Fei Protocol, born with a golden spoon in its mouth, is experiencing the darkest moment of survival. Whether to shut down Tribe DAO, how to compensate users who were damaged by the hacker attack, it has been 4 months since the attack, and the unresolved results have dragged Fei Protocol into the abyss of trust. Although everything has not yet settled, PANews hopes to give the encryption world a little reflection by reviewing what happened to Fei Protocol.

first level title

History of Fei Protocol

With the endorsement of well-known institutions, Fei Protocol has also successfully achieved a cold start through the Genesis phase. In the initial Genesis phase, 10% of the total governance token TRIBE will be directly distributed to the minters of the stablecoin FEI. Fei Protocol raised 639,000 ETH during the Genesis phase and minted about 1.3 billion FEI. After all, who can refuse this kind of "whoring for nothing". The largest decentralized stablecoin, DAI, had a circulation of only 3.17 billion at that time. It can be said that Fei Protocol was born with a "golden key".

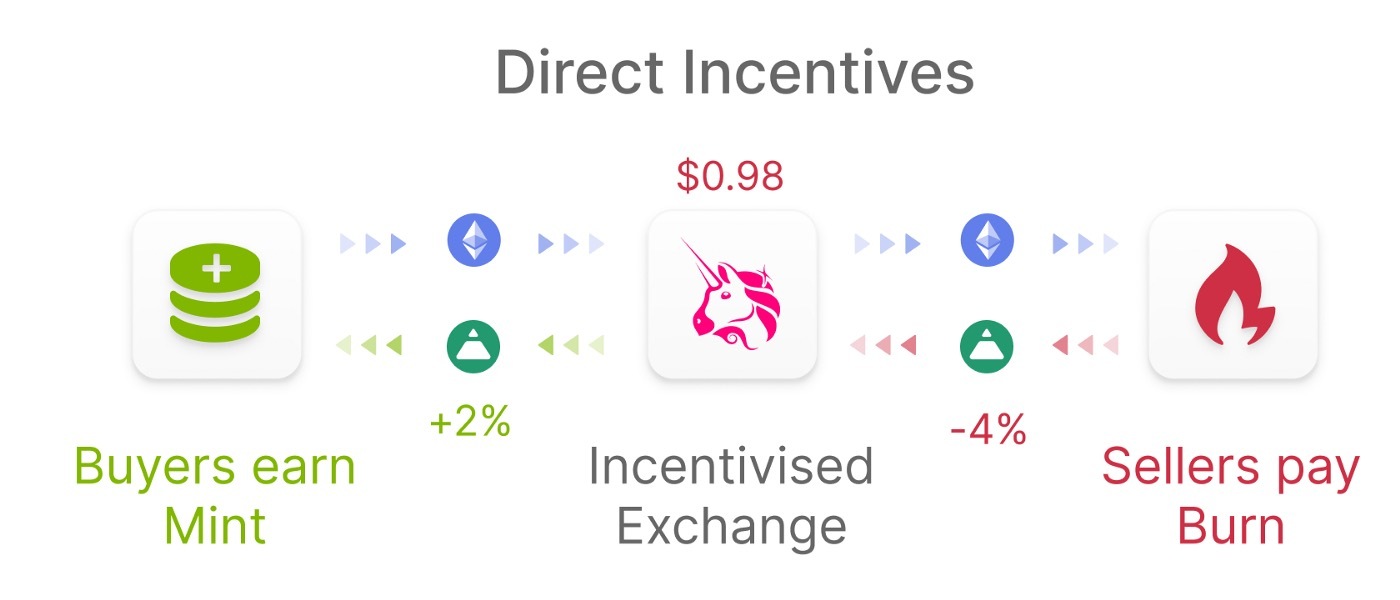

Since a large number of minted FEI are just for the "free whoring" governance token TRIBE, after the launch, users began to rush to sell FEI. At that time, FEI was still a real algorithmic stable currency. When the price of FEI was lower than $1, selling FEI required burning an additional part of FEI, and buyers would be rewarded. The incentive and reward and punishment mechanism of Genesis led to the peak of Fei Protocol when it was launched, and then fell into a "water prison". Misfortunes never come singly, and then Fei Protocol shut down the burning mechanism and reward mechanism due to loopholes, which made the price of FEI completely lose the motivation to return to $1.

Fortunately, ETH gradually rose from $2,000 at the time of minting to $4,000. The project party finally fixed the loophole and allowed users to redeem a certain value of ETH from the agreement directly with FEI. In the end, the price of FEI returned to $1, and a large number of users redeemed FEI for the equivalent ETH. Fei Protocol is equivalent to buying ETH from users at $2,000 (Genesis minting stage), and selling ETH to users at $4,000 (a large number of users redeem FEI for ETH here). Users were able to escape the "water dungeon", and Fei Protocol also accumulated additional ETH.

Since then, the burning and reward mechanism in the original design of Fei Protocol has not appeared again. If that’s all, users can mint FEI with ETH and redeem FEI for $1 in ETH. In the case of extreme market conditions, Fei Protocol's treasury funds may not be enough to allow all FEI to be redeemed for DAI. In order to avoid the risk of market fluctuations, Fei Protocol has gradually exchanged the ETH it holds for stable coins, and bound FEI and DAI. Only DAI is allowed to mint FEI, and FEI can only be redeemed for DAI, similar to DAI in MakerDAO Anchored and stabilized module with USDC. So far, the price of FEI has become a real stable currency, and the possibility of insolvency is very low.

In the case of stable prices, Fei Protocol and Ondo Finance jointly launched Liquidity-as-a-Service (LaaS) to help other projects enhance liquidity in DEX.

first level title

Merge and Stolen

In December last year, Fei Protocol and DeFi protocol Rari Capital completed the merger. Anyone can build a lending pool on Rari Capital’s Fuse, and different lending pools are isolated from each other. As a lending agreement, Rari Capital has a deposit of more than 1 billion US dollars, and FEI as a stable currency is also widely used in Rari. At that time, the merger of the two is undoubtedly a strong alliance, which is conducive to expanding the market of both parties. Since then, Rari's RGT tokens have also been converted into TRIBE tokens, which are directly managed by Tribe DAO, but this also paves the way for subsequent risks and disagreements from the community.

According to PANews, there have been multiple hacking incidents at Rari Capital, as follows:

On May 8, 2021, the ETH fund pool associated with Rari Capital and Alpha Finance was attacked, resulting in a loss of approximately US$15 million.

On November 3, 2021, the No. 23 lending pool Vesper Lend beta on Rari Capital was attacked, with a loss of about $3 million; then on December 31, the No. 23 lending pool Vesper Lend beta was attacked again, with a loss of about $1 million Dollar;

On January 15, 2022, Pool No. 90 on Rari Capital, namely the Float Protocol pool, was attacked by oracle machine manipulation, and about US$1 million in funds was stolen, and the hacker finally returned the stolen funds of US$250,000;

The attack in April this year was the final straw for Rari. On April 30, Rari's Fuse pool was hacked, and the loss was about $80 million due to reentrant attacks.

On May 13, a FIP 106 proposal to compensate Fuse for stolen funds was launched on the snapshot, and the vote was passed. Although the snapshot vote is not binding, it needs to vote on the chain and generate executable code. But in the next month, the team did nothing, and just during this period, the market ushered in a sharp drop. Declining willingness to use Fei Protocol’s PCV funds to repay Fuse stolen losses.

On June 18, the on-chain vote of "repaying bad debts of Fuse" was initiated, but ultimately failed. The relevant parties of TRIBE are not willing to damage their own interests. If the compensation is not fully paid, the remaining funds after liquidation will belong to TRIBE holders.

first level title

Compensation Dispute

According to the compensation standard discussed now, the stablecoin FEI can be redeemed as an asset of US$1, and small and medium-sized investors may be fully compensated if the loss is less than US$500,000, but there are still more than 20 users whose losses cannot be fully covered. The higher the payout ratio, the lower the PCV remaining funds are allocated to TRIBE token holders.

But the biggest losses happened to be Frax Finance and Olympus DAO, two DeFi projects with strong communities, which lost about $13 million and $9 million respectively in this attack. Under the circumstance that the project side is not willing to fully pay, there are endless discussions around "Should PCV funds be used to repay users' losses?", "Equity priority or creditor's rights priority?" "Does the lost funds in DeFi belong to the project's debt?" .

The current TIP-121 proposal proposed by Fei Labs includes the following four points: redeem FEI for 1 DAI; compensate most victims of the Fuse hack; TRIBE holders redeem the remaining assets controlled by DAO in proportion; remove all governance rights . This also means that Fei Protocol will end here, but there is no agreement on how to pay the compensation, how to clear the assets in the Treasury has not yet been determined, and the voting on the chain has not yet started.

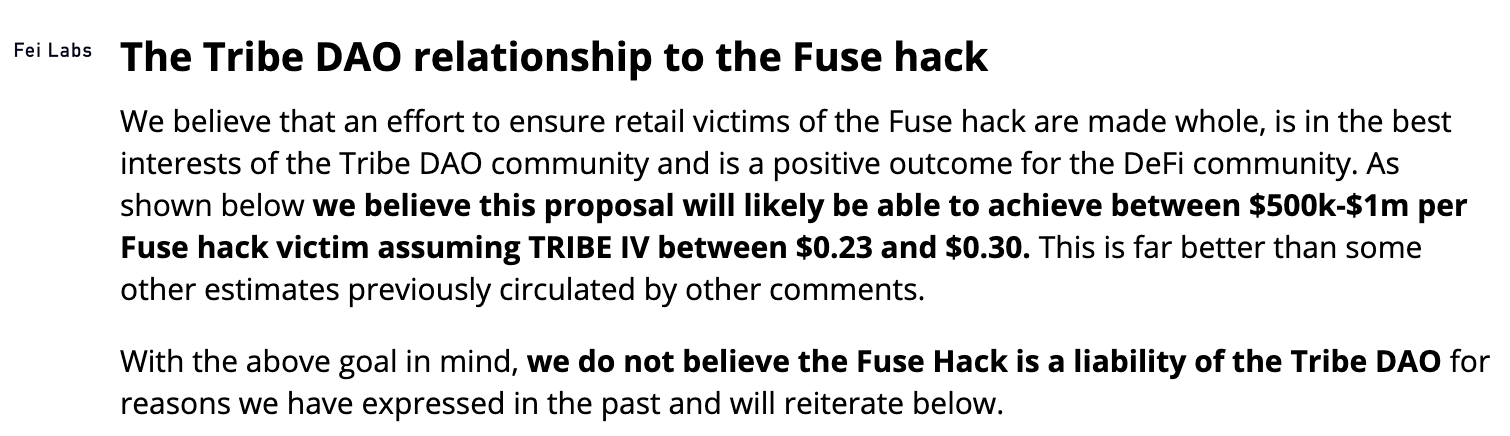

First of all, the Fei Labs team believes that Tribe DAO should not be responsible for the losses suffered in Fuse. The team believes that Fuse was not deployed by Tribe DAO, and Tribe DAO is not the insurer of Fuse or users. Tribe DAO has never controlled Fuse and has not charged any Fuse's income, Tribe DAO was also a victim of the Fuse attack. This move puts the responsibility entirely on Fuse, and Fei Labs claims that in order to guarantee retail users, (57 million) TRIBE tokens should be distributed from RGT and TRIBE’s anchor exchange to repay the victims, which is also the compensation currently under discussion Sources of funds.

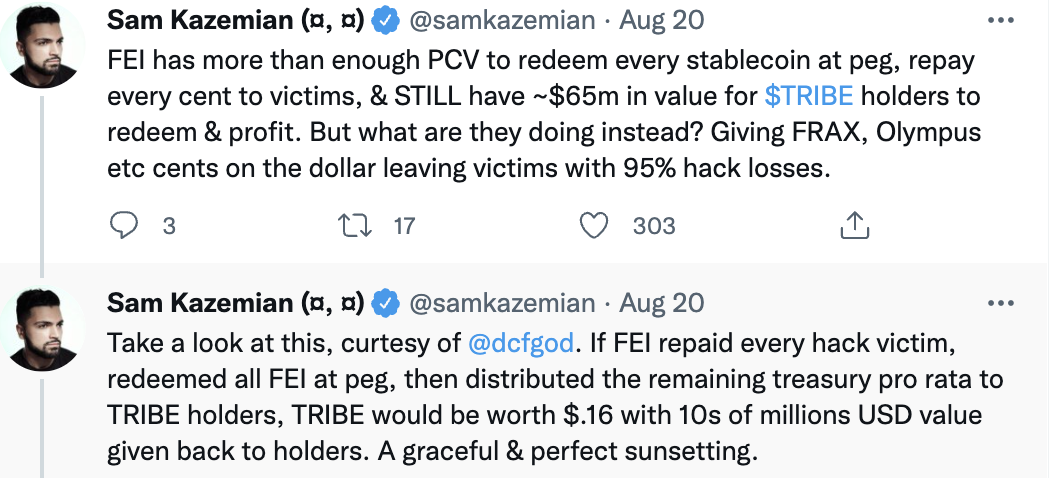

Frax founder Sam Kazemian is a major opponent of the current proposal. Kazemian first questioned that the snapshot vote in May had not been effectively implemented, and then the market plummeted. Kazemian's main point is that even if everyone's losses are paid, Fei Protocol still has tens of millions of funds left that can be distributed to TRIBE holders. According to the current standard, Frax pays only 2% of losses, Olympus DAO pays 3%, Balancer pays 19%, and Vesper pays 27%.

first level title

end

After a year and a half, Fei Protocol is coming to an end along with Tribe DAO. Although TIP-121 has not yet been voted on the chain, the dissolution of Fei Protocol is almost doomed. The unlocked tokens allocated to the team have been transferred to the DAO in TIP-120. Fei Labs also stated that it will complete the proposal after TIP-121 To stop participating in Tribe DAO, the current controversy is whether to pay full compensation for the hacker attack, and then how to deal with the assets in the Treasury.

As of August 22, Fei Protocol's PCV still has US$217 million in funds, and the FEI belonging to users is about 105 million, which is indeed enough to repay the losses of all users. But Fei Labs wants to get more benefits. Buckerino, a member of the Uniswap community, pointed out that the victims of hacking are not creditors, but if Fei Labs’ plan is implemented, the core developers may face lawsuits. have a fiduciary duty. Refuse to pay when there are enough funds to pay, and the team is likely to be sued for "unjust enrichment".

The dissolution of Tribe DAO could be the unraveling of the largest DAO in the history of the crypto community right now. At the same time, it also gives us some warnings: First, DeFi is not as secure as we think. Several large-scale security incidents, such as the Poly Network hacker finally returned the funds, and Wormhole and Ronin were funded by the project party for compensation , inspiring. However, the stolen funds in DeFi may be difficult to identify as the debt of the project. Therefore, Fei Labs also found various reasons to refuse to pay if there were sufficient funds in Tribe DAO.

This also shows that under the high transparency of DeFi, the team's private messages are easy to be caught. Once the black swan time is not actively processed and the best processing time is missed, the confidence and trust of the community will be lost. The voting results of Tribe DAO also exposed the problem of DAO governance. Users holding governance tokens may harm the interests of protocol users because of their own interests, and the voting results are only controlled by a few stakeholders.