The much-anticipated merger of Ethereum has finally entered the final countdown.

As of 15:00 on August 25th, the "Ethereum Merger Countdown" page of Okey Cloud Chain shows that Ethereum is expected to complete the merger at around 5:30 on the 21st. The Ethereum official also issued a statement stating that the final date of the merger is expected to be around September 16.

In the article "There are too many professional interpretations of Ethereum mergers, but this one is the most suitable for novice users", Ouyi Novice Academy also made an easy-to-understand but detailed and comprehensive introduction to this hot event. Interested parties Readers can click to read directly.

To put it simply, the merger is the process of Ethereum converting from the POW mechanism to the POS mechanism. The former uses computing power mining to produce blocks, which benefits miners; while the latter adopts the method of pledging assets, which benefits users and developers. That is to say, the output of Ethereum is no longer mined by computing power. Ordinary users can complete transaction confirmation and receive rewards by depositing ETH assets on the chain, which means that miners lose their jobs and the threshold for user participation is lowered. In this regard, the miner group resisted in the form of a hard fork, that is, another Ethereum chain that continues to adopt the POW mechanism, which is equal to the POS version.

As the merger is approaching, Ouyi Novice Academy has sorted out 10 must-read questions for users, and correspondingly gave comprehensive, clear and easy-to-understand answers to help novice users grasp the key points of this major event Relevance is based on, or it is used to further enhance the understanding of Web3.

1. What is the relationship between the merger and Ethereum 2.0?

Ethereum 2.0 is the ultimate goal of Ethereum, and the merger is only the first stage of realizing Ethereum 2.0, and the two cannot be equated. After the merger, four stages of optimization and upgrades need to be completed before Ethereum 2.0 can be finally realized, and the realization time is estimated to be around 2025. At that time, the TPS of Ethereum (that is, the number of transactions that can be confirmed per second) can theoretically reach 100,000, but now it is only less than 50.

2. After the merger, will the gas fee and TPS issues be significantly improved?

After the merger, the problems of high gas fees and low TPS will be alleviated to a certain extent, but the current predicament will not be completely reversed.

Because the sharding technology upgrade that completely solves the underlying performance problem needs to be completed in four stages after the merger. The merger stage is mainly to realize the smooth switching of the consensus mechanism, that is, to transfer from POW to POS safely and stably. But what is also exciting is that after switching to POS, the energy consumption of Ethereum will be directly reduced by more than 99%, because physical mining machines are no longer needed, and the widely criticized pollution problem will be solved once and for all.

3. Why can the merger bring about the deflation of ETH?

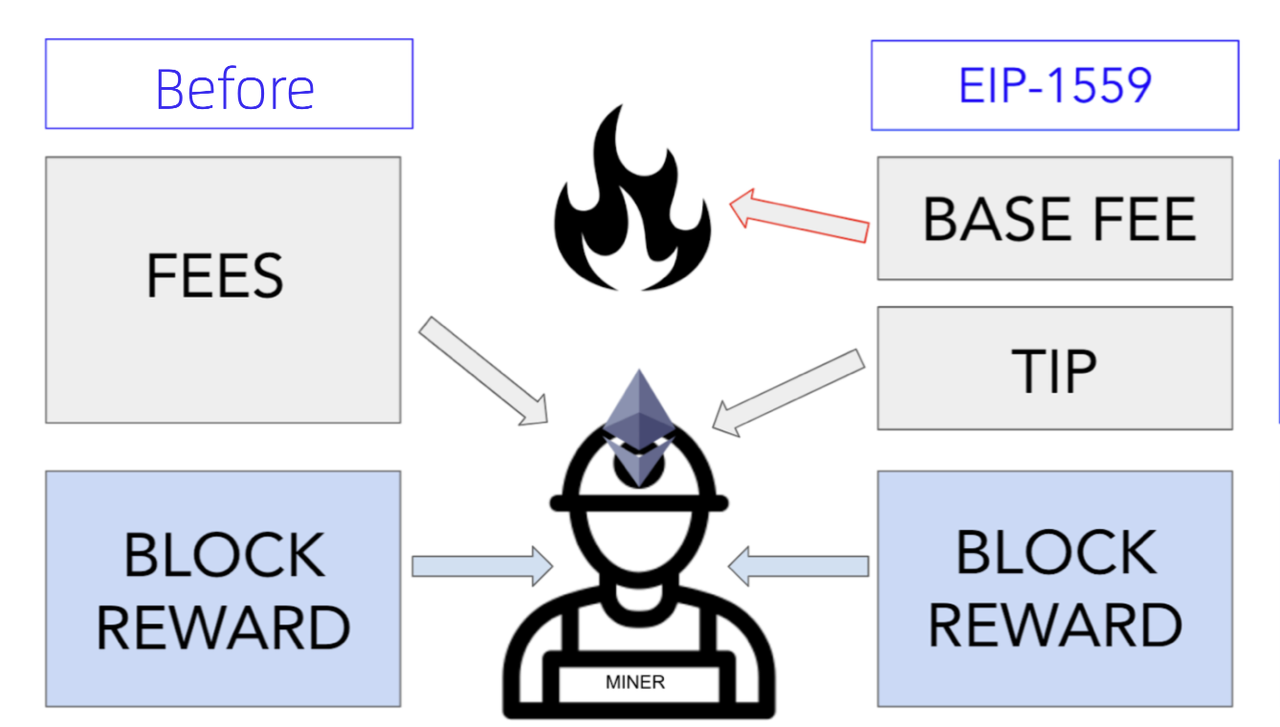

In the POW mechanism, in order to maintain the operation of the network, Ethereum needs to pay a large amount of ETH as a service fee reward. This part of ETH is actually an additional issuance of assets. After flowing into the market, it will form an inflation model, that is, there will be more and more Ethereum in circulation. Therefore, this model that affects the scarcity of assets is bound to be detrimental to value preservation and appreciation.

After merging the transfer to POS mechanism, Ethereum no longer needs to pay additional fees to miners, and ETH theoretically does not need to issue additional tokens. In addition, as early as 2020, Ethereum introduced the EIP-1559 protocol, which is a plan for targeted destruction of miner fees, so the current stock of Ethereum will become less and less, theoretically entering a deflationary model, in the long run Conducive to the strengthening of asset prices.

4. Why do you need to pledge 32 ETH to run a verification node?

tradetrade. To become a verification node, there must be a certain threshold. If the number of pledged ETH is too low, it will cause vicious competition between large and small miners similar to the POW mechanism, delaying the transaction confirmation speed, and causing Ethereum to be congested and expensive. But why does it have to be 32 ETH? Because 32 is 2 to the 5th power, and the message transmission under the POS mechanism is exponential, according to the design of the POS mechanism, transaction verification involves mutual recognition of information between the submitter and the verifier, that is, the information submitter and the verifier Confirmation needs to be completed in the shortest possible time based on the number of pledged assets. After system calculation, 32 ETH is the optimal solution. Of course, this number may be dynamically adjusted as the performance is optimized in the later stage.

5. Will Ethereum stakers sell their withdrawn ETH after the merger?

In fact, Ethereum has been preparing for the merger, and in November 2020, it pre-opened a small-scale pledge mode. As of August 1, the data on the chain shows that the total amount of Ethereum pledged is about 13.132 millionETH. As the merger approaches, a considerable number of users who hold ETH worry that these pledgers will sell their pledged funds.ETH, thereby affecting asset prices. According to the mechanism design of Ethereum after transferring to POS, the pledger can only withdraw the pledged assets within 6 to 12 months after the merger is completed. Therefore, there will not be a large amount of pledged ETH sold at the initial stage of the merger. Even after the withdrawal date expires, Ethereum officials will impose restrictions on this, and the withdrawal of assets will need to be queued at that time. To understand it more vividly, the pledged asset pool is like a pool, and the speed of releasing water will be very slow, like a trickle, instead of opening the gate to release the flood.

6. Why has the merger of Ethereum been delayed again and again? Can this Ethereum merger be completed on schedule?

The merger of Ethereum is essentially to make a fundamental adjustment and change to the benefit distribution mechanism of all parties in the ecology. The completion of this task itself has certain challenges. It should be noted that there are tens of millions of Ethereum users, developers, and miners, even all over the world. In addition, Ethereum has developed rapidly in recent years, and the assets and applications on the chain have exploded, which directly increases the difficulty of mergers, because the technical security and interest coordination issues involved are more complicated, so mergers have been considered since several years ago. postponed until now. Before the official merger of the mainnet, Ethereum has successfully completed three testnet mergers, that is, three rehearsals and training before the merger. Officially, the merger is expected to be completed around September 16. In this regard, Ouyi Novice Academy will continue to pay attention to it, and we will also do follow-up interpretations of popular science related to the latest situation.

7. After the merger, will Ethereum encounter cyber attacks?

Under the POW mechanism, the security threat of Ethereum mainly comes from the fact that miners who have mastered more than 51% of the computing power, that is, more than half of the transaction confirmation rights, stop producing blocks, causing network paralysis. After switching to POS, this problem will no longer exist, but new security problems will follow one after another. Because the pledged assets correspond to the voting rights of key issues in the community, this gives the large pledged assets certain authority to do evil. They can vote for proposals that are not conducive to the community, or veto proposals that are beneficial to the ecology, so as to achieve their own goals. In other words, the more assets pledged, the greater the possibility of doing evil.

8. In the face of ETHs and ETHw after the hard fork, how do the leading projects choose?

We also mentioned in the article "There are too many professional interpretations of Ethereum mergers, but this one is the most suitable for novice users". The means by which miners fight back against the merger. After the hard fork, ETH will split into two chains: ETHs (Pos version of Ethereum) and ETHw (Pow version of Ethereum), and the project parties and users on the chain must choose sides. From a common sense point of view, choosing the ETHs chain is the common will of developers and users, because it is more in line with their interests, and it can be seen from the current statements of all parties. At present, the project parties that support ETHs account for the majority, mainly including:

1. The two most mainstream stablecoin issuers: Tether (USDT) and Circle (USDC);

2. Leading DeFi projects: oracle machine Chainlink, lending agreementAave, the decentralized wallet DeBank, and the stable currency trading protocol Curve;

3. NFT projects: BAYC Boring Ape publisher Yuga Labs, etc.

However, most of the project parties that publicly support ETHw are not at the top, and the volume and potential energy are smaller. Some KOL miners are more out of self-interest considerations, and there are very few responders.

9. If the hard fork fails, where will the previous POW miners go?

The current public opinion environment shows that the hard fork has not received widespread support, and it is more of a self-help action initiated by miners. Therefore, after the hard fork fails, miners can only move elsewhere. The main destinations are: turn to other public chain mining that supports the POW mechanism, such asETC; carry out computing power mining of some unpopular assets and projects, such as Grin; carry out other network computing power services besides mining.

It should be noted that the influx of large-scale Ethereum miners into other public chains will bring huge shocks to the output of other project assets, which in turn will affect asset prices. Users who intend to invest need to make prudent judgments, control risks, and choose when buying, such asETC。

10. How can ordinary users enjoy the dividends of this merger of Ethereum?

For the majority of users, the biggest dividend of the merger of Ethereum is that it opens up the earning mode of saving money and earning interest for everyone. In other words, as long as the pledge is deposited in Ethereum, you can get rewards.

At present, the ideal way to participate is the ETH 2.0 lock mining node operator service provided by OKX. Users only need 0.1 ETH to participate in the project, and 100% of the income on the chain is distributed to users. Mining income is dynamically adjusted according to the amount of locked positions on the chain, and the annualized rate of return is expected to be between 4% and 20%.

The platform issues the mining certificate BETH at 1:1, and takes a snapshot of user positions at 00:00 (HKT) every day, divides up the profits on the chain in proportion to the user's BETH holdings, and distributes the mining income at 11:30 (HKT) the next day. whenETH2.0After the mainnet is launched, it can be exchanged back to ETH according to the amount of BETH held 1:1.

Ouyi Reminder: Users should pay attention to the market risks derived from mergers

tradetrade. In addition, if forked chains and forked coins are generated during this process, the airdrop distribution and withdrawal of the forked coins will be determined after their evaluation and confirmation. It should be noted that before and after this major event, it is not ruled out that some organizations issue so-called "forked coins" in a way of speculation, and users need to be cautious. All forked tokens traded on Ouyi must go through the official review process, and tokens that have not been reviewed will not be open for trading.

Ouyi Novice Academy finally reminded that the market price of Ethereum and related assets near the merger may fluctuate greatly, and users need to do a good job in position management and risk warning in advance.