As Layer 2 such as Optimism matures, new projects emerge. When OP governance tokens are issued, part of them are allocated to projects in the ecosystem, bringing new opportunities for liquidity mining. PANews previously wrote an article listing Optimism The ecology has launched liquidity mining projects. This article screens out projects in Optimism and other ecosystems that are worth using stablecoins to participate in, and is also a series of PANews stablecoin financial management articles.

*Because mining is affected by token prices, the data in this article are all taken from the morning of August 22.

Lyra Finance

Lyra is an options trading protocol built on top of Optimism. Its mechanism is relatively complete. Liquidity providers only need to deposit sUSD into the Vault, and Lyra AMM quotes options with different strike prices and expiration dates through implied volatility and the Black-Scholes formula. The protocol will hedge the risk of market making by buying and selling synthetic assets in Synthetix, making AMM close to delta neutral. Whenever a time threshold (such as every 12 hours) passes, the robot will run to call the DeltaHedge function.

Since most risks have been hedged, using sUSD to provide liquidity in Lyra can usually earn market-making profits. Take the above 30 days as an example, the annualized rate of return of using sUSD to provide liquidity for the sETH-sUSD trading pair is 12.63%, and now there are additional OP token rewards, the annualized rate of return is about 6.12%, and the overall rate of return was 18.75%. If you pledge LYRA tokens, you can also increase the yield of OP tokens and get additional unlocked stkLYRA.

It should be noted that in case of extreme market conditions, liquidity providers may lose money, and the entry and exit of mining in Lyra also requires a waiting period of several days, but this method of relying on the profitability of the project to distribute rewards to users is recommended.

Velodrome Finance

Velodrome is a DEX on Optimism. The code is forked from Solidly developed by Andre Cronje on Fantom. The Velodrome team also developed veDAO on Fantom.

Velodrome continues Solidly's low transaction fees, and non-stable currency transactions only require a 0.02% fee. For traders, as long as the liquidity is good enough, Velodrome will be a better choice, but this also means that Velodrome needs to rely on its own governance tokens to attract liquidity. Optimism distributed part of the tokens to ecological projects after issuing tokens, and Velodrome distributed this part of OP tokens to the pledgers of its own governance token VELO, which also increased the price of VELO in disguise and improved liquidity mining. rate of return.

Other project parties can also bribe VELO stakers to vote for their own tokens to increase liquidity and yield. Currently, the APR of USDC/sUSD in Velodrome is 10.58%.

Canto

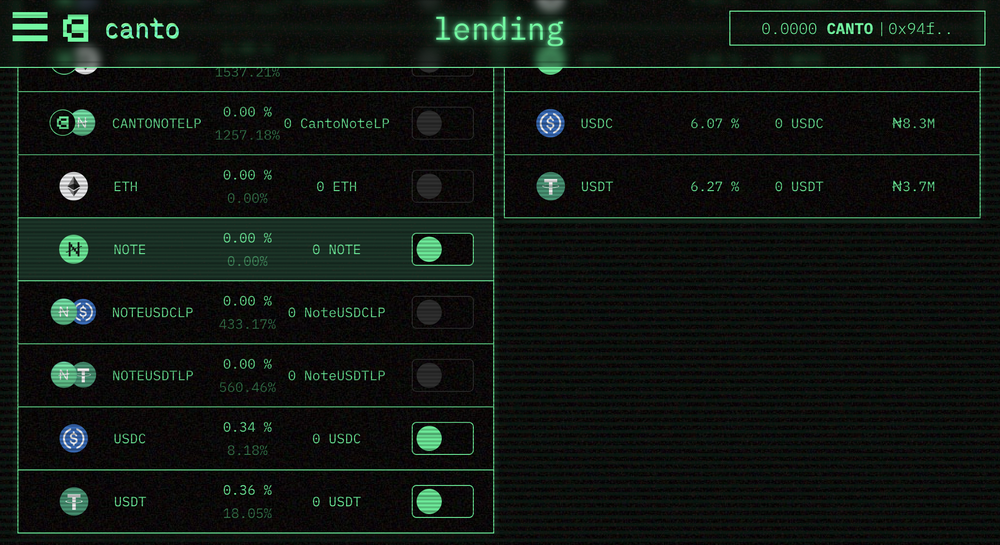

Canto is a Layer1 DeFi public chain based on the Cosmos SDK. Its ecology integrates three core components of DeFi: DEX, lending market and native stable currency. It can be said that Canto has received a lot of attention when it is planned to launch. On August 20, Canto started liquidity mining through governance voting.

Users can cross-chain supported tokens to the Canto native blockchain, and then transfer to the Canto EVM chain. Currently, Canto’s official website shows that the deposit APR of USDC in lending is 8.52%, and the deposit APR of USDT is 18.41%.

Convex+Curve

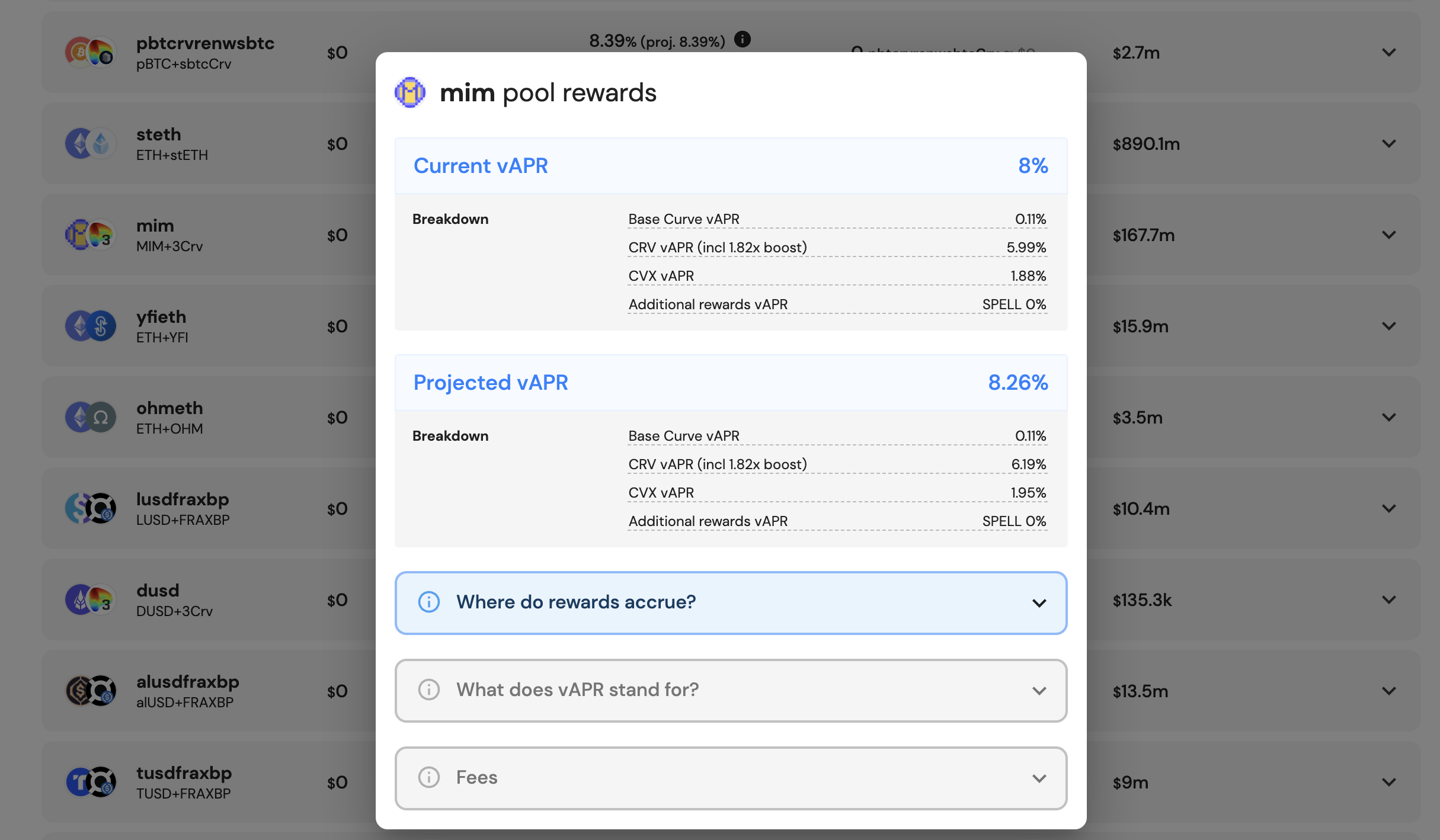

Curve can provide stable currency exchange services with low slippage, and also has the best stable currency liquidity. Convex can use its pledged CRV to help Curve's liquidity providers obtain higher multiple returns. The combination of the two provides a large number of Opportunities for stablecoin mining and a large amount of financial support also mean that the security of these two projects is relatively high (the security of the supported assets needs to be considered separately).

For example, MIM+3Crv pool, MIM is a stable currency generated by over-collateralization in Abracadabra.money, and 3Crv is an LP token obtained after depositing USDT/DAI/USDC into Curve 3pool. Users can directly use one or more tokens of MIM, USDT, USDC, and DAI to provide liquidity in the Curve MIM+3Crv pool, and then pledge LP tokens to Convex to start mining. The income is mainly CRV tokens, and then CVX and transaction fee sharing. The current APR is 8%, and the funds in this liquidity pool on Convex are about 170 million US dollars.

If you are worried about the risks of MIM, users can also mortgage assets in Abracadabra.money (such as cvx3pool tokens, that is, USDC/DAI/USDC will provide liquidity in Curve 3pool, and then pledge LP tokens to Convex to obtain LP tokens. currency), lend MIM, and only choose MIM when providing liquidity in the Curve MIM+3Crv pool. This process is equivalent to shorting part of MIM.

Similarly, there are some new stable currency pools in Convex, such as DOLA+3Crv, APR 10.12%, liquidity is about 100 million US dollars; ApeUSD+FRAXBP, APR 14.13%, liquidity is 7.3 million US dollars. Relatively speaking, the smaller the liquidity, the greater the risk may be.

Euro Stablecoins

Euro stablecoins are not as popular on the blockchain as USD stablecoins, and the yield on the chain is slightly higher than that of USD stablecoins to attract enough liquidity. More and more institutions have realized the importance of this part of the market, and Circle also launched its own Euro stablecoin on June 30. The liquidity and mining of this part of the stable currency still need to rely on Curve and Convex.

For example, the EUROC+3Crv trading pair shows a yield of 9.2% in Convex and a liquidity of $2.5 million. EUROC is the euro stable currency launched by Circle. Users can use one or more tokens of EURCO, USDT, USDC, and DAI to provide liquidity in the Curve EUROC+3Crv pool, and then pledge the LP tokens to Convex. You can start mining.

Similarly, the Euro stablecoins in Convex also include ibEUR+sEUR with an APR of 11.07%, and ibEUR+agEUR with an APR of 13.02%.

Risk reminder: The overall risk of the encryption market is higher than that of the traditional financial market, and there have been frequent security incidents recently. Do not put all your funds in one place. Please understand the specific risk points before investing. Do your own research. PANews will continue to update the series.