In the Ethereum of the PoW stage, miners compete for bookkeeping rights through hash collisions and order transactions. After adopting the proof-of-stake Ethereum, people will randomly become verifiers by pledging Ethereum on a new chain (beacon chain), and order transactions in the network, thereby forming a new consensus form.

Original source:FastDaily

Ethereum Merger Completes, ETHW Emerges

At 14:00 on September 15, 2022 (UTC+8), the epic Ethereum merger was finally announced to be successfully completed. Since then, Ethereum has officially entered a new era.

The biggest feature of this merger is that the consensus mechanism of Ethereum has changed from PoW (Proof of Work) to PoS (Proof of Stake). Although the difference between the two is only one letter, the number of interest groups involved in this transformation can be said to be unprecedented.

In the Ethereum of the PoW stage, miners compete for bookkeeping rights through hash collisions and order transactions. After adopting the proof-of-stake Ethereum, people will randomly become verifiers by pledging Ethereum on a new chain (beacon chain), and order transactions in the network, thereby forming a new consensus form.

When the time came to September 16, the day after the merger of Ethereum, many users found that they still could not access its blockchain using ETHW's official mainnet information, and could not use encrypted wallets to connect to its network.

Therefore, it is not surprising that with the continuous advancement of the merger of Ethereum, a wave of forking has begun to prevail in the miner circle. KOL Guo Hongcai (Bao Erye) in the early domestic currency circle and Sun Yuchen, the founder of Tron, also became active as community leaders. They opened the chapter of the hard fork of Ethereum under the banner of defending the interests of miners.

Bad start

According to the plan, 24 hours after the completion of the merger of Ethereum, the mainnet of the forked network ETHW (EthereumPow), which continues to maintain the PoW consensus mechanism, will be officially deployed, and then the chain ID of ETHW will be switched. In order to reserve enough time, the ETHW main network will go online at a specified time after processing 2048 empty blocks.

However, this process did not seem to be smooth from the very beginning. There was an episode during the launch of the ETHW mainnet.

When the time came to September 16, the day after the merger of Ethereum, many users found that they still could not access its blockchain using ETHW's official mainnet information, and could not use encrypted wallets to connect to its network.

After the ETHW mainnet went live, some of the original Ethereum miners switched their computing power to the ETHW network, and its total network computing power reached a maximum of 80.56 TH/s.

After the ETHW mainnet went live, some of the original Ethereum miners switched their computing power to the ETHW network, and its total network computing power reached a maximum of 80.56 TH/s.

According to the past experience of blockchain forks, the price trend of forked chain tokens after they go online can reflect the consensus basis behind them to a certain extent.

According to the past experience of blockchain forks, the price trend of forked chain tokens after they go online can reflect the consensus basis behind them to a certain extent.

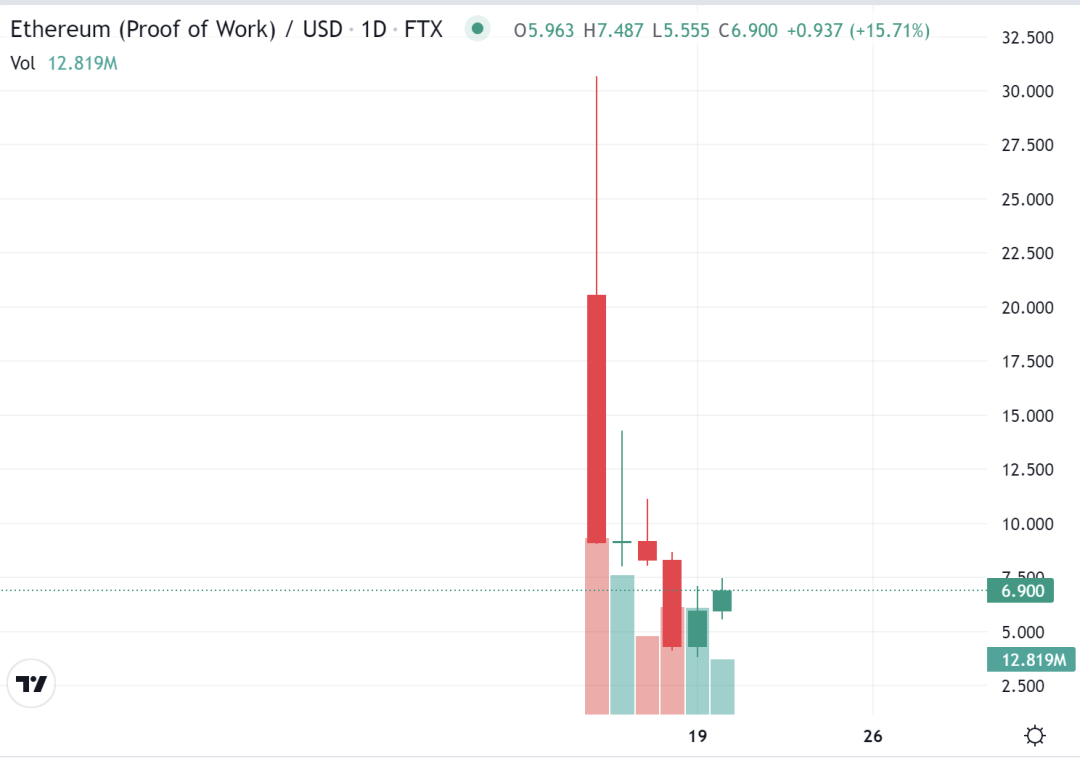

Taking the OKX platform as an example, ETHW opened at a price of US$15, and its price once rose to US$27.99 after its launch. After a brief surge, the price of ETHW began to drop rapidly, and the closing price of the day fell to $12.08, a drop of 56.8% from the highest point.

As of now, the price of ETHW has pulled back to $6.42, with little intraday fluctuation.

As of now, the price of ETHW has pulled back to $6.42, with little intraday fluctuation.

The reason why the price of ETHW ushered in a sharp drop in just 5 days is that the main reason is a large number of sell-offs by token airdrop holders.

According to the data of the ETHW browser of Okey Cloud Chain on September 19, after the ETHW mainnet was launched, the network processed more than 9.56 billion ETHW transactions. According to its price trend, most users choose sold. At present, there is even news that Guo Hongcai, as a community leader, has also shorted ETHW in his hand.

Subsequently, ETHW officially issued a statement stating that this attack was not a chain-level transaction replay, but a call data replay caused by a defect in a specific contract. But even so, people's concerns about ETHW are still hard to dispel.

replay attack storm

According to the monitoring of the security agency BlockSec, some attackers have implemented replay attacks on the ETHW chain. Replay attacks usually occur after the blockchain network forks. Since the addresses and private keys on the two chains are the same, and the transaction format is exactly the same, transactions on one chain are completely legal on the other chain . Transactions initiated on one chain will also be confirmed if replayed on another chain.

And ETHW is not unprepared for this. During the preparation of the fork, the ETHW team implemented replay protection at the code level, requiring all transactions to be signed with the chain ID. But despite this, someone still found a loophole.

According to analysis, the attacker first transferred 200 WETH to the ETH network through the Omni cross-chain bridge of the Gnosis chain, and then replayed the same message on the PoW chain to obtain an additional 200 ETHW. Although the amount of assets involved in this attack is not large, it makes users question the technical capabilities and security of ETHW.

Subsequently, ETHW officially issued a statement stating that this attack was not a chain-level transaction replay, but a call data replay caused by a defect in a specific contract. But even so, people's concerns about ETHW are still hard to dispel.

In contrast, networks using the same mining algorithm, such as ETC, RVN, and ERGO, have all experienced substantial increases in computing power, especially ETC, which once increased from 50 TH/s before the merger to more than 200 TH/s. This also means that ETHW is not the only option for original Ethereum miners.

But in reality, these quick fixes are minor technical problems, but the heartbreak they bring is the real death blow.

Miners flee with computing power

After the ETHW mainnet went live, many mining pools such as F2Pool, Poolin and BTC.com announced their support for ETHW mining. The ETHW community also jointly launched a backup mining pool——Ethwmine, which is committed to providing long-term mining pool services for ETHW.

These mining pools serving miners hope to continue to earn revenue from miners who transfer to ETHW. But what I never expected was that the computing power of the ETHW network was rapidly lost in just a few days.

When the ETHW mainnet was first launched, some of the original miners of Ethereum switched their computing power to the ETHW network, and its total network computing power reached a maximum of 80.56 TH/s.

But when the time came to September 19, the computing power of ETHW's entire network dropped to 29.92TH/s. In just four days, the computing power of ETHW's entire network dropped by 62.8% compared to the peak value of 80.56 TH/s after the mainnet went live. According to its current level of computing power, it only accounts for 3.89% of the total computing power of 769 TH/s before the merger of the Ethereum mainnet.

In contrast, networks using the same mining algorithm, such as ETC, RVN, and ERGO, have all experienced substantial increases in computing power, especially ETC, which once increased from 50 TH/s before the merger to more than 200 TH/s. This also means that ETHW is not the only option for original Ethereum miners.

But ETHW is not without support. The PoW to PoS conversion of Ethereum not only involves the interests of miners, but also forces major mining pools to respond. Therefore, many mining pools have announced support for ETHW.

It is precisely because of the poor performance of ETHW prices that more and more miners have begun to flee with their computing power because they are unprofitable. In the case of the relatively weak foundation of the ETHW consensus, the group of miners also abandoned it because of no profit. This ill-fated forked chain now looks even more gloomy.

How should ETHW face the future?

For the future development trend of ETHW, it is difficult for us to maintain an optimistic attitude. As we all know, the value of the public chain depends on the construction of the ecology on the chain. The more prosperous the ecology on the chain, the more active the activities on the chain, the more recognized the value of the public chain. At present, most of the core developers and mainstream applications of the Ethereum ecosystem do not support forked projects such as ETHW, which directly leads to the inability of ETHW to inherit the original mainstream on-chain applications of Ethereum. Therefore, the current ecology on the ETHW chain is very weak.

But ETHW is not without support. The PoW to PoS conversion of Ethereum not only involves the interests of miners, but also forces major mining pools to respond. Therefore, many mining pools have announced support for ETHW.

In addition, many exchanges will launch ETHW one after another according to market conditions. This will allow ETHW to get some ecological support in the short term.

Original link