TL;DR

first level title

The encrypted derivatives market is dominated by centralized platforms, and the vast majority of trading volume is contributed by centralized trading platforms.

Among the DeFi derivatives projects, perpetual contracts, options, synthetic asset platforms, and Staking projects are more popular.

Solana and L2 ecological derivative projects have developed rapidly this year and are worthy of attention.

DeFi derivatives projects propose solutions to decentralization, capital efficiency, liquidity, user experience, etc.

Derivatives are an important sector of the encryption market. In June, the trading volume of encrypted derivatives was 2.75 trillion US dollars, accounting for 66.1% of the total trading volume, and the vast majority of trading volume was contributed by the CeFi platform.

Although the trading volume of the DeFi platform is difficult to compete with the CeFi platform, the DeFi platform has expanded the imagination of the track, with perpetual contracts, options, futures, synthetic assets, interest rate derivatives, staking products, prediction markets and other product types.

CeFi and DeFi platforms have their respective advantages, making the encrypted derivatives track one of the most potential tracks this year.

Jump Crypto was optimistic about the encrypted derivatives track in its report at the beginning of the year. Jump Crypto believes that the rise of the encrypted derivatives track is marked by 3 trends:

The rise of centralized and decentralized options infrastructure;

Growth of decentralized perpetual contracts;

Continuous innovation around new encryption factors, such as structured vaults, perpetual options, etc.

As the trend of function aggregation strengthens, we will see derivatives platforms with more complete functions and better user experience. At the same time, we face composability risks and liquidation risks of derivatives in the sluggish encryption market.

first level title

Crypto Derivatives Market Overview

The current transaction scale of the encrypted derivatives market has reached the trillion-dollar level. According to the market transaction report released by CryptoCompare in June this year, the transaction volume of encrypted derivatives reached 2.75 trillion US dollars that month, accounting for 66.1% of the total transaction volume.

Even though the encryption market has declined significantly since then, the current transaction scale of the encryption derivatives market remains at a relatively high level. According to CoinGecko data, the trading volume of perpetual contracts on July 19 was 224.3 billion US dollars, and the futures trading volume was 11.3 billion US dollars, with a total of 235.6 billion US dollars.

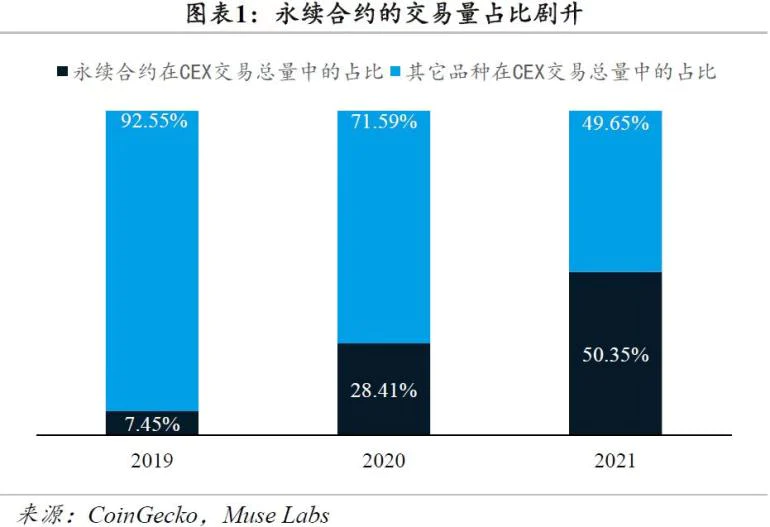

Among the derivatives transactions, the largest trading volume is the perpetual contract. Citing the table produced by Muse Labs, the proportion of perpetual contracts in the total volume of CEX transactions soared from 7.45% in 2019 to 50.35% in 2021, and the market share has exceeded 50%. Judging from the volume of transactions this year, the perpetual contract is "one of the best" in the entire derivatives track, ahead of other types of derivatives.

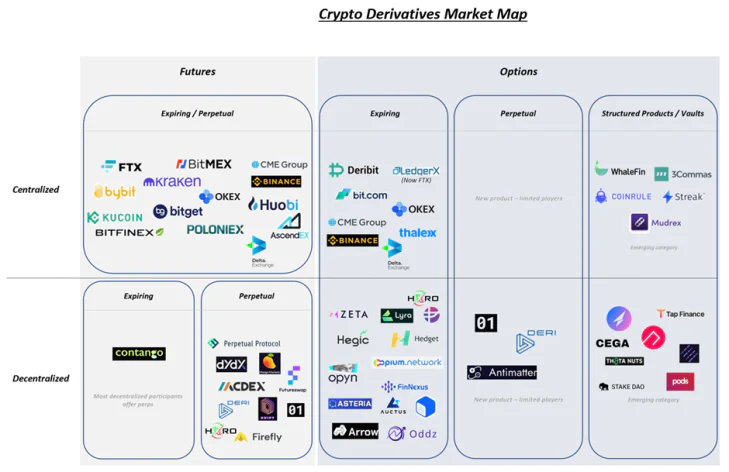

The dominance of perpetual contracts in futures trading can also be seen from the distribution of trading platforms. Among the centralized trading platforms, well-known trading platforms such as Binance, FTX, Kraken, and BitMEX all provide perpetual contract trading services. Among the decentralized trading platforms, dYdX, the decentralized derivatives platform with the largest trading volume, also focuses on perpetual contract trading.

Jump Crypto pointed out in the report at the beginning of the year that the proportion of trading volume of options and futures in encrypted derivatives is completely opposite to that of US stocks. Cryptocurrency options account for only 2% of spot trading volume. In the US stock market, this proportion is 3500%.

Other types of derivatives include: options, futures, synthetic assets, interest rate derivatives, staking products, prediction markets, etc. Decentralized derivatives platforms cover more types of derivatives, while centralized derivatives transactions focus on perpetual contract transactions.

The Jump Crypto report pointed out that dYdX accounted for more than half of the decentralized derivatives trading volume, while the decentralized derivatives trading volume only accounted for about 1% of the total.

first level title

Centralized derivatives trading platform

CoinGecko has included 53 CEXs with derivatives trading business. Among the CEXs that focus on derivatives trading, Bybit, FTX and Bitget have the highest trading volume.

According to CoinGecko data, on July 19, the trading volume of Bybit derivatives was 15.6 billion, the trading volume of FTX derivatives was 12.4 billion, and the trading volume of Bitget derivatives was 8.5 billion.

From the perspective of trading volume, the trading volume of Bybit, FTX, and Bitget is more than 8 times that of the leading decentralized derivatives trading dYdX. The trading volume of dYdX in the same period was 1.17 billion US dollars.

In terms of financing, FTX is the most active derivatives trading platform in financing. This year, both FTX and FTX.US have completed financing of 400 million US dollars. FTX completed a $400 million Series C round of financing at a valuation of $32 billion, with participation from Softbank, Paradigm, and Tiger Global. FTX.US completed a $400 million Series A round of financing at a valuation of $8 billion, with participation from Softbank, Paradigm, and Temasek.

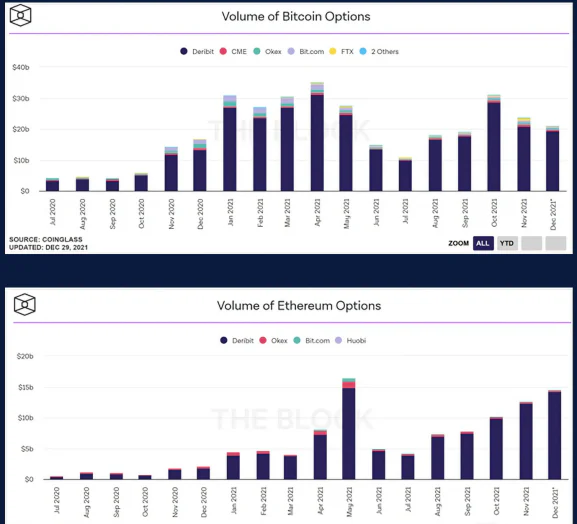

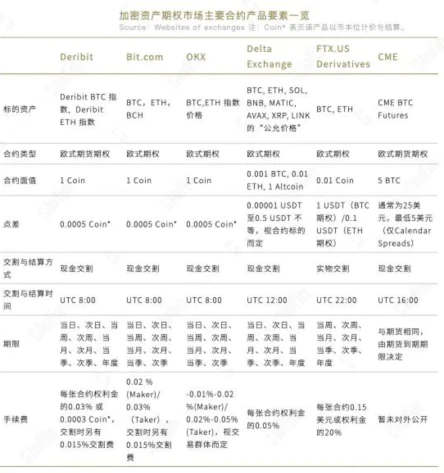

In terms of derivatives, the main types of derivatives traded on the centralized trading platform include perpetual contracts, futures, and options. In terms of trading volume, perpetual contracts dominate. Options trading accounts for a small proportion of trading volume, and Deribit leads in options trading.

The Block data shows that Deribit has an absolute advantage in BTC options and ETH options trading volume in 2020–2021. During this period, Deribit's BTC option monthly trading volume once exceeded $30 billion, and ETH option monthly trading volume was close to $15 billion.

first level title

secondary title

Derivatives trading platform

Derivatives trading platform

Among the 68 decentralized derivatives platforms compiled by Beep News, there are 34 derivatives trading platforms, accounting for 50%. Throughout the entire derivatives track, the derivatives trading platform is also the category with the largest number of projects in the track.

The types of derivatives traded on the derivatives trading platform include perpetual contracts, futures, options, synthetic assets, etc.

dYdX

Representative projects: dYdX, Kine Protocol

Introduction: dYdX is a decentralized derivatives exchange that adopts an order book model and supports spot trading, margin trading, contract trading and lending. By using off-chain order books and on-chain settlements, dYdX aims to create efficient, fair and trustless financial markets that are not controlled by any centralized authority.

The dYdX perpetual contract trading market uses StarkWare's L2 solution. As of July 19, dYdX's L2 locked-up volume was 550 million US dollars, second only to Arbitrum and Optimism.

dYdX recently announced that it will build an independent blockchain in the Cosmos ecosystem and release dYdX V4 on this basis.

Token: The governance token of dYdX is DYDX, and the total amount of DYDX is 1 billion, which will be distributed within 5 years. In terms of token distribution, 50% is allocated to the community, 27.73% is allocated to investors, 15.27% is allocated to the founding team, employees and advisors, and 7% is allocated to future employees and advisors.

Volume: On July 19, the volume was $1.77 billion.

Investment institutions: DeFiance Capital, Wintermute, Hashed, etc.

Project advantages: At present, dYdX has two main advantages: it provides a low-gas trading experience, and users can obtain passive income by staking tokens.

Provide a low gas transaction experience

dYdX uses StarkWare's L2 expansion solution to reduce transaction gas fees and improve user transaction efficiency and transaction experience. The choice of dYdX is wise. At present, dYdX's lock-up amount in L2 projects is second only to Arbitrum and Optimism.

dYdX previously announced that it will migrate to the Cosmos ecosystem and build a proprietary chain in order to meet the transaction needs of users, which has been well received by the industry. The migration of dYdX to the Cosmos ecosystem can be seen as its potential breaking point.

Users can earn passive income by staking tokens

Investors have three ways to earn rewards on the platform.

Retroactive mining rewards are rewards for historical users of the dYdX protocol and miners who have participated in previous activities throughout the network.

Trading Rewards provide rewards for investors participating in dYdX. This incentive is also created to increase market liquidity.

Kine Protocol

Liquidity provider rewards are a direct incentive for Ethereum-based users to continuously liquidate dYdX markets over the long term. Users must maintain 5% of their trading volume for 28 days to receive the reward. This reward method is the longest duration among dYdX rewards.

Brief introduction: Kine Protocol is a decentralized derivatives trading platform, and its current functions include leveraged trading and pledge. L2 network is used for on-chain pledge to realize long/short transactions with 0 gas fee and 0 slippage.

The peer-to-pool mechanism is adopted to allow traders to trade immediately according to the order price. This mechanism allows the trader's counterparty to be not other traders, but a liquidity pool where pledgers provide liquidity, thereby providing users with unlimited liquidity.

It is currently listed on ETH, BNB Chain, Polygon, and Avalanche.

Token: The governance token of Kine Protocol is KINE, with a total of 100 million pieces. 40% for ecosystem grants, 20% for team and advisors, 13% for seed backers, 12% for private placement participants, 10% for liquidity partners, 5% for balancer liquidity bootstrapping pool (LBP).

Investment institutions: Ascensive Assets, Divergence Capital, NGC Ventures, CMS Holdings, Hypersphere Ventures, Original Capital, DeFi Alliance, etc.

Project Benefits:

Project Benefits:

Use the L2 network for pledge and transactions to achieve 0gas transactions;

Support multi-chain asset transfer and multi-currency pledge.

secondary title

synthetic assets

Synthetix

UMA founder Hart Lambur divided blockchain synthetic assets into four types: Stablecoin or Stablecoin-related synthetic assets, cryptocurrency-related synthetic assets, commodities, stocks, etc.-related synthetic assets, and unknown synthetic assets. Representative projects of synthetic assets include UMA, Synthetix, Mirror Protocol, etc. This article will introduce Synthetix, the leader in synthetic assets.

Introduction: Synthetix is currently the most well-known synthetic asset protocol in the Ethereum DeFi ecosystem. It was originally a DAI-like stablecoin project Havven. At the end of 2018, it changed its name and turned to the synthetic asset track.

Synthetix mainly has two products, one is Synthetix.Exchange for trading synthetic assets, and the other is DApp Mintr that allows SNX holders to mint and burn synthetic assets. Synthetix currently supports asset types such as synthetic fiat currencies, cryptocurrencies and commodities, and plans to support synthetic stocks, futures, leverage and other products in the future.

Tokens: The governance token of Synthetix is SNX, with a total issuance of 215,258,834 and a market value of SNX tokens of $300 million.

Volume: $204 million on July 19th.

Project advantages: Synthetix has a long development time, and it is a leading project on the synthetic asset track of the potential track. Synthetix synthesizes asset types such as legal currency, cryptocurrency, and commodities, uses Chainlink to feed prices, and introduces off-chain assets to the chain, expanding the gameplay of DeFi and Web3.

secondary title

option agreement

Opyn

Options are widely used in hedging and risk hedging scenarios. Traders buy/sell call options and put options based on their judgment on the market. Among the decentralized option protocols, representative projects include Opyn and Lyra. This article will introduce Opyn.

Introduction: Opyn is a decentralized options protocol based on Ethereum, which will be launched on the mainnet in June 2020. Opyn option products are T-shaped quotation options similar to options in the traditional financial field. Options can only be purchased or sold according to a fixed delivery time and strike price.

The Opyn v2 version includes improved margin utilization, currency options that are automatically exercised at expiration, multiplier-free call options, cash-settled European options, allowing yielding assets (such as cToken, aToken, yToken) to be used as collateral and Earning yield, collateral-free lightning option minting, operator functionality (allowing users to delegate control of their vaults to third-party smart contracts), settlement of option prices using oracles, and more.

Project advantages: Opyn focuses on decentralized options, and has launched a series of developer tools to help developers use tools to create applications and continuously expand the Opyn ecosystem. Opyn ecological expansion, improving the composability of Opyn and other DeFi, increasing available functions.

secondary title

Interest Rate Derivatives

Divergence

Interest rate derivatives are a financial innovation tool whose profit and loss depend on the interest rate level in a certain way, including forward interest rate agreements, interest rate futures, interest rate options, interest rate swaps and other products. Representative projects include Divergence, Pendle, and Prism. This article will introduce Divergence, a decentralized volatility derivatives platform.

Introduction: Divergence is a decentralized volatility derivatives platform. Its first product is AMM's binary options market, which covers a wide range of underlying asset prices, interest rates and mortgage yields. Users can use any alternative tokens (including DeFi assets issued by other protocols) to complete minting and seeding in one step, and can choose the option execution price and expiration cycle to create a market.

Divergence aims to improve the combination, sustainability and capital utilization efficiency of the on-chain option market, create financial risk management and increase income.

Token: Divergence's governance token is DIVER, with a total of 1 billion pieces. The distribution ratio is 18% for financing, 34% for community rewards, 20% for reserves, 10% for ecological funds, 15% for development, and 3% for working capital. Token holders can participate in governance, participate in the modification of platform parameters, and obtain platform dividends through platform trading activities.

Investment institutions: Mechanism Capital, Arrington XRP Capital, KR1, etc.

Project advantages: Divergence has certain innovations in terms of liquidity and capital efficiency.

Divergence supports the use of any homogeneous token to cast options, and the mortgage asset does not have to be the underlying asset of the option, which improves capital efficiency to a certain extent.

secondary title

Staking protocol

The emergence of the Staking protocol provides liquidity solutions for users. The decentralized Staking protocol allows users to perform Staking (pledge) through the middle layer, and the middle layer issues certificates corresponding to the mortgaged assets (such as stToken issued by Lido), which can be traded and circulated in the market while obtaining pledge income .

Lido

Representative projects include Lido and Bifrost. This article will introduce Lido, the ETH2.0 Staking protocol.

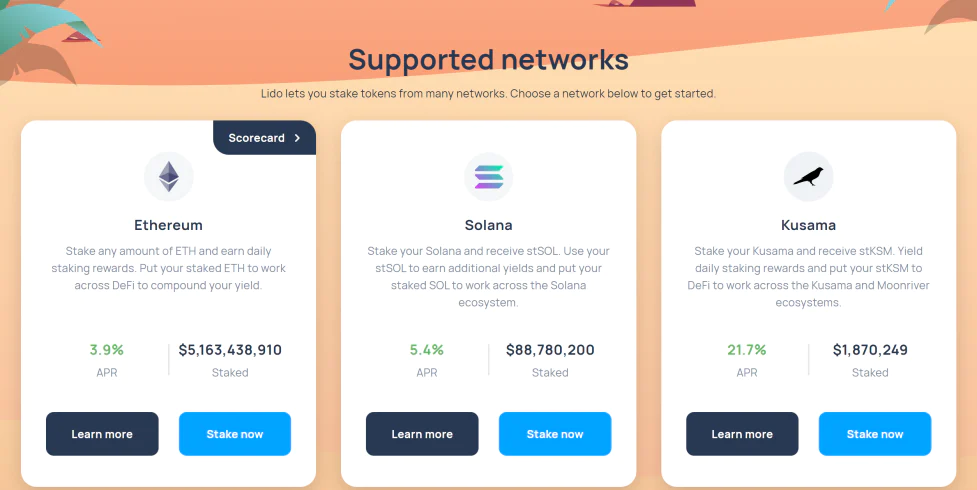

Introduction: Lido is a decentralized liquidity staking protocol that provides liquidity solutions for node staking.

Taking ETH pledge as an example, the user deposits ETH into Lido's smart contract, and the smart contract will give it to the node operator selected by DAO for staking. The user's funds are handled by DAO, and the node operator will not directly access the user's pledge things.

After depositing ETH, the user will obtain the corresponding pledge certificate Token stETH at a ratio of 1:1. The user can sell it or use it in various DeFi projects, and obtain additional income by using stETH in other DeFi protocols.

Token: Lido's governance token is LDO, with a total of 1 billion pieces. By holding LDO tokens, one can gain voting rights in Lido DAO.

Lock-up volume: According to the data on July 19, the lock-up volume of Lido is about 6.65 billion US dollars

Investment institutions: a16z, Coinbase Ventures, Three Arrows Capital, Paradigm, etc.

Project advantages: Lido has three main advantages:

Low pledge cost;

Support asset pledge of multiple chains, expand user choice space.

first level title

The new force on the track: Solana ecological derivatives agreement, L2 derivatives agreement

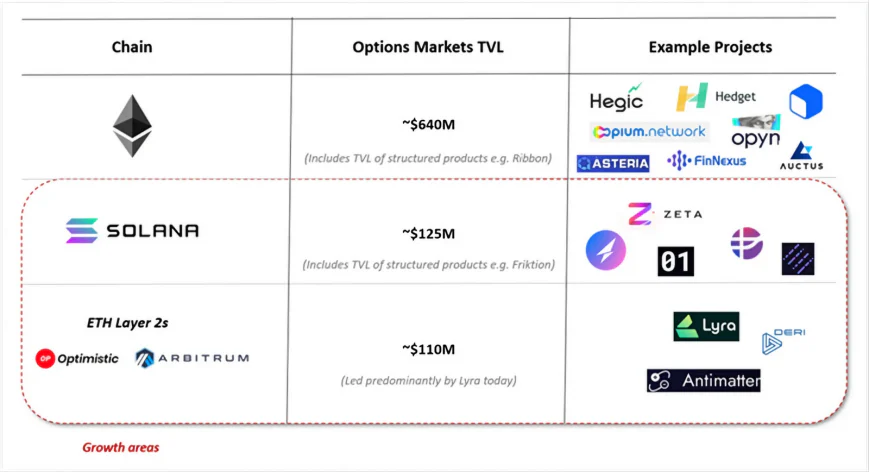

Jump Crypto specifically mentioned the derivatives market of Solana and L2 in its report at the beginning of the year. Jump Crypto believes that the derivatives market of Solana and L2 is an opportunity that can be captured this year.

Considering the difference in the size of the Ethereum ecology, the Solana ecology, and the L2 ecology itself, the development of the Solana and L2 derivatives markets is favored by Jump Crypto. This year, the two ecological derivatives markets have indeed ushered in significant development.

secondary title

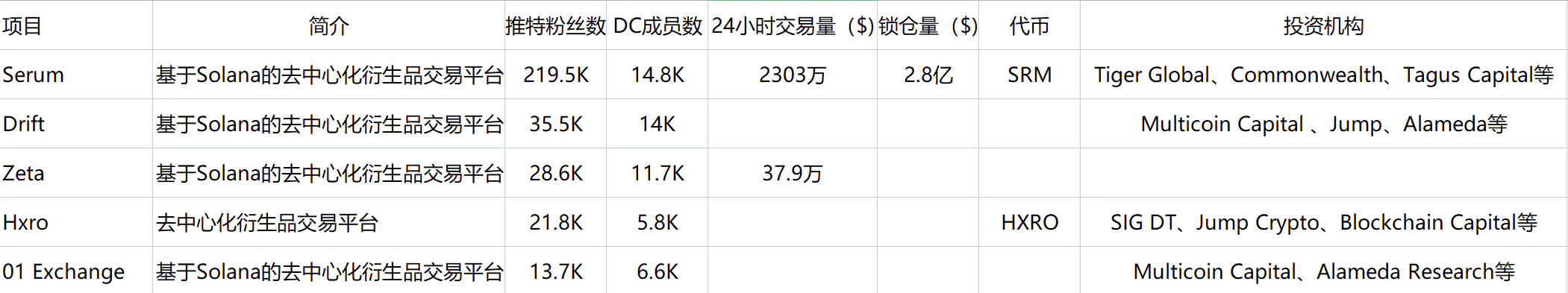

Solana Ecological Derivatives Agreement

Most of the Solana ecological derivatives protocols are trading platforms. Among the 34 decentralized derivatives trading platforms counted, 5 are deployed on the Solana chain, namely Serum, 01 Exchange, Hxro, Zeta Markets and Drift.

Among them, Serum and 01 Exchange are more popular, both of which provide a more comprehensive scenario for Solana's ecological derivatives transactions.

Serum itself is a decentralized derivatives trading platform that supports cross-chain, stablecoins, packaged tokens, order books, and futures transactions, providing users with a fast and low-cost cross-chain trading experience.

The Serum portal shows that the current ecology built around Serum has begun to take shape.

There are currently 30 applications in the Serum ecosystem, including derivatives protocols Zeta, 01 Exchange, and Mango. Users can enter these projects through the ports provided by Serum for transactions. Serum's empowerment has a certain effect on the development of Solana's ecological derivatives.

01 Exchange is a potential new star in this year's Solana ecological derivatives agreement. Highlights include:

Cross-chain deposit service, supporting Ethereum, Solana, BNB Chain, Polygon, Avalanche, Oasis and other chains;

Plan to support more than 50 Tokens as collateral;

lending function;

Multiplier perpetual contracts can better gather liquidity;

The development of Solana's ecological derivatives also benefits from the support of FTX and Alameda. FTX is the leading centralized derivatives exchange, and SBF's idea of doing centralized derivatives and decentralized derivatives is in the same line. It brings Solana's ecological derivatives Come user and developer experience.

secondary title

L2 Derivatives Agreement

The number of L2 derivatives agreements has shown an upward trend in the past two years. In addition to the migration of Ethereum ecological derivatives protocols to L2 (such as Synthetix, dYdX), native derivatives protocols have appeared on the L2 network, such as GMX on Arbitrum and Optimism. Pika Protocol, ZKX on StarkNet.

The L2 derivatives agreement is mainly based on trading agreements and liquidity agreements, and has relatively high requirements for network performance and Gas. With the expansion of derivatives trading scale, L2 is an important direction for the migration of leading derivatives trading platforms.

Perpetual contracts and options are the core growth points of encrypted derivatives

secondary title

The core advantages of perpetual contracts

As mentioned above, perpetual contracts account for more than 50% of the trading volume of encrypted derivatives, far exceeding other derivatives. Both the leading CEX and the leading decentralized derivatives trading platform have launched perpetual contract transactions.

Compared with delivery contracts, perpetual contracts have the following three advantages:

The operation of the perpetual contract is simple, and there is no need to consider steps such as delivery and swap, which lowers the professional investment threshold for investors;

There is no delivery time for the perpetual contract, and investors can hold the perpetual contract for a long time to obtain higher investment returns;

The price of the perpetual contract is anchored to the spot market price at a high level, while the price of the delivery contract deviates greatly.

As institutional investors enter the market, options and futures transactions that are closer to traditional financial markets are more likely to be welcomed by them. This is the core factor for perpetual contracts to gain more use in the current encrypted financial market.

secondary title

Options are a weapon for hedging crypto risks

The encryption market is highly volatile, and options are investment tools for investors based on judgments about future market changes. Investors buy and sell call/put options, which can effectively hedge the risks of the encryption market and obtain additional income from them.

According to The Block data, the total volume of BTC and ETH options transactions in June reached 29.44 billion US dollars. Among them, the trading volume of BTC options was 18.64 billion US dollars, and the trading volume of ETH options was 10.8 billion US dollars.

Centralized option platforms dominate the options market, and Blofin compared centralized option platforms in this year's article.

Option products provide more low-threshold, profitable games to help attract users in a bear market, and option products are expected to gain room for growth in a bear market.

Advantages and development trends of the derivatives track

secondary title

Advantages of Derivatives Track

The variety of derivatives is rich, effectively hedging investment risks

The types of token-based derivatives include perpetual contracts, futures, options, synthetic assets, interest rate derivatives, staking products, prediction markets, etc. Investors can choose appropriate derivatives according to investment needs, market conditions, and yields of derivatives.

Derivatives have increased investors' demand for encrypted assets, and the gameplay in the encrypted world is not limited to spot transactions. The encrypted derivatives market introduces the gameplay of the traditional financial world into the encrypted field, which helps to better link the encrypted field with Wall Street.

In addition to increasing the gameplay in the encryption field, the use of encryption derivatives can effectively hedge the risks of the encryption market. For example, users can trade call/put options based on their judgment of the market. Users can use synthetic assets related to the traditional financial world (such as fiat currency-related synthetic assets, securities and commodities-related synthetic assets) to conduct diversified investment allocations to hedge risks.

Composable imagination

One of the most eye-catching designs of DeFi applications is its composability. The decentralized derivatives protocol improves capital efficiency and liquidity through the composability of DeFi.

Common designs in decentralized derivatives protocols include pledges, liquidity pools, interest rates, synthetic assets, etc. Decentralized derivatives expand their functions through cooperation, and add new functions in the upgrade iteration to provide users with more Multiple trading and earning options.

Derivatives trading volume and user demand are on the rise

In June, the trading volume of encrypted derivatives reached 2.75 trillion US dollars, accounting for 66.1% of the total trading volume, and the decline in the trading volume of encrypted derivatives was smaller than that of the spot trading volume in the same period. The side shows that encrypted derivatives trading is a hard demand at the moment, and features such as hedging risks and increasing income help it maintain a high trading volume in a bear market.

Increased trading volume, gradual diversification of user needs, and diversification of gameplay are the advantages of the current development of the derivatives market.

secondary title

Development trend: Derivatives agreements with more functions and more complete will be more impactful

Judging from the distribution of project types in the derivatives track, derivatives trading platforms occupy a dominant position. The derivatives trading platform will cooperate with other types of derivatives agreements to enrich users' trading experience.

Users pay more attention to the user experience of the derivatives agreement, the hedging effect of derivatives on the market, and the capital efficiency of derivatives. Therefore, the derivatives track project will be developed and iterated from the direction of complete decentralization, functional aggregation, and optimized user experience.

Problems Existing in the Derivatives Track

secondary title

The amount of interaction on the decentralized derivatives platform is relatively small

At present, among the trading platforms on the derivatives track, centralized trading platforms dominate. As mentioned earlier, the daily trading volume of the leading centralized derivatives trading platform is more than 8 times that of dYdX. In the decentralized derivatives trading platform, dYdX is far ahead of other platforms in transaction volume.

Although there are more types and gameplays of decentralized derivatives protocols, protocol developers strive for better capital efficiency, but users are still concentrated on centralized trading platforms and a few decentralized platforms.

secondary title

liquidation risk