Original Author: msfew@Foresight Ventures

text

Original Author: msfew@Foresight Ventures

first level title0. More Rollups, More Chains

As the narrative of Rollup is becoming more and more attractive, and the entire industry has higher and higher requirements for App-chain performance, sovereignty, and deployment, StarkEx's App-rollup service, Celestia's reusable Layer1 security layer, and other The high-performance DA solution has become the mainstream choice in building App-chain.In the past App-chain = App as an L1:Before, an application needs to build a chain by itself, which requires a lot of development costs. If it is a PoS mechanism, then there must be additional capital expenditures for starting the initial node. Although there are various SDKs and consensus engines, doing A chain is still a very troublesome thing.Present and Future App-chain = App as an L1 + App as a Rollup + App as a Validium…:

Only Layer 2 based on Ethereum has

25In addition, App-L1 on Cosmos and Subnet on Avalanche will emerge in endlessly.

Whether the existing application protocol is transformed into App-chain (similar to Uniswap, which can directly become Unichain), or the application is directly launched in the form of App-chain (dYdX starts with App-rollup and transforms into App-L1), it will eventually mean write

There may be dozens of new chains (L1, App-chain, App-rollup, Subnet) in the next year or two.first level title.

1. Application chain > application on the chainRecently, Dan Elitzer took Uniswap as an example and analyzedWhy Uniswap will definitely transform into a separate application chainCharged by the Uniswap protocol

Second only to the Ethereum mainnet, it is the sum of BSC, Aave, Bitcoin, and GMX.

As such an AMM protocol with stable income, good operation, and used by everyone, why might Uniswap change from an on-chain Protocol to an App-chain?

There are four main benefits for Uniswap:secondary title

a) Token Value CaptureUNI token is essentially a Meme Coin,,At present, it can only be used for governance. For UNI holders, the value of UNI cannot directly capture the growth and benefits of the Uniswap protocol and ecology to a great extent. The root cause I think is mainly a regulatory issue. Due to the function of the product itself It is more sensitive. In order to comply with regulations, Uniswap's organizational structure is also relatively special.

The concept of Protocol Fee

But now this Fee Switch has not been opened through governance. If it is opened, intuitively speaking, it can directly bring hundreds of millions of dollars to UNI holders in one year (regardless of the side effects on LP earnings and liquidity). This is a huge plus to the value of the UNI token.

At the same time, if Uniswap becomes a PoS chain, then UNI tokens can be used as pledge tokens and gas tokens, which can play a very positive role in capturing the value of UNI.

secondary title

b) Agreement Economic Mechanism

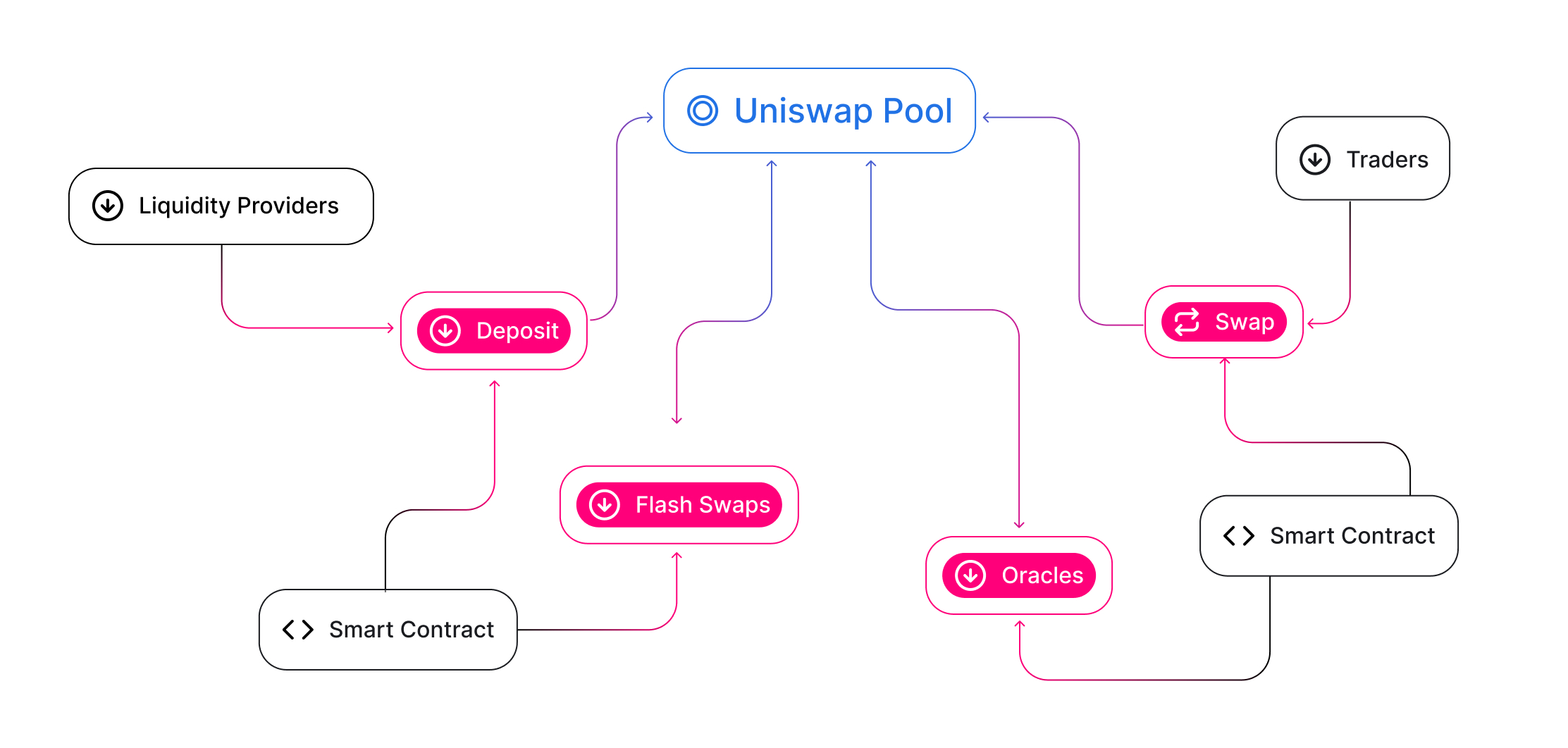

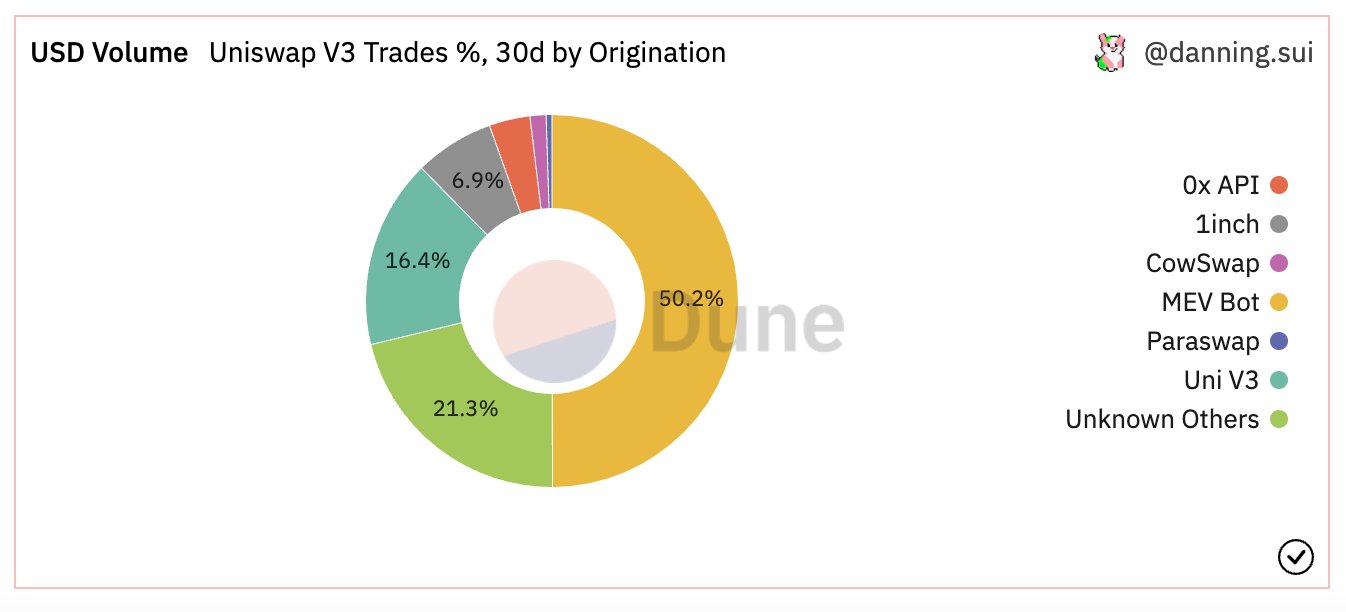

For a Uniswap Pool, the two most intuitive participants are users and LPs, but for the use of the entire protocol, participants also include network nodes and MEV Bots.

For a user, performing a Swap requires many transparent and opaque handling fees:

Swap Fee: Pay to Liquidity Provider. ~0.171%.

Gas Fee: Paid to Ethereum network nodes. ~0.235%.

MEV Tax: Paid to MEV Bots and Ethereum network nodes (more than 50% of the transaction volume in the above figure is MEV Bot, they secretly search for users' income). ~0.254%.

These fees combined are very high compared to centralized exchanges.< 0.235%

For these three Fees, Uniswap currently has no way to directly regulate them.< 0.254%

But if Uniswap is transformed into App-chain, then Gas Fee and MEV Tax can be directly optimized:

Gas Fee: Pay to UNI network nodes.

MEV Tax: Paid to MEV Bots and UNI network nodes. At the same time, the total amount of MEV Tax can be reduced through a new mechanism.

In this way, Uniswap can take the initiative in handling fees and agreement economic mechanisms, and actively regulate the economic mechanisms through governance and other means.

c) Trading experience

If it is an independent App-chain, then Uniswap can use new technologies to build the protocol without considering technical dimensions such as EVM compatibility and general contract deployment. All on-chain experiences are directly empowered by the functions of the protocol The construction of the surrounding ecology with the agreement.

For users, you can experience:

Higher TPS: The chain can be specially optimized for operations such as transactions.

Lower transaction fee: lower MEV Tax + lower or even 0 Gas Fee like the future dYdX.A better overall system: The ecology will be built more vertically, all for the chain and Uniswap itself.

d) Application Sovereignty

Just like dYdX fled from StarkEx,

If Uniswap becomes an App-chain, it will be able to gather the above advantages and gain more initiative over its own tokens, the functions and upgrades of the entire protocol, the governance of the entire network and protocols, and the construction of the entire ecology and infrastructure .e) Additional features of App-RollupHowever, there may be weakening of the other advantages above, for example, it is still necessary to put most of the value (

Accounts for ~60% of the total cost of L2

) are all returned to Layer1 as DA Fee, and there is no way to reduce the Gas Fee expenditure more significantly. If only Sequencer is the case, it means that most of the MEV Tax has been captured by it.

first level title

2. Disadvantages of application chainAlthough the application chain form has so many advantages, compared with the application form on the chain, it also has several small disadvantages, which can also lead to the interoperability issues we want to discuss in the next section:

a) Consensus and ecology

A chain must have Social Consensus. Under the current situation, if an application is born out of nowhere and goes online directly in the form of a chain, it is difficult to have a consensus.Therefore, many applications have landed on the Ethereum network in the form of agreements or Rollups, relying on the existing security and social consensus of Ethereum.Take Uniswap as an example. As an application named by Vitalik himself, it is deeply bound to Ethereum. If it “escapes” from the Ethereum mainnet, it will inevitably encounter resistance from many Ethereum parties and users.

at the same time,

The greatest value of Uniswap is the issuance of assets (ERC-20) without permission on a global permissionless largest decentralized network (Ethereum),If it turns into issuing assets on its own chain, it will be slightly less attractive. In contrast, dYdX, a dedicated Trading Platform, is more meaningful as an application chain.

b) InteroperabilityGoing back to what we said at the beginning, there will be dozens of new App-L1, App-rollup, App-subnet.),If they all become chains and form their own network, then the difference from the Web2 network will be even smaller...

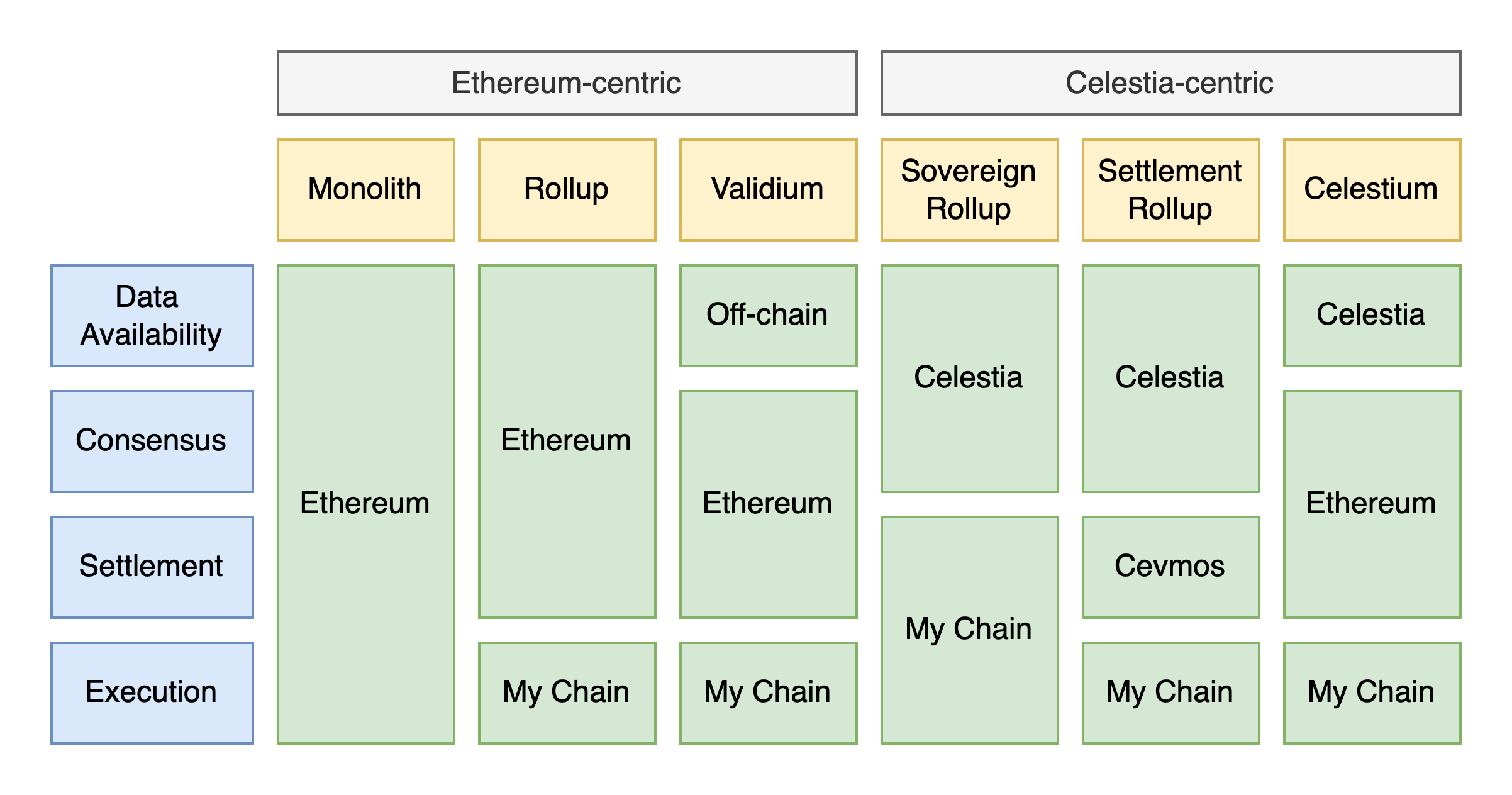

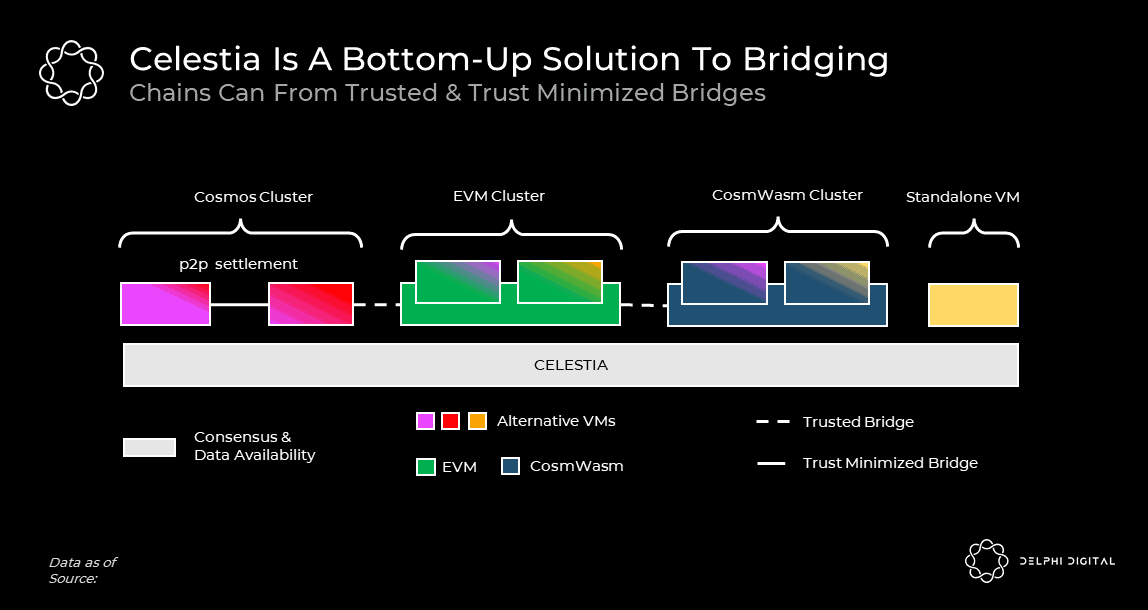

At the same time, I think that many of the App-rollups in these App-chains will become Sovereign Rollups. Then they will not have their own Trust-minimized bridge built on the same Layer1 bottom layer (

or

Therefore, it is used as the interworking layer. They need to use Cevmos and other architectures to communicate with other Clusters or networks with IBC through Trusted Bridge. The architecture is not so simple, and the concept is relatively new.

I think this thing looks very good, but it will be very troublesome in terms of actual engineering implementation. The Secured Rollup on Ethereum itself only needs to build its own L1-L2 Bridge, but now it needs Evmos Settlement Layer and other The network (or between several Evmos) builds bridges.

3. Interoperability solutions in the application chain and multi-chain era

An example of interoperability issues, take Uniswap as an example. In extreme cases, if its main body becomes a chain, you may have to cross the chain to it when Swap, and then Swap and then cross back to get the best offer.

For interoperability solutions in the application chain + multi-chain era, the most effective solutions I can think of are:

a) copy paste

1. Actively Fork key protocols on each chain

That is to continue the current solution adopted by Uniswap, and deploy a new Uniswap protocol on each chain. Its own App-chain is used as an Add-on dedicated to transactions. This is actually similar to USDT, USDC and other assets. .

In fact, this approach can be said to have not solved the problem, did not solve the interoperability, but cloned itself several times, and each protocol has separate liquidity and trading activities. They just run under the name of Uniswap.

1. Each chain is connected to IBC

Every application chain (and chain) is connected to IBCIt is a very simple and crude solution, which can directly solve the interoperability problem.),The disadvantages of this scheme are:

Existing chains may not be directly connected (such as

If Ethereum wants to connect to IBC, it needs ZK

Cosmos chain performance is not necessarily enough (so App-rollup)The user experience is actually not as good as the previous solution (although IBC is fast, it still takes more than ten seconds to come and go, so the two methods may need to be combined).

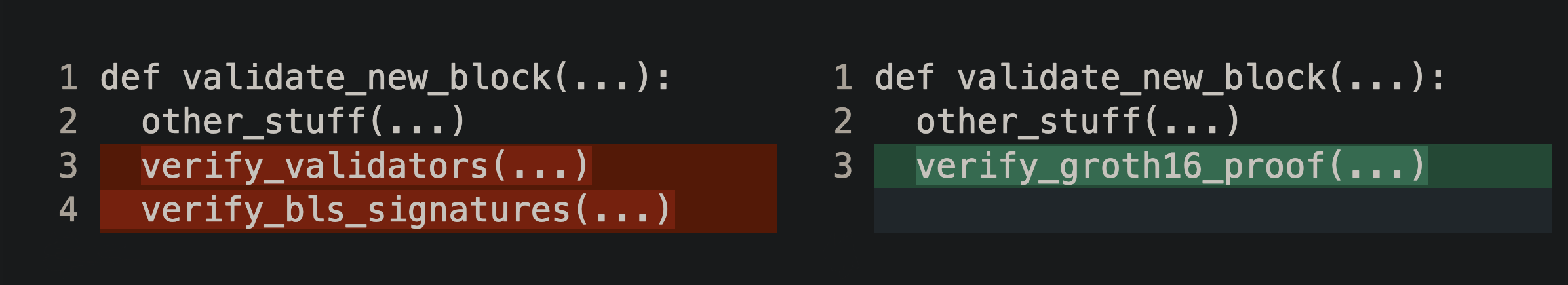

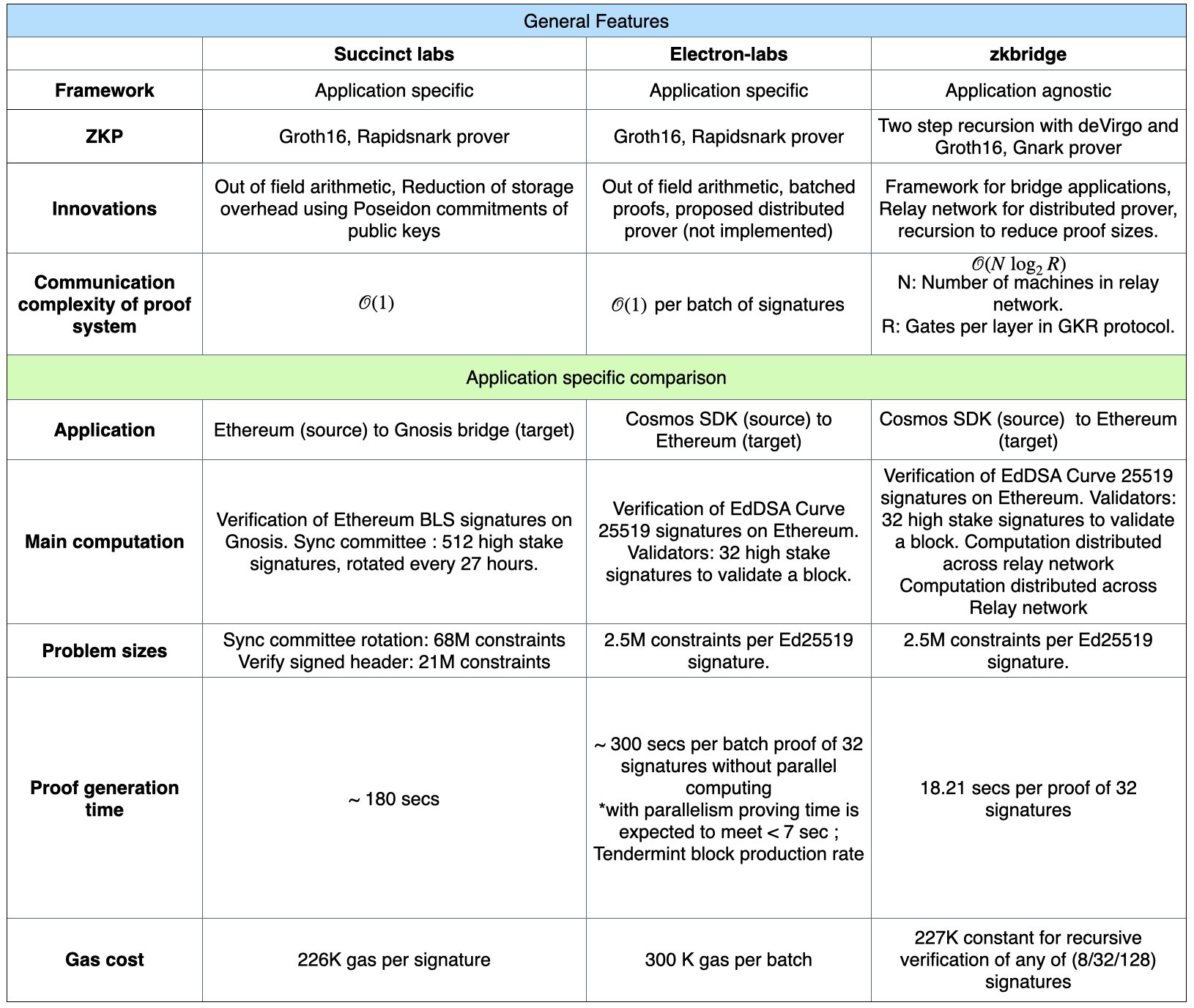

2. Each chain has a Trust-minimized BridgeWe directly ignore the intercommunication schemes that are not Trust-minimized Bridge. To achieve intercommunication and security, then Light Client Bridge (essentially the same principle as IBC), or.

Trustless Bridge between L3

The difficulty of this solution is mainly that the overhead of various verifications (Validator, Signatures) is too large to be carried out on the chain (EVM). However, the overhead of verifying ZKP is smaller, so recently there are

Many companies are doing ZK Light Client

I agree with this direction very much, but it is more difficult to realize than the previous one, and it is a long-term solution.

However, dozens of newly added chains will create liquidity fragmentation and interoperability problems. To solve this problem, either pass the Fork infrastructure to a different chain, or access a trusted interoperability protocol.

About Foresight Ventures

Foresight Ventures bets on the innovation of cryptocurrency in the next few decades. It manages multiple funds: VC fund, secondary active management fund, multi-strategy FOF, special purpose S fund "Foresight Secondary Fund l", with a total asset management scale of more than 4 One hundred million U.S. dollars. Foresight Ventures adheres to the concept of "Unique, Independent, Aggressive, Long-term" and provides extensive support for projects through strong ecological forces. Its team comes from senior personnel from top financial and technology companies including Sequoia China, CICC, Google, Bitmain, etc.

Website: https://www.foresightventures.com/

Twitter: https://twitter.com/ForesightVen

Medium: https://medium.com/@foresightventures-zh

Substack: https://foresightventures.substack.com

Discord: https://discord.com/invite/maEG3hRdE3

Linktree: https://linktr.ee/foresightventures

Related Links

0:

https://twitter.com/nickwh8te/status/1576683671267856384

https://l2beat.com/scaling/tvl/

1:

https://medium.com/nascent-xyz/the-inevitability-of-unichain-bc600c92c5c4

https://docs.uniswap.org/protocol/concepts/V3-overview/fees#protocol-fees

https://twitter.com/apolynya/status/1565173169987588096

2:

https://twitter.com/AgoLajko/status/1536732016040869890

https://twitter.com/OisinKyne/status/1576180356818296832

https://twitter.com/DittoJoBrr/status/1576606365040013312

https://forum.celestia.org/t/an-open-modular-stack-for-evm-based-applications-using-celestia-evmos-and-cosmos/89

https://members.delphidigital.io/reports/pay-attention-to-celestia/

3:

https://twitter.com/dystopiabreaker/status/1576328090011115520

https://ethresear.ch/t/bringing-ibc-to-ethereum-using-zk-snarks/13634

https://geometryresearch.xyz/notebook/the-road-to-slush

https://www.youtube.com/watch?v=5hO9NbtFc0g&t=21844s

https://twitter.com/ingo_zk/status/1576995003251195904