From BendDAO to Sudoswap, more and more NFT-FI projects are appearing in everyone's field of vision. Without exception, these projects try to solve some pain points in the NFT market. For example, Sudoswap hopes to make liquidity Providers provide instant liquidity for NFT transactions. BendDAO can solve the needs of instant lending for holders of blue-chip NFTs through a point-to-pool approach. This article will focus on another track - NFT options, and will explain NFT The basic concept of options, the horizontal comparison of NFT option track projects and possible future development directions. The article only represents personal opinions.

What are NFT options?

Before understanding NFT options, we can review the definition of options in traditional financial markets:

Option is a right to choose whether to trade or not. When the option buyer pays the premium (Premium), he has the right to pay the contract seller according to the agreed conditions or the strike price (Exercise Price, Strike Price, or exercise price, Strike price), the right to buy or sell a certain amount of underlying objects, this right is called an option. If this right is to buy the subject matter, it is called a call option (Call Option, or call option, subscription option), referred to as the right to buy; if this right is to sell the subject matter, it is called a put option (Put Option, Or called short option, put option), referred to as put option.

From this deduction, we can know that an NFT option consists of the following basic elements

Subject matter (Underlying Asset):Refers to the NFT assets to be traded (including NFTs with specified NFT Collection and certain IDs under a specific NFT Collection).

Expiration Date:The exercise date means that the buyer can only effectively exercise the option within a certain time (or at a certain time).

Strike Price:The strike price is the price at which the buyer of a contract buys or sells a particular subject matter on the performance date.

Premium (Premium):Option premium refers to the fee charged by the option seller for selling the right.

The issuer of the option can create a right to buy or sell NFT at the strike price (Strike Price) before the expiration date (or at a specific time) (Expriation Date) and collect the option premium (Premium). By paying the premium, you can buy or sell NFT at the strike price (Strike Price) before the expiration date (Expriation Date) (or at a specific time).

We can explain the basic operation of NFT options by observing a case, for example:

Alice holds a CryptoPunk NFT with ID #1000, Alice chooses to create a right to buy NFT (sell call option)

"Buy CryptoPunk#1000 with 100ETH before December 31, 2022, and the premium price is 10ETH"

In this case, the subject matter is CryptoPunk#1000, once the right is purchased, Alice can receive an option premium of 10ETH as income.

And Bob can pay Alice an option premium of 10ETH to obtain the right to purchase this NFT with 100ETH before December 31, 2022.

If the price of CryptoPunk reaches 150ETH before the expiration date, Bob can execute the right, that is, buy the NFT with 100ETH, and then sell the NFT at the price of 150ETH in the market.

secondary title

Advantages of NFT options

The birth of NFT option products fills the lack of existing derivatives in the NFT market, and clearly demonstrates some advantages

lever

Compared with spot markets like OpenSea, LooksRare, etc., NFT options can provide NFT buyers with a certain leverage effect. NFT option buyers can lock the price of NFT for a period of time by paying a certain option premium. Generally, The price of the option premium will be much lower than the spot price of NFT. And its biggest loss is only the option premium itself.

income

secondary title

NFT option agreement

The author researched the following NFT option agreements (the items are sorted by product launch time)

Nifty Option

Putty

Hook

OpenLand

Jpex

Capsid

Fuku

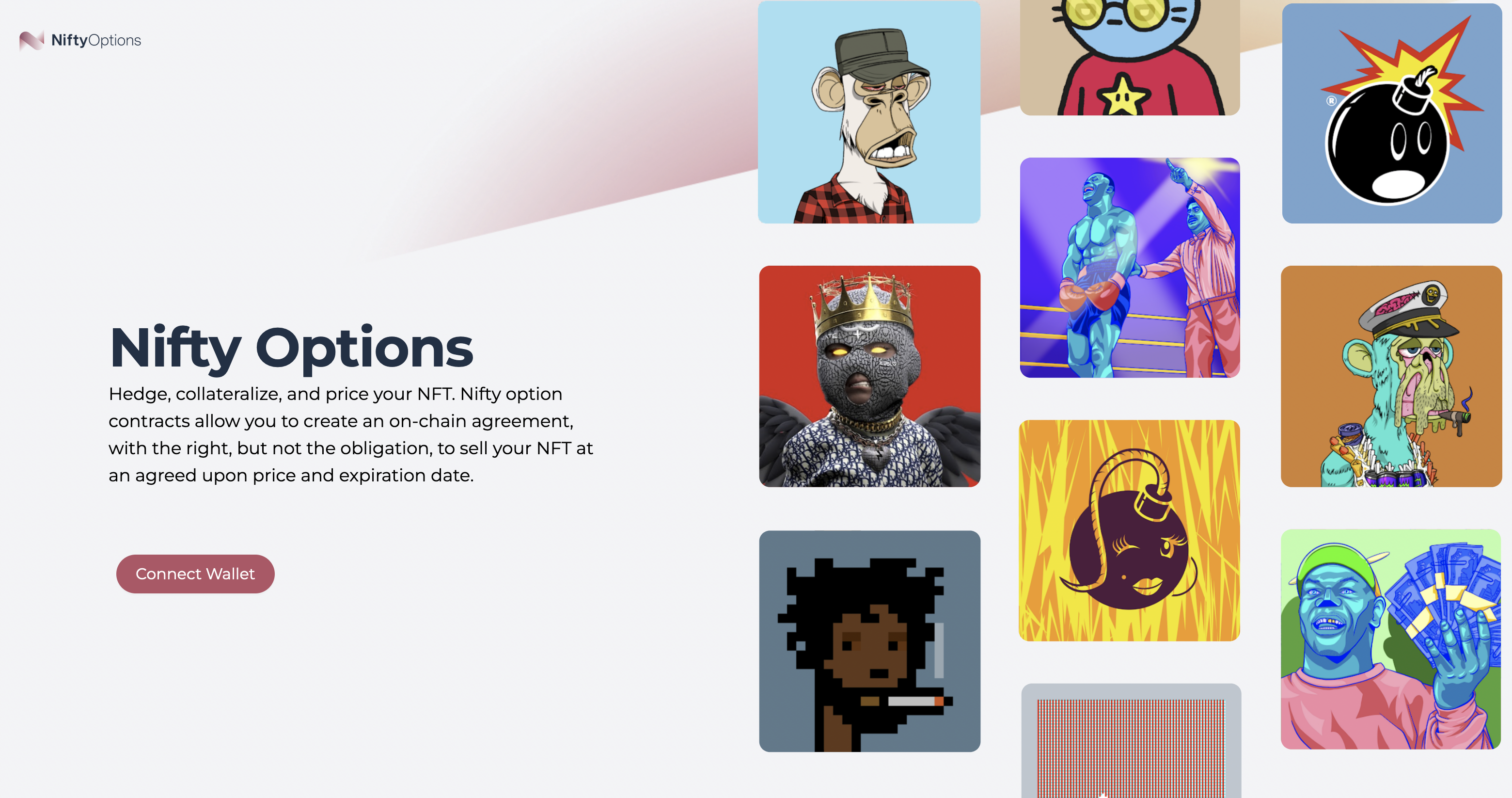

Nifty Option

Website : https://niftyoptions.org/

Twitter: https://twitter.com/NiftyOptionsOrg

Discord:discord.gg/mh7RMqEFSD

Nifty Options is one of the earliest NFT protocols. The project was released in September 2021, and its product design is relatively simple.

In the product design of Nifty Options.OrdercreatorparticipantparticipantThe option premium is charged and the obligation is fulfilled.

In Nifty Optionsorder creatorYou can fill in the subject matter, option premium, strike price and strike date to generate a put option (Long Put) for your own NFT. The order creator will need to pledge the set premium to the Nifty Option contract, whenmarket participantsWhen B purchases, B needs to pledge the Token of the performance price set by the order creator to enter the Nifty Option contract, and obtain the option premium set by the order creator.

Therefore, on the market page, when users choose Purchase Option, they do not need to "buy options", but instead collect a certain option premium and need to undertake the obligation to purchase NFT.

Summary: As the earliest NFT option protocol, Nifty has demonstrated the application of NFT options very well, and has a contract security guarantee of the first 10 million US dollars TVL. However, due to the simplicity of the product design, only NFT holders can create rights (rather than obligations), it will greatly limit the liquidity of the market. In addition, because Nifty Options adopts the process on the whole chain, it will cause a high Gas cost when there is no counterparty in the peer-to-peer market.

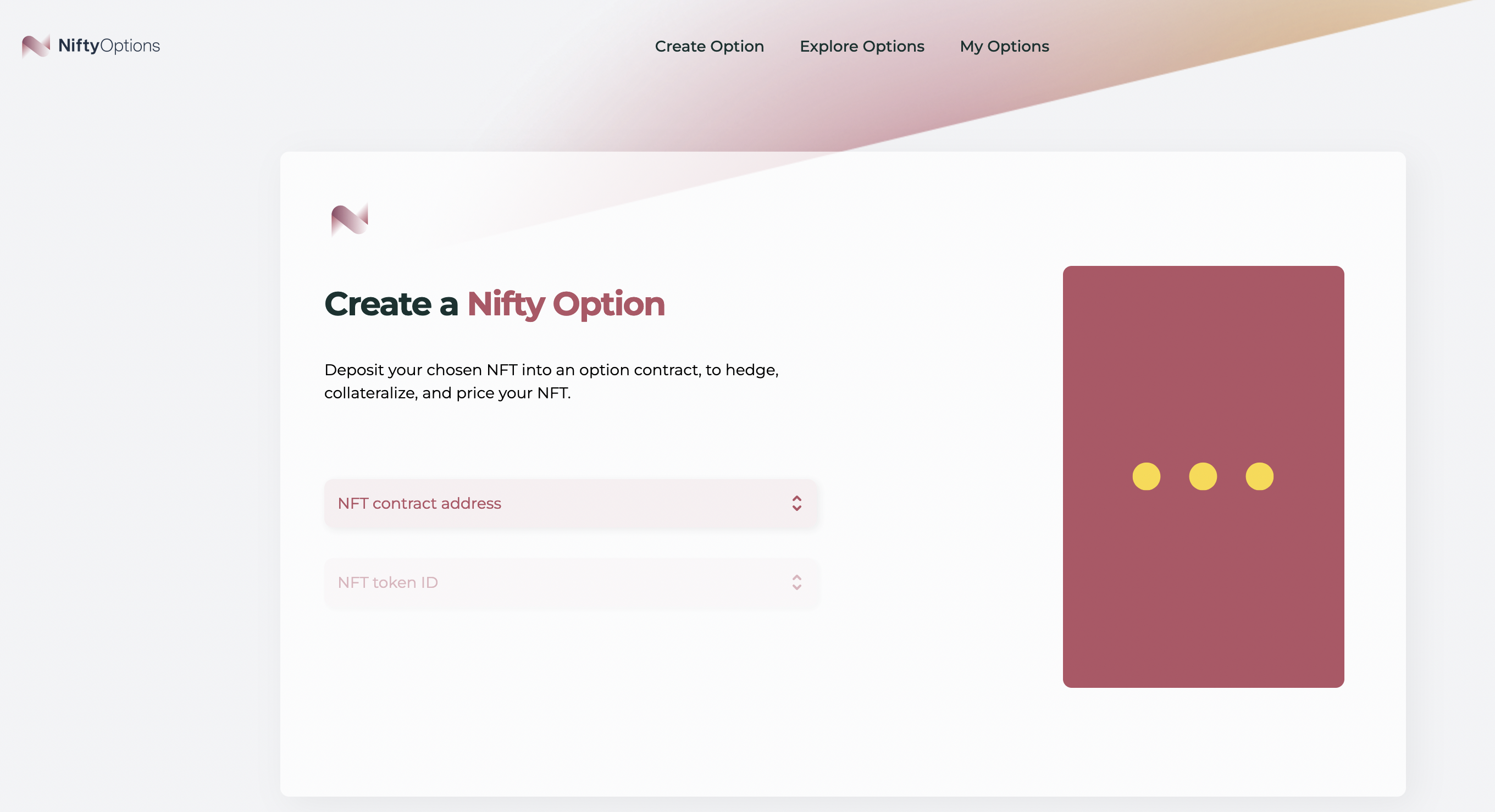

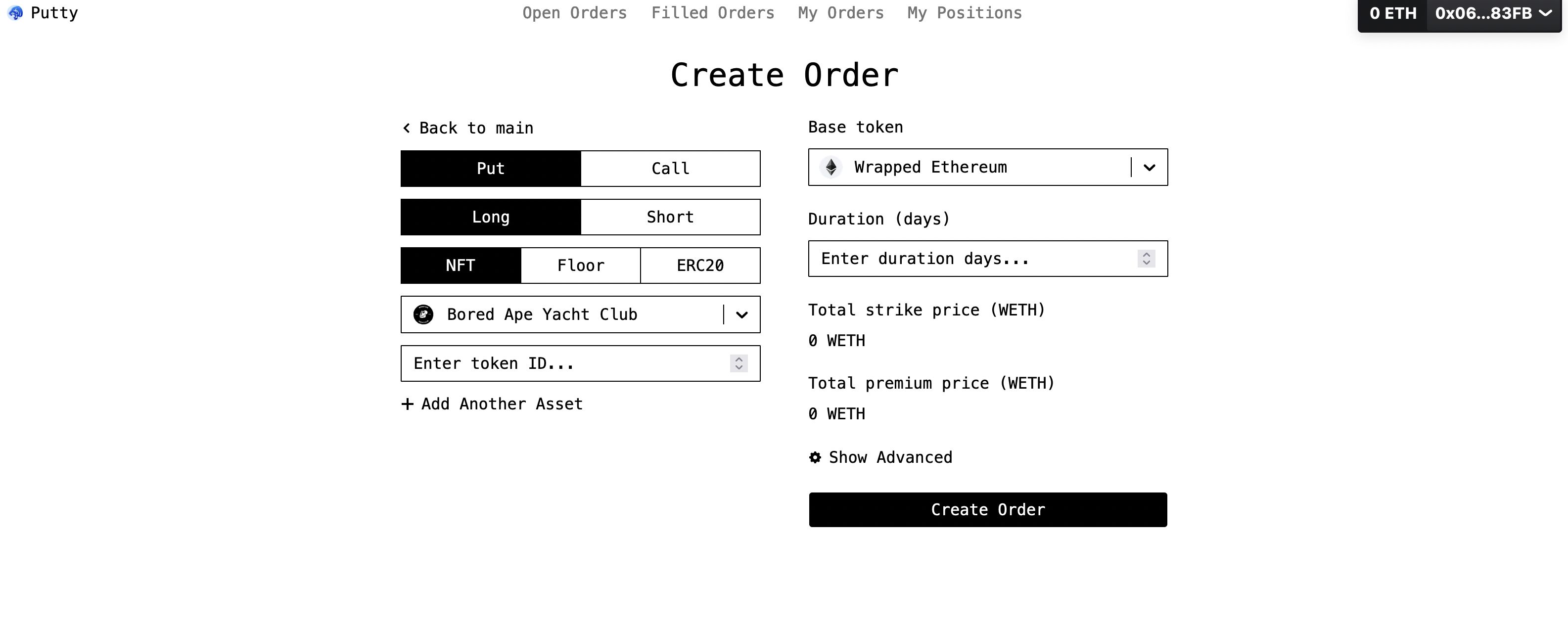

Putty

Website: putty.finance

Twitter: https://twitter.com/puttyfi

Discord:discord. gg/rxppJYj4Jp

The Putty project was established in January 2022, and the existing products will be released on August 30, 2022. Users have more choices in Putty Finanece. Users can choose Put (sell)/Call (buy) To combine the combination of Long (long)/Short (short) to meet different needs.

When a user creates a“Put - x days - Long ”, it is similar to the design of Nifty Options,order creatorFor the party that owns the rights, it is necessary to set the option details and pledge the premium. Fororder participant,Then you can collect the premium, but you need to pledge the Token corresponding to the performance price as a guarantee for fulfilling the obligation.

When a user creates a“Put - x days - Short ”hour,order creatorAs the party that owns the obligation, the creator can set the option details and pledge the Token that is the same as the performance price as a guarantee for fulfilling the obligation.order participant,You need to pay a certain premium to obtain the right to sell the specified NFT in the future.

When a user creates a“Long - x days - Call ”hour,order creatorIt is for the party that owns the rights and needs to set the option details and pledge the premium,order participant,Then you can collect the royalties, but you need to pledge the NFT required by the creator of the order as a guarantee for fulfilling the obligation.

When a user creates a“Short - x days - Call ”when ordercreatorAs the party with the obligation, the user can set the option details and pledge NFT as a guarantee for fulfilling the obligation.order participant,A certain premium needs to be paid to obtain the right to buy the specified NFT in the future.

Summary: In the latest product released on August 30, 2022, Putty not only demonstrated the basic functions required by a peer-to-peer NFT option market, but also provided many bright functions. In addition to supporting specified NFT, Putty also supports NFT Floor, Bundle and ERC20. It also provides option price calculators to help order creators and order participants evaluate option prices. However, Putty's products currently only support 10 NFT items, and do not support user-defined additions project, I hope that Putty will be able to open the function of custom projects in the future.

Hook

Website : hook.xyz

Twitter: https://twitter.com/hookprotocol

Discord:https://discord.com/invite/eFz9MDHZW9

Hook Protocol was created in February 2022 and has been released on the Ethereum mainnet.

The option creator chooses to create a Call Option according to the NFT category, and selects the performance date set by the system, the performance price and the corresponding option premium. The option buyer can select the corresponding option purchase in the Collection, and has the right to follow the performance date after paying the premium Buy at strike price.

Summary: On the option creation page of Hook, currently only supports the creation of Long Call options, and only supports the two Collections of CryptoPunk and Good Minds. In the selection of execution, the monthly fixed date is also selected. Suggested premiums under different strike prices (users can adjust). It can be seen that Hook is trying to create a pre-standard NFT option agreement through preset conditions. However, since the current project is still in the early stage, the preset conditions are reducing Whether the market threshold will limit the diverse needs of users is unknown.

OpenLand

Website : openland.wtf

Twitter: https://twitter.com/openlandwtf

Discord:discord.gg/openland

Openland was created in September 2021 and is currently running on the Goerli test network.

Compared with similar projects, OpenLand's product design is similar to an NFT Marketplace, which is relatively closer to the usage habits of NFT users, and the rights and obligations of the creators and participants of the order are relatively clear. Simply put, the order The creator is the obliged party, and everything that can be purchased in the market is a right. It is worth mentioning that when a participant purchases an option in OpenLand, he will receive an Option NFT representing this right and can use it on the NFT Marketplace transfer to gain early access to the intrinsic value of the option

whenorder creatorWhen a "Put" is created in Openland, it means that the creator is obliged to purchase the subject matter at an agreed price within a certain period of time in the future

whenorder creatorWhen a user creates a "Call" in Openland, it means that the creator is obliged to sell the subject matter at an agreed price in the future

whenorder participantBuy a "Put Option" at OpenLand", it means that it has the right to sell the subject matter at an agreed price within a certain period of time in the future

whenorder participantPurchase a "Call Option" at OpenLand", it means that it has the right to purchase the subject matter at an agreed price within a certain period of time in the future

OpenLand's products adopt the form of Marketplace that NFT users are more accustomed to. At the same time, options are also made into transferable NFTs. The cost of point-to-point matching orders is also released using off-chain signatures and on-chain matching transactions to save The cost of users. In addition, OpenLand also provides NFT Forward (forward) contracts in addition to options to allow users to gamble on the value of NFT. However, since OpenLand has not announced the roadmap of its project, the project The launch time of the mainnet is unknown.

Jpex

Website: jpex.finance

Twitter: twitter.com/jpexfinance

Discord:None

The project was founded in May 2022, participated in EthGlobal, and appeared in institutional research reports as a representative project of the NFT option track many times, but the project is not yet online.

Capsid

Website : capsid.one

Twitter: twitter.com/Capsid_One

Discord:https://discord.gg/capsid

The project was founded in January 2022, and announced the seed round financing of 3 million US dollars on August 4, 2022. The product is not yet online.

Fuku

Website : Fuku.xyz

Twitter: twitter.com/FukuNFT

Discord:https://discord.gg/capsid

The project was created in January 2022 and is organized by@AlphaVentureDAOIncubation, currently not online.

future

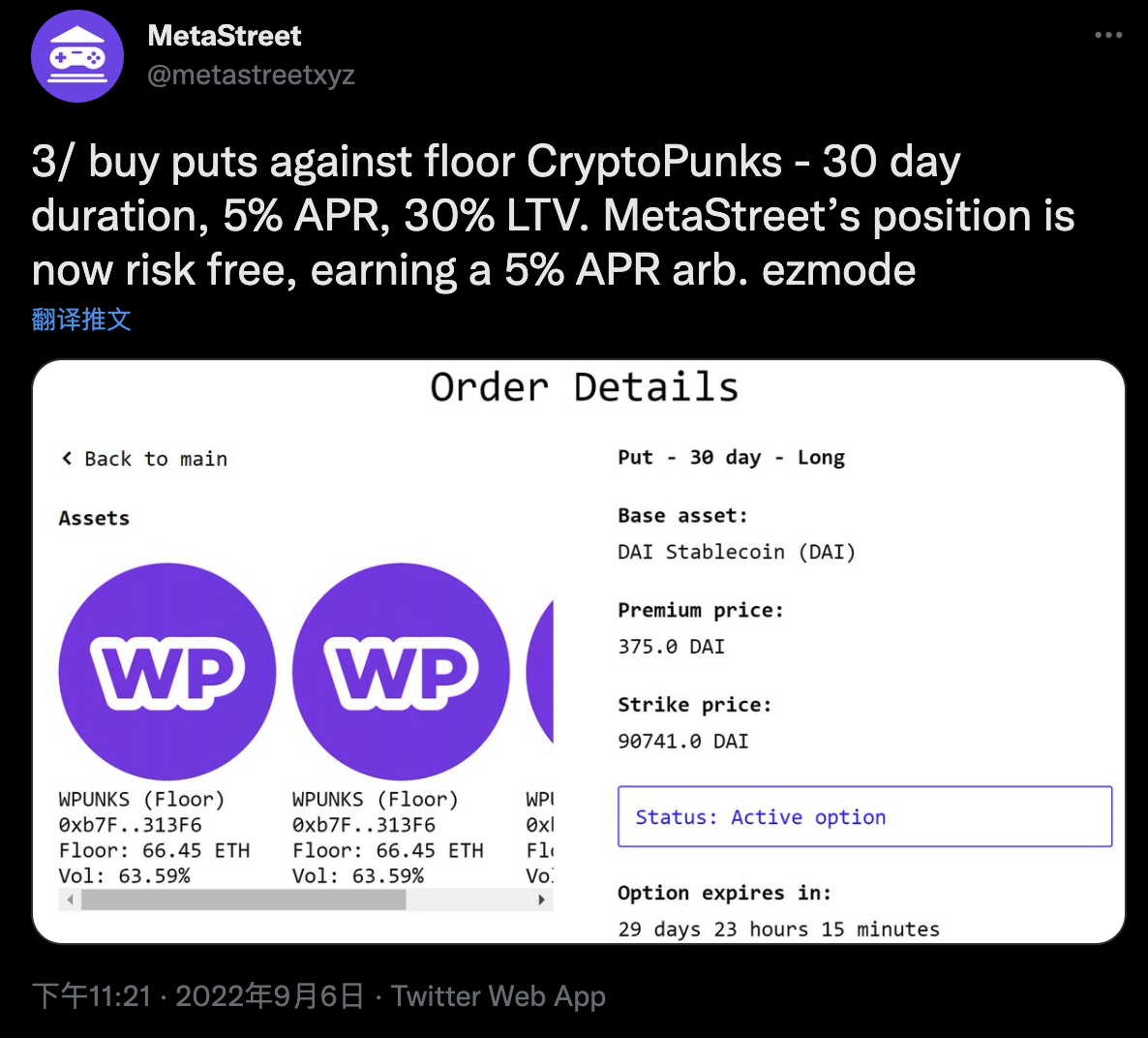

The birth of NFT options provides many new ideas for the development of NFTfi and the possibility of forming structured products. For example, MetaStreet and Putty, a liquidity provider in the NFT point-to-point market, have recently cooperated. MetaStreet is on NFTfi (a point-to-point NFT lending market). Provided 3 CryptoPunks with a loan interest rate of 10% annualized. In order to hedge its risk exposure, MetaStreet purchased a put option on the floor price of CryptoPunk on Putty (the annualized premium for the option premium is 5%), so MetaStreet’s Take a risk-free position and get a 5% spread.

Compared with NFT, the option agreement of NFT is earlier, and it also faces many challenges. Some of the NFT option agreements mentioned above are based on the peer-to-peer market, which allows users to create and trade more freely , but will face more dispersed liquidity. The point-to-pool scheme requires fairer option pricing, and perhaps a market-making scheme similar to Sudoswap may bring some thinking and opportunities to NFT option agreements. At the same time, NFT assets The evolution of the category may also make NFT options appear in the field of vision of more and more people.