Last month, the decentralized exchange MDEX officially announced a strategic cooperation with the decentralized perpetual contract exchange ApolloX. Although there were only a few words, it also revealed the next development focus of MDEX-perpetual contracts.

Perpetual contract, the next step of MDEX ecological expansion

Specifically,MDEX will use the "DEX Engine" provided by ApolloX to launch this new function, and its governance token MDX will also realize new utility in this new function, providing a 10% transaction fee discount for all contract transactions.

ApolloX was launched in 2021. In June this year, the project completed a seed round of financing, with participation from Binance Labs, Kronos Research, Lingfeng Capital, SafePal, Token Pocket, 3Commas and LUX Capital. The so-called "DEX Engine" is a one-stop derivatives trading solution launched by ApolloX in July.

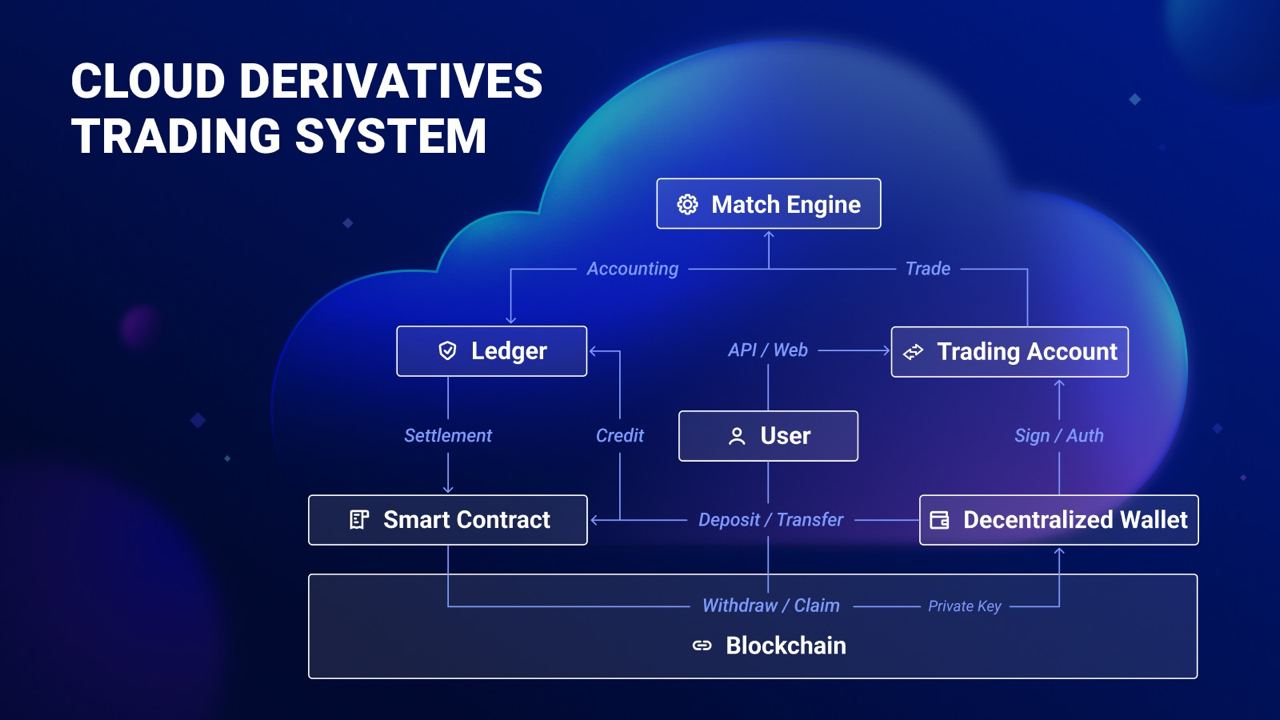

According to the official introduction of ApolloX, through the "DEX Engine" solution, any project that wants to provide new trading functions for its own platform can easily and quickly build a set of derivatives trading framework. The project only needs to focus on the front-end presentation, according to its own Brand tonality to provide a product interface that is more in line with the user's operating habits, and all other things in the back end are done by ApolloX.

image description

Schematic diagram of the operation process of "DEX Engine"

As of this writing, the one-stop solution designed by ApolloX has been supported by many exchanges in the industry, including PancakeSwap, the largest decentralized exchange on BNB Chain, and MDEX is the latest supporter of this solution.

Although there is not much official information released temporarily,However, according to people familiar with the matter, the cooperation between MDEX and ApolloX is expected to be officially launched in October.At that time, MDEX users will be able to directly participate in the perpetual contract transactions of multiple currencies on the platform, and experience the deep liquidity and tight spreads brought by the "DEX Engine".

From the perspective of experience, the operation level of perpetual contract transactions has not changed much. Users can still directly use wallets to link without any KYC. The difference is that contract transactions will not involve direct buying and selling of assets Instead, you need to deposit a certain margin before buying (opening long) and selling (opening short) leveraged positions with a larger face value to bet on market fluctuations. Compared with spot trading, this will bring higher capital utilization efficiency and magnify the potential profit space. Of course, the risk will also be magnified simultaneously.

For MDEX, the launch of perpetual contracts is undoubtedly a key expansion of its product matrix, and it is also in line with MDEX's long-term belief in the concept of "always committed to meeting the different trading needs of different users". Since its launch in January last year, although the data performance of MDEX has also experienced large fluctuations along with the ups and downs of the industry as a whole, but from the product level alone, MDEX has continued to expand in all dimensions.

In terms of horizontal ecological coverage, MDEX has expanded to BNB Chain, Ethereum and other ecosystems besides HECO; in terms of vertical product updates, with the implementation of the perpetual contract function, MDEX will soon become a platform integrating spot trading and liquidity mining. A comprehensive DeFi protocol that integrates mining, Boardroom, IMO, perpetual contract and other sectors.

Derivatives, the future of DeFi

And if we focus on the development trend of the industry, the layout of perpetual contracts is also a major strategic move for MDEX to make efforts towards the future. The construction of the decentralized financial system is bottom-up. Stablecoins, loans, and DEX are the underlying financial infrastructure, which in turn meet the basic needs of users for asset preservation, financial intermediation, and asset transactions. With the gradual development of DeFi Lego Heaping high, the next step is naturally to aim at higher-level user needs.

Derivatives trading was born out of spot trading. Compared with spot trading, derivatives trading has richer application scenarios, which can help users flexibly respond to different market trends, amplify profits, hedge risks, hedging, optimize resource allocation... to meet users' more diverse and complex needs financial needs. At a time when the growth rate of DeFi users is slowing down, derivatives transactions are expected to bring new incremental users and introduce more vitality to the market, thus laying the foundation for the outbreak of DeFi again.

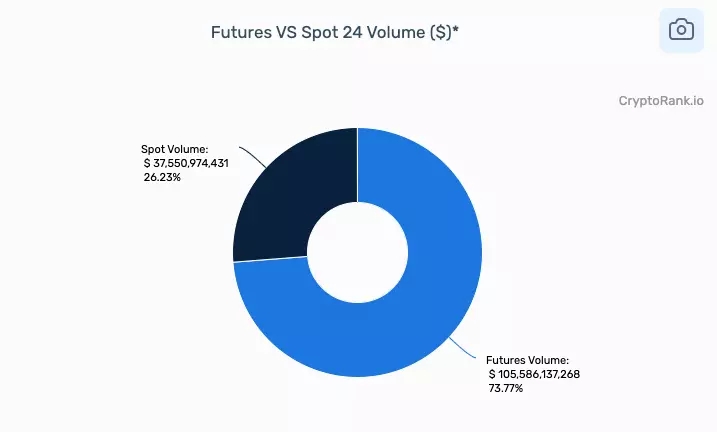

From the perspective of the potential growth space of the market, whether it is the traditional financial world or the cryptocurrency market based on the centralized exchange (CEX), the trading volume of derivatives is much higher than that of spot trading.CryptoRankThe data shows that as of 13:00 on October 10, the futures trading volume of the cryptocurrency market in the past 24 hours was as high as 45.386 billion U.S. dollars. In contrast, the spot trading volume was only 13.551 billion U.S. dollars, and the former trading volume was 3.35 billion U.S. dollars of the latter. times.

In contrast, in the DeFi field, based on CoinGecko data, except for the leading project dYdX, which is still fighting, other derivatives exchanges have a large data gap compared with spot transactions. From the point of view of the overall transaction volume, the total amount of spot transactions in the current DeFi field is still much higher than the total amount of derivatives transactions, which is inverted from the situation in CEX.The data comparison gives the most intuitive conclusion that there is still a lot of room for growth in decentralized derivatives transactions on the chain in the future.

Although due to various reasons such as incomplete infrastructure, product design still needs to be explored, and user education needs to be improved, there is still a long way to go for decentralized derivatives trading to be fully popularized, but it is undeniable that this is the future One of the incremental engines of the DeFi market. Compared with the services of centralized exchanges, decentralized derivatives exchanges have obvious advantages in terms of asset custody and transparency. A decentralized trading platform that does not need to rely on any intermediaries can avoid some common concerns of users, such as asset misappropriation, extreme market asset redemption, running away with money, drawing lines for liquidation, and harvesting by sitting on the bank, etc., from the underlying structure. The two key attributes of "safety" and "credibility" have been upgraded.

Going back to MDEX, it is precisely because of this general trend that the project will choose to take perpetual contracts as the next strategic development direction, in order to seize the position in advance when DeFi recovers again in the future.

The cryptocurrency market is bearish, and DeFi is in the midst of a deep winter. To survive such a bleak period, everyone in the industry needs to work together. Fortunately, we can see that many projects have not stopped moving forward when facing severe challenges, from the successful merger of Ethereum, to the emergence of several new public chains with new technical concepts, to applications such as MDEX We have reason to believe that the shadow will eventually pass, and the future of Web3 is still bright.