first level title

TL;DR

1. The merger of Ethereum is to prepare for sharding, followed by a more friendly environment, higher security and decentralization.

2. The complexity of merging the mainnet is far greater than that of the testnet. We are pessimistic about whether the merger will be possible on September 19th.

3. After the merger is completed, the production of ETH will be reduced by 90%. The ETH released by pledge cannot cover the burning of Gas. Ethereum is very likely to enter the era of deflation.

4. Compliance will become the sword of Damocles of the PoS Ethereum network.

5. In the short term, the merger of Ethereum will bring development dividends to the staking track. In the long run, the development of STaaS mainly depends on the ecological prosperity of the public chain and the innovation of the track itself.

The Ethereum Merge (The Merge) is just around the corner.

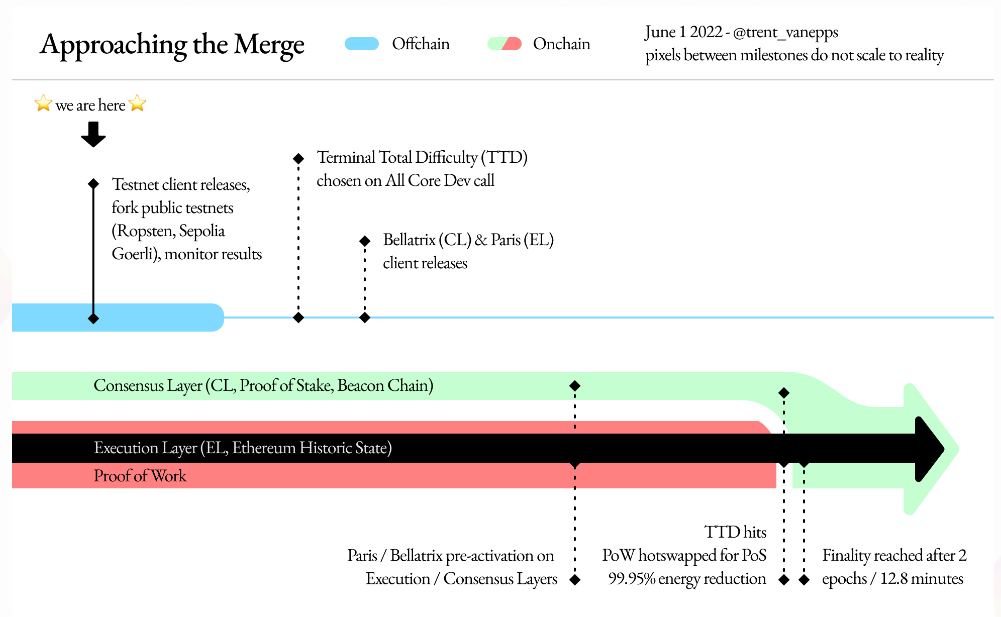

According to the developer conference call, among the three testnets, Ropsten and Sepolia have been successfully merged, and the merger of the last testnet Goerli is expected to take place in the second week of August. The Bellatrix update will be deployed in early September. Then there is a 2 week merged deployment. If all goes well, the mainnet merger is expected to take place around September 19th.

Source: https://blog.ethereum.org/

first level title

Why merge?

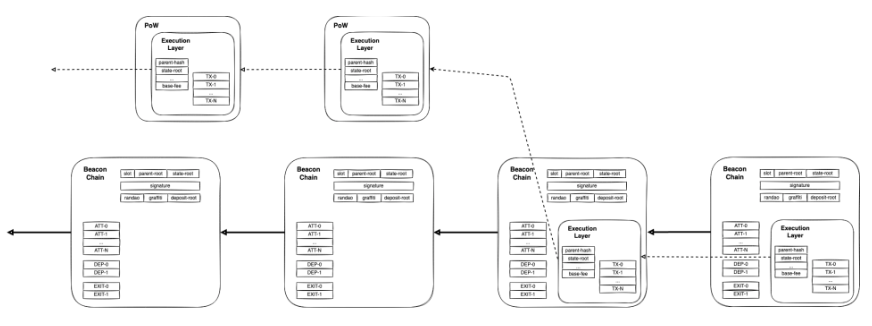

The Ethereum merger we are talking about refers to the merger of the Ethereum mainnet and the Beacon Chain (Beacon Chain). The entire Ethereum network will inherit the transaction status of the original main network, and the beacon chain will be incorporated as the consensus layer. The most intuitive change after the merger is that the consensus mechanism of Ethereum has changed from PoW to PoS.

Before the merger was the PoW (Proof of Work) mechanism. Nodes violently calculate, compete for the right to generate blocks, and earn profits. In this process, in order to ensure network security, a high proportion of nodes are required to store all (or most of) data, and each node must participate in transaction verification. Nodes are treated indiscriminately, and all transactions are also processed indiscriminately.

After the merger is the PoS (Proof of Stake) mechanism. Block producers (Proposer) and verification nodes (Verification Committee, Committee) are randomly selected. When the next stage after the merger is "data sharding", different nodes can only store part of the data, and the verification is only carried out by the selected Committee.

secondary title

Prepare for sharding

The reason why the Ethereum network is converted to PoS is to prepare for sharding.Actually the combination of PoS and sharding is recognized in official documents. “The Beacon Chain (PoS) will handle/coordinate sharding and staker networks,” writes the official Ethereum website.

The author believes that the ultimate goal of the merger is to expand capacity, which must be achieved through sharding + Rollup. In order to shard, the Ethereum network needs to be converted to PoS first, because PoS and sharding are more logically consistent. PoW considers globality, while both PoS and sharding use "random number" elements, and they both pursue "minimum sufficiency and necessity" to reduce storage/verification redundancy.

secondary title

PoS is more environmentally friendly

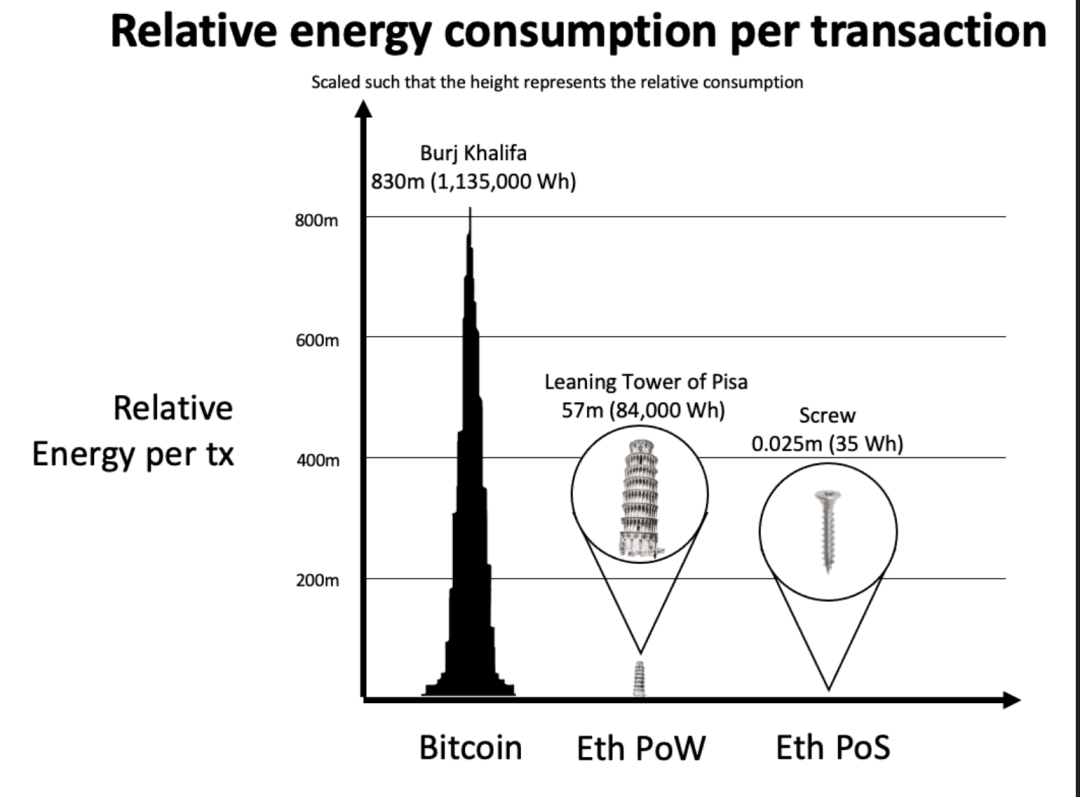

Producing blocks on the PoW network is a competition for computing power, which puts higher and higher requirements on machines and electricity. Take Bitcoin, the most typical PoW network, as an example. According to previous data from Cambridge University, the annual electricity consumption of the Bitcoin network is about 121.36 billion kWh, which exceeds the annual electricity consumption of Argentina, the Netherlands, and the United Arab Emirates.

Although the power consumption of Ethereum is much lower than that of Bitcoin, as a representative of an emerging technology field, it is also pursuing to become more environmentally friendly.

It is understood that after the merger, the power consumption of the Ethereum network will be reduced by more than 99%. 100,000 Visa transactions consume about 149 kilowatt-hours of electricity. In contrast, the combined PoS Ethereum network consumes only 0.667 kilowatt-hours of electricity for 100,000 transactions.

secondary title

Security and Decentralization

As for network security and decentralization, Vitalik has discussed why he believes PoS is more advantageous than PoW.

Overall, the participation threshold for PoS nodes is lower. The competition among Bitcoin PoW nodes has "evolved" to ASIC. In addition to funds, there are machine construction, operation and maintenance thresholds, and ordinary people cannot participate.

A PoS network cannot deny anyone a node (or part of a node). Although 32 ETH now means a high capital threshold of about $45,000, more and more service providers support small ETH pledges, and PoS has lower thresholds for machines and operations.

In addition, according to some data given by Vitalik, the attack cost of PoS network is higher than that of PoW network. PoS is also more resilient than PoW networks after being attacked. (will be introduced later)

On the widely-controversial issue of PoS making the rich richer, because PoS supports a wider group of participants, the node's pledge + Gas income will be shared (equivalent to slowing down the wealth growth of giant whales with the advantage of the number of small nodes). Vitalik believes that after Ethereum is converted to PoS, it may take a century for the doubling of wealth concentration. During this process, the redistribution of ETH, such as consumption and charitable donations, will also slow down the trend of wealth concentration.

first level title

The beacon chain before and after the merger

Based on the above reasons, Ethereum has determined the future development path of sharding + Rollups + PoS.

secondary title

before the merger

It is as if the space station (Ethereum main network) needs to add new modules (beacon chain), and the spacecraft (beacon chain) needs to prepare for docking (merge) in advance. The preparation of the beacon chain will start at least on December 1, 2020 .

On December 1, 2020, Ethereum launched the Beacon Chain. Since its launch, the Beacon Chain has been running in parallel with the Ethereum mainnet and independent of each other.

The Beacon Chain is a PoS chain. The Proposers responsible for generating blocks and the Committee responsible for transaction verification are randomly selected from the validators who pledged ETH.

So from the first day of launch, the beacon chain has supported the ETH pledge/storage function. By pledging 32 or more ETH, you can become a validator and earn pledge interest. At present, the deposit of ETH is still a one-way process, and the withdrawal of ETH and interest will wait until the merged Shanghai is upgraded.

Now the Beacon Chain has no other functions except for staking ETH, randomly selecting nodes to produce blocks and verification, rewarding and punishing nodes, and maintaining the normal operation of the network. Currently, it does not support accounts and smart contracts.

after the merger

after the merger

When the beacon chain is merged into the Ethereum mainnet, the PoW consensus layer of Ethereum will be replaced by the beacon chain (PoS), and the transaction status will be inherited from the original Ethereum mainnet.

Source: Danny Ryan

The beacon chain will coordinate the pledge network, similar to a central ledger, record the list of verifiers, and reward and punish verifiers. After the merger, the beacon chain will become a part of the Ethereum as a whole, and it should also undertake transaction execution and data at the same time. available responsibilities. After sharding is implemented, the beacon chain will also coordinate the shard network.

Judging from the current plan, the future development path of Ethereum is to improve the performance of the main network by optimizing the main network consensus (PoS) and data storage/verification efficiency. Rollup expansion.

Therefore, the whole process can be seen as a transition to Rollup to undertake the Ethereum transaction execution layer, and Ethereum Layer 1 serves as a more efficient data effective layer and consensus layer. Future development does not rule out this situation: Ethereum Layer 1 retreats behind the scenes, Rollup becomes a highly scalable machine for transaction execution, and Ethereum Layer 1 provides guarantee for Rollup data validity and consensus.

first level title

Merger Status

The merger of Ethereum needs to be achieved by code changes. Although the merger is based on the principle of "minimum disruption", because of the large number of applications and funds involved, the process must be cautious. Node and DApp developers can operate according to https://ethereum.org/en/upgrades/merge/ prompts.

Before the merger of the main network, Ethereum conducted merger tests on the Kiln, Ropsten, Sepoli, and Goerli test networks respectively. At present, Kiln, Ropsten, and Sepoli have successfully transitioned to PoS. Goerli's merger is expected to take place on August 11.

Since Goerli is the testnet closest to the Ethereum mainnet, the Goerli merge test is more important. Prior to this, the shadow fork test will be carried out on Goerli and the main network respectively. The shadow fork is a trial run of merging, and the previous shadow forks were not without problems.

Consider also that the testnet merger is not a true Ethereum mainnet merger. Thousands of nodes, more than 550,000 token smart contracts, and tens of thousands of DeFi and NFT applications are running on the Ethereum main network. In contrast, the applications and funds in the test network are much lighter. The merger of the Ethereum main network The complexity far exceeds that of the testnet.

Plus the merger of Ethereum has experienced multiple delays. Jiang Zhuoer also said that there are still a large number of applications that have not yet started to test the merger. Therefore, we are not optimistic about whether the merger can be completed as scheduled on September 19.

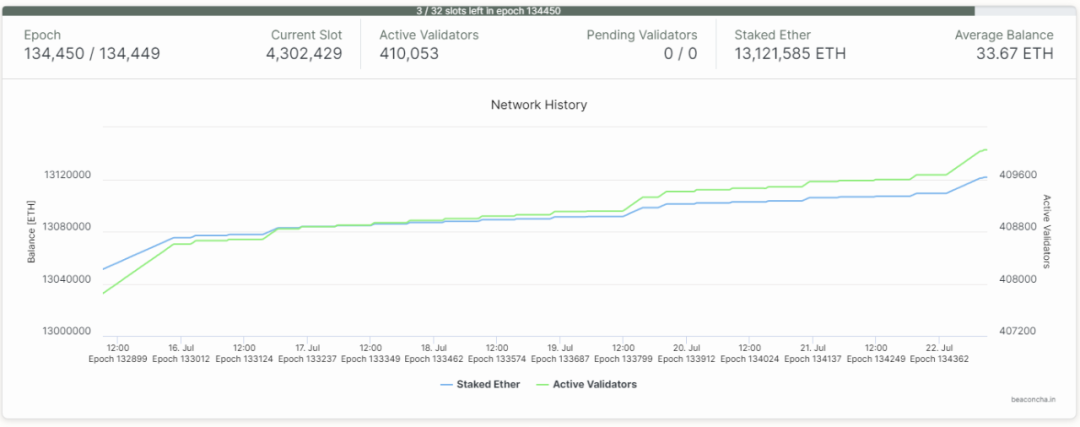

In terms of the beacon chain, the number of validators currently exceeds 410,000, and the number of ETH pledges exceeds 13.1 million, accounting for about 11% of the total supply. Since its launch, the Beacon Chain has been running stably, and the Beacon Chain is ready for the merger.

first level title

Comparison of data in five dimensions before and after the merger

degree of decentralization

degree of decentralization

image description

Ethereum PoW node distribution, source: etherscan.io/nodetracker

In contrast, there are more beacon chain validators who will take over PoW in the future. At present, there are more than 410,000 beacon chain verifiers (clients who pledge 32 ETH).

It should be noted that the nodes in the PoW network are distinguished by size, and different nodes have different levels of computing power. In the beacon chain, each validator has pledged 32 ETH, and the shares are the same, so there is no difference. There may be situations where a large number of validators are controlled by the same whale. Therefore, only comparing the number of nodes cannot fully explain the problem.

When we compare the degree of decentralization, we should also consider the participation threshold of the network. Although the Ethereum PoW competition is still mainly at the GPU stage, after the merger, the participation threshold is expected to be lowered.

In the PoW era, to participate in the Ethereum network, you need to have a dedicated machine, and the cost of the machine is not low, and the machine is still undergoing continuous iteration. In the PoS era, the requirements of the Ethereum network for machines, machine operations, and maintenance have been reduced. Users can also directly participate in the pledge with a small amount of ETH through the pledge service provider, which can further avoid the trouble of machine configuration and operation and maintenance.

Therefore, the participating groups supported by the merger of Ethereum will be more extensive than PoW, and you can participate as long as you have ETH.

PoS may bring wealth concentration problems, which is an important reason why many people are skeptical about the merger of Ethereum. In fact, no system can prevent the tendency of resources and wealth to concentrate.

Considering that the participating groups of Ethereum are more extensive, and the pledged tokens can be recovered with interest, compared with machine depreciation and elimination, participants are more willing to invest in the pledge. The number and continuous participation of "small nodes" can slow down the growth rate of giant whale wealth. Vitalik believes that it may take a century for the concentration of wealth on the Ethereum network to double.

safety

safety

In terms of security, Vitalik once published an article arguing that the merged Ethereum network is more secure. The demonstration is explained from the attack cost and the difficulty of recovery after the attack.

1) Attack cost

Assuming the network has a block reward of $1 per day, what is the cost of attacking the network?

GPU-based PoW network

You can rent cheap GPUs, so the cost of attacking the network is just renting enough GPU computing power to outnumber existing miners. For every $1 of block reward generated, the cost to existing miners will be close to $1 (if the cost is higher than $1, miners will quit because it is unprofitable, otherwise new miners will join). Therefore, the cost of attacking the network only needs to be higher than $1/day, and it may only need to last for a few hours.

Total attack cost: ~$0.26 (assuming 6 hours of attack, the attack cost is >$1/24*6), and because the attacker can receive block rewards, this number may be reduced to zero.

ASIC-based PoW network

ASICs are really a capital cost: when you buy an ASIC, you expect it to last about two years as it wears out or is replaced by better performing hardware. If a chain is attacked by 51%, the community may change the PoW algorithm to respond, and your ASIC will lose value at this time. On average, PoW node costs are about 1/3 recurring costs and 2/3 capital costs.

Therefore, for every $1 in block rewards, a PoW node spends ~$0.33 per day on power and maintenance, and ~$0.67 on ASICs. Assuming that the ASIC can be used for about 2 years, the miner will need to spend $486.67 per unit of ASIC hardware. ($486.67= 365 days x 2 x $0.67)

Total attack cost: $486.67 (ASIC) + $0.08 (power and maintenance, 0.33/24*6) = $486.75

PoS network

The cost of Proof of Stake is almost 100% of the cost of capital (collateralized coins). The only operational cost is the cost of running a node. Unlike ASIC, the pledged currency will not depreciate, and you can get back the pledged money within a short period of time when you don't want to pledge. Therefore, participants should be willing to pay a higher cost of capital for the same level of incentives than is the case with ASICs.

Let's assume ~15% staking rate is enough to attract people to stake (this is the expected APR after the ETH merger). So a block reward of $1 per day will attract a mortgage equivalent to 6.667 years of funds ($1 / (15%/year), which translates to an amount of $2,433 ($1/day x 365 x 6.667).

The cost of hardware and electricity consumed by the nodes is very small, and every thousand yuan of computers can mortgage thousands of assets, and the electricity and network fees of ~$100 per month are also sufficient. But to be conservative, let's assume these recurring costs are ~10% of the total cost of staking. So we only have a block reward of $0.90 per day corresponding to the cost of capital, so we have to reduce the above number by ~10%.

Total attack cost: 90% * $2,433 (capital cost) + $0.10/24*6 (electricity) = $2,189

The author adds: In order to realize the attack in the PoW network, it needs to meet >50% computing power. In the PoS network after the merger of Ethereum, according to some people's analysis, 1/3 of the pledge share is a relatively important security threshold. In this case, 0.26/2<486.75/2<2189/3。

From the calculation results, the attack cost of the PoS Ethereum network is higher than that of the PoW Ethereum network. This anti-fragility comes from the market's confidence in Ethereum (Ethereum is unlikely to become worthless).

Compared with the depreciation and elimination of machines, the pledged coins will not be lost, but will generate interest, especially when the pledged assets are expected to appreciate. This incentivizes more common users to participate. The more decentralized the market participation and the more pledged funds, the higher the cost of capital required to leverage the Ethereum network.

2) Easier to recover from attacks

In terms of attack recovery, Vitalik believes that the resilience of PoS networks is stronger than that of PoW networks.

For the PoW network maintained by GPU, once it is breached, the network has almost no resistance and recovery ability.

For PoW networks maintained by ASICs, the community can respond to the first wave of attacks and change the PoW algorithm through hard forks. But at the same time, all machines (including ASICs of attackers and honest nodes) will become worthless. Because there is not enough time to create a new ASIC for the new algorithm, the attack and resistance situation will return to the GPU situation (Note: Since the attacker and the honest node return to the same starting line, the situation will be worse than that of the attacker in the prepared situation. It is better to attack the GPU network under the attack). Attackers can attack and attack again, rendering the network irrecoverable.

secondary title

ETH supply and node income

Now the most exciting narrative in the market for the merger of Ethereum is "production reduction". After the merger, the output of ETH will be reduced; EIP-1559 will burn the Base Gas fee; users will be encouraged to pledge ETH, which will reduce the circulation of ETH. These factors are more likely to bring Ethereum into the era of deflation.

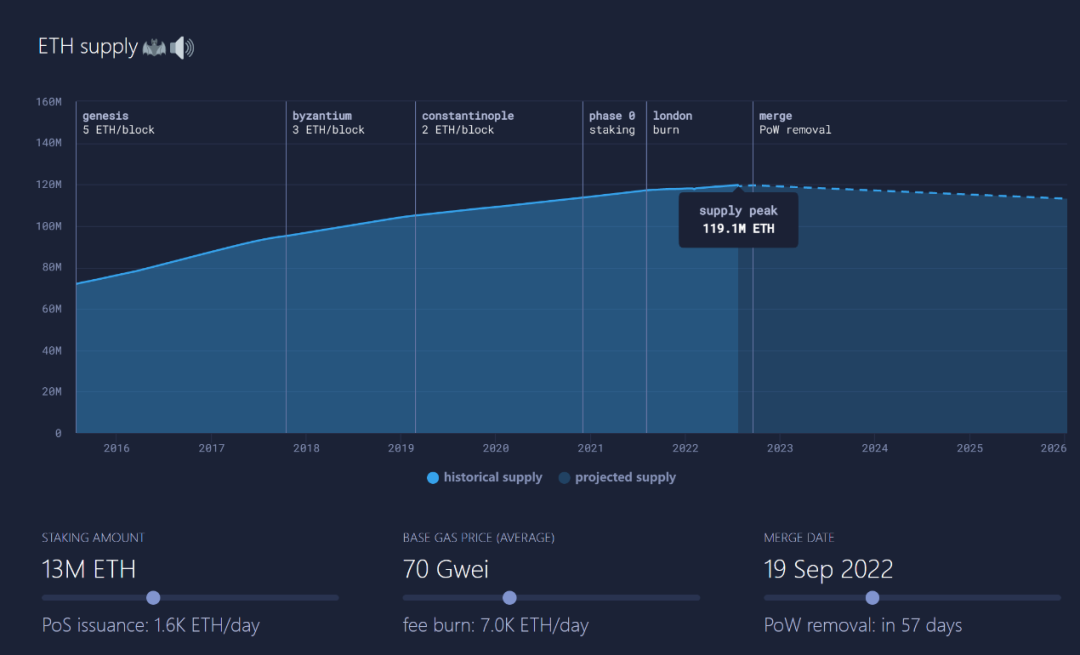

The inflation/deflation of ETH depends on two factors, namely the annual output of ETH (new increment) and the amount of ETH burned as Base Gas each year (destroyed amount).

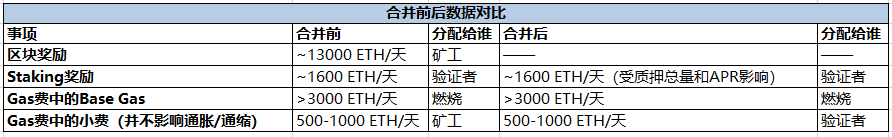

The output of ETH comes from two parts, namely block rewards and ETH pledge rewards on the beacon chain. Before the merger, the block rewards belonged to the miners, with an average output of 2.08 ETH every 13.3 seconds, so the block rewards in one year were about 4.93 million ETH. After the merger, block rewards will be cancelled.

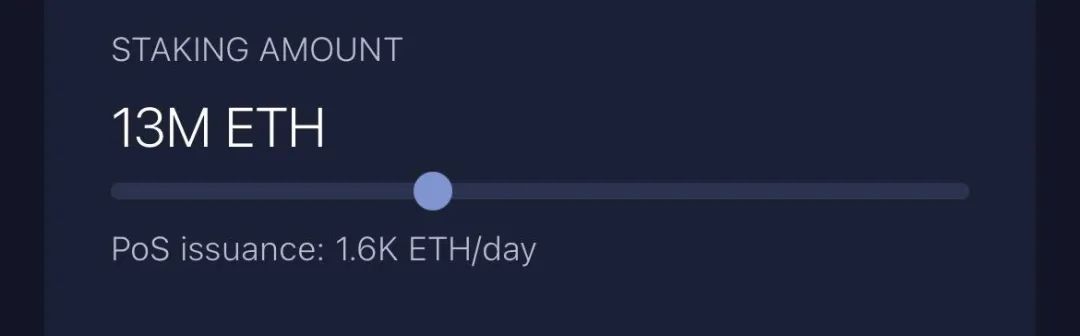

As for ETH staking rewards, a total of about 13 million ETH is currently pledged, and about 584,000 ETH are released a year as staking rewards. Both before and after the merger, staking rewards are distributed to validators on the Beacon Chain.

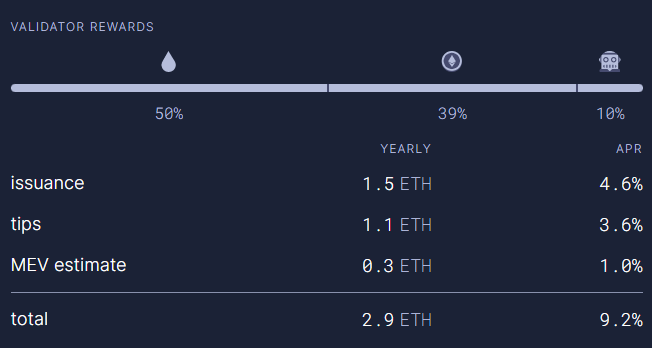

The staking reward depends on the total staking amount and APR, and the APR gradually decreases. Source: Ultrasound.money

Now the total supply of ETH is 119.7 million, so before the merger, the annual output of Ethereum accounted for (493+58.4)/11970=4.6% of the total supply, after the merger, this data becomes 58.4/11970=0.49%. The merger resulted in an 89.4% reduction in ETH production.

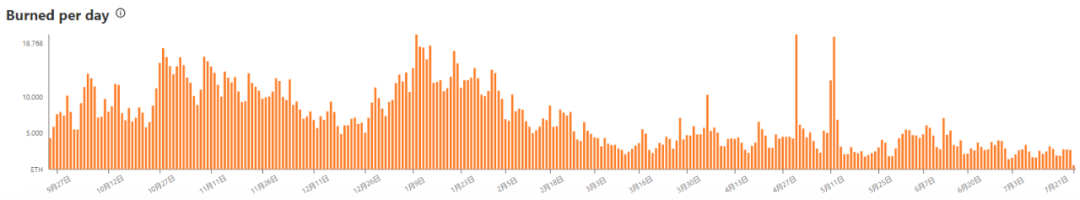

In terms of ETH burning, according to Watchtheburn.com data, the base gas fee for daily burning continues to fluctuate. Since EIP-1559 came into effect (September 27, 2021), in less than a year, more than 2.55 million ETH has been destroyed.

2.55 million ETH>584,000 ETH,It can be seen that after the merger, unless the amount of ETH pledged increases sharply, the ETH reward released by pledge is far from enough to cover Gas burning and burning. Ethereum is very likely to enter the era of deflation after the merger.

Coupled with pledge incentives (some people have called ETH "on-chain treasury bonds", because the income is stable and users are willing to participate, 11% of ETH has been pledged to the beacon chain), the market circulation of ETH should be at a relatively high level. Low levels, those are price boosters.

But at the same time, the author also believes thatFor an "app currency", the deflationary model is not sustainable in the long run because it is insufficient to meet the slowly growing usage demand. (Not intended as investment advice)

Base Gas burning situation, the average daily burning >3000 ETH, source: watchtheburn.com

Source: Beep News

ETH supply curve simulation source: Ultrasound.money

Before and after the merger, due to the adjustment of ETH release and distribution, the verifier will take over part of the income of the original miners, and the verifier's annual rate of return will increase from 4.6% to 9.2%.

Source: Ultrasound.money

compliance risk

Ethereum is the closest virtual asset to the concept of a "commodity" after Bitcoin, but a merger could change that image. Heath P. Tarbert, the former chairman of the CFTC, once hinted that "on the blockchain with PoS as the consensus mechanism, those tokens used as collateral will likely be regarded as securities commodities."

Stake.fish also analyzed in the "2021 Pledge Ecosystem Report" that "since staking looks like fixed income in a sense, this may lead regulators to believe that verifiers are closer to financial entities than miners. If it happens In this case, there is no way for validators to remain compliant.”

first level title

Staking has become a new bonus track

With the countdown to the merger of Ethereum, the Staking track has received unprecedented attention.

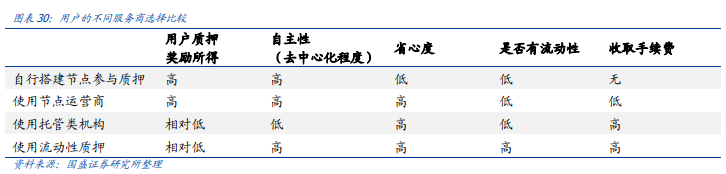

There are three problems in directly staking ETH. One is that the amount threshold must reach 32 ETH or more. The other is that the pledge and interest cannot be withdrawn immediately, resulting in a high opportunity cost. The third is that there is a node operation threshold. The pledge service provider (Staking as a Service, STaaS) is the link between ordinary users and the beacon chain, so that ordinary users can also participate.

STaaS solves the above three core problems: capital threshold, capital liquidity, and node operation. STaaS gathers user funds, and every time 32 ETH is collected, you can join the network as an operator.

When STaaS receives the user's funds, it issues a corresponding amount of xETH derivatives to the user as a certificate for redeeming ETH and earning interest. These xETH can be circulated in the secondary market, thereby releasing the liquidity of the user's "deposit" and reducing the opportunity cost down to 0. xETH can also participate in DeFi Lego to improve capital efficiency.

Some STaaS runs nodes by itself, while others match the user's ETH pledge requirements with the node operator's node operation capabilities, allowing ordinary users to save the trouble of node configuration, operation, and maintenance.

Source: Beep News

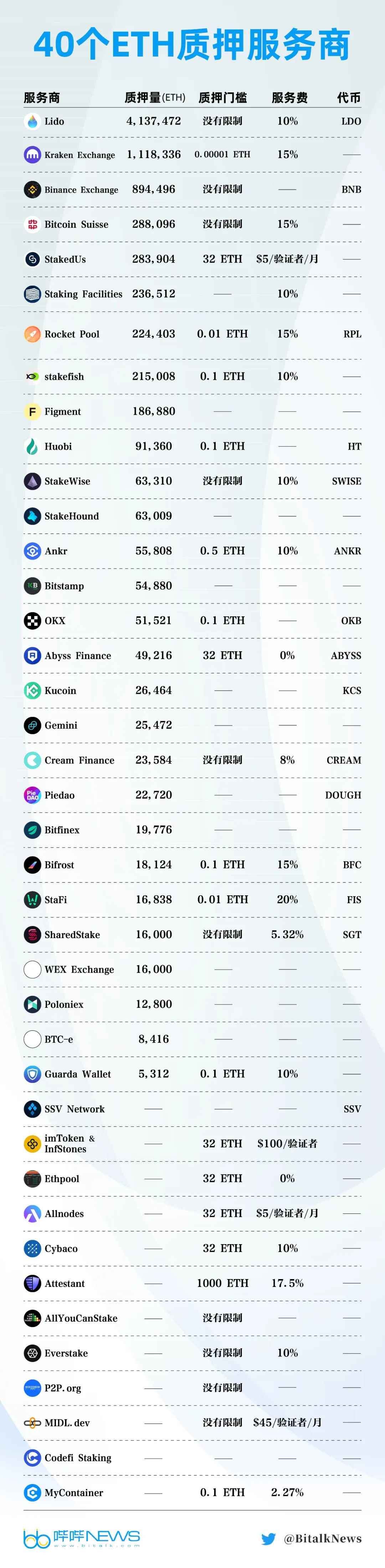

On the whole, the head effect of this market is obvious.

From the perspective of the number of users and the amount of ETH pledged, Lido is the absolute leader. CEXs such as Kraken and Binance also occupy a lot of shares because they are closest to users and easy to operate. The second is professional pledge service providers like Stakefish and Figment. In terms of decentralized staking liquidity pools, Rocket Pool's data is also at the forefront.

Due to the serious homogeneity of operation and function, the competition among STaaS is fierce.Most of these platforms lower the capital threshold to 0.1 ETH (some even have no capital limit), and the corresponding service fee ratio is basically stable at 10-15%. On these platforms, user operations are similar.

Lido's success as a leader is mainly due to two points, one is the brand effect, and the other is the transaction depth of the derivative stETH. DeFi apps like Lido and Curve build deep relationships. Now the ETH/stETH pool on Curve has a liquidity of 1.2 billion US dollars, which provides sufficient transaction depth for users to change hands of stETH.

But these cannot serve as an absolute moat for Lido. For example, the price of stETH has been unanchored in the recent black swan event. Lido has also been questioned as a centralization risk for Ethereum. At present, no STaaS has an absolute differentiation advantage. Users can still choose another STaaS without any resistance.

From the perspective of fundamental needs, the competition among STaaS will focus on comprehensive dimensions such as user experience (ease of operation), capital threshold, service charges, degree of decentralization (degree of security), and depth of xETH transactions.

Source: Guosheng Securities

In the short term, the Ethereum merger event has brought development dividends to the staking track. In the long run, the main reason for the development of STaaS is the ecological prosperity of the public chain and the innovation of the track itself.

The innovation of the track itself may come from two aspects, one is xETH derivatives, which will contain both unanchor risk and DeFi combinable potential; the other is the innovation of STaaS mechanism.

Rocket Pool and SSVNetwork are STaaS with relatively innovative mechanisms that Beep News has seen so far.

The Rocket Pool platform provides services by "matching" node operators and users. Unlike Lido, which screens node operators through DAO, any node operator can create a mini-pool on Rocket Pool.

They only need to pledge 16 ETH and the platform token RPL worth 1.6 ETH. The remaining 16 ETH will be collected by Rocket Pool from the client side. When a node is slashed, the ETH of the node operator will be deducted first. RPL will be sold for ETH to supplement the ETH of node operators.

For each node operator, the user funds they can aggregate are capped at 16 ETH. Although this brings scalability limitations, it can bring good decentralization effects.

SSV Network uses Decentralized Validator Technology (DVT). User pledge involves two kinds of private keys, namely the withdrawal private key and the verifier's signature private key. Among them, the verifier's signature private key needs to be continuously signed. Offline or malicious behavior will result in fines. Therefore, when the user entrusts the node operator or mobile When a sex service provider pledges ETH, it needs to send the verifier's signature private key to the other party.

Reference article:

Reference article:

"Ethereum Founder Vitalik's Detailed Explanation: Three Key Factors for POS Security to be Superior to POW" by ChainDD

What Potential Centralization Risks Will Ethereum Face After Merger? 》by TJ Keel

"Ethereum to PoS is coming soon: an in-depth analysis of the Staking track and representative projects" by Mint Ventures

"The Big Transformation of the Blockchain Industry - The Merger of Ethereum, Starting from the Price Decline of Graphics Cards" by Guosheng Securities

Note: This article is not intended as investment advice