Vitalik said in 2021:

In general, my own view is that in the short term, optimistic rollups are likely to win out for general-purpose EVM computation and ZK rollups are likely to win out for simple payments, exchange and other application-specific use cases, but in the medium to long term ZK rollups will win out in all use cases as ZK-SNARK technology improves.

(In general, my own opinion is that in the short term, Optimistic Rollups may win for general-purpose EVM calculations; while ZK Rollups may win for simple payments, transactions, and other specific use cases. With the improvement of ZK-SNARK technology, ZK Rollups will win in all application scenarios in the medium and long term.)

Now the most famous ZK Rollups projects have not yet issued tokens, such as zkSync, StarkEX, StarkNet, Aztec, etc., but the tokens of Optimism among the peerless twins of Optimistic Rollup have been circulated and traded in major mainstream exchanges, and recently with the Affected by various factors such as the implementation of interest rate hikes, the approach of ETH2.0, and the exhaustion of selling pressure from OP airdrops, OP prices also performed well. Faced with this strong currency price performance, many people can't help but ask: How is OP inferior to ZK?

Let me first list some of the most critical differences between Optimisitic Rollup and ZK Rollup:

First, security, ZK Rollup is better than Optimistic Rollup. The new state submitted by zk Rollup to L1 comes with Proofs, which can inherit the security guarantee of L1; while the new state submitted by Optimistic Rollup to L1 does not come with proofs. When the TVL increases to a certain amount, miners may be bribed to cause errors. The final fraud proof is not included in the block, and then the risk of theft occurs;

Second, scalability, ZK Rollup is better than Optimistic Rollup. The actual throughput limit of Optimistic is 500TPS, while ZK exceeds 2000TPS, and StarkEx can even reach 9000TPS;

Third, verifiable finality, ZK Rollup is better than Optimistic Rollup. The finality time of zk Rollup is very short, for example, zkSync is 10 minutes; while the finality time of Optimistic Rollup is at least one week. There is a big difference in capital efficiency between the two;

Fourth, EVM compatibility, Optimistic Rollup is better than ZK Rollup. Optimistic Rollup is compatible with EVM, and they can attract various Dapps on the existing Ethereum Layer1 very quickly and conveniently. Therefore, the TVL of Layer2 projects in the Optimistic Rollup series currently ranks high. However, with the development of zkVM, this advantage of Optimistic Rollup will also be weakened.

To understand why Optimistic is not as secure as ZK and has low capital efficiency, it is necessary to understand the working principle of Optimistic Rollup. Next, take Arbitrum Rollup as an example:

Arbitrum Rollup is an Optimistic Rollup.

Its basic structure is as follows:

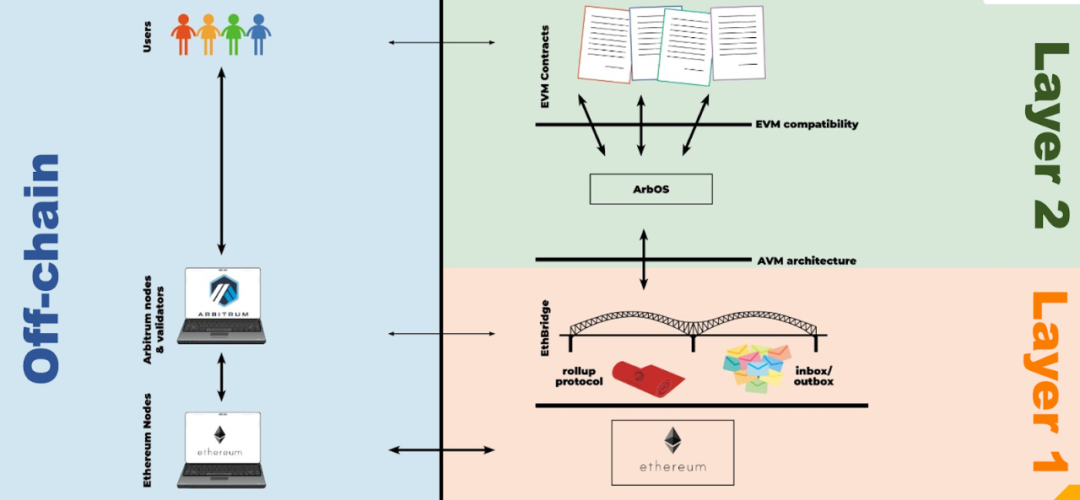

Arbitrum is the Layer 2 protocol of Ethereum, and EthBirdge is the ultimate authoritative source of what is happening in the Arbitrum chain, and also needs to maintain the Inbox/Outbox of the chain. The execution environment of Arbitrum is AVM, and the design starting point of AVM is EVM, which has not changed in many aspects, so Arbitrum supports programs written or compiled by EVM. The operating system written by Offchain Labs for Arbitrum is ArbOS. ArbOS provides an execution environment compatible with EVM for smart contracts, so ArbOS can run EVM-compatible Dapps in this operating system, which means that various Dapps on the Ethereum chain can be directly migrate over.

secondary title

How to reach a consensus?

Arbitrum Rollup is an optimistic Rollup, which means that everyone is honest by default, so when an assertion is issued, it is not required to be accompanied by a proof of its validity. Instead, the mechanism of fraud proof is adopted to ensure the correct consensus of the Layer2 network.

Arbitrum’s Fraud Proofs: When an Assertion is posted on-chain, the validator who made the Assertion posts a bond, and there is a window of time for anyone to post it if they think it’s false own margin and challenge the assertion. During the challenge window, asserters and challengers can interact with the agreement back and forth, and the on-chain contract acts as the referee of the agreement. In the end, the referee determined that a party had made a false claim and punished that party by forfeiting the bond.

So how exactly did Arbitrum resolve the controversy during the challenge period?

The core is Interactive Proving. This is actually a plan to analyze the disputes in detail to find key disputes and judge them through Layer1 Referee (L1 referee).

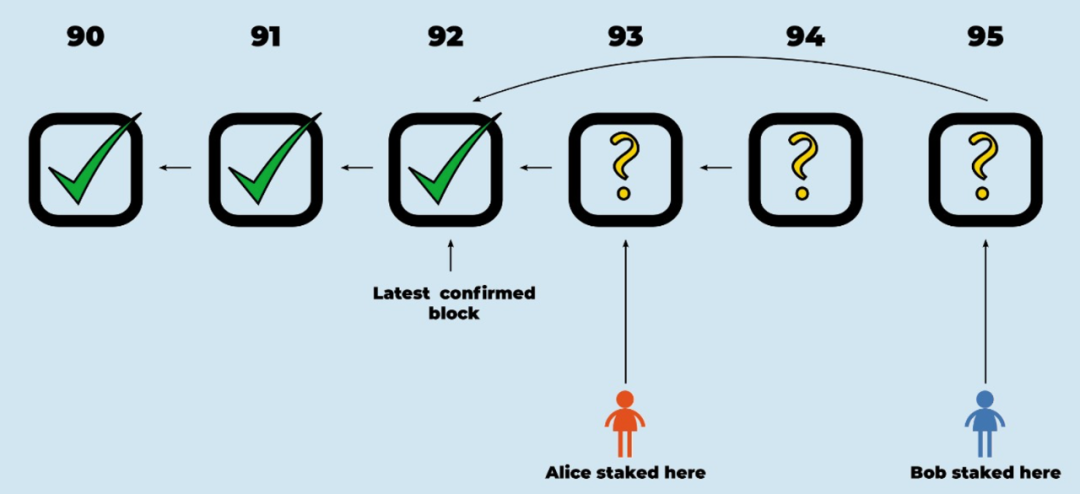

To illustrate: Suppose Alice submits an assertion (committing 93 to be true), and Bob disagrees and initiates a challenge (committing 95 to be true). If Alice's statement covers N steps of execution, she issues two statements of size N/2 which combine to produce her initial N-step statement, and then Bob chooses one of Alice's N/2-step statements to challenge . Now the size of the controversy has been cut in half. This process continues, halving the dispute at each stage until they disagree on an execution step. When the dispute is narrowed down to a single step, the L1 referee needs to resolve the dispute by looking at what the instruction actually does and whether Alice's statement about it is correct.

Compared with the re-executing transaction (Re-executing Transaction) adopted by Ethereum Layer 1, the interactive proof adopted by Arbitrum differs in that: re-executing the transaction requires simulating the execution of the entire transaction, while the interactive proof allows Alice and Bob to re-execute the transaction by themselves. The dispute is narrowed down to one step, so that the L1 referee only needs to simulate the execution of 1 transaction. The difference between Arbitrum and Optimism is also reflected in the resolution of disputes. Optimism runs the entire problematic transaction through EVM.

It can be seen from the above that the key reason why Optimistic Rollups are not as secure as ZK and have low capital efficiency is that the proof mechanism is different.

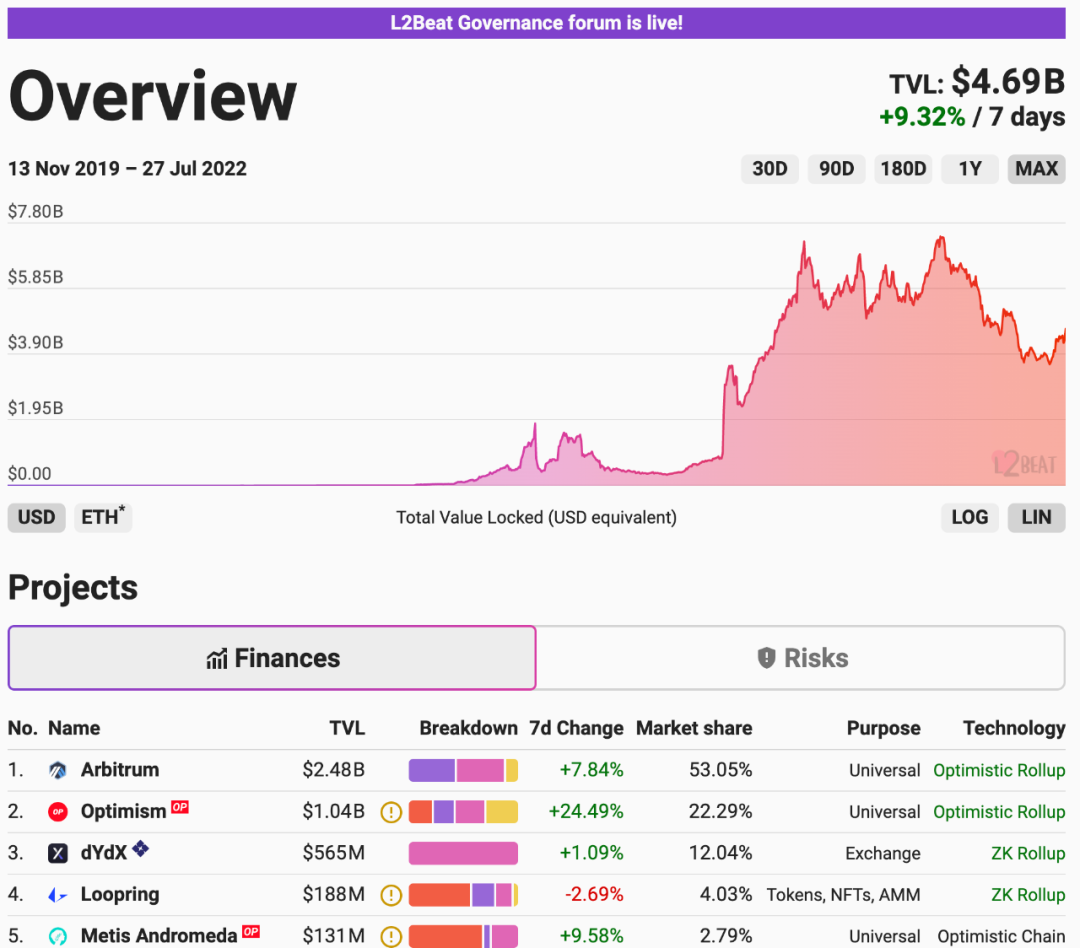

Returning to the original intention of expansion, compared with the performance of Ethereum L1, Optimistic Rollup has actually achieved the main purpose of expansion, and because Optimistic Rollups has the advantage of EVM compatibility, the development is not bad. On the TVL list of Layer2 projects, Optimistic Rollups’ peerless twins Arbitrum and Optimism rank in the top 2 with TVLs of 2.48B and 1.04B respectively. The Arbirum ecosystem has 249 application protocols in 21 categories, and the Optimism ecosystem has 179 projects.