This article comes from ForbesThis article comes from

, original author: Alex Konrad, compiled by Odaily translator Katie Gu

Helium is touted as the best real-world use case for Web3 technologies. But as the project struggled to generate revenue, a Forbes investigation found that Helium executives and their friends had quietly hoarded most of their wealth since the project’s inception.

If demand for the Helium system rises, pushing up the value of its Helium Network Token (HNT), the company hinted that the benefits of the network will be shared among all. But after being exposed by Forbes, he was severely "slapped in the face".

secondary title

The establishment of Helium and internal bugs

In 2013, Napster co-founder Shawn Fanning and then-renowned game designer Haleem formed a startup called Skynet Phase 1, which referenced the genocidal computer systems featured in the Terminator movies. The company, which has since been renamed Helium Systems, claims to be creating wireless networks for the Internet of Things, one of the hottest areas for venture capital.

Building on Shawn Fanning's fame, Helium raised $15 million in 2014 from big-name investors including Khosla Ventures and Salesforce founder Marc Benioff. But after five years of failed product launches fueled by a $50 million investment, Helium turned to the booming crypto market, with the "User Network" unveiled in August 2019. (Shawn Fanning left the company before going live, according to three sources.)

But at the same time, Helium found that its new system was full of cheaters. To artificially increase the rewards, some users purchase multiple hotspots, sometimes dozens, and manipulate their locations to make them appear scattered across a city or town when in reality they are all in one place. When the machines authenticate each other, a clear signal is still produced, thus more tokens are produced. Helium employees say this phenomenon is common.

Although the community now manages a blacklist of more than 70,000 hotspots that may belong to cheaters, and Helium claims to have implemented anti-spoofing measures, it is well known within the company that employees have engaged in such behavior, with three former Says a Helium employee: "When you see customers doing this, you think, why don't I just grab a piece of it?"

Haleem says it has been focused on how to tackle spoofing, and nearly 12 months after its launch, Helium says its hotspots cover more than 1,000 cities in North America. Not long after, major crypto exchanges Binance and FTX listed their tokens, allowing people to buy, trade and sell HNT. By July 2021, there will be more than 100,000 online hotspots, but the rewards of HNT will continue to decline accordingly. Like other cryptocurrency projects, Helium initially issued the most tokens, issuing more than 60 million HNT in the first year, and according to official documents, this number will be halved every two years in order to protect the value of the cryptocurrency.

In August 2021, a16z led a $110 million token financing, and Helium's token price continued to rise until reaching $55 in November. At the time of the sale, three a16z partners wrote in a blog post that Haleem's dream of "creating a more connected world" had become a reality.

When Helium first launched, it created a special token — Helium Security Tokens, or HST for short — which guaranteed that about a third of all Helium tokens would be transferred to investors and company executives as a support network compensation. While users complain about their reduced rewards. CEO Haleem lauded it on Discord: “Fairest token distribution of any project I know of so far.”

secondary title

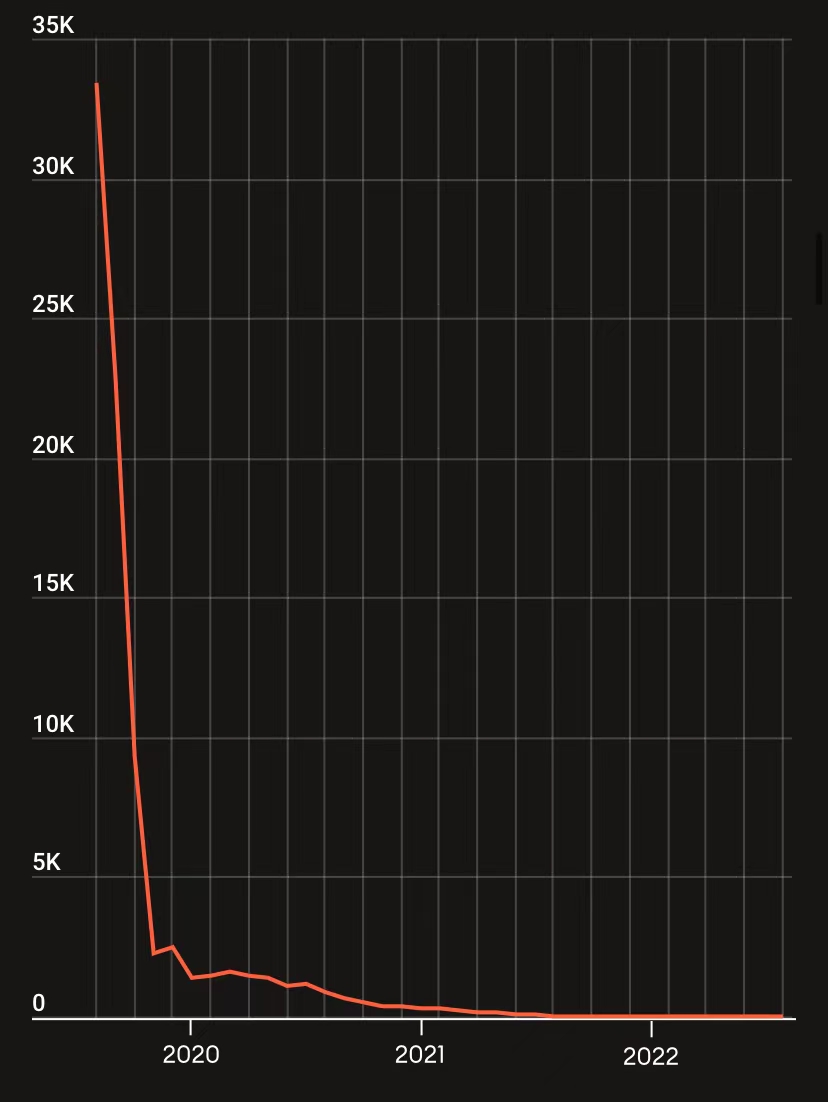

Helium hotspots earned the most tokens during the network’s first three months, when company insiders made up a large portion of the Helium mining community.

image description

Average monthly revenue per Helium hotspot

But what the community didn't know was that Haleem and several Helium executives, their friends and family, and some investors, on top of these guaranteed dividends, also received a previously undisclosed windfall -- in the wake of the earnings plunge. Before, they got the lion's share of tokens. They quietly amassed most of the tokens the project received at its inception, hoarding most of the wealth generated during the project’s earliest and most lucrative days.

Forbes found 30 digital wallets that appeared to be linked to Helium employees, their friends, family and early investors. According to an analysis corroborated by blockchain forensics firm Certik, the group of wallets mined 3.5 million HNT, almost half of all Helium tokens mined in the first three months of the network’s launch in August 2019. Within 6 months, more than a quarter of HNT has been poached by insiders. That compares with a peak value of around $250 million last year when HNT prices peaked. Those tokens are still worth $21 million today, even after the price of the cryptocurrency plummeted.

Lee Reiners, who teaches cryptocurrency law at Duke University School of Law, said: “This is a recurring pattern in the cryptocurrency economy. Projects are designed to enrich the founders and early backers at the expense of those buying hot spots thinking they will The benefit of ordinary people who bring value."

secondary title

Helium struggles to generate revenue on its own

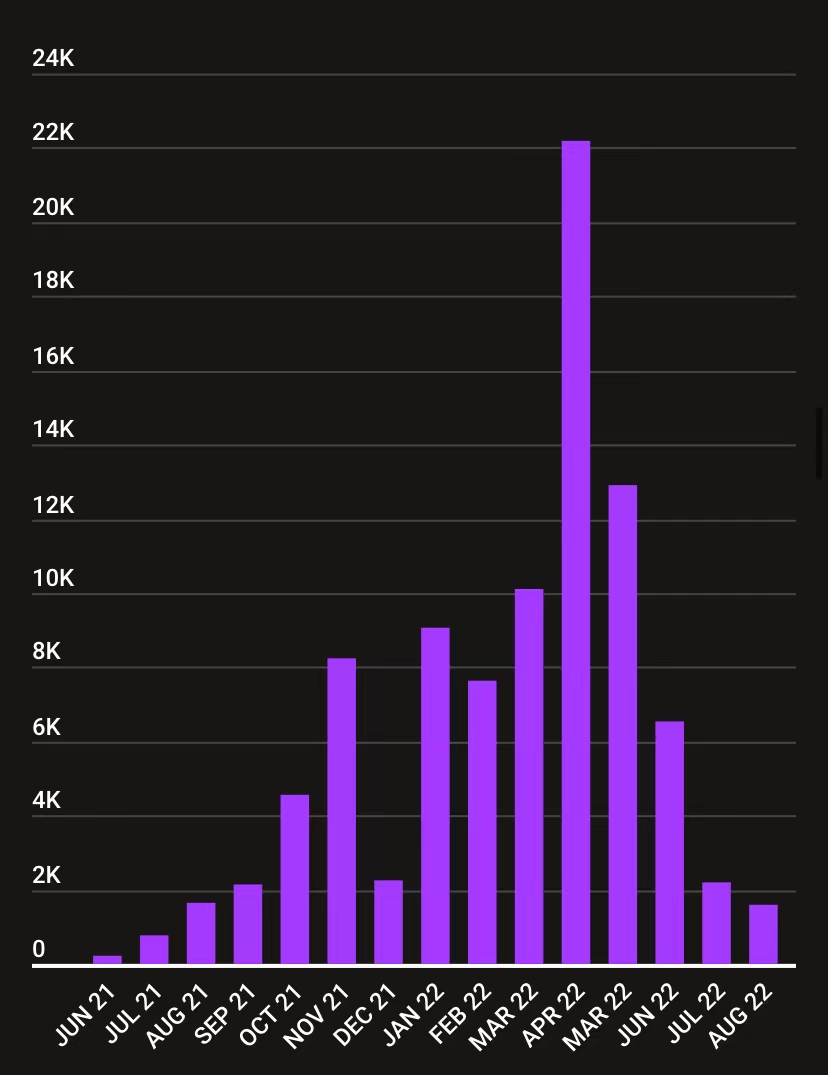

In addition to issues with miners and the token system, Helium appears to have a more serious problem — the company appears to be struggling to generate revenue from its network. Forbes found that in the past year, from June 2021 to August 2022, according to Helium's own data, only $92,000 in revenue was generated via web data, a figure that the parent company received from investors. The $250 million raised there stands in stark contrast. Instead, the vast majority of Helium's revenue ($53.3 million in the same period) came from people registering their new hotspots and authenticating other devices on the network.

In an interview with Forbes, Haleem said that generating revenue from network data "didn't happen overnight," adding: "Helium's network has only become viable in the last nine months. A few years."

In an interview with Forbes, Monsur Hussain, head of research at Fitch Ratings, said that the cryptocurrency space is “full of projects that are basically half-finished because there is no fundamental financial return on the final promise.” Hussain added: "In order for Helium's network to be profitable, you would actually need to cover the entire planet with devices to consume enough data."

The graph below reflects the number of data credits consumed per month for hotspot data transfers, the company's primary source of demand-side revenue, in dollar terms of revenue figures.

Revenue generated using Helium's wireless data

secondary title

Helium exaggerates its partnerships

In August, the US city of San Jose decided not to renew a pilot project with Helium because it failed to subsidize Internet costs for low-income households through mined HNT as promised. The city bought 20 hotspots last year, and the amount of HNT produced by each miner has dropped. Clay Garner, the chief innovation officer for the mayor's office, told Forbes: "The drop in generated HNT is because of the lack of network transmission data, and San Jose can't afford projects that don't scale up significantly."

The company also appears to have exaggerated the nature of some of the partnerships. In July, Internet news blogs Mashable and The Verge accused Helium of exaggerating its relationship with enterprise customer Salesforce and electric scooter-sharing company Lime. The two companies confirmed to Forbes that they do not use Helium, even though they are listed as customers on the company's website (Helium has removed Salesforce and Lime from its website).

secondary title

Summarize

SummarizeDue to low network usage, a disgruntled community and falling cryptocurrency prices, Helium is now trying to grow its community on a brand new network.

(Odaily Note: On September 22, Helium's proposal to migrate the network to Solana was voted through.)