is expected to take place immediately after the first hard fork (possibly 6 months after the merger).

Many sources mention mergers, but few offer a comprehensive view. In this article, a systematic and comprehensive view will be given from the aspects of the significance of the merger, the technical principles of its implementation, the impact on the industry, and possible risks.

secondary title

1. What is Merger

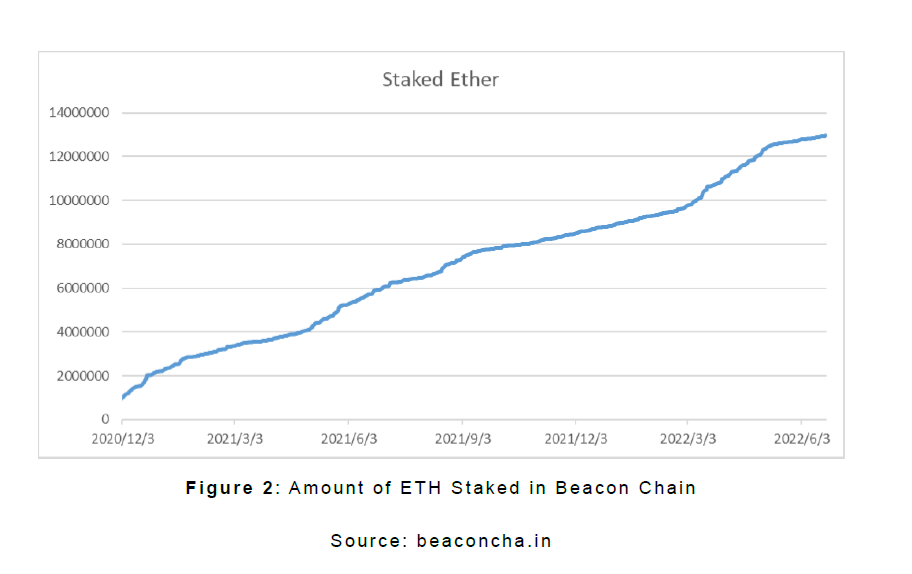

The current Ethereum has two networks: one is our old friend - the Ethereum blockchain network, which is powered by POW; the other is the Beacon Chain (Beacon Chain, also called ETH 2.0 in the early days), which is executed by POS . Beacon Chain has held its own since its launch, with the number of ETH pledged in smart contracts growing steadily and now stands at 13 million.

That is to say, POW will be separated from the Ethereum main network, while retaining and delivering the execution functions of smart contracts, complete historical data and current user status to the beacon chain driven by POS machines. This is not just a normal upgrade of the fork, but also a major change in the consensus mechanism.

During the merger, POS validators will replace POW miners. When the merge occurs, the Beacon node will monitor the current POW chain and measure a predetermined difficulty threshold, which is called TERMINAL_TOTAL_DIFFICULTY: any block whose difficulty exceeds the threshold will be marked as the final POW block. From then on, blocks produced and verified by validators on the Beacon Chain will all be POS blocks, marking the completion of the merge.

Compared with the merger, the previous plan had intended to support 64 shard chains on the beacon chain as independent Ethereum POW operations for 3-5 years, and users could migrate freely, so there was no merger at all. However, the merger is to adopt the Ethereum mainnet without POW as the first shard chain of the beacon chain, and integrate the two thereafter, and at the same time, users and applications are migrated to the POS Ethereum network. Merging is now the most feasible route, which is related to the previously planned technical routes of various shard chains and the unprecedented difficulty of developing shard chains in a short period of time. Conversely, merging can inherit the previous execution layer, which requires less computational power. While the impact on users is minimal in terms of identifiable changes, their transition costs are low.

secondary title

2. Why merge?

text

2.1 POS is conducive to fragmentation management

Although the beacon chain assigns and coordinates verifiers for various shard chains in the technical structure of Ethereum, the system operates in different ways under different consensus mechanisms. For PoS, the system needs to pledge 32 ETH to obtain the corresponding voting rights and pledge benefits (which will not be confiscated). Giant whale verifiers can allocate funds to various accounts and become small verifiers in disguise to gain more benefits. In other words, even with a considerable amount of ETH held, its holdings will be randomly diluted across shard chains, so it is almost impossible to obtain higher voting power on one chain. Therefore, validators are always in balance within each chain. Unless you hold 51% of the pledge of the entire network, it is almost impossible to destroy the security of the network. For PoW, the miners are the verifiers, the miners are in the hands of the miners, and the miners can connect or disconnect at any time according to their wishes, that is to say, the hash rate is unknown and may change in a short period of time. If a whale miner centralizes the hashrate to 51% of the entire network, it can take control of a shard chain and compromise its security. So in order to obtain a more secure sharding structure, PoW must be replaced by PoS.

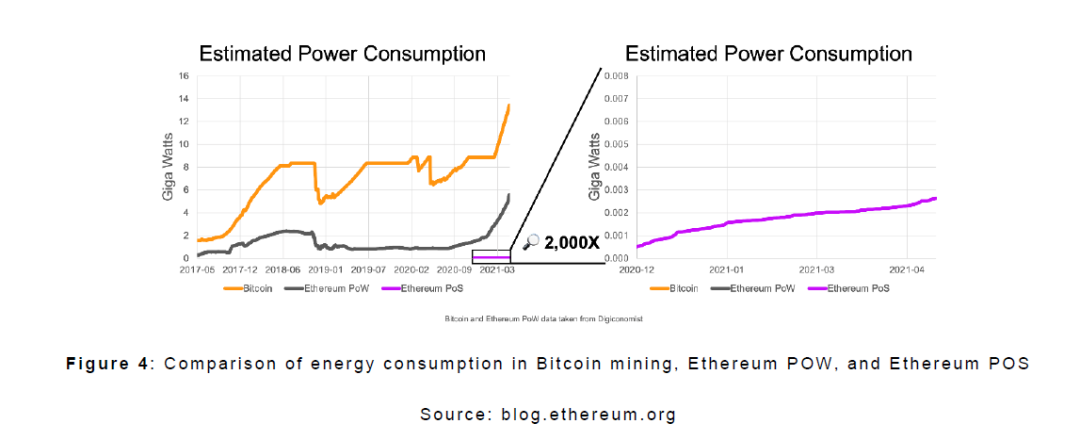

2.2 POS is energy friendly

According to Digiconomist, Ethereum has made progress in terms of the energy consumption of Bitcoin mining. However, the energy consumption of Ethereum mining (PoW) is still more than 44.46 TWH, which is equivalent to the annual energy consumption of Finland or Sweden. Each transaction needs to consume 84KWH (kilowatt hours) of electricity, which can supply a family for 2.8 days. Under PoS, maintaining the network system does not require verifiers to repeatedly complete energy-consuming hash calculations, energy consumption will be reduced by more than 99.95%, and energy efficiency will be improved by more than 2,000 times. Each transaction requires only 35KWH of electricity, which is about the same as watching TV for 20 minutes.

secondary title"3. Post-merger changes"text

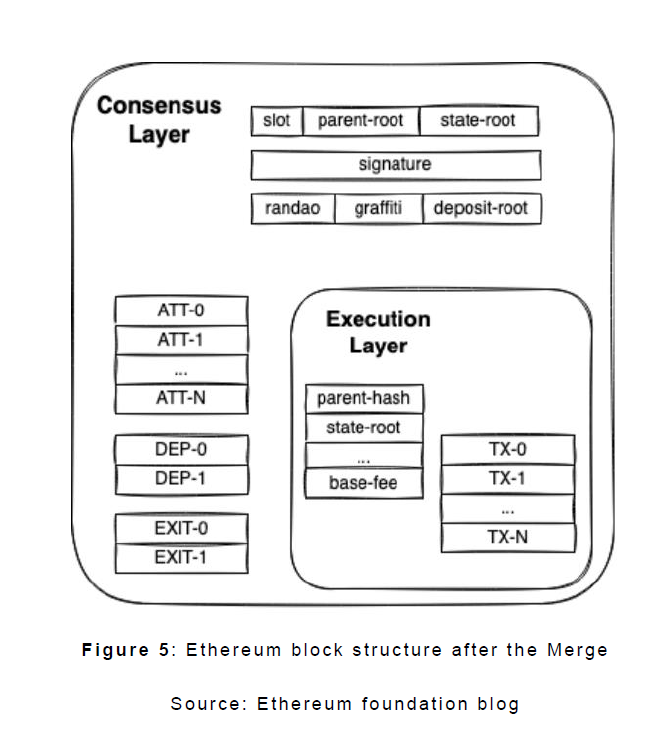

3.1 Block Structure

shape

. The merged content is also called execution payload (execution-related information), that is, the transfer of Ethereum provided by the execution layer (former PoW node) and the interaction of smart contracts. The execution layer and the consensus layer can be connected at the block level together.

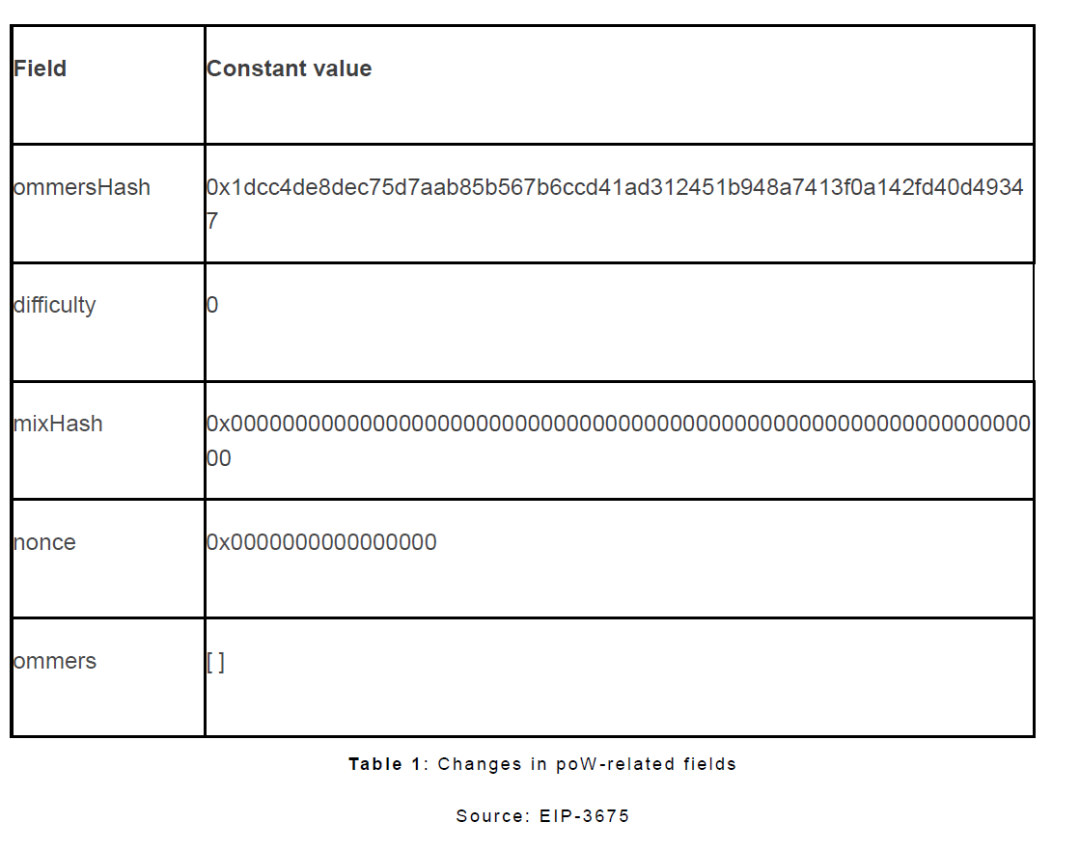

Since PoW is no longer used, dynamic block strings related to PoW, such as difficulty, mixHash, nonce, ommers, ommerHash, will be automatically modified to 0 or other constant values; the length of extraData will also be limited within 32 bytes.

The consensus layer (beacon nodes) still verifies all strings in the current beacon block, but the content in the block is now verified by the execution layer (current POW).

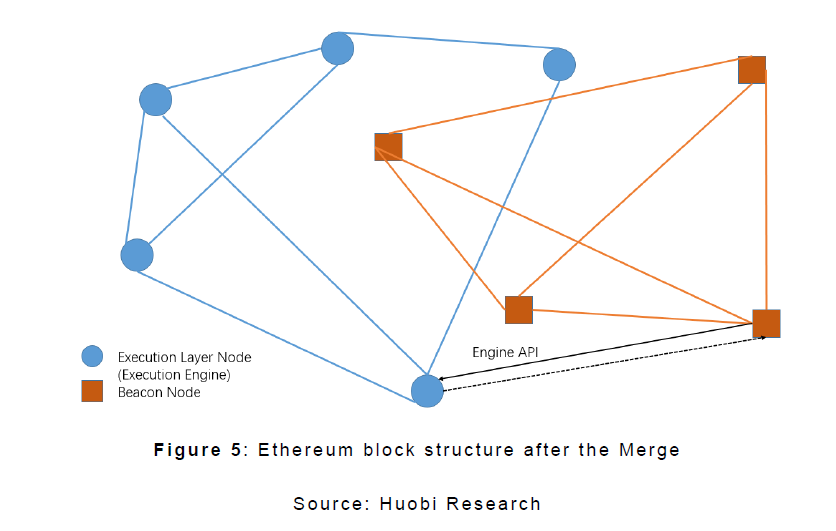

3.2 Network structure

After the merger, the network structure will be modified. Ethereum adopts the structure of consensus layer and execution layer (execution engine) to generate and synchronize blocks. Previously, the two P2P networks were mutually exclusive. Combined they must collaborate and coordinate while remaining independent.

The transfer and call of the smart contract is packaged, broadcast and executed by the execution engine (the former ETH full node), and the tip of the GAS fee remains in the execution engine. The main goal of the execution layer is to establish communication with the execution engine, facilitate the generation or verification of the execution payload, and thereafter create a complete beacon block according to the consensus of the beacon nodes. Engine API acts as a bridge between the two networks. The consensus layer captures the content that needs to be agreed from the execution engine through this place, and calls other execution engine nodes to verify the legitimacy of the transaction. Once consensus is reached, the latest network state is communicated through the same channel to the execution engine, which is then synchronized with that state. In other words, the consensus layer helps the previous PoW network reach consensus.

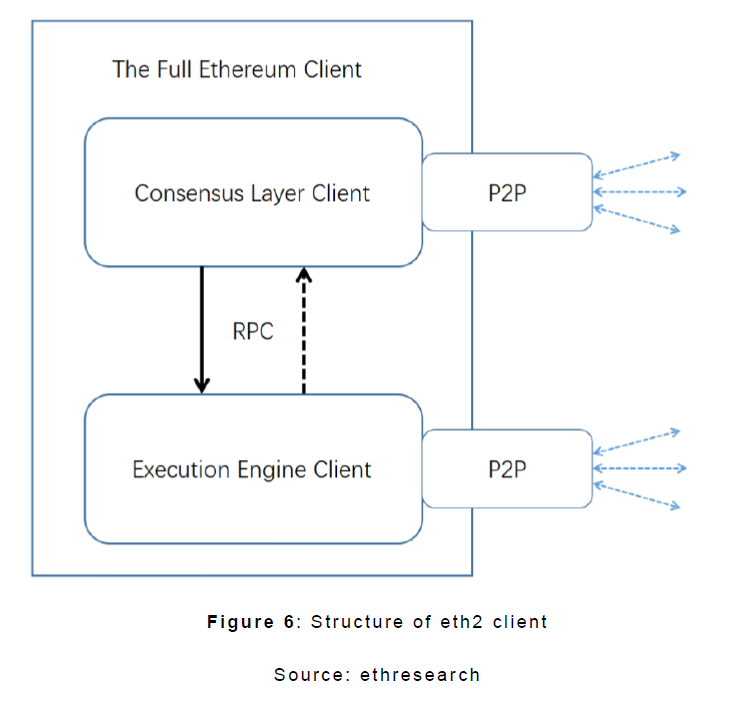

As mentioned above, there will be a hierarchical relationship after the merge. The consensus layer is like the commander, while the executive layer is the soldier. In the author's opinion, the eth2 client diagram below clearly demonstrates this relationship. This hierarchical relationship will exhibit consensus mechanisms and state changes.

text

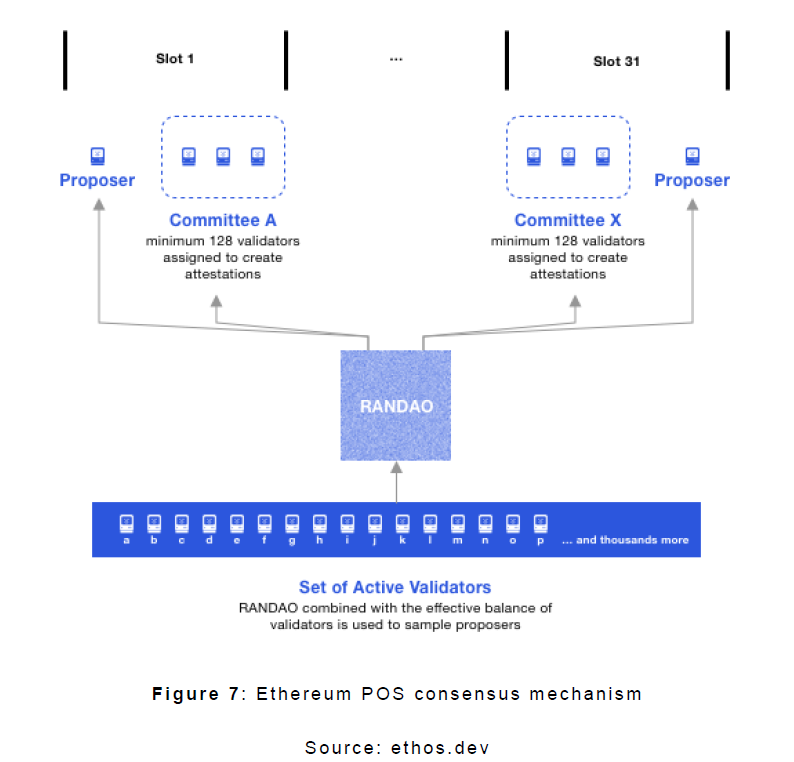

The purpose of the merger is to change the consensus mechanism. The Ethereum beacon chain will adopt PoS, which is proposed and voted by the validator committee to reach a consensus on a certain block.

After merging, the time units of a block will be in the form of slots and epochs. A slot is created every 12 seconds, and each epoch package consists of 32 slots. An epoch is a fixed period of time at which verifiers are reassigned.

To become a validator and gain voting rights, users must stake at least 32 ETH. As of June 20, there are over 403,000 validators. The rule of Ethereum is that for each epoch, validators will be randomly assigned to 32 committees, ensuring that each committee consists of at least 128 validators. The system uses the random algorithm RANDAO to assign 1 verifier to each period, and at the same time randomly selects a committee for this period. This validator is responsible for proposing blocks, and the committee is responsible for validating and voting on proposals. Once the vote is passed, a block will be generated and the proposer will be rewarded; otherwise, not only the reward cannot be obtained, but the security deposit will also be forfeited. The same applies to ordinary verifiers: If you follow the rules correctly, you are rewarded, while vandals are punished. Once the 32 ETH deposit drops below 16 ETH, the validator's eligibility will terminate.

The random selection process for validators and committees is almost indistinguishable from the pre-merger Beacon Chain. The only difference after merging is that the merged consensus must contain consensus on the execution payload. In the future, when there are more shards on Ethereum, that is, 4 shards, each committee will be divided into 4 equal shares to participate in the voting of each shard.

text

3.4 Status

Statelessness becomes a notable feature after the merger, as changes in the network change the state of the network.

First of all, Ethereum adopts the account model, and each account is composed of user state and contract state. State, in short, is the specific external representation of the system at a specific time, including account balances, hashes of contract code, or stored data. The full Ethereum state records all accounts and associated account balances, as well as the history of all smart contracts deployed and executed in the EVM. After each node reaches a consensus, a block on the main chain has only one state. Additionally, the state of the system continues to change as new blocks are confirmed. More specifically, nodes that generate blocks need to access and check the current state of the system, record the new state after execution, and synchronize with other nodes in the network. Other client nodes need to verify and execute transactions within the block to ensure that there is always consensus in the network.

As more new users enter and decentralized applications are deployed on Ethereum, more new data will be generated, and the status data of accounts will grow without limit. It is almost unrealistic for nodes to store all state data in memory. If you want to consider using hard disks, the speed of reading data from mechanical hard disks may be too slow, which makes it difficult to synchronize the latest data with nodes, while solid-state disks are not cost-effective. In the long run, the problem of state expansion will require nodes to have larger storage space and stronger performance, which increases the threshold for node operations.

To solve the problem of state inflation, the community has proposed two possible solutions: state rent and statelessness. The former imposes a continuous rent on contracts that retain state, otherwise availability would terminate, but this is complicated in practice: on the one hand, the appropriate way to collect rents cannot be determined; on the other hand, it is difficult to say who can be the legal recipient of the rent , therefore, the exploration of the rent mechanism has stopped. The latter proposal enables all transactions and state verification processes without any actual storage of state by light clients.

The question boils down to one, why is statelessness so critical to PoS Ethereum? First of all, if you simply add eth1 execution and all state functions to all Beacon clients, then the hardware threshold is too high for nodes. Considering the increasing difficulty of full-node operation, the degree of centralization on Ethereum has been exacerbated. The purpose of POS Ethereum is to allow all nodes "either have all the states, or have no state at all" to participate in the verification to maintain network security, which also brings a high degree of decentralization of the network.

More importantly, statelessness is a prerequisite for sharding. Ethereum may have multiple shards in the future, and each shard consists of accounts and contract states deployed on it. Each shard randomly selects validators to form a committee; that is, if there is no statelessness, the validator must have all the state data of all shards, which may overwhelm ordinary validators, and sharding can alleviate Ethereum. Bad performance, while statelessness underpins the highly decentralized Ethereum network. Statelessness is critical in laying the groundwork for future updates, and it is a major technical upgrade.

1. Client without ETH1 execution engine

3. A client with a fully stateful ETH1 execution engine

The first type of client is the most portable, as it can only participate in consensus, but cannot verify transactions from the execution layer. It exists to oversee other types of nodes on the consensus layer. The third type of client is fully functional, with all state, execution and consent capabilities, in other words, a full node. The number of clients of the third type will be small, as the required investments may be huge data storage, hardware, and tokens for staking. The second type of client has an advantage in being stateless because it calls data from a stateful execution engine and uses its own execution to verify the validity of the transaction. The second type of client may be more common in the network due to the cost savings of state storage.

secondary title

4. Features of Merger

text

Ethereum will not adjust the difficulty of block generation to increase the competitiveness of miners. In any case, each block can be produced after each epoch, which takes 12 seconds. The benefits are:

Ø User experience has been improved. For on-chain transactions, users must wait for miners to package. When the time required to produce a block is known, one can easily estimate which blocks are likely to consist of transaction data during a certain period of time, thereby predicting the time required to complete the transaction.

Ø More accurate planning for future upgrades. According to past experience, each upgrade is carried out at a certain height of the block. For example, the Berlin upgrade happened at block height 12,244,000. However, specific plans have been delayed due to changes in the time required to produce new blocks, which has led to community dissatisfaction with the development team, but this may be alleviated if the time for producing blocks is certain.

text

As mentioned earlier, state inflation makes the verification of blocks more difficult, which places stricter requirements on the hardware. After the merger, Ethereum enables lightweight nodes that previously could not maintain the full network state to participate in the network and verify all transactions and state proofs. In other words, giant mining machines are no longer a must for nodes, and service-level equipment is sufficient to participate in the verification network.

text

By natural design of the development team, the merger provides a seamless transition to PoS for clients that will be the executive layer. For end users and developers, the execution layer is where most interactions with Ethereum take place, most functionality (e.g. EVM, state, execution methods, etc.) Might be done after one's nap and no one will even notice.

secondary title

5. Possible impact

No words are enough to describe exactly what the merger means for Ethereum. Although the performance bottleneck cannot be solved immediately, all ambitions and technical routes of Ethereum must be established from this stage. As the first step in the voyage, the merger has profound implications.

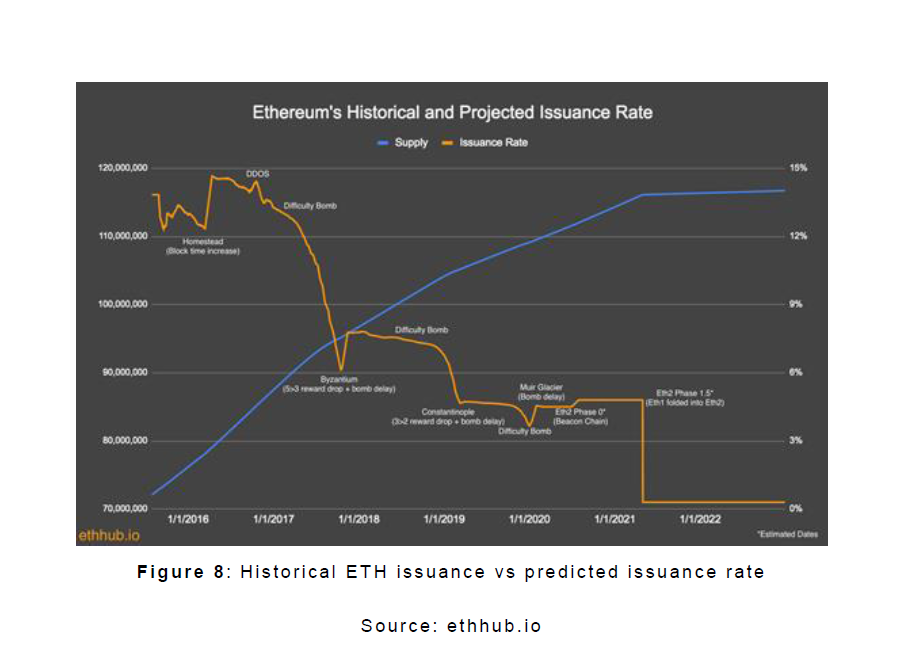

text"5.1 Deflation"As mentioned earlier, the merger will transfer Ethereum from PoW to PoS, stop producing new blocks under the current PoW, which also ends the traditional mining rewards, and any incremental ETH in the system can only be used as a node to participate in PoS The verification process comes to minting, which will greatly reduce the total supply of ETH. From the graph below, when Ethereum moves to PoS, ETH issuance is expected to drop dramatically. In addition, the system will not release any pledged locked ETH even after the merger is complete. The first unlocking of ETH will be granted after the first hard fork after the merger is complete, which will be several months away. At the same time, the system has strict limits on the daily unlock amount and the total number of applicants to prevent large-scale selling pressure.

Since the rules of supply reduction are similar to those of Bitcoin halving, the community named it

three halved

However, the unlocking could cause distress for ETH holders and be accompanied by a short-term market price drop.

text

While Bitcoin's success convincingly demonstrates PoW's near-impeccable credentials, miners use enormous amounts of energy repeatedly computing what could become the asset's unique hashrate. Given the current global emphasis on low-carbon activities, PoS may be the solution.

5.3 The impact on the competition situation of the L1 layer public chain

The merger will eventually affect the current competitive landscape of L1 layer chains to a certain extent. Due to the difficulty bomb, the time drain will increase faster after the merge. In theory, miner nodes would still be able to mine via the fork, but they would have to accept a trade-off between limited rewards and rising costs — which would mean abandoning Ethereum. However, the available solutions are also very limited: mining on a similar PoW chain or selling mining equipment in exchange for liquidity to invest in POS. For other PoW chains, the influx of miners and hash rate may improve the status quo of the ecosystem and increase the price of tokens. For other PoS chains, even though Ethereum is accused of many shortcomings, no one can deny that the Ethereum community still dominates the industry, and the security is top-notch. After the merger, the shortcomings of Ethereum will begin to be resolved, and the ecologically prosperous L2 layer ecosystem will further reduce transaction costs on the chain, not to mention the integration of shards will improve network operation efficiency as a whole, and perhaps the demand for Ethereum will rise Ultimately it erodes other ecosystems.

secondary title

6. Merger Risks

6.1 Will there be a hard fork?

To review, the current Ethereum is the product of a hard fork. Will history repeat this large-scale upgrade of the ETC-like hard fork event? Based on current facts, Ethereum follows a scientific technical route and its grand vision, which will greatly improve its performance and attract enough heat to make future development more sustainable. On the other hand, the difficulty bomb will force PoW miners to retreat from the original battlefield of the Ethereum mainnet. In addition, the community's approval for the merger is also very high, so no miner group has made a strong voice for the fork.

Assuming miners can simulate a new Ethereum-like network, such as ETH Legacy, which is the same as PoW Ethereum but without the difficulty bomb, the new network will face several strong competitors before it can be launched, including For Ethereum and other L1 layer chains, this challenge is also accompanied by the problem of insufficient assets. After the fork, ETH must copy the entire ledger of Ethereum, not only forked tokens will appear (such as ETL), but derivatives of other assets must also be processed, such as WBTC, USDC, DAI, LINK, BAYC, CryptoPunks, etc. So no matter where the assets are issued, no matter whether the issuing institution is centralized or decentralized, only the uniqueness of the assets is important, because only assets on one network will be recognized. More specifically, only assets on PoS Ethereum will be recognized as real assets by the issuing institution. Obviously, ETH Legacy or other similar entities are more likely to die prematurely due to poor performance, insufficient assets and weak consensus.

In conclusion, post-merger, hard forks are less likely to occur.

text

6.2 Will the degree of centralization be strengthened?

Some may be concerned about the degree of centralization after the merger. The consensus mechanism of PoS naturally confers more benefits to those with large stakes—in other words, more voting power, which means more control over the network, but this problem is not unique to PoS: in In PoW, miners with more hash rates can use mining rewards to purchase more hash rates, increasing the chances of successful block generation. So PoS does not solve this problem, nor does it exacerbate it.

Second, Lido's massive growth has drawn skeptics. Lido is a large-scale staking pool, accounting for more than one-third of the entire network, and some people claim that if another Lido existence is formed, this existence will have the ability to control the entire network. It is worth noting that Lido is not controlled by any single entity. There are 30 node operators within Lido, and nodes are mutually exclusive to each other or Lido. Moreover, these operators are top-level node operators, have credible records and legal entities, and have traceability rights, and they must pass the vote of DAO and be under the monitoring of DAO at all times. Therefore, it is invalid to equate Lido with a centralized mining pool. Conversely, Lido’s continued efforts towards decentralization have given it the upper hand in competition with CEX mining pools, i.e. the risk of a monopoly or coalition taking over the network is not as high as is commonly believed.

In short, increased centralization is not a major concern.

references

[1]. https://tim.mirror.xyz/sR23jU02we6zXRgsF_oTUkttL83S3vyn05vJWnnp-Lc

[2]. https://ethresear.ch/t/eth1-eth2-client-relationship/7248

[3]. https://blog.ethereum.org/2021/11/29/how-the-merge-impacts-app-layer/

[4]. https://blog.lido.fi/the-road-to-trustless-ethereum-staking/

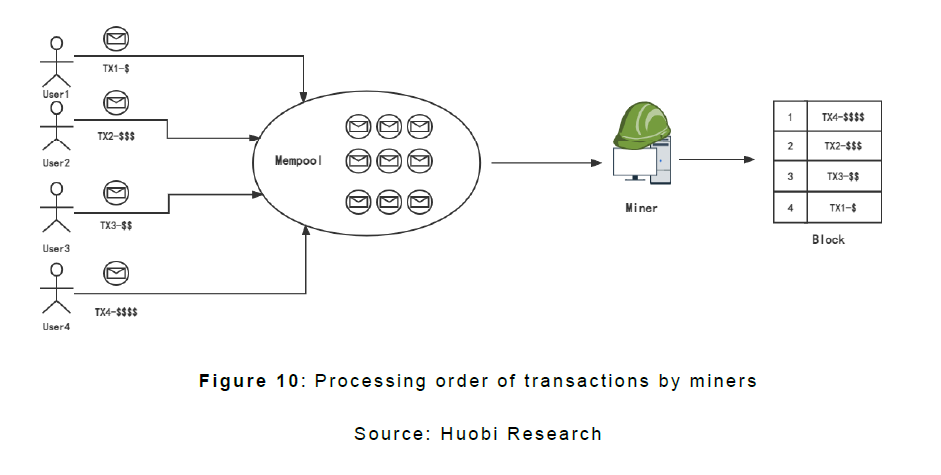

MEV represents the value that miners can extract, and is essentially an arbitrage behavior of miners when generating new blocks—similar to the pre-operation in traditional financial transactions. Specifically, due to the limited space of blocks on the chain, submitted transactions will first enter the mempool and wait for miners to package them. For miners, the right to decide the order in which these transactions are processed and uploaded to the chain is in their hands. Usually, miners will make decisions based on the amount of gas fees they receive: transactions with more gas fees will be processed first. Therefore, the priority of transaction processing on the chain does not depend on the time of submission, but on how much gas fees the user is willing to provide. The extra profit that this activity brings to miners is MEV.

Disclaimer: Readers are requested to strictly abide by local laws and regulations. The above content does not constitute any investment advice.

When it becomes PoS, the processing procedure has not changed much, and the execution engine replaces the miners to decide the order, which is still a matter of the same group of people. Therefore, the problem of MEV has not changed.