The Ethereum Foundation issued a document last week confirming that this merger and upgrade of Ethereum will be divided into two upgrades, Bellatrix and Paris. The earlier Bellatrix performed an epoch-making 144896 on the Beacon Chain on September 6, and the Terminal Total Difficulty value that triggered the merger was 58750000000000000000000 , is expected to be between September 10-20. So far, the high-profile Ethereum merger and upgrade has finally confirmed the specific opening time.

image description

first level title

1. What is a merger

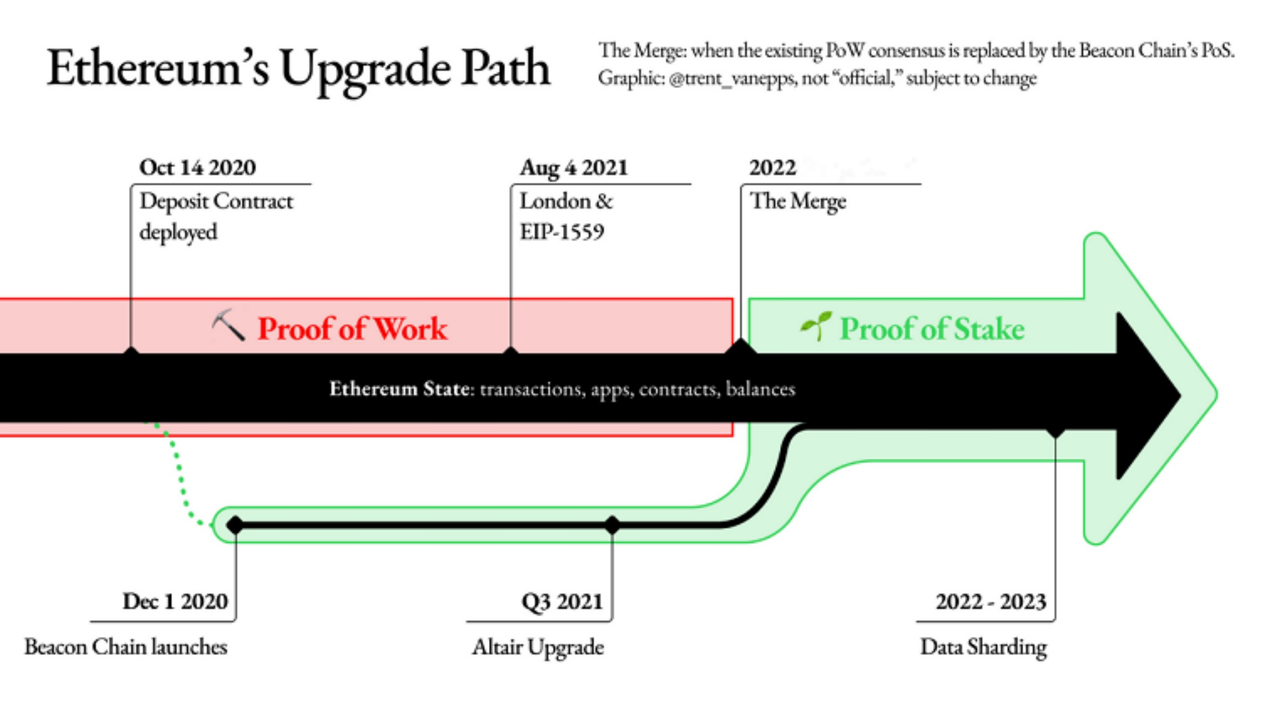

Discussing the risks of an Ethereum merger requires knowing what the merger itself is. The merge is a planned ethereum network upgrade that removes the proof-of-work consensus layer and merges the beacon chain's proof-of-stake network into the current ethereum mainnet.

During a merge, the consensus layer is upgraded and the data layer remains unchanged. Ethereum's blockchain data is structured and consists of two basic elements: pointer and linked list. A linked list is a list of linked blocks that contain data and use a pointer to the previous block. Since the merger is not a release of a new version of Ethereum, but rather an upgrade, the data layer will not be affected in the process. Once this transition is complete, Ethereum will now be in a more sustainable and greener ecosystem.

After the merger, the Ethereum blockchain will passIndividual upgrades, post-merge cleanup, and shardingto prioritize adding new features. Some of the planned features include the ability to allow stakers to withdraw staked ETH, among other features. A post-merge "cleanup" upgrade to handle these features is expected shortly after the merge is complete.

Finally, the sharding process will be used to further scale Ethereum. Currently, Ethereum can only process about 15 transactions per second. With sharding, Ethereum will have the ability to scale thousands of transactions by dividing the blockchain into "shards" (separate chains).

Sharding is one of the strategies commonly used by Web2 to scale databases. But with Ethereum, this lowers the barrier to entry for validators to store and run data, and is much more convenient than running an entire blockchain. At that time, due to the existence of the shard chain, fromLaptop or mobile device running an Ethereum nodefirst level title

2. What are the risks? from where?

First, a failed merger could have ripple effects affecting other blockchains and ecosystems that rely on Ethereum.

Because a merge is a major update to a very complex system. Based on this merger, Ethereum may run slowly or may stop completely. During this process, other unexpected errors may also occur. Additionally, the overall security of Ethereum may change as a result of the merger. When moving to proof-of-stake, new technical challenges and unexpected problems may arise.

secondary title

(1) Institutions who hold Ethereum pledges on their behalf

In addition to running the consensus layer client, validators on the beacon chain also need to run the execution layer client after the merger. Stakers are strongly encouraged to do so before merging, but some validators have outsourced these functions to third-party providers. This is possible because the only data required by the execution layer is the update of the deposit contract.

After the merger, validators must ensure that the blocks of user transactions and state transitions they created and attested to are valid. To do this, each beacon chain node must be paired with an execution layer client. Note that multiple validators can still be paired with a single beacon chain node and execution layer client combination. This expands validator responsibilities, but also entitles validators who propose blocks to associated transaction priority fees (which currently belong to miners).

While validator rewards are still generated on the beacon chain and require subsequent network upgrades to be withdrawn, transaction fees will be paid, burned and distributed on the execution layer. Validators can designate any Ethereum address as a recipient of transaction fees.

After updating the consensus client, be sure to set fee recipient as part of the validator client configuration to ensure transaction fees are sent to addresses you control. If you use a third-party provider for staking, it is up to the provider you choose to specify how these fees are distributed.

Staking Launchpad has a merge readiness checklist that stakers can use to ensure they have completed each step of the process. EthStaker also held validator readiness workshops, with more workshops planned.

secondary title

(2) Ethereum application or tool developers

The merge has minimal impact on the subset of contracts deployed on Ethereum, none of which should be broken. Also, most of the user API endpoints will remain stable (unless you use proof-of-work specific methods such as eth_getWork).

That said, most applications on Ethereum involve far more than on-chain contracts. Now is the time to ensure that front-end code, tooling, deployment pipelines, and other off-chain components work as expected. It is recommended that developers run a full test and deploy cycle on Sepolia or Goerli and report any tooling or dependency issues to the maintainers of those projects.

secondary title

(3) Ethereum miners or node operators, and did not participate in the upgrade

If the miners were previously mining on the Ethereum mainnet, the merged network will run entirely under the Proof of Stake (PoS) algorithm, and POW mining will no longer be possible at that time.

If you are using an Ethereum client that is not updated to the latest version, the client will sync to the pre-forked blockchain once the network upgrade is complete.

secondary title

(4) Ethereum users or ETH direct holders

1) Choose a large platform and be wary of fraud

Whether using Ethereum applications on-chain, holding ETH on an exchange, or in a wallet in their own custody, the holders of the above do not need to do anything. If the app, exchange or wallet used provides additional instructions or advice, coin holders should verify that these instructions or advice come from them, and beware of scams.

For users who are entrusted with ETH on major centralized trading platforms and other institutions, there is also a risk of asset loss. In this regard, Ouyi OKX's entire platform supports the Ethereum upgrade plan, and will not suspend any transactions of ETH before and during the merger. Ouyi promises that after the merger is completed, the ETH assets on the platform will become ETH on the POS network.

And Ouyi made it clear that if a fork chain and a new fork token are generated during the merger and upgrade of Ethereum, Ouyi will evaluate and support the airdrop distribution and withdrawal of the fork token, and try its best to protect the user's asset security and security. rights and interests.

2) Be wary of price fluctuations

But this does not mean that the above-mentioned currency holders can sit back and relax. According to the announced merger time, the price of Ethereum may experience extremely serious short-term fluctuations during the merger process. During this period, there is room for profit in frequent transactions, but the risks are also high. And in the long run, Ethereum also risks losing its dominance as the cryptocurrency of choice for smart contracts. The most likely outcome is that several programmable cryptocurrencies will dominate, not just one.

3) Users on the chain

For many users on the chain, if there is a fork, they must get airdrops through their own wallets to have a real sense of participation. And the wallet on the chain can obtain the airdrop Token and NFT of all protocols except the main network currency. Ouyi Web3 Wallet has officially announced that it will support ETHW within 12 hours after the fork.

The above is the risk analysis of the merger and upgrade of Ethereum. As the most concerned event in the encryption industry in September, I hope this article will be helpful to readers.