Original author: NFT KOLfoobar

Compilation of the original text: Fog Sea, PANews

Royalties provide a decent income for artists and creators, and if you can make money off royalties, that's great, but it's not enforceable, and it's not suitable for a blockchain. Next I explain why relying on royalties is unsustainable, and how artists can think about more reliable monetization mechanisms.

My goal is not to dispel the idea of an artist or creator relying on royalties to make money, but to help understand what is sustainable and what is not. I want to discuss with you while reserving differences, not arguing tit for tat. Creators who fully integrate cryptographic thinking and create decentralized assets through well-thought-out mechanism design will be rewarded handsomely. This article starts from the following four aspects:

royalty incentive mismatch

Royalty cannot be enforced

Centralization destroys value support

first level title

royalty incentive mismatch

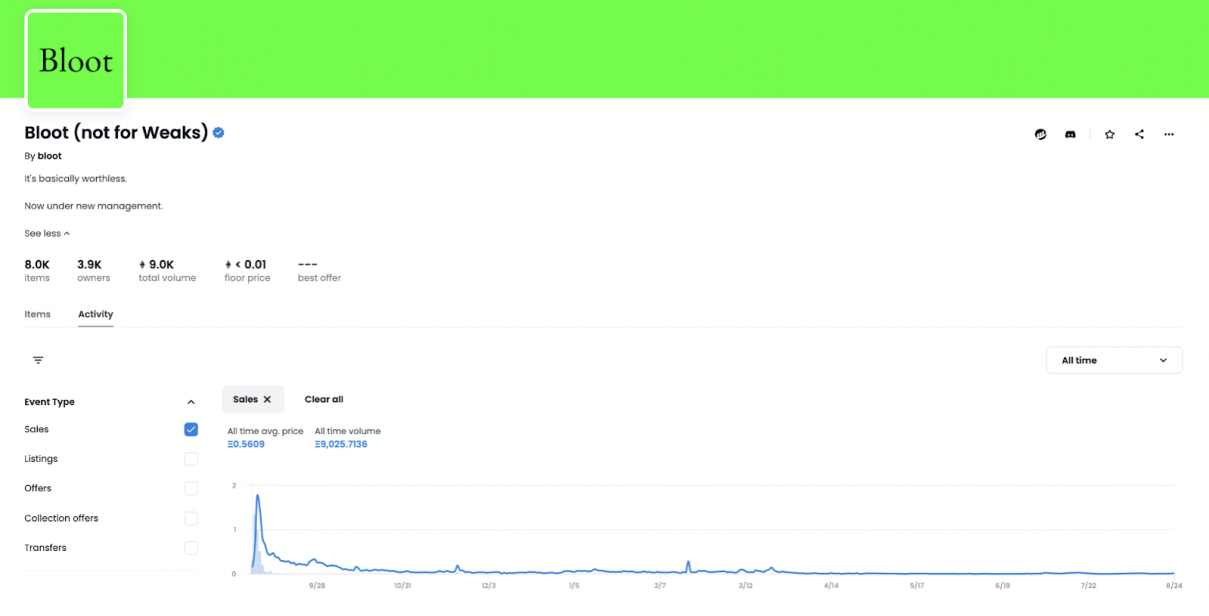

Take a closer look at the picture below. The project party set a 6.9% royalty, thus earning hundreds of ethers, and millions of dollars flowed into the freemint project. Bloot is a failed project, leaving collectors with nothing, while the project side still earns a lot of money from royalties.

Bloot, a notorious freemint project pumped out by Beanie & co. The transaction volume is as high as 9000 ETH, but the current floor price is less than 0.01 ETH

Creators should be incentivized based on the market value of collectibles, not the volume of collectibles traded. There is an obvious variant of incentives where creators profit based on the volatility of collectibles and the transaction frequency of holders, while earning nothing from diamond hands or faithful believers. This also clearly incentivizes lower quality pull-ship freemint releases, so it's no coincidence what we're seeing.

The remuneration of trustees of traditional financial institutions is proportional to profits, not to transaction volume. When an NFT project party is sold to zero because the community learned about the disgraceful deeds of the founding team, this disgraceful founding team gets a secondary income through royalties, which is wrong.

What kind of incentive matching model is better?

first level title

Royalty cannot be enforced

NFTs are decentralized bearer assets. A bearer asset means that the person holding it has ownership and full control, and decentralization means that ownership/control cannot be revoked by a third party at any time. Enforcing royalties on-chain is not possible without introducing the control of a centralized mechanism.

The first concept to understand is side payments. Unilateral payment means that Alice pretends to sell to Bob at a low price on the chain, and then Bob sends the payable funds to Alice alone. The true transaction price cannot be checked out in the sale transaction itself.

The second concept to understand is the wrapper contract. A wrapper NFT collection corresponds to an original NFT collection, and allows users to mint the wrapper version by sending the original NFT to the escrow contract. The wrapper NFT acts as a claim against the target, can be traded freely, and is not subject to all the restrictions that the original NFT project party may write into the contract. See Wrapped Penguins, an experiment by the community against Cole before he sold ownership of the project.

Wrapped Penguins, a community rebellion led by Vincent Van Dough against Cole's previously ineffective leadership

The third concept to understand is the free transfer of assets between wallets. Swapping wallets is a fundamental direction for theft prevention, financial security, key management, privacy, and personal security. While a few experiments such as veTokens limit transfers, this makes no sense for transferable veNFTs. Some have proposed breaking this functionality by having centralized administrators reverse transfers after the fact, adding KYC requirements to prove wallet ownership, or adding a fixed fee for transfers. However, this workaround is worse than a virus and destroys the very heart of the ethos of cryptocurrencies.

Next, refute several common views.

What if you put royalties hard in your contract? This just speaks to a lack of understanding of how ERC721s work. The transaction is carried out through authorization and transfer on the NFT trading platform contract.

What if you hard-coded fixed fees into any asset transfer contract? It's not a royalty, it's just a transfer fee. It is also possible to transfer the NFT to a Wapper contract at one time to avoid taxation on transactions after the NFT, because the Wapper contract generates a new Wapped NFT that can delete the original mechanism.

What if you hardcoded oracle fees in any asset transfer contract? Running an oracle is difficult and centralized. Although it affects the transfer of assets between wallets, the original mechanism can still be deleted by transferring to the Wrapper contract, in the same way as above.

What if you blacklist marketplaces that don't respect your royalties? You cannot blacklist a trading market website, you can only blacklist a contract address. Trading platforms can replace contracts, and new contracts can always be replaced. It's a constant game of cat and mouse. This requires continuous control, and the risk of asset freezing due to accidents or malicious intent is inevitable in the process.

first level title

Centralization destroys value support

solution"solution"is to grant creators permanent administrative access to blacklist addresses, destroy assets, or revoke transfer permissions. For crypto collectors, this is an unacceptable trade-off with obvious unknowable risks. DCinvestor said it best:

I will never buy an NFT that contains code that could limit my ability to transfer it, not because I won't pay royalties, but because I believe in NFTs as permissionless, censorship-resistant bearer assets. Destroy it, and such an NFT becomes meaningless to me.

when people suggest"Cancellation of transfers between wallets","Add a centralized blacklist",or"Let creators destroy assets"first level title

How can creators profit sustainably?

The reason for moving away from reliance on mandatory royalties is not that they are morally wrong. As mentioned above, they just don’t fit the paradigm of permissionless blockchains in the long run. So, what kind of creator mindset works best on the blockchain?

1) Creators reserve some works to maintain liquidity

Creators can reserve part of their work for themselves. LarvaLabs does this, so does 8liens, among many other projects. Through NFT financial tools like sudoswap, you can also earn handling fees without the need to pull and ship to fans or community members.

2) Social leaderboards with voluntary payment of royalties

Even though royalties are not enforced, many collectors in the field are willing to pay royalties. So making a public leaderboard with information on collectors who voluntarily support artists can be gamified and encourage altruistic behaviour.

3) First sale after proving self-strength

The profits are pretty lucrative too, check out LarvaLabs, YugaLabs, XCOPY, Deekaymotion and more.

4) Supporting work after proving self-strength

Some say it's bad because it requires the artist to have fans. But this is an attention-based economy, and building your own brand is a must for any capitalization case. An unknown creator won't make any money in royalties without being thoughtful.

5) Official endorsement of derivative works

In cryptocurrencies, traceability is everything. So, how does the creator's initial thought accumulate value from derivative works? You have a powerful voice, and even endorsements for high-quality derivative works can be lucrative.

6) Harberger Taxes

Harberger taxes are the cryptocurrency equivalent of royalties. Each NFT holder makes a personal assessment of the value of their asset and periodically pays the creator a fraction of it. Anyone can buy out assets at any time at the current owner's valuation to prevent undervaluation. If you make the transaction curve smoother instead of discrete, this is compatible with free transfer, solves the price oracle problem, and is decentralized.