Original Author: DataFinnovation

Compilation of the original text: Wu Zhuocheng, Wu said blockchain

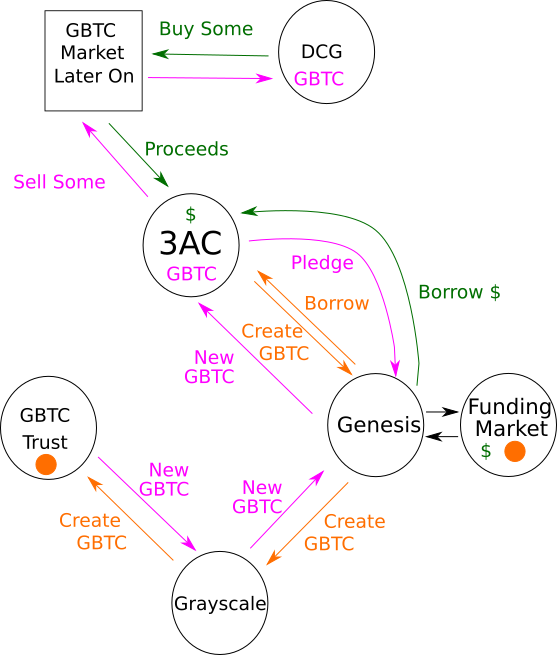

It looks like DCG and 3AC are involved in some sort of scheme to extract value from the GBTC premium. This provides a lot of leverage for the 3ACs, which they cash out and use to fund various things, and it also generates a lot of short-term profit for DCG through fees. But 3AC was highly leveraged and they went bankrupt with Luna's debacle. The epic damage from this debacle is only starting to be felt, and GBTC may be at the center of even bigger troubles.

DCG owns Grayscale and Genesis, Grayscale issued a GBTC fund, they are desperately trying to turn it into an ETF; and Genesis provides lending services, including BTC and GBTC and USD.

GBTC is a US registered security and Genesis is a US registered broker. There are two key points here:

We are talking about securities here with 100% certainty.

Both companies have made numerous filings with the SEC.

first level title

GBTC

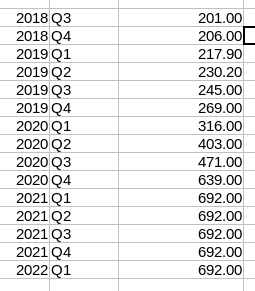

Grayscale Bitcoin Trust has a number of filings with the SEC and from there we can work out the historical share count.

Grayscale is owned by DCG, which has been buying shares in the trust for some time.

DCG bought 15 million shares between March 2021 and January 2022, and then purchased about 3 million more shares between February 2022 and March 2022.

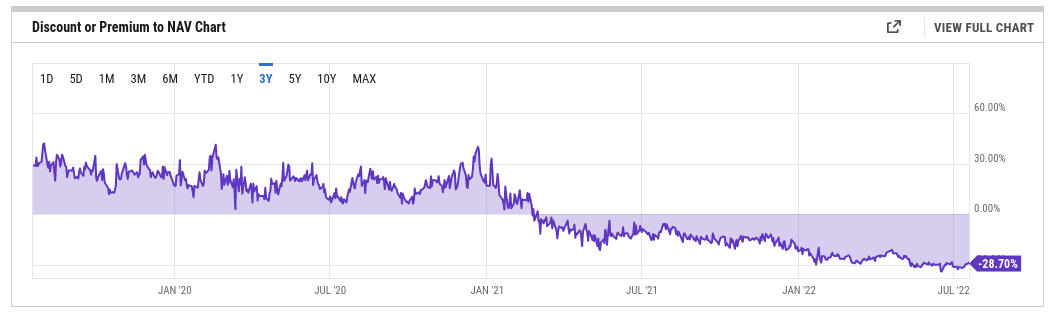

Also during this period, the GBTC price changed from a premium to a discount:

When it trades at a premium, you can use bitcoins — not dollars — to create shares and make money. You can't do that anymore when it's trading at a discount. And, famously, you cannot take your bitcoins out of the trust.

Finally, GBTC is a registered security. In the US, if you own more than 5% of this stuff, you need to file a form to disclose it. Based on the outstanding share counts above, here are the reporting threshold levels for four different dates, the significance of which will become clear shortly:

December 31, 2019: 13.45 million

June 2, 2020: 16.763 million

December 31, 2020: 31.95 million

first level title

3AC

Three Arrows Capital attaches great importance to this security issue. Here are the key points:

3AC did not file a holding report for December 31, 2019, so they owned fewer than 13.45 million shares as of that date.

3AC did apply for 21 million shares on June 2, 2020.

3AC also applied for 39 million shares on December 31, 2020.

The 3ACs did not file at the end of 2021, so they are below the threshold.

This is of course assuming 3AC is following the 13G rules correctly, they appear to have filed and are using a very generic US broker. So anyway, this doesn't look like a trick:

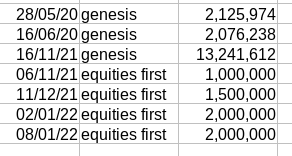

$2 million loan committed to Genesis on May 28, 2020.

Pledged 2 million to Genesis on June 16, 2020.

Another 13 million committed to Genesis on November 16, 2021.

Pledge $6.5 million to Equities First from late 2021 to early 2022.

first level title

Genesis

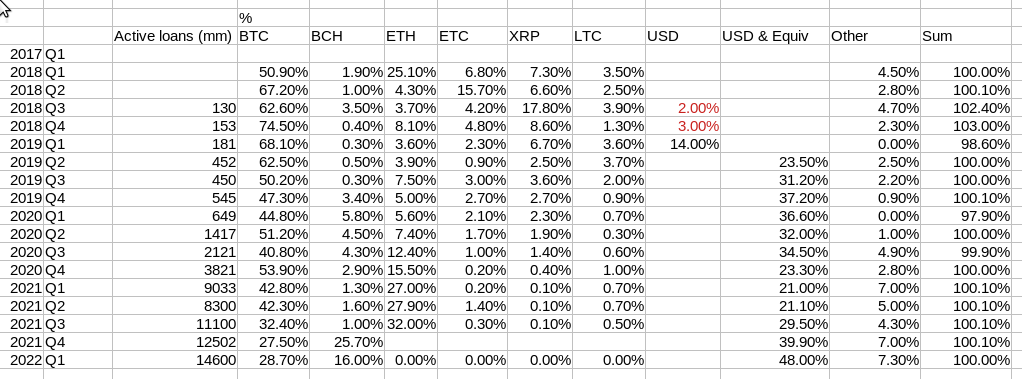

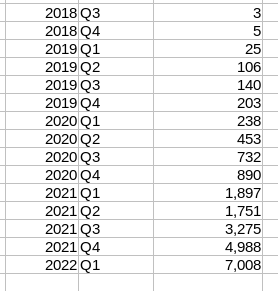

Genesis publishes quarterly reports that contain extensive detail. Here we round up their borrowings over several years:

This indicates a steady increase in their lending activity. This is not counted in dollars, but in GBTC shares (in millions). 1 GTBC is equal to 0.001 BTC, so 1 million GBTC is 1000 BTC.

From 2018 to 2022, Genesis's GBTC balance in BTC loans represents approximately 15% of the outstanding amount, which has remained constant.

first level title

dollar loan

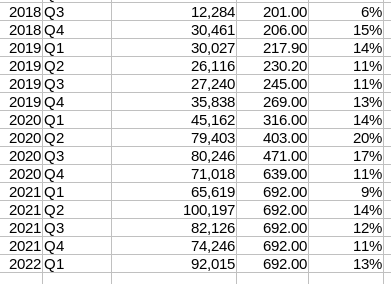

In addition, 3AC mortgaged its GBTC stock to lend USD, and the following table is a partial interception:

As of mid-2020, 3AC borrowed about 4 million shares of stock from Genesis, worth about $45 million. Then in late 2021, they borrowed an additional 13 million shares worth more than $625 million. Let's see how many loans Genesis has outstanding:

what happened

what happened

So what's going on here? The following are only speculations:

3AC acts as a lender to borrow BTC from Genesis with a small amount of collateral.

3AC transfers these BTCs to Genesis as authorized participants to create GBTC shares. Genesis locks BTC in trust through Grayscale and returns shares.

The shares trade at a premium, so this is "free money" for 3AC.

3AC then pledged these shares to Genesis for a US dollar loan. If the premium is large enough, the loan will be worth more than the BTC they borrowed in the first place.

After 6 months of creating GBTC, you can try to sell it. But if the price is too low, there are two big problems:

3AC was unable to repay the dollar loan.

3AC cannot repay the BTC loan.

3AC subsequently sold approximately half of their position to DCG and mortgaged the remainder to Genesis and Equities First for loans. Their positions are worth over $1 billion and their loans are huge because of the incredible rally in BTC. They spent the money on yachts, houses, LUNA and other altcoin investments.

first level title

why do you do this

Simply put: arbitrage from the GBTC premium. If Grayscale can limit the supply so that the trust trades at a premium, then anyone who can create shares with BTC can get free money. They just need to keep the premium for the 6 month lock and sell.

But DCG can't do that on its own. All of this will be resolved if GBTC is converted to an ETF, which is probably the real reason why DCG is pushing so hard for the switch.

Whatever happened, a few facts clearly show that regulators can find out the truth in a short time:

3AC is in liquidation, and liquidators tend to work with regulators with ease and enthusiasm.

Genesis is a U.S.-registered broker-dealer, and regulators have direct access and request data. And, where court approval is required, it will be straightforward. It's hard to see offshore regulators rushing to protect 3AC these days.

Grayscale is a US-registered issuer of securities, and like Genesis, investigations are easy.

3AC trades their GBTC through another US broker, TradeStation. TradeStation, on the other hand, is completely independent, owned by a Japanese financial conglomerate called Monex, and they're not going to get in trouble for this fiasco.

Original link