secondary title

TL;DR

1. The prosperity of the DeFi market: it has expanded to different public chains and Layer 2, and derived application scenarios such as DEX, lending, Staking, derivatives, bridges, etc., and new DAPPs continue to appear to optimize user experience.

2. DEX, Staking, and lending are the DeFi scenarios with the clearest needs and models. When any new ecology emerges, these three types of DeFi protocols are always the first to be deployed.

3. The new ecological DeFi may contain some opportunities, such as DeFi projects on Alternative L1 and Layer2.

4. TVL, user volume, transaction volume, protocol revenue, MV, FDV, MV/TVL, P/S (market-sales ratio), P/E (price-earnings ratio), and innovation can be used to evaluate DeFi protocols.

The encryption market has developed to this stage, and DeFi is the most obvious track.

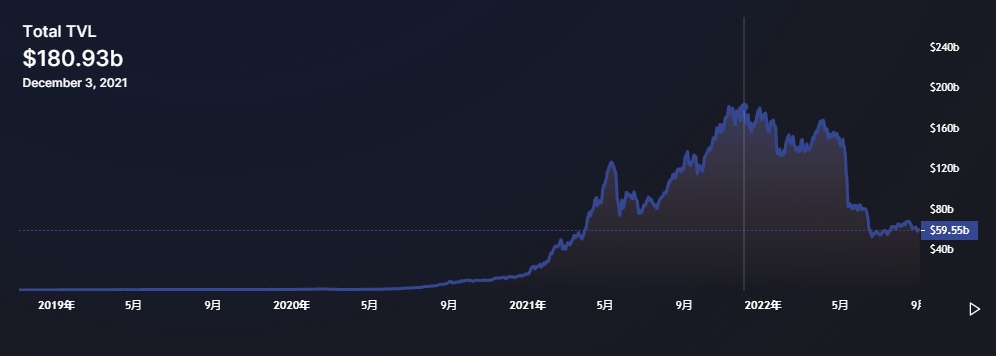

Since the DeFi Summer in June 2020, DeFi has expanded into a huge, rich, complex and interoperable ecosystem. Trading, lending, staking, stablecoins, bridges, derivatives, insurance and other sub-tracks are constantly seeing new protocols being born, and the lock-up volume (TVL) continues to grow.

According to data from DeFiLlama and Coingecko, DeFi has been deployed to over 140 chains, the number of protocols exceeds 3,000, and the locked value is about 60 billion US dollars. The number of DeFi tokens exceeds 400, with a total market value of more than 40 billion US dollars.

Vitalik once said at the EthCC conference that the Ethereum community cannot be limited to DeFi, and non-financial applications are equally important. But in fact, DeFi has become an important foundation for the development of non-financial applications.

DeFi and NFT, chain games, Web3, DeSoc (decentralized social) and other sectors will all have intersections. For example, a holder of BAYC will not be satisfied with only holding and displaying blue-chip NFTs that he/she bought at a high price. He/she may borrow USDC by mortgaging BAYC to obtain liquidity. In the SocialFi field, fan tokens can earn interest through staking. With the development of the chain game sector to the current stage, it has become a norm for chain game guilds to lend game assets to players.

DeFi can be said to have penetrated into every link on the chain. Applications that cannot participate in DeFi Lego are lifeless. DeFi is a very important base layer of the encryption market. At present, DeFi is also the most real on-chain demand scenario. Its asset circulation, lending, and staking models have also been fully verified.

image description

TVL Top50 DeFi Protocols, Source: Beep News

The rise of DeFi

It all started with DeFi Summer in June 2020. At that time, Compound launched the governance token COMP to provide COMP rewards for lending users on the platform. Later, DeFi protocols followed suit and launched Yield Farming, Liquidity Farming, and Staking Farming farming methods.

image description

The highest point of DeFi TVL exceeded $180B, an increase of more than 140 times. Source: DeFiLlama

Evolving to the present, Yield Farming, Liquidity Farming, and Staking Farming have become standard configurations in DeFi protocols. Farming helps DAPP cold-start, attracts users, transaction volume, and locked positions in a short period of time, and consolidates DAPP's "brand image".

But if you think about it, farming is actually a form of DAPP subsidies. When all DeFi protocols subsidize users with tokens and handling fees, user loyalty will be very dependent on farming income. After the platform subsidy is eroded (for example, the token price is diluted by mining, selling and withdrawing), the transaction volume, liquidity and depth of the pool will quickly dry up. Protocols don't get long-term development.

The real value and core of DeFi lies in no access, decentralization, low friction, and composability. This should be the original driving force for DeFi to continue to attract users and funds.This is why we are optimistic about the development of DeFi/DeCeFi (the fusion of DeFi and CeFi).

Taking traditional financial scenarios as an example, we need to provide ID card, bank account and other information to open a stock account. Stock trading also has a time limit, not 24h*365 days. In the cross-border transfer scenario, it usually takes 3-5 days to complete the transfer, and multiple third-party institutions may be involved in the process.

In contrast, anyone can create a crypto wallet account without providing any information. After creating the account, save the private key/mnemonic phrase, this account is completely under your control, and the third party cannot freeze it.

After you deposit encrypted assets into this account, you can participate in any DeFi application by connecting the wallet, such as trading tokens on Uniswap, and you can participate 24h*365 days. Even when the Ethereum network is congested, it does not take 3-5 days to transfer assets on the chain. Generally, you can know whether the transaction is successful in about 10 minutes.

Instead of using banking services and paying service fees, you can make markets for DEXs such as Uniswap (providing liquidity for trading pairs), so as to obtain part of the DEX's fee income. Your market-making certificate LP Token on Curve can also be used as collateral to lend other tokens on platforms such as MakerDAO.

Therefore, anyone can participate in DeFi. The friction of the flow of DeFi funds is very small, and the capital efficiency of DeFi has been greatly improved. It is for these reasons that DeFi will be a market that cannot be ignored.

DeFi event

DeFi experienced rapid development from June 2020 to May 2022, and the DeFi track once reached its heyday. At that time, everyone was talking about DeFi, and those who had stablecoins were thinking about which safe and high APR pool to invest in. The collapse of the liquidity pool by giant whales was a topic that LPs often discussed.

Today, although the market's attention, TVL, users, and transaction volume are attracted and dispersed by new topics such as new public chains and NFTs, and market confidence has also been hit due to downward price drops, we still believe that the DeFi market has shown some pomp. DeFi has solidified itself as a regular tool for crypto-natives.

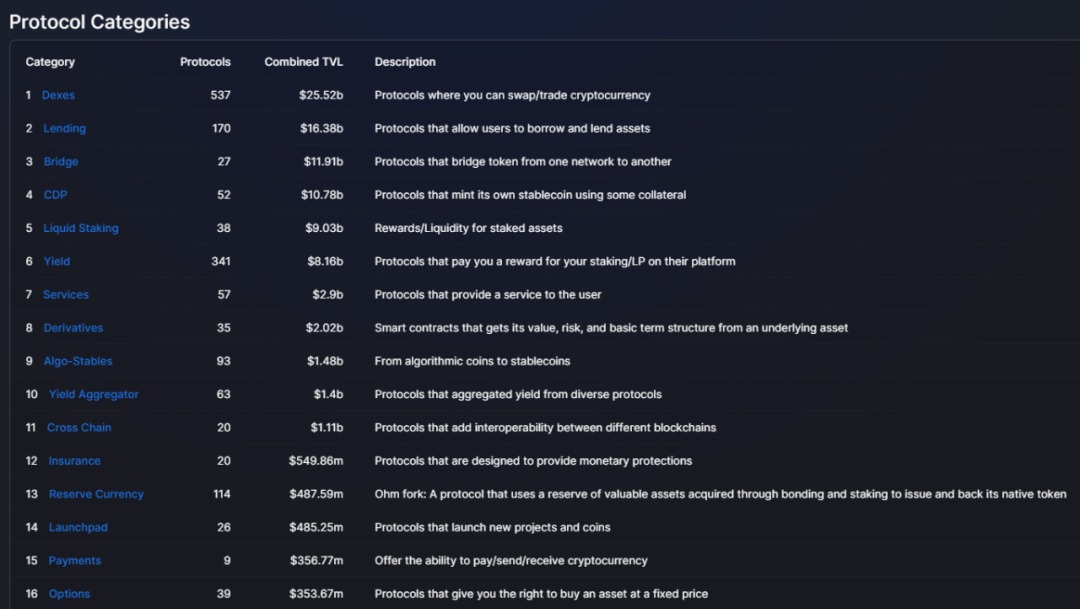

At present, DeFi has developed into a huge self-running financial system. DeFi is a key industry on Ethereum, BNB Chain, Avalanche, Solana, Tron, and Layer2, providing lock-up values of $34.1B, $5.25B, $1.84B, $1.4B, $5.7B, and $5.1B for these chains/layers, respectively.

image description

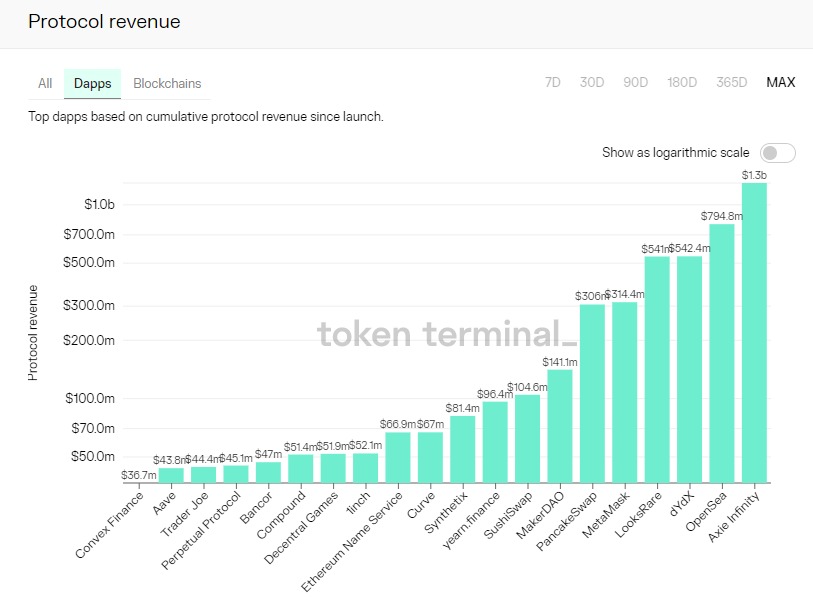

DAPP protocol income, source: Token Terminal

image description

The DeFi protocol at the head of each chain, from: DeFiLlama

secondary title

DEX

DEX is the most important category of the DeFi track, currently mainly divided into two modes: AMM and order book. Among the TVL Top50 DeFi protocols counted by Beep News, the DEX is mainly of the AMM type, while the order book type mainly appears in the derivative DEX.

In addition, PancakeSwap, Sushi, and VVS Finance (the forked version of Uniswap on Cronos) have derived a limit order model, allowing users to set the transaction price within a certain range.

The integration of DEX to NFT will become a trend.On the one hand, there are top DEXs like Uniswap that integrate SudoSwap. On the other hand, such as PancakeSwap has placed an NFT market similar to OpenSea in DEX.

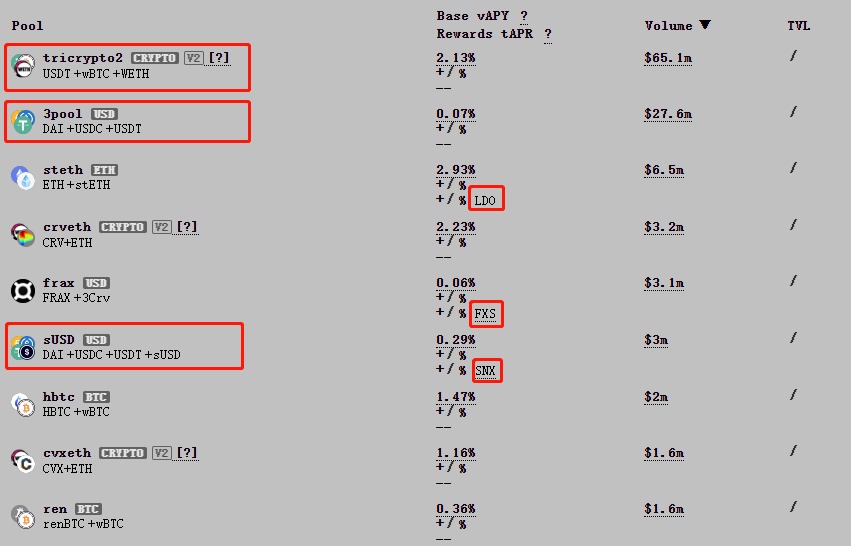

In addition, many DEXs are no longer satisfied with only providing swap functions. They also put cross-chain bridges, lending, staking, asset management (financial optimization) and other functions in the interface. DEXs like Curve are known for encouraging the lock-up of the governance token CRV, and veToken’s gameplay is followed by more and more protocols.

There are also some DeFi protocols that specifically serve DEX.Arrakis Finance manages the LP Token of Uniswap V3 to optimize LP income. Convex is committed to promoting Curve staking and also providing users with better income solutions.

Due to the clear requirements and patterns of DEX, they are often the earliest applications deployed on Alternative L1 and Layer2.New DEXs in the new ecosystem are worthy of attention, such as LiquidSwap on Aptos, VVS Finance on Cronos, DefiChain DEX on DefiChain (for BTC DeFi), Ref Finance on Near, etc.

In addition, top DEXs also tend to expand multi-chain deployments, such as Curve, Uniswap, and Sushi.

Changes in the past year: According to the data of OKLink, in the past year, the TVL of DEX has dropped from 48 billion US dollars to 25 billion US dollars, and the TVL has been reduced by about half. DEX has indeed cooled down due to some black swan events and the overall downturn of the market, but we I prefer to call this period the consolidation period.

secondary title

Head DAPP: Uniswap, Curve

Uniswap is recognized as the number one application in the DEX ecosystem. Although the AMM model was not originally proposed by Uniswap, AMM has been carried forward through Uniswap. At present, on Uniswap Twitter, there is a wealth of information about Uniswap surroundings, AMM activities, and team members. The integration of NFT should be the next important direction of Uniswap. The team's NFT product leader Scott (founder of the original NFT aggregation platform Genie) said: Uniswap will be the interface for all NFT liquidity.

Curve focuses on stable currency and anchor asset exchange. This precise positioning and innovation are worth learning from other protocols. Because the prices of the assets that make up the trading pair are relatively stable, this positioning can well alleviate the problems of DEX impermanent losses and transaction slippage.

image description

borrow money

borrow money

image description

The number of agreements and TVL of each DeFi track, source: DeFiLlama

Observing the lending agreements in the TVL Top50 DeFi projects, we can find that mainstream lending agreements such as MakerDAO, Aave, and Compound accept relatively conservative mortgage assets and loan assets, and mainly use various stable coins, BTC, and ETH to reduce liquidation risk.

Restrictions on the scope of assets limit the development of the protocol itself, so some leading lending protocols are making some expansion attempts.For example, Aave said it will launch its native stablecoin GHO, a stablecoin with a mechanism similar to Dai, and the wider usage scenarios of stablecoins can achieve some expansion.

Extending tentacles to institutional users is another attempt by lending protocols.Compound launched Compound Treasury to provide institutional clients with financial products with stable returns. Institutional clients put funds into Compound Treasury and receive a 4% APY, and the funds will enter the Compound protocol, which is equivalent to connecting institutional funds with the retail lending market.

In fact, Aave also launched the institutional lending platform Aave Pro in July 2021, emphasizing features and functions such as KYC. The combination of DeFi's openness, decentralization, composability and CeFi will become the trend pursued by many DeFi protocols.

Changes in the past year:In the past year, the total amount of loans in the decentralized lending market has dropped from US$28.4 billion to US$16.2 billion, and the total deposits have dropped from US$78.2 billion to US$40.3 billion. The cooling in the market has also affected the lending market. At this stage, MakerDAO and Aave have been in the top position. Compound once occupied 20-30% of the market, but now it is less than 10%.

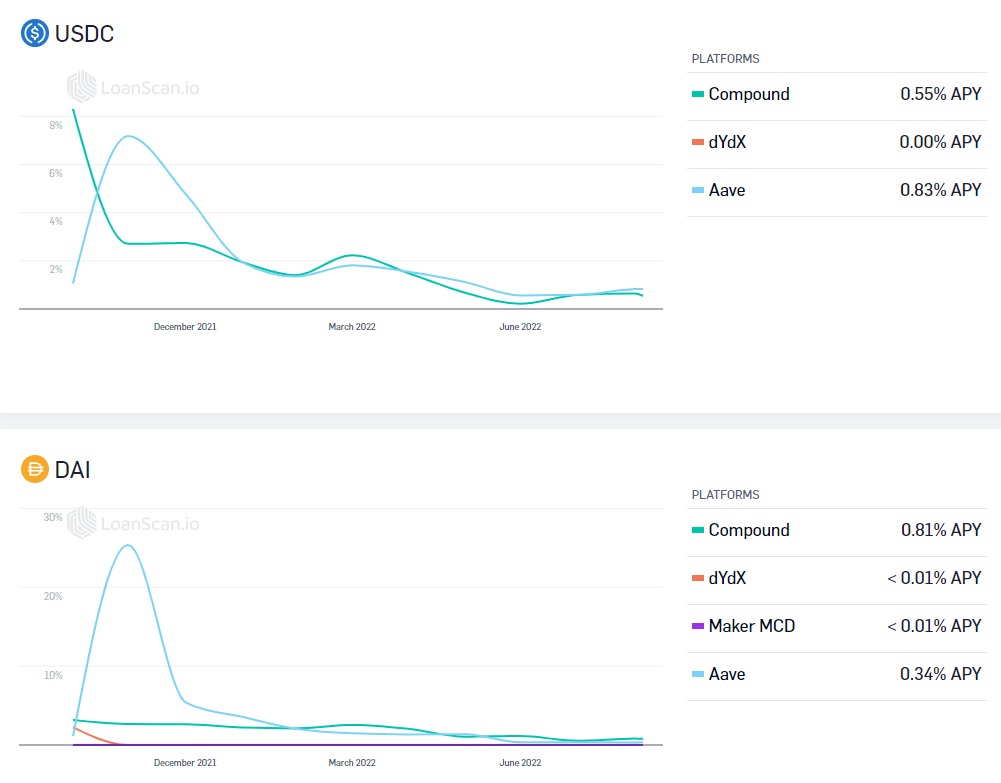

In addition, the cooling of the market is also reflected in the yield.image description

text

Top DAPPs: Aave, Compound

Staking

Staking has a wide range of uses, and it is a function commonly deployed by DeFi protocols. In this research report, Beep News also includes revenue aggregation, optimization, and asset management in this category. Such agreements can often bring better income for users and the agreement itself.

There are some agreements on the market that are purely for staking, wealth management, and income aggregation/optimization, such as Lido, Convex, Yearn Finance, Rocket Pool, Arrakis Finance, Aura (optimizing income for Balancer LP and BAL stakers), Beefy, Marinade Finance (Solana liquidity staking platform on

This type of agreement is also recognized by the market because of its clear requirements and models.They attract users with simple token pledge operations, pledge income, liquidity release, etc., and have relatively good TVL performance. However, because the revenue aggregation/optimization platform is based on DeFi protocols such as DEX, lending, and staking, once these DeFi protocols have security problems, the revenue aggregation/optimization platform will also be affected.

Staking is often built into DEX and lending agreements as an additional function. For example, Curve encourages users to stake the governance token CRV as veCRV. Curve provides veCRV holders with governance voting rights, more agreement income/transaction fee distribution in exchange for long-term lockup of CRV.

text

stable currency

stable currency

Stablecoins are an indispensable component of the DeFi ecosystem and even the entire encryption market. Because of stable prices, stablecoins are widely used in lending, staking, risk hedging and other scenarios.

Decentralized stablecoins are often generated through collateralization (in many cases, over-collateralization). The mortgage rate varies with different mortgage assets.

For example, through MakerDAO's oasis.app, you can mortgage ETH at a mortgage rate of 170%, and lend/generate stablecoin Dai. You can use these Dais for DeFi scenarios such as lending and staking. If wBTC is mortgaged, the mortgage rate is 175%.

When you return the loaned Dai and pay the stability fee (the stability fee also varies with different mortgage assets, ETH is 0.5%, wBTC is 0.75%), after the agreement destroys Dai, you can get back the mortgaged ETH.

When the price of mortgaged assets falls, the value of mortgaged assets/the value of lent assets reaches or falls below the mortgage rate, the mortgaged assets will be liquidated.For a stablecoin protocol like MakerDAO, the liquidation and auction mechanism of mortgage assets is very important, which will determine whether the protocol can cope with the price black swan.

Compared to over-collateralized stablecoins, algorithmic stablecoins seem to have been falsified by the market so far.

text

Derivatives

Derivatives

Derivatives are considered to be the most potential track of DeFi. However, due to the limited assets supported, the limited liquidity and depth of derivatives, and the high risk of leveraged trading, the adoption of decentralized derivatives platforms is not high., which is manifested in the small number of related DAPPs, not many users using decentralized derivatives platforms, and not many funds on these platforms.

text

Head DAPP: Synthetix, dYdX, GMX

Synthetix supports the minting of synthetic assets by staking the governance token SNX with a high mortgage rate. Synthetic assets can be understood as mirror assets that anchor the prices of other assets, such as sUSD and sEUR (synthetic assets do not hold a position in the anchored asset, nor do they have attributes other than the price of the anchored asset). Synthetic assets can mainly be used for speculation based on the price of the anchored asset.

Synthetix also supports trading between synthetic assets. Different from AMM, etc., the swap between synthetic assets does not require a counterparty, but is calculated by smart contracts. There is no problem of insufficient liquidity. The exchange rate is captured by the oracle machine to avoid impermanent losses and transaction slippage. point.

Synthetix provides a better synthetic asset casting and trading model. dYdX and GMX represent decentralized leveraged trading platforms. The decentralized nature of GMX is stronger. Leverage traders and liquidity providers are counterparties to each other. The platform provides rewards to LPs to encourage market making, which is similar to the operating mechanism of AMM.

Cross-chain bridge

Cross-chain bridge

In the TVL Top50 DeFi protocol, there are only two cross-chain bridges, namely Stargate and Synapse.

Head DAPP: Stargate

Stargate is favored by many. Most cross-chain bridges realize cross-chain by mapping assets. Assets are transferred from chain A to chain B, assets on chain A are locked, and mapped tokens are generated on chain B.

Insurance

Insurance

Insurance is also a track that DeFi has not fully explored. As more and more security incidents occur, the importance of decentralized insurance protocols will be highlighted.

There are two insurance items in the TVL Top50 DeFi agreement, namely Armor and Nexus Mutual, among which Nexus Mutual is a decentralized insurance agreement that is more commonly mentioned.

Nexus Mutual provides various types of DeFi insurance, including Yield Tokens (farming token insurance), DeFi protocol insurance (for smart contract vulnerabilities being attacked), and hot wallet insurance. You can purchase insurance for farming tokens, DeFi agreements, etc. for 30 days or more by paying ETH and NXM. Once the claim is voted on, you will be paid an equal amount.

In Nexus Mutual, NXM holders are both gainers and risk takers. After staking NXM to become a claim assessor, you have the right to vote on claim events. If the compensation proposal is passed, part of your pledged funds will be used for compensation, otherwise you will receive NXM benefits.

Head DAPP: Nexus Mutual

Overall, the DeFi market has the following characteristics:

1. Ethereum DeFi dominates. The number of DeFi DAPPs on Ethereum exceeds 1/6 of the entire market, and the locked-up volume accounts for 58%. Followed by ecosystems such as BNB Chain, Fantom, and Avalanche.

2. DEX, Staking, and lending are the DeFi scenarios with the clearest needs and models. When any new Alternative L1 and L2 appear, these three types of DeFi protocols are always the first to be deployed.

3. The new ecological DeFi may contain some opportunities, such as new public chains, DeFi projects on Layer2, such as VVS Finance on Cronos, DefiChain, Benqi on Avalanche, Marinade Finance on Solana, and Ref Finance on Near. The underlying tokens of these new ecology are also worthy of attention.

4. Decentralized derivatives and insurance tracks still have great potential waiting to be tapped.

Value Capture in DeFi

Generally, we can use TVL (total locked position value), user volume, transaction volume, revenue, MV (market value), FDV (fully diluted valuation), MV/TVL, P/S (market-to-sales ratio), P/E ( Price-to-earnings ratio) and other dimensions to measure DeFi.

TVL is the most commonly used metric for evaluating DeFi protocols. Although traditional finance advocates capital flow and transactions, considering that DeFi is in its early stages of development,TVL is a data that can explain the scale of the DeFi protocol.

TVL means how much money users are willing to lock into a DeFi protocol, trusting it to a certain extent, in exchange for whatever utility it provides (such as earning yield, lending assets). Since TVL only represents the overall size of locked assets, the degree of dispersion of users participating in locked positions needs to be considered at the same time, so as to rule out the situation where a few whales with relevant interests raise the TVL.

The degree of usage of the protocol can be said to be the fundamental indicator to measure the value of the DeFi protocol.When more and more users use DeFi, such as trading, lending, staking, insurance, etc., there will be a huge transaction volume and transaction value on the protocol,Especially when this phenomenon occurs in a non-farming situation, this DeFi protocol proves to be very attractive.

Income refers to the fees charged by the DeFi protocol to users who use its functions. For Uniswap, the income is the user's transaction fee. For Compound, the income is the interest paid by borrowers on the platform. For Lido, the income is Total staking revenue.

Some DeFi protocols will distribute income to ecological participants, such as holders of governance tokens. This is the protocol revenue of the DeFi protocol, which is equivalent to the protocol ecology capturing the value brought by protocol interaction.

For Curve, it will distribute part of the user transaction fees to CRV holders. For Aave, holders of AAVE can get a part of the interest paid by borrower.

Revenue provides funds for the operation and improvement of the DeFi protocol, and is an important indicator of the sustainable development of the DeFi protocol. The protocol income allows DAPP to capture the value of the protocol and return it to the ecology. This tends to provide upward momentum for governance tokens of DeFi protocols.

The comparison between MV and FDV can be used to assess whether there are still a large number of tokens that have not yet entered circulation, which may bring greater selling pressure.

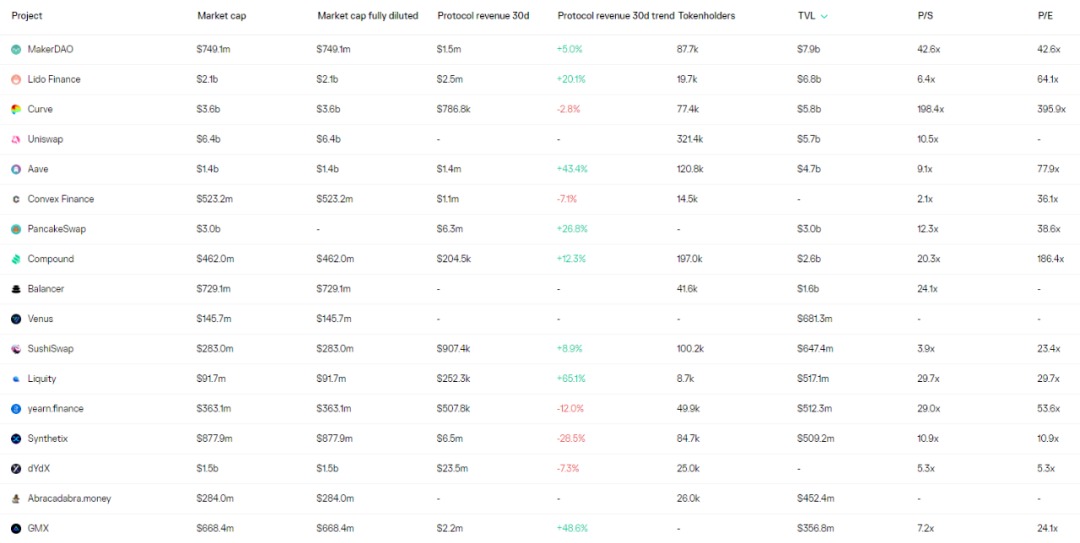

MV/TVL, P/S, and P/E are often used to measure whether the market value/price of the DeFi protocol is overvalued, and whether there is a large upside potential. The calculation method of the first two indicators is to divide MV (or FDV) by TVL and revenue respectively, and the calculation method of P/E is to divide FDV by agreement revenue.image description

Various indicator data of some DeFi protocols, source: Token Terminal

In addition, the innovation and team of the DeFi protocol itself are also very important factors.Innovation is mainly measured by the track (problem to be solved), positioning, and solution (feasible, concise, and innovative) that the protocol cuts into.

Curve is positioned to provide swap services for stable coins and linked assets, single-currency liquidity and multi-currency pools proposed by some DeFi protocols, and the synthetic asset trading model proposed by Synthetix (no counterparty is required, the exchange price is calculated), etc. are very good example of.

Through the evaluation of the above dimensions and the focus on innovation, we can find some high-quality and even exciting DeFi protocols, and becoming a participant in these ecosystems may help us capture the dividends of DeFi development. Opportunities are also buried in potential tracks such as decentralized derivatives, as well as new public chains and Layer2 DeFi ecology.

Opportunities and Challenges

Recall that in real life, where do your assets mainly go? I believe that many people's answers will be bank deposits, stock investment, encryption investment, real estate and so on. If these activities are translated to the chain world, they are actually staking, DEX and other scenarios.

At present, the total lock-up value of DeFi is about 60 billion US dollars, which is still a baby compared with the market value of the encryption market of 1 trillion US dollars. Although DeFi has experienced a midsummer, we believe that its market and potential are still huge.

Although the current DeFi market has blossomed, there are obvious homogenization problems among DeFi protocols. This market needs more innovations, such as the research and integration of NFT AMMs, such as the development of decentralized derivatives markets. They may constitute the driving force for the second round of DeFi rise.

Reference article:

Reference article:

"The first anniversary of the outbreak of liquidity farming, let's see how DeFi grows" by Pan Zhixiong

"Using 12 Indicators to Comprehensively Evaluate Different DeFi Protocols" by Way of the Metaverse