Original title:How to Win the Ethereum PoW Fork

Author: William M. Peaster

Compilation of the original text: Dongxun

Compilation of the original text: Dongxun

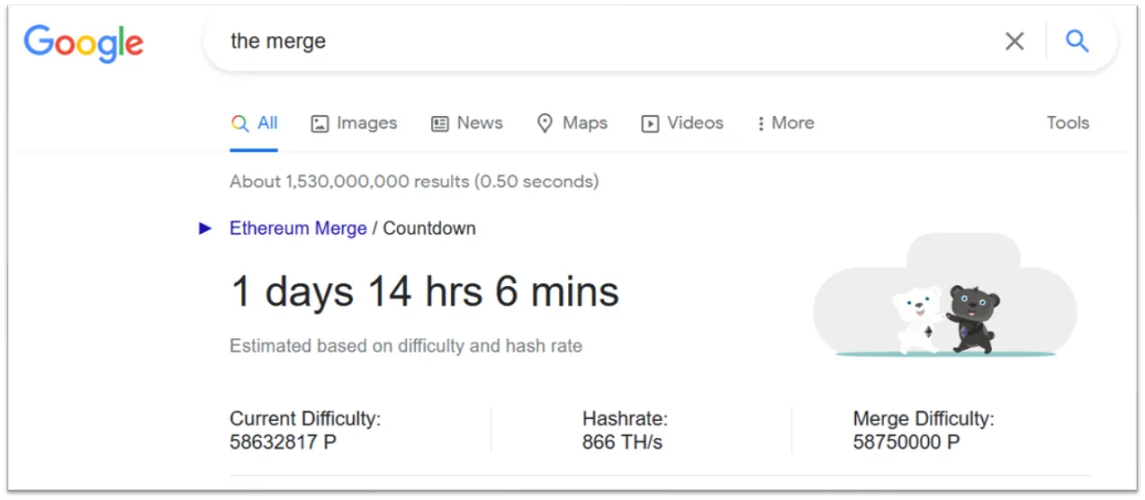

When this countdown hits zero, most of the ethereum ecosystem will move to the new proof-of-stake chain, save for a handful of disgruntled ethereum miners who will be sitting on million-dollar mining rigs.

Instead of stopping their operations, these miners announced their plan to merge and fork and maintain Ethereum’s version of proof-of-work (ETHPOW).

If this happened, you could have a replica of every existing digital token on a ghost town replica version of the old ethereum chain.

Some of these tokens may have value, but most will not. If you are thinking of dumping them for a quick profit, do so very cautiously! There are many technical challenges that you need to be aware of. This article provides a handy checklist of what to look out for.

image description

Image credit: Logan Craig

Image credit: Logan Craig

During the merger, while the rest of the Ethereum community migrated to Proof-of-Stake (PoS), a group of miners planned to fork and maintain an alternative to Proof-of-Work (PoW).

The fork, dubbed EthPoW, isn't ready to have a serious future yet, but it's supposed to award ETH holders new ETHPOW tokens in a 1:1 ratio.

Interacting with ETHPOW can be extremely risky, so this Bankless strategy will provide a checklist by which you can safely navigate forks.

Goal: Sell as much of your EthPOW as possible for ETH

Skills: Intermediate

ROI: Potentially increase your ETH amount

first level title

Learn the basics of mergingLeighton CusackCo-Founder, PoolTogether

A "merge" refers to a change in the consensus mechanism of the Ethereum blockchain. Instead of Proof of Work (PoW), it uses Proof of Stake (PoS). what does that mean?

The tl;dr (summary) of the merger is as follows:

Ethereum is migrating from PoW to PoS consensus.

PoW uses energy (in the form of computation) for security. PoS uses capital (in the form of encrypted tokens) to guarantee security. The former is obviously very energy-intensive, while the latter is very energy-efficient.

The result is that Ethereum's energy usage will drop by about 99% after switching to PoS.

The overwhelming community support for this merge into PoS means that almost the vast majority of Ethereum community members and projects are migrating to the newer Ethereum chain and will not support any PoW forks.

Understand the basics of EthPoW forksEthereum Foundation Community ManagerHudson Jameson says

: “I very much doubt how much computing power they will get if they launch after the merger. At that time, the computing power will be on other chains, and the value support of ETHPoW is already very fragile.”

The summary of EthPoW is as follows:

Since July 2022, miners such as Chandler Guo have accelerated plans to fork a PoW version of Ethereum during or shortly after the merger.

Since essentially all Ethereum activity is moving to the PoS chain, this EthPoW fork doesn't have a significant value proposition - it's a money grab masquerading as a permissionless blockchain for participating miners to Maintain some form of dominance in the merged world.

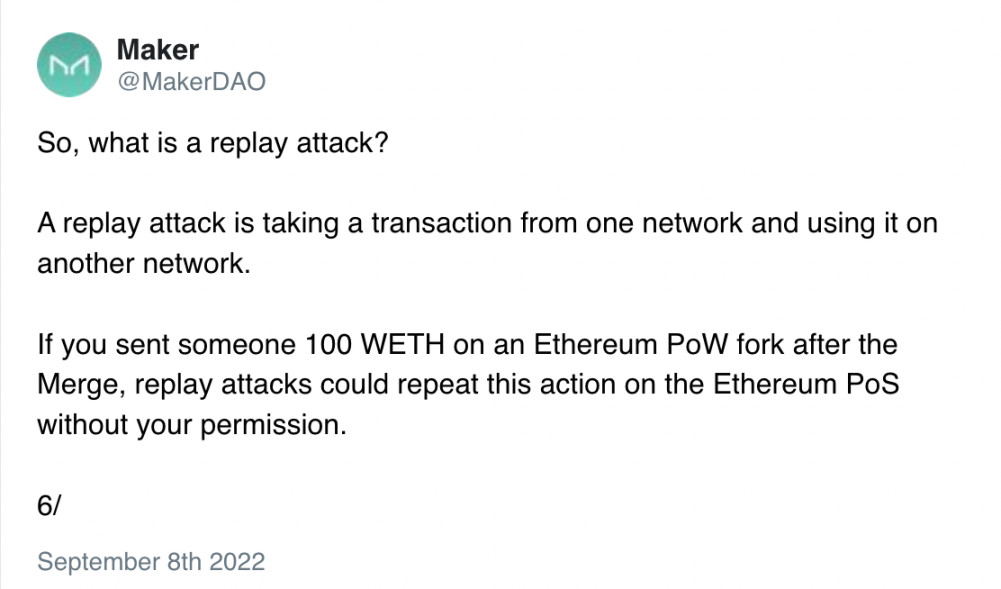

When it launches, EthPoW will "airdrop" ETHPOW tokens to ETH holders on a 1:1 basis. Trying to sell these tokens may expose you to a replay attack (replay attack, which refers to the same transaction being executed repeatedly), wherein the attacker "replays" your EthPoW transaction on the real Ethereum chain and steals your EthPoW transaction accordingly. funds. See below for more information on this attack vector.

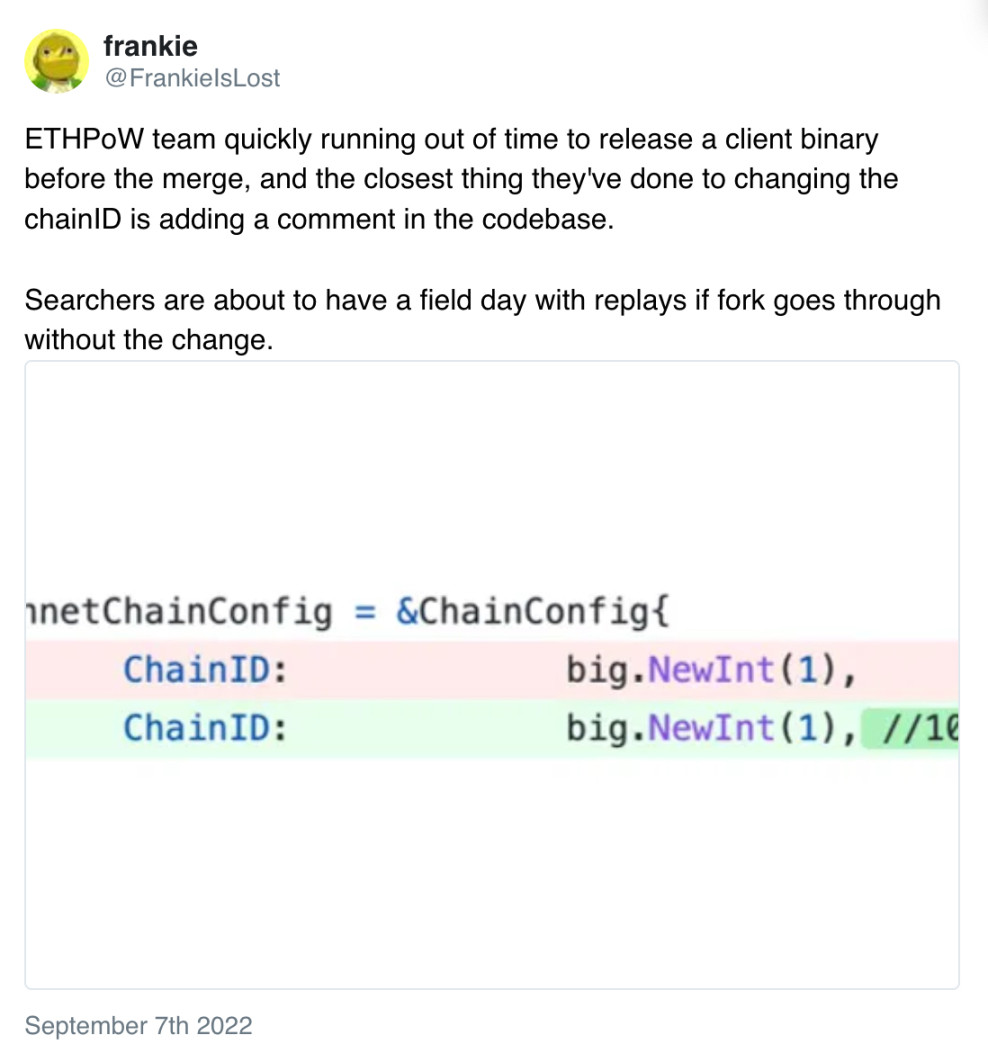

Check ChainIDParadigm Research AssistantFrankie says

, the ETHPoW team quickly ran out of time to release client binaries before merging, and the closest thing they did to changing the ChainID was adding a comment to the codebase.

A summary of the EthPoW ChainID situation is as follows:

ChainID was originally introduced in EIP-155 to mitigate replay attacks between Ethereum and Ethereum Classic chains; the former's ChainID remained at 1, while Ethereum Classic moved to 61.

At the time of writing, the developers of EthPoW still haven’t updated the forked ChainID from 1 in their codebase — which means that EthPoW is about to roll out the same ChainID as Ethereum.

So, what is a replay attack? A replay attack is to transfer transactions from one network to another network. If you send someone else 100 WETH on a merged Ethereum PoW fork, a replay attack can repeat this action on Ethereum PoS without your permission.

If EthPoW continues with this dangerous dynamic, it will create ideal conditions for hackers to conduct replay attacks.

Note that if ETHPOW starts the chain with a ChainID of 1, do not under any circumstances interact with the ETHPOW fork. You may lose all your ETH.

In other words, the first major item on this checklist is to check whether the initial ChainID of EthPoW is 1 or the planned alternative 10001. If the creator chose the former over the latter, at no point should you attempt to interact with the fork.

Determine if ETHPOW is worth the effort

Assuming EthPoW starts with a ChainID of 10001, mitigating most of the replay attack issues - even if that is the case, is the value of ETHPOW worth the time and effort to claim tokens?ETHPOW IOUThis is the biggest question right now! At the time of writing,

is worth $29.30 per token.

Furthermore, the difference between the current spot price of ETH ($1726) and the current price of ETH September 30 futures ($1710) suggests that the implied price of ETHPOW was around $16 before the release.

Claiming tokens worth $16 to $30 each is not economically worthwhile for many ETH holders, although by the time ETHPOW hits exchanges, price discovery will likely push it above that range. On the other hand, the price of ETHPOW may drop rapidly as many people sell tokens in large quantities.

Prepare your ETH stackCo-founder and COO, CoinGeckoBobby Ong says

, the Ethereum merger is scheduled for September 13. The Christmas season is here again. ETH holders will soon receive airdropped ETH PoW tokens. What should you do to put yourself in the best position?

Here are a few steps you can consider to take full advantage of the merger:

If EthPoW actually started with a ChainID of 10001, and the ETHPOW token started with some decent price action, it might be worth selling your ETHPOW for real ETH, USD, etc.

In order to prepare to sell ETHPOW, you can get the best guarantee by keeping your ETH in a non-custodial wallet that you fully control before the ETHPOW fork. If you have ETH in your exchange wallet, that exchange may hold your ETH airdrop.

Please make sure you hold your ETH on Ethereum before the fork, not on L2 such as Arbitrum. Only ETH on Ethereum can get ETHPOW tokens on EthPow.

Unwrap your Wrapped ETH (WETH) to ETH before the fork so you don't have to try and unwrap your WETH on the EthPoW side once/if it goes live.

At the same time, withdraw your ETH from the DeFi liquidity pool, because at the time of the fork, any ETH you have in the liquidity pool will not be credited to ETHPOW.

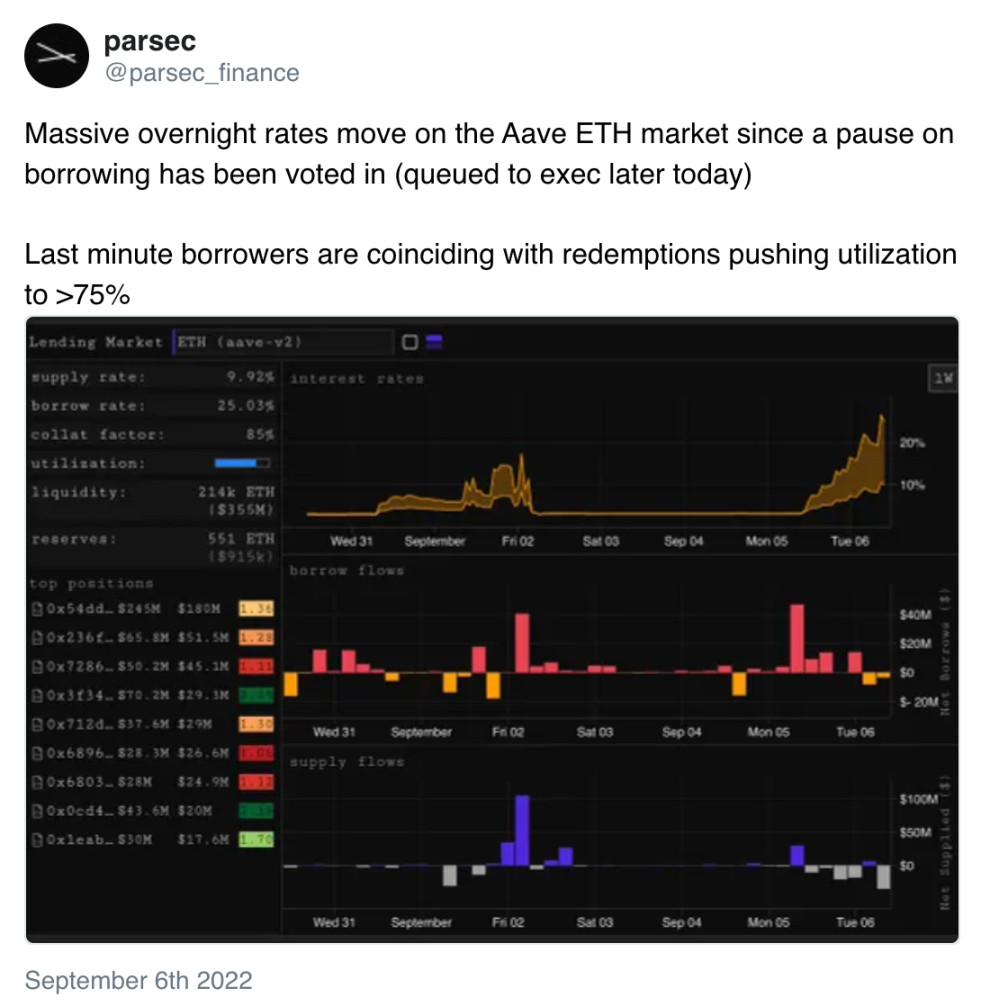

Consider borrowing ETH using a DeFi lending protocol to maximize your ETH holdings before the fork; however be aware that lending protocols like Aave have suspended ETH lending amid a spike in lending activity.

Massive overnight rate moves in the Aave ETH market as the lending moratorium has been voted in (lined up later today).

choose your exchange

Some exchanges, such as BitMEX, have announced plans to support ETHPOW trading.

That said, it may take days, weeks or months for some exchanges to support ETHPOW deposits and/or account credits - make sure the exchange you land on has clearly detailed its support plan so you can Know what you can do and when you can do it.

worried? do nothing

Now, there are a lot of "ifs" when considering whether you should try to sell ETHPOW.

The key thing to remember is that doing nothing is a viable strategy here.

If you can’t confidently complete the list above, “winning the EthPoW fork” might just mean abstaining and watching from the sidelines.

The big question is whether this humble fork will launch with a ChainID of 1 or 10001. If it's 1, then don't interact with the fork, because the risk of a replay attack on your real ETH far outweighs the gain you get from selling it.

Original link