Original Author: Yilan

Summary

Summary

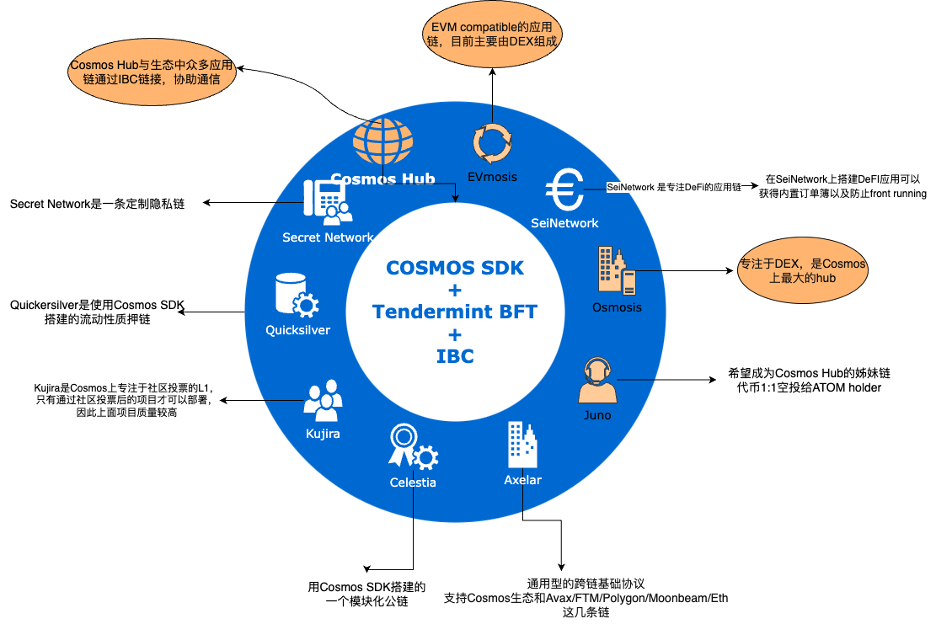

As the third-generation blockchain, Cosmos SDK and Tendermint BFT lower the threshold for developing and running public chains.The establishment of an independent ecological chain by the Cosmos SDK has become an ideal app-chain construction method. Projects using these infrastructures will surpass smart contract applications and become scalable systems with dedicated blockchains and their own communities.

Merger features of multi-chain cross-chain coupling and architecture decoupling.Cosmos has ecological expansion and coordination, and it is likely to stand out in the next public chain narrative, but at the same time, customized application chains have the disadvantage that they cannot be called at will compared with smart contracts.

On-chain sovereignty and operability are strong.The founders of Cosmos believed that a single blockchain would not work at scale due to differences in opinions and views among groups/regions. Therefore, Cosmos attaches great importance to the sovereignty of each chain to avoid "tyranny" and disagreement on the chain, and provides an equal and interconnected communication relationship (IBC) for each chain, which weakens the value capture of $ATOM and Cosmos Hub, but is not conducive to ecological prosperity. very important.

The Cosmos decentralization model enables more Alphas to exist in the Cosmos ecosystem.Cosmos Hub captures stable Beta, and the release of Cosmos 2.0 provides Cosmos Hub with the opportunity to capture some ecological Alpha.

The Cosmos system cycle flywheel optimizes the ability to capture the value of tokens.Introduction

Introduction

On September 28, 2022, the Cosmoverse Conference (The legendary Cosmos Conference) came to an end in the Colombian city of Medellin, and the Cosmos 2.0 white paper was finally officially released.Launched inter-chain security ICS, cross-chain coordinator Interchain Scheduler, cross-chain allocator Interchain Allocator, liquid pledge Liquid Staking and released the latest token economic model.first level title

1. The top-level design and operating mechanism of Cosmos

image description

Source: Cosmos Whitepaper

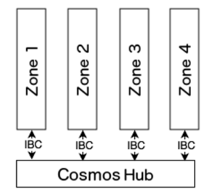

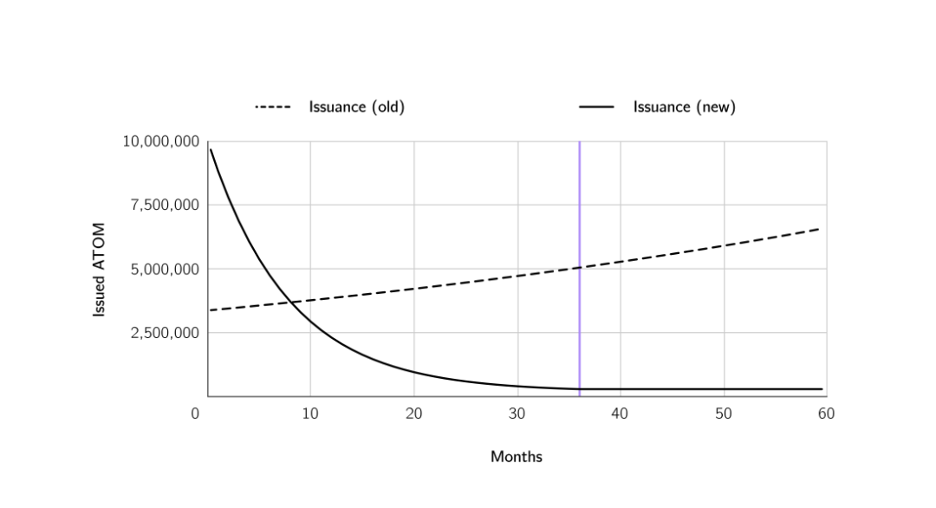

The Cosmos stack is built by the Cosmos SDK as the application layer, Tendermint as the network consensus layer, and IBC as the communication medium linking Hubs and the custody chain.

The consensus layer is the Tendermint Consensus Mechanism designed by Tendermint.Inc. The advantage of this consensus mechanism is that it is scalable and interoperable, has a throughput of 10k TPS, and 1/3 of the verifiers are online + 2/3 of the honest verifiers can be normal trade. However, due to Tendermint's quadratic complexity calculation, the blockchain verification system based on it is relatively centralized. Currently, there are only 150 verifiers (with a linear increase of 13% to 300 per year over time).

first level title

2. ATOM 2.0 and its impact on the Cosmos system

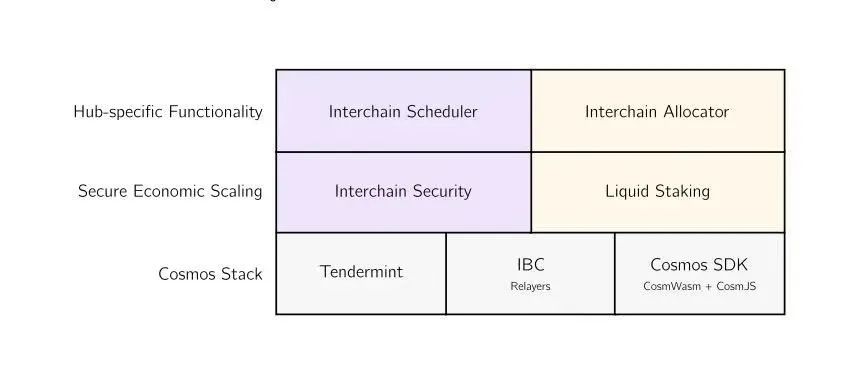

The Cosmos 2.0 white paper has finally been officially released recently, launchingimage description

Source: ATOM 2.0 Whitepaper

ICS Interchain SecurityIt mainly solves the weak security problem of the ecological blockchain built on the Cosmos Hub. ICS allows to protect the Cosmos ecological chain with a small market value by renting out the pledge verification ability of ATOM. The ecological chain needs to pay a certain fee as a reward, so it brings ATOM pledgers income. In addition to the role of ecological chain security protection, the use of ICS also includes Rollup settlement, IBC routing, relay contract market, chain domain name service, etc.

At present, the Cosmos ecological chain that has announced access to the inter-chain security (ICS) solution has 4 chains including QuickSilver and Neutron, and the overall scale is relatively small. Larger Cosmos ecological chains such as Evmos, Cronos, and Osmosis currently do not use $ATOM as a verification pledge. In terms of improving $ATOM value capture, most of the fee income leased to the ecological chain will be directly allocated to the ecological chain, and the remaining proportion will be allocated to the Cosmos Hub, and the value captured by $ATOM will be paid by the verification nodes who choose to lease the Cosmos Hub proportion of the cost.

Liquid StakingIt has greatly improved the user experience and capital efficiency in the Cosmos system. By requiring providers to host assets, it draws on the proposition of Olympus liquidity as a service to a certain extent to increase the pledge rate while releasing liquidity. The pledge rate of ATOM assets makes the liquid pledged assets the main trading medium, and then rewards the pledgers with the interest generated by the pledged assets. This is a major change to the Cosmos Hub security model. The most effective way to ensure long-term security is to ensure that individual suppliers and supply markets remain decentralized, rather than rewarding stakers with unsustainable inflationary rewards. As an integral part of ATOM 2.0, liquidity staking provides an optimized solution to the security issues that the original monetary policy (i.e. purely staking $ATOM) aims to solve.

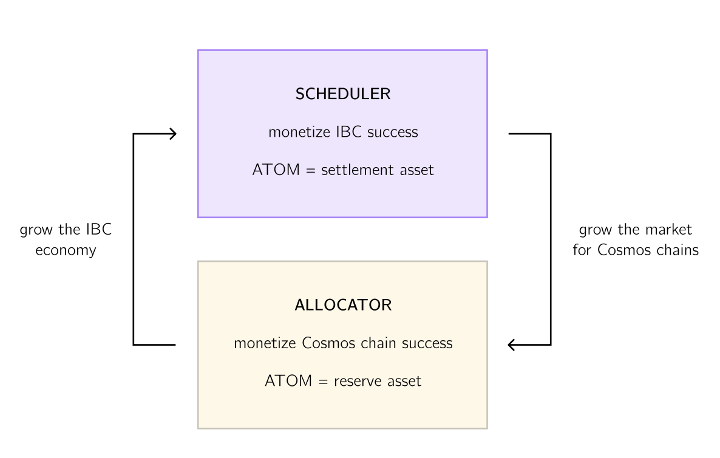

Interchain SchedulerBlock space market regulation based on inter-chain security. The specific mechanism is that when an ecological chain opens the coordinator module, future block spaces can be auctioned in the cross-chain contract, and the coordinator will mint NFT for these specific block spaces as reserved evidence. Moreover, these block spaces can be circulated in the secondary market before the reserved NFT is redeemed by the verifier, and part of the auction fee is distributed to the ecological chain to exchange block space. The cross-chain MEV income generated by the inter-chain Scheduler will flow back to the Cosmos Hub to promote the balanced growth of the entire ecology by utilizing the infrastructure Interchain Allocator.

Interchain AllocatorIts function is to provide new Cosmos projects with a more efficient path to user acquisition, liquidity, and long-term ecosystem balance.

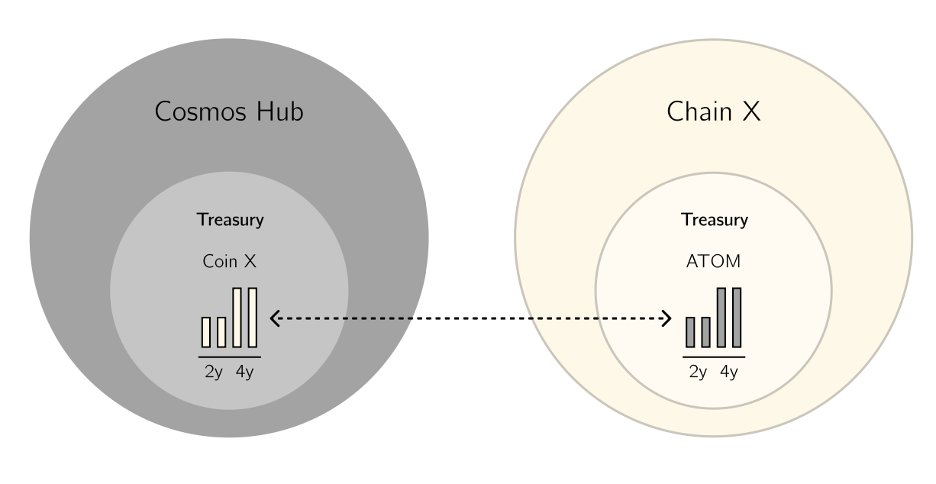

In inter-chain distribution, through the two tools of contract and rebalancing, the more tokens Cosmos Hub holds in its ecological chain, the more $ATOM this ecological chain holds.

The distribution DAO composed of $ATOM pledgers can sign agreements with other chains through contracts (token swap, etc.) For a long time, there may be multiple DAOs in the Hub, and the voting rights of DAOs are related to the number of pledges and the lock-up period of the DAO , which effectively turns the Cosmos Hub into a multi-DAO managed fund. The rebalancing system can reduce the slippage in DAO investment, and gradually move to the target combination by using fixed investment/Dutch auction.

image description

Source: ATOM 2.0 Whitepaper

image description

first level title

3. Monetary Policy Changes

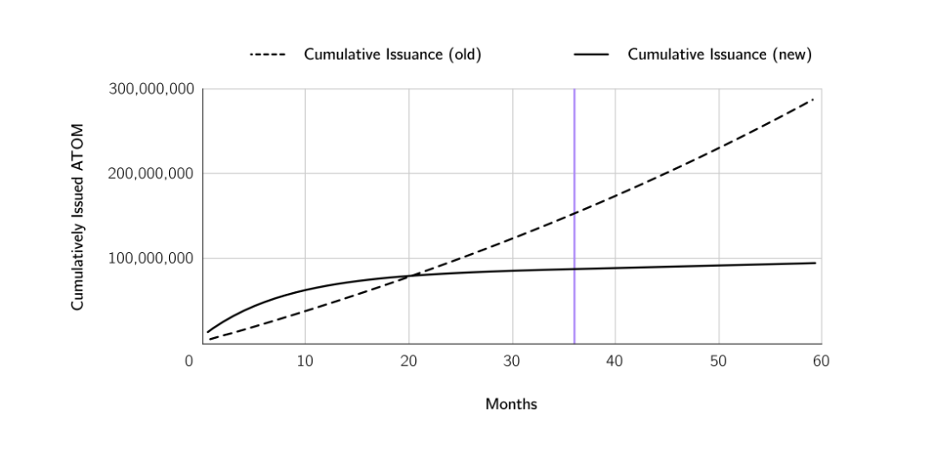

ATOM 1.0 adopts an inflation model, and the annual inflation rate is floating. It is adjusted with the total pledge ratio within the annual inflation range of 7%-20%. If the pledge rate is above 67%, the inflation rate will gradually approach 7%, and the pledge rate will be lower than 67%. The inflation rate will gradually increase to 20%. The inflation of ATOM is actually more inclined to punish non-staking holders than to reward staking. If the overall staking rate of the system is reduced, the inflation will accelerate.

The update of the ATOM 2.0 token economic model has a far-reaching impact on the systemimage description

Note: ATOM monthly circulation curve, the dotted line is ATOM 1.0, and the solid line is ATOM 2.0

image description

first level title

4. Value Capture Analysis

first level title

5. Safety balance point and market supply and demand analysis

first balance pointComparing the cost of doing evil and the TVL value, the current Tendermint BFT cost of corruption is that 2/3 of the pledge nodes are doing evil at the same time, and the market value of 2/3 of the pledge is currently about 1.8 billion. Compared with the TVL of ATOM 730 million, there is no evil motive. However, with the expansion of the ecology, the requirements for security are higher, which is why the new monetary policy of Cosmos has set a transition period with higher inflation and flexible implementation.

second balance pointCompare the daily new supply and daily consumption of ATOMfirst level title

image description

Cosmos ecology noteworthy characteristic app-chain

Note: The yellow ones are the three most active IBC DAU chains (24hrs), which are Osmosis, Evmos and Cosmos Hub, and the IBC DAUs are 6978, 4728 and 2711 respectively

From the perspective of ecological chain data, Osmosis not only includes the main cross-chain transaction AMM DEX, but also an application chain independently developed based on the Cosmos SDK IBC. Its TVL is 252 million, ranking first in the Cosmos ecosystem. The IBC interface of Osmosis is much higher than that of the Cosmos Hub, and it is one of the most active hubs. In theory, the Osmosis token OSMO will have a value capture capability similar to that of ATOM at the Hub level. From the horizontal comparison of public chain DEXs, Osmosis currently has a relatively high P/S value. Compared with its monthly transaction income of 2.5 million US dollars, the total market value of 1.38 billion is relatively high. However, because Osmosis has public chain attributes and Hub functions, Compared with the public chain horizontally, the market value is relatively low. Osmosis combines transaction privacy (using threshold to decrypt transactions to prevent frontrunning) with cross-chain AMM, and realizes cross-chain through IBC.

Kava is a DeFi platform for encrypted assets that supports multi-asset mortgages, self-issued loans, creation of stable tokens, etc. to create a CDP platform. Currently, Kava TVL 271 million is much higher than that of its direct competitor Evmos or due to its extremely high staking income , which is currently 2800%, and Evmos pledge income is 181%; the top two TVL rankings in the Kava ecosystem are both lending agreements, which shows that the Kava ecosystem leverage ratio is very high. The Kava 10 mainnet activates Kava Network's Ethereum Virtual Machine (EVM), allowing users to encapsulate and decapsulate KAVA assets as ERC-20 on MetaMask, and Kava Network can now directly connect these resources and tens of thousands of assets in the network count of active developers, dApps and blockchain projects.

Evmos TVL 1.6million,54% of it is composed of Dex Diffusion Finance, and 7 of the 11 projects currently built on Evmos are Dex; Secret TVL 10million, 68% of which is composed of the privacy protocol Sienna Network, and 4 projects are currently under construction.

Summarize

Summarize

The Cosmos Hub competes with other chains that have the size and functionality of the Hub, so the impact of $ATOM on the Cosmos ecology is still unclear. If Juno, EVOMOS, OSmosis and Axelar ecological chains with large market capitalization want to become Security Hubs, they will reduce the market share of $ATOM and the pricing power of ATOM.

From the perspective of cross-chain, the cross-chain supported by IBC is better than the previous cross-chain technology, but there are also problems with relatively large limitations, and it cannot compete with the new cross-chain technology formed by MPC.In addition, the customized application chain of the Cosmos ecology has the disadvantage that it cannot be called at will compared with the smart contract, so the interoperability at the calling level is poor.Cosmos Hub decentralizes token rights in exchange for long-term ecological development, but there is also a problem that alpha is likely to be in the Cosmos ecology. Cosmos Hub's $ATOM captures stable Beta, and the release of Cosmos 2.0 provides Cosmos Hub with the ability to capture part of the ecological Alpha. Chance.

ATOM 2.0's cross-chain coordinator and cross-chain allocator based on cross-chain security and liquid pledge together form the new cycle flywheel of the Cosmos system, and changed the pure collateral role of $ATOM, increasing the overall attractiveness of $ATOM-denominated collateral.【Reference】

【Reference】

[1]https://informal.systems/2022/08/11/interchain-security-pre-release/)

[2]https://www.stakingrewards.com/earn/cosmos/metrics/

[3]https://v1.cosmos.network/resources/whitepaper

[4]https://www.reddit.com/r/cosmosnetwork/comments/xort1i/atom_20_whitepaper_is_official/

[5]Data retrieved 2022.09.18