July 2022, Thiago Freitas

Data Sources:Footprint chartimage description

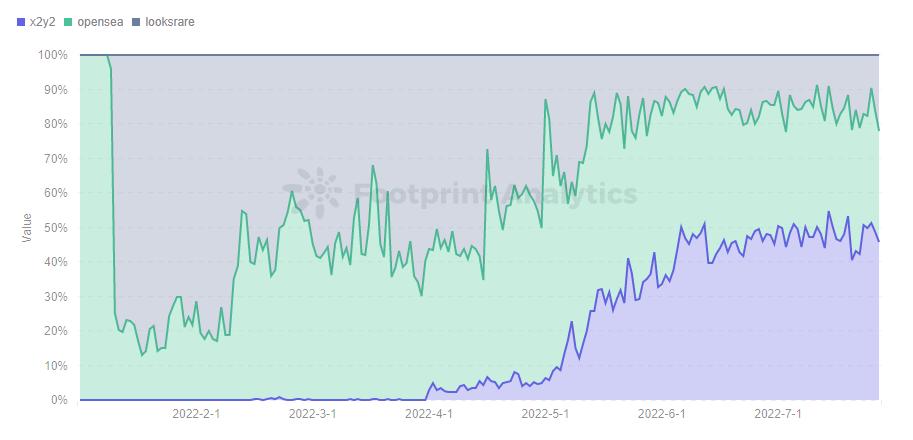

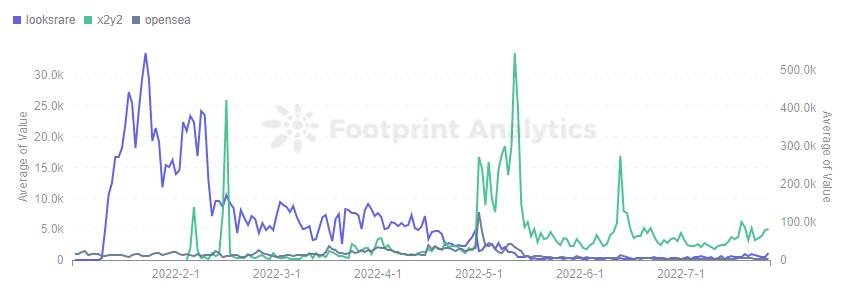

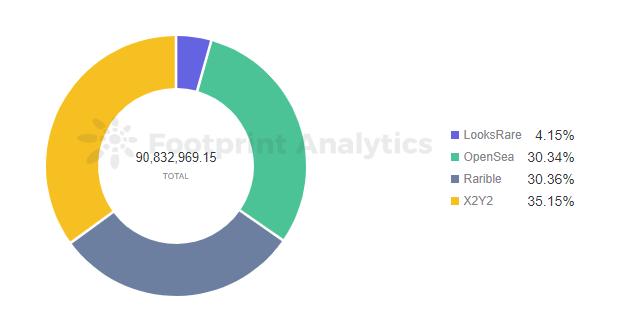

Footprint Analytics - Market Share of OpenSea & X2Y2 & LooksRare Volume

LooksRare gained more and more market share after its launch, but after the debut of X2Y2, a part of LooksRare's market share migrated to X2Y2, that is because X2Y2 has better trading conditions and made novel changes to its native X2Y2 token proposal. Since mid-May, X2Y2 has achieved a larger market share than OpenSea in terms of transaction volume. X2Y2 now accounts for more than 50% of the market share in trading volume. This can't help but make people wonder:

Where are these volumes coming from?

What is different about trading on these new trading market platforms?

secondary title

What the Entry of New Players Means for the NFT Exchange War

Since the launch of the platform, LooksRare and X2Y2 have taken the same approach to acquire users from OpenSea – airdropping tokens to OpenSea’s active users. This strategy is called"vampire attack", which aims to provide economic benefits to precise users through the native tokens of the airdrop platform.

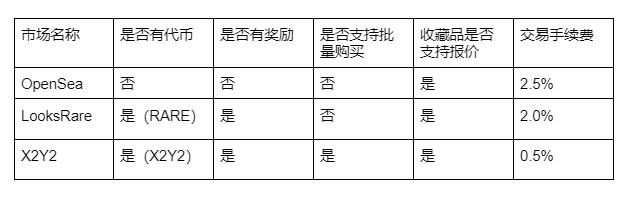

But these two new platforms are not simply"copy and paste"image description

Source: Official Website

secondary title

Transactions: Number of users, transaction volume, and average transaction value

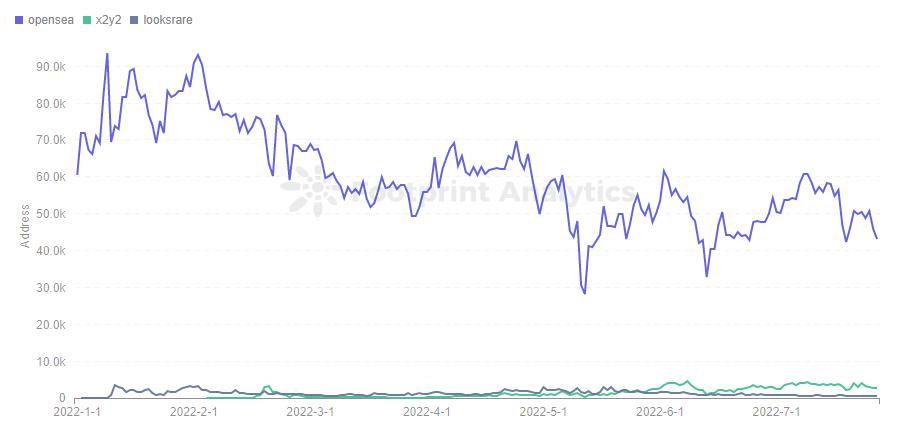

The figure below is a comparison of the number of users of the three platforms over a period of time. It can be seen that the new platform was attractive for a period of time when it was first launched, but OpenSea is still the dominant one. From the chart of daily active users below, it can be seen that see. itsdaily active usersimage description

Footprint Analytics - OpenSea & LooksRare & X2Y2 Daily Active User

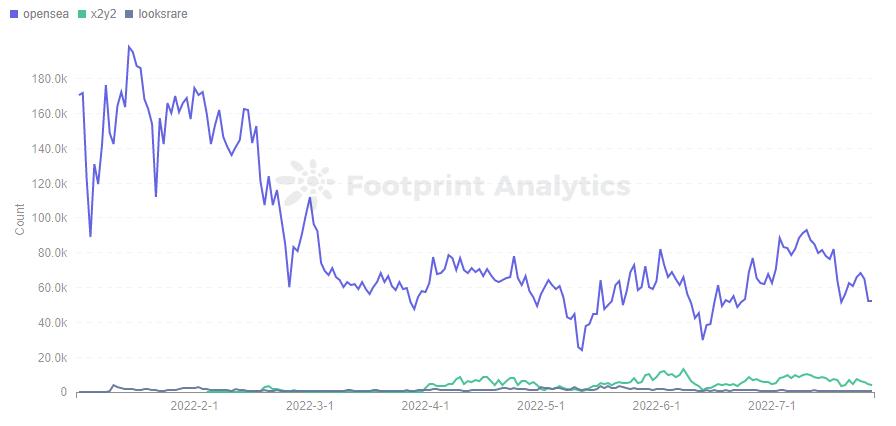

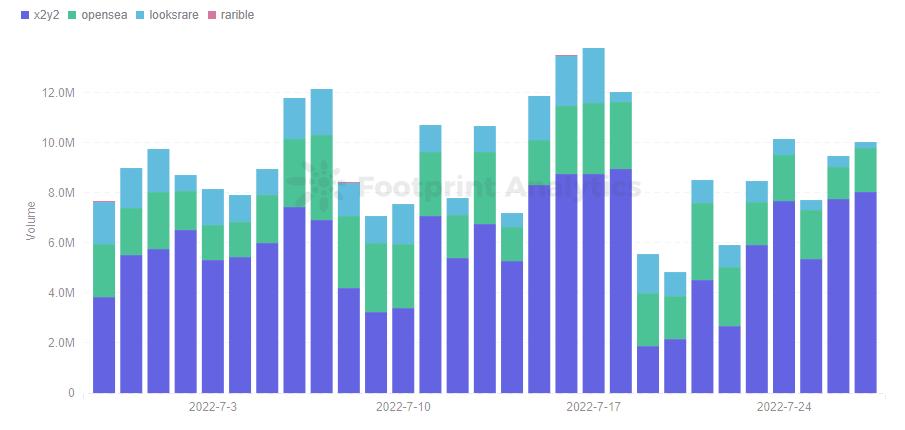

Transaction volume usually reflects the number of users, and Opensea still dominates in this metric. the followingFootprint Analytics chartimage description

Footprint Analytics - Number of OpenSea & LooksRare & X2Y2 Transactions

From the figure below, we can clearly see that OpenSea has the largest transaction volume and number of users, far ahead of X2Y2, which ranks second. However, if we look closely at the average price per transaction, we see thatimage description。

Footprint Analytics - Average Daily Trading Volume of OpenSea & Looksrare & X2Y2

secondary title

Where are the top NFTs traded?

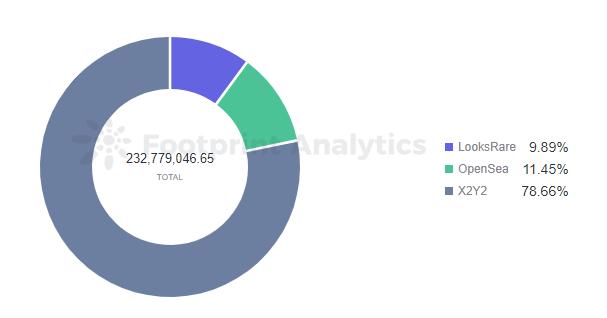

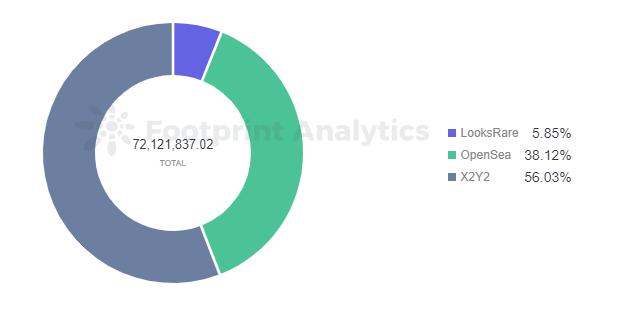

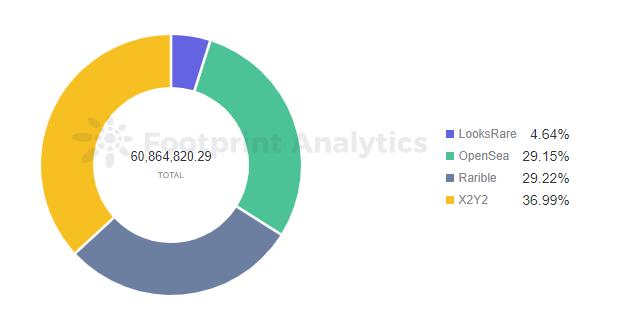

the followingpie chartis 4"blue chip"image description

Meebits transaction distribution, last 30 days - source: Footprint Analytics

BAYC transaction distribution, last 30 days - source: Footprint Analytics

MAYC transaction distribution, last 30 days - source: Footprint Analytics

Otherdeed transaction distribution, last 30 days - source: Footprint Analytics

Based on the information above, we list some of the main reasons why users choose to conduct NFT transactions on X2Y2:

Fewer fees are charged when trading, and it is more profitable for sellers to use X2Y2, especially when selling higher-value NFTs, the platform charges less.

The shopping cart function (bulk transactions) makes buying easier for buyers. Buyers can select all NFTs at once for checkout. Multiple NFTs can be purchased in one transaction, which also helps buyers save gas fees.

Rewards in the X2Y2 native token are distributed among buyers and sellers, and this reward model creates a virtuous cycle of user growth.

secondary title

Footprint Analytics - Volume of BAYC/MAYC/Meebits/Otherdeed in Different Marketplace(Last 30 Days)

Summary (TL;DR):

Combining the information in the above chart, we can understand that X2Y2, with its sustained high transaction volume, is already the leading market for blue-chip NFT collections. Smart NFT trading users know that choosing NFT trading markets with lower transaction fees as much as possible can save a lot of money.

Because X2Y2 tokens entitle users who hold tokens to receive a portion of the revenue generated by the platform. Therefore, the purchase of the exchange marketnative tokenThis work is original by the author, please indicate the source for reprinting. Commercial reprinting needs to be authorized by the author, and those who reprint, extract or use other methods without authorization will be investigated for relevant legal responsibilities.

This article comes fromFootprint Analyticscommunity contribution

The above content is only a personal opinion, for reference and communication only, and does not constitute investment advice. If there are obvious understanding or data errors, feedback is welcome.

Copyright Notice:

This work is original by the author, please indicate the source for reprinting. Commercial reprinting needs to be authorized by the author, and those who reprint, extract or use other methods without authorization will be investigated for relevant legal responsibilities.

The Footprint Community is a global, mutually supportive data community where members leverage data visualizations to co-create communicable insights. In the Footprint community, you can get help, establish links, and exchange learning and research on blockchains such as Web 3, Metaverse, GameFi, and DeFi. Many active, diverse, and highly engaged members motivate and support each other through the community, and a worldwide user base is built to contribute data, share insights, and drive the community forward