Original title: "On the Merge"

Original compilation: ChinaDeFi

Original compilation: ChinaDeFi

feed

The merger significantly changed the monetary policy of Ethereum, and the issuance of Ethereum was reduced by about 90%. In 6-12 months, the validator's principal (32 ETH) and newly issued will also be illiquid and will be "stuck" on the beacon chain. Deflationary monetary policy and increased demand for pledged ETH could lead to a significant contraction in the supply of circulating ETH.

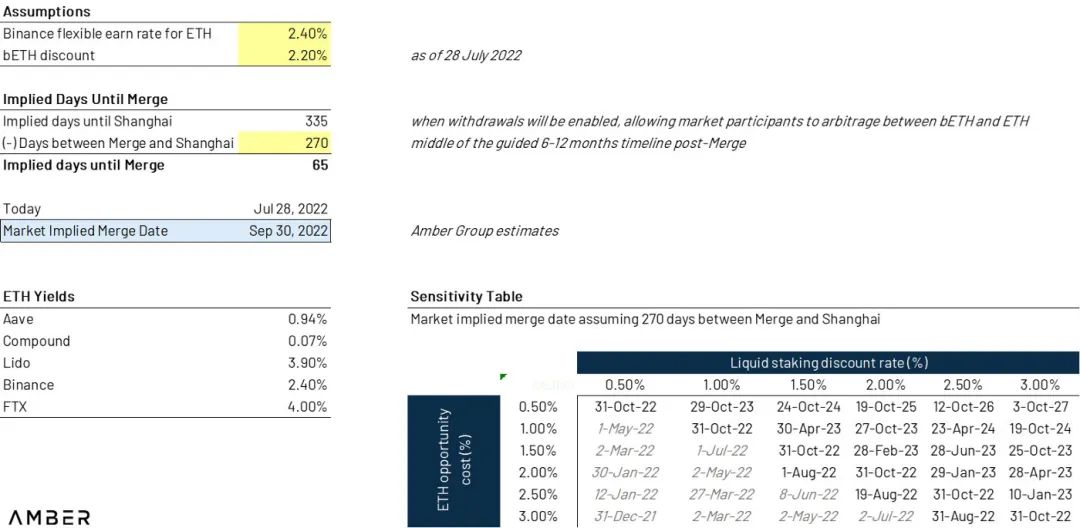

Comments from the ethereum community hint at a soft target for a September merger. A range of market indicators suggest the market expects a merger to happen at least by the end of the year. Pricing for Binance Rate suggests that the market expects the merger to happen by the end of September.

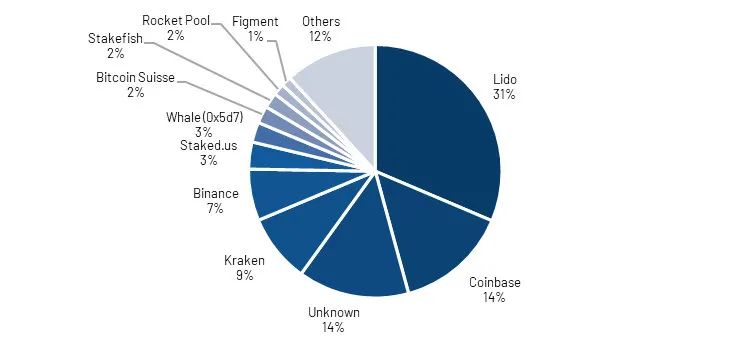

Ethereum MEV will change after the merger. Most validators will be running MEV-boost - free and open-source software that democratizes earning MEV rewards. However, due to several factors (MEV smoothing, multi-block MEV potential, DoS mitigation), validator pools and centralized entities may continue to gain validator market share in the short term. Ethereum developers are working on solutions to solve this problem at the protocol level.

introduce

introduce

Merger is coming. Ethereum will transition from Proof of Work to Proof of Stake while improving its security and sustainability. However, questions remain about what the merger actually does, how it affects various stakeholders, and when it will actually come. This report covers the current status of the merger, key pre- and post-merger effects, and a range of measures to gauge market sentiment.

current state of the merge

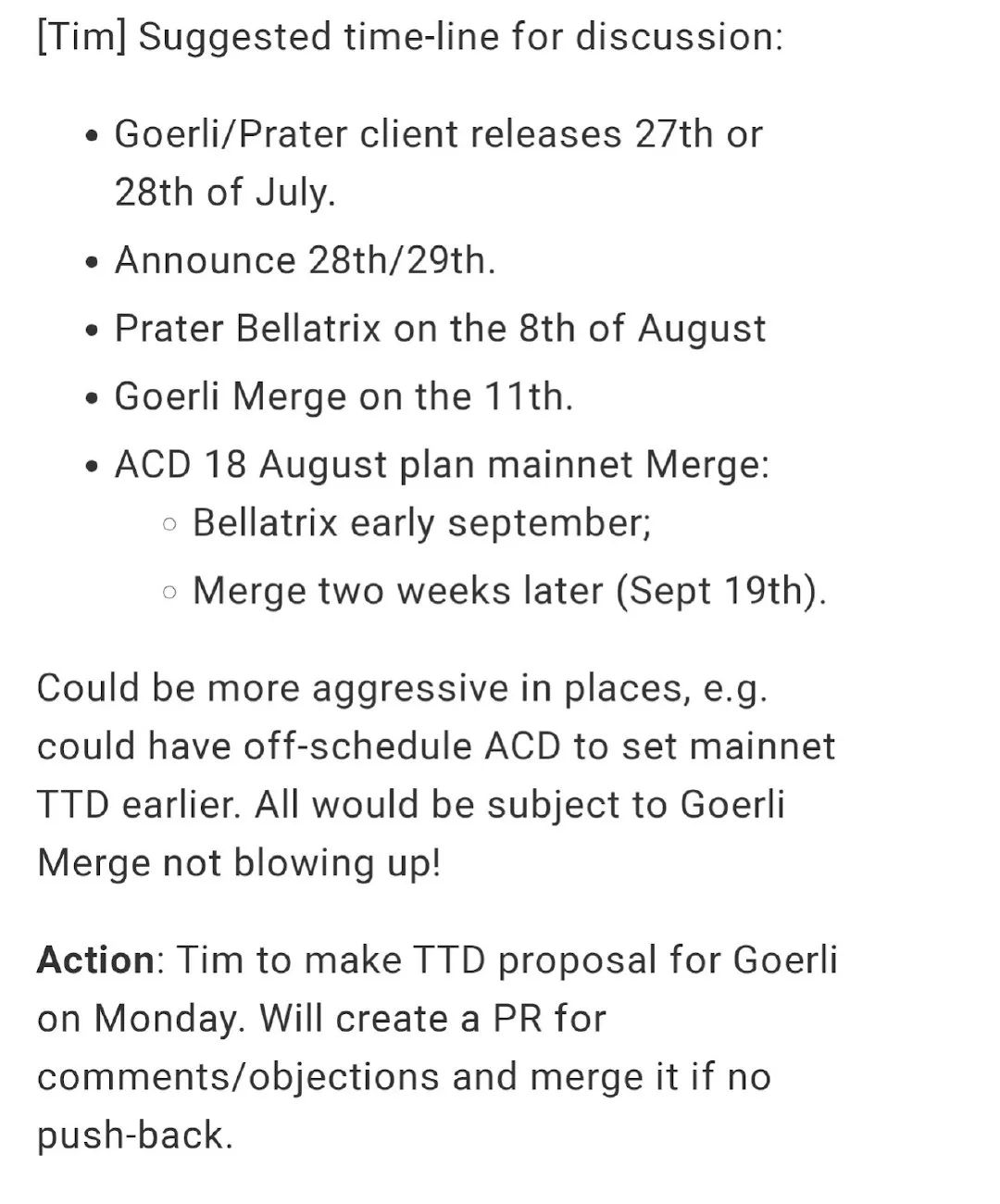

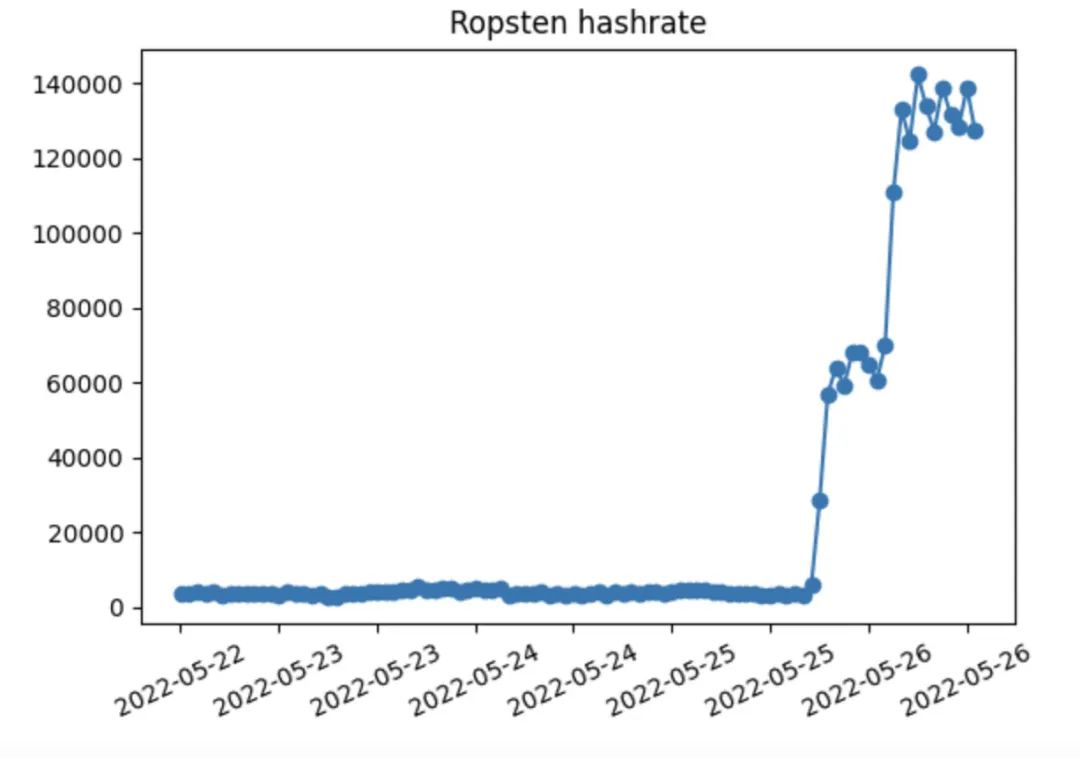

Two live testnets, Ropsten and Sepolia, have been successfully merged. Additionally, there are ten largely successful shadow forks on the mainnet. These hands-on runs exposed multiple minor bugs, most of which have since been fixed. Goerli will be the last testnet to undergo the merge, which is expected to take place around August 6-12.

image description

Source: Phone #91 of PoS implementers

What Merger Can and Cannot Do

Merging will not greatly increase transaction throughput and reduce gas costs. It simply changes the consensus mechanism from Proof of Work (PoW) to Proof of Stake (PoS). All else being equal, fees will be slightly lower as the block production speed will increase from about 13 seconds to 12 seconds.

The ETH pledged after the merger cannot be withdrawn. The Shanghai hard fork is expected to be launched within 6-12 months after the merger. Only after the fork can the pledged ETH be withdrawn and new ETH issued on the beacon chain. However, transaction tips and MEV fees will flow immediately upon merging. We will clarify how withdrawals work later in this report.

Merge does not support on-chain governance. Some PoS blockchains have on-chain governance, where rules and upgrades are governed using some form of on-chain voting (eg Cosmos and Polkadot). But that’s not the case with merged Ethereum. Similar to Bitcoin or the current version of Ethereum, protocol changes are discussed and decided off-chain through a social layer with broad stakers.

Merging does not mean stakers get their funds for free. Under PoW, the Ethereum protocol must provide sufficient incentives to compensate miners for their operating expenses and, on top of that, make them a small profit. A common argument is that by transitioning to PoS, validators have little ongoing cost and stakers can easily enjoy high yields.

But staking is not free. Validators have a capital opportunity cost when they choose to invest their funds in ETH and stake their ETH in the beacon chain compared to other ETH benefits. If staking is free, people will continue to acquire and hold more capital until a similar equilibrium point. In fact, this situation has already appeared in the stETH leveraged trading that closed positions in May-June.

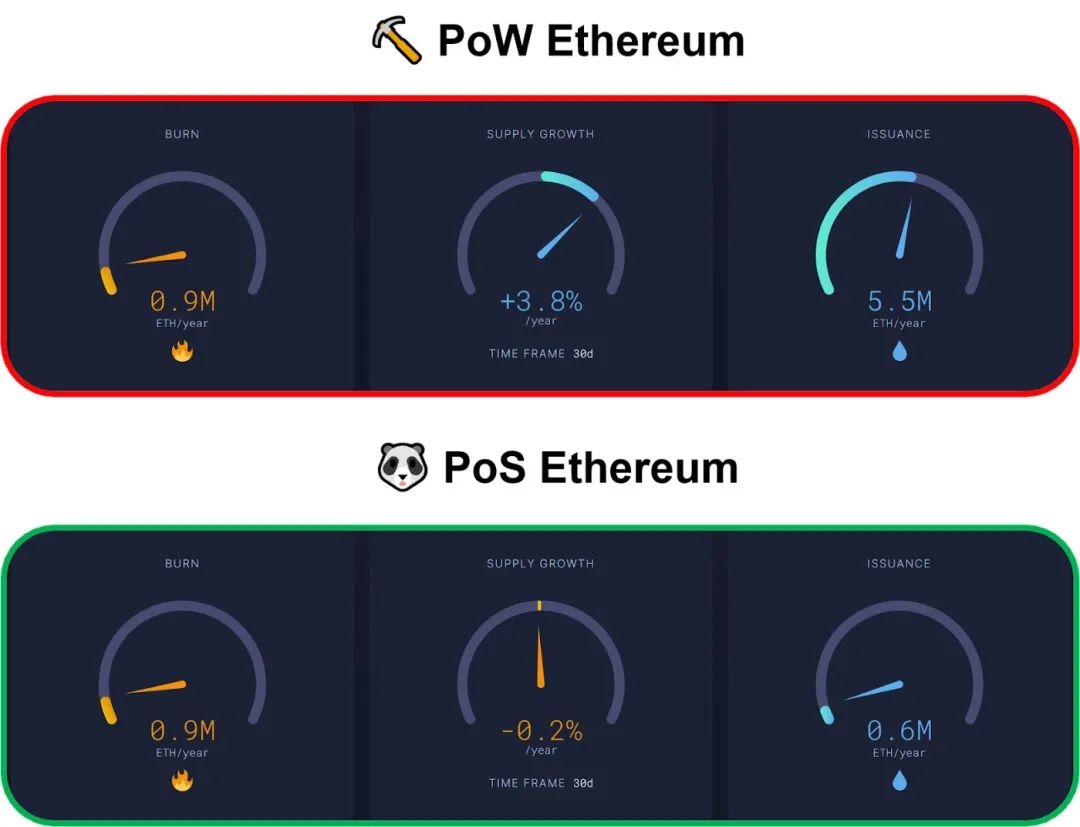

The merger significantly changed Ethereum's monetary policy. Ethereum is currently rewarding miners (at a rate of 2 ETH per block) and validators on the beacon chain. After the merger, rewards for miners will stop, which will result in a reduction of about 90% in the issuance of ETH, which is known as the "triple halving".

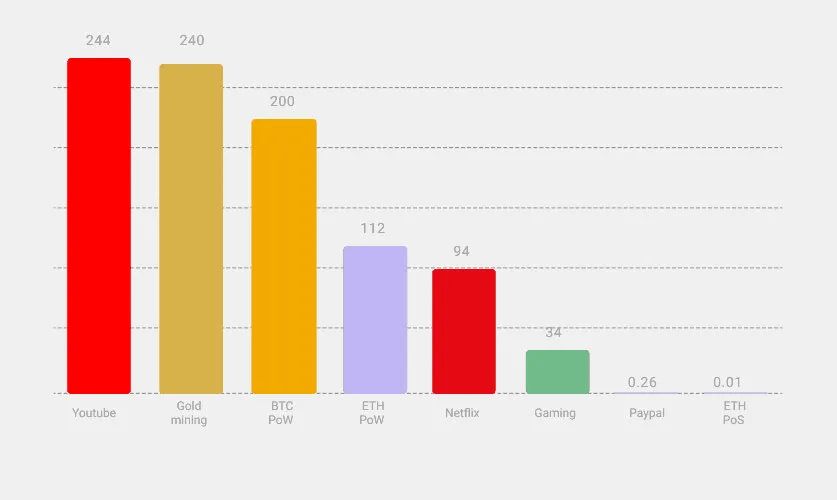

The merger significantly reduces Ethereum's energy consumption and carbon emissions. In the PoW mode, entities need to purchase energy-intensive mining equipment to secure the Ethereum network, which results in high power consumption and hardware waste. Ethereum’s current energy consumption is comparable to that of Chile; its carbon footprint is similar to that of Hong Kong.

Post-merger, entities pledge collateral to secure the network. There is no longer a competition to acquire more powerful mining equipment, thereby reducing energy bills considerably. Most predictions indicate that Ethereum’s energy consumption will be reduced by more than 99.95%.

image description

Source: Ethereum.org, Digiconomist

Focus - key areas

"Triple Halved"

The merger is expected to significantly alter the flow of capital into and out of the Ethereum ecosystem.

On the supply side, Ethereum is currently incentivizing miners (under PoW) and validators (under PoS). Miners produce new blocks at a price of 2 ETH per block, for which they will receive seigniorage, which will also be distributed to validators on the Beacon Chain. After the merger, rewards to miners would stop and Ethereum issuance would be reduced by about 90%. That’s why this merger is also colloquially known as the “triple halving” — a nod to Bitcoin’s halving cycle.

Ethereum can reduce the issuance of ETH because PoS is a more effective way to secure the network compared to PoW. Under PoW, Ethereum needs to issue enough ETH to cover miners' costs (buying mining equipment and paying for electricity) and the meager profits. Under PoS, Ethereum only needs to pay the opportunity cost of funds. Furthermore, PoW can only incentivize well-behaved miners through rewards, while PoS also allows Ethereum to disincentivize misbehavior through slashing.

image description

Source: Ultrasound.money

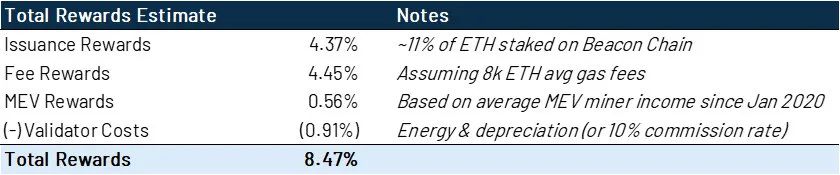

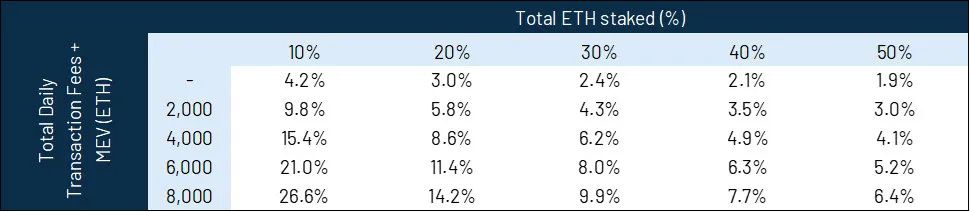

Demand for Ethereum post-merger is also expected to increase due to a number of factors. First, the staking rewards for validators will increase immediately. Validators will receive the transaction tips currently earned by PoW miners, likely increasing the APR by about 2-4%. Additionally, since they are able to reorder transactions, they will also start earning MEV (Maximum Extractable Value). Researchers at Flashbots, an R&D agency that studies MEV burst behavior, say that due to MEV (assuming 8 million staked ETH), validators could gain an additional 60% in yield. So, if the merger happened today, validators can expect to earn around 8-12% APR in total due to all the factors mentioned above.

image description

Sources: @StakeETH, @eth2calculator, Etherscan, Beaconcha, Flashbots

Note: The estimate of MEV rewards is conservative as it is a lower bound estimate from Flashbots.

Of course, such a rate of return is not sustainable. Therefore, we expect a significant increase in ETH staked post-merger. If the percentage of total ETH staked is comparable to the alternative L1 (Solana and Tezos: 75%, Cosmos: 64%, NEAR: 39%), then the Ethereum staking yield will compress to below 2% APR.

image description

Sources: @StakeETH, @eth2calculator, Etherscan, Beaconcha, Flashbots

Other factors expected to affect ETH supply and demand include:

After successfully transitioning from PoW to PoS, ETH has reduced its risk.

Eliminate criticism of energy usage and network energy spending will drop by 99%.

Due to its staking returns, Ethereum will increasingly be viewed as a financial instrument, similar to equity or perpetual bonds.

Withdrawals on the Beacon Chain will not be enabled until after the Shanghai hard fork, which is expected to start within 6-12 months of the merger.

Shanghai Hard Fork

Withdrawals on the beacon chain are often misunderstood. The withdrawal of ETH staked on the Beacon Chain and the issuance of new ETH will not be enabled at the time of the merger. Instead, it will be enabled in the Shanghai upgrade, tentatively scheduled for 6-12 months after the merger.

However, priority fees and MEV fees (which can account for more than half of the total staking rewards) can be withdrawn immediately after merging.

Post-merger capital outflow?

Two separate withdrawals are allowed after the Shanghai hard fork. The first is a partial withdrawal — allowing active validators to withdraw their accumulated rewards and bring their staked balance down to 32 ETH. These are important because it allows validators to withdraw the revenue they generate without completely shutting down and reactivating validators. It also allows validators to maximize efficiency, since when a validator's balance exceeds 32 ETH, the excess tokens are not efficient. If some funds are not withdrawn, the returns earned become idle capital.

The maximum number of partial withdrawals per epoch is currently set to 256. Each day consists of 225 epochs, so 57,600 validators can withdraw their rewards every day. Currently, the average balance of all active validators is 33.66 ETH. We can expect that number to climb to around 34 ETH when Shanghai upgrades, implying partial withdrawals from the market:

(34-32) x (57600) = 115200 ETH / day

(approximately $173 million if ETH = $1500)

This could last anywhere from 7 days (based on the current validator set of 410k) to 14 days (if the validator set increases to 800k).

Validators can choose to withdraw in full. To ensure the security of the Ethereum network, full withdrawals and withdrawals per epoch are limited, currently set to approximately 6 per epoch. If all currently active validators want to withdraw, it will take more than a year.

We expect that most of the rewards from partial withdrawals will be creating new validators rather than selling to the market, and that the demand for new deposits will outweigh the potential selling pressure that full withdrawals might bring. Still, we point out this dynamic because it operates differently than PoS-based blockchain networks and can create confusion.

result

ETH issuance decreased by about 90%.

For 6 months to 1 year, validators' stake (32 ETH) and issuance rewards will be illiquid and stuck on the beacon chain.

The circulating supply of ETH will likely continue to be reduced by deflationary monetary policy and the need for collateralized ETH.

building blocks

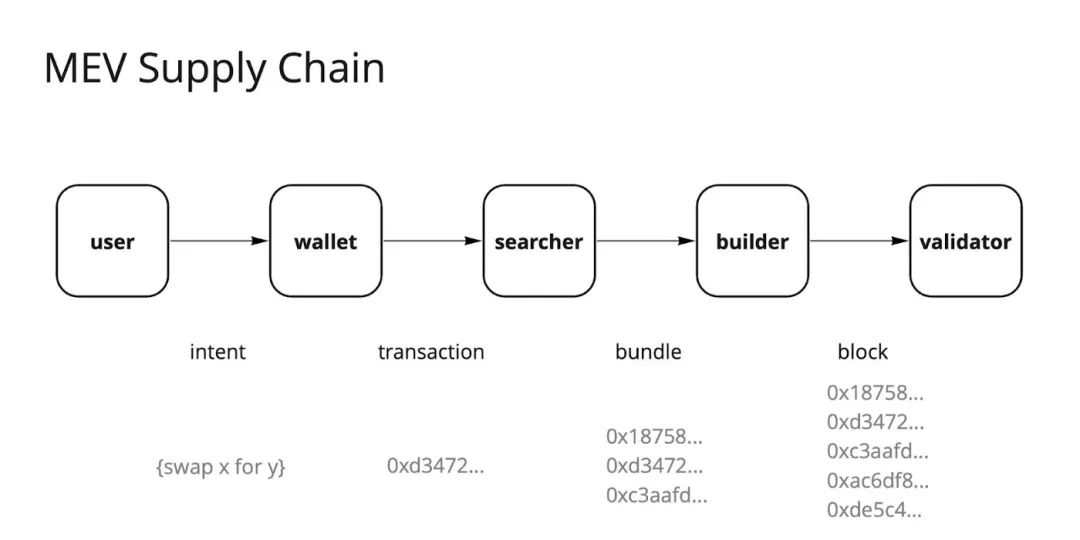

MEV has grown from a niche topic a few years ago to the focus of blockchain research today. MEV affects all areas of blockchain. The full impact of MEV is beyond the scope of this report, so we will only briefly describe how MEV will affect validators after the merger.

Maximum Extractable Value (MEV for short), broadly refers to the total amount that a miner or verifier can increase its balance in a series of blocks given the available operations. These actions can include reordering transactions, censoring blocks, or even attempting to reorganize the chain. Some common forms of MEV include sandwich attacks, arbitrage, and liquidations.

History and current status of MEV

In the current state of Ethereum, most users send their transactions to the public mempool via wallets. Seekers are constantly monitoring the mempool for potential profit opportunities. In the early days of MEV, Seekers took advantage of these opportunities by bidding high gas prices to gain transaction priority.

As MEV became more competitive, it led to Priority Gas Auctions (PGA), which increased network load, which in turn led to volatile gas prices, inefficient use of block space, and more. Other negative externalities also began to emerge. The team started building infrastructure around the world to provide faster and wider access to various mempools. Miners provide a service that allows Seekers to execute transactions privately, bypassing the public mempool.

Several solutions to mitigate these negative externalities have emerged. The most prominent ones are Flashbots.

These solutions democratize MEV to a large extent. Searchers who spot unique MEV opportunities avoid revealing their strategies to other searchers and reap most of the profits. For more competitive strategies such as arbitrage, miners earn MEV revenue through bids submitted by searchers.

Merged MEV

After the merger, validators will replace miners. But there is no built-in mechanism at the protocol level to help validators capture MEV. If left unchecked, this structure will allow specialized companies and larger entities to better capture MEV by setting up multiple validators and strategies for building optimal blocks. Other validators will not be able to effectively compete.

Source: Flashbots

MEV supply chain

Source: Flashbots

Within this framework, Seekers will continue to seek out monetization opportunities from MEV and bid for their bundles to be included. Builders aggregate all these bundles to build the best full block that pays the most. When it is a validator's turn to propose a block, they query the MEV-Boost relay with the highest paying payload and include it in their proposed block.

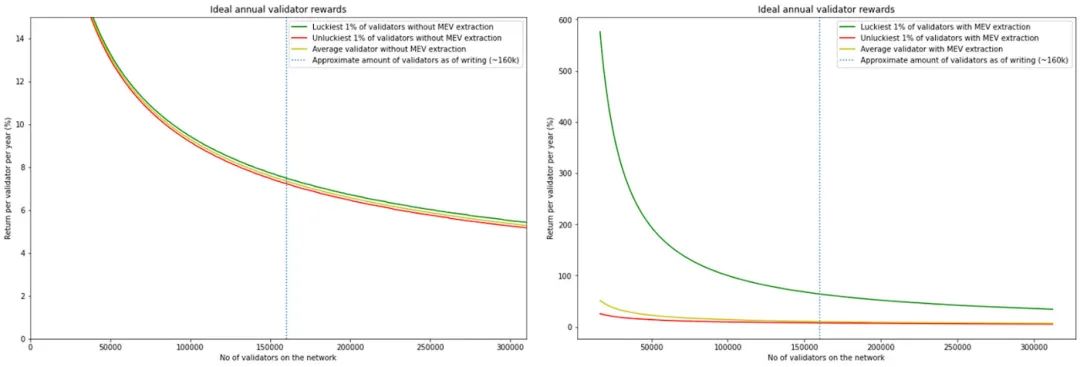

However, MEV rewards are subject to change. For example, periods of high volatility tend to result in higher MEV fees. Validators who make proposals during these periods may be rewarded with higher MEV. A Flashbots study last year confirmed that inequality among validators increases when MEV is factored in.

Source: Flashbots

Source: Flashbots

Note that the distance between the green and red lines widens significantly with MEV extraction.

Therefore, large institutions and validator pools that can socialize/smooth MEV by running thousands of validators will benefit. This dynamic is similar to why home-based GPU miners join mining pools today — stability and predictability of income. The potential of multi-block MEVs is a further source of strength.

image description

Source: Beaconcha.in

Until Ethereum smoothly builds MEV into the protocol layer (which is currently a work in progress), validator pools and centralized entities will likely continue to gain market share.

Miners, forks, etc.

Miners are an important part of the Ethereum ecosystem. In total they spent about $15 billion on GPUs. After the merger, all their equipment and infrastructure will be idled and alternative uses will need to be found. In anticipation of the merger, GPU resale prices have already halved from the beginning of the year.

Therefore, what miners do before and after the merger remains highly uncertain. Some arguably confrontational behavior has been observed. In May, before the Ropsten beacon chain went live, a miner significantly increased the hashrate to reach TTD, forcing developers to retest the merge on Ropsten.

In the miner's words, the rationale for this is: "This is a stress test for the ROPSTEN network to see what happens if the merger goes beyond plan."

image description

Source: bordel.wtf

Before the merger, the miners' reaction may be more violent, which will seriously reduce the user experience on Ethereum.

For example, miners can steal MEV. When Seekers send bundles to miners via Flashbots, Seekers trust miners not to steal/expose/preempt. As the merger nears, miners can start doing this, as the cost of getting caught will decrease.

image description

Source: @ethermine_org

We hope that the largest mining pools like Ethermine will not act maliciously. F2pool is the second largest mining pool in the world and merged with its sister company Stakefish a long time ago. Ethermine also launched a beta version of its staking pool service.

Still, smaller miners may try to eke out as much revenue as possible before merging through malicious behavior.

Where will the miners go?

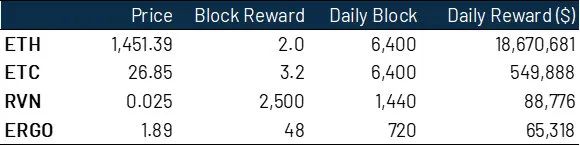

Post-merger, if these machines were trying to function within the crypto ecosystem, the most likely candidate would be Ethereum Classic, the ethereum fork that resulted from the 2016 DAO hack. Just this week, Antpool, the eighth largest ethereum mining pool, committed $10 million to develop the ethereum classic ecosystem.

But Ethereum Classic’s daily fees are orders of magnitude smaller than Ethereum’s. Additionally, the profitability of mining these networks will inevitably decrease if miners use GPU hashrate heavily, especially if prices do not increase.

GPU mineable blockchains

Clearly, other GPU-minable blockchains cannot handle the large number of idle GPUs after the merger. Additionally, Bitpro estimates that for GPU miners to remain profitable in the crypto ecosystem, roughly 95% of GPUs need to be turned off. This is unlikely to happen immediately after the merger.

Therefore, it is possible for miners to try to keep the PoW fork after the merge. Some miners have already gained support for the ETHPoW fork. If some exchanges support the fork while a small group of miners continue to use the fork, the lifespan of the fork may be longer than expected.

Even if this happens, almost all users and developers will stick with canonical PoS Ethereum. The ETHPoW fork does not have any meaningful philosophical or ideological support. Also, the Ethereum ecosystem is very different now than it was in 2016 (when the ETH/ETC fork happened). Real-world asset issuers, such as Circle (USDC) and Tether (USDT), will only support minting/redemption on the canonical chain. Packaged assets such as wBTC will do the same. L2 and bridges will also only support assets bridged from the main chain. DeFi on the ETHPoW fork has become a strange existence, and billions of assets will become useless overnight.

Therefore, we expect the fork to potentially generate a lot of headlines, but be of negligible value in the long run.

pricing?

Liquidity Collateralized Derivatives

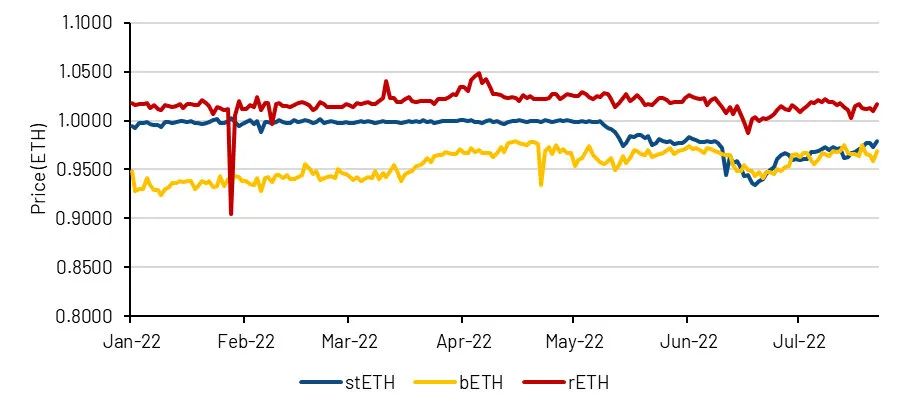

Liquid collateralized derivatives can serve as a gauge of market sentiment. The biggest three are Lido (stETH), Binance (bETH) and Rocket Pool (rETH).

stETH and bETH are adjusting the token base - 1:1 ratio of token balance to ETH, token balance is updated regularly to reflect rewards. Therefore, after the Shanghai hard fork, stETH and bETH should converge to a price of 1 ETH, as users will be able to arbitrage between ETH and their liquid collateralized derivatives.

In contrast, rETH is designed as a value-added token. Therefore, the rETH-ETH exchange rate will increase over time. However, trading rETH back to ETH is dependent on protocol liquidity, which is limited until withdrawals are enabled. As a result, the market price of rETH has fluctuated over the past year.

image description

Source: CoinGecko

Prior to May of this year, stETH traded essentially on par with ETH due to high demand for staking ETH. This further reinforces the (incorrect) view that stETH is "pegged" to ETH in the same way 1 USDC is pegged to 1 USD, giving market participants the confidence to leverage their yield. In this transaction, participants deposit their stETH into a money market protocol (most commonly Aave) as collateral to borrow ETH, pledge the borrowed ETH to obtain stETH, and cycle the transaction again.

Several products have emerged that offer leveraged ETH staking

Market turbulence events starting in May forced large market players, notably Celsius and Three Arrows Capital, to sell their stETH collateral. stETH-ETH lack of liquidity and crowded leveraged trading has resulted in a lot of people trying to exit through a small door.

image description

Source: Dune (@LidoAnalytical)

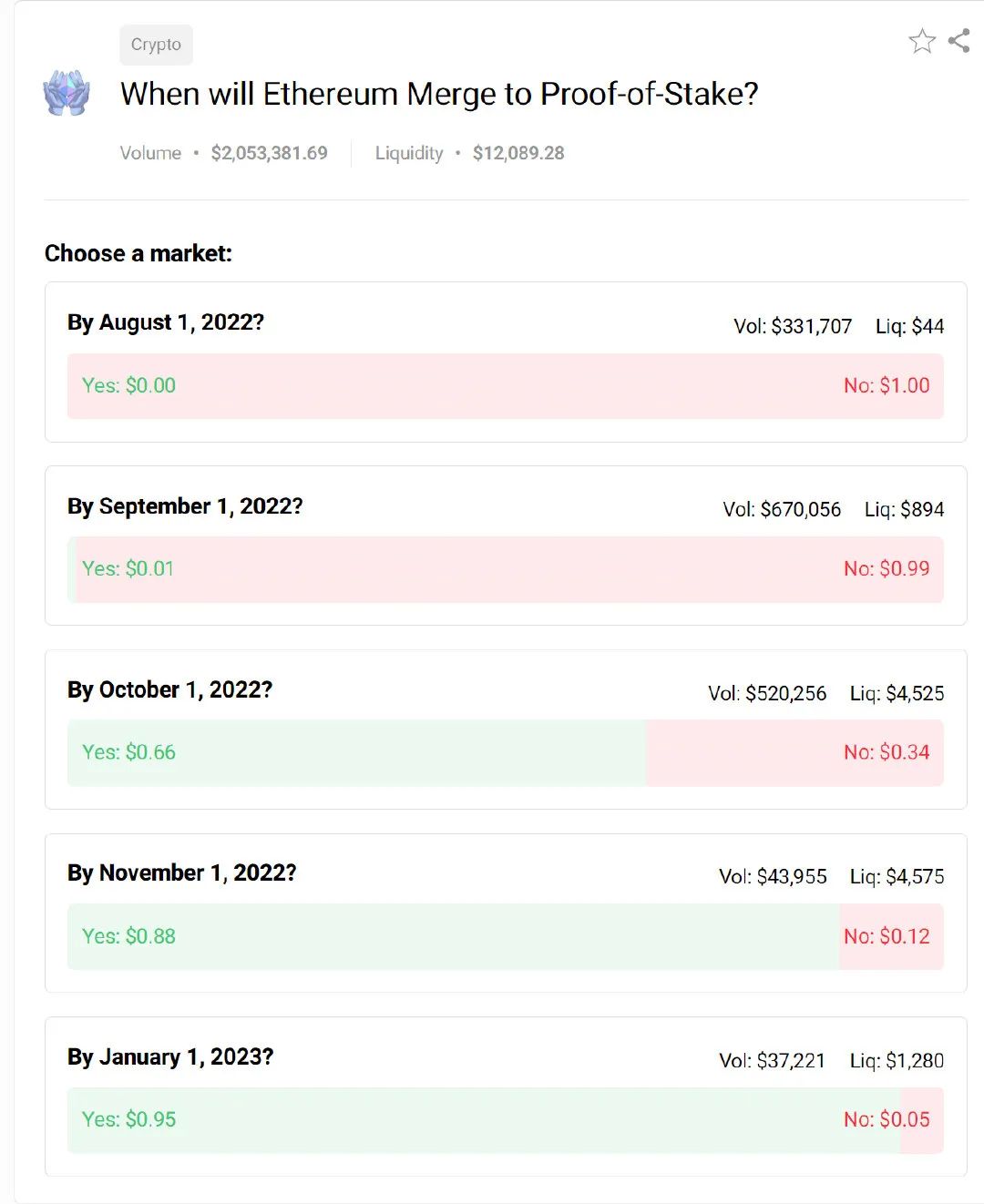

market pricing

bETH is currently trading at a 2.2% discount to ETH, while its “flexible” staking yield is 2.4%.

The developers have indicated that the Shanghai hard fork occurred 6-12 months after the merger. Assuming the midpoint of these estimates, this means the merger will occur around September 30, 2022.

This approximation is not perfect, taking into account liquidity factors and market technical factors, but it can be used to gauge market sentiment. The same operation can also be used for stETH, but we use bETH and Binance's flexible yield to exclude the impact of counterparty risk, and it is easier to offset the opportunity cost of capital.

ETH / BTC

image description

Source: Binance, TradingView

beneficiaries of the merger

The price performance of some publicly traded tokens benchmarked against ETH also provides another reading on market sentiment.

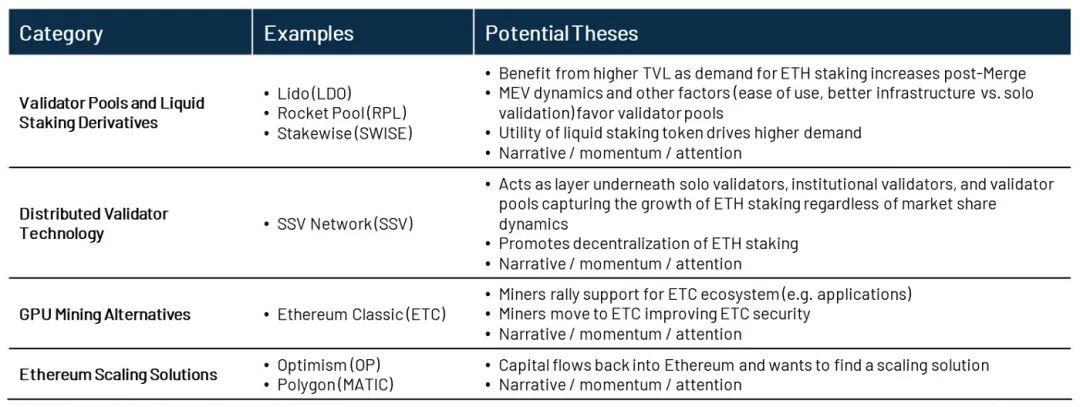

Beneficiaries of the merger include:

Most coins in the aforementioned categories have outperformed ETH since June, with a few exceptions.

Price performance of selected tokens (based on ETH)

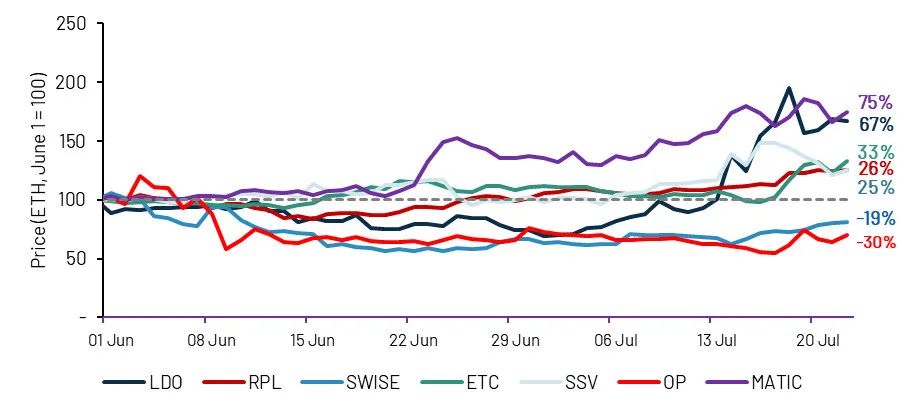

Polymarket

Polymarket has the largest consolidated prediction market. It offers another, simpler way of gauging market sentiment toward a merger, although incredibly low liquidity cripples its predictive power.

Currently, Polymarket participants believe there is a 66% probability that the merger will occur according to the proposed timeline, and a 95% probability that it will occur by the end of the year.

merger risk

Execution Risk. Good communication between all stakeholders is key to a successful merger. Before merging, validators on the consensus layer need to perform several operations, such as updating the correct TTD value, keeping nodes updated and synchronized. User error or misinformation may result in node loss. Clients of the consensus layer may also have undiscovered bugs. If enough nodes fail, Ethereum may temporarily stop. There are also execution risks for applications or exchanges running on Ethereum.

The Ethereum community has been actively working to mitigate these risks. For example, the community rallied to improve client diversity, reducing Prysm's validator share from 68% in April to 41% today. This way, the consequences of potential bugs are greatly reduced.

miner risk. As mentioned in the previous section, miner incentives will change before and after the merger.

Validator risk. A new set of cyber risks emerges from the merger. One attack is a potential denial of service (DoS) attack. Proposers will be known in advance, which will incentivize some participants to maliciously DOS verifiers. This also acts as a kind of centralization, favoring institutional validation pools for handling and mitigating DoS risks.

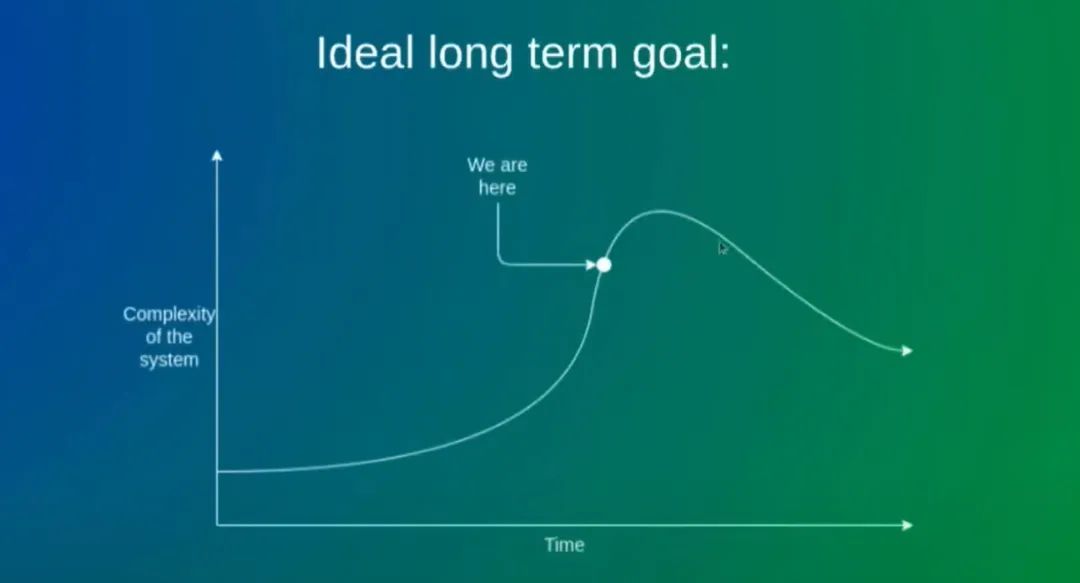

Complexity risk. Ethereum would effectively merge two separate networks, expanding technical complexity. To join the beacon chain, I personally need 2 clients. To run a validator, you need 3 of them. To get MEV rewards, you need 4 of them. The risk is that, as Ethereum becomes modular and specialized, this trend will continue to the point where it becomes difficult for anyone to understand the full picture.

Vitalik also touched on this issue in his recent EthCC speech, calling on the community to start thinking about reducing the complexity of Ethereum.

Summarize

Summarize