secondary title

core points

1/ Manta supports private transactions and public transactions, and privacy is one of the options for Manta.

2/ Manta private transactions, compatible with ERC20 Token, ERC721, ERC1155 and other NFTs and soul-bound tokens.

3/ Manta is based on the asset type zkAssets of zero-knowledge proof, which supports users to independently disclose information, customize KYC permissions, and meet regulatory requirements.

first level title

Project Introduction

Project Introduction

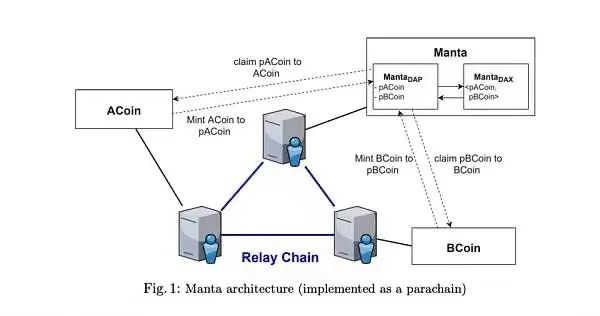

MantaNetwork ($MANTA) is a privacy layer smart contract protocol based on Zero-Knowledge Proof, developed using the Polkadot Substrate framework.

Users can transfer existing ERC20 tokens, ERC721, ERC1155 and other NFT tokens to Manta on Manta, convert tokens into privacy tokens, conduct private transactions, private DeFi interactions, private LP mining, private GameFi, etc. operate.

secondary title

zkAssets: A Compliant, New Privacy Asset Type

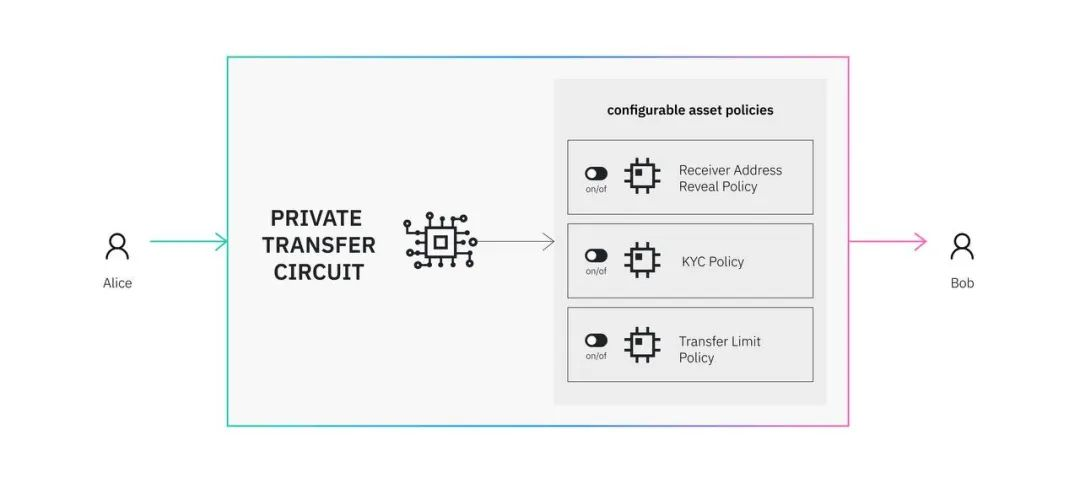

Based on zero-knowledge proofs, Manta created a new asset type zkAssets, which supports homogeneous tokens such as ERC20, non-homogeneous tokens such as ERC721 and ERC1155, soul-bound tokens, and private transactions between Polkadot parachain assets.

Existing tokens and NFTs can be converted into privacy assets through Manta for operation. zkAssets also has the following features:Default Privacy:

zkAssets is private by default on the chain, and the address of the asset holder, the asset of the holder, and the asset type are all encrypted.Voluntary Disclosure:

With the permission of the asset holder, zkAssets supports the disclosure of provable asset information.

Specifically, the holder can disclose the asset transaction history to the auditor without disclosing the Spending Secret. Holders can also selectively disclose asset information that can be verified through ZK.zkAssets transaction issuer, can customize access rights, such as KYC rules, access rights, for example, whether hacker assets can be blacklisted.

secondary title

zkAddress: privacy address

Manta also created a private address type for transfers between private assets zkAssets.

In zkAddress, the ciphertext is randomly generated (eg using the BIP39 mnemonic) and two other keys are derived, the zkAddress and the read-only key. To transfer zkAssets, you need to spend ciphertext (Spending Secret) to generate a zero-knowledge proof.

Based on the privacy asset type zkAssets and privacy address zkAddress, Manta will also provide payment (MantaPay), smart contracts, and DEX (MantaSwap) basic components and functions.

secondary title

Manta protocol infrastructure components: MantaPay, privacy smart contract and MantaSwap

MantaPay is the transport layer for transferring private assets zkAssets to private addresses zkAddress. Currently, MantaPay is in the code audit stage and will be launched on Calamari soon. More information about MantaPay will be announced this quarter.

MantaSwap is a DEX built on a privacy smart contract layer.

secondary title

Technical solutions

1/ Zcash was the first to introduce zero-knowledge proof into the blockchain to realize private transactions. Since Zcash was founded too early, the issue of scalability was still in the early stages of discussion.

Zcash only supports private transactions between native tokens ZEC, and it is difficult to support tokens such as ERC20.

When users use it, they can only buy ZEC on the exchange, put it on the Zcash chain, and trade with ZEC to achieve the purpose of private transactions.

2/ Since then, zero-knowledge proofs have come a long way. Each protocol also launches its own zero-knowledge proof scheme according to different goals, such as Aztec's PLONK, Aleo's ZEXE and so on.

Some are novel and need to be perfected, some are more mature and practical, some tend to prove the efficiency of generation, and some tend to be composable, etc.

3/ Currently, the most widely used zero-knowledge proof protocol is TornadoCash.

TornadoCash is built on Ethereum and supports ERC20 currency mixing. Benefiting from the liquidity of Ethereum, TornadoCash has developed rapidly, but there are still problems.

Functionally, TornadoCash only provides currency mixing services. When users deposit tokens and convert them into privacy tokens, they cannot conduct DeFi loans, LPs mining and other transactions based on TornadoCash.

In terms of compliance, TornadoCash uses currency mixing, and privacy is a must, not an option. Second, TornadoCash refuses to communicate with regulators.

4/ Manta adopts Zcash's mature Groth16 zero-knowledge proof scheme + UTXO payment model, with a built-in zero-knowledge proof circuit.

And created a private asset type zkAssets compatible with ERC20 tokens and NFT, added a private payment channel MantaPay, used the concept of a private asset pool, directly supported AMM transactions of private assets, LPs mining, GameFi on the chain and other functions.

And after the user converts the token into a privacy token on the Manta network, he can directly use the privacy token to perform operations such as AMM, DeFi lending, LPs mining, and on-chain games, which is scalable.

secondary title

Pioneer Network Calamari

Manta has launched Calamari, a pilot network in Kusama, and Dolphin, a privacy test network. Dolphinv1 will be launched in December 2021, and more than 6,000 independent wallet addresses participated in the test.

Currently, Dolphinv2 is live, and participants can get KMA token rewards. The test address and reward form are as follows:

secondary title

summary

summary

Currently, Manta private transactions can be experienced on the testnet Dolphin.

In fact, the Manta network defines two types of assets: public assets (PublicAssets) and private assets (zkAssets).

Similarly, users will also have a public address (PublicAddress) and a private address (PrivateAddress) in Manta.

The public asset trading experience is no different from trading in Uniswap.

When a user transfers assets to Manta, the asset type is PublicAssets. Users can turn public assets into private assets (zkAssets, generated through zero-knowledge proof), and then transfer private assets between private addresses.

first level title

financing

financing

On February 2, 2021, a US$1.1 million financing led by Polychain was completed. Participating parties include Multicoin, Alameda, Hypersphere, Defiance, BTC12, Genblock, Rarestone, AU21, etc.

On October 19, 2021, a financing of US$5.5 million was completed. The institutions include more than 30 institutions including hedge funds CoinFund, ParaFi, LongHash, CMS, and Spartan in the encryption field.

first level title

Token Economic Model

Token Economic Model

https://crowdloanstrategy.manta.network/about-manta-network/the-manta-token

When Manta participated in the Polkadot slot auction, he announced some details of the token economic model.

The original token MANTA, with a total issuance of 1 billion pieces, deflation model. The usage scenarios are as follows:

1/ Network Fee

2/ Casting public assets into private assets minting fees

3/ Fees for converting private assets back to public assets

4/ Pledge Stake

Therefore, the value of MANTA is directly linked to the user's use of privacy features.

Project Analysis

secondary title

1/ How big is the market for Manta? What is the current market situation?

Zero-knowledge proof is the foundation of Manta, and the core functions and future development of Manta are brought about by the property of zero-knowledge proof. Therefore, the track where Manta is located should first be zero-knowledge proof, which is actually privacy.

At present, the main directions and representative projects of zero-knowledge proof (usually abbreviated as "ZK" or "ZKP") are as follows:

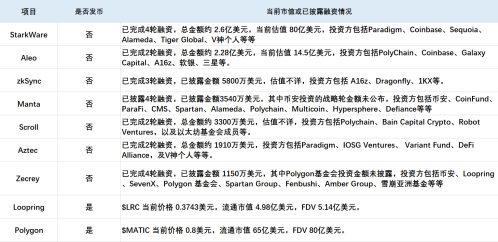

A. Ethereum Layer 2 expansion: StarkWare, zkSync, Scroll, Loopring, Polygon, etc.

B. Privacy: Manta, Aleo, Aztec, etc.

(1) The overall financing amount and valuation of the ZK track are relatively large, and the current highest valuation is StarkWare's 8 billion US dollars. The reason for StarkWare’s large financing and valuation is that, as the implementation layer of Ethereum Layer 2, it also captures part of the value of the Ethereum mainnet while sharing the pressure of Ethereum traffic.

Secondly, Vitalik once said that in the medium and long term, he is more optimistic about the expansion based on ZK-Rollup. Compared with Optimistic, ZK-Rollup can redeem assets without waiting for the appeal period, and the experience is better.

Optimistic Rollup and ZK Rollup?

Optimistic and ZK are reconciliation methods. Rollup is the way transactions are processed.

Optimistic, meaning "optimistic, positive."

Optimistic Rollup "optimistic" assumes that the transaction information is true. Eliminating transaction verification also improves the efficiency of Optimistic Rollup in processing transactions. This is why Aribitrum and Optimism are fast enough.

What if someone provides false transaction information? If you have used Aribitrum or Optimism, you will find that when you transfer tokens back to other networks, you need to wait a few days. This is the "waiting period".

ZK Rollup

During the "waiting period", any node can submit and prove that a transaction is false. If the challenge is successful, the other party's deposit will be fined.

ZK Rollup will generate a zero-knowledge proof, ZK proof, after the transaction is executed.

For the contract responsible for verification, only the verification certificate is required, and no specific verification details are required.

This is why ZK Rollup is also faster, but not as fast as Optimistic Rollup - it takes time to prove it.

Since the proof file is small and the verification time is fixed, the proof itself will not become larger as the number of transactions increases.

More importantly, ZKRollup has no waiting period.

(2) Aleo, which is also a privacy layer smart contract agreement with Manta, is currently valued at 1.45 billion US dollars.

The price of the Manta community round is US$0.3, and the FDV is US$300 million. Compared with Aleo’s valuation, there is nearly 5 times the space.

Among them, Binance only invested in Manta in the ZK privacy track, and invested in Zecrey in the field of expansion.

secondary title

2/ How to support the high valuation, zero-knowledge proof application analysis

First explain what is a zero-knowledge proof. Use a simple example: What is ZK-Knowledge Proof?

How can I prove that I can drive?

Show your driver's license.

This is the basic property of zero-knowledge proof (hereinafter referred to as "ZK"):

1/ Generate a proof.

2/ Privacy. Only the driver's license needs to be shown, and no further information will be disclosed.

3/ Efficiency. Just show your driver's license, and you don't need to spend time showing off your driving skills.

In zero-knowledge proof, there are two parties, one is the transaction initiator and the other is the transaction verifier. The transaction initiator can generate a zero-knowledge proof through the agreement, and the verifier is responsible for verifying the authenticity of the proof.

During this process, the initiator only produced a certificate without disclosing other information. In the verification process, only one node needs to judge that the proof is true, and the proof can be true without redundant calculation.

In addition to expansion and privacy, zero-knowledge proofs are currently applied in the field, and representative projects also include:

(1) Chain games, representing the project DarkForest Dark Forest

Usually, chain game props should be made into NFT chain, which makes the game props and other settings transparent, and the playability is not strong. This is also the reason why most of the current chain games are card games and development games.

Zero-knowledge proof can help chain games generate "fog of war" and hidden props, etc. The project party can hide the map or props and generate a zero-knowledge proof to prove the real existence of the map or props, but it will not be made public yet.

The strategy game on the chain, DarkForest, uses this feature to generate a "fog of war" for players to decrypt the map.

(2) Digital identity DID or personal sovereign identity SSI, representing the projects Humannode, PolygonID

Digital identity DID or personal sovereign identity SSI is personally owned, independent, credible, and verifiable information on the chain. It can be applied to metaverse identities, or on-chain credit reporting to realize scenarios such as non-full mortgage lending.

About metaverse identities. You don't need to display the NFT you hold in your wallet all the time, such as Boring Ape. But you can prove that you are indeed a bored ape holder by holding "a certificate" to participate in the "yacht club".

About on-chain credit reporting. The same is true, there is no need to show the asset situation, only need to show "proof" to prove the asset situation.

In addition, zero-knowledge proof can also be derived from other scenarios, such as private key security.

When a user interacts with the protocol and needs to provide a signature, is it possible to submit a "proof" for signing without providing the signature itself. Even if there is fraud in the agreement, the user's assets will not be affected.

Because only the "proof" is shown, and the proof cannot transfer the wallet assets.

More importantly, in the author's opinion, "privacy" is an "addiction", once you have it, you can't go back to the past.

There are two simple criteria for judging whether a project or technology will become a new paradigm or whether it will bring about change.

1. Once this "thing" is used, can it return to its original state.

2. Will it change the original multi-party game situation?

For example, after using Didi taxi, can you return to the state of waving at the side of the road? Even if you want to take a taxi on the side of the road, you can't do it, because the game situation has changed.

Drivers do not use Didi, and it is difficult to receive orders, so even if users really wave at the side of the road, they may not be able to get a taxi. This behavior will become so inefficient that everyone will use Didi.

The same situation also occurs in many fields such as takeaway.

Therefore, the development of Internet of Things technologies such as cellular communication and WiFi, and the mobile Internet spawned by it, is a new paradigm and a new revolution.

The development of zero-knowledge proof is the same for Web3.0.

It is currently widely believed that privacy only applies to "whale" accounts that hide their whereabouts. But the truth is, most people don't realize the importance of privacy.

Just like, people will understand the importance of anti-theft after losing their mobile phone once.

Currently on-chain, based on ENS or address, it is easy to find out someone's NFT holdings. What if someone pretends to be an artist and announces an airdrop for a certain project, such as Boring Ape, which seems to be a beautifully crafted work of art, but is actually a scam to steal the private key of the wallet?

The "law of the dark forest" has always played a role, but it has not shown its power at the moment because the industry is relatively small.

More importantly, when interacting with the agreement to sign, the "certificate" is used instead of the private key itself, so you are not afraid of being scammed. Can the user go back to the previous state? Will the game situation change? Like Didi for travel?

secondary title

3/ What is the future growth rate of zero-knowledge proof in the eyes of capital? Use Aleo's valuation to reverse Manta's potential growth rate

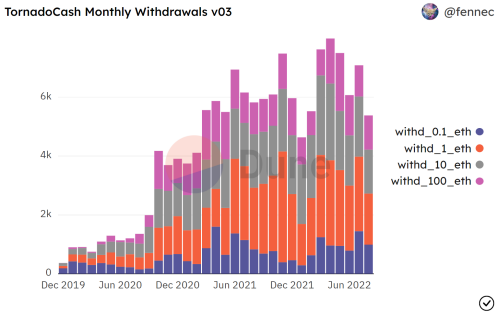

As mentioned above, when private assets are converted into public assets, the handling fees generated will be directly destroyed. Therefore, we can use TornadoCash data as a reference.

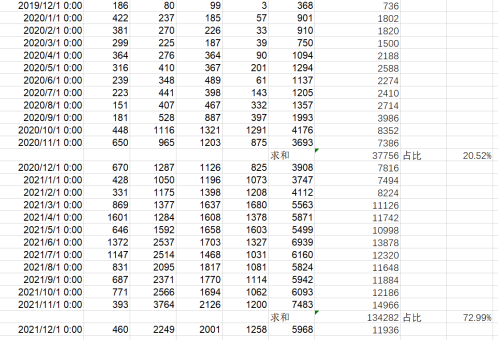

The picture above shows TornadoCash's monthly token withdrawal (redemption). From December 2019 to November 2020, within a total of 12 months, 37,756 ETHs were redeemed, accounting for 20.52% of the total redemption volume of the agreement.

In the second year, 134,282 ETHs were redeemed, accounting for 72.99% of the total redemption amount, with a growth rate of 255.66%.

TornadoCash has generated a total fee income of US$18,701,979 so far. We assume that the Gas fee for each interaction is the same, and the operation is simply divided into pledge Deposit and redemption Withdraw. The redemption then yields a total proceeds of $9,350,989.

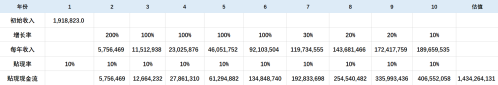

Redemptions generated a fee income of $1,918,823 in the first year and $6,825,287 in the second year.

Thus, our known conditions are:

A. First year income is $1,918,823.

B. Current valuation of $1.4 billion.

C. Assuming that usually DeFi can achieve 10% risk-free return, so the discount rate is 10%.

Then there is the following calculation method:

Revenue per year = 1,918,823*(1+growth)ⁿ where n is the year.

Discounted cash flow is how much the income would be worth now if it were generated some future year.

Discounted Cash Flow = Annual Revenue / (1+ Discount Rate)ⁿ

The following results can be obtained:

To reach a valuation of $1.4 billion, first, the revenue in the first year must reach at least the current level of TornadoCash. On the second day, the growth rate should be equal to that of TornadoCash, reaching a growth rate of more than 2 times.

This may be the growth rate that can be obtained in the next 10 years for the zero-knowledge proof privacy track represented by Manta and Aleo in the eyes of capital.

secondary title

4/ What is the core competitiveness of the project? Are barriers created?

At present, the project is still in its early stage, and it is hard to say that barriers have been created.

secondary title

5/ Future direction of the project? How scalable is the business? Can business expansion expand market value?

The dApp developed based on the Manta network can also effectively expand the Manta business, thereby increasing the value of the MANTA token.

secondary title

6/ Team situation

Kenny Co-Founder

Master of Business Administration from the Massachusetts Institute of Technology (MIT). During his studies, he studied under Gary Gensler, the current chairman of the US SEC (Securities and Exchange Commission), and studied blockchain courses. He once founded a cloud computing company.

Victor Co-Founder

Master of Economics from Harvard University, investor background.

Co-founder of Shumo

Mainly responsible for the technical direction, Ph.D. in computer science and engineering from the University of Washington, and an expert in cryptography.

Personal website https://shumochu.com/.

secondary title

7/ Social Media Situation

Telegramhttps://t.me/mantanetworkofficial 21,Twitter @MantaNetwork 70,335 followers

Discordhttps://discord.com/invite/PRDBTChSsF 37,147 followers (Currently, Telegram is read-only, you can communicate in the official Discord group)

MantaNetwork Chinese Community Twitter @manta_china https://twitter.com/manta_china

secondary title

8 / What are the people and motivations for token selling and buying? Can the demand for token purchases continue? Can it offset the token sell-off? Can business expansion increase token demand?

The value of Manta tokens is based on the use of the protocol, especially the user's need for privacy. The fee for turning private tokens into public tokens will be used to burn Manta.

Anyway, a negative cycle can also be created. The key indicators are protocol usage and destruction.

secondary title

9 / risk

(1) Substitutability risk. Zero-knowledge proof technology is replaced as a whole.