first level title

Table of contents:

first level title

secondary title

1.1 Price drop due to reduced ETH usage

1.1.1 Industry Foam Extrusion

secondary title

1.2 The reduction in the number of ETH obtained by mining machines due to the reduction in the share of POW mining rewards

1.2.1 EIP-1559 reduces miners' income

1.2.2 The Beacon Chain goes online

first level title

secondary title

secondary title

2.2 The main body of the mining market - POW miners move elsewhere

2.2.1 Fork of the original chain

2.2.2 Turn to ETC mining

secondary title

secondary title

first level title

first level title

Preface: Changes in the mining industry ecology caused by the approach of "merger"

In mid-July, Tim Beiko, the core developer of Ethereum, predicted that the implementation date of the merge upgrade of Ethereum's consensus algorithm to PoS would be September 19, which caused shocks in the entire Crypto industry. The merger is to merge the beacon chain run by PoS with the original chain run by PoW, and gradually stop the PoW part of the original chain. This upgrade means that Ethereum will switch to the PoS consensus in the near future. This is a key step for Ethereum towards 2.0, and it has also attracted much attention because it involves the change of public chain consensus. Among them, the group of miners who pay the most attention to this trend may be because it is highly related to their vital interests.

image description

(The average computing power of the entire Ethereum network, the picture comes from OKLink)

first level title

1. Reasons for the decline in the scale of computing power

The scale of Ethereum computing power has shrunk by 16% in two months. The reason is that, on the one hand, the fading of the industry bubble and the cannibalization of competing products have jointly led to a decrease in the project's demand for ETH usage, which further led to a decline in the price of ETH. On the other hand, established improvement plans such as EIP-1159 and Ethereum 2.0 have changed the income structure of Ethereum miners. From EIP-1159 to the launch of the beacon chain directly led to a reduction in the share of POW mining, and then after the "merger" It is expected to gradually shift from POW to POS mining. All of them will lead to a reduction in the profitability of the current Ethereum mining machines, and together contribute to the shrinking of the scale of the Ethereum computing power.

The most direct factor affecting the mining behavior of miners is profit. According to the mining machine profit formula:

Profit = mining machine ETH income - mining machine operating costs

Profit = current price of ETH * amount of ETH obtained by the mining machine - operating cost of the mining machine

secondary title

1.1 Price drop due to reduced ETH usage

text

1.1.1 Industry Foam Extrusion

After experiencing the DeFi boom in 2020 and the NFT trend in 2021, the industry bubble has gradually subsided, the applications on the chain tend to shrink, and the frequency of users paying with ETH has been greatly reduced.

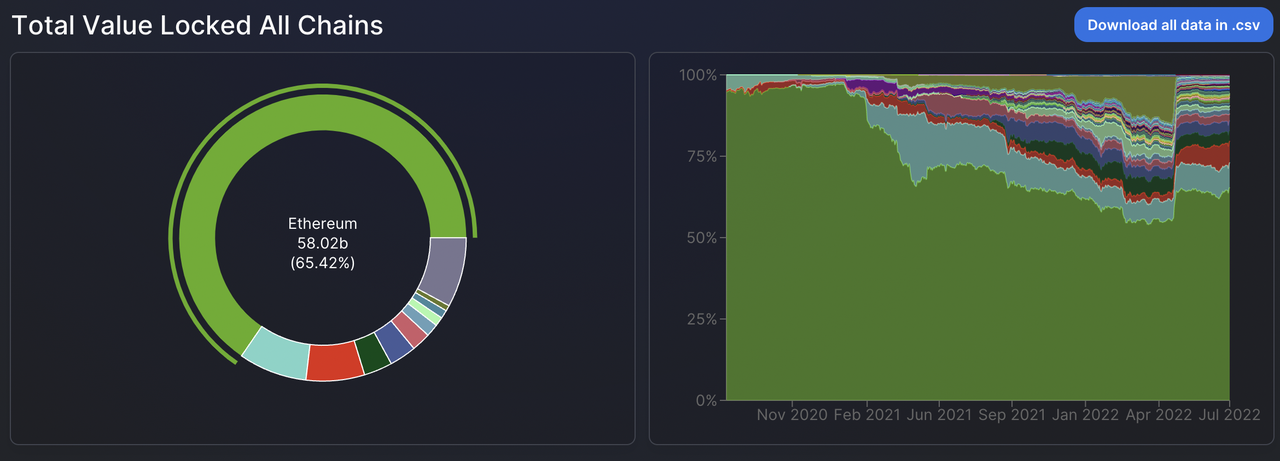

image description

secondary title

1.1.2 Occupation rate of competing products

Many public chains are committed to solving the expansion and performance problems that Ethereum is currently facing. Most of them are compatible with Ethereum codes at the smart contract layer, so as to most quickly undertake Ethereum developers and divert a large number of ETH usage needs. Typical representatives include Solana, Avalanche, Tron and so on.

image description

secondary title

1.2 The reduction in the number of ETH obtained by mining machines due to the reduction in the share of POW mining rewards

According to the mechanism setting, the income of Ethereum miners previously came from block rewards (fixed at 2 ETH) + handling fees, and usually the benefits brought by block rewards are higher than handling fees. Since August 2020, affected by the upsurge of DeFi and NFT, activities on the Ethereum chain have increased sharply, Gas fees have risen sharply, and the proportion of handling fees in the total income of miners has also gradually increased.

text

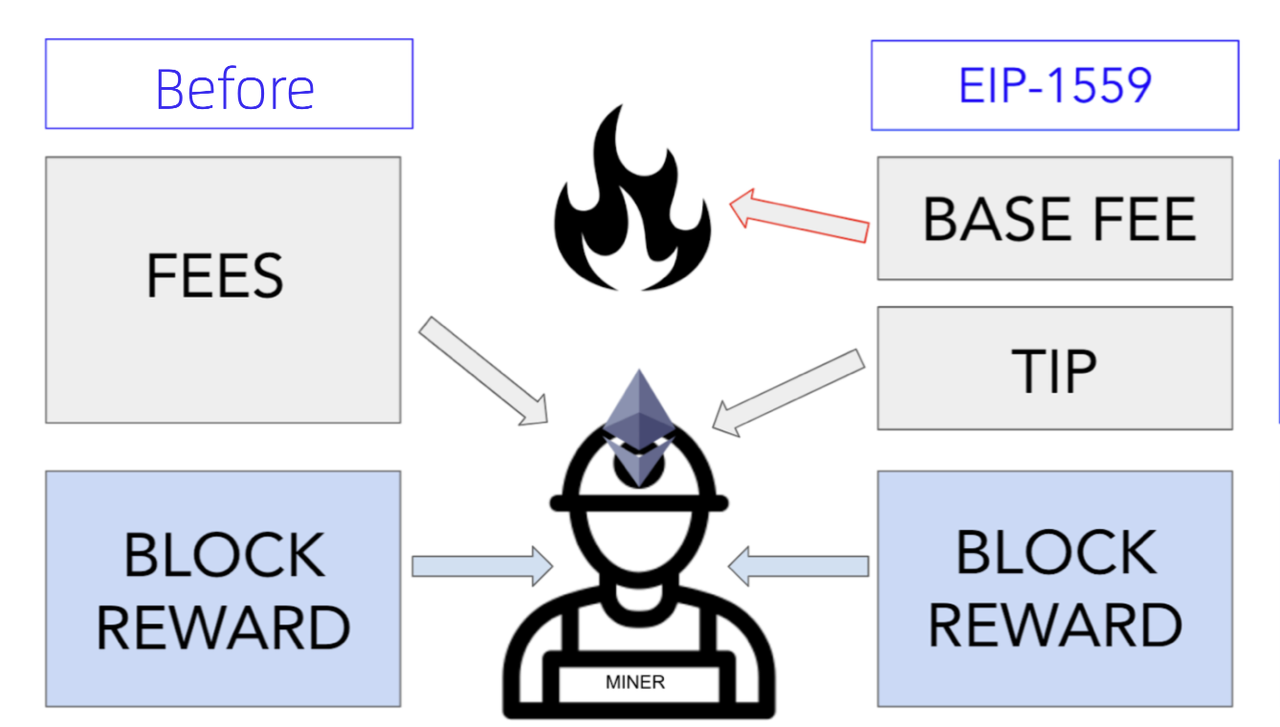

1.2.1 EIP-1559 reduces miners' income

image description

(The change of miners’ income before and after EIP-1559, the picture comes from the Internet)

image description

text

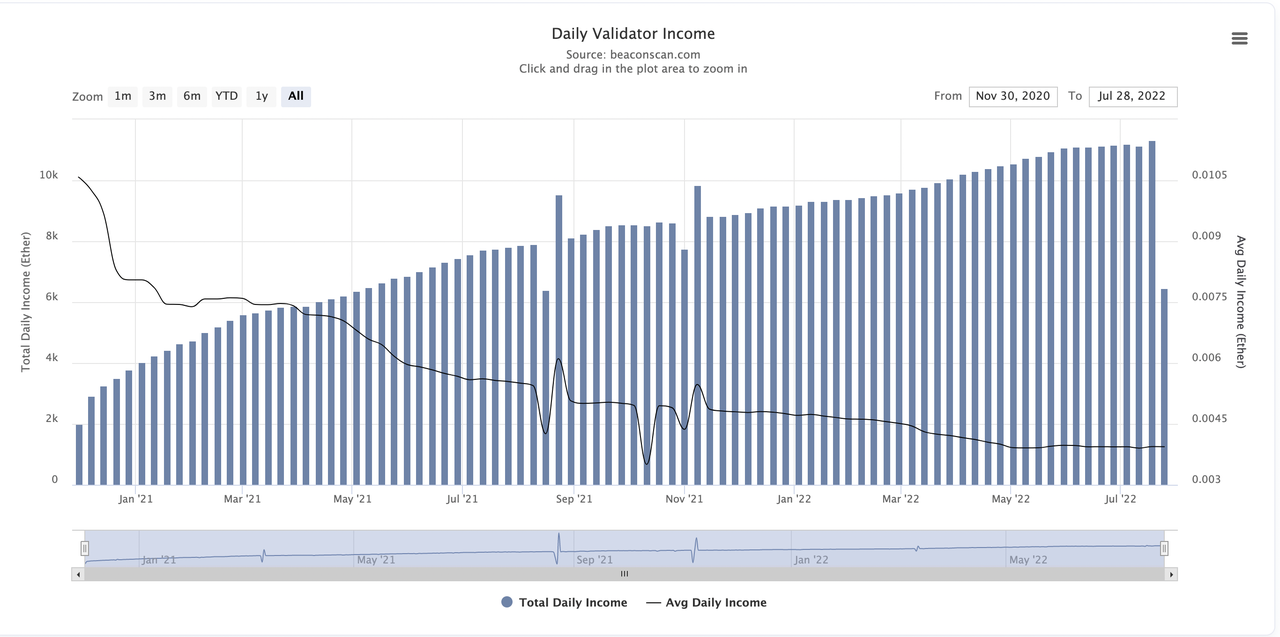

1.2.2 The Beacon Chain goes online

Ethereum 2.0 is an established plan to solve the current network performance bottleneck of Ethereum, and is committed to greatly improving the scalability and performance of the Ethereum network without reducing decentralization. In order to achieve this goal, it has set four development stages. The first three stages adopt the PoW model, and the fourth stage will complete the transformation from PoW to PoS, as well as important upgrades such as sharding and replacing EVM with eWASM. It is the final form of Ethereum. The Ethereum 2.0 network improves the scalability and processing capacity of the network by introducing fragmentation, and the beacon chain is the "command and control center" of the entire Ethereum 2.0 network.

Its latest roadmap shows that the main node beacon chain of the fourth phase of Ethereum upgrade is online, "merged", and sharded. At present, the beacon chain has been launched in December 2020. Since then, the beacon chain has operated in the form of PoS. The process of generating blocks at the execution layer is still carried out by the original chain in the form of PoW. Ethereum has entered a phase of PoW+PoS hybrid mining , Paving the way for the transition of the entire network to PoS.

The beacon chain is online, and the Staking function is enabled, and users can deposit their own Ethereum on the Ethereum 2.0 network. People can lock (pledge) 32 ETH in the software to become validators and participate in verifying transactions to ensure the decentralization and security of the network. In return, stakers will be eligible for ETH rewards. This part also leads to less POW mining rewards.

image description

text

2.2.3 "Merger" is approaching and will gradually switch to POS mining

According to V God, the "merger" planned by Ethereum in the third quarter of 2022 will merge the consensus layer (PoS beacon chain) with the execution layer (PoW original chain), and gradually stop the PoW part of the original chain , this upgrade represents the official switch of Ethereum to the PoS consensus in bu jbu ji. Under the PoS mechanism, the Ethereum revenue that miners can obtain will be related to the ratio of their pledged ETH to the entire network's ETH pledge, without the need to purchase hardware such as mining machines. This means that Ethereum PoW mining will soon withdraw from the stage of history, and it also brings a certain amount of pressure to the miners who are conducting PoW mining.

The conversion of Ethereum POW to POS mining is a gradual process. The launch of the merge difficulty bomb in September is the beginning of the merger. The specific process can be briefly summarized as follows:

Difficulty Bomb Started -> Prolonged block time -> Miners gradually left -> The computing power of the whole network decreased -> Set TTD -> Reached the final target difficulty -> Switched from PoW to PoS (realize mainnet merger)

first level title

2. The impact of PoW to PoS mining

secondary title

2.1 Mining hardware equipment - hardware providers such as graphics cards shrink shipments

The most upstream hardware provider in the industry has benefited a lot from Ethereum’s POW mining. Last year, Nvidia CEO Jensen Huang revealed that Nvidia achieved a profit of US$155 million within three months after launching the Ethereum mining processor; last year, Q2 Nvidia graphics card mining revenue reached US$266 million, the highest in history. Previously, Nvidia had publicly admitted that the transformation of Ethereum from POW to POS was a potential threat to the demand for graphics card (GPU) products. On May 20, a week before the release of the Q1 financial report, the chip giant Nvidia announced a slowdown in recruitment, which aroused special attention and key interpretations from practitioners in the encryption circle. Machine demand plummeted.

secondary title

2.2 The main body of the mining market - POW miners move elsewhere

text

2.2.1 Fork of the original chain

text

2.2.2 Turn to ETC mining

text

2.2.3 Compatible coins for other mining machines

secondary title

2.3 The overall output of the mining industry - the total computing power has dropped sharply temporarily

Undoubtedly, according to the previous article, after the conversion of Ethereum to POS, it mainly adopts the method of pledging tokens instead of mining machine computing power for mining, which is also in response to the call of "carbon neutrality". Therefore, a considerable number of mining machines are temporarily shut down and forced to stop, waiting to find a new usage scenario before restarting. Therefore, it is foreseeable that in the short term, the overall output of the mining industry—the total computing power of Ethereum will drop sharply, and the total computing power of the entire network will also temporarily decline to a certain extent.

secondary title

2.4 The development direction of the mining industry - the rise of Staking pledge mining

After the "merger", Ethereum will gradually switch from P0W to POS mining, and the threshold for users to participate in mining will be lowered. Only 32 Ethereum can be pledged to apply to become a verification node to participate in mining. Therefore, the form of Ethereum mining will undergo a fundamental change, that is, from offline equipment mining to online pledge mining. With the increasing pressure of "carbon neutrality" on the encryption circle, it is not ruled out that some public chains will learn from the leading Ethereum and also choose POS. This will further compress the living space of the physical equipment mining industry, but this is more Just a trend.

Returning to the present reality, after switching to POS, projects based on Ethereum pledge services will become the mainstream, and the proportion of Ethereum pledges before and after the merger will increase significantly. The staking service also has a scale effect. In the case of limited cakes, projects with higher market share are more likely to increase the staking share ratio through scale advantages, thereby further increasing their market share. The top project of this track is worthy of attention , such as Lido.

In addition, because the centralized exchange naturally accumulates various PoS chain assets, and has relatively professional knowledge reserves and equipment resources, it has an advantage in pledge operation services. In addition, the exchange can directly open the trading pair service of pledged derivatives to release liquidity, so most of the current mainstream centralized exchanges in the industry are ETH2.0 self-running node pledge service providers.

image description

first level title

Conclusion: The transfer of Ethereum from POW to POS is a technological upgrade and a redistribution of benefits

Based on the foregoing analysis, the following conclusions can be drawn:

The extrusion of industry bubbles and the encroachment of competing products have led to a decrease in the demand for ETH in Ethereum projects. The established improvement plans such as EIP-1159 and Ethereum 2.0 have also changed the performance of Ethereum while working to improve the performance of Ethereum The income structure of Ethereum miners leads to the reduction of miners’ mining share. These factors combined lead to the reduction of miners’ income, which in turn leads to the reduction of the scale of Ethereum’s computing power. But this also has an invisible and important connection with this round of Ethereum mergers.

Under the established route of Ethereum 2.0, the transfer of Ethereum from POW to POS is a technical upgrade on the one hand, and a redistribution of benefits on the other. In the POW era, miners contributed to maintaining the high-quality operation of the system, and also received huge ecological rewards. After converting to POS, the original POW miners will not be able to continue to participate in mining, and there is a possibility of forking a new chain, "mining" ETC or other miner-compatible coins. Node and pledge services based on Ethereum Staking in the ecosystem will become mainstream.

Since its birth, Ethereum has experienced two rounds of industry cycle tests. It is still the benchmark of public chain ecology and the source of blockchain innovation. At present, it has made many breakthroughs in various underlying technologies, including Layer 2 and Ethereum 2.0. try. The previous POW mining has contributed to the security and stability of the system. After the "merger" and gradually shifting to POS mining, the competition of the public chain ecology will enter the 2.0 stage. The location competition is worth looking forward to.

Based on the current situation, for assets with an unlimited total amount such as ETH, there is no "story" that the total amount of BTC is constant, and the price is mainly maintained by the "supply and demand relationship": that is, the dynamic balance between new increments and burning volume. The amount of burning is closely related to ecological applications. It represents the need to maintain "trust" in the decentralized digital world. Only when the ecology becomes richer and the demand for "trust" increases, can the prosperity of the ETH ecology continue. Therefore, what determines the development prospect of the blockchain is the prosperity of its developer ecology, and the "out-of-the-circle" application is the existence that leads the future of the blockchain.

It can be seen that the impact of Ethereum's transformation from POW to POS mining on the Ethereum mining industry is particularly far-reaching, comprehensive, and even fundamental. In addition, we will follow up research and pay attention to the impact of the merger itself, including the future Ethereum 2.0, on the Ethereum ecosystem and the entire encryption circle. Including a series of potential impacts on the development trend of the subsequent pledge track, whether it will reverse siphon the ecology of other public chains, and where the projects of the Layer 2 track will go, etc., the Ouyi Research Institute will choose an opportunity to publish a special research report in the later stage , in-depth interpretation for readers.