Original source: LD Capital Research

first level title

sequence

Back in 2020, with the advent of a bull market, the increase of Web3 users on the chain and the emergence of Uniswap, Opensea, and more Defi and NFT-related Dapps, public chains such as Ethereum began to be overwhelmed. The skyrocketing Gas fee, congested network and the rampant trading robot MEV make the Web3 user experience extremely poor.

At this time, some maverick public chains or infrastructure began to find new ways, trying to break through the plight of public chains such as Ethereum and go out of their own style.

For example, Terra focuses on algorithmic stable tokens, FLOW focuses on NFT, Cosmos and Polkadot focus on multi-chain and cross-chain, Avalanche innovates through the three-tier network architecture of X, P, and C, and NEAR achieves higher speed through sharding. These public chains are challenging the impossible triangle of the blockchain, trying to achieve better scalability and security, more decentralization, and greater security, or to give users a better experience by focusing on overcoming specific difficulties.

first level title

focus makes a difference

Blockchains are divided into public blockchains (public blockchains), consortium blockchains, and private blockchains. The public blockchain with the largest TVL and users is Ethereum. In addition to Ethereum, other public chains will have different focus points in terms of their own positioning classification or subdivision characteristics, and compete with Ethereum through differentiation.

secondary title

Canto: DeFi public chain based on Cosmos

image description

Data source: Canto.io

After observing the development of DeFi, the team came to a conclusion: from the launch of DAI at the end of 2017, to the emergence of many DeFi projects in 2020/2021. The Defi ecosystem has three core elements - DEX, lending and decentralized stable tokens. And with the development of the ecology, these projects will make the same decision to issue governance tokens. Therefore, Canto puts forward a radical concept: the core element of DeFi should exist as a free and unlicensed public infrastructure (Free Public Infrastructure) to promote the development of the ecology.

As a Defi public chain, three Dapps have been officially launched: Canto DEX, Canto Lending Market (CLM) and $NOTE token.

Canto DEX

The official DEX, like most DEXs, Canto uses an automated market maker (AMM) to price assets. To prevent predatory rent-seeking, the DEX will run forever without charging fees, cannot be upgraded, remains ungoverned, and will not roll out tokens or impose additional fees over time.

Canto Lending Market (CLM)

The code is derived from Compound v2's fork lending platform. CLM will allow Canto DEX's LP tokens to be used as collateral. Collateral can be deposited in the lending market, but users will not be allowed to lend LP tokens. CLM is governed by Canto token stakers. For better ecological development and user cultivation, the pledgers of Canto tokens have common interests, so the CLM administrators will not collect rent at the application layer.

$NOTE Token

$NOTE is an over-collateralized token, the core of the Canto public chain. Its value is stabilized at 1USD by an algorithmic interest rate. The characteristics are: over-collateralization, high capital efficiency, decentralization, and full automation.

The only way to obtain $NOTE is to borrow from CLM, and the interest on the loan is used for the ecosystem and managed by Canto DAO.

NOTE The way to control the price stability of the pass is to control the interest rate through the contract to affect the circulation supply. The contract is adjusted every 6 hours. When the value of the NOTE token is lower than $1, the contract will increase the interest rate of the NOTE deposit. Conversely, when the value of the NOTE token is higher than $1, the contract will reduce the interest rate of the NOTE deposit.

secondary title

Aztec Network: Privacy Layer 2 using zk Rollup

Aztec is the first private zk-rollup on Ethereum, which realizes anonymous transactions between accounts through the underlying Plonk proof mechanism, and realizes private interactions with Defi projects through Aztec Connect.

image description

Data source: aztec.network

The team believes that decentralization is premised on individual rights, and that without privacy, it compromises our ability to choose and earn a living. Therefore, the team takes privacy as the core, and the goals are: privacy (use zk-rollup with privacy priority, and can access Ethereum Dapp privately), ease of use (reduce Dapp interaction cost and maintain privacy through Aztec), compliance ( Privacy programming language support joins auditability and compliance).

zk.money and Aztec Connect are currently available. Noir, a Rust-based privacy programming language created by Aztec Network, will be launched soon, allowing developers to safely and perfectly build privacy-protecting smart contracts on Aztec.

zk.money

zk.money is a Layer 2 privacy application built on the Aztec network, using Plonk (zk-SNARK) to ensure the anonymity of sending and receiving tokens, and will not publicly release any transaction data. Ethereum users can use it to protect their transaction data from being made public. At present, through the function of Aztec Connect, zk.money can already interact with dapps such as Lido, AAVE, Curve, UNISWAP and Liquity.

Aztec Connect

Aztec Connect is a set of privacy tools that connect the Ethereum DeFi protocol to Aztec, allowing composable private DeFi operations on Ethereum. The current privacy tools are Bridge Contracts (Bridge Contracts that connect Ethereum smart contracts to Aztec's wire interface) and SDK (a front-end toolkit that supports a web interface to access the Aztec Connect integration).

To put it simply, Aztec Connect is like a ladder, using the rollup contract as an agent to interact with Ethereum Dapp on the Aztec network, and can save users' gas costs.

secondary title

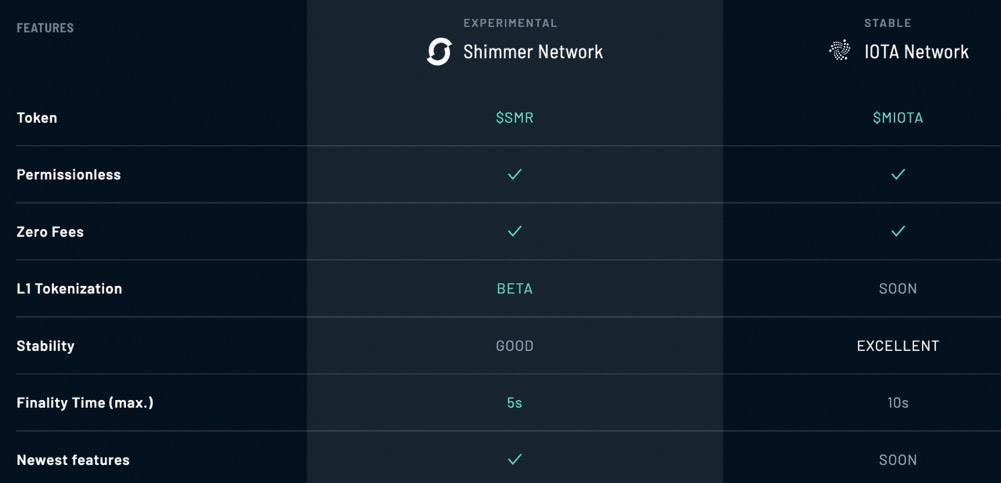

Shimmer: The leading modular network of IOTA2.0

Shimmer is a Layer 1 network. The protocol is based on IOTA's parallel DAG (Directed Acyclic Graph, IOTA's "Tangle"), and has been upgraded and added new features (such as native tokens, output types, Layer2, decentralization, etc.). It and IOTA are building a new distributed architecture that will be the new scalable, modular decentralized blockchain, with cutting-edge developments to validate innovative technologies before launching on the IOTA mainnet.

Shimmer will use the Stardust protocol, which is an upgraded version of IOTA 1.5 (also known as Chrysalis), which can upgrade IOTA to a distributed public chain that supports multiple assets and supports the operation of smart contracts.

image description

Data source: shimmer.network

Data Cap/Byte Cost:Since storage space is a finite resource for any blockchain, Stardust will place an upper limit on the data included in a transaction, which can scale with the number of tokens included in the transaction. The space used in this way can be distributed fairly, while keeping Shimmer unaffected, and guaranteeing that the block size does not grow uncontrollably like most blockchains. The maximum block size is limited by the number of existing tokens, which limits the ability to store data indefinitely in a block, and binds the token value of the transaction, known as the "byte cost".

Protection against dust attacks:The function brought by the byte cost, if the data needs to be kept in the Shimmer block, the token needs to be locked for permanent storage of the data. It is only possible to inflate blocks by spamming them if a dusting attacker is willing to pay for it.

Output unlock condition:When the user transfers the custom pass, it must be sent with a certain amount of original pass to support its data storage in the block.

To this end, Stardust introduces an output unlocking condition: if the sender provides the required token deposit, it can be set that the receiver must replace the sender's deposit with his own deposit when receiving the custom token. The certificate deposit will be refunded automatically. The sender can also set the receiver to complete the deposit replacement within a certain period of time. If the receiver fails to replace it within the specified time, the token or NFT will be automatically returned to the sender.

Modularity:Later, with the development of the smart contract architecture layer Assembly, the various application chains built above can be connected as the settlement layer IOTA2.0 and Shimmer, combining various possibilities.

secondary title

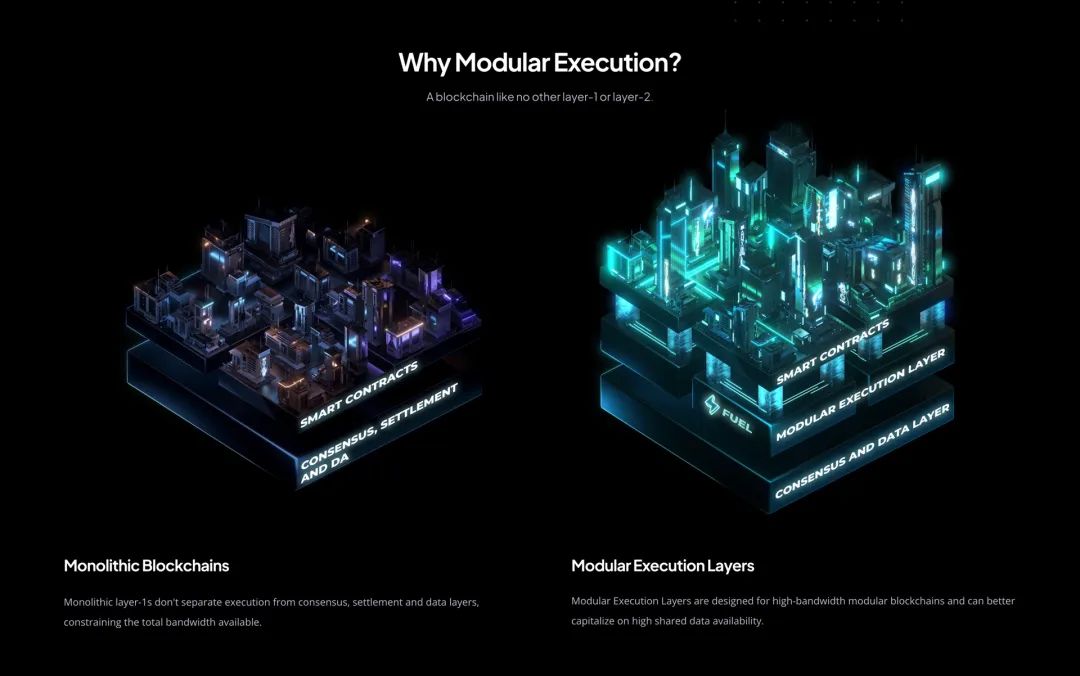

Fuel: High-speed modular execution layer

Initially, Fuel V1 was Layer 2 of Ethereum, which was deployed at the end of 2020 using Optimistic Rollup, while the current Fuel has started the V2 high-speed modular execution layer plan.

image description

Data source: fuel.network

Parallel transactions:Using the UTXO model, it provides unparalleled processing capabilities through strict state access lists and parallel execution of transactions.

FuelVM:With FuelVM, the goal is to reduce the wasteful processing of traditional blockchain virtual machine architectures, while greatly increasing the potential design space for developers.

Excellent development experience:Use self-developed Sway and Forc (Fuel Orchestrator) to provide developers with a better development environment. Sway is the domain-specific language of FuelVM, developed based on the Rust language, and is a blockchain-optimized VM specially designed for the Fuel blockchain.

Summarize

Summarize

With the approach of Ethereum Merge and the development of Layer 2, some developers also found that simply copying the overall design of Ethereum cannot stand out from the crowd of public chains. Therefore, some teams have turned to a more subdivided public chain market to gain the favor of mainstream users, developers and blockchain native users. Now FLOW insists on developing the NFT ecology, developing users through youth related IP and mainstream related IP, as well as Canto, Aztec, Shimmer, Fuel mentioned in this article and more through modularization, privacy, developer & user friendliness, NFT, Layer2 and other directions, targeted development of the public chain.

It is believed that the combination of public chains that serve market segments and large public chains such as Ethereum will eventually bring a more secure, private, fast, and life-like blockchain to WEB3 users, developers, and mainstream users who use blockchain in the future.

References

References

[1] https://canto.io

[2] https://docs.canto.io/overview/about-canto

[3] https://canto.mirror.xyz

[4] https://aztec.network

[5] https://medium.com/aztec-protocol

[6] https://shimmer.network

[7] https://blog.shimmer.network/

[8] https://fuel-labs.ghost.io/