background

Compilation of the original text: The Way of DeFi

background

Ethereum is scheduled to merge to Proof-of-Stake (PoS) on September 15, 2022, as expected, fueling speculation of a Proof-of-Work (POW) Ethereum (ETHW) fork. While there is precedent for an Ethereum fork, we’ll explore why it might not work this time around, and what it means for Ethereum (ETH) and Ethereum Classic (ETC).

Ethereum Classic (ETC) was born in 2016 when a bug in the code of a fledgling decentralized autonomous organization (dubbed "The DAO") was exploited and hackers stole more than 3.6 million ETH. While most of the community supports a hard fork to modify the network’s transaction records to invalidate the attacker’s actions, a portion of the community believes that no changes should be made to the chain state. A forked version of the Ethereum network became the Ethereum chain we have today, and a subset of users who opposed the fork went on to host the version of the network that The DAO's attackers successfully attacked, now known as Ethereum Classic (ETC).

Since then, Ethereum has grown into a robust on-chain ecosystem of decentralized applications (dApps) and users, while Ethereum Classic remains largely a store-of-value asset. Despite the differences, Ethereum Classic (ETC) offers a new proof-of-work (PoW) variant of the Ethereum network that users, developers and miners can seamlessly transition to if an Ethereum merger results in a hard fork .

image description

Source: TradingView, as of August 15, 2022

Historically, forking assets has been very profitable, with many of the top coins by market capitalization starting as forks of Bitcoin and Ethereum. For example, in July 2016, when Ethereum (ETH) forked into ETH and ETC, anyone holding tokens on the original blockchain at the time immediately owned an equivalent amount of the new tokens. By the end of the year, ETC ranked sixth with a market capitalization of $124 million, while ETH was at $697 million. Today 5, Ethereum Classic (ETC) is the 19th largest token by market capitalization, worth over $5.6 billion.

Despite the precedent of forks creating value in the past, we will explore why creating an Ethereum PoW fork might not be a viable solution this time around.

Ethereum is more than a currency

image description

Source: CoinMetrics, CoinGecko, as of August 15, 2022

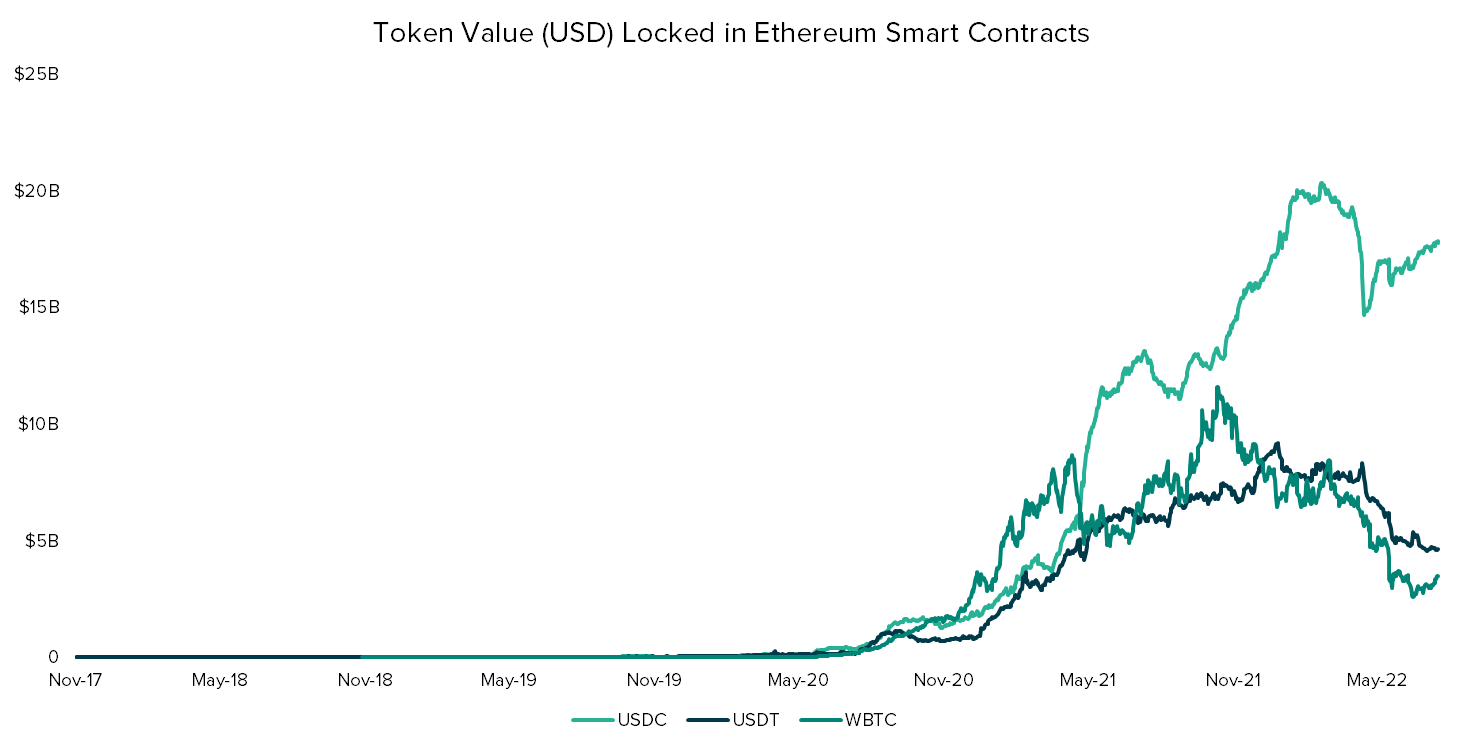

Tether and other stablecoin issuers, such as Circle (USDC), have stated that only tokens on PoS networks can be redeemed after the fork. This means that all stablecoin variants on ETHW could become worthless, in addition to other “asset-backed tokens” such as wrapped Bitcoin (wBTC) and staked ETH (stETH).

image description

Source: CoinMetrics, August 15, 2022

So far, the speculative market for ETHW has not reflected strong support for the fork. The price of ETHW, which can be considered a proxy for how much support a potential fork might have, has been trending down since ETH IOU trading began on Aug. 10 when Poloniex launched support. ETHW traded at a peak of 0.08 ETH before continuing to rise, with a steady downward trend to 0.03 ETH.

image description

Source: CoinGecko (Ethereum POW on Poloniex), as of August 15, 2022

Unnecessary complexity for protocol teams

In addition to the loss of value of non-redeemable asset-backed tokens on the ETHW chain, an ETHW fork could introduce new operational issues for many Ethereum-based protocols. When protocol token holders vote to deploy on new blockchains, the circulating supply of protocol tokens does not change to prevent value and utility from being diluted. However, on a PoW fork, the protocol will be replicated, as will any native token. This means they may be transacting at a different price than their counterparts on the PoS chain.

As such, the protocol will need to determine how to manage tokens of value held by duplicate vaults, duplicate tokens, NFT ownership, etc. How to consolidate governance rights? Can someone buy a cheaper variant and still have the same amount of voting power? Will duplicate tokens in the protocol vault be held or sold? Protocol teams may find it much simpler to deploy new protocol instances on Ethereum Classic (ETC) without any token variant issues.

The Bull Case for Ethereum Classic (ETC)

The success of the ETHW fork requires not only users, funding, and development efforts, but also strong support from the existing blockchain infrastructure. Major exchanges and DeFi protocols are already deciding whether to support ETHW tokens, although these do not necessarily indicate a preference or endorsement of ETHW technology.

Now that a potential ETHW fork is gaining traction, miners may play a more critical role. After the merger, miners will no longer be able to receive rewards from the Ethereum network and will seek to transfer their resources to the new network. With about a month to go until the expected merger, there is still no documentation or expected timeline for how miners will need to adjust their machines and software to mine the ETHW chain. Meanwhile, Ethereum Classic (ETC) is fully documented and operationally ready to absorb the current hashrate of mining Ethereum.

in conclusion

in conclusion

ETHW forks will face significant challenges due to the complexity of DeFi and the proliferation of asset-backed tokens. While the chances of success are expected to be low, there has been some support for the PoW fork from miners and exchanges. So far, speculation on the ETHW token has resulted in a steady price drop of more than 50% since launch, while ETC's price has risen by about 9%. In addition to declining interest in the ETHW token, major Ethereum protocols and players, such as Tether and Circle, have expressed support for ETH PoS as the canonical chain—an important sign of support, as the two companies are responsible for nearly 1,200 A token backed by $100 million on-chain assets. If the protocol finds out that token holders do want to have a variant of the protocol on Ethereum's PoW chain, they will likely favor ETC over getting bogged down in the complexities of an on-chain ecosystem replicated on ETHW.