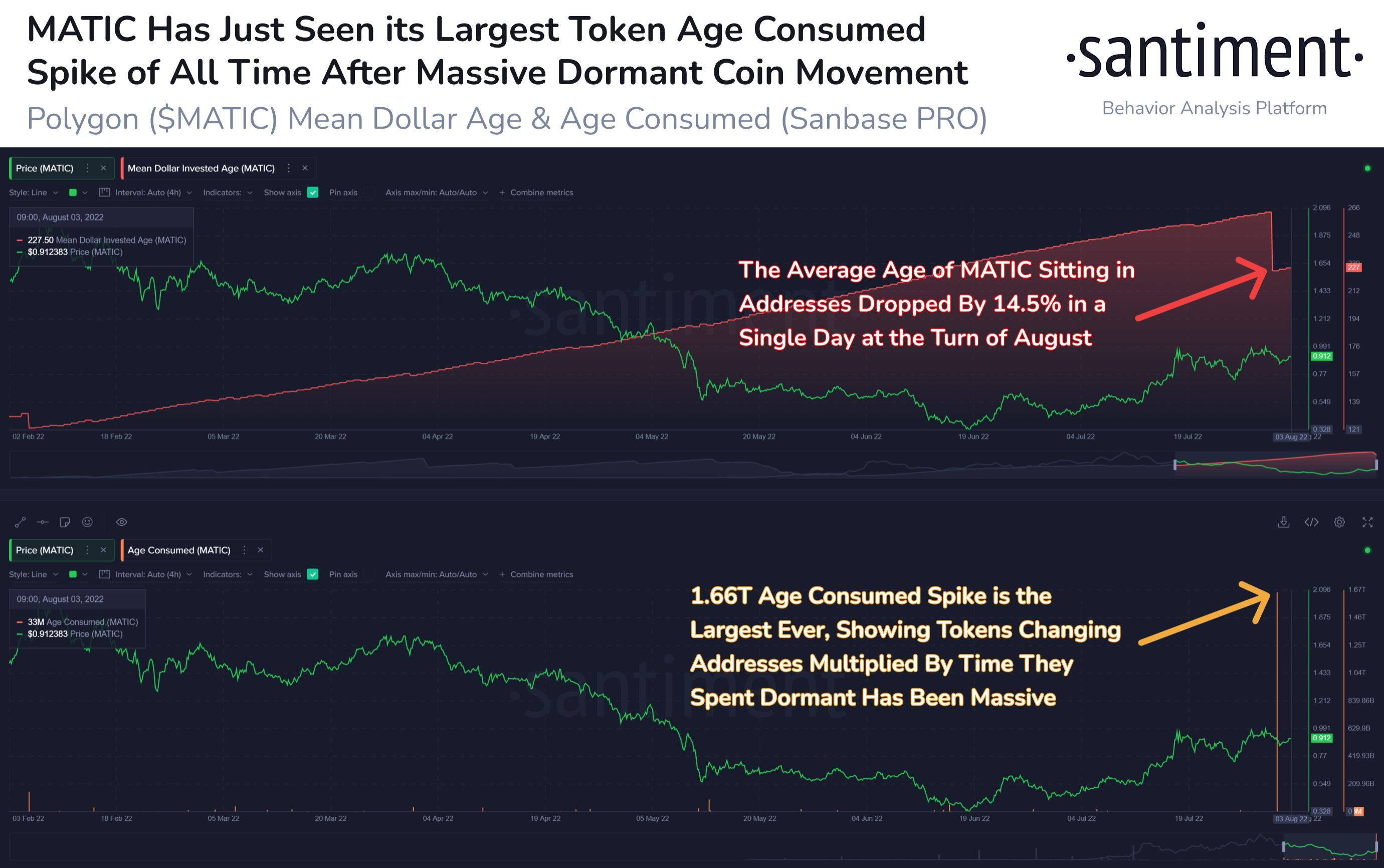

On-chain analysis companySantiment The consumed token age (the consumed token age) on the Polygon network reached a new all-time high as old and dormant addresses moved large amounts of MATIC tokens, according to a post on Wednesday. “MATIC’s age of spent tokens has reached an all-time high, and Polygon’s average age has also declined, indicating that old and dormant addresses are rapidly moving assets.”

According to the chart released by Santiment, the average age of MATIC tokens dropped by 14.5% in early August, and the age of consumed tokens reached 1.66 T (Note: Age of consumed tokens = number of tokens changed addresses * dormancy time).

Although Santiment did not explain the reason for the awakening of the dormant address, users speculated that it was related to the unlocking of MATIC tokens. In early August, Blockworks researcher Sam found that the Polygon token vesting contract unlocked 1.4 billion MATICs, accounting for 14% of the total supply. The news quickly caused panic in the market, and the price of MATIC tokens fell by more than 10% that day.

Sandeep, the co-founder of Polygon, later clarified and responded that the movement and pledge of nearly 1.4 billion MATICs was related to the foundation treasury plan, and they were directly unlocked without contracts.AnnounceAnnounceExplains the token unlock plan:

The 1386609632 MATICs unlocked since April 21 last year were unclaimed, and the Polygon Foundation will claim these tokens;

Among them, 640 million MATIC (6.40%) will be allocated to the team, and will be directly pledged by the co-founders after claiming;

546,609,632 MATICs (5.46%) will be allocated to the foundation, and the team will update the community on the movement of the foundation wallet in advance;

200 million MATICs (2%) will be allocated for staking rewards from May 2021 to December 2021.

Polygon’s official announcement alleviated the community’s anxiety about selling pressure to a certain extent. MATIC tokens once rebounded by $0.92, up more than 5%, and are currently at $0.88. In fact, in the past July, MATIC has risen from US$0.48 to more than US$1, with a maximum increase of 110%. In July, it closed up 92%. The secondary market performed better than ETH (+37%) and BNB (+14%) ), Solana (+4.5%) and Polkadot (-2%) are the top ten mainstream coins by market capitalization.

Behind the rise of MATIC is inseparable from the rise of the Polygon ecology.According to the official second-quarter report, Polygon’s network usage grew rapidly in the second quarter. The total number of unique addresses reached 5.34 million, a quarter-on-quarter increase of 12%; the total transaction volume reached 284 million US dollars, a quarter-on-quarter increase of 4%; Dollar. What's more, developer activity is also surging. “More than 90,000 developers released their first contracts in Q2, which is more than 3 times the growth rate in Q1. On average, 1,000 new creators and 2,700 new contracts go live every day.”

In addition, Polygon has also gained a group of outside partners. Earlier in July, news broke that the company was included in Disney’s business accelerator program, the only blockchain company on the list; less than a week ago, the Mercedes-Benz Group revealed that they were using Polygon to launch A blockchain-based data sharing platform; Reddit announced that it will launch an NFT avatar market, Polygon Network will power the new NFT market; London-based Nothing Technology Limited is working with Polygon to expand Web3's mobile applications.

These strong fundamentals contributed to MATIC's good gains in July.