Draft Cosmos Hub 2.0 White PaperIt has been officially announced on the Governance Forum, describing the new ecological role of Cosmos Hub and the new token economics of ATOM. The white paper will be uploaded to the chain on October 3rd for community voting.

Earlier, Delphi Digital, a well-known investment institution in the industry, announced that its protocol research and development department, Delphi Labs, would turn to research and develop the Cosmos ecosystem, and released a research report on choosing Cosmos after comparing different public chains. ATOM ushered in a 23% increase that day.

secondary title

issue reduction

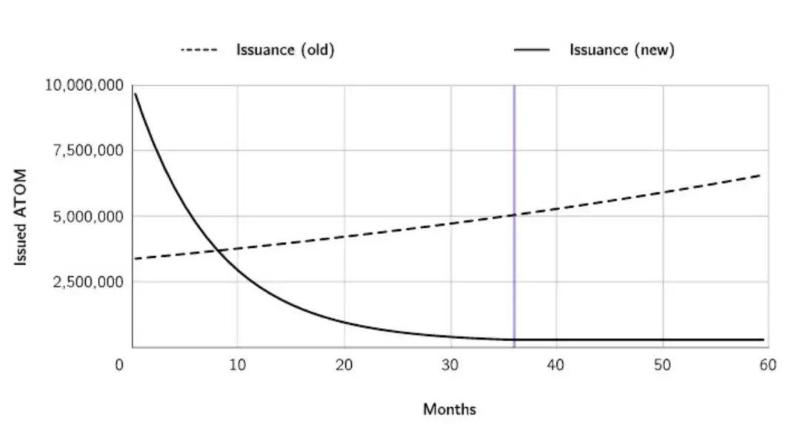

First, in terms of token supply, the issuance of ATOMs is gradually decreasing.

Cosmos 2.0 proposes new ATOM issuance rules. The release of ATOM will be adjusted to transition phase and stable phase. The transition period is 36 months. At the beginning, 10 million ATOMs will be issued per month. If the implementation is approved immediately, the inflation rate will soar in a short period of time, reaching 40% for a short time, and then steadily decline until it reaches 300,000 ATOMs per month. circulation, thereby effectively reducing the inflation rate of ATOMs to 0.1%.

secondary title

Weakened liquidity

With the arrival of ATOM liquidity staking, more and more ATOMs will be pledged, and the supply of ATOMs in the market will decrease.

secondary title

Gas settlement

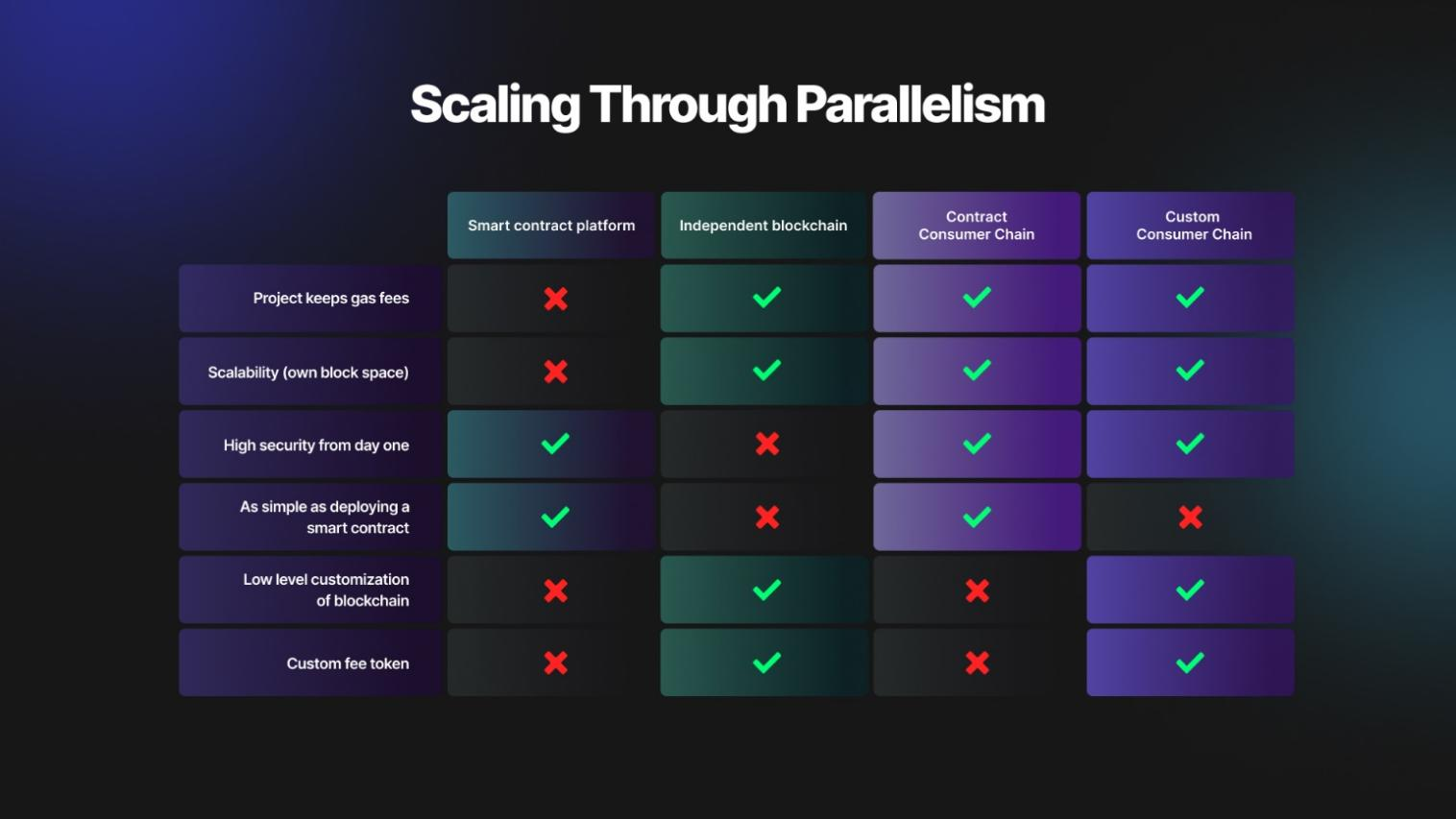

The previous article mentioned the changes in supply and liquidity of ATOM, and then we will introduce the changes in demand for ATOM.In Cosmos 2.0, some networks in Cosmos use ATOMs to settle Gas, which will increase the demand for ATOMs.

secondary title

treasury revenue

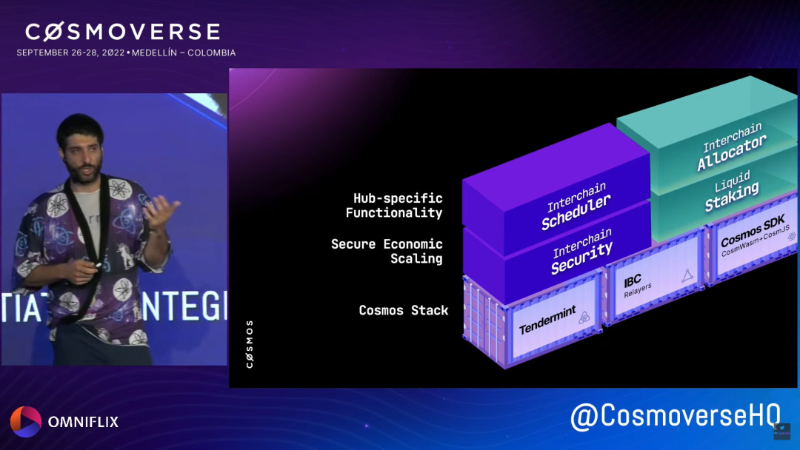

The white paper introduces two application-specific features, InterChain Scheduler and InterChain Allocator. InterChain Scheduler is a cross-chain block space market in Cosmos. The generated cross-chain MEV revenue is collected by InterChain Allocator to promote inter-chain collaboration, thereby expanding the potential market of Scheduler. To put it simply, Scheduler is the block market on Cosmos. Chains with idle blocks can sell their own blocks to chains in need, and the price difference will be collected by Allocator as the income of Cosmos Hub.

secondary title

secondary title

community governance

ATOM also has governance rights.

For example, the Cosmos Hub community initiated a proposal on September 20, planning to spend 20,000 ATOMs from the community fund pool for the incentives of the inter-chain security public testnet, of which 10,000 ATOM tokens will be rewarded for completing the testnet Milestone Cosmos Hub validators. In addition, since ATOM is also a Gas settlement token, ATOM may also be used in governance proposals to modify the Gas rate in the future.

In general, with the release of the Cosmos 2.0 white paper, new token economics affect the supply and demand of ATOMs. On the supply side, ATOM issuance and liquidity are gradually decreasing. On the demand side, the demand for Gas settlement and network governance will further increase. Therefore, we can expect that ATOM may become in short supply in the future, and the price will rise accordingly.