first level title

What is a brush transaction in NFT?

On the one hand, the order brushing transaction may be to create the illusion that the supply of the project exceeds demand, and on the other hand, it may be to obtain the activity rewards provided by the platform.

first level title

Current status of brushing transactions

Traditional securities and futures markets prohibit brushing transactions, but there are still a large number of brushing transactions in the NFT market in the early stages of development. According to NFTGo.io data, there are currently 1,075 projects in the NFT market that involve swiping transactions, and the addresses involved in swiping transactions exceed 82,000. In addition, the number of swiping transactions on the entire network reached more than 250,000 times.In the market, some project parties will "pull the market" by swiping orders to achieve marketing effects. This is essentially an act of deceiving users with data. However, there are many reasons and methods for swiping orders. , cannot be generalized. For example, among the top ten projects with a high degree of brushing transactions, there are not only some unknown projects, but also the potential blue-chip project Meebits. This shows that, at this stage, the order-swiping transactionIt cannot evaluate the quality of a project, but it can still help us understand the composition of a project's transaction volume

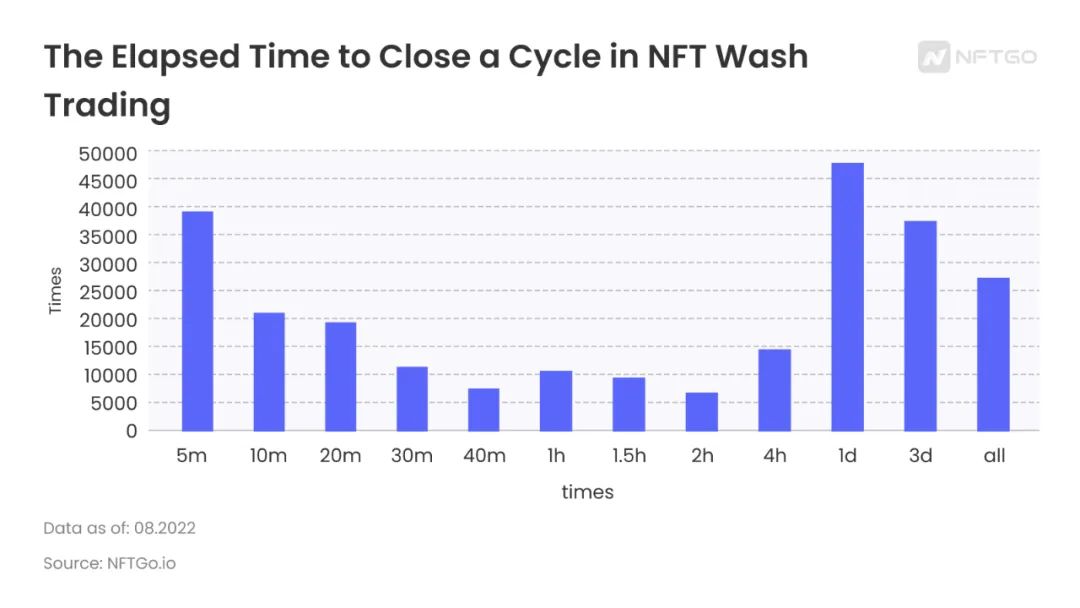

, If the chips in the trading volume are too "centralized", investors should be cautious about this situation. For example, the figure below shows the top ten projects involving brushing transactions, and the proportion of brushing transactions of R*** and T*** ranks first and second respectively.Most brushing transactions haveInstantaneous, high-frequency features, and usually over a long period of time. According to NFTGo.io data, most of the cycle required to complete a round of NFT brushing transactions is 5 minutes. The longer the time, the first is that the price may fluctuate, and the other is that other participants may steal profits. Understanding the above purpose, we can identify the key to brushing transactions based on behavior——Buyer and seller are often single or multiple addresses under the control of the same person.

Just as people discovered Melania’s brushing transactions, we can also capture the traces of brushing transactions from the chain.

Why is the closed-loop transaction within a day also a small high point? The study found that the swiping transactions in these projects present a characteristic: usually a certain address trades all the NFTs in its own assets once a day (this amount is usually relatively large, reaching tens of thousands), and The transaction comes back the next day to form a closed loop. Because the base of NFT is large enough, this seemingly "slow" brushing transaction can often generate a huge transaction volume, which in turn creates a false picture of market prosperity.

secondary title

The purpose of brushing transactions

At present, the number of NFT issuance projects and daily transaction volume of Ethereum are among the top of all public chains. To a certain extent, this will also make it easier to cover up the traces of swiping transactions. Swiping transactions on Ethereum will also consume a large amount of Gas fees. The high cost of swiping orders has also reversely screened the implementers of swiping transactions. These people have some common characteristics, such as sufficient funds and clear strategies.

There are three main purposes of swiping orders for NFT in the market: one is for hype, to increase the transaction volume and price of designated items through funds, and attract players to enter the game. The second is for money laundering. For example, some hackers flow "dirty money" into the NFT market and then transfer it out, thus completing the whitewashing process. The third is to obtain $LOOKS income and enhance the value of their own NFT. For example, it is more common that some people will conduct multiple transactions in order to obtain $LOOKS by swiping orders on LooksRare. once. Therefore, frequent transactions far above the floor price, abnormal transaction records under the same address of a single NFT, etc. can be used as the basis for identification.

first level title

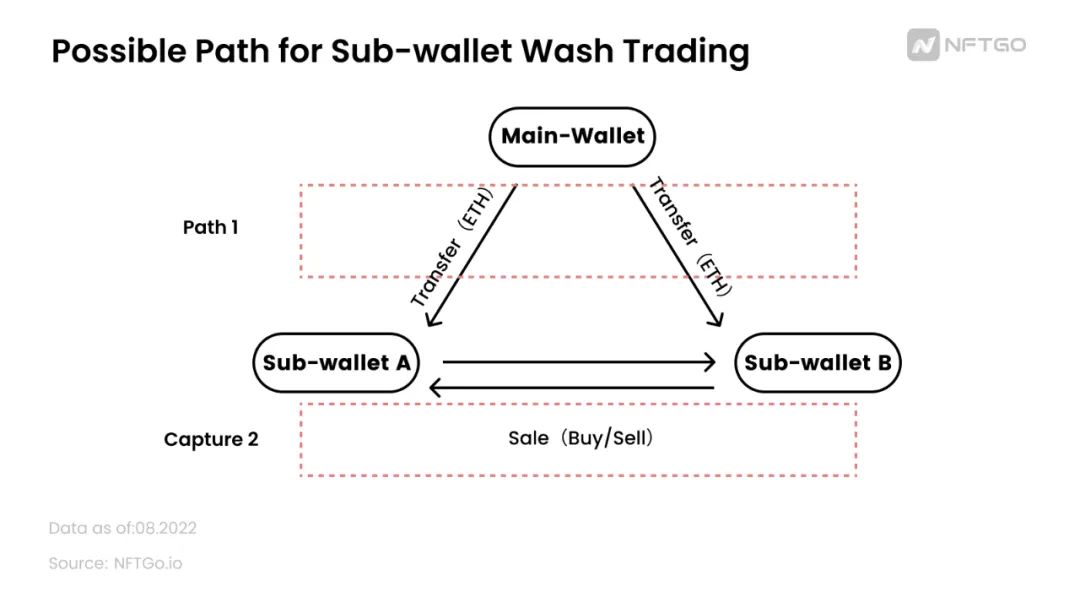

How to identify and capture fraudulent transactionsWe enumerate the on-chain behavior of brush traders by assuming the most basic brush path. First, the same user may create multiple sub-wallets for transactions between their own wallets. Before preparing to trade, these wallets also need to have enough funds to interact, and some brush traders willDirect off-site transfers from the parent wallet, thus producing"One to many"

, so we capture multiple sub-wallets (associated wallets) created by the user based on this behavior. At present, we can use the data on the chain to carry out "traceable" brush transactions, and track the original mother wallet to determine the identity of the "swiper", but once the funds enter the off-site, the chain will be "broken".Second, wallet correlation clustering can be performed to capture mutual closed-loop transactions between wallets. If two or more wallets have been conductingUninterrupted high-frequency transactions without interacting with other wallets

, we can also determine its suspicion. Some mechanical swiping transactions can be identified through limited queries on these two on-chain behaviors, so as to reversely identify sub-wallets, but the disadvantage is that when the funds come from outside the market, the identity of the "swiper" cannot be known.

Third, check the historical transaction records under a certain NFT. The same NFT has been traded many times in a short period of time at a price much higher than the floor price, and the transaction price position has not changed significantly.

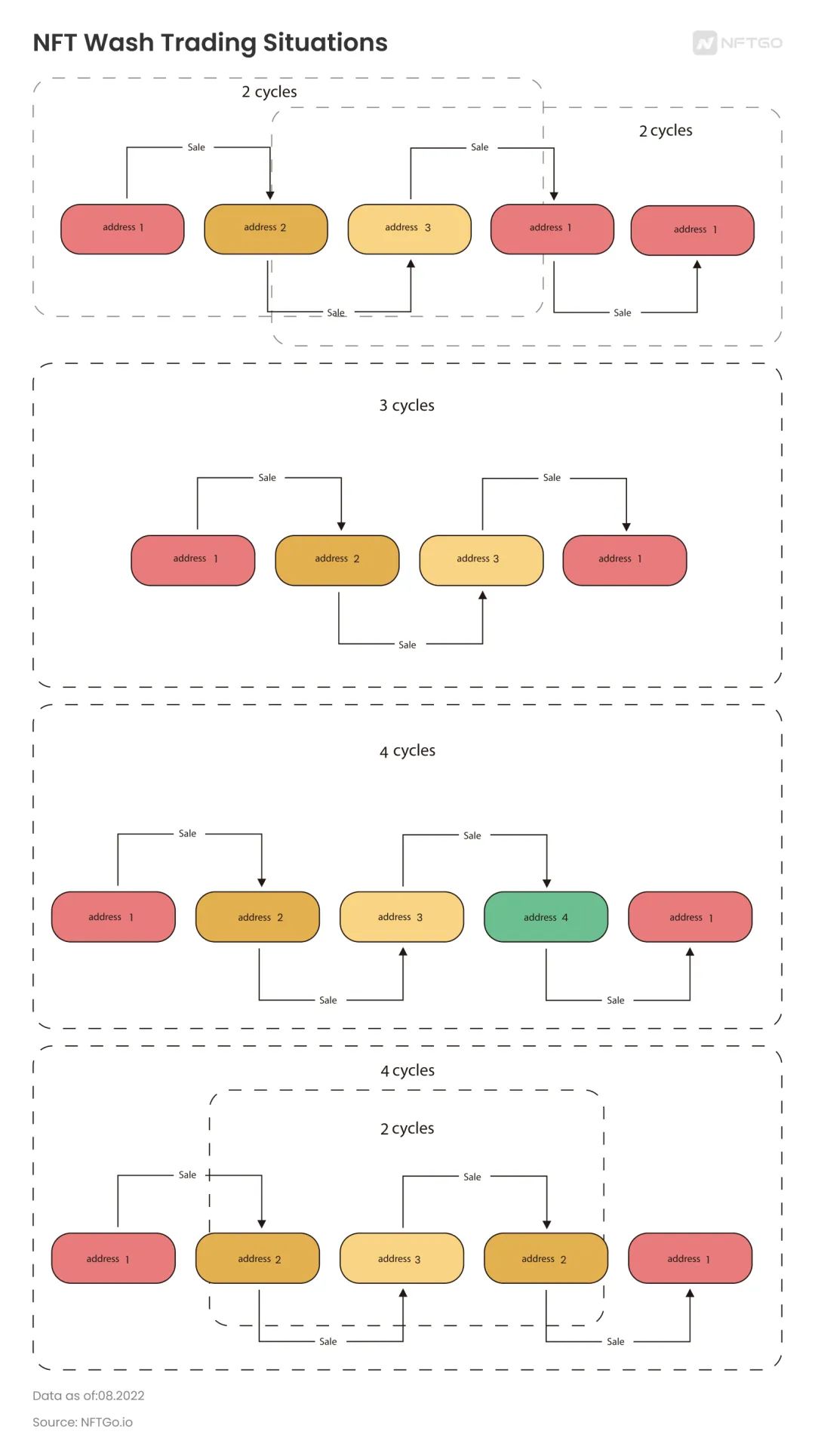

Usually in a swiping transaction, NFT and funds will be returned to the trader's initial address, or returned to the trader's wallet through an over-the-counter transaction. Hence the loop for "primary trader - other address - primary trader". We can classify and analyze transaction flow based on address clustering and priority.

secondary title

Types of brushing activity

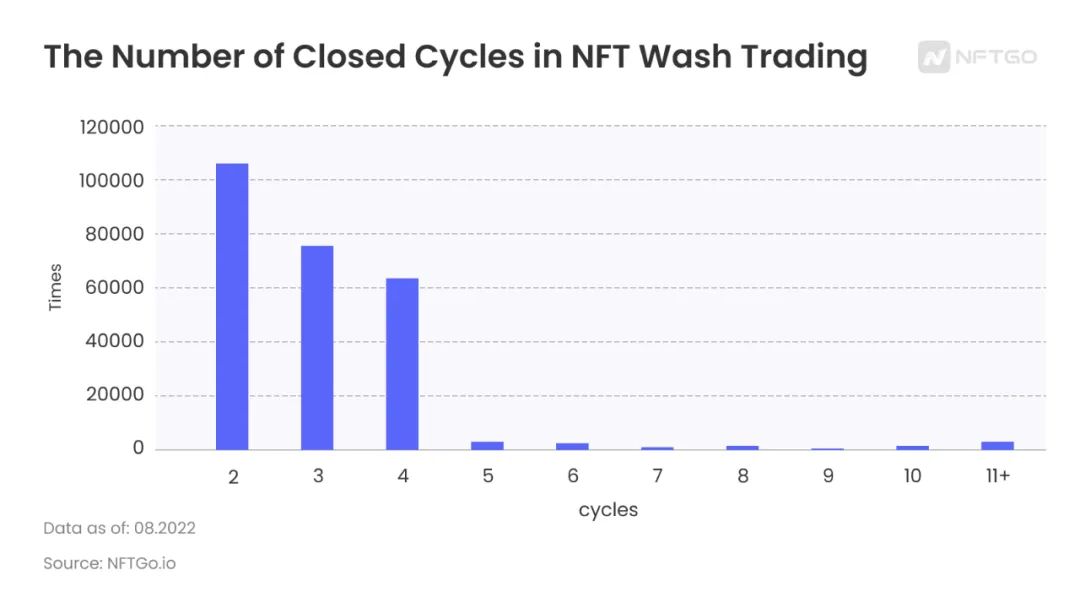

According to the above classification, we found that the number of closed-loop transactions between two yuan rings is the highest, followed by three yuan rings.

first level title

How to cut out the "noise" and master the data?

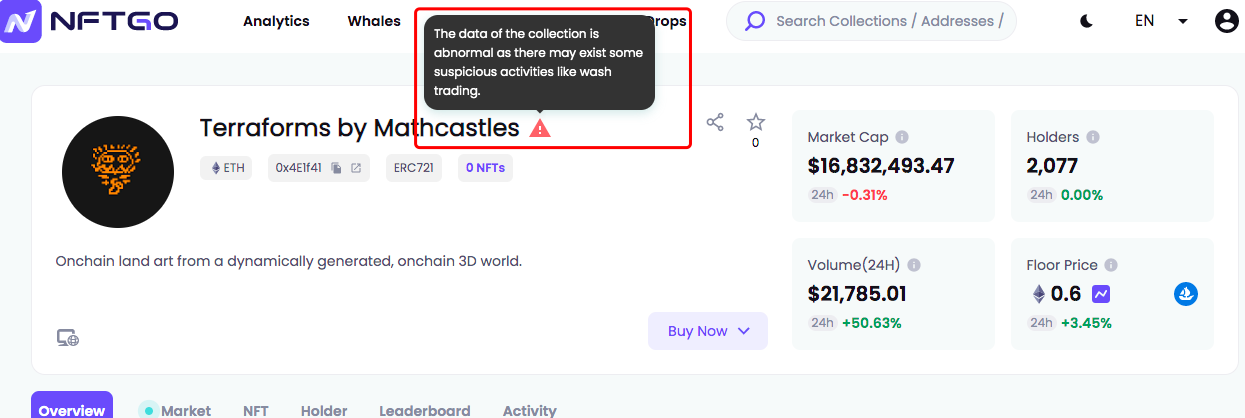

NFTGo.io recently launched a new wash trading feature (Wash Trading Feature), which can filter out all suspicious brushing activities on the project details page and main indicators, including price, transaction volume, trader, sales and giant whale tracking wait. Our team develops a strategy for identifying scams through extensive research, algorithmic analysis, and tracking trades for each listing. We are also one of the first NFT data analysis platforms to integrate this function into the data and open it to the public.

The NFTGo.io platform now automatically filters suspicious scams based on key metrics on the page, including items, NFTs, addresses, markets, and market overviews.

Please refer to the product documentation to view more detailed information on NFTGo.io, such as key indicators and pages that can display real data through the brush trading filter.

🔗 https://docs.nftgo.io/docs/wash-trade-filter

secondary title

Brushing Filters and Flags

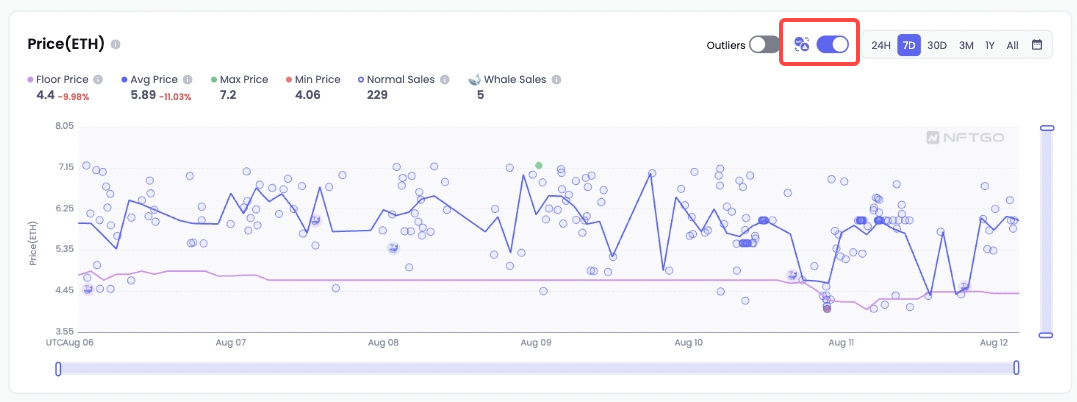

At the top of all item price charts and event pages, we have a new "Filter Wash Trades" button. This feature allows users to better understand market activity by filtering out brush transactions.

Taking Meebits 7D data as an example, you can see that the data is different before and after you turn on the "Filter Trading" button.

Before starting the "Filter Scalping Transactions" button:

When the filter button is off, a red flag will be placed next to all suspicious transactions to alert the user. With the push of a button, these suspicious transactions will be removed from the data.

secondary title

first level title

epilogue

epilogue

Although there is no clear way to avoid fraudulent trading, you can find a solution from the above link. For example, adding KYC when the sub-wallet interacts with the trading market, so that the situation of "one person with multiple wallets" can be identified, but the trading market may lose some users who pay more attention to privacy.