Original title: "Why ETH PoW forks are not orthodox from a technical point of view"

Original Author: @0xTodd, Partner at Nothing Research

I see that many friends often confuse various "forks" and why ETH PoW is unorthodox from the perspective of forks. I want to popularize a little concept today.

Blockchain, as the name suggests, is a chain of many blocks. New blocks, never stop receiving old blocks. If we say that our real world calculates time in seconds, the world on the blockchain calculates time in blocks as the smallest unit.

There are two types of forks in the world:

1. Forks caused by out-of-sync networks.

2. Forks caused by differences in versions.

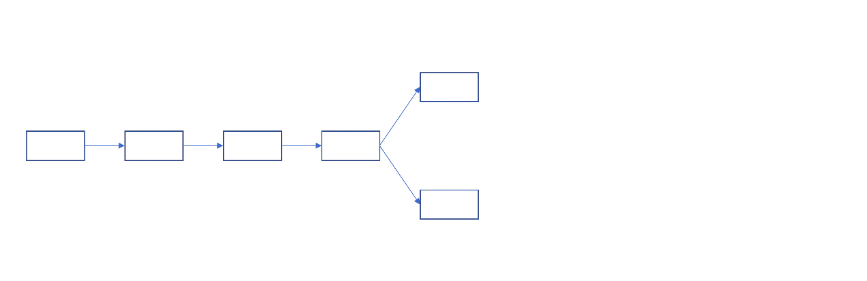

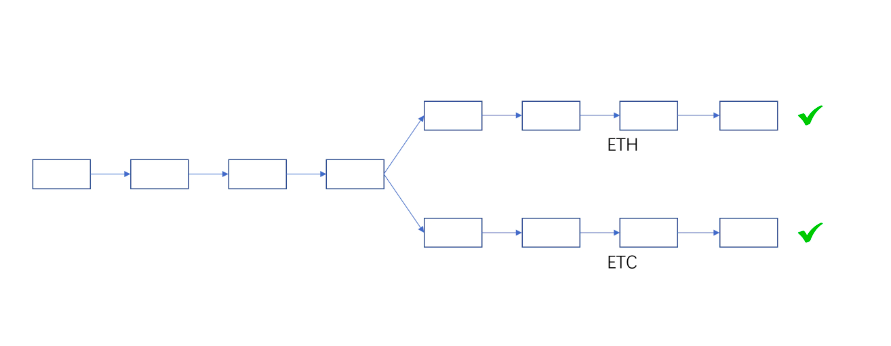

Let me talk about the first type first, the fork caused by network problems. This is a very common phenomenon that happens every day. For example, when two miners solve the problem almost at the same time and package a new block, whose block is eligible to receive the old block? Bifurcations occur naturally.

image description

Receive new blocks at the same time

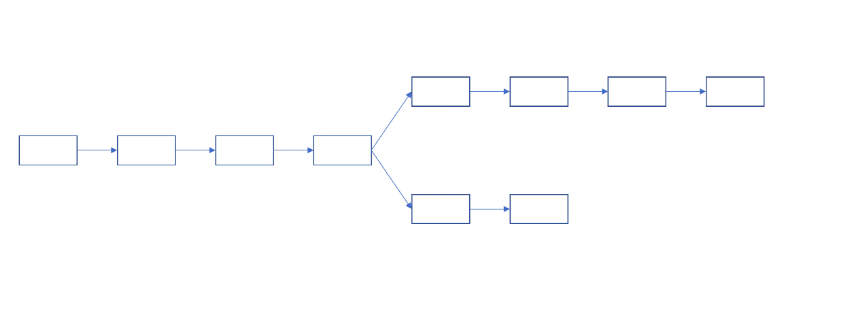

In order to solve this problem, the industry has the "longest chain principle". It stipulates that if the blockchain is bifurcated at a certain height, the block whose chain is longer will be meaningful, and the shorter one will be discarded.

image description

Computing competition

Winners earn all block header rewards + handling fees, losers get nothing, wasting electricity for nothing.

Of course, in order to solve this problem, ETH specially designed uncle blocks. Uncle is father's younger brother, but uncle has no son. It allows losers to get a little compensation, which can prevent some miners from dying.

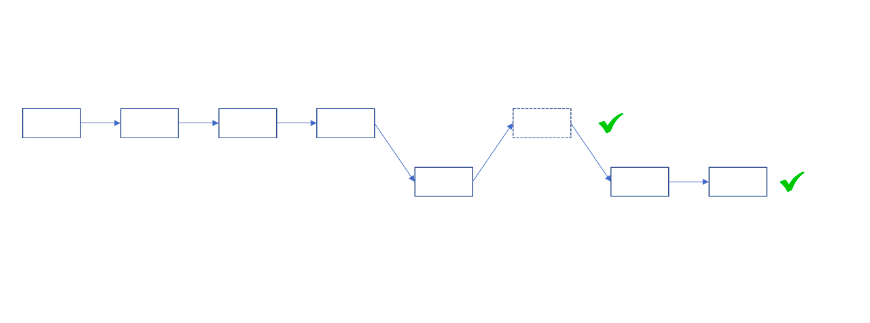

If one party is malicious, it's a 51% attack. If neither party is malicious, it is a normal fork. This is also the reason why when the exchange requires tokens to be recharged, they have to wait for several blocks before they are credited.

image description

The winner becomes the orthodox main chain

Then let's talk about the second type, what is the fork caused by the divergence of versions.

In theory, ETH has been forked many, many, many times, most of which are due to system version upgrades. For all forks caused by version upgrades, the longest chain principle [does not] apply. The longest chain principle is only applicable to solving network synchronization problems.

Here it will be further divided into hard forks and soft forks.

image description

EIP1559 is a standard hard fork upgrade

image description

ETC and ETC exist at the same time without interfering with each other

Therefore, hard forks are risky, and there is no guarantee that the entire network will agree every time. Therefore, the Bitcoin world prefers soft forks, which are much less risky.

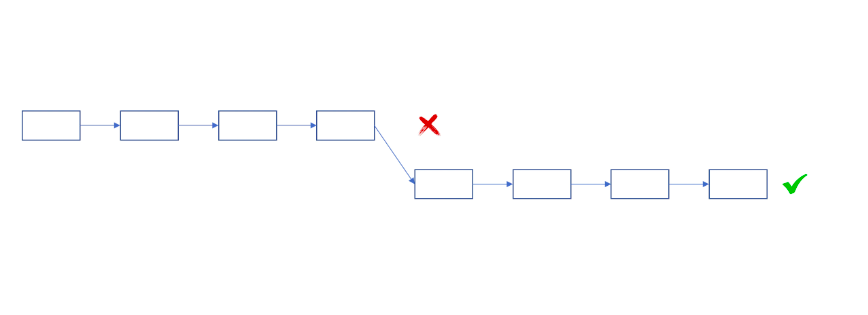

What is a soft fork? That is, although the version has changed, it can be upgraded or not, and everyone is still in the same network. Everyone knows that each state in the United States has its own laws, but they all follow the US Constitution. Soft fork is like a certain state in the United States has introduced new regulations, so it does not need to be adopted nationwide, and it will not cause division.

image description

Soft fork: old and new versions can coexist

Soft forks are very concerned about the issue of "forward compatibility", while hard forks have no way to be "forward compatible". So, you can see that Bitcoin's reforms "seem" to be small, while Ethereum's reforms are all drastic. Because the soft fork is a test of the wisdom of the core developers.

Friends who do software development may have a deep understanding of how difficult it is to want to add new features and want to continue to use the old version. This is dancing with shackles, and it is very difficult to design a solution that has the best of both worlds. But Bitcoin has done it, using a lot of political trade-offs and development wisdom, and the design of each soft fork is exquisite and amazing.

The reason is that Bitcoin is a public chain with an absolutely stable "fiscal policy". This feeling is very reassuring. Bitcoin pursues the ultimate in stability. In another 10 or even 100 years, Bitcoin will not be much different from today, just like real gold. In the next 100 years, the dollar may disappear, but gold will not.

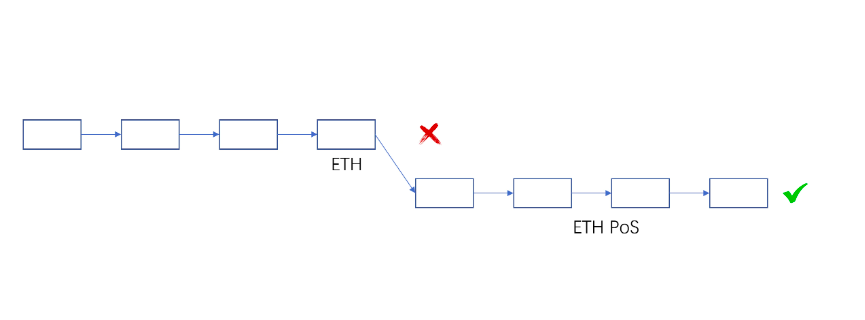

On the Ethereum side, God V is still alive, and Ethereum does not pursue ultimate security, but seeks to break through the impossible triangle, so every time it takes risks to upgrade hard forks. Be aware that hard forks can easily cause divisions in the community. ETC in the past, ETH PoW today.

image description

It was a technical upgrade

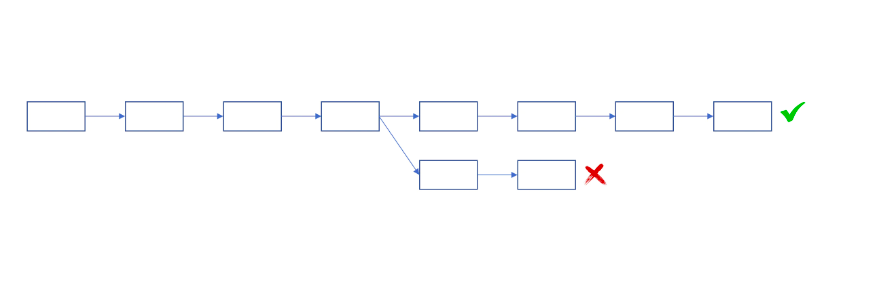

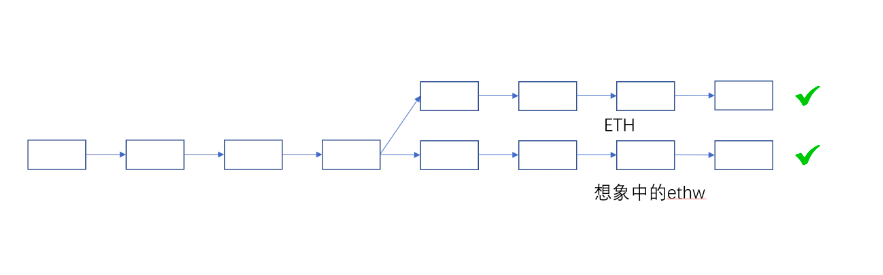

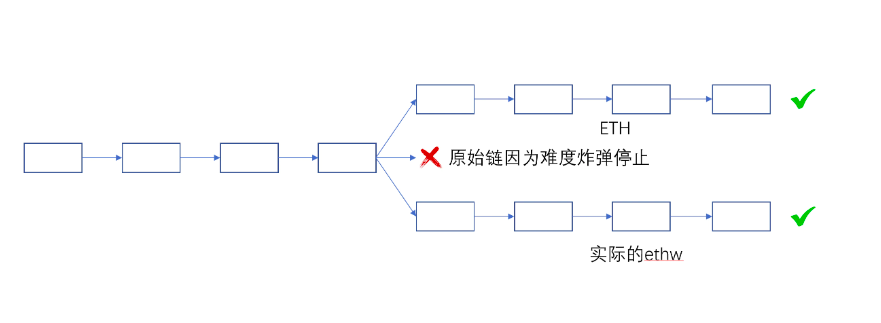

But the ETHPoW team is determined to carry out another hard fork upgrade at the same height as PoS Merge. This upgrade removes the difficulty bomb and more. Here is a common mistake: ETH PoW is not the original PoW chain of ETH. Many people mistakenly think that as shown in the figure below, one goes straight and the other turns left.

image description

often misunderstood situation

image description

The real situation, one is going to the left, one is going to the right, no one is going straight

Therefore, the actual situation is: ETH PoS and ETH PoW are actually new chains generated by hard forks, but they happen to be at the same height, and the original ETH PoW chain will die because of the difficulty bomb.

So ETH PoW is also weak in orthodoxy. In other words, if it forks today and does not choose the same height as PoS Merge, it is completely okay. Then why does it have to choose to fork at the same height as PoS ETH? The answer is Sima Zhao's heart, which everyone knows.

Someone may ask, Todd, why do you clarify these things so clearly? I think that each chain is actually a country. When you live in a country, you must figure out its legitimacy and system. Since it starts with 0x, as a citizen of the ETH world, it is natural to get to the bottom of it.

Original link