Original Compilation: Alpha Rabbit

Original Compilation: Alpha Rabbit

core point of view

core point of view

This is the first time that smart contracts on the chain have been directly sanctioned by OFAC

Although the sanction against Tornado Cash is the first time OFAC has included smart contracts on the SDN list, OFAC has sanctioned other cryptocurrency-related individuals and entities (and associated cryptocurrency addresses) before.

It is not enough to point out the function of Tornado Cash to confuse the source of funds. The real sanctions need to identify "money laundering". To qualify as money laundering, the obfuscated funds must be the proceeds of illegal activity, or the obfuscation must be for illegal purposes. And the fact that most of Tornado Cash's inflow comes from DeFi apps and CEXs shows that there is a large number of ordinary users using the protocol for enhanced privacy rather than for illegal reasons

Users of MetaMask, the most widely used Ethereum wallet, are now also prohibited from interacting with Tornado Cash (because MetaMask relies on Infura to interact with Ethereum, users who still want to use Tornado Cash must manually set the node configuration of MetaMask without using Infura to ensure MetaMask can interact with Tornado Cash), but doing so will face the responsibility of violating US sanctions. Such manual configuration has a threshold, which severely limits the number of Tornado Cash users.

TORN Governance Token will also be difficult to operate, not only because there will be fewer and fewer Relayers for TORN Token collateral, but also because Github does not support Tornado Cash business at all.

But because Tornado Cash is a decentralized application deployed on Ethereum (a blockchain that cannot be tampered with), the application itself will continue to run unaffected on the network, with virtually no way to stop it.

When calling the transfer function on USDT or USDC, the smart contract will query the off-chain blacklist to ensure that neither the sending address nor the receiving address exists. If the address appears on the blacklist, the transaction is blocked. While this permission may not grant the ability to blacklist individual tokens, or seize tokens from specific addresses, it is capable of affecting blacklisted addresses.

Some critics believe that MakerDAO and DAI are facing the existential risks posed by PSM and USDC - if regulators may demand a large increase in blacklisting or freezing USDC, or if they force the establishment of an actual white list that inhibits the free transfer of USDC, Then the debt of most DAI Makers will not be able to be backed, making the system insolvent

background

background

On Monday, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) added the Ethereum addresses associated with Tornado Cash to its list of sanctioned entities. Why is this a landmark event? Because this is the first time that the US government has imposed sanctions on smart contract applications.

main conclusion

main conclusion

OFAC sanctioned 38 smart contract addresses associated with Tornado Cash, an on-chain mixer.

This is the first time OFAC has sanctioned a smart contract agreement;

Ethereum node providers, wallets, and codebases quickly banned access to Tornado Cash users, raising serious questions about the decentralization of a technology stack used by many;

The issuer of the stable currency froze the assets related to Tornado Cash, clearly stating that the Token that needs to be responsible to the issuer under the chain is the main loophole of the encryption ecosystem (especially DeFi);

Given the reliance on USDC and USDT, it speaks volumes that even decentralized stablecoins are vulnerable. The two largest decentralized stablecoins DAI and FRAX rely on USDC for more than 2/3;

OFAC's action also raises policy questions about Internet privacy and how U.S. government agencies at all levels view differences between privacy technologies;

Overview of OFAC

On Monday, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) added Ethereum-based privacy app Tornado Cash to its list of restricted entities. Specifically, OFAC added 38 Ethereum smart contracts 38 Ethereum smart contract addresses related to the Tornado Cash application were added to the U.S. list of Specially Designated Nationals (SDNs), making them restricted entities, i.e. , it is illegal for an entity to interact with the Tornado Cash protocol or assets derived therefrom.

Specifically, OFAC added 38 Ethereum addresses related to the Tornado Cash application to the DN List (U.S. Specially Designated Nationals List), which means that any entity with the Tornado Cash application or assets derived from Tornado Cash Interaction is illegal.

This is the first time that an on-chain smart contract has been directly sanctioned by OFAC.

In the press release, OFAC stated that the Sanction on Tornado Cash is because the application substantially assists, sponsors or provides financial, material or technical support, or provides goods or services for all or most of the network activities originating outside the United States, and is likely to be able to poses a significant threat to the national security, foreign policy, or economic health or financial stability of the United States, resulting in the serious misappropriation of funds or economic resources, trade secrets, personally identifiable or financial information, the acquisition of commercial or competitive advantage by certain criminals, or private economic Benefit.

U.S. Treasury Department's Office of Foreign Assets Control

OFAC (Office of Foreign Assets Control of the U.S. Department of the Treasury) is part of the U.S. Department of the Treasury and is mainly composed of lawyers and intelligence investigators. The office aims to support the national security and foreign policy goals of the United States, and its task is to impose sanctions on the economic and trade fields. OFAC will add individuals and entities to the SDN List (US Specially Designated Nationals List), prohibiting Americans and entities from interacting with them in any "trade or financial transactions and other transactions." Note that those who conduct transactions with those on the list may themselves be sanctioned.

History of OFAC Sanctions on Cryptocurrencies

Although the sanction against Tornado Cash is the first time OFAC has listed smart contracts on the SDN list, OFAC has previously sanctioned other cryptocurrency-related individuals and entities (and related cryptocurrency addresses), as follows:

Sanctions for crypto addresses or entities involved in cryptocurrencies (in part):

November 28, 2018. OFAC Sanctions Increase BTC Addresses of Iranian Nationals

August 21, 2019: OFAC Sanctions Add BTC and LTC Addresses Said to be Chinese

March 2, 2020. OFAC Sanctions Adds Crypto (Mostly BTC) Addresses Belonging to North Korea (Lazarus Group)

September 10, 2020. OFAC Sanctions Adds BTC, ETH, LTC, ZEC, and BSV Addresses Alleged to Belong to Russian Citizens Trying to Influence US Presidential Election

September 16, 2020. OFAC Sanctions Adds BTC, ETH, XMR, LTC, ZEC, DASH, BTG, and ETC Addresses, Claims They Belong to Russian Hackers

April 15, 2021. OFAC Sanctions Adds BTC, ETH, BCH, LTC, ZEC, DASH, and XVG Addresses Alleged to Belong to Russian Citizens Trying to Influence US Presidential Election

July 28, 2021. OFAC Sanctions BTC Addresses Allegedly Belonging to Syrian Nationals

September 21, 2021. OFAC Adds BTC, ETH, and USDT Addresses Allegedly Belonging to Cryptocurrency Exchange (SUEX) Involved in Laundering Funds Earned Through Ransomware

November 8, 2021. OFAC Adds BTC, ETH, LTC, DASH, XMR, XRP, BCH, and USDT Addresses Allegedly Belonging to Ransomware Group

April 5, 2022: OFAC Adds BTC, ETH, and USDT Addresses Alleged to Belong to Estonian Darknet Hydra Market

April 14, 2022: OFAC Adds an ETH Address Allegedly Belonging to North Korea’s Lazarus

May 6, 2022: OFAC Adds BTC Addresses Allegedly Belonging to Bitcoin Mixing Service Blender.io, OFAC Sanctions ETH Addresses Belonging to North Korean Lazarus Group Hackers, These Wallet Addresses Belong to Axford, Axie Infinity’s Ronin Bridge Funds Stolen related

April 20, 2022: US Specially Designated Nationals List Adds Russian BTC Miner and Custody Provider Bitriver and 10 Subsidiaries

August 8, 2022: OFAC Adds 45 ETH Addresses Related to Tornado Cash

Who is using Tornado Cash?

Since its launch in 2019, Tornado Cash has been used by a number of entities, some of which have been found to be criminal organizations. According to a recent report from Chainalysis, 50% of the money flowing into Tornado Cash comes from decentralized finance (DeFi), 20% comes from centralized exchanges, and nearly 30% of the funds flow into and attempt to launder the addresses of hackers and sanctioned addresses relevant. In another analysis, an estimated 35 percent of Tornado Cash transaction volume came from criminal organizations.

Tornado Cash has been used to “launder more than $7 billion worth of virtual currency” since its launch, OFAC said in a press release. Cumulative total transaction volume via Tornado Cash is $7.6 billion, but based on the above data from Chainalysis and Nansen, the amount from criminal organization shuffling is likely to be much lower.

Moreover, as discussed at the end of this article, it is not enough to point out that Tornado Cash can confuse the source of funds. The real sanction needs to be identified as "money laundering". To qualify as money laundering, the obfuscated funds must be the proceeds of illegal activity, or the obfuscation must be for illegal purposes. And the fact that most of Tornado Cash's inflow comes from DeFi applications and CEXs shows that there is a large number of ordinary users using the protocol to enhance privacy, rather than for illegal reasons.

Of course, it's hard to know exactly how many Tornado Cash interactions from DeFi and CEXs belong to innocent users rather than sanctioned addresses, but people understand why users use Tornado Cash.

Some of these reasons include (per Twitter @Rezajafery):

Get paid in cryptocurrency but don't want your employer to know all your financial details

Pay for services in ETH, but don't want them to see everything you do on-chain

Has been doxxed and harassed online

Want to Donate to Polarizing Causes

want to send an anonymous gift

It bothers you to think that people who know your friends know you better

Believing that encryption will achieve mainstream adoption means everyone will have access to all this information (retailers, banks, potential employers), doubting they will use it ethically

Ethereum co-founder Vitalik Buterin admits to using Tornado Cash for donations.

Application Data for Tornado Cash

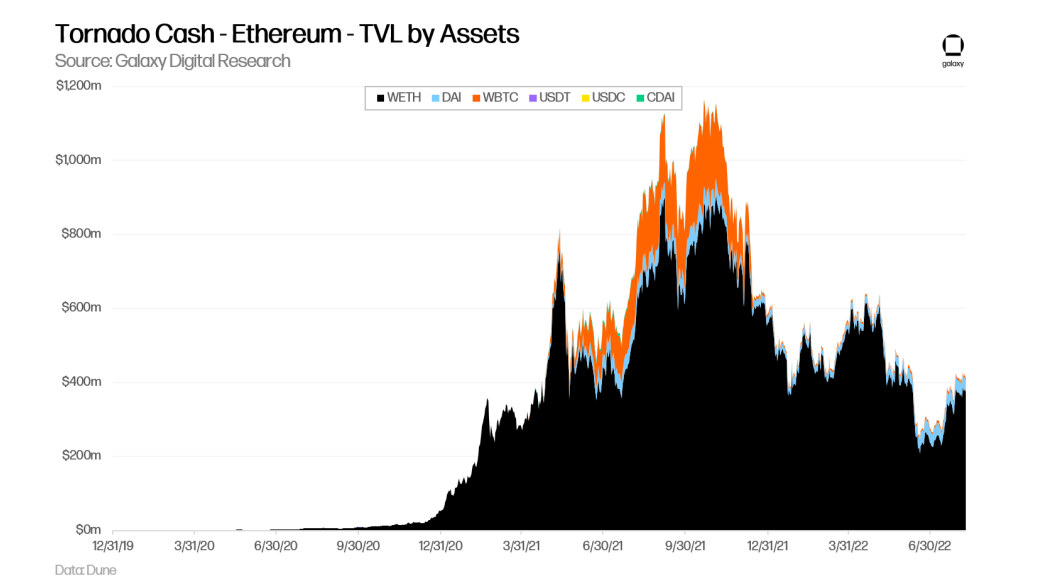

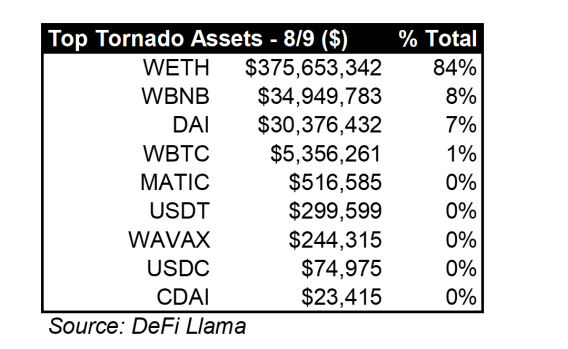

Since its launch in August 2019, Tornado Cash has achieved a cumulative TVL of $7.6 billion. Currently, Tornado Cash exists on 7 different networks, although 92% of funds are held on Ethereum (92%) and 8% are held on the BNB chain.

Various aspects of the sanctions

0. Impact on Tornado Cash

The recent U.S. Treasury Department sanctions against Tornado Cash have resulted in the banning of all individuals and entities in the U.S. from using the app, either directly or indirectly through third-party services. Of course, this is not the first currency mixing service to be sanctioned by the U.S. Treasury Department. Earlier this year, the U.S. Treasury Department sanctioned Blender.io, a currency mixing service that runs on the Bitcoin blockchain. But unlike Blender.io, Tornado Cash is a decentralized service that primarily works through smart contracts on Ethereum. This means that despite the sanctions against Tornado Cash, its official website, and on-chain addresses, the protocol itself cannot be shut down. Users who send transactions to this Tornado Cash will still be able to get the currency mixing service.

This sanction has resulted in restricted access to Tornado Cash, and users will not only be unable to log on to Tornado Cash's official website, but third-party node operators such as Infura and Alchemy will also stop supporting Tornado Cash related services. Moreover, users of MetaMask, the most widely used Ethereum wallet, are now prohibited from interacting with Tornado Cash (because MetaMask relies on Infura to interact with Ethereum, users who still want to use Tornado Cash unless they manually set MetaMask node configuration, do not use Infura, To ensure that MetaMask can interact with Tornado Cash), however, doing so will face the responsibility of violating US sanctions. Such manual configuration has a threshold, which severely limits the number of Tornado Cash users.

It is worth noting that most users interact with Tornado Cash through a third-party interface, such as the official website of Tornado Cash, which has been offline after being sanctioned, but the smart contracts of Tornado Cash still exist and can still be registered on the Ethereum blockchain. Users can still interact with Tornado Cash directly, but users can no longer access the front-end pages of the website.

In addition, the sanctions against Tornado Cash also include all Tornado Cash developers and code contributors. While Tornado Cash is still available on Ethereum for now, this sanction means that any further changes to the protocol via governance are illegal anyway. Tornado Cash's GitHub has been deleted, and founder Roman Semenov's GitHub account is said to have been suspended as well. Therefore, while the Tornado Cash itself continues to run on Ethereum, there may be no way to modify its code and no new developments can be made.

Adding new Tornado Cash pools on different chains will be stopped. Of course, it is also possible that an anonymous individual or group has copied the Tornado Cash codebase for further development. However, the clear signal from the US Treasury Department is that all these types of applications will be subject to US sanctions, which may prevent most engineers from participating in the development of Tornado Cash.

Finally, while the core functionality of Tornado Cash will not be affected by the U.S. sanctions, the additional privacy services provided to users through Tornado Cash will be discontinued.

What is Relayer Registry

(The Relayer registry passed with a 100% vote in favor (approximately 35,000 TORN), and any user who pledged more than 300 TORN can become a relayer. Currently, the proposal will be implemented around 17:50 today. Tornado Cash, an Ethereum privacy trading platform, is released Governance proposal, which proposes to update the relevant rules of Relayer to improve the decentralization level of the agreement and further improve the holding efficiency of TORN. The main content of the proposal is: any user who pledges more than 300 TORN will be able to become a Relayer and be added to the priority list. Through Each withdrawal of Relayer requires Relayer to pay a fee in the form of TORN (the current fee ratio is 0.3%), which will be stored in the StakingReward contract and obtained by TORN holders participating in governance.) Reference: Block Rhythm BlockBeats

The Relayer can pay network fees and users withdraw funds from Tornado Cash so that users' wallets or addresses cannot be easily linked to Tornado Cash. Due to recent sanctions, it is a clear violation of US law for Relayers to withdraw funds from Tornado Cash on behalf of users. Therefore, the Relayer role may not work at all and most Relayers located in the US will abandon operations to comply with the sanctions. The TORN governance Token will also be difficult to operate, not only because there will be fewer and fewer Relayers for TORN Token mortgages, but also because Github does not support Tornado Cash business at all.

To sum up, the U.S. sanctions on Tornado Cash have mainly affected user access to the protocol, collaborative code development, and some protocol functions, such as the distributed relayer network. would make it more difficult for ordinary users to participate in any of these activities. However, since Tornado Cash is a decentralized application deployed on Ethereum (a blockchain that cannot be tampered with), the application itself will continue to run unaffected on the network, with little or no way to stop it.

1. Vulnerabilities exposed by stablecoins

First, issuers of fiat-backed stablecoins are required by law to comply with relevant KYC/AML and transaction monitoring activities. In order to comply with these laws, issuers of fiat-backed stablecoins can maintain administrative control over their stablecoins by maintaining blacklists of these blocked addresses, or preventing specific addresses from interacting with their stablecoins.

For example, when calling the transfer function on USDT or USDC, the smart contract will check the off-chain blacklist to ensure that neither the sending address nor the receiving address exists. If the address appears on the blacklist, the transaction is blocked. While this permission may not grant the ability to blacklist individual tokens, or seize tokens from specific addresses, it is capable of affecting blacklisted addresses. In a blog post published Tuesday, Circle affirmed compliance with the latest Treasury Department sanctions against Tornado Cash, blocking 38 addresses that collectively held $149,000 in USDC ($3,921/address on average) from entering USDC from Circle Accounts of.

While complying with the Treasury Department's order, Circle disagrees with enforcing the blacklist feature of its open source protocol, arguing that being forced to use this feature to shut down all USDC access protocols across an open source project is problematic. In the past, Circle has stated that all sanctioned digital assets to date are designed to comply with OFAC sanctions and court orders in law enforcement, adding: “Blocking is in no way unilateral or arbitrary by Circle and follows the obligations of the relevant agencies. "

However, this power to block arbitrary transactions reflects the limitations of the existence of fiat currency-backed stablecoins. The limitation is that for on-chain interactions such as DeFi applications, users' decisions to blacklist addresses are almost completely ignorant. Nothing is visible. Such a situation is completely contrary to the open and transparent governance process of the ideal encrypted network, which puts the decision-making power in the hands of the community.

While fiat currency supports stablecoin holders, they can only believe that the centralized stablecoin issuer itself has no problems, behaves well, and will not abuse power. In fact, we can clearly see that the danger of granting such blacklist authority to centralized companies is likely to be abused by such commercially driven companies.

2. Wider impact

Because stablecoins are critical to the proper functioning of on-chain and off-chain crypto markets, fiat-backed (or custodial/regulated) stablecoins account for 92% of the $155 billion in stablecoins today. There is also the problem, given that many crypto-backed or “non-custodial” stablecoins rely heavily on fiat-backed stablecoins, such as USDC and USDT for backing. For example, significant correlations between USDC and decentralized stablecoins, DAI and FRAX. According to DaiStats data, as of July 31, USDC backed more than half of DAI. If USDC-related LPs are included, it indirectly accounts for 2/3. FRAX, a stablecoin using a fractional collateral/algorithmic stabilization mechanism, is over 90% backed by USDC.

According to DaiStats statistics, as of July 31, USDC directly accounted for more than half. When including LPs related to USDC, DAI’s support and indirect accounts for about 2/3. FRAX is a stablecoin using a fractional collateralization/algorithmic stabilization mechanism, backed over 90% by USDC.

Decentralized stablecoins that rely on regulated stablecoins like USDC may come under extended scrutiny. Since Maker accepts centralized stablecoins as collateral deposits, the risks associated with centralized stablecoins associated with frozen assets or potential censorship extend to DAI.

Some critics believe that MakerDAO and DAI are facing the existential risks posed by PSM and USDC - if regulators may demand a large increase in blacklisting or freezing USDC, or if they force the establishment of an actual white list that inhibits the free transfer of USDC, Then the debt of most DAI Makers will not be able to be backed, making the system insolvent.

In other words, MakerDAO was created to serve as a decentralized stablecoin system and rely on centrally issued assets as collateral, which defeats the stated purpose and core value proposition of the system.

Non-custodial stablecoins/DeFi protocols aim to reduce reliance on USDC to avoid the risk of USDC being blacklisted. In Maker, informal discussions have emerged amid dissonance over possible emergency measures to force lower USDC deposits. In the most extreme cases, they include negative interest rates on USDC deposits, implementing Maker's emergency shutdown feature to enable only debt repayments, or updating the Maker contract to enable blacklisting of DAI so that the protocol can comply with sanctions and avoid being blacklisted itself list of risks.

Increased demand for decentralized stablecoins. While encrypted networks and protocols may be permanent; and, decentralized stablecoins that rely on regulated stablecoins like USDC may also be subject to regulatory scrutiny. Non-custodial stablecoin/DeFi protocols need to reduce their dependence on USDC to avoid the risk of USDC blacklist. On Maker's Discord, there was a discussion about emergency measures, hoping to rely on USDC. In the most extreme case, how to deal with negative interest rates on USDC deposits, and how to implement Maker's emergency shutdown function? Or update Maker's contract to enable the blacklist of DAI so that the protocol can comply with sanctions and avoid the risk of being blacklisted.

Demand for decentralized stablecoins will increase, and while decentralized stablecoins’ cryptocurrency networks and protocols are decentralized, centralized fiat currency-backed stablecoins can be troublesome if the underlying asset is centralized . In fact, this technology can also be used in the future, that is, to restrict the transfer of fiat-backed stablecoins to any address that is not whitelisted.

If such restrictions are implemented, most stablecoin activity may go to more decentralized emerging stablecoins. Since the Treasury Department sanctioned Tornado Cash, there has been greater demand for stablecoins and their associated governance tokens fully backed by decentralized assets such as ETH and WBTC, including Liquity USD (LUSD due to increased demand) Trading above $1.05, LQTY is up over 30%) and Magic Internet Money (MIM is trading at $1.01; SPELL is up 40%), which is in line with the governance tokens of Maker (MKR -10%) and Frax (FXS -11%) The underperformance is in stark contrast.

3. The impact of accessing and building Ethereum

Regarding the recent sanctions on Tornado Cash and the impact on the entire ecosystem, there are several important considerations:

The Lazarus Group, an official hacking organization in a certain country, used Tornado Cash to launder more than $455 million worth of cryptocurrency black money, which is widely considered one of the reasons for the sanctions. Although regular legitimate users will also use the app to enhance the privacy of their on-chain transactions. So with the action this week by the U.S. Treasury Department deemed national security, will other permissionless applications on Ethereum be subject to the same type of scrutiny by the U.S. government? Especially if it involves decentralized finance applications being used by hackers to lend and trade? Will these apps be sanctioned as well?

Many Ethereum applications are decentralized, so how does US sanctions affect Tornado Cash? How does the sanction affect access to other decentralized software on Ethereum? Users who currently rely on accessing Tornado Cash through centralized infrastructure providers such as Infura and Alchemy are now unable to use Tornado Cash.

This means that it is more of a concern that if there is a lack of users running their own infrastructure to connect to the Ethereum blockchain, if there is an over-reliance on Infura and Alchemy, will the future be scrutinized by other parties besides Tornado Cash sanction?

Overreliance on Infura in particular has been an ongoing concern for Ethereum core developers since 2018. Attempts to mitigate this problem have largely focused on the requirement of making it easier for ordinary users to run an Ethereum node.

However, these attempts are still in progress, and excessive reliance on centralized running nodes is still a widespread problem on Ethereum.

Another centralized entity that could disrupt Ethereum applications is GitHub.

As mentioned earlier in this report, the development of Tornado Cash as a protocol is primarily conducted and shared through GitHub. Since the sanctions were imposed, all Tornado Cash repositories have been deleted and contributor accounts banned.

Note that 2019 is no different, with developers from Iran, Crimea, and other US-sanctioned countries also banned from using the GitHub development platform. Therefore, this fully embodies the potential problem of Ethereum decentralized application software development and Ethereum protocol development, which is over-reliance on GitHub.

As highlighted in previous ethereum developer calls, there have been concerns that the development process driving upgrades to the client software relies on GitHub, which could one day become unreliable for reasons beyond the control of the core developers.

This has sparked discussion of the need to transition core Ethereum development steps and code to other open source platforms — namely, alternatives to GitHub.

All in all, the sanctions on Tornado Cash highlight the problem of relying on centralized platforms based on Ethereum and Ethereum’s various protocol technologies. In order to mitigate the impact of additional sanctions on other Ethereum dapps and Ethereum itself, an accelerated push to decentralization is very much needed. , especially when running node infrastructure and storing codebases.

4. Long-term effects

Money Laundering vs Privacy

While OFAC's role remains focused on protecting and advancing U.S. national security and foreign policy through financial intelligence and law enforcement, rather than on privacy, the sanctions on Tornado Cash have raised questions about financial privacy and the Internet. Fundamental issues of privacy. Criminals and unscrupulous entities, have started using Tornado Cash to launder money earned through illegal activities, but as discussed earlier, individuals, charities, activists, and others are also using Tornado Cash.

It is worth noting that obfuscating the source of funds (such as anonymous donations, etc.) is not illegal in itself, but "money laundering", which is the process of converting illegally obtained funds into cash, is illegal. Shipping, transmitting or transferring funds outside of the United States is also illegal for money laundering under the United States Code and related anti-money laundering laws. But the thing is, obfuscating financial transactions or money transfers is not illegal unless the reason for doing so is to conceal illegal activity or channel illegally obtained funds into legitimate financial transactions. There are many other reasons an individual or entity may seek to maintain financial privacy, especially when operating in a transparent on-chain environment, where the need for privacy is not illegal per se.

OFAC with DOJ and FinCEN

OFAC with DOJ and FinCEN

Additionally, approval of decentralized, non-custodial applications (a tool) appears to be the basis for the new OFAC. Our review of the Tornado Cash contract confirms a common belief in the DeFi ecosystem: Tornado Cash cannot freeze user funds, prohibit interaction with its application, or upgrade its application for this purpose. This is very different from other OFAC-approved cryptocurrency mixing service Blender.io, which is centrally operated and controlled on a custodial basis.

In addition, OFAC is currently sanctioning a decentralized application and tool such as Tornado Cash, which is a new field. There has been a long-term decentralized operation in the DeFi ecosystem. Tornado Cash itself has no ability to freeze users’ funds, nor can it ban interaction with the app, and cannot be sanctioned by upgrading its app. This is very different from OFAC's choice to sanction Blender.io earlier this year, which is centrally operated and controlled in a managed manner.

Notably, OFAC did not sanction the software developers who started Tornado Cash, nor did it sanction DAO members who controlled Tornado Cash vaults. Of course, no sanctions were imposed on the developers, likely because OFAC has not yet determined whether they are aliens, and OFAC can operate under the framework proposed by the US Department of Justice. Unlike the Treasury Department, the U.S. Department of Justice wrote in an October 2020 report: According to FinCEN, anonymity service providers and some anonymous cryptocurrency issuers are individuals in the money transfer business who merely provide anonymity software. or entities do not count. (According to FinCEN, anonymizing service providers and some AEC issuers are money transmitters, whereas an individual or entity that merely provides anonymizing software is not.)

Note: FinCEN, the U.S. Department of the Treasury also has a subsidiary agency called the U.S. Financial Crimes Enforcement Network (FinCEN). Financial Crimes Officer.

According to the Department of Justice (DoJ), which cites FinCEN, the agency that also pursues financial crimes within the Treasury Department, OFAC may consider Tornado Cash to be an "anonymity service provider" rather than just an "anonymity service provider." software". Of course, OFAC has not provided any detailed analysis on this, we are only speculating and cannot know exactly to what extent they are basing this distinction on sanctions. But given Tornado Cash's decentralized, non-custodial, non-custodial nature, and its structural inability to comply with sanctions, OFAC appears to view Tornado Cash as an anonymous service provider rather than an anonymous service provider if it follows guidelines similar to those of the DOJ and FinCEN software.

Another, more likely explanation is that OFAC is more focused on the use of Tornado Cash—no matter how Tornado Cash is characterized, it is an established fact that Tornado Cash is frequently used by the Lazarus Group and other criminals. OFAC can differ from the FinCEN standard, and OFAC sanctions need not be specifically related to compliance with the Bank Secrecy Act.

The Biggest Vulnerability: The DeFi Ecosystem

The effect of OFAC sanctions is obvious, especially for DeFi protocols, but the bigger problem is that there may be big problems in the DeFi system centered on stablecoins supported by centralized fiat currencies. Over the years, many people have believed that Circle and Tether can blacklist USDC and USDT users at will, and then these coins are useless.

This week, the Tornado Cash incident brought this old question to life.

Original link