Original Author: Jasmine

Less than 6 hours away from the merger of Ethereum, this blockchain network, which is regarded as the underlying infrastructure of the next generation Internet Web3.0, will completely change the consensus mechanism, from the PoW mechanism of the proof of work to the PoS of the proof of equity.

Before the merger was imminent, Steve Bassi, founder of PolySwarm, a decentralized security network market, suggested in an interview with the media that scammers may take advantage of the Ethereum merger as a market hotspot to launch new scams targeting novice crypto users. ETH2.0 token swaps, fraudulent ETH staking pools, fake airdrops, etc.

The Ethereum official website also reminds on the latest "Security" page that the merger does not generate any "ETH2" or any other new tokens, and do not transfer ETH to any designated address in exchange for fake "ETH2" tokens, " Never share your wallet's seed phrase with a stranger."

Don’t fall into fraudulent staking pools for high returns

Due to the merger of Ethereum, the PoW consensus that uses mining to maintain network operation will be replaced by the PoS consensus that relies on pledge to become a verification node. According to Ethereum rules, staking is the act of depositing 32 ETH to the beacon chain to activate validator software. Validators will be responsible for storing data, processing transactions, and adding new blocks to the blockchain. Validators earn new ETH while keeping the Ethereum network running securely.

Steve Bassi believes that for many holders of ETH, if they do not have the 32 ETH required to become an independent validator, joining the staking pool will be the only way for them to benefit from staking rewards. But co-staking providers “carry their own risk” as it typically requires users to deposit ETH and relinquish control of the asset.

New staking providers “may offer very attractive terms,” Bassi said, but could “rug pull suddenly,” affecting participants in the pool. “This risk currently exists in various asset pools or tokens on DeFi platforms, and scammers are likely to use the Ethereum merger to find a new role.”

image description

Comparison of ETH Staking Services

Ethereum officials emphasized that these paths are aimed at a wide range of users and vary in terms of risk, return, and trust. "Users must do their own research before sending ETH anywhere."

Be wary of falling into the "ETH2 token" upgrade scam

Bassi also warned of another scam — tricking users into signing fraudulent transactions or extorting users’ private keys under the guise of “migrating to a new ethereum chain.”

An upgrade scam that has been repeatedly warned by Ethereum officials is to use the concept of "ETH2"-before the merger comes, scammers are likely to trick users into exchanging their ETH for "ETH2 tokens." In fact, the merger does not produce any "ETH2" or any other new tokens. "The ETH you currently own is still the same ETH after the merger, without any exchange."

The common sense that needs to be known is that as early as January this year, the official Ethereum abandoned the terms "ETH1" and "ETH2", and replaced them with the execution layer and the consensus layer.

Before this, ETH1 was often referred to as the existing proof-of-work chain, which would be deprecated via a difficulty bomb after the merger. Users and applications will be migrated to a new proof-of-stake chain previously known as ETH2.

In order to avoid confusion and prevent scams, the terms ETH1 and ETH2 have been abandoned. Ethereum officially requires core developers to stop using these two terms, and replace the term ETH1 with "execution layer" and the term ETH2 with "consensus layer".

Therefore, any project that requires users to replace new tokens under the guise of "ETH2" can be regarded as a scam. The Ethereum official website reminds on the security page that scammers may appear as "technical support" and tell users that they need to deposit the ETH in their hands to the designated address to get "ETH2". In fact, this is not supported by Ethereum's official technology, and there are no new tokens. "Never share your wallet's mnemonic with strangers."

At the same time, it should be noted that some derivative tokens or certificates may represent the pledged ETH, such as Rocket Pool's rETH, Lido's stETH, Coinbase's ETH2, but these do not need to migrate ETH to the non-existent "new Chain", users do not need to handle the underlying consensus conversion of ETH by themselves.

Don't fall into the trap of phishing websites because of coveting airdrops

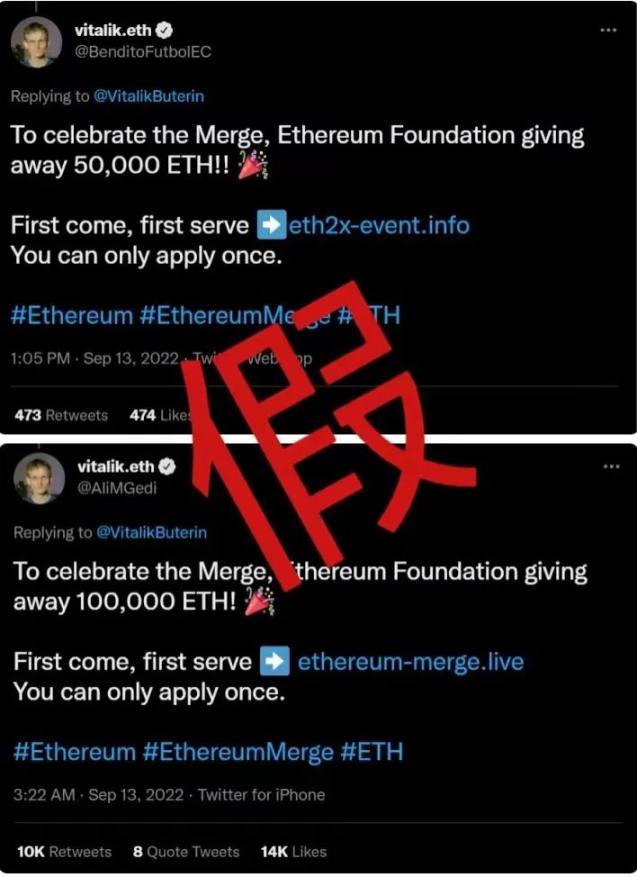

In addition to the above two scams, Bassi added that another possible fraud medium will appear in the form of "fake airdrops"-convincing users to sign transaction authorization or visit phishing websites to receive fake airdrops. A good excuse for these scammers to pretend to be a well-known, financially valuable project that promises an airdrop.”

Bassi explained that these airdrops could direct users to a phishing site where they could be tricked out of their ETH and private keys, or fall into an elaborate transaction signing trap.

image description

Fake Tweet Using Vitalik Buterin's Information

In addition to scams, hacks targeting Ethereum mergers should not be underestimated. Given the experience of previous testnets, most onlookers expect the merger to be successful. But it’s still possible that scammers or hackers will find a way to game the system, Bassi said, “We really don’t know if scammers or hackers have developed attacks or DDoS techniques that target the chain when ETH 2.0 has the full economics of ETH 1.0. value, they can use attack techniques post-merger.”

Original link