Original Author: Li Yun

first level title

secondary title

1. Core investment logic

The crypto credit track is still in its infancy.Credit lending has a large scale in traditional finance, but in the crypto industry, it is still only an inconspicuous segment of the lending track. With the improvement of infrastructure in the future, the credit lending track has the possibility of explosive growth.

Excellent risk control ability, no bad debts yet.TrueFi is currently the leading project on the credit track. After the thunderstorm of DeFi and CeFi in 2022, there have been no problems so far, maintaining a 0 bad debt rate.

The governance model and business model motivate TRU holders to actively participate in governance.secondary title

2. Valuation

secondary title

3. Major risks

In general, TrueFi faces five risks:

(1) Competition from other projects in the credit loan track.

(2) Credit DID gradually matures to break the monopoly of the current TrueFi risk control model.

(3) The tightening of regulatory measures for the crypto field has led to a shrinking credit demand from downstream institutions.

(4) Whether it can continue to maintain a zero bad debt rate, especially during the repayment wave in August this year.

first level title

secondary title

1. Project business scope

secondary title

2. Past development and roadmap

In February 2018, TRU conducted a Pre-Sale on CoinList, raising approximately US$28 million.

The first stage: 2020.11, the V1 version is released, and TRU token is issued at the same time, but the V1 version only issues credit loans based on TUSD.

The second stage: 2020.11-2021.02, deploy the V2 version, add (1) "liquid exit" to facilitate the exit of depositors; (2) improve the staking model, from staking for a single loan to staking for all loans, staking is also available Earn TRU and interest income; (3) Governance is all on the chain.

The third stage: 2021.03-2021.05, deploying the V3 version, adding (1) USDC pool; (2) improving the credit model; (3) allowing the transaction of loan tokens (deposit certificates obtained by depositors after depositing stable coins, similar to in Aave’s aToken).

The fourth stage: 2021.06-2021.08, deploy the V4 version, adding (1) can support any ERC-20 token; (2) allow other lending agreements to provide liquidity for TrueFi loans; (3) allow other agreements to become credit loans Channel provider; (4) launch USDT pool; (5) set up SAFU (secure asset fund for users) (user security asset fund, which is used to give priority to repaying investors in case of loan default), and inject 5 million TRUs.

secondary title

3. Business situation

3.1 Service object

TrueFi's customers are divided into deposits and borrowing ends:

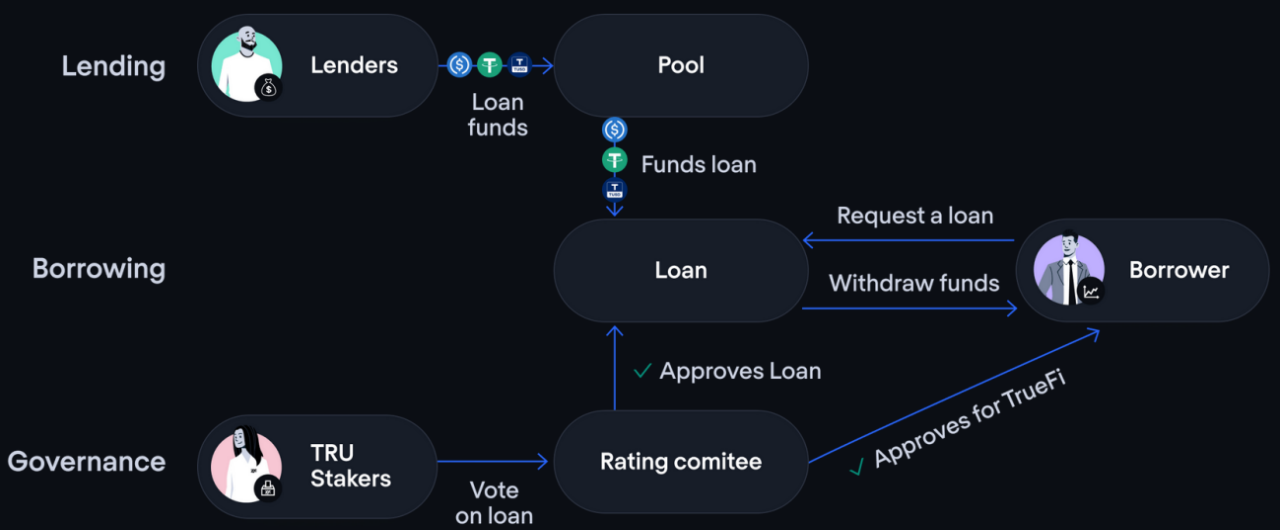

On the deposit side, anyone who holds USDC/USDT/TUSD/BUSD can deposit stablecoins, and choose the corresponding lending pool to add liquidity to them, so as to earn income by lending and earning interest.

On the borrowing side, there are two types of business.

The first type of business is the credit loan business under the supervision of TrueFi DAO—TrueFi DAO Pools. TrueFi’s early positioning of this business is to serve crypto-native trading investment institutions, and then gradually expand to other agreements. In the future, it plans to further expand to companies and personally. Among the loans that have been disbursed, the main borrowers include: trading investment institutions, exchanges, market makers, DeFi, high-net-worth individual investors, asset management companies, etc. In terms of the number of loans, they are mainly crypto-native trading investments Mainly institutions and market makers.

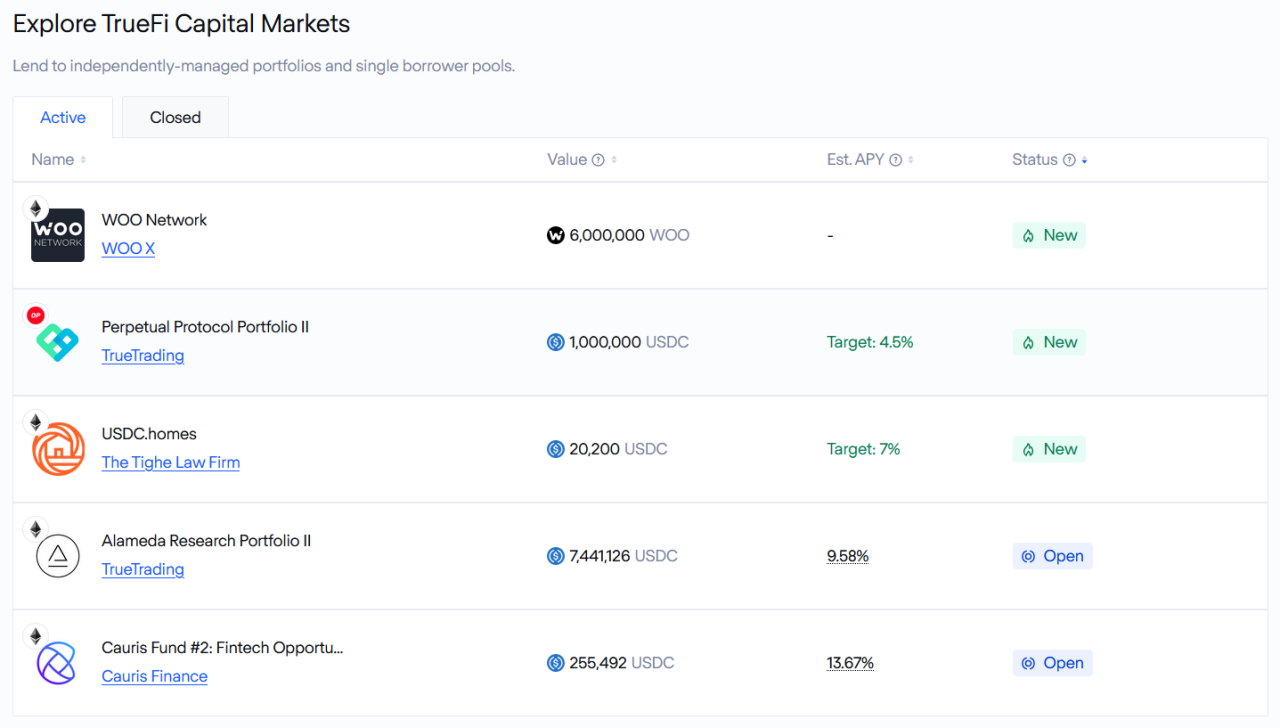

The second category is TrueFi Capital Markets, a lending project managed by a third-party independent organization. Borrowers include TrueTrading, Cauris Finance and other institutions.

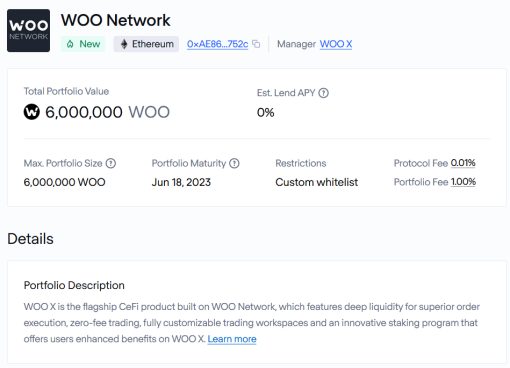

Recently, TrueFi has reached a cooperation with Woo Network. The depositor is a specific WOO DAO, and the borrower is certain trading customers in Woo Network. In the future, this kind of credit service for a certain type of specific customers will also become one of TrueFi's important business lines.

3.2 Business Classification

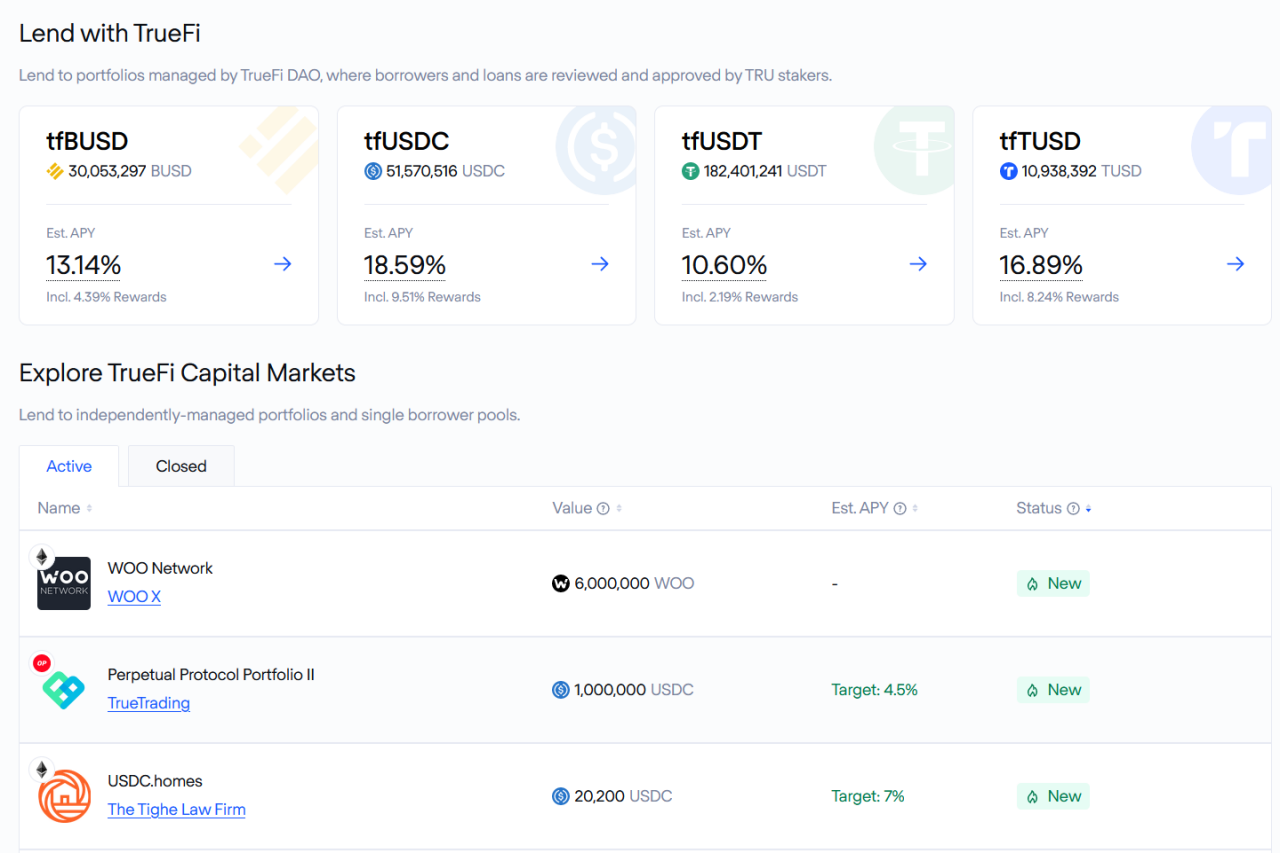

Now TrueFi has two business lines: TrueFi DAO Pools and TrueFi Capital Markets.

source:

source:https://app.truefi.io/home

3.3 Business Details

3.3.1 TrueFi DAO Pools

source:

source:https://truefi.io/

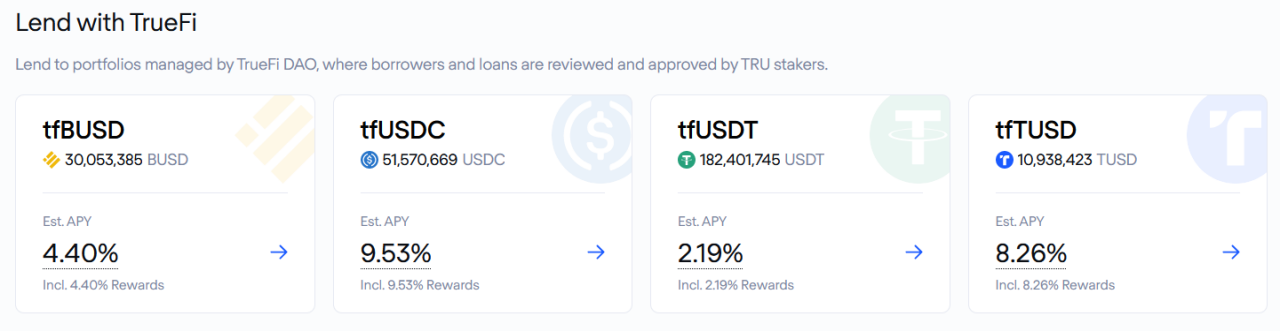

On the deposit side, users can choose from 4 stable currency pools: BUSD, USDC, USDT and TUSD.

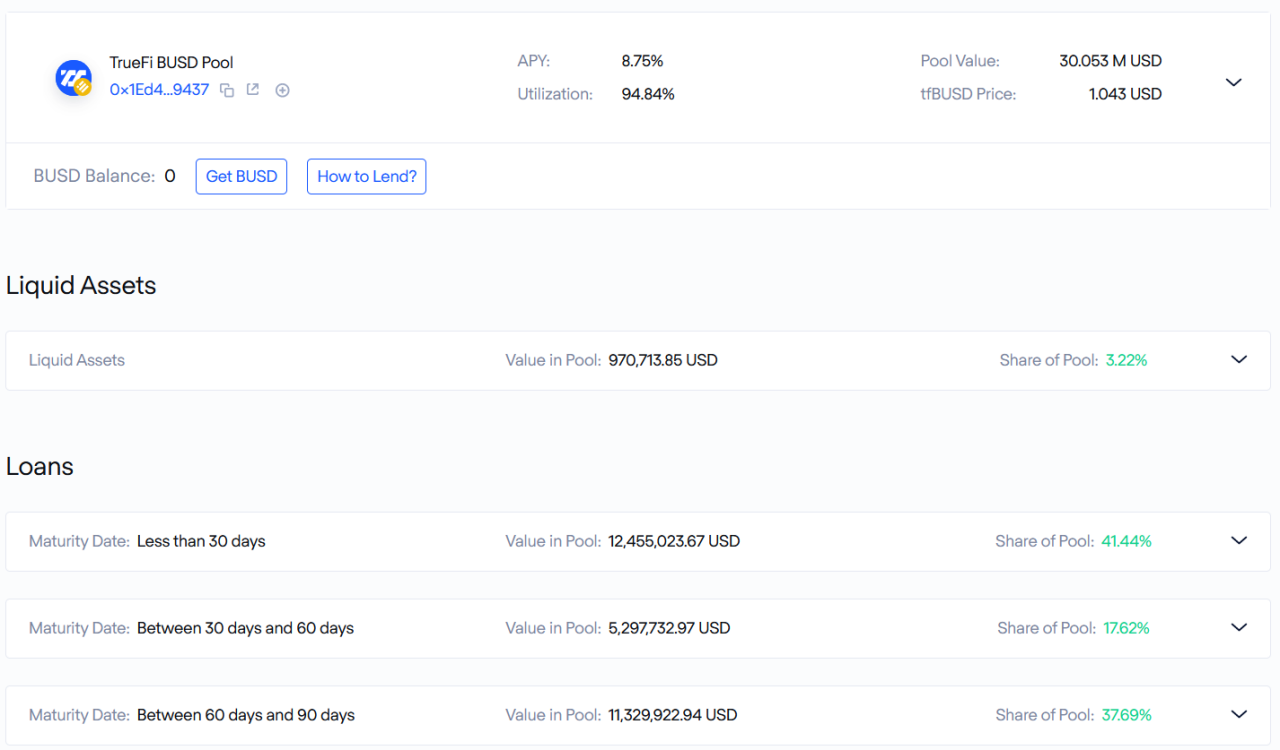

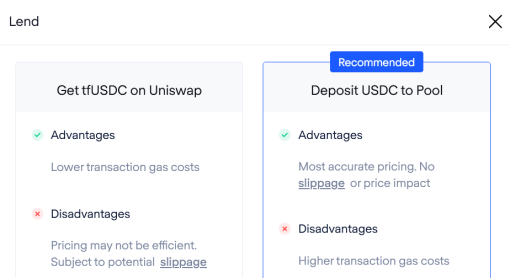

After depositing the corresponding stable currency, the user can obtain tfToken to represent the principal and interest. at any point in time,tfToken has a price, but this is an estimated value based on the full repayment of all loans in the pool in the future.source:

source:https://app.truefi.io/home

source:

source:https://app.truefi.io/pools/0x1Ed460D149D48FA7d91703bf4890F97220C09437

source:

source:https://app.truefi.io/lend

source:https://info.uniswap.org/#/pools/0xd7c13ee6699833b6641d3c5a4d842a4548030a82

Users do not have to wait for the underlying loan to expire, and can redeem assets at any point in time, as long as there is sufficient liquidity in the stablecoin pool.

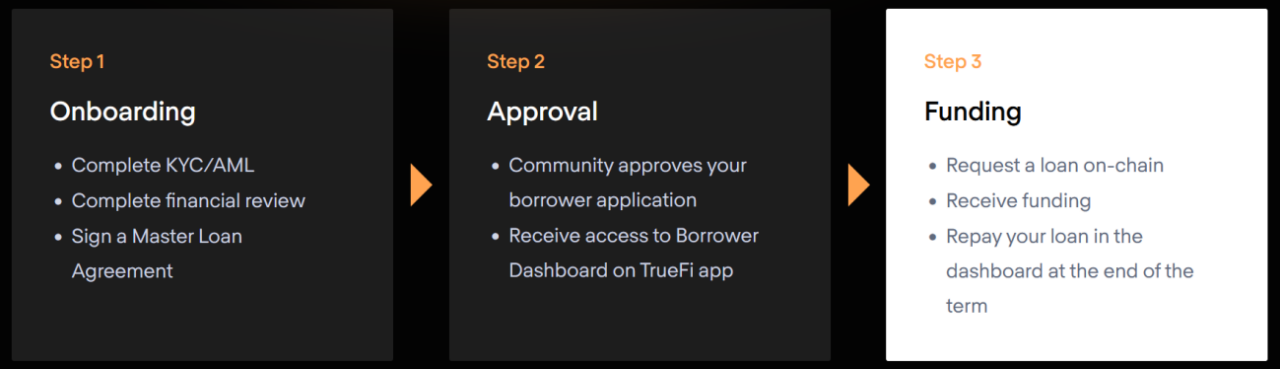

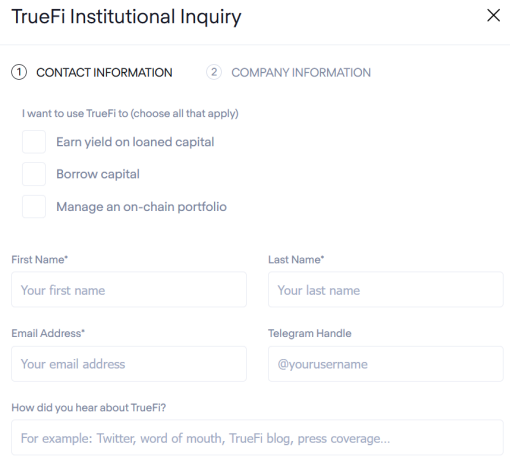

On the borrower side, the source of business comes from borrowers initiating loan applications.

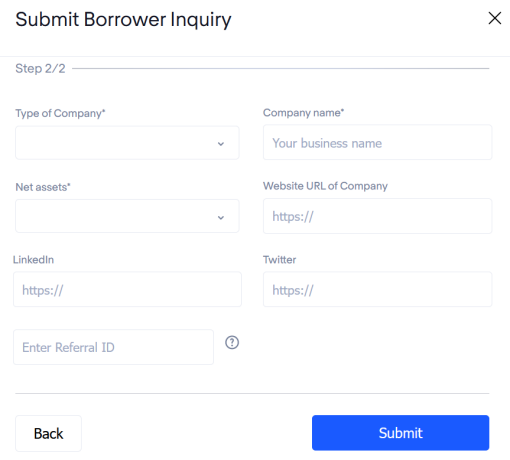

To become a qualified borrower, you need to fill in relevant company basic information and loan basic information.

source:

source:https://truefi.io/institutions

source:https://truefi.io/institutions

source:https://truefi.io/institutions

source:https://app.trusttoken.com/choose-account-type

In order to assess the credit qualification of borrowers, TruFi launched the "TrueFi creditworthiness score" in the third phase, with a score between 0 and 255.The assessment of "TrueFi creditworthiness score" will affect the borrower's credit line and interest rate level, the evaluation system will assess information in the following dimensions:

(1) Company background: including compliance, legal affairs, finance, etc.;

(2) Repayment history: At this stage, it is only the repayment history in TrueFi, and it will be expanded to more data sources in the future;

(3) Operation and transaction history: including transaction data in crypto and traditional financial fields;

(4) AUM: including scale, asset type and custodian;

(5) Credit indicators: including leverage ratio, liquidity and risk exposure, etc.

Although this set of credit rating models will continue to integrate data from centralized exchanges and more on-chain data in the future, it can be seen from the above informationThe entire scoring framework is currently more like a traditional bank lending model, just integrates the data in the crypto field and the traditional field, and at the same time turns the borrowed funds into digital currency.

At present, 33 companies (Amber Group, Alameda Research, etc.) and two large households (0x819, 0xB60) have become "qualified borrowers".

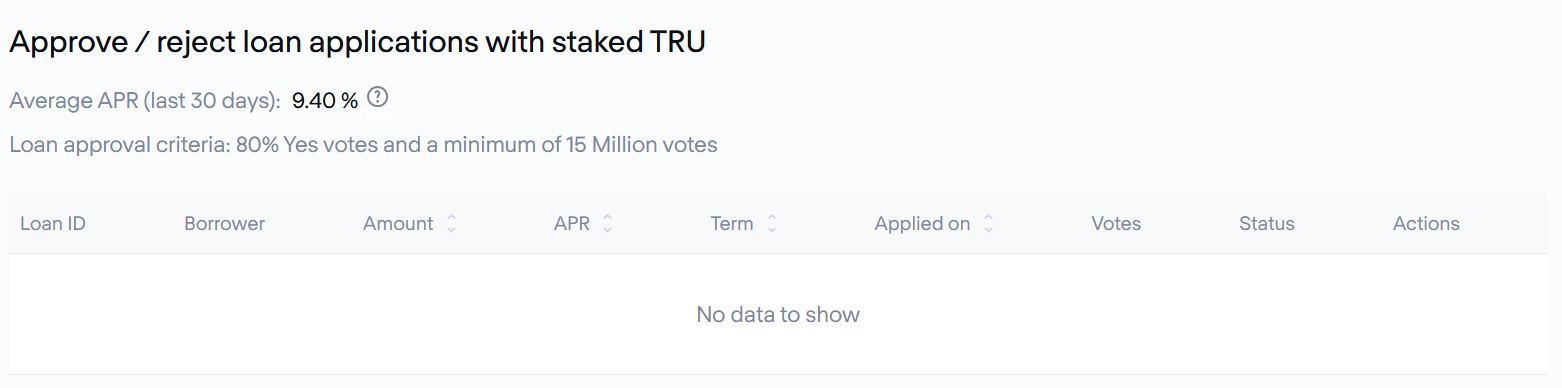

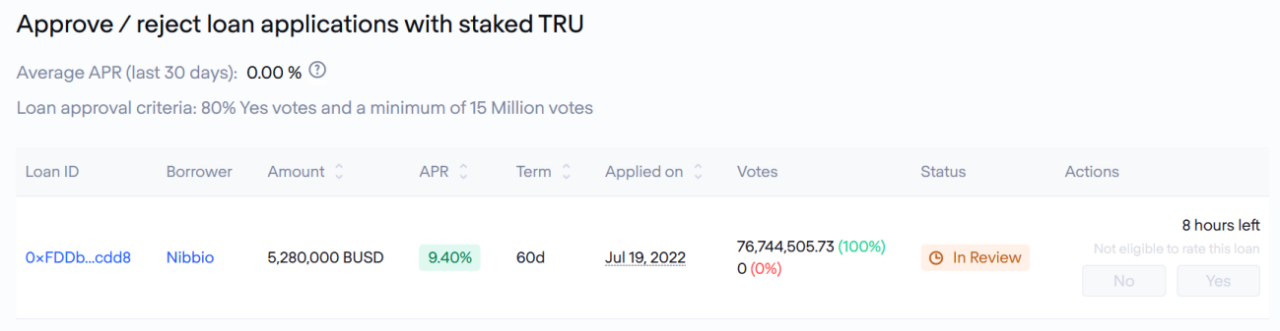

In the loan approval stage, it is divided into two stages: (1) TRU stakers Voting and (2) Rating Committee Voting.

TRU holders have the power to vote on every loan after staking. For any loan to borrow in this round of voting, it needs to obtain more than 15 million votes, and at least 80% of them voted for "YES". After the "TRU stakers Voting" is passed, the Rating Committee finally decides whether to issue loans.

source:

3.3.2 TrueFi Capital Markets

source:https://app.truefi.io/home

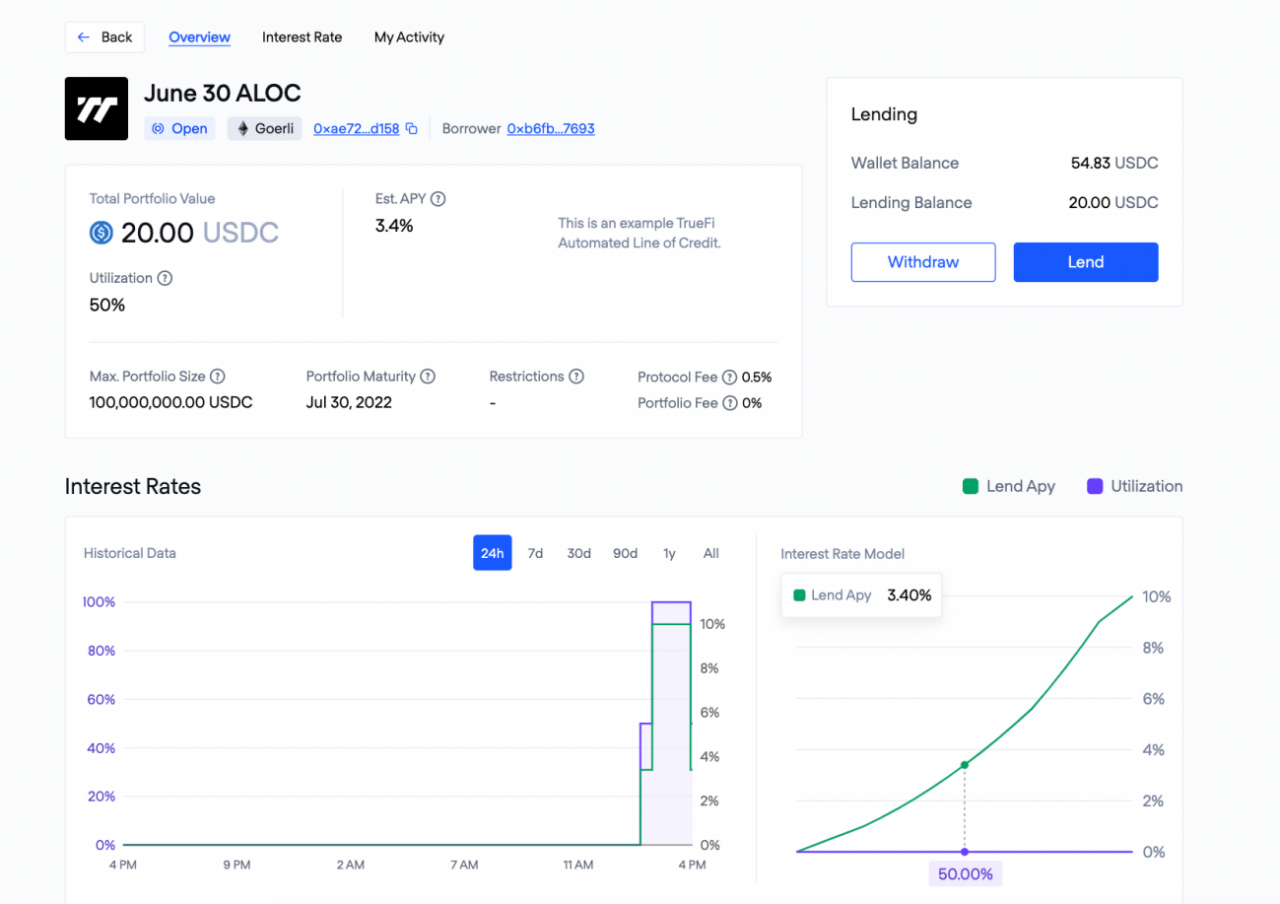

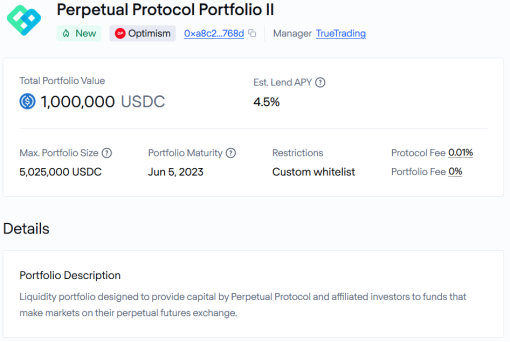

TrueFi Capital Markets is still a credit loan business, and the important difference from TrueFi DAO Pools is the manager. The manager of TrueFi Capital Markets is a third-party institution, which includes two types of pools: Managed Portfolios and Lines of Credit.

For Managed Portfolio, the qualification of "Manager" must be reviewed first. The application process of this step is similar to the process of TrueFi DAO Pools' "qualified borrowers", but it is also necessary to explain the strategy and requirements of the portfolio to be established, and whether it will apply for TRU incentives and other details. For the review of "Manager", the final decision is made by TrueFi DAO.

After confirming that the "Manager" meets the entry threshold and the "portfolio" requirements are suitable, the sponsor "Manager" can set up special loan products.Like TrueFi DAO Pools, borrowers of special loan products still need to complete two reviews of "qualified borrowers" and "loan applications". Same.

For Managed Portfolio investors, this type of product is like a regular financial product. Assets can only be redeemed when they expire, and the obtained portfolio token cannot be transferred to other addresses.Not only that, each Managed Portfolio also has two fees: (1) Protocol fee, the proportion of this fee is not fixed, and different borrowers will have different rates, which are currently within 0.5%. It will be transferred to TrueFi Protocol Treasury when the product expires; (2) Portfolio fee, the ratio is not fixed, it is still negotiated on a case-by-case basis, and this fee will be transferred to the Manager's wallet address when the product expires. The "Manager" of Managed Portfolio can also design the entry threshold for investors, and such investors need to carry out KYC.

source:

source:https://app.truefi.io/portfolios/mainnet/0x3eabf546fff0a41edaaf5b667333a84628571318

On July 14th, TrueFi announced that it has reached a cooperation with Woo Network, and Woo DAO will provide WOO tokens to provide TrueFi’s institutional customers with credit loans of such tokens.This is TrueFi's first managed portfolio of non-stablecoins. All interest will be injected into Woo DAO.source:

source:https://app.truefi.io/portfolios/mainnet/0xae86120411c450bc792e7465653f99e2fe47752c

Lines of Credit

Lines of Credit This type of credit loan is initiated by the borrower, but it is different in several ways:source:

source:https://docs.truefi.io/faq/truefi-capital-markets/automated-lines-of-credit

3.4 Multi-chain deployment

source:

source:https://app.truefi.io/portfolios/optimism/0xa8c2f1571785007c9b5ff039957173e82a48768d

Overall, Ethereum is still the main place to do business, with $308 million of the current TVL of $309 million as of August 4 on Ethereum.

3.5 Default response strategies

When a default occurs, TrueFi’s response strategy is to first let SAFU (from the official 5 million TRU) and TRU stakers absorb the loss. If it is still not enough to fill the bad debt, the depositor needs to bear the remaining default loss. The full value of the loan was subsequently written down and proceedings were initiated against the defaulting debtor. If the lawsuit is successful in recovering the loan, the funds of the borrower, stakers and SAFU will be restored.

On June 7, 2022, the TrueFi Foundation, registered in the British Virgin Islands, was established to represent the TrueFi DAO and to exercise rights such as prosecution after a debt default.

3.6 Business data

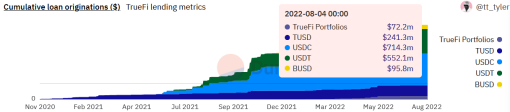

(1) Total issuance of credit loans

source:

source:https://dune.com/tt_tyler/tru-staking-burns

(2) Due loans

source:

source:https://app.truefi.io/loans

The TOP 5 borrowers have borrowed a total of US$1.01 billion in loans, accounting for 71.6%, and the concentration is relatively high.

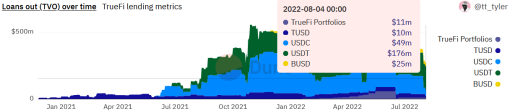

(3) Credit loan stock

Currently, there are 14 loans with a value of 260 million US dollars, with an average value of 18.81 million US dollars and an average term of 126 days. in:

A total of 8 loans will be due in the rest of August, worth 130 million US dollars (for details on the risks of this part of the loan, please refer to 3.2: Project Competitive Advantages and Moats - Risk Assessment Model);

1 deal due in September, worth 10 million US dollars;

source:

source:https://dune.com/tt_tyler/truefi-loan-stats

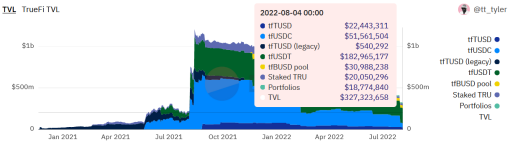

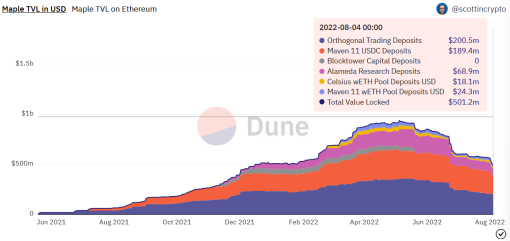

(4)TVL & Utilization Ratio

The current TVL is around $320 million, and the ATH is $1.22 billion, which has fallen by 73%.

source:

source:https://dune.com/tt_tyler/tru-staking-burns

(5) Total revenue and bad debt ratio

So far, TrueFi has earned $29.85 million in interest income for investors, and has maintained an excellent performance of zero bad debts.

secondary title

4. Team situation

4.1 Overall situation

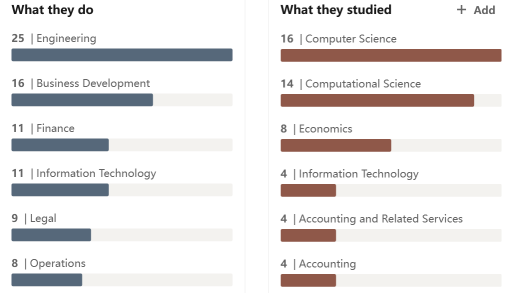

source:

source:https://www.linkedin.com/company/trusttoken/people/

source:

source:https://www.linkedin.com/in/rafaelcosman/

Rafael Cosman is the founder and CEO of TrueFi and graduated from Stanford University. Before founding TrueFi, he had experience in Palantir Technologies and Google, and served as a partner at Lightspeed Ventures. Then he founded TrustToken and was mainly responsible for engineering business. He has good qualifications in finance, engineering and investment. It is worth mentioning that the stablecoin TUSD is another project of TrustToken. In December 2020, the ownership of TUSD will be transferred to an Asian alliance that cooperates with Tron.

4.3 Core members

Members of the main business line have rich and deep backgrounds in related fields.

Head of BD: Ryan Rodenbaugh, worked as an investment analyst or consultant in VM Capital, BlueRun Ventures and other investment companies, and became the head of BD of TrustToken in 2018;

CIO (Chief Investment Officer): Bill Wolf, who worked as a partner in traditional financial leading companies such as Goldman Sachs, HSBC, and Credit Suisse, and joined TrustToken as a consultant in 2018;

secondary title

5. Financing situation

TrueFi is one of TrustToken's business lines, and all previous financings have been based on TrustToken.

In June 2018, TrustToken received a total of US$20 million in financing from a16z crypto, BlockTower Capital, Danhua Capital, Jump Capital, ZhenFund, Distributed Global and GGV Capital to develop the TrustToken asset tokenization platform and expand its legal , partners, product and engineering departments.

In August 2018, TrustToken raised $8 million through ColinList;

A total of 26.75% of TRU tokens were sold in the above two rounds.

first level title

secondary title

1. Industry space and potential

1.1 Classification

The track where TrueFi is located is an unsecured loan track. In addition to TrueFi, there are currently Maple Finance, GoldFinch, Clearpool and Atlantis Loans, but the latter few projects are not large in scale.

In the traditional field, under the continuous upgrading of many infrastructures such as regulatory laws and regulations, credit ratings, and pricing theories, credit loans have not only become an important tool for enterprises to obtain financing, but also provide convenience for residents' daily consumption. Credit loans have become An important business branch in the traditional financial field.

Now the lending market in the crypto field is almost all mortgage loans. In order to improve the utilization rate of funds, different projects have made many attempts in terms of mortgage rate, interest rate pricing, and collateral. From the perspective of capital utilization, the capital utilization of unsecured loans is undoubtedly the best.

1.2 Market Size

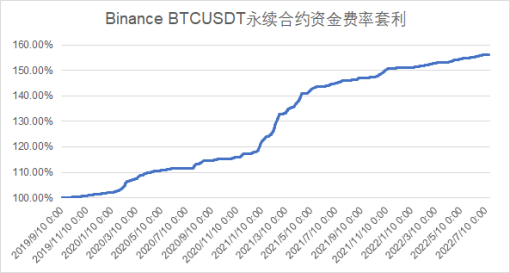

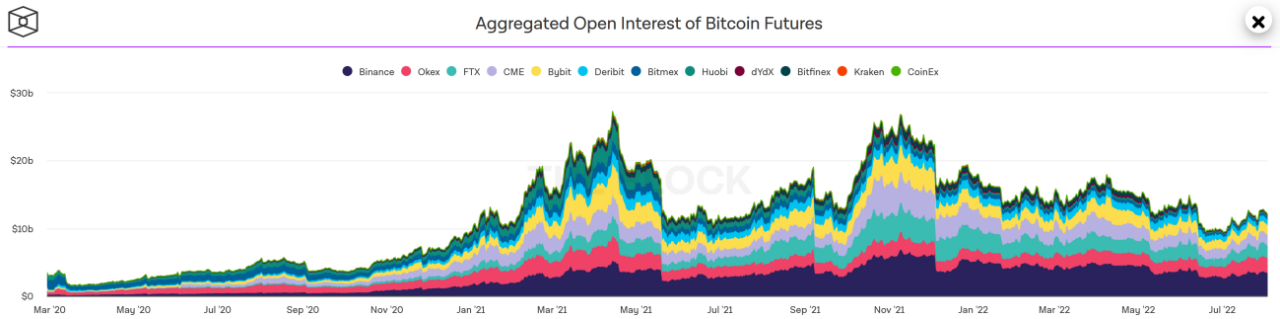

The main customers of credit loans at this stage are market makers and quantitative trading institutions, and their main purposes are arbitrage, execution of market neutral strategies, and market making. Especially in the bull market stage, low-risk arbitrage opportunities emerge in endlessly.

source:

source:https://www.binance.com/zh-CN/futures/funding-history/quarterly/1

image description

Source: https://www.theblock.co/data/crypto-markets/futures/aggregated-open-interest-of-bitcoin-futures-daily

In addition, the market-making needs of both traditional market makers and Dex's liquidity pool have begun to be gradually replaced by credit loans.

secondary title

2. Token model analysis

2.1 Total amount and distribution of tokens

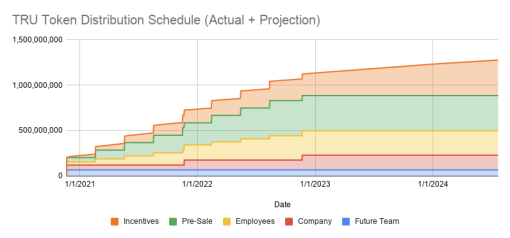

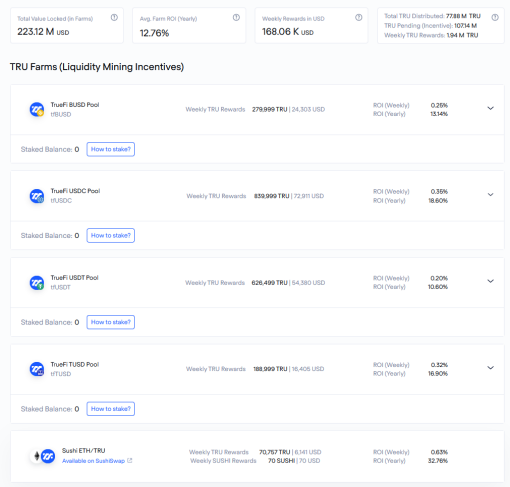

TRU was issued in November 2020, with a total of 1.45 billion. TrustToken, Inc burned a part in February 2021, and now there are still a total of 1.44 billion. in:

39% are used for incentives, including TRU Staking, Lending, Sushiswap TRU-WETH Liquidity Providing, etc.;

26.75% are pre-sale;

18.5% belong to the team;

11.25% belong to the company or foundation;

source:

source:https://blog.trusttoken.com/truefis-tru-token-economics-7facea6651c0

source:

source:https://app.truefi.io/farm

By the beginning of 2023, there will be only about 350 million tokens in incentives and less than 200,000 tokens belonging to future team members to be released, and all tokens will be released by 2025. Before the release is completed in 2025, the annual circulation inflation rate will be around 20%.

In addition, in order to ensure the stable operation of the project in the future, 5 million of the tokens originally scheduled to be released to the company in 2021 entered SAFU as insurance funds.

2.2 Token Value Capture

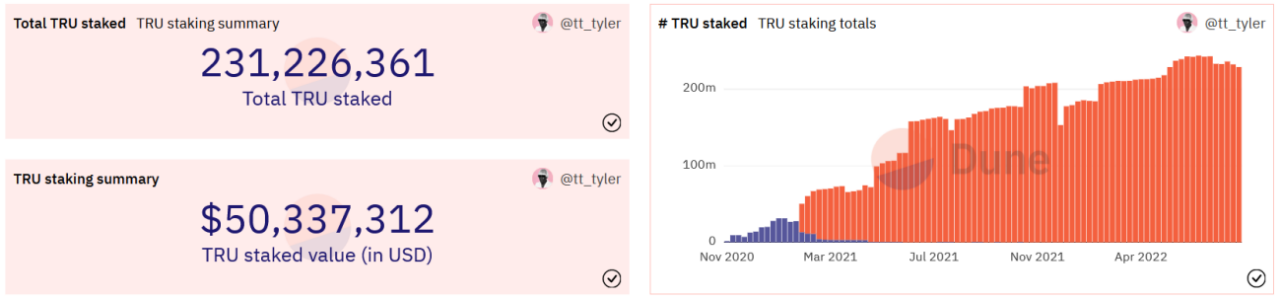

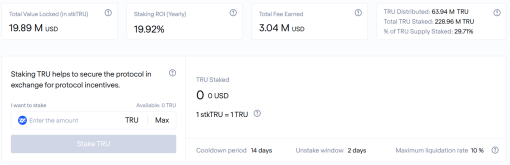

Only the TRU token in staking can get the value capture ability.

source:

source:https://dune.com/tt_tyler/tru-staking-burns

source:

source:https://app.truefi.io/stake

In addition, a total of US$3.04 million worth of interest income and protocol fees were distributed to TRU Staker.

source:

source:https://app.truefi.io/stake

2.3 Token core demand side

Investors who are optimistic about the credit lending track and TrueFi for a long time have a need for layout in this round of bear market.The credit track is still in its early stages. At present, it seems that the internal risk control of the track is stable enough, and the only one with a large scale is TrueFi. With the recent launch of the multi-chain strategy and the directional credit loan project, TrueFi’s business scale is likely to grow rapidly after on-chain arbitrage opportunities emerge. So at this stage, whether it is "lending/liquidity providing first and then staking" or "directly buying staking", it is a good strategy.

For the borrower, holding a larger amount of TRU helps to increase the possibility of passing the loan.Because each loan requires no less than 15 million votes, and 80% of the votes in a single vote are in favor, then TRU has an incentive for borrowers to participate in governance. According to the current price of 0.093 US dollars per piece, the cost of obtaining 15 million votes is about 1.4 million US dollars. According to the 15% annualized rate of return of perpetual fund fee arbitrage and the average borrowing cost of 11%, the cost of 15 million TRUs can be fully covered by a loan amount of no less than 35 million US dollars.

2.4 Summary of Token Model

Future token releases will revolve around how to do a good job of incentives.As of July 2022, the number of remaining non-incentive tokens to be released is not much. The main release amount in the future will come from the incentive mechanism. Through the incentives for Lending and liquidity staking, the deposit side will still have a relatively large amount of tokens in the future. Appeal.

By distributing interest income to match the risk and return of TRU stakers, it is more motivated to review each credit loan.TRU stakers not only take on the pre-loan risk—they themselves vote to decide which borrowers to provide credit support, but also assume the post-loan risk—if they encounter bad debts, TRU stakers are also the first wave of people who suffer losses. In some tokenomics, only staking incentives are provided without distributing profits. TrueFi’s not low profit sharing ratio makes TRU holders more willing to participate in staking and voting, which alleviates the previous situation of simply doing staking “lying to win”.

However, in the next two years, the ratio of newly released tokens to the total amount of tokens in circulation at the beginning of the year will reach 20%, and the bear market with lack of arbitrage opportunities will have little demand for credit loans, and the price of TRU will be under considerable pressure in the future.

secondary title

3. Project competition landscape

3.1 Basic Market Structure & Competitors

3.1.1 Competitors at this stage

Credit lending projects in the current market include Maple Finance, Goldfinch, Clearpool, and Atlantis Loans, etc. From the perspective of business model and business volume, the current main competitor is Maple Finance.

In the long run, the core factors of credit loan inspection are: scale, risk control ability and risk pricing ability.

From the perspective of the total distribution scale, the difference between TrueFi and Maple Finance is not obvious, but from the perspective of TVL, Maple Finance's TVL is 500 million US dollars, which is higher than TrueFi's TVL (320 million US dollars), which reflects that the two companies are absorbing deposits Ability is different. Because the deposits of TrueFi and Maple Finance come from ordinary users, anyone can lend assets, so the ability of the project party in marketing and customer acquisition is an important factor in determining the scale of credit loans in the pro-cyclical period. In this regard, Maple has advantages:

First of all, Maple Finance is more active on social media, and has carried out more Twitter Space and various activities, which is conducive to promoting the project to absorb more deposits.Especially after the CeFi thunderstorm in June, through Twitter Space, various types of podcasts/interviews and other programs, publicize product positioning, etc., and respond to community issues in a timely manner. This may be one of the important reasons why the price of Maple Finance's token quickly rose back to before the incident in this wave of rebound. It can also be seen from the number of tweets that Maple has posted a total of 2,895 tweets since 2019, and TrueFi has posted 4,180 tweets since 2017. In contrast, the average annual number of tweets of Maple Finance is higher than that of TrueFi About 25%.

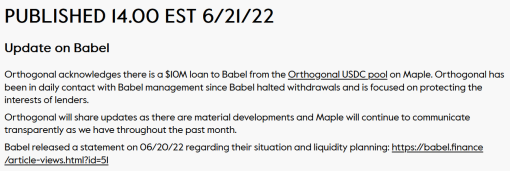

Secondly, the rate of return is higher than that of TrueFi, and the possible strategy is to tap customers with higher risks, which may be easier to attract more funds during the bull market stage.source:

source:https://dune.com/scottincrypto/Maple-Deposits

source:

source:https://maple.finance/news/updates-on-celsius/

The problem reflected this time is that there is a problem with Maple's risk control, which may determine the life and death of the project, and TrueFi has an advantage in this regard.

Risk control capabilities are divided into pre-loan risk control, loan risk control and post-loan risk control. In the traditional financial industry, fraudulent loans can generally be divided into three situations:

(1) Using other people's identity information to defraud loans;

(2) Use real personal information, but forge credit data, such as asset certificates and income certificates;

(3) Falsifying the use of funds.

For the first case, with the development of technology, it is now generally possible to achieve a certain degree of evasion through real biological information, such as fingerprints, face recognition and other technologies, which need to be handled in person, and valid identity documents. There are already many solutions in the traditional financial industry.

For the second type of situation, users are generally required to submit asset certificates with official endorsements, income certificates, credit reports, and regular on-site visits by loan officers for risk screening.

The risk management measures for the first and second types of situations belong to pre-lending risk control.

For the third case, it generally stipulates the use of funds. For example, within the scope of its own business system, after the user places an order to purchase goods, the payment method can be changed to a credit loan.

The risk management measures for the third type of situation belong to risk control in lending.

Once a credit default occurs, traditional financial institutions will use methods such as collection, legal proceedings, and selling the asset package to a non-performing asset disposal agency to collect the money. Since the final punishment mechanism falls on specific individuals or companies, this set of models can generally ensure that the default rate of credit loans in the traditional financial system is at a low level, and cover potential defaults through higher interest rates.

The risk management measures for default disposal belong to post-loan risk control.

In the field of credit lending in Crypto, it is still impossible to achieve a complete closed loop of "before-loan-loan-after-loan" on the pure chain, because if there is a default, it can only be handled off-chain.Since the credit demand side is often a crypto native investment institution, there is no regulatory constraint, there is no clear requirement for the use of funds, leverage ratio, etc., and it is more difficult to clarify the "off-balance sheet financing" and the real use, so it is necessary for lending institutions not only to have off-chain The power of prosecution also requires the ability to analyze and collect information on the chain.

TrueFi has not had a thunderstorm so far, while Maple Finance has borrowed from Babel Finance. Maple Finance's credit evaluation system needs to be improved, and this will determine the final fate of the project.

Risk pricing power is related to interest rate spreads.This thunderstorm at least shows that the current spread may still not be enough to cover potential risks, and Maple Finance needs to further revise its pricing model.

3.1.2 Potential Competitors

Credit DID or a potential competitor in the future.Vitalik mentioned soulbound tokens (SBT) in the article "Decentralized Society: Finding Web3's Soul". If a credit evaluation system connecting crypto and the real economy can be established through SBT, then this type of project is likely to be another S&P Global Ratings, Sesame Credit or FICO Score, it is easier to enter the credit lending field, which will threaten the realization of TrueFi's long-term vision.

However, TrueFi’s credit evaluation system also includes on-chain data to form a more comprehensive evaluation plan. With the enrichment of on-chain data dimensions in the future, TrueFi may not lose the competition with DID represented by SBT.

3.2 Project Competitive Advantages and Moat

TrueFi now has two core advantages:

risk management measures.Both TrueFi DAO Pools and TrueFi Capital Markets adopt a two-tier evaluation structure: first evaluate the borrower, and then evaluate a single loan, which draws on the risk control process of the traditional financial system. The approval and evaluation of credit loans before lending can only be judged based on the data and information at the time of approval, and the evaluation model cannot include the tail risk after lending. Risk management measures are very important. Since we are unable to know the specific risk management model and parameters of TrueFi, judging from TrueFi’s lending to Three Arrows Capital in May, there may be problems with its pre-loan risk control, but this loan should have expired in August this year The credit loan was repaid in advance in June, which also shows that TrueFi has an advantage in post-loan risk management capabilities. TrueFi has been assisted in the selection of borrowers and loan conditions in order to maintain a zero bad debt rate. The centralized maturity of loans in August this year may test TrueFi's risk control capabilities again. In general, among all outstanding loans, Alameda Research still needs to repay 35.04 million US dollars, accounting for about 13%, Amber Group still needs to repay about 65.86 million US dollars, accounting for about 1/4, and Wintermute also needs to repay. About $92 million needs to be repaid, accounting for about 35%. In addition, the debtors also include Bastion Trading, Folkvang, etc. However, the above-mentioned debtors have not disclosed that there is a risk of bankruptcy or default for the time being, and now it seems that the probability of the remaining debt storm is not high.

Business scalability.secondary title

4. Risk

Competition from other projects in the credit loan track.Clearpool, which has the same subdivision track, has been running steadily so far, and may survive and grow stronger in this round of bear market. There are also differences in the business model of the credit lending track. For example, Goldfinch absorbs on-chain deposits and lends to off-chain merchants, and can enter the credit market of small and medium-sized institutions by adapting its own risk control model.

The gradual maturity of credit DID can also become the technical cornerstone of credit lending, breaking the exclusivity of the current risk control model.TrueFi’s current risk control methods are exclusive to a certain extent. If DID is now more mature and incorporates more data dimensions, then there is a possibility of cutting into credit loans, which may form a new risk control paradigm superior to TrueFi.

Regulatory measures have tightened the crypto field, resulting in shrinking downstream demand.first level title

secondary title

1. Core issues

(1) Market space

Even if the total market value of digital currencies stays at the current level, the perpetual contract fund arbitrage based on the TOP 5 non-stable currency currencies will have an annualized capacity of about 100 billion, which does not include centralized exchanges and AMM market making need. If the "digital gold" narrative of Bitcoin can finally be realized to a certain extent in the future, and functional public chains such as Ethereum further mature, the demand for arbitrage and market-making in the entire market will further expand. At this stage, the credit demand of trading investment institutions and asset management companies as the main customer groups will also increase accordingly.

(2) The periodicity of downstream demand:

Credit demand is a pro-cyclical demand. Now crypto credit lending is mainly used in financial activities such as market making and arbitrage, especially arbitrage is a relatively lagging demand, so the outbreak period of credit loan demand may be even more lagging. Then a project like TrueFi may be a strong cyclical target.

source:

source:https://app.truefi.io/stake

(3) Replacement of TrueFi credit evaluation model after maturity of SBT and others

secondary title

2. Valuation level

In view of the strong cyclicality of TrueFi's business, traditional valuation indicators such as PS and PE are likely to soar due to the cooling of business in the future. At the same time, TrueFi has not experienced a complete bull-bear cycle, and the time dimension of past historical indicators that can be referred to is not enough.

The investment in TrueFi may still have to make vague judgments from the big cycle and the gradual recovery of business volume. The following indicators help us make a decision:

(1) Demand forward-looking indicators: perpetual contract funding rate, term spread, Gas Fee and other indicators that can represent market heat;

(2) Scale indicators: TVL, Total Loans Outstanding;

(3) Risk control indicators: bad debt rate;

(4) Profit indicator: Fees paid to stkTRU;

(5) Liquidity indicator: TRU pledge rate.

secondary title

3. Summary of preliminary value assessment

Even judging from the current downstream demand for arbitrage and market making, credit lending is one of the tracks with great potential in the future in DeFi. With the maturity of other infrastructure such as DID, the application scenarios and demand scale of credit lending will become more abundant.

TrueFi has become a very competitive project in this track, no matter from the perspective of scale indicators such as TVL and loans issued, or from the perspective of safely surviving the CeFi/DeFi thunderstorm this time. Its main competitive advantage comes from risk management Measures and scalability of future business.

The TrueFi team has senior experience in the traditional financial field, and can transplant past knowledge and experience of risk management into the project. Especially at the current stage when infrastructure such as credit DID and other on-chain risk management measures are relatively lacking, this experience and ability can help TrueFi deal with risk events with greater impact. The recent cooperation with Woo Network also shows that TrueFi does not stick to its own business scope, and is willing to innovate products to meet new needs of customers under the premise of risk control.

first level title

Section 5 References

Project mechanism:

Project data:

https://dune.com/tt_tyler/tru-staking-burns

https://www.linkedin.com/company/trusttoken/people/

https://dune.com/queries/636881/1186840

https://info.uniswap.org/#/pools/0xd7c13ee6699833b6641d3c5a4d842a4548030a82

Other data:

https://dune.com/scottincrypto/Maple-Deposits

https://www.binance.com/zh-CN/futures/funding-history/quarterly/1