As the Ethereum PoS upgrade is approaching, the original PoW miners are not willing to be abandoned by the Ethereum Foundation, and are actively preparing to retain the PoW chain and hard fork Ethereum. At 8:00 pm on September 8th, BitCoke Exchange held an online AMA (ask me anything) event, and jointly invited satoshi_song, the Ethereum Fair project owner, JACK LIAO, the ETH1 hard fork project owner, and Kuaichain Toutiao, to explain the reasons why miners insist on hard forking Consider and discuss the challenges and problems that PoS Ethereum may face, as well as the trading & arbitrage opportunities before and after this upgrade.

The guests participating in this online AMA are:

JACK LIAO : miner, founder of Bitcoingold lightningasic

Liao Xiang, a veteran miner, entered the blockchain industry in 2012. He has been involved in mining machine manufacturing, mining, and also invested in related hardware wallets, ATM machines, and invested in exchanges. In 2017, as the founder, Bitcoingold was established. Liao Xiang is currently communicating with the Korean community as the coordinator of three different Ethereum PoW hard fork projects.

Satoshi_song:Ethereum Fair Dev

Launch the dogecoin Chinese community in 2019, launch the defi seven o'clock community in 2020, and launch the Ethereum fork in 2022. He is also an old currency citizen who started his business in Garage Coffee in 2011, and has been engaged in technology-related work in this industry.

Three years ago, we prepared the fork of Ethereum and launched ClassZZ, a POW public chain, with the goal of cross-chaining dogecoin and carrying the computing power of Ethereum.

Xichen: Founder of Kuaichain Toutiao

Kuailian Toutiao, as a media platform that has been in the web3 industry for 18 years, has been helping the industry with cutting-edge information, in-depth investment research and brand services. At the same time, he is also the brand manager of MetaStone.Group, a risk hedge fund covering web3 primary investment and secondary asset management. At present, the fund size is nearly 1 billion US dollars, and the primary investment is unity/metamask and other projects.

In 2018, Kuaichain Toutiao also participated in overseas mining. Currently, it mainly makes primary investment, focusing on infrastructure NFT Defi and other fields.

Loopy Lu: Researcher

Loopy has been swaying in the secondary market, and DeFi Summer has entered the circle. Doing investment research in media/institutions, and also participated in two NFT projects as a consultant responsible for marketing.

Question from Sister Q on behalf of BitCoke:

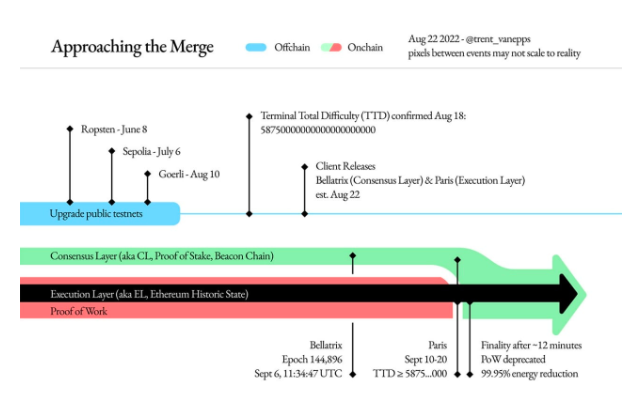

1. Many people are not particularly aware of the PoS upgrade schedule, please let Leo and Loopy explain

LEO: The roadmap for PoS upgrade released by the official foundation.

At present, the migration from the PoW chain to the PoS chain is officially completed on the 15th.

2. The Ethereum Foundation has previously stated that it does not support hard forks. Why do miners keep the PoW Ethereum chain? What are the two considerations for supporting the hard fork?

2. The Ethereum Foundation has previously stated that it does not support hard forks. Why do miners keep the PoW Ethereum chain? What are the two considerations for supporting the hard fork?

LIAO:

First of all, the interests of the Ethereum Foundation and the miners of the hard fork are contradictory.

The reason why I coordinate multiple teams to fork Ethereum is mainly based on two reasons.

The first upgrade of Ethereum is risky. There are three risks, one is the risk of code security; the second is the change brought about by the change of regulatory policy. The entire ecology of Fangfang will collapse under the new regulatory conditions.

The risk lies in who is the real public chain project between Pow and POS? I personally believe it is POW, not POS. Why do you say that, the inventor of the first POS is BM, who has engaged in two projects and failed. Everyone advertises that POS saves power and has high TPS. These two things are not a core technical indicator of the blockchain, but a secondary technical indicator. Why do you say that, assuming power saving and high TPS are the core indicators, then the blockchain should not exist, neither should Bitcoin, let alone Ethereum. Now our electronic payment methods, such as Alipay, can achieve 1 million TPS during Double 11, which is several hundred times higher than the current Ethereum after the upgrade of POS, let alone Save electricity, everyone saves electricity, all use servers.

So I support the fork of Ethereum based on this reason, to hedge the risk of uncertainty in the upgrade of Ethereum, but I do not object to Ethereum trying to do this, or to make this innovation. That is to say, he follows his plan A, and we follow our plan B.

The second reason is that the mining industry is probably a group of people with money and people. The assets of the mining industry are 10 billion US dollars, and there are hundreds of thousands of miners around the world. So rich, someone is our customer. From the perspective of customers, we have to provide services for everyone and customers. In this way, supporting such a fork project will inevitably have a certain commercial value. From the perspective of hedging risks and the perspective of customers, it is incumbent to support everyone in the POW fork project. This is the core reason why I am coordinating three different forks.

SONG:

First of all, in the early days of Ethereum, Vitalik also focused on finding miners in China to promote the development of the Ethereum chain. From the birth of Ethereum to the present, how much effort the miners have spent on Ethereum, and how many batches of miners have carried out the survival of the fittest. The current miners retain POW without excuse, not only in terms of interests, but also in the essence of the industry.

Since the development of Ethereum, POW, as the bottom layer, has promoted the development of Ethereum’s market value of 100 billion US dollars in terms of security and decentralization. It is also POW that is escorting Ethereum. Although the times need to develop and move forward, this industry has its own particularity , that is, the only constant is decentralization. Performance is secondary, and there are many ways to replace it, but the essence of decentralization is that you cannot give up and compromise at will. And the essence of this kind of decentralization, in my opinion, is that it has the characteristics of unconditional entry and unconditional exit.

In terms of security, I also tell everyone that you can attack me, but whether you can bear the cost and time to pay, and the chain that grows in this kind of attack is more reliable for people to rely on.

At present, the conversion of Ethereum to POS basically completely abandons POW. Then firstly, mining machines with millions of dollars need to find a way out; secondly, this fork of Ethereum is completely different from that of ETC in 2016. After the development of defi, web3, nft, etc., it already has a strong ecology that can run independently; thirdly, the current number of Ethereum addresses has exceeded 200 million, and the number of contract applications has exceeded 80 million. These will become unowned traffic.

Then a strong unowned traffic and many ecosystems that can operate independently, and the support of a large number of miners at the bottom, then this Ethereum fork is the best way and route, and it can also preserve the fire for the industry under the supervision of POS in the future.

Supervision should be able to target applications or other centralized products, and the underlying chain should not be regulated. This is like soil that can grow crops and poisons, and the soil should not be regulated.

3. What plans do ETHF and ETH1 have in the follow-up ecological construction?

LIAO:

Regarding ecological construction, I think there are two directions that can be considered. Not only ETH1, ETF can also refer to this idea. The first is to inherit the ecology of ETH on the original forked chain. How to activate them, of course, because each company has a different degree of close connection with the Ethereum Foundation, and their business models are different, some projects naturally cannot support this forked chain, but some projects , it can continue to operate on the forked chain, that is, these Dapps to be forked.

In addition, those projects that have failed to compete on ETH, or in the second echelon, they must have this urge, or have this necessity to go to Pow to harvest the early traffic. Many third parties have contacted us and said that they want to deploy their services and applications on the fork. In fact, these two parts can build a preliminary and prosperous ecology.

At the same time, from a technical perspective, POW also has the opportunity to achieve this high performance. In 2019, I published an article, which expanded this POW workload proof. I named it the appropriate workload proof mechanism, or it can be called pow2.0. This article of mine was posted on the blog , Interested friends can go and have a look. I am applying for this patent in the United States, then I think that this patent will be put into the blockchain defense patent room in the future, allowing everyone to use it freely, but if a third party claims rights, we will use it and the third party’s Patent claims to be a counterbalance or an exchange.

SONG:

Currently, Ethereum Fair has released the latest test chain version after the merger of Ethereum Bellatrix, including the version of Ethereum Sentry Omega (v1.10.23). Bitkeep is currently testing 1inch’s dex aggregation transactions, and a third-party R&D team is providing front-end products for makerdao, curve, benddao and opensea.

In terms of ecological planning, the most important thing at present is to run through the current important ecological projects on Ethereum. After all, there are tens of millions of ETH in the ecology. These ETHs are equivalent to ecological minerals, which require everyone to work together to dig them out or exchange them. For example, makerdao can generate dai, which can be exchanged for usdt in the curve through dai, and then 1inch to aggregate transactions, fork candy ETF, etc.

In the early days, oracle machines like chainlink were missing, so the prices of many oracle machines remained unchanged, and there were many arbitrage opportunities in the ecology, which also gave everyone a fair opportunity to participate in ecological mining.

The most important thing in ecological minerals is USDT. I believe many people think that USDT will return to zero this fork. On the contrary, I think that the USDT of the POW chain may be worth more than the USDT of the POS chain. Of course, this is just my deduction and speculation and does not constitute investment advice. .

Another big ecological plan is NFT. I think that where the NFT community is, the project will be there, not where the NFT project party is, and NFT will be there. NFT will be better developed in the forked chain, not only the continuation of benddao, but also the continuation of opensea. Although, for example, Boring Ape has a copy in the forked chain, it is also in the address of the owner, and the address of the owner is also required. Unified transactions will generate transactions, so the NFT of the POW chain has more playability.

In the future planning of ETF, related NFT agreements such as mortgages and loans will be designed, as well as leases, copyrights, and agreements to create incentives multiple times. The last important ecological plan belongs to layer2. Layer2 has the property of unlimited expansion. We are also in contact with more layer2 project parties. The POW chain will be the best destination for layer2.

4. Everyone commented on the PoS mechanism of Ethereum, what problems and challenges may they face in the future?

LIAO:

For the POW mechanism, I think there are two biggest challenges in the future. One is how to deal with regulatory policy changes. For example, after the US SEC or the US Treasury defines Ethereum as a security, its entire valuation model will be completely changed from today’s From the asset blockchain track of the existing blockchain to the traditional Internet financial track, the entire ecology above all needs to comply with new regulations. There will be a risk of collapse in the entire ecology, and this is the first one.

Second, why support POW. It is because POW is an open, competitive, and dynamic system, while POS is a static and closed system, and it is a powerful system. You can compare, POS is actually very similar to the landlord class in feudal society, so a closed system, it is impossible to introduce external competitive dynamic resources, it can not achieve a state of survival of the fittest. It is possible that POS Ethereum will become a backwater. In terms of thermodynamics, it will become a state of increasing entropy. In other words, Ethereum is very likely to repeat BM. Stepping into the footsteps of the two projects of the founders of POS companies, BitShares and Steemit, is to go to zero.

It turns out that the EVM chain of POW is successful, or there are only one or two chains. Then Ethereum has only one competitor, which is ETC. Now that Ethereum has been changed to POS, its competitors are infinitely enlarged. There are EOS in the distance, and all EVM compatible chains in the near, including BSC, Solana, Matic, Heco and so on. His entire playing field has completely changed. In the POS state, I think Binance should be the most capable of success, because Binance holds the off-chain traffic resources in one hand, and has its own son, BSC, in the other. He will inevitably intercept his traffic through corporate behavior. flow. You can see that Binance has done something recently. It stopped USDC and converted it to his BUSD. In the future, the POS version of ETH will be forcibly converted to BSC and BNB. I don't think it is difficult. Once Binance is strong enough to monopolize traffic, he will do so.

SONG:

Judging from the previous development of Ethereum POW, the Ethereum Foundation has already made a statement. If it turns to POS and drives away the miners, then Ethereum will eventually become web2, a real company product.

After Ethereum is converted to POS, it may face overly enthusiastic supervision, and this supervision will expose the centralized nature of ETH POS, which will bring a huge disaster.

In the Ethereum staking system, bribery will affect decision-making. In POS Ethereum, if more than 2/3 of the pledged ETH, the attacker can initiate the deletion of the verified block from the chain. At present, the random number algorithm of Ethereum POS is still a black box state. If this is not open source, then Ethereum POS will be a completely centralized chain. If it is open, it may face the situation before EOS. In the future, large pledge groups such as Liod and Coinbase will appear. This kind of group is effective in the short term, but it will be a disaster in the long run.

The existence of the industry depends on BTC POW alone. In a powerful application chain, there must be a POW.

Then this time Ethereum Fair will take on this role.

5. Why did BitCoke exchange fork USDT

LEO:

Users should have noticed BitCoke’s recent series of actions on the hard fork of Ethereum, including the launch of contracts for three forked coins. In order to support the hard fork, we specially launched the fork of USDST. The user deposits USDT, and can click "fork exchange" to get 1:1 USDTS + USDTW

Stablecoin is the most important asset in the public chain ecology. Even though centralized stablecoin issuers such as USDT and USDC have indicated that they will migrate to the PoS chain dominated by the Ethereum Foundation, the general consensus is that PoW on the Ethereum chain will still Stablecoins are required. Accordingly, in order to respect the opinions of users who have different attitudes towards PoS upgrades, BitCoke launched the USDT (pre) hard fork to support users to freely exchange USDT for USDTS and USDTW "candy".

As the PoS upgrade is approaching, we have also held a special reward event for users who perform fork exchange. The USDT you deposit can not only get 1 USDTS and 1 USDTW, but also a special NFT commemorative reward for this USDT hard fork event.

SONG:

POW USDT is a more powerful meme token than lunc dogecoin.

LIAO:

This question asks why the fork token of USDT needs to be listed on BitCoke for trading. So here's my take on the matter. First of all, we divide the tokens issued by these DAPs in all ecosystems on the ether today into five categories.

First of all, the first one is like a stable currency, which is backed by assets, which is a type; the second one has certain financial attributes, such as Inchilker, which has loans and insurance; The third category is for services; the fourth category is like oracle machines, such as UNISWAP; the last category is particularly fun, that is, NFT, which is a non-homogeneous asset. He does not make any delivery with any third party. After being divided into these categories, in fact, everyone can think about what kind of valuation we give him, or how to set his price, and then we can draw some very interesting observations in the future.

Using assets as an endorsement, 100% endorsement of this type of TOKEN, he must only support one chain, because he only has one asset, he cannot back up two or three tokens, so he must only choose one Chain to stand in line. The forked one, such as USDT, is worthless at all. I think it still has a value, which may be relatively low. Then I choose a target as a reference. Fundamentally speaking, LUNAC has no value at present, but LUNAC has still become a project with a market value of several billion dollars today.

As far as the forked USDT is concerned, it will still have value. This is the first one. The second is the forked USDT, which may become a truly ownerless stable currency, because now there are two models of stable currency, one is asset-backed, and the second is what we call algorithmic stability currency, but the algorithmic stablecoin seems to have failed so far, so will this ownerless stablecoin succeed? I think there is this possibility. Let’s think about it, for example, all of our stablecoin projects today, whether it’s USDT or USDC, if one day they are required to be regulated by the U.S. government and supervised like a bank, then the value accumulated on it now It will be automatically mapped to these stable coins that are currently unowned. Then there is such a possibility that today's USDTW will grow hundreds of times.

I would like to give an example, on the other extreme, if the forked NFT is valued, it will not be mortgaged, nor will it be delivered to a third party. How do you think it should be valued? I personally prefer to use the traditional stock valuation model, which is ex-rights. Just like a stock, today I will split the stock for you, one share will be divided into ten shares, and its price will theoretically become 1/10. As for NFT, I think its value should be divided according to this amount. It turned out to be worth one ETH, split into two, that is 0.5 per person, and then three is 0.3 per person. I accept such a valuation model, because for all users, his scarcity, his endorsement, etc., it is exactly the same.

So for the part among you, you can take a look. According to his business model, his degree of risk, and the degree of ownership of his customers, he can give him a certain valuation. So BitCoke is the first exchange in the world to launch this forked token. I think the entire team of BitCoke has a very deep understanding of the blockchain, and they have a very strong execution ability, so they can become a global exchange. The first exchange that supports Ethereum's hard fork token TOKEN to be traded online.

There was a saying before, that token, the ecology under Ethereum will be a floating river of Ethereum, and it is impossible to fork. Then I think time will prove that the token on Ethereum is not the floating river of Ethereum, but a stimulus for forking. At the same time, the different types of its tokens will have different story models and different project parties on the forked chain. It will make some corresponding deployments on the forked chain, you can wait and see. Then this round of making the right choice in the tide of Ethereum fork, whether it is a fork team, a trading team, or an exchange, I think in the next four years, it will become a real , In other words, it will take a big step forward, and will enter the first-tier echelon from the original second-tier echelon.

6. What do the media think of the PoW hard fork of Ethereum? Is it an extremely risky move?

Xichen:

I think it's rather risky. The first aspect is whether mining will be hit by policies in the future under the background that energy consumption is constantly being criticized. Ethereum currently consumes 93.97 terawatt-hours of electricity per year, which is equivalent to Kazakhstan’s total annual electricity consumption, and its carbon footprint is equivalent to Sweden’s annual total. Creating an ordinary NFT on the Ethereum network under the PoW mechanism will bring about 200 kilograms of carbon. After casting, sales, auctions, transfers, and secondary sales will all generate a large amount of carbon footprint. It is impossible to judge the pros and cons from a moral point of view. After all, almost every activity in life involves carbon emissions. The increase in total carbon emissions means that people's lives are getting better due to consumption. Of course, more and more miners Moving to renewable energy is a positive thing.

The second aspect is whether economic incentives can recruit miners to support the network. After all, the value of ETH is not only the formation of consensus. Without sufficient ecological construction and richness of tokens, without extensive community support, and without funds injected into the project, will the economics of participating in ETHW mining increase? The value of the currency can not be guaranteed. Although it is different from previous forks, referring to ETC, the challenges faced by hard forks are also very difficult.

Combined with the second point, miners who adhere to the spirit of decentralization contribute their own hardware, electricity, and time to defend the rights of citizens in the digital world. If there are no sustained economic incentives, it may make some unsettled speculative miners quit. The unsustainable price is one aspect. Whether the computing power of the forked chain will be decentralized is more critical (currently, the specific data of the mining pools that support forks are unknown and cannot be judged).

LOOPY:

It is a milestone event in the history of Ethereum. This upgrade makes the consensus model of Ethereum change from PoW to PoS. Behind this is not only a technical upgrade, but also involves huge interest issues and community concepts.

Ethereum Merger Forces $19 Billion PoW Mining Practitioners to Find Another Way. Although miners can contribute part of the GPU computing power to Web3 protocols such as Render Network, Livepeer, and Akash, it is difficult for these protocols to undertake all the computing power.

From the data point of view, the total market value of GPU minable tokens other than ETH is only 4.1 billion US dollars, accounting for about 2% of the market value of ETH, and ETH mining revenue accounts for 97% of the daily income of GPU miners.

The security issue of forked coins is also worth considering, because this hard fork is not as simple as when ETH/ETC split. At that time, you only need to continue mining and continue to run the same client software. Each of the codes in the code will need to remove the POS conversion logic, disable the difficulty bomb, and at the same time update the chain ID for protection.

Mining software may also need to be forked/updated. The upgrade of Ethereum is very close, and the time is very tight. If there is a loophole in the underlying code of the ETHW fork currency, it is easy to be hacked because it is too late to audit, which will cause asset prices to plummet.

SONG:

At present, the Ethereum Fair has completed the audit and released the binary client

The current P network and many exchanges are collectively referred to as ethw for ETH POW

P Network also had a twitter space with ETF at the beginning and clarified the matter

So you can also think that ETF is also ethw.

7. Does the PoS upgrade of Ethereum have any impact on ordinary users, and how to participate in the hard fork to make a profit?

LOOPY:

Now the DeFi TVL on the ETH chain is about 40 billion US dollars, and where these assets go has become a big problem. Of course, this price figure on the new chain is definitely wrong.

At present, there is a high probability that the tokens in DeFi on the new chain will be locked in it forever. In addition to various protocols, there are also various bridge-locked multi-chain assets. It can be said that the current ETH chain is already part of the entire multi-chain world, and it is difficult to deal with it separately. This is also the biggest difference from the fork of etc.

When the bifurcation was just started, various ERC tokens such as centralized stablecoins and project governance tokens of the PoW chain had essentially returned to zero due to the lack of value support. For example, USDTW this time will become a large meme. Thanks to the smart contract and AMM mechanism, although it is worthless, it still has a price, and there is a lot of room for arbitrage. In a short period of time, many PoW zero coins can be sold through DEX to exchange for more PoW ETH. But this requires direct interaction with the contract, which has a certain threshold for ordinary users.

Thanks to AMM, after this bifurcation, the various coins of the huge Ethereum ecosystem can be said to have added a huge amount of various ERC coins to the entire PoW ETH market. They have no value but have prices and can be traded at the same time.

LEO:

USDTW can refer to the ETH-PoW chain, participate in the defi ecology, or trade, and will become a new generation of meme coins in the future.

Xichen:

The design goal of the PoS merger is to minimize the impact on dapp developers, and proceed with the principle of minimal damage. The application client will switch to PoS without any sense, and ordinary users will not need to make any preparations, and there will be no impact.

From the perspective of the currency standard, it has no impact on ordinary users. The ETH held will continue to maintain the same ETH after the merger, and there is no need to exchange any ETH for the merger. From the perspective of the U standard, the volatility of the currency price will definitely increase.

Let me talk directly about the income. Odaily’s friends have analyzed a lot and I will make some supplements on the basis.

Users with high risk appetite have many choices: hold some ETH (lend out ETH in the lending agreement to enlarge risk exposure) to obtain hard fork tokens/you can also choose liquid pledge service to pledge ETH/or observe the status of stETH Exchange rate opportunities.

8. What are the changes in converting ETH to PoS? What impact will it have on the Metaverse and NFTs built on Ethereum?

Xichen:

The changes are summed up by the official scalability, security and sustainability;

They are:

- Prepare for the next shard to process more transactions per second without increasing the network node size.

- The transition to proof-of-stake means that the Ethereum protocol has greater resistance to attacks.

- The energy consumption of Ethereum will be reduced by about 99.95%, which will save more energy, and will use less carbon to ensure better security; the requirements for hardware will be reduced;

To be honest about the metaverse and NFT impact built on Ethereum is going to evolve.

Ethereum is limited by low scalability, crowded ecology, and users are only "small circles". Based on our assumptions, the current adoption rate of encryption users is only 0.3% (this is about the adoption rate of the Internet in 1995 ≈ 0.4%), which also shows that we are in a very early stage. The PoS mechanism is one of Ethereum’s scalability plans. If it can support thousands of transactions per second and reduce the cost of use after merging and sharding, so that it can be used conveniently in most parts of the world, then we can look forward to the following A pioneering Internet. From the perspective of DeFi alone, there are still 1.7 billion people in the world without bank accounts. If the system load and transaction volume of Ethereum are guaranteed, and the compliance issues of the blockchain can be solved, these people are potential users of open finance .

In the fields of NFT, Social, Game and even consumption, it is very likely that a new business model will be born.

The complexity of applications and protocols at this stage urgently requires a more efficient and scalable underlying infrastructure. With the technological leapfrogging of the underlying infrastructure and the openness provided by blockchain for development, it is foreseeable that the innovation diffusion curve of applications will be faster than that of any industry. Steeper, faster penetration. The interoperability and layered nesting of various applications and protocols will achieve network effects.

My opinion is that the Internet based on blockchain technology is subverting the Internet development in a period of 10 years at a rate of technological innovation every 5 years.

LOOPY:

Maybe nothing happens. Which chain the NFT is in depends mainly on the decision of the project party or the consensus competition between the two parties.

As the organizer, BitCoke actively supports and cooperates with the hard fork project party. Currently, the three hard fork contracts of ETH1, ETHF, and ETHW have been launched, and the USDT hard fork has been launched simultaneously. Users can choose to exchange the deposited USDT into USDTS and USDTW (candy coins).