TL;DR

secondary title

1. In the bear market, the growth potential of stablecoin trading platforms and derivatives trading platforms has increased;

2. AMM+NFT is a new trend in the development of DEX;

3. The new public chain DEX is growing rapidly, and the public chain competition pattern of DEX presents a situation of one superpower and many strong ones;

4. The market wants to see new functions and new species of DEX.

In June 2020, DEX (decentralized trading platform) has grown rapidly amidst the DeFi boom, and the monthly transaction volume has increased by 105 times in one year, reaching 203.95 billion US dollars.

The market growth of DEX started from Ethereum and spread to BSC, Solana, Avalanche and other chains.

So far, the volume of DEX on the Ethereum chain still occupies an absolute dominant position, and there is a certain gap between DEX on other chains and Ethereum in terms of transaction volume and lock-up volume.

DEX types include AMM, cross-chain transaction protocol, derivatives transaction protocol, stablecoin transaction protocol, and DEX aggregator. Among them, AMM is the most common type of DEX track, and Uniswap is the most well-known AMM.

Beep News has counted the top 60 DEXs in terms of locked positions, and obtained five trends of the DEX track.

1. A few DEXs occupy most of the market share;

2. The proportion of cross-chain and cross-layer transaction protocols has increased, accounting for about 1/4 of the leading DEX;

3. AMM+NFT is a new trend in the development of DEX;

4. All mainstream public chains have DEX among the top, and the new public chain DEX is rising rapidly;

5. Stablecoin trading platforms and derivatives trading platforms have great growth potential.

Against this background, the DEX track has 5 directions worthy of attention: DEX on the old Ethereum chain, cross-chain DEX, stable currency trading protocol, Cosmos ecological DEX, and new public chain DEX.

first level title

This chapter will explain the overall situation of the current DEX track from the perspective of DEX trading volume, lock-up volume, top DEX agreement income, DEX category and its representative projects.

secondary title

(1) DEX track data

1. Transaction volume

The research report is divided into 3 categories to illustrate the trading volume of DEX: spot trading, derivatives trading, and DEX aggregator. Among them, spot trading platforms dominate DEX.

1.1 Spot transaction

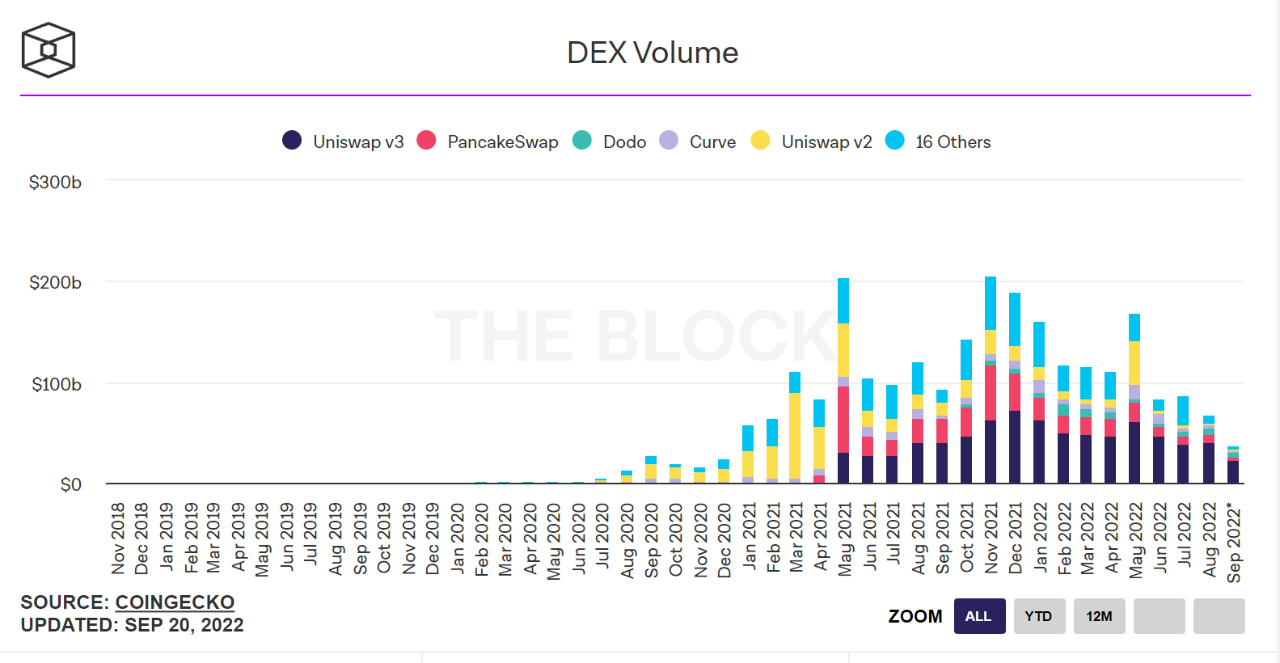

Data from The Block shows that spot trading-focused DEX volumes have grown since June 2020, which coincides with the start of DeFi Summer.

In June 2020, the transaction volume of DEX in this category was 1.92 billion US dollars, and by May 2021, it ushered in the first high of 203.95 billion US dollars, an increase of 105 times in one year.

Since 2022, the overall transaction volume has shown a downward trend. In August, the transaction volume was US$66.76 billion, down 58.3% from January's US$160.14 billion.

The distribution of trading volume shows that the combined trading volume of Uniswap and PancakeSwap accounts for more than half of the total. The historical highs of Uniswap v2, Uniswap v3, and PancakeSwap all exceeded 30% in that month.

Uniswap v2 set a record high transaction volume of US$85.06 billion in May 2021, accounting for 76.5% of the total for that month.

Uniswap v3 set a record high transaction volume of US$71.98 billion in December 2021, accounting for 38% of the total for that month.

PancakeSwap set a record high transaction volume of US$65.21 billion in May 2021, accounting for 31.9% of the total for that month.

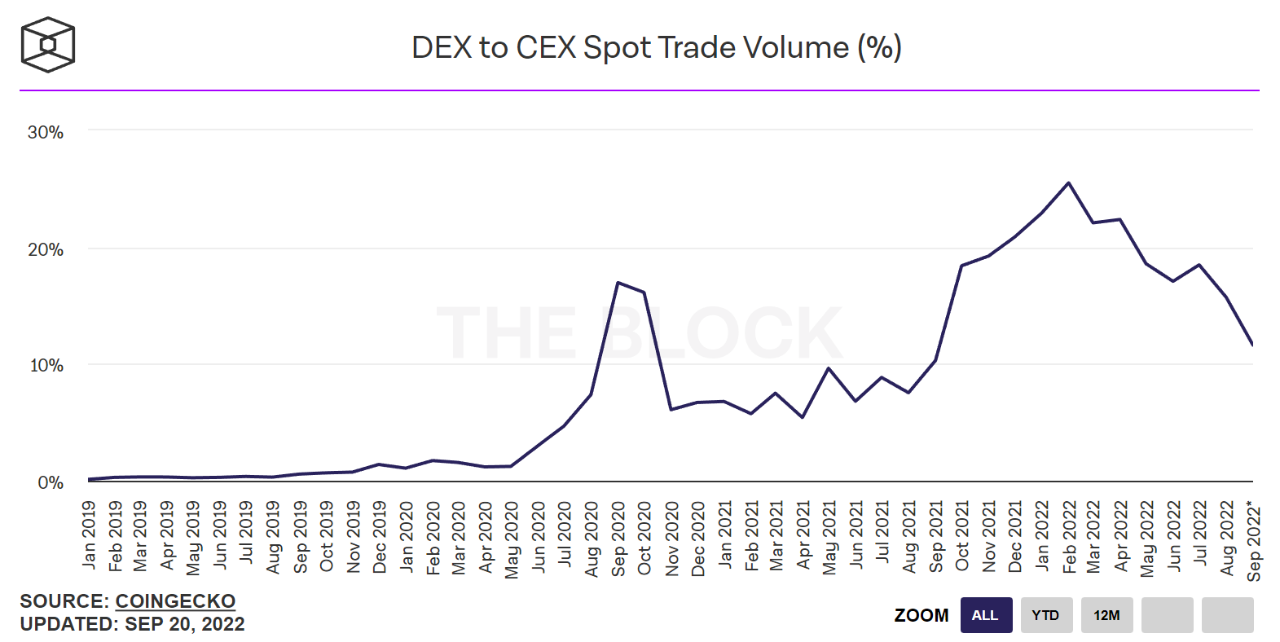

The spot transaction volume ratio of DEX and CEX ushered in phased highs in September 2020 and February this year, with the ratios being 16.97% and 25.51% respectively. Since February this year, the ratio has shown an overall downward trend, and it was 18.49% in August.

1.2 Derivatives Trading

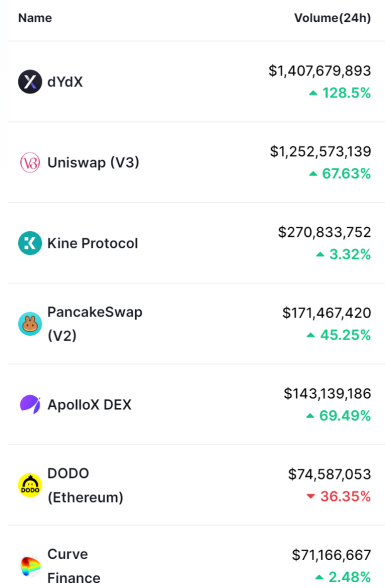

In the decentralized derivatives trading track, dYdX occupies an absolute dominant position.

According to CoinMarketCap data, dYdX had a trading volume of $1.38 billion on September 21, ranking first among all DEXs.

The trading volume of Kine Protocol, which ranks second among the decentralized derivatives trading platforms, was $270 million, only 19.5% of that of dYdX.

The daily trading volume of dYdX and Kine Protocol ranks first and third among all DEXs, reflecting that decentralized derivatives trading platforms occupy a certain share in the DEX market.

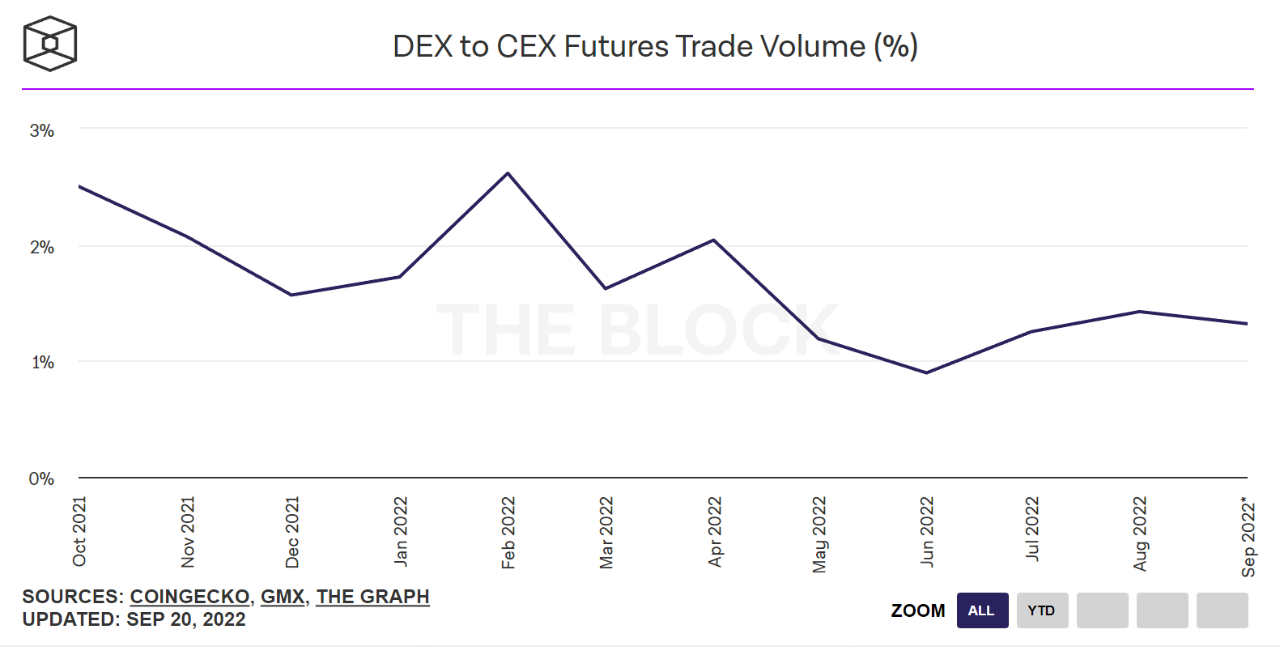

The derivatives trading market is currently monopolized by centralized trading platforms. According to The Block data, the ratio of DEX futures trading volume to CEX futures trading volume is only 1.4%, and has been lower than 3% for a long time.

1.3 DEX Aggregator

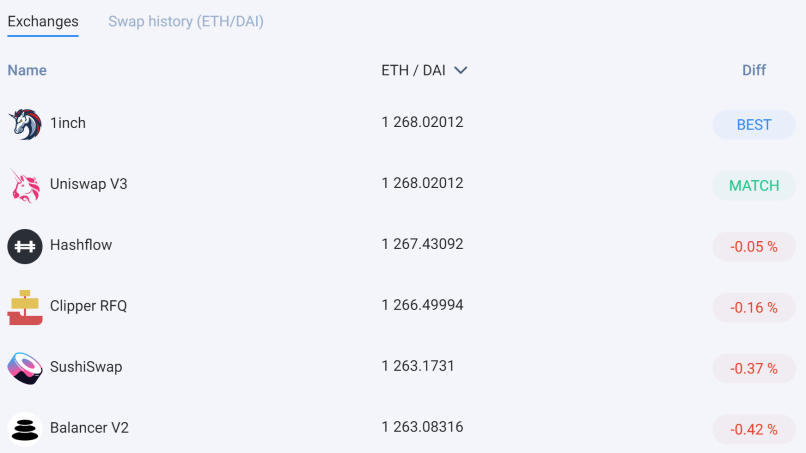

The DEX aggregator collects the information of multiple DEXs, aiming to find the optimal swap path for users. The top projects in this category include 1inch, Matcha, and OpenOcean.

According to data from CoinMarketCap on September 21, the 24-hour trading volume of 1inch was 1.066 million US dollars, and the 24-hour trading volume of OpenOcean was 517,000 US dollars, and the trading volume was relatively small.

2. Locked amount

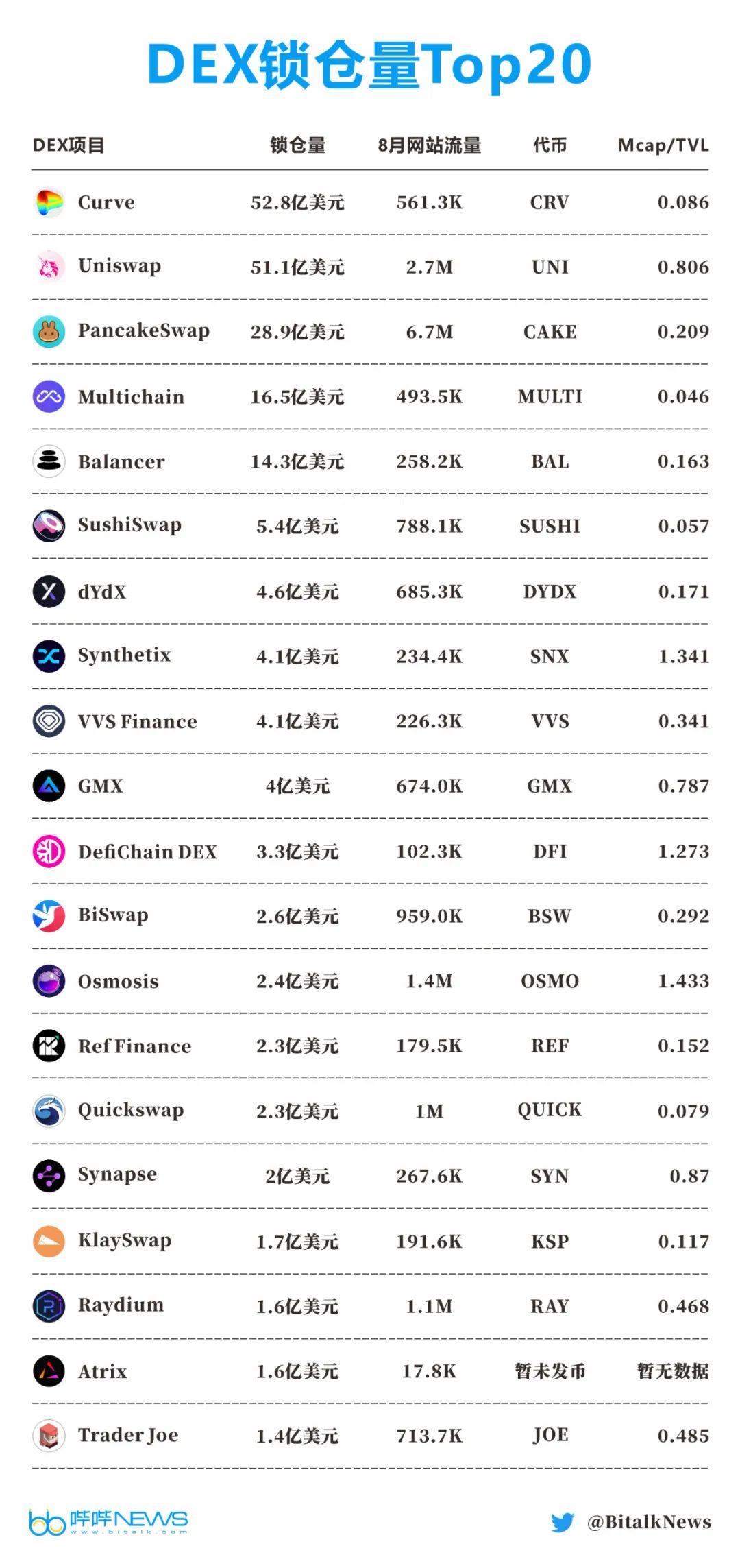

According to the statistics of Beep News, there are currently 5 DEXs (including cross-chain protocols with trading functions) with locked positions exceeding US$1 billion.

They are Curve, Uniswap, PancakeSwap, Multichain, and Balancer.

Curve, Uniswap, and PancakeSwap are all among the top 10 lock-up volumes of DeFi protocols. The three accounted for 10%, 9.6% and 5.4% of the lock-up volume in DeFi respectively, and the three contributed 1/4 of the lock-up volume in DeFi.

image description

(Top 20 DEX lock-up volume)

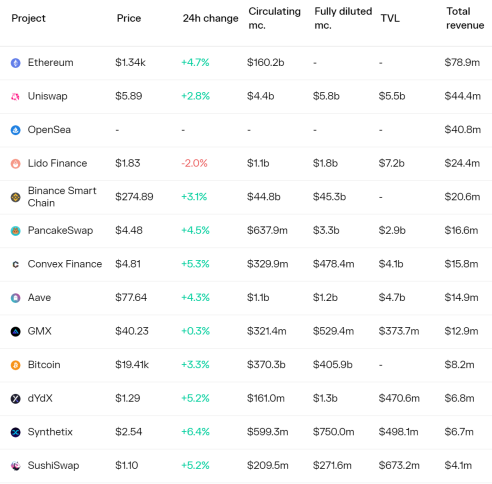

3. Revenue from top DEX protocols

Three of the six DEXs belong to derivatives trading platforms, namely GMX, dYdX and Synthetix.

secondary title

(2) Types of DEX

1.AMM

Beep News has counted the top 60 DEXs in terms of locked positions, including AMM, cross-chain transaction protocols, derivatives transaction protocols, stablecoin transaction protocols, and DEX aggregators.

AMM (Automatic Market Maker) is currently the most common type in the DEX track. AMM can automatically calculate the buying and selling price based on a simple pricing algorithm.

In the AMM model, LP (liquidity provider) puts its own assets into the liquidity pool (Liquidity Pool) in a certain proportion to provide liquidity for the exchange. When traders trade, they are actually conducting transactions with the liquidity pool. trade.

The leader in AMM is Uniswap, whose trading volume and lock-up volume dominate all AMMs, and it is the DEX with the most forks.

2. Cross-chain transaction protocol

The cross-chain transaction protocol refers to the protocol with both transaction and cross-chain bridge functions. The cross-chain transaction protocol can realize cross-layer (L1-L2) and cross-chain asset swap. For example, Hop Protocol, Multichain, and Hashflow all have the function of cross-chain swap.

3. Derivatives Trading Agreement

Derivatives trading agreements include perpetual contract trading agreements, options trading agreements, synthetic asset trading agreements and other categories. Beep News pointed out in the previous research report on encrypted derivatives that the volume of perpetual contract trading agreements is the largest. The representative projects of perpetual contract trading agreements are dYdX and GMX, both of which use L2 expansion solutions.

Representative projects of option trading agreements include Lyra and Opyn, and representative projects of synthetic asset trading agreements include Synthetix and Mirror.

4. Stablecoin Trading Protocol

The stablecoin transaction protocol is a transaction protocol specially created for stablecoins (USDT, USDC, DAI, etc.). Curve, which ranks first in the number of locked positions in DEX, is the largest stablecoin transaction protocol on the Ethereum chain.

Users can trade stablecoins and perform liquidity mining through Curve.

Transaction: Curve uses the AMM mechanism of StableSwap (stable exchange) to realize stablecoin transactions. Users can trade stablecoins (such as USDC, DAI) and encapsulated assets (such as stETH).

Liquidity mining: Curve has a liquidity pool with three types of tokens: ① a variety of stablecoins paired; ② stablecoins paired with encapsulated assets; ③ stablecoins paired with liquidity tokens (such as 3Crv).

5. DEX aggregator

Taking 1inch as an example, through the interface in the above figure, users can choose the DEX with the lowest slippage for trading.

secondary title

LinkLink。

image description

(partial DEX data)

From the data analysis and actual experience of the top DEX projects, five trends in the development of the DEX track are drawn:

1. A few DEXs occupy most of the market share;

2. The proportion of cross-chain and cross-layer transaction protocols has increased, accounting for about 1/4 of the leading DEX;

3. AMM+NFT is a new trend in the development of DEX;

4. All mainstream public chains have DEX among the top, and the new public chain DEX is rising rapidly;

These five trends are elaborated below.

text

A Few DEXs Occupy Most of the Market Share

It can be seen from the lock-up volume and transaction volume that a few DEXs occupy the vast majority of the market share.

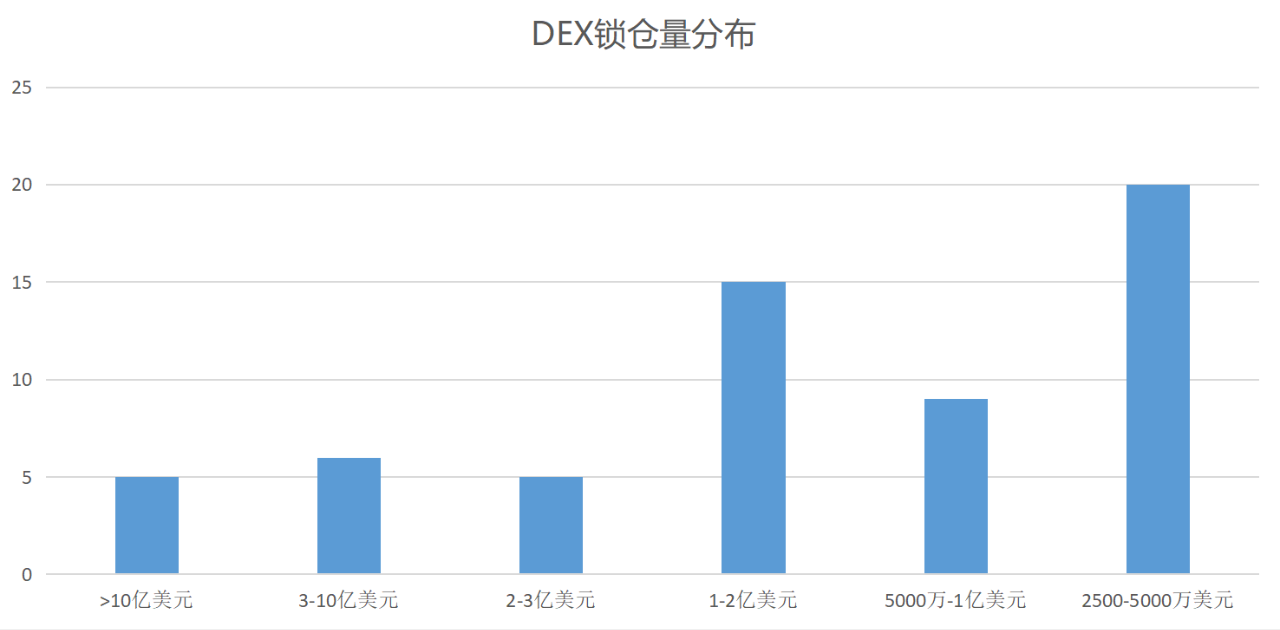

1. Distribution of locked positions

Among the 60 top DEXs counted by Beep News, the lowest value is 25.92 million US dollars (BabySwap), and the highest value is 5.28 billion US dollars (Curve).

Within this interval, the lock-up volume of DEX is distributed as follows:

Locked amount > 1 billion USD: 5;

The locked amount is between 300 million and 1 billion US dollars (including 300 million and 1 billion): 6;

The locked amount is between 200 million and 300 million (including 200 million and excluding 300 million): 5;

The locked amount is between 100 million and 200 million (including 100 million and excluding 200 million): 15;

The locked amount is between USD 50 million and USD 100 million (including 50 million and excluding 100 million): 9;

Locked volume below USD 50 million: 20

According to the data provided by DeFillama on September 21, the total locked amount of DEX (first echelon) with locked amount > 1 billion US dollars is 16.36 billion US dollars, and the locked amount of DEX (second echelon) with locked amount between 300 million and 1 billion US dollars Echelon) has a total lock-up amount of USD 2.55 billion.

The total lock-up volume of the second echelon accounted for only 15.5% of that of the first echelon, showing the strong dominance of the first echelon in terms of lock-up volume, and most of the funds flowed into these five DEXs.

In the first echelon, the locked positions of Curve and Uniswap both exceeded US$5 billion, and the combined locked positions of the two were US$10.39 billion, accounting for 63.5% of the total locked positions of the first echelon.

2. Transaction volume

According to data from CoinMarketCap on September 22, only five DEXs had a trading volume of more than $100 million in the past 24 hours. Among them, dYdX and Uniswap v3 ranked the top two, with trading volumes of $1.4 billion and $1.25 billion, respectively.

The transaction volume of Kine Protocol, which ranks third, is US$270 million, which is far behind the top two.

If the scope is widened to more than 10 million US dollars, including DEXs exceeding 100 million US dollars, a total of 30 DEXs have reached this level, accounting for 12.5% of the total DEXs included in CoinMarketCap, which shows that the trading volume is relatively concentrated.

The proportion of cross-chain and cross-layer transaction protocols has increased, accounting for about 1/4 of the top DEX

Cross-chain and cross-layer (L1-L2) is the mainstream trend of DeFi development, which is evident on DEX. Among the 60 head DEXs counted, the total number of cross-chain protocols and cross-layer deployment protocols is 16, accounting for about 1/4 of the statistical samples.

The most widely used cross-chain and cross-layer swap is the cross-chain transaction protocol, which has both cross-chain bridge and transaction functions, such as Hop Protocol, Multichain, and Hashflow.

These cross-chain protocols support multiple inter-chain transactions and asset transfers, and support user transactions and asset transfers between L1 and L2 (Arbitrum, Optimism, etc.).

The multi-chain deployment of DEX without cross-chain function is the mainstream trend. These chains include L1 and L2. Deploying on the L2 network can reduce its gas, speed up transaction confirmation time, and improve user experience.

Among the top ten projects with locked positions, Curve, Uniswap, SushiSwap, Balancer, dYdX, and Synthetix have all deployed on the L2 network or used L2 expansion technology.

Cross-chain AMM is a new species. SushiXSwap, the first cross-chain AMM launched by the cooperation of SushiSwap and LayerZero, is realized through Stargate's cross-chain function and Sushiswap's multi-chain liquidity.

AMM+NFT is a new trend

AMM+NFT is divided into two categories, one is an NFT trading platform based on the AMM mechanism, and the other is adding NFT categories to AMM tradable assets. The representative project of the former is sudoswap, and the representative project of the latter practice is Uniswap.

1. NFT trading platform based on AMM mechanism

As mentioned above, in the AMM model, LP (liquidity provider) puts its own assets into the liquidity pool (Liquidity Pool) in a certain proportion to provide liquidity for the exchange. Trade with liquidity pools.

The NFT trading platform based on the AMM mechanism is composed of many separate NFT liquidity pools, and LP can provide liquidity to these liquidity pools.

Taking sudoswap as an example, the LP of sudoswap can create a liquidity pool, and the LP can only deposit tokens and specify the NFT series to be bought or sold, the number of NFTs, the starting price, and the pricing function.

This type of NFT trading platform innovatively introduces the AMM mechanism to improve the liquidity of NFT.

2. Attempt to add NFT transactions to the top AMM

Top AMMs actively introduce NFT transactions, among which Uniswap has more actions.

Uniswap Labs acquired NFT trading aggregator Genie in June this year. Uniswap Labs said at the time that users could trade NFT directly on Uniswap this fall.

One month later, the head of the Uniswap NFT product said that Uniswap will realize NFT transactions by integrating sudoswap, while accessing the on-chain liquidity provided by sudoAMM.

Uniswap and sudoswap have a high degree of fit. Both are based on the AMM mechanism and provide liquidity for ERC20 tokens and NFT respectively. The integration of the two can be described as a powerful combination. Uniswap's acquisition of Genie allows Uniswap to have the function of NFT aggregation transactions on the basis of NFT AMM.

After Uniswap, it is expected that more AMMs will launch NFT trading products to provide users with a trading experience in multiple asset classes.

All mainstream public chains have DEX among the top, and the new public chain DEX is rising rapidly

The top 60 DEXs in the amount of lockups counted by Beep News include native projects from 23 public chains such as Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, NEAR, and Avalanche.

The native DEX on the Ethereum chain occupies a dominant position in the market. Among the top 8 DEXs with locked positions, the native DEX on the Ethereum chain accounts for 7 of them.

According to DeFillama data, as of September 21, the total lock-up volume of these seven DEXs was 14.88 billion US dollars. The total lock-up volume accounts for 46.8% of the DeFi lock-up volume on the Ethereum chain, which is nearly 2.9 times that of the DeFi lock-up volume on the BNB Chain chain ($5.2 billion).

The top three native DEX locked positions on other public chains are:

PancakeSwap from BNB Chain, with a lock-up volume of 2.89 billion US dollars, ranking third;

VVS Finance from Cronos, with a lock-up volume of 410 million US dollars, ranked 9th;

GMX from Arbitrum ranks 10th with a lock-up volume of $400 million.

Among the top 30 DEXs in terms of lockup volume, native DEXs on the new public chain performed well. One of the native DEXs of 6 new public chains, including Cronos, Arbitrum, DefiChain, Osmosis, Klaytn, and Elrond, entered the top 30.

Among the statistical DEXs, there are 4 application chains with built-in DEXs, namely DefiChain, Osmosis, THORChain, and Canto. Among them, Osmosis, THORChain, and Canto all belong to the Cosmos ecological public chain. In the wave of new public chains, the Cosmos ecological DeFi public chain deserves continuous attention.

In addition, among the new public chains, Klaytn is worthy of attention. The lock-up volume of native DEXs on the three Klaytn chains ranks among the top 60. Based on the fact that only one DEX is shortlisted in nearly half of the public chains, Klaytn, as a new public chain, has performed well.

Klaytn is a public chain owned by South Korean Internet giant Kakao, aiming to become a "one-stop" blockchain for metaverse builders. KlaySwap is the largest DEX on the Klaytn chain, with a lock-up volume of $170 million, ranking 17th.

Stablecoin trading platforms and derivatives trading platforms have great growth potential

Users' investment propensity for stablecoins and encrypted derivatives is largely based on the overall sluggish market.

In the case of the overall market downturn, due to the continued appreciation of the US dollar, the OTC prices of USDT, USDC and other stablecoins linked to the US dollar have recently exceeded 7 yuan. The recent income of holding such stablecoins is better than that of holding ETH and BTC .

The increase in stable currency income may stimulate market demand for stable currency income products. The stable currency trading platform based on the AMM mechanism is one of them. Representative projects include Curve and Wombat Exchange.

Curve is the No. 1 DEX in terms of locked positions. As an established stablecoin trading platform, it has a large base of trading users and liquidity providers. The token combinations of three liquidity pools provide users with choices of different risk levels and yields. Let users take out a part of the stable currency to strive for higher returns on the basis of hoarding the stable currency.

According to the data on Curve's official website on September 21, the minimum APR of Curve's liquidity pool is about 6.3%, and the highest APR is about 15.9%.

Curve’s locked-up volume increased by 12.5% in 7 days, ranking first among the top 10 DeFi projects with locked-up volume.

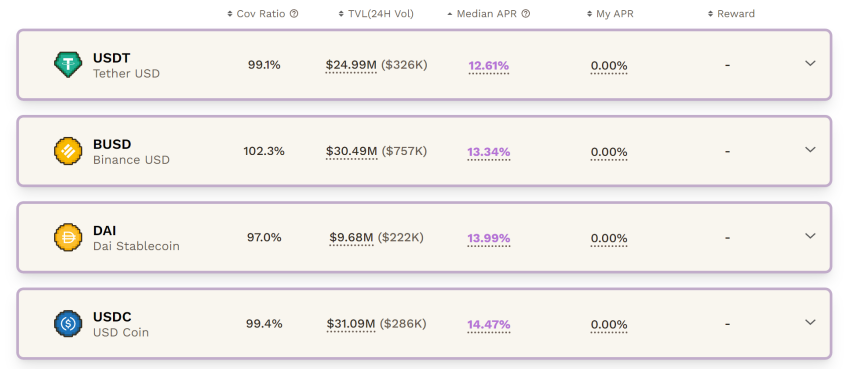

Wombat Exchange is a recently popular multi-chain stablecoin trading protocol. Wombat Exchange uses a single currency liquidity pool to improve capital efficiency.

The three pools with the highest locked-up volume on Wombat Exchange are USDC pool, BUSD pool and USDT pool, and the median APR is between 12% and 15%.

first level title

Summarize

Summarize

According to the current hotspots and the above-mentioned explanations, Beep News has summarized 5 directions that can be paid attention to:

1. DEX on the old Ethereum chain (such as Uniswap, SushiSwap);

2. Cross-chain DEX (such as Hop, Hashflow);

3. Stablecoin trading protocols (such as Curve);

4. Cosmos ecological DEX (such as Osmosis);

5. New public chain DEX (such as Canto DEX).

The overall DEX track is in a state of oversupply, and the trading and liquidity mining functions provided by DEX can basically meet the needs of users.

The new DEX is innovating in terms of liquidity pool, AMM mechanism, function aggregation, products, customized functions, etc., and strives to gain market share. Users can pay attention to the segmented track of DEX.

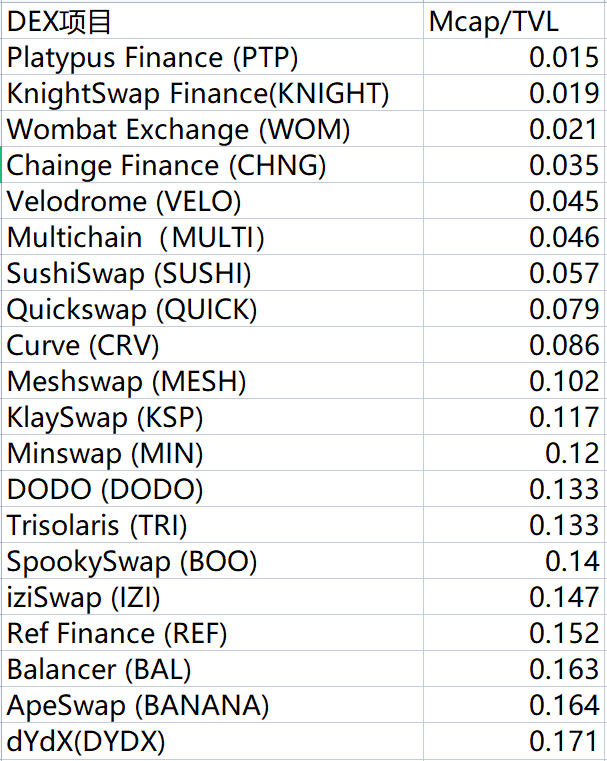

In the context of the overall market downturn, the data of Mcap/TVL (market value/locked volume) shows that 20 of the DEXs in the statistics are lower than 0.2, reflecting that the value of these DEXs is underestimated, including the above-mentioned Curve, Wombat Exchange, dYdX.

DEX in the undervalued range is the focus of investors. However, the overall market is currently in a downturn, so no investment advice is made here.

In the long run, DEX is still an important pillar of DeFi and the entrance for users to participate in DeFi.

In the DEX track, it is also necessary to pay attention to the development of DEX on L2. The advantages of low slippage and low gas can improve the user's trading experience. The DEX on the Ethereum chain will gradually migrate to the L2 network, and the L2 native DEX (such as Starkswap, SyncSwap, etc.) will also expand its market share.