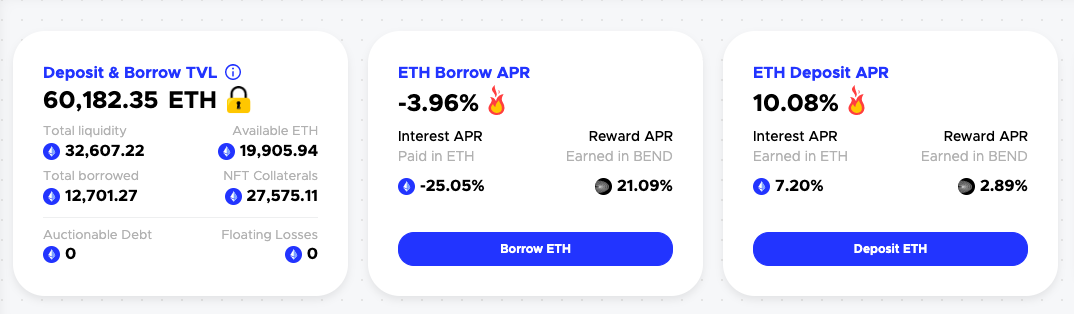

In the past week, the event that has attracted much attention in the NFT market is that BendDAO encountered a liquidity crisis. The latest data on the official website shows that its total liquidity is currently 32,607 ETH, of which 19,905 ETH is available, which has risen to the level of a week ago, basically declaring that the run crisis has been lifted.

BendDAO is an emerging "NFT-Fi" platform that mainly provides NFT mortgage loans. Users can pledge seven NFT projects including BAYC (boring ape) and MAYC to lend ETH, and lenders can deposit ETH to obtain income for The platform provides liquidity.

Since last week, as NFT transactions have been cold, the floor prices of many NFTs on BendDAO have continued to fall, triggering liquidation, and lenders have withdrawn funds. In just four days, as of August 23, the balance of ETH in the BendDAO ETH lending pool dropped from more than 16,000 coins to a minimum of 0.58 coins, which was almost emptied.

BendDAO officials also took immediate measures, including adjusting the auction period, interest rate basis, liquidation threshold, and continuing to discuss the settlement of bad debts. In addition, the floor prices of NFTs such as BAYC have risen in the past two days, market confidence has gradually recovered, and ETH deposits have finally increased. back to pre-crisis levels.

secondary title

Community members remain calm, and the institution's "discount hunting" failed

In this crisis, there are also a few interesting things worth sharing.

First, the mentality of community members is generally good, and there is not much pessimism. Especially as the incident unfolded, many foreign media reported that in the eyes of many community members, it was a "disguised propaganda" of the BendDAO project.

"The withdrawal of funds by depositors will at most affect the short-term expansion of the project. Users cannot mortgage new NFTs to obtain funds. Those who have already mortgaged loans can be liquidated directly when they touch the liquidation line. There are not so many bad debts. Why panic?" Some community members Tell Odaily.

The actual situation is that as BendDAO adjusted the liquidation factor (liquidation threshold, auction time) in time, the liquidation efficiency was greatly accelerated, and it was decided to display how many floating bad debts there are in ETH on the BendDAO auction page, thereby increasing transparency. “Providing more transparency about what’s going on is really important. Even a 100 ETH floating bad debt can panic a 15,000 ETH depositor if someone FUDs (panic, doubt, uncertainty).Transparency is key to trust.”

The second is that some institutions try to buy tokens at a discount.

On August 24, a fund called "ABCDE Capital" issued a proposal in the BendDAO community, saying that it plans to provide it with 10,000 ETH liquidity, provided that the community takes out 2 billion BEND from the treasury (accounting for 20% of the supply). %) sold the fund at a price of 2400 ETH, and the tokens the fund promised to acquire would be locked for 18 months through veBend. (Note: ABCDE Capital is a $400 million Web3 fund established by BMAN, the initiator of the developer community BeWater, and Du Jun, the co-founder of Huobi.)

According to the market price of the day, the value of 2 billion BEND tokens is about 18 million US dollars (11,000 ETH). The fund is trying to "buy the bottom" at a price that is 20% off the market price; and the treasury assets are only 2.3 billion tokens, which is equivalent to the fund's Directly bought the entire project and took a strong "holding".

secondary title

What are the opportunities for the implementation of the new regulations?

first,

first,Can deposit ETH to earn interest. At present, BendDAO plans to adjust the base interest rate to 20%. This move can prompt more NFT holders to repay ETH, and can also attract more ETH depositors to earn more interest. At present, the official website shows that the deposit comprehensive rate of return is 10%, which is composed of two parts: ETH return (7.2%) + BEND return (2.8%), which is much higher than the current mainstream deposit agreement.

Of course, many depositors are worried that their deposits will be loaned out after entering BendDAO and eventually become bad debts. But from the current situation, the risk is relatively low; the ratio between the collateral value (27707 ETH) and the loan debt (12701 ETH) is greater than 2, which also means that unless the current NFT floor price is cut in half again, there will be a large area of bad debts less likely.

Furthermore,Participating in NFT liquidation is more profitable. The new regulations plan to gradually reduce the liquidation threshold from the initial 90% to 70%, and adjust the liquidation time from 48 hours to 4 hours. The specific timeline is as follows:

UTC at 12:00 on August 30th, 90%➡️85%, 48 hours➡️24 hours;

UTC at 12:00 on September 6th, 85%➡️80%, 24 hours➡️12 hours;

UTC September 13 at 12:00pm, 80%➡️75%, 12 hours ➡️ 4 hours;

UTC September 20 at 12:00pm, 75%➡️70%

(Note: The above plan is a BIP9 proposal. The latest BIP10 decision will adopt loose governance, that is, when the liquidation threshold reaches 80%, a new vote of 75% and 70% of the liquidation threshold will be initiated; two votes will also be held at the liquidation time.)

This also means that as the floor price falls for a period of time in the future, NFTs on BendDAO will be more likely to trigger liquidation, and position defaults will be easier; moreover, BendDAO has also canceled the restriction that the liquidation price must be higher than 95% of the floor price. Short (assuming the final adjustment is 4 hours), and you quote at the first time, the possibility of picking up a low price will greatly increase. (Note: The liquidation bid must be higher than the debt amount of the NFT, that is, the loan amount + interest.)

Take yesterday’s BAYC liquidation as an example, the bidding price of BAYC #1590 was 70.1 ETH, far below the floor price of 75.4 ETH. Therefore, interested users are reminded to pay close attention to relevant auctions on BendDAO in the coming weeks.

The credit crisis of BendDAO shows that the NFT lending industry is in its early stage, and there are many problems. It still needs actual combat tests, but it cannot deny innovation in this field. At least BendDAO has provided valuable experience for latecomers with its mistakes and lessons.