This article comes from PolygonThis article comes from

The merger would significantly change the way Ethereum operates, how green it is, and the narrative. With this hard fork, Ethereum will run on a new consensus mechanism, PoS, instead of the original PoW. In this article, we’ll cover the key events taking place in the governance forums of each of the leading DeFi players as the merger approaches.

secondary title

Lido pledge

Lido provides liquid staking for ETH holders who want to earn income by staking ETH2.0, but do not need to hold the 32 ETH required to run a full node to stake their assets. Lido has lowered the threshold for staking ETH and provided stETH (liquid derivatives of pledged ETH), which is convenient for users to use in other DeFi protocols.

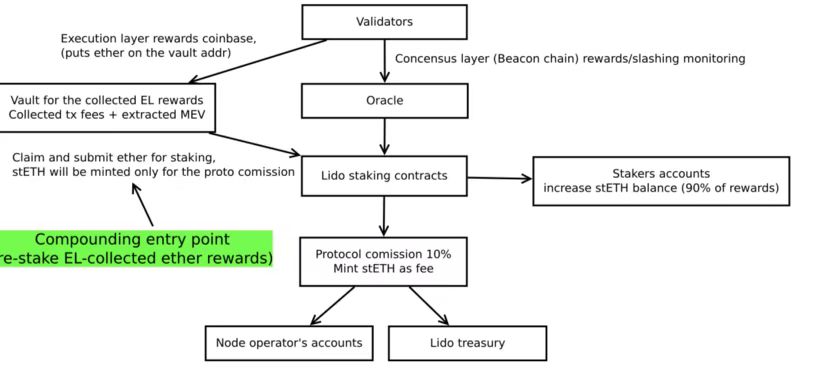

The Lido protocol was upgraded to reset new rewards after the merger of Ethereum to achieve multiple rewards.

image description

The proposal proposes to redistribute all collected executive layer rewards while only generating protocol fees (0%) stETH as part of the Beacon chain reward distribution run. But there are no protocol fees charged/distributed for non-profit Lido oracle reports.

text

The allocation mechanism is as follows:

Node operators collect ETH-specified execution level rewards on dedicated treasury contracts. Precisely, MEV rewards can be earned in such a treasury contract.

The Lido contract withdraws all collected rewards from the treasury, re-stakes them, and mints new stETH for only the protocol fee (10%) as part of the beacon chain (or consensus layer) reward distribution run.

If it is a non-profit Lido oracle report, it will not mint any new stETH (ie protocol fee).

The proposal will bring multiple rewards, fast transaction times due to minimal impact on existing distribution schemes. It's also fairly automated and autonomous. Finally, in case of delays in merging the hard fork, it will fall back to the already adopted solution.

Airdrops of forked tokens and maintenance pegs: If there is any airdrop of ETH PoW to ETH stakers, it will be returned to potential holders of stETH.

secondary title

AAVE Lending

AAVE is a decentralized lending market, and the lending yield is based on the utilization rate (borrowing amount/depositing amount).

Leveraging your position and accumulating more ETH seems to be the option for most crypto investors considering the merger is the perfect opportunity for a PoW airdrop or just hoping for a merger that hasn't been priced in yet.

However, there are many problems with this:

If there are any merger related issues > ETH price drops -> mass liquidation happens.

Borrowing limits on Aave have been lowered and fees have been increased until ETH borrowing is fully suspended until the merger is complete.

text

Technical Analysis of Aave Affected by Ethereum PoS Merger:

Claims that the merger should not affect AAVE's systems.

Block structure: Unaffected.

Blocking time: Only Aave governance is slightly impacted (voting time).

Smart contracts: Aave is not affected.

On-chain sources of randomness: Unaffected.

Chainlink's position will be aligned with PoS chains. Chainlink will not be integrated into the Ethereum PoW fork, it will be fully committed to the PoS chain, which ensures that there is no problem with the oracle and data.

text

AAVE ETH PoW fork risk mitigation plan:

Except for ETH, most tokens may be worthless on the ETH PoW chain. Therefore, a possible strategy for users to maximize their crypto holdings might be to borrow as much ETH (mainly secured by stablecoins or other tokens) as possible.

Speculative strategies related to PoS mergers and potential ETH PoW forks may have implications for Aave, especially since Aave allows ETH to be borrowed from stETH. stETH being used to stake and borrow ETH on Aave has become a popular strategy and has boosted ETH market utilization to a level of 62%.

text

Speculators are taking advantage of ETH market-related risks:

High utilization of ETH may make liquidations more difficult or impossible.

With the ETH market heavily leveraged, the market begins to experience high volatility due to the merger event and it may not be possible to liquidate regular ETH long/short stablecoin positions.

This is due to the fact that liquidators will not be able to obtain ETH as collateral since most of the ETH will be borrowed.

This in turn may cause some positions to become uncollateralized.

High ETH utilization increases the ETH rate to a level where the APY of the ETH/th bit is negative.

High ETH utilization increases ETH velocity to a level where ETH/ETH positions generate negative APY.

Once the ETH lending rate hit 5%, which happened shortly after 70% utilization (we are now at 63%), the stETH/ETH positions started to become unprofitable.

Currently, borrowers on Aave are not maximizing leverage due to depreciation risk. Therefore, it is possible that the APY of some positions will be negative earlier. This will cause users to close their positions until the ETH lending rate returns to a stable level, allowing APY to level off.

This means we will see massive redemptions of stETH to ETH, which in turn will drive the price of stETH down. As regular stETH holders switch to ETH for the benefits of ETH PoW work.

Already high ETH utilization has caused regular ETH providers to start withdrawing their ETH.

Due to the uncertainties and risks associated with ETH PoW forks (PoS mergers in general, and ETH usage on Aave in particular), current liquidity providers may become increasingly concerned about their ETH on Aave and may in turn Withdraw ETH from the supply side.

The increase in utilization has nothing to do with ETH borrowers.

Additionally, if ETH price falls, ETH long/short stablecoin positions may need to be deleveraged by selling ETH supply.

Alternative: Increase the APR on variable borrowing at 100% utilization from 103% to 1000%.

text

AAVE DAO's position on the ETH PoW fork:Aave Request for Comments (ARC) on Aave Governance

Aave DAO is required to commit to electing to run the Ethereum mainnet under Proof-of-Stake consensus, rather than any Ethereum fork running an alternative consensus such as Proof-of-Work.

Authorize community guardians to take necessary action to shut down Aave deployments on any fork resulting from the Ethereum Paris hard fork (merge).

text

It is recommended to limit ETH borrowing close to the merger.

secondary title

The Compound lending marketplace is very similar to AAVE, but with fewer assets available for borrowing. It only exists in Ethereum, while AAVE has moved towards multi-chain.

text

Adjust the ETH interest rate model:

Update the cETH rate model to the new jump rate model with the following parameters:

Rate at 0% Utilization: 2%

Best Utilization (Inflection Point): 80%

Best utilization: 20%

Set a borrowing limit of 100,000 ETH for the cETH market.

Bancor DEX

secondary title

Bancor is a decentralized exchange that allows users to trade between tokens. Its unique value proposition is the ability to provide liquidity to DEXs through its native BNT token without facing temporary losses, however, due to poor performance in the recent bear market, users did face temporary losses. lashed out.

Proposal: To determine the actions of the Bancor Governance Forum in the event of a fork:

It is recommended to disable the Bancor contract on all PoW forks.

Disable Contract: This option will include disabling all Bancor platform functionality on the Ethereum fork. There should be little risk in this option. The main argument for this is that most tokens on the proof-of-work fork will quickly become worthless, causing the Bancor platform to be drained of any value that could be extracted on the forked chain.In the event of an Ethereum fork, no action is taken. This poses no risk to Bancor on the Ethereum mainnet, however, any value that might have been extracted from the Ethereum fork would be quickly lost.

secondary title

Synthetix Derivatives

SNX tokens will still be tradable, but all other parts of the protocol such as synthetic exchanges, futures, loans, staking (claim, mint, burn) and cross-chain bridges will be suspended. Once the suspension is complete, communication will be made through all channels and all agreement partners will be notified.

secondary title

Frax is safe:

FRAX stablecoin can only be redeemed on ETH PoS

Sam Kazemian (founder of FRAX) submitted a proposal for the project’s stablecoin to be redeemable only on the Ethereum Proof-of-Stake (PoS) mainnet.

While this is a step towards the future of Ethereum PoS, it may cause FUD among Ethereum PoW users.

secondary title

MakerDAO Stablecoin & Lending

Overview of risks and market implications - backwardation and negative financing:

Spot holdings of ETH will gain exposure to any PoW forked tokens, while exposure to ETH quarterly futures or perpetual contracts will not. Assuming the market is efficient, this means that quarterly futures after the expected merge date should start trading at an additional discount based on the expected value of the PoW fork token.

Recently, we have seen the December 2022 quarterly forecast report shift from premium to backwardation, reflecting the possibility of PoW forks accumulating some “marketable value”. In practice, market participants can buy spot ETH and then sell an equal amount of ETH futures, staking the value of the fork while maintaining delta neutrality. As the expected date of the merger draws closer, we may see some similar activity on perpetual contracts, with deep discounts and negative funding reflecting the expected value of the PoW fork ETH.

Response: Keep rates competitive and avoid losing excess volume to futures contracts.

text

stETH value drops:

stETH and other liquid collateralized assets are likely to become worthless on any PoW Ethereum fork.

Reaction: Monitor stETH liquidity, respond to parameter changes if necessary (increase stability fee or liquidation ratio); monitor competitive rates across DeFi lending protocols using ETH collateral.

text

External asset fork selection:

Ethereum hosts a wide variety of externally backed assets. Including cross-chain bridges, centralized stablecoins, and real-world assets. Because these assets are backed by external collateral (either held off-chain or on another chain), they can only be fully collateralized on a single chain at a time, and issuers typically need to put a chain on a chain during a fork. A chain identified as a canonical.

The merge upgrade has strong support among the Ethereum community, DeFi users, and protocols, which should help ensure that the fork choice unanimously supports mainnet (PoS) Ethereum. However, due to financial exposure to miners or other reasons, one or more external asset issuers may acknowledge the PoW fork to some extent. This could render the underlying assets connected to mainnet Ethereum worthless.

Tether in particular is considered a potential risk due to potential financial ties to miners.

Reaction: Confirmed merged support for key external asset providers that interact with the Maker protocol, including: Circle, Paxos, Binance, Bitgo, Gemini, Centrifuge issuers, other RWA (Real Assets) issuers, and those that connect DAI to other chains Serve. such as Wormhole, Axelar, Gravity Bridge, and Multichain).

text

Liquidity Pool Protocol:

Maker does not provide users with collateral to lend, as many other lending protocols (including Aave, Compound, and the Euler protocol) do. Immediately after a PoW fork, a significant subset of assets on the forked chain, including stablecoins and cross-chain bridge assets, will become worthless. This could render the centralized lending market insolvent and incentivize users to borrow all available ETH in the market (as the asset most likely to retain some value across the fork).

The withdrawal of ETH from liquidity protocols (Aave and Euler in particular) could lead to a spike in ETH borrowing costs, which would put pressure on leveraged stETH positions and could affect price parity with ETH.

Response: Monitor user behavior and maintain competitive rates to facilitate any potential migration or user acquisition; monitor stETH leveraged positions and ETH borrow utilization on Aave, Euler; monitor FX liquidity and account for parameter changes as necessary.

text

Oracle Network and Index:

Other oracle networks such as Maker and Chainlink are planning to support the merger and consider mainnet Ethereum as the canonical chain. However, the possibility of PoW forks complicates this somewhat, increasing the possibility of incorrect data due to potential centralized exchange issues or code conflicts.

Response: Confirm the centralized exchange plan, including PoW fork list, quotation and API changes; encourage industry participants to adopt alternative quotations for any PoW fork, avoid conflicts, and ensure the continuity of mainnet Ethereum data.

text

Network downtime:

This merger is arguably the largest upgrade in the history of Ethereum. With this major protocol change, there is an increased risk of technical failures that could result in event failures and unavailability. If Ethereum falls for a period of time, DeFi protocols like Maker may experience price gaps (discontinuous price drops) in collateral assets, which may drive treasury liquidation or even bankruptcy.

Response: Consider changing parameters to increase the safety margin of treasury positions (such as increasing the liquidation ratio, increasing the stability fee for high-leverage treasury types); encourage users to increase their position safety margins before merging and upgrading.

text

Replay Attacks:

Replay attacks allow transactions or messages signed on one chain to be "replayed" on another chain under certain circumstances. Ethereum users (or even hosting or infrastructure providers) could fall victim to so-called "replay attacks" after a PoW Ethereum fork.

Although EIP-155 provides a simple protection against transaction replay by adding Chain ID as a transaction signature parameter, there is no guarantee that PoW forks will adopt a different Chain ID (Chain-ID 1) than the Ethereum mainnet.

Impact on Maker: The possibility of unexpected transactions on the main network increases, replaying from the PoW fork chain (such as closing treasury positions, selling forked DAI or forked MKR tokens, etc.); the possibility of main network transactions, including Maker oracle and keeper operations are replayed to the PoW fork chain.