This article comes from Medium, the original author: Arthur Hayes, compiled by Odaily translator Katie Koo.

This article comes from

, the original author: Arthur Hayes, compiled by Odaily translator Katie Koo.I will apply this theory to discuss the Ethereum merger. The conclusion is:

The merger itself is not affected by the price of Ethereum, and its success or failure depends entirely on the skills of Ethereum core developers.

secondary title

The merge will bring two changes

It will eliminate PoW ETH emissions per block (i.e. ETH paid to miners in exchange for the computing power they provide to maintain the network). Currently, these emissions total about 13,000 ETH per day. After the merger, the 13,000 ETH per day emission from miners will be replaced by a smaller 1,000 to 2,000 ETH per day emission that will be replaced by network validators (that is, those who spend ETH Which ETH transactions are valid and which are invalid in exchange for more ETH). These emissions will occur at the same rate regardless of the price of ETH and usage of the Ethereum network.

Every block burns a certain amount of gas fees (meaning that the ETH used to pay these fees is permanently withdrawn from circulation). This variable depends on network usage. Network usage is a reflexive variable, which I explain in more detail later.

Total ETH inflation = block emission - gas burning fee

I take the block emission as a constant over the current local conditions. Gas fees depend on network usage.

Inflation = block emission > gas fee

Deflation = block emission < gas fee

Those who believe that ETH will be a deflationary currency must also believe that network usage (and thus, fees paid by users for consuming ETH) will be high enough to offset the ETH emitted every block as rewards for validators. However, to assess whether they might be right, we must first ask — what determines the usage of a cryptonetwork like Ethereum?

market participants' views on the market situation;

Applications: Which network has the most robust Dapps? Which of these applications are leading the way? Which of these apps has the greatest trading liquidity?

Market participants' prediction of the situation

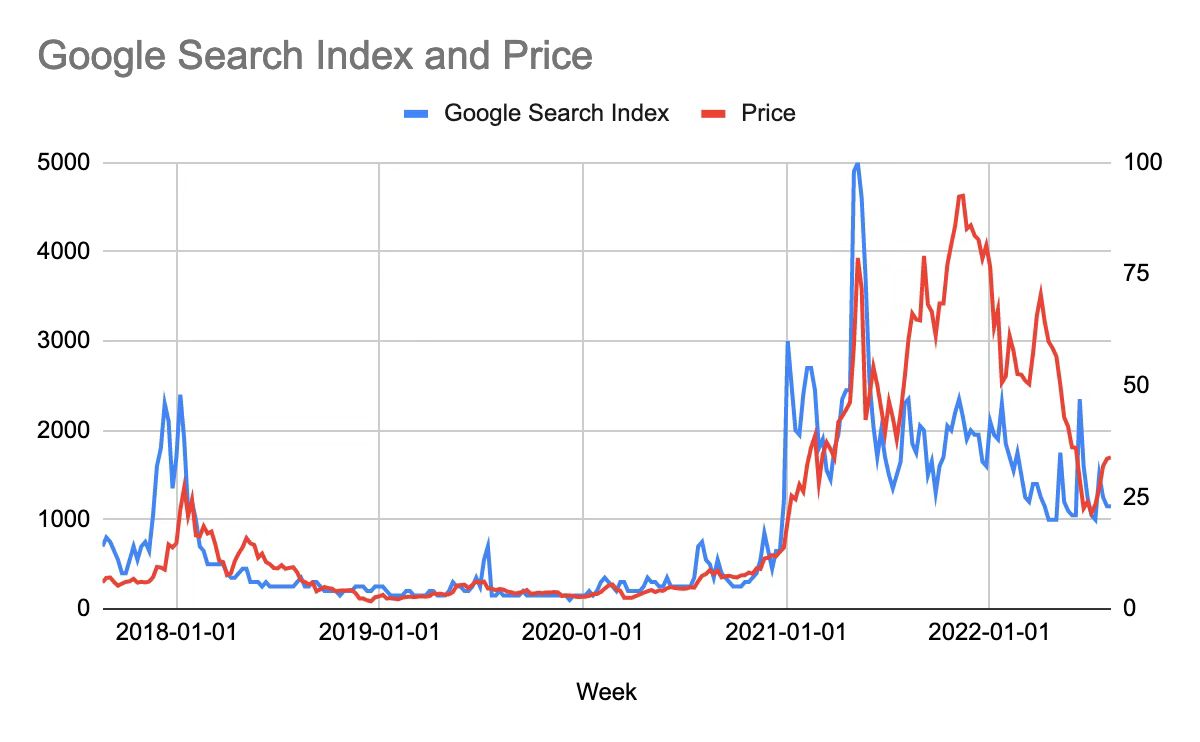

There is a reflexive relationship between market participants' perceptions of the market situation and the price of ETH. The graph above shows Ethereum Google search trends and Ethereum price. It can be seen that they are closely related. If I run a correlation between the two data series, r = 0.77. Conceptually, this makes sense. Interest in the Ethereum network ebbs and flows with the price of its native token — as the price rises, more and more people hear about Ethereum and want to buy and use the network, further driving the price up.

secondary title

The quality of applications on the web depends on the quality and quantity of network engineers. As a developer, you create things for people to use. If no one is using the web, you're less likely to use it for development. Obviously, developers want to write code in a language they are familiar with, but this preference is secondary to the number of users that can interact on a given decentralized network.

The number of developers is directly related to the number of users their work can serve. As we established above, the number of users of a given network is directly related to the price of the native token. Because the number of users and price share a reflexive relationship, the number of developers and price must also share a reflexive relationship. As the price rises, more people hear about Ethereum, more people use the network, and more developers are drawn to build applications on the network, attracting a large and growing Growing user base. The better the application, the more users will join the network.

secondary title

Two Possibilities for the Future Crypto World

The degree of deflation of ETH depends on the gas fee burned.

The amount of the gas fee depends on the usage of the network.

Use of the network depends on the number of users and the quality of the application.

There is a reflexive relationship between the number of users and the quality of applications and the price of ETH.

Therefore, it can be seen from the transitivity that there is a reflexive relationship between the deflation rate and the ETH price. With this in mind, there are two possibilities for the future of the crypto world.

If a merge occurs:

If the merger is successful, there is a positive reflexive relationship between the price and the amount of monetary deflation. So traders will buy ETH today, knowing that the higher the price, the more the network will be used, the more it will become deflationary, driving the price up, causing more use of the network, and so on. This is a virtuous circle for the bull market. A ceiling occurs when everyone has an Ethereum wallet address.

If the merge did not happen:There is a bottom line to this relationship as the network is the longest operating decentralized network. ETH gained massive market cap without consolidation. The hottest Dapps are built using Ethereum, which also has the most developers of any L1 chain.

As I mentioned in my previous post, I don't believe the price of ETH will fall below the $800-$1000 it experienced during the TerraUSD or Three Arrows Capital crypto credit crash.

secondary title

market opinion

We now need to determine the market's perception of the success or failure of the merger.In my opinion, this can best be answered from the chart below, which shows the ETH/BTC ratio. The higher the ratio, the better ETH outperforms Bitcoin. Since Bitcoin is the reserve asset of the crypto capital market, in my opinion, if ETH outperforms Bitcoin at this stage, it means that the market believes that a successful merger is more and more likely.

Since the crypto credit crisis, ETH has outperformed BTC by about 50%. So I think it's reasonable to assume that the market is increasingly confident that a successful merger is on the horizon.

The current expected merge date proposed by Ethereum core developers is September 15, 2022. But this is just the point of view of the spot market. What about the perspective of derivatives traders?

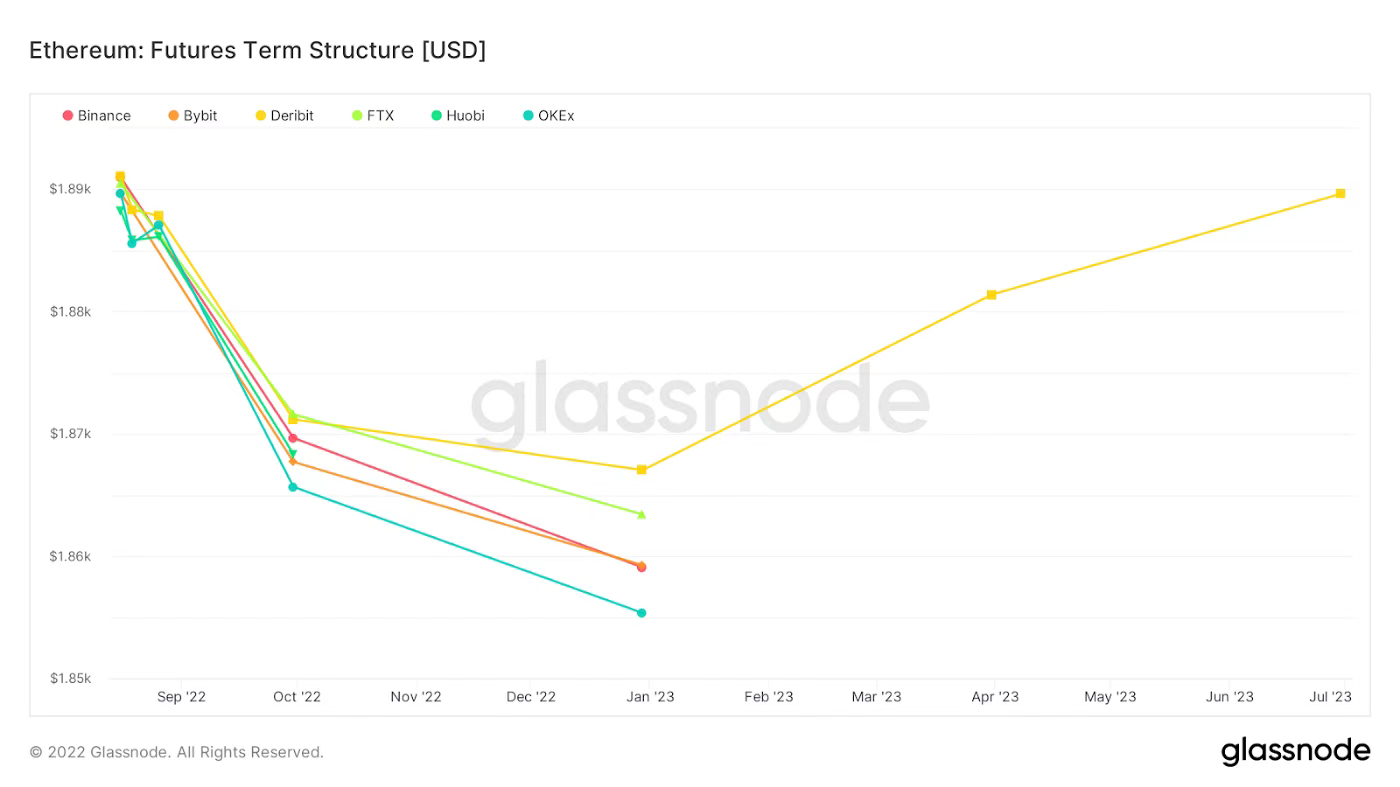

The chart above illustrates the term structure of ETH futures. The futures term structure plots the current price of a futures contract against the time to expiration. It allows us to forecast supply and demand conditions for different maturities by calculating the premium or discount of the futures contract relative to the underlying spot price.

backwardation = futures price < current spot price; discounted futures trade

Considering that the entire curve through June 2023 is in backwardation, this means that the futures market predicts that the price of ETH by the expiration date will be lower than the current spot price. On margins, selling pressure outweighs buying pressure.

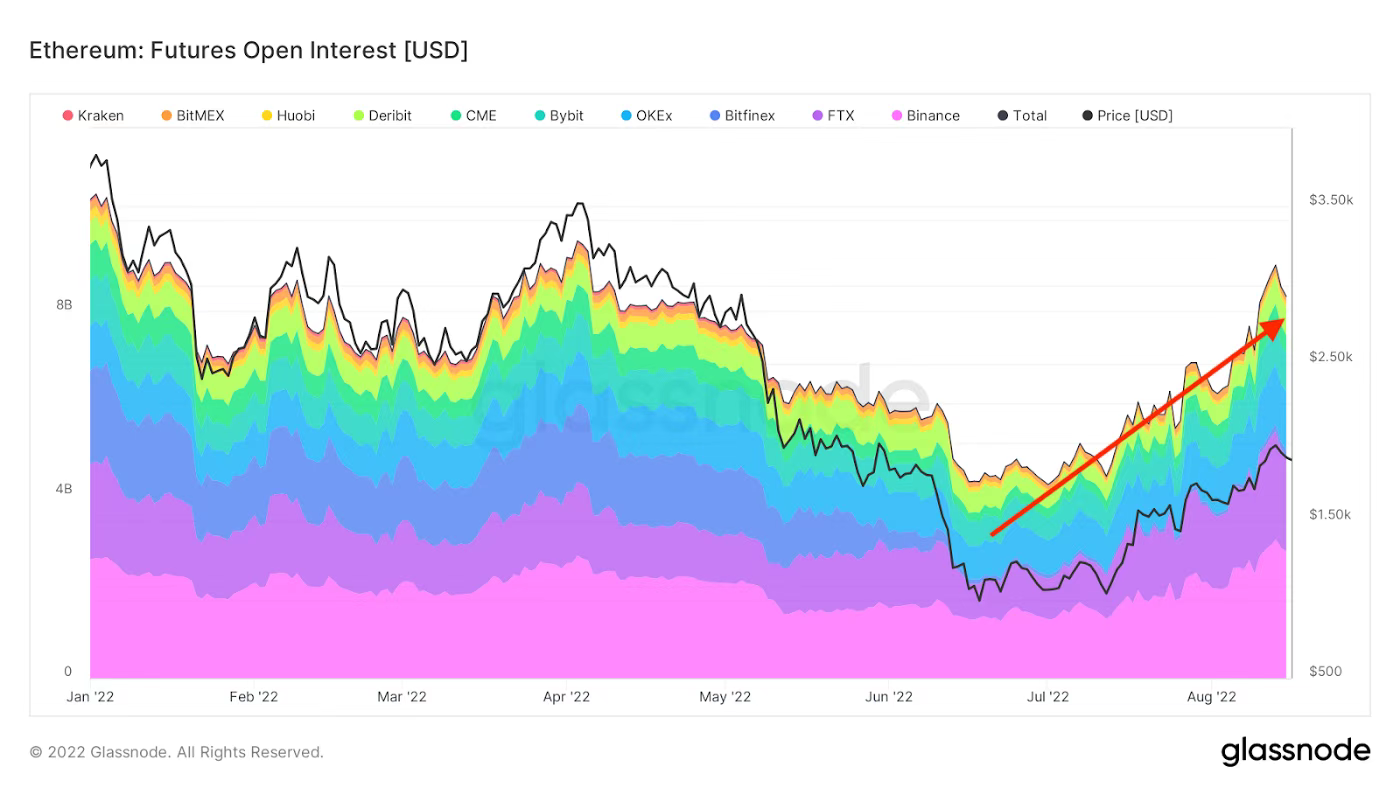

Here is a chart of ETH futures open interest. Open interest is the total number of open futures contracts held by market participants at a given point in time. As you can see, it is recovering from its lows during the crypto credit crash in mid-June. The curve is in backwardation while the open interest is increasing. In my opinion, this means that the selling pressure is increasing. Conversely, if the curve is in contango (futures price > current spot price), the amount of open interest increases, which would indicate significant and rising buying pressure on the margin.

secondary title

Two potential reasons for the current selling pressure

You are long ETH, but not sure if or when the consolidation will work out, so you fully or partially hedge your ETH exposure by selling futures contracts at a price above the current spot price.

You want the merge to happen and want to be able to pick up free public chain split tokens that will be minted and distributed when some related token of ETH resists the merge and creates a fork to maintain ETH's PoW chain To all ETH holders. So, you are long Ethereum, but you also want to hedge your exposure to Ethereum by selling futures contracts. If you sell the futures contract at a discount to the value of the chainsplit tokens you received, then you can make a profit.

But remember I just showed that ETH outperformed BTC by 50%. Selling by market makers in the spot market is no match for the long-term flow of bulls. This means that market confidence in a successful merger is undervalued and overshadowed by short-hedging liquidity from market makers.

If the market believes that the odds of a merger happening are increasing every day, what happens to those who are hedging through futures contracts if the merger succeeds?

If the merger is successful, and the tokens of the public chain split are distributed, they will be sold for whatever value, and those who hedged their positions will be liquidated immediately. Now, they may decide to sell spot ETH and close out their positions completely, but I bet these traders will be in the minority. The possibility that ETH could benefit from positive reflexivity will be discovered.

I think a successful merger will create some buying pressure, reversing market makers' futures positions in the process. They will switch from being long/short in futures to being short/long in futures. The spot they are short has to cover (which means buying spot), and if they are net short futures, they must now go into the market and buy additional spot. The unwinding of derivative flows that resulted in backwardation prior to the consolidation will result in contango post-consolidation.

secondary title

trading decision

For those who believe the merger will go through as planned, the question becomes: How do you express your bullish view?

Lido Finance

Spot/ETH

The most straightforward transaction is to buy ETH with fiat currency, or add ETH to your crypto portfolio.

Lido Finance is the largest Ethereum Beacon Chain validator. Lido allows players to stake ETH to earn validator rewards. In return, Lido will receive a 10% reward in ETH. Lido has a token-issuing DAO - LDO.

This is an attractive option if you want to take on more consolidation risk. It's riskier than owning spot ETH because Lido's value proposition is entirely dependent on the success of the merger - whereas with spot ETH, it might still be successful because it has other value propositions (i.e. powering the second largest public chain by market capitalization) ).

LDO is up more than 6x since the crypto credit crash in mid-June as the combined beta is higher.

Go Long ETH Futures

Going long on ETH futures is a good choice for those who want to gain more profits by increasing their leverage trading. Because of the negative basis, those who hold long futures are rewarded by holding exposure to ETH.

Basis = futures - spot

Looking at the term structure, futures contracts expiring in December 2023 are the cheapest. If the merge succeeds, due to the remaining time value. Futures contracts expiring in September 2023 still have 1-2 weeks of time value after combining, and you won't get the same basis effect as if you were long December futures.

Long ETH call options

Buying call options is a good strategy for those who like leverage but don't want to worry about being liquidated like with futures contracts. Implied volatility for September and December futures is currently lower than realized volatility. This is expected since hedgers use not only futures contracts but also options.

Interestingly, when I entered the market to buy a December 2022 $3000 ETH call option, I was able to trade at a much larger quote than what was on the screen. I've been told this is because traders have a lot of long call options and hedgers are hedging their long ETH positions through long coverage. Traders are more than happy to reduce their long call exposure as this frees up margin and they are showing very tight prices on quotes.

Long December Futures vs. Short September Futures

This is a curvilinear approach. You need to watch your margin very carefully. While you have no exposure to the ETH price, you will be showing unrealized losses on the one hand and unrealized profits on the other. If the exchange in question does not allow you to offset these losses, then you will have to margin call the losing portion of the trade, otherwise, you will be liquidated.

secondary title

Buy when the rumour, or sell when the truth emerges?

Assuming you're long via some ethereum-related instrument, the question becomes - do you fully unload or close your position before the consolidation happens?

Because of the positive reflexivity that drives up the price of ETH before the merger, "textbook trading: suggests that you should at least reduce your holdings before the merger. However, the reality rarely meets expectations.

Yet a structural decline in inflation will only occur post-merger. I hope we see something similar to the Bitcoin halving. That said, we all know the dates when they will happen, but Bitcoin still bounces after the halving.With this thought experiment in mind, and my belief in the reflexive nature of the situation,

I will not reduce my position before and after the merger. But I will add to my position when the market sells off because I believe the best prices are yet to come.

secondary title

how to sell

To think deeply, we also have to consider the best strategy for reducing the time that merges take place. Given the current market sentiment and price action, those who were shorting ETH prior to the merger are fighting a reflexive trade. This is a very dangerous situation. When you short something, your maximum gain is 100% unaffected because the price can only go towards zero (while the maximum loss on the way up is unlimited). Therefore, timing is very important.The best time to shorten the time is before the merge takes place. That's going to be when expectations are highest, you have a short period of time between entering a deal and when the merger happens or doesn't happen. If the merger fails, the sell-off will be swift, given the market's high expectations and objective reality. This way you can exit the trade quickly with a profit.You know in advance your maximum loss, which is the put premium. This will allow you to eliminate unlimited losses if the merge is successful. Your downside target is a quick move below $1000.

Summarize

secondary title

Summarize

This article helped me really think about my trades and ultimately increased my confidence in my portfolio positioning. If I can't rationalize the thinking behind my portfolio, then I need to reexamine my trading decisions. In the course of writing past articles, I've made major changes to my portfolio and lost faith in previously held beliefs because I couldn't defend them well in written words.