Author: David

Author: David

Author press:

Generally, hedge funds will introduce correlation indicators as an important reference for investment and asset allocation. By reviewing the correlation trend between BTC and the Nasdaq 100 Index (NDX 100 Index) in the past four years, it can help us eliminate market noise, eliminate the false and preserve the true, and extract the key factors that really affect the market trend. In operation, grasp the real signal.

Indicator selection instructions:

Nasdaq 100 Index (NDX100):

In stock index selection, we mainly consider the Nasdaq 100 Index. The index includes the top 100 non-financial companies listed on the NASDAQ market. At present, 56% of the weight in the index is technology companies, including Tesla, Apple, Google, Nvidia, Netflix, etc., followed by consumer service companies, such as Amazon and Starbucks. The market value status of BTC in the currency circle and the industry attributes of the blockchain, NDX100 and BTC have strong similarities and comparability.

Monetary policy and macro-level indicators:

Considering that the overall currency circle and the stock market have been greatly affected by macro trends and monetary policies in the past four years, and various related interpretations on the news surface are overwhelming and numerous, ordinary investors often have a feeling of being at a loss. This analysis also lists the main indicators of macro and monetary policy. In the extended time dimension, we can make a peek at the real relationship between market trends and macro.

Federal Funds Rate:

The federal funds rate is a target interest rate guideline regularly set by the Federal Reserve Monetary Policy Committee. Commercial banks borrow excess reserves from the Federal Reserve or other banks overnight to meet reserve requirements based on this rate. It can be understood as the minimum cost of funds for the US financial system. The interest rate is one of the important tools of U.S. monetary policy.

U.S. 10-year Treasury yield:

The 10-year treasury bond yield can be understood as the lowest cost of capital for enterprises. Investors in bonds, stocks, commodities and real estate generally use the ten-year treasury bond yield as a measure of the opportunity cost of funds, so fluctuations in the ten-year treasury bond yield usually directly affect the pricing of large categories of assets.

The size of the Fed's balance sheet:Substitutability between Balance Sheet Reductions and Policy Rate Hikes: Some Illustrations and a Discussion1The expansion and contraction of the Fed's balance sheet is equivalent to the easing and tightening of monetary policy. According to the Fed's own research, the impact of 2.5 trillion asset contraction is equivalent to raising interest rates by 0.5 percentage points (

). This indicator needs to be examined together with the federal funds rate.

Correlation coefficient (CC) and BTC independent market:

The correlation coefficient is an indicator of the strength of the existing relationship between two different variables x and y. A linear correlation coefficient greater than zero indicates a positive correlation. A value less than zero indicates a negative relationship. A value of zero indicates that there is no relationship between the two variables x and y. Note that CC can only measure the correlation between the two, not the respective change ratios.

When comparing the BTC price to the NDX100 index, we used the CC indicator (purple area). The larger the purple area on the horizontal line, the greater the positive correlation between the two; the larger the purple area below the horizontal line, the greater the negative correlation between the two; the closer to the horizontal line, the smaller the correlation between the two.

Overall, it can be seen from the figure below that the positive correlation between BTC price and stock index has a gradually increasing trend. However, there are also multiple stages in the middle where the trend of the two shows a weakening positive correlation or even a negative correlation interval (marked with a red box). This range shows that BTC has stepped out of the independent market with the stock market, and it is worthwhile for us to focus on the reasons behind it.

2018:

Market summary:

The whole of 2018 was a big bear market for BTC, falling from 16,000 at the beginning of the year to around 3,500 at the end of the year, a drop of up to 78%. During the same period, the NDX100 index rose by 18% from 6500 points at the beginning of the year to 7660 points at the end of August. After that, the stock index fell and fell back to 6500 points at the end of the year.

Macro progress:

On February 3, 2018, Powell took office and adopted a hawkish policy. Throughout 2018, interest rates were raised 5 times, and the shrinkage of the balance sheet was also greatly accelerated. However, in January 2018, the Trump tax reform bill was passed to reduce tax rates and a $2 trillion infrastructure plan. The conservative monetary policy and the aggressive fiscal policy offset each other, and the conservative monetary policy has limited impact on the entire market. On October 3, Federal Reserve Chairman Powell's hawkish speech led to a rapid rise in U.S. bond yields, and the three major U.S. stock indexes collectively plunged. Despite the mid-month rebound, a host of companies missed revenue and forward guidance during the late October earnings season, sparking a fresh sell-off.

On October 31, 2018, the Federal Reserve did not replace the US$23 billion released by the treasury bonds that matured that day with new bonds, thus setting a new record for the scale of shrinkage in a single week. The Fed shrunk a total of US$33.8 billion that week. As of November 7, the Fed's total assets and liabilities have shrunk to $4.14 trillion, the lowest since February 2014, and a total reduction of more than $320 billion.

BTC's independent market:

In 2018, due to the impact of the ICO bubble burst in 2017, the entire BTC market fell sharply from a high level. In the middle of the year, when the stock market stabilized and rose slightly, it did not follow the upward trend, but continued to consolidate at the bottom. The monetary policy at the end of the year The tightening has affected the trend of the stock market and BTC at the same time.

2019:

Market summary:

In 2019, the BTC price resumed its upward trend, rising from 3,500 at the beginning of the year to around 11,500 in early July, an increase of 228%. It fell in the second half of the year, falling as low as 6,900 in early November, and closing at around 8,700 at the end of the year. During the same period, NDX100 rose from 6800 at the beginning of the year to around 9300 at the end of the year, an increase of 37%.

Macro progress:

On July 31, the Fed announced a rate cut of 25 basis points after the interest rate meeting, lowering the target range of the federal funds rate to 2% to 2.25%, which was the first rate cut since December 2008. At the same time, the Federal Reserve also announced the end of the balance sheet reduction policy, which is called quantitative tightening by the market, two months ahead of schedule.

In the early morning of September 19, the Federal Reserve announced another 25 basis point cut in interest rates, which was the second cut in 50 days; at the same time, the Fed also cut the interest rate on excess reserves by 30 basis points. Powell said that the question of when to expand the balance sheet will be rediscussed, and the expansion time may be earlier than expected.

At 02:00 on October 31, the Federal Reserve cut interest rates by 25 basis points, and the target range of the federal funds rate was lowered to 1.50% to 1.75%, in line with market expectations. And just after this rate cut, the Fed hinted that it will pause interest rate cuts in the future. The Fed's statement removed language that had said it would "act as appropriate" to sustain the economic expansion, suggesting they believe that policy accommodation may have ended for now. The shrinking of the balance sheet lasted for two years, and the scale of the shrinking balance sheet reached 44600-37700 (September 2019). The total scale of the shrinking balance sheet was 690 billion.

On the afternoon of October 24, the Political Bureau of the Central Committee of the Communist Party of China conducted the eighteenth collective study on the development status and trends of blockchain technology. Xi Jinping, General Secretary of the Central Committee of the Communist Party of China, emphasized when hosting the study that the integrated application of blockchain technology plays an important role in new technological innovation and industrial transformation. For such heavy good news, the price of BTC did not rise but began to fall after the news was released. It is not ruled out that there are big funds selling the news.

BTC's independent market:

The correlation between BTC and Nasdaq has maintained a certain degree of positive correlation since the beginning of the year. Until September, BTC began to fall, while the stock market started a wave of large gains during the same period due to dovish policies such as cutting interest rates and expanding the balance sheet. 7800 rose to 9000 points, an increase of 15%. We believe that the market price of BTC in the first half of the year is partly due to the fact that there are funds to start planning for the BTC halving in May 2020 a year in advance. At the end of the year, BTC did not follow the rise of the stock market. It is speculated that part of the reason was due to large funds selling the news.

Observing the BTC independent market in 2018/19, it was found that BTC did not rise with the stock market when the monetary policy turned better twice. It seems that it is still digesting the impact of the ICO bubble burst in 2017.

2020:

Market summary:

In 2020, BTC has risen from 9,300 to around 38,000 at the end of the year, an increase of more than four times, but most of the increase occurred in the fourth quarter, and the price of BTC in the first three quarters was consolidated at around 10,000. In terms of NDX100, due to the new crown epidemic at the beginning of the year, the index fell from 9,000 points to about 7,000 points in mid-March, and then rose under the stimulus of the Fed's easing policy. double.

Macro progress:

On March 15, 2020, in order to alleviate the new crown, the Federal Reserve shifted the goal of quantitative easing to support the economy. The Federal Reserve announced on the same day that the federal funds rate was directly lowered by 1.5 percentage points. Reduce the funds rate to 0% to 0.25%. It said it would buy at least $500 billion in U.S. Treasuries and $200 billion in government-guaranteed mortgage-backed securities "in the coming months." These moves quickly boosted market sentiment, and the stock market came out of a V-shaped reversal.

These policies led to the rapid expansion of the Fed's balance sheet, from 4.2 trillion in March to more than 6 trillion at the end of the year, an expansion of more than 50% in less than a year, which is rare in the world. The federal funds rate has remained at a level close to zero throughout the year.

BTC independent market:

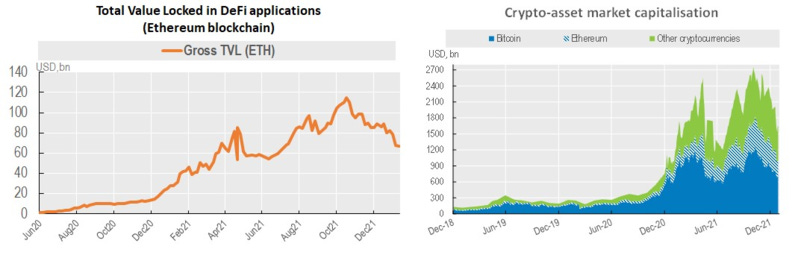

BTC maintains a high correlation with NDX100 throughout the year. At the end of the first quarter, it fell to around 5,000 with the general trend, and then followed the stock market to rise. During the DEFI summer in the second and third quarters, BTC was basically consolidating around 10,000, and in the fourth quarter, the market nearly quadrupled. During the DEFI summer, the amount of funds locked on the entire ETH chain increased sixfold from 20 billion at the beginning of the year to 120 billion at the end of October, attracting a large number of new users in the currency circle, especially institutional users. One of the reasons for the skyrocketing.

At the same time, the output of Bitcoin will be officially halved in May 2020. Although there are already funds in 2019 that have begun to expect the benefits of the halving, we have observed that the price of the currency has not changed much in the five months before and after the halving. The BTC market did not start until the fifth month after the official halving occurred.

This big market started in October 2020 and lasted until March 2021. Bitcoin went from 10,000 to 60,000. During this period, it experienced two macro-favors but failed to keep up (digesting the previous round of bubbles for a long time). One of the biggest releases has experienced a substantial increase in new investors brought by DEFI summer, a large influx of traditional corporate and institutional investors (see appendix) and the benefits of halving. Surrounded by many benefits, it is quite Shanshan Feeling late.

2021:

Market summary:

In 2021, BTC surged from around 38,000 at the beginning of the year to a high of nearly 60,000 in the first half of the year, then adjusted to an annual low of 32,000 in mid-July, and then rose again to a peak of around 69,000 in early November, closing at around 43,000 at the end of the year. An increase of 43%. The NDX100 index rose from 13,000 at the beginning of the year to 16,500 in mid-November, and closed at 15,600 at the end of the year, an annual increase of 20%.

Macro progress:

Loose policies in response to the new crown epidemic will run through 2021.

At the FOMC meeting on November 3, 2021, the Federal Reserve began to send out hawkish signals, announcing that the pace of asset purchases will be gradually reduced, buying US$10 billion in US Treasury bonds and US$5 billion in MBS per month.

By the end of 2021, the inflation rate in the United States will reach 6.8%, far higher than the Fed's 2% target, the overall unemployment rate will drop to 4.2%, and the labor market will be close to the Fed's "maximum employment" target. At its December 2021 meeting, the Federal Open Market Committee, the Fed's policymaking committee, said a majority of its members expect to raise interest rates by three-quarters of a percentage point in 2022 while reducing the size of its balance sheet. Doubled the speed, reducing US Treasury bond purchases by $20 billion and MBS bond purchases by $10 billion per month. The meeting marked the official start of austerity.

BTC independent market:

This year, BTC has gone through two independent markets, from mid-February to mid-July, and the correlation gradually changed from positive to negative; the second time was from early November to the end of the year, and the correlation showed a significant decline.

In the first independent market, the BTC price tried to break through 60,000 four times. From May 3 to 17, it fell directly from 57,000 to 35,000 in half a month, a drop of 39%. On May 19th, China announced a ban on mining, causing a large number of miners to shut down, and the computing power reached a historical low. After 519, BTC came out of a two-month downward trend, falling from 35,000 to about 32,000.

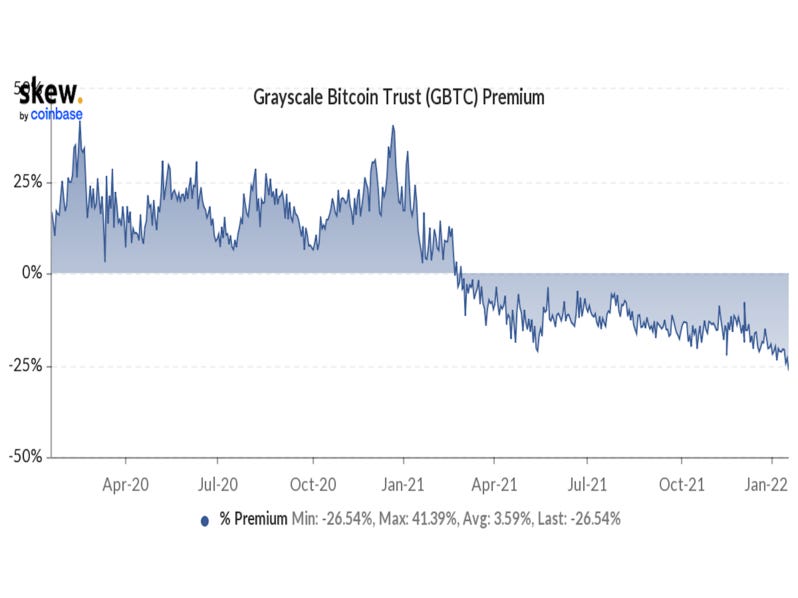

After the failure of BTC to hit 60,000 for the first time in mid-February, Grayscale’s GBTC market began to undergo significant changes. The premium of GBTC began to turn from positive to negative, marking that a large number of institutional disks began to stop entering the encryption market, and even began to withdraw.

After failing to hit 60,000 for the second time in March, Musk began to shout for BTC: Not only did Tesla accept BTC as a means of payment, but Tesla also announced the purchase of BTC as a reserve asset. In hindsight, Internet celebrities using market sentiment to shout orders usually means that the price has reached a staged top.

In the second independent market at the end of the year, BTC dropped rapidly from an all-time high of 69,000 in early November to 42,000 at the end of the year, a drop of 40%. In the same period, NDX fell from a high of 16500 to 15600, a drop of only 5%. In hindsight, this decline was a response to the Fed's policy shift, and it is clear that BTC is more sensitive to changes at the macro level than the stock market during the same period.

By observing the BTC independent market stage from 2020 to 2021, we can see that after the last round of sharp rise, BTC was subject to periodic price pressure, and only corrected downward after several surges. At the same time, due to the entry of traditional institutions in this round, the large outflow of funds in related derivatives markets such as GBTC or futures often points to periodic high prices. It is also because of traditional institutions that BTC price trends are more sensitive to changes at the macro level than the stock market.

Summarize:

Summarize:

Through the investigation and analysis of the correlation between BTC price and NDX100 index, we can conclude the following conclusions:

1. The overall price trend of BTC is more and more positively correlated with NDX100.

If there is a decline in correlation, generally speaking, it is because of specific factors in the BTC market that make BTC go out of the independent market.

2. BTC often takes a long time to digest the impact of the bubble burst.

Observing the BTC independent market in 2018/19, it was found that BTC did not follow the stock market to rise twice when the monetary policy improved. It seems that it is still digesting the impact of the ICO bubble burst in 2017.

Beginning in October 2020 and continuing until March 2021, Bitcoin went from 10,000 to 60,000. During this period, it experienced two macro-favors but failed to keep up (digesting the previous round of bubbles for a long time), and experienced the largest release of water in history. First, after experiencing the substantial increase of new investors brought by DEFI summer, the influx of traditional enterprises and institutional investors (see appendix) and the benefits of halving, surrounded by many benefits, this big market is quite good Feeling late.

3. BTC is more sensitive to changes at the macro level than the stock market.

By observing the BTC independent market stage from 2020 to 2021, we can see that after the last round of sharp rise, BTC was subject to periodic price pressure, and only corrected downward after several surges. At the same time, due to the entry of traditional institutions in this round, the large outflow of funds in related derivatives markets such as GBTC or futures often points to periodic high prices. Also because of the intervention of traditional institutions, the BTC price trend is more sensitive to changes at the macro level than the stock market.

Appendix: As the popularity of DEFI summer increases, the most notable event in 2020-2021 is the rapid entry of traditional financial companies

Visa has announced a USDC stablecoin settlement payment blockchain on Ethereum, and PayPal has begun allowing users to pay with the token at its global online merchants. Listed blue-chip companies are expanding their direct holdings of cryptocurrency assets, such as Microstrategy, Tesla. Centralized exchanges and other fintech companies offer user-friendly interface products (such as Metamask wallets) related to DeFi protocols and/or native crypto assets issued in DeFi.

CME launched bitcoin futures and options in 2021, Goldman Sachs launched a bitcoin investment vehicle, and Morgan Stanley offered its private wealth management clients access to bitcoin and cryptocurrency funds. BlackRock has added bitcoin futures as a potential non-prime investment (small allocation) for two of its funds, while some investment banks are launching digital asset divisions. In October 2021, the ProShares Bitcoin Strategy ETF was launched, the first ETF linked to CME BTC futures listed on the US market.