to reportto report, FTX Ventures, the venture capital arm of FTX, will buy a 30% stake in Tianqiao Capital, which was founded by former White House communications director Anthony Scaramucci and has aggressively entered the encryption market since last year. In response to this transaction, both parties expressed on Twitter that they look forward to the follow-up cooperation.

Skybridge Capital began investing in the encryption field at the end of 2020. In April of this year, founder Anthony Scaramucci said that half of the $3.5 billion managed by Tianqiao Capital was related to encrypted assets. At that time, he said that he hoped to become a "management company for encrypted assets" and expected that the assets under management would increase by three times in the future. times, reaching $10 billion.

Affected by the collapse of the encryption market, Tianqiao Capital seems to be also affected. The return rate of the Legion Strategies fund under the capital has dropped by 30% this year, so it suspended user redemption in July.

However, Anthony Scaramucci remains confident in crypto assets. He pointed out that many institutions including BlackRock and Coinbase have begun to establish Bitcoin trusts, which indicates the potential institutional demand in the encryption market.

Regarding this acquisition, Anthony Scaramucci expressed his excitement:

"I'm also very excited, today is really great. Sam is a visionary, we will discuss together and realize the vision together."

Details of the deal were not disclosed, but Anthony Scaramucci said $40 million of the funds would be used to buy cryptocurrencies and hold them for the long term.

Continue to buy, continue to expand

According to Bloomberg, since this year, SBF has been buying on dips, including:

1. 2022/02/02: FTX acquired Japanese compliance exchange Liquid, and finally changed its name to FTX Japan

2. 2022/03/22: FTX US acquired Good Luck Games and merged into FTX Gaming

3. 2022/05/02: SBF purchased Robinhood stock for $648 million, about 7.6%

4. 2022/06/17: FTX acquires Canadian exchange Bitvo and enters the Canadian market

5. 2022/06/17: Alameda provides approximately $485 million in loans to Voyage Digital

6. 2022/06/22: FTX US acquires Embed to provide FTX Stocks services

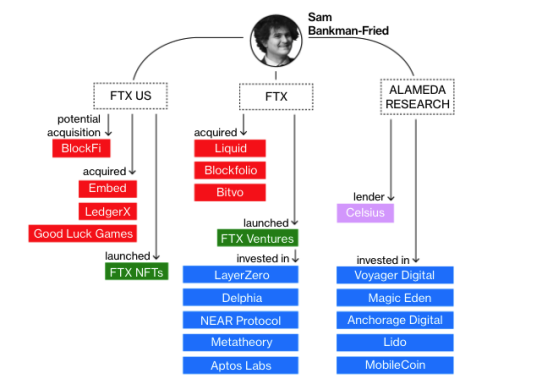

image description

SBF's encrypted landscape, Source: Bloomberg

Coupled with this acquisition, SBF will complete at least eight acquisitions this year.

On the other hand, FTX has also made breakthroughs at the global regulatory level. At the end of July, FTX Exchange FZE, a subsidiary of FTX, was licensed by the Dubai regulator to provide derivatives trading services for institutional investors.

There have also been reports that FTX may acquire a stake in South Korean crypto exchange Bithumb.

Earlier this month, FTX US Derivative also hired former CFTC Commissioner Jill Sommers to help with future regulatory compliance and integration into financial markets.

Overall, this transaction to acquire a 30% stake in Tianqiao continues the strategy of FTX founder SBF to continue to expand in the bear market and continue to act as the borrower of last resort in the encryption market.